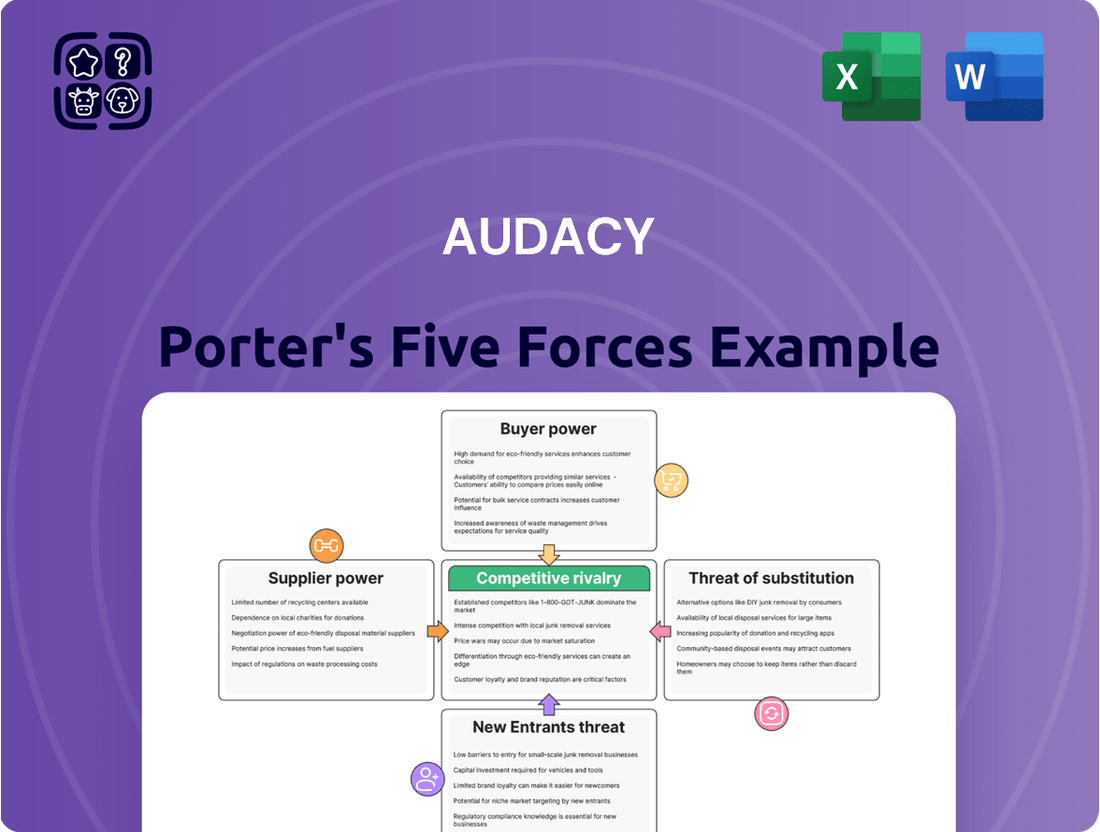

Audacy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Audacy Bundle

Audacy navigates a dynamic media landscape, facing intense rivalry and shifting consumer preferences. Understanding the bargaining power of both buyers and suppliers is crucial for their strategic positioning. The threat of new entrants and the availability of substitutes constantly challenge their market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Audacy’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Audacy faces substantial bargaining power from premium content providers, particularly those holding exclusive rights to major sports broadcasts or popular music. These suppliers possess leverage due to the unique and essential nature of their offerings, which are vital for drawing and keeping listeners and advertisers. For instance, securing rights to the NFL or major music festivals often involves significant upfront costs and ongoing royalty payments, directly impacting Audacy's profitability.

The concentration of these premium content providers means Audacy has fewer alternatives, amplifying supplier power. In 2024, the continued demand for live sports and exclusive music content has driven up licensing costs across the industry. Companies that control these sought-after assets can dictate terms, potentially leading to higher fees that squeeze Audacy's margins.

Renowned on-air personalities and popular podcast creators wield significant bargaining power. Their ability to attract and retain large, loyal audiences makes them indispensable assets, enabling them to negotiate favorable terms, including higher compensation and greater creative freedom. For instance, in 2024, top-tier podcast hosts often command six-figure or even seven-figure annual salaries, a testament to their direct impact on listener engagement and, consequently, advertising revenue.

Music licensing bodies like ASCAP, BMI, and SESAC wield significant bargaining power over Audacy. These organizations represent a vast number of artists and songwriters, essentially controlling the rights to a substantial portion of the music Audacy needs to broadcast. This collective strength means Audacy must adhere to their licensing terms and fees to operate legally.

Audacy's reliance on these licensing bodies for music content on its radio stations and digital platforms leaves it with little room to negotiate the industry-standard fees. These costs are a critical component of Audacy's operational expenses, directly impacting its content acquisition budget and overall profitability. The inability to significantly alter these fees underscores the suppliers' strong position.

Specialized Technology and Ad-Tech Vendors

Suppliers of specialized broadcasting equipment, digital streaming infrastructure, and advanced advertising technology (ad-tech) wield moderate to high bargaining power over Audacy. The intricate integration and significant switching costs associated with these critical operational systems create a considerable barrier for Audacy to change vendors, even if alternatives exist. Audacy's increasing dependence on sophisticated ad-tech for its digital marketing and revenue generation further amplifies the leverage these specialized technology providers possess.

For example, in 2024, the global ad-tech market was valued at approximately $75 billion, with specialized components like programmatic advertising platforms and data management solutions representing key areas of supplier influence. Audacy's investment in these areas means that a disruption or price increase from a key ad-tech supplier could directly impact its digital advertising revenue streams and operational efficiency.

- High Integration Costs: The complexity of integrating new broadcasting or ad-tech systems can lead to significant upfront costs and potential operational disruptions for Audacy.

- Specialized Knowledge Required: Vendors often possess proprietary knowledge and highly specialized expertise, making it difficult for Audacy to find readily available replacements with equivalent capabilities.

- Reliance on Ad-Tech Innovation: Audacy's strategy to grow its digital segment necessitates staying at the forefront of ad-tech, increasing reliance on vendors that drive innovation.

Increasing Importance of Data and Analytics Providers

As Audacy increasingly relies on digital marketing and advertising solutions, its dependence on data and analytics providers becomes more pronounced. These suppliers furnish essential insights into consumer habits and campaign effectiveness, which are critical for attracting and keeping advertisers. Companies offering advanced audience data and measurement tools could see their bargaining power rise, particularly if their datasets or analytical skills are distinctive or confer a significant competitive edge.

The market for data analytics is dynamic, with specialized firms often holding proprietary information or unique methodologies. For instance, in 2024, the digital advertising market saw continued growth, with programmatic advertising, heavily reliant on sophisticated data, accounting for a significant portion of ad spend. This reliance on specialized data makes it harder for companies like Audacy to switch providers without impacting campaign precision and advertiser confidence. The cost of acquiring and integrating high-quality data can also be substantial, further solidifying the position of established providers.

- Data Dependency: Audacy's digital-first strategy amplifies its need for precise audience data and campaign analytics.

- Supplier Leverage: Providers with unique data sets or advanced analytical capabilities can command higher prices or more favorable terms.

- Market Dynamics: The growing complexity and value of data analytics in advertising strengthen supplier bargaining power.

- Switching Costs: High costs and potential disruption in campaign performance make changing data providers challenging for Audacy.

The bargaining power of suppliers significantly impacts Audacy, particularly premium content providers and music licensing bodies. Exclusive rights to major sports and music content are essential, driving up licensing costs and limiting Audacy's alternatives. In 2024, the demand for live content continued to empower these suppliers, dictating terms and affecting Audacy's profitability.

Top-tier on-air personalities and podcast creators also hold considerable sway due to their ability to attract large audiences, commanding high salaries. For example, in 2024, leading podcast hosts could earn seven-figure annual salaries, directly influencing Audacy's talent acquisition costs and content strategy.

Specialized equipment and ad-tech suppliers possess moderate to high bargaining power due to high integration costs and specialized knowledge. The global ad-tech market, valued at roughly $75 billion in 2024, highlights the influence of these tech providers, whose innovations are critical for Audacy's digital growth.

| Supplier Category | Bargaining Power Level | Key Factors | 2024 Industry Context |

|---|---|---|---|

| Premium Content Providers (Sports, Music) | High | Exclusive rights, essential content, limited alternatives | Continued high demand for live broadcasts driving up licensing fees. |

| Music Licensing Bodies (ASCAP, BMI, SESAC) | High | Control vast music catalogs, industry-standard fees | Essential for legal broadcasting; fees are a significant operational expense. |

| Top Talent (Personalities, Podcasters) | High | Audience loyalty, direct revenue impact | Top talent commanding six-to-seven-figure salaries. |

| Specialized Ad-Tech & Infrastructure | Moderate to High | High integration costs, specialized expertise, switching barriers | Ad-tech market valued at ~$75 billion in 2024; critical for digital revenue. |

| Data & Analytics Providers | Moderate to High | Unique data sets, advanced analytics, data dependency | Growing value of data in programmatic advertising, impacting campaign precision. |

What is included in the product

Audacy's Five Forces analysis details the bargaining power of buyers and suppliers, threat of new entrants and substitutes, and intensity of rivalry, all within the context of the audio entertainment industry.

Instantly visualize competitive intensity with a pre-built, customizable Porter's Five Forces template, removing the guesswork from strategic analysis.

Customers Bargaining Power

Audacy's listeners have incredibly low switching costs. They can jump from one audio platform to another with a simple click, and the sheer volume of choices available today means they have abundant alternatives. This makes it very easy for them to leave Audacy if they aren't satisfied.

The market is flooded with options like Spotify, Apple Music, YouTube, and countless podcasts, each offering diverse content. In 2023, the global podcasting market alone was valued at over $20 billion and is projected to grow significantly, illustrating the competitive landscape Audacy operates within.

This ease of switching and the wide variety of entertainment available directly impacts Audacy's ability to dictate terms to its listeners. If Audacy fails to provide compelling content or a smooth user experience, listeners will simply move to a competitor, limiting Audacy's leverage.

Advertisers wield significant influence over Audacy as a key revenue stream. The sheer abundance of media and digital marketing channels means advertisers have ample alternatives for their advertising budgets, from established television networks to a vast array of social media, search engines, and other digital audio and non-audio platforms. This competitive environment necessitates that Audacy consistently proves its value, offering compelling reach, precise audience targeting, and a demonstrable return on investment to secure and retain advertising partnerships.

Advertisers today are laser-focused on return on investment (ROI) and sophisticated analytics. They demand proof that their spending on platforms like Audacy actually drives results. This means they have significant power to choose where their money goes, favoring those that offer clear performance metrics and precise targeting. For instance, a 2024 report indicated that over 70% of digital advertisers consider performance data a key factor in platform selection.

Audacy needs to continually refine its digital ad offerings and provide transparent, robust data to satisfy this demand. If Audacy falls short in demonstrating effective performance or offering superior targeting compared to competitors, advertisers are likely to redirect their budgets. This shift could significantly impact Audacy's revenue streams, as advertisers have a growing array of choices in the digital media landscape.

Price Sensitivity in a Competitive Advertising Market

In the fiercely competitive advertising landscape, customers, particularly advertisers, exhibit significant price sensitivity. They are perpetually searching for the most economical avenues to connect with their desired audiences. As of early 2024, the digital advertising market continues to be characterized by intense competition, with platforms vying for advertiser spend, making price a critical differentiator.

The ability for advertisers to easily compare pricing and the effectiveness of ad placements across numerous media channels directly contributes to downward pressure on Audacy's advertising rates. This transparency means Audacy cannot simply dictate prices; it must align with market expectations.

Consequently, Audacy is compelled to offer highly competitive pricing structures and demonstrate clear, measurable value to attract and retain its advertising clientele. This necessitates a strategic focus on optimizing campaign performance and providing demonstrable ROI to justify advertising expenditures.

- Advertisers' Price Sensitivity: In 2023, average CPMs (Cost Per Mille) across major digital platforms often fluctuated based on demand and inventory, highlighting the importance of competitive pricing for advertisers.

- Ease of Comparison: The proliferation of ad tech platforms and analytics tools in 2024 allows advertisers to benchmark Audacy's offerings against competitors with unprecedented ease, increasing their bargaining power.

- Value Proposition: Audacy's success hinges on its ability to articulate and deliver superior audience reach, engagement metrics, or unique creative opportunities that justify its pricing, especially when compared to alternative media.

- Market Pressure: Competitors offering lower entry-level pricing or more flexible package deals can directly siphon advertisers away from Audacy if its value proposition is not sufficiently compelling.

Fragmented Audience Leading to Reduced Individual Listener Power

Audacy operates within a highly fragmented audio landscape, where listeners access content through a multitude of platforms. This diffusion of the audience means individual listener groups or segments possess minimal bargaining power over Audacy's strategic decisions or content offerings. For instance, as of early 2024, the podcasting market alone features millions of distinct shows, making it difficult for any single listener cohort to exert significant influence.

While this fragmentation limits individual customer power, it presents a strategic challenge for Audacy. The company must continuously adapt its content and distribution strategies to cater to a wide array of diverse listener preferences. This is crucial for building and maintaining audience loyalty in a competitive environment where listener attention is divided across numerous audio sources.

- Fragmented Market: The audio content market, encompassing radio, podcasts, and streaming, is highly segmented, with listeners engaging across various platforms.

- Limited Individual Influence: No single listener group or demographic segment commands enough market share to significantly dictate Audacy's content or pricing strategies.

- Audacy's Challenge: The company faces the ongoing task of attracting and retaining listeners amidst this fragmentation, requiring constant innovation and adaptation.

- Data Point: In 2023, the global podcasting market was valued at over $20 billion, showcasing the vastness and diversity of audio consumption.

Customers, particularly advertisers, hold considerable bargaining power due to the vast array of media choices available. Advertisers can easily shift their spending to platforms offering better value, targeting, or ROI. For example, in 2024, digital advertising spend across all platforms is projected to exceed $800 billion, indicating a highly competitive market where Audacy must continually prove its worth to retain advertising revenue.

Audacy's listeners also possess significant, albeit diffuse, bargaining power. With millions of podcasts and streaming services, listeners can switch platforms with minimal effort. This ease of substitution means Audacy must consistently deliver high-quality, engaging content to prevent audience attrition. The global digital audio advertising market is expected to reach over $30 billion by 2025, underscoring the intense competition for listener attention.

| Customer Segment | Bargaining Power Factor | Audacy's Response/Challenge | Supporting Data (2023/2024) |

|---|---|---|---|

| Advertisers | High | Need to demonstrate superior ROI and targeting. | Digital ad spend projected to exceed $800 billion in 2024. |

| Listeners | Moderate (collectively low, individually high) | Must provide compelling content and user experience. | Global digital audio ad market to surpass $30 billion by 2025. |

Full Version Awaits

Audacy Porter's Five Forces Analysis

This preview shows the exact Audacy Porter's Five Forces analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape within the audio entertainment industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors, all presented in a professionally formatted document. This detailed analysis will equip you with a strategic understanding of Audacy's market position and the forces shaping its profitability. The document you see here is the actual, ready-to-use report, ensuring no surprises and immediate applicability to your business strategy.

Rivalry Among Competitors

Audacy faces formidable competition from pure-play digital audio platforms such as Spotify, Apple Music, and SiriusXM. These giants boast vast on-demand music catalogs, exclusive podcast content, and highly personalized user experiences, directly impacting Audacy's digital strategy. For instance, Spotify reported over 615 million monthly active users by the end of Q1 2024, highlighting the scale of these competitors.

These platforms aggressively vie for consumer attention and advertising dollars, posing a significant threat to Audacy's growth in the digital audio space. Their substantial user bases and advanced recommendation algorithms allow them to capture a large share of listening time and a significant portion of the digital advertising market, making it challenging for Audacy to gain traction.

Audacy faces significant rivalry from established traditional radio broadcasters like iHeartMedia and Cumulus Media. This competition is fierce for listener attention, advertising revenue, and popular on-air talent, especially within local markets. The traditional radio industry's maturity means there's limited growth, intensifying the fight for existing market share.

The podcasting landscape is intensely competitive, fueled by a vast number of independent creators, specialized networks, and established media giants all vying for listener engagement and advertising dollars. This proliferation means Audacy faces a constant battle for audience share.

Low barriers to entry mean new podcasts are launched daily, diluting the market and making it harder for Audacy's content to gain traction and build a loyal following. As of early 2024, the number of available podcasts globally has surpassed 5 million, a testament to this rapid growth.

This intense rivalry puts pressure on Audacy to continually innovate and invest in high-quality content to differentiate itself. The sheer volume of choice available to consumers means listener loyalty is hard-won and easily lost.

Cross-Media Competition for Advertising Spend

Audacy faces intense cross-media competition for advertising dollars, extending beyond traditional radio rivals to include digital giants and established broadcast networks. Advertisers are strategically distributing their budgets across a diverse media ecosystem, prioritizing platforms that offer superior audience engagement, precise targeting capabilities, and demonstrable return on investment. This dynamic intensifies the battle for marketing spend, forcing audio companies to prove their unique value proposition.

The competition for advertising revenue is fierce, with digital platforms often commanding significant portions of marketing budgets due to their advanced targeting and analytics. For instance, in 2024, digital advertising spending was projected to reach hundreds of billions globally, far exceeding traditional media. This trend necessitates that audio platforms like Audacy demonstrate their ability to reach specific demographics and provide measurable campaign results to compete effectively.

- Digital Dominance: Social media, search engines, and online video platforms are major competitors for advertising spend, leveraging vast user data for highly targeted campaigns.

- Traditional Media Resilience: Television and even print media continue to vie for advertising budgets, particularly for broad reach campaigns and specific demographic targeting.

- ROI Focus: Advertisers increasingly demand measurable outcomes, pushing all media providers to enhance analytics and demonstrate campaign effectiveness.

- Audacy's Challenge: Audacy must clearly articulate its unique reach and engagement metrics to capture a fair share of the fragmented advertising market.

Audience Fragmentation and Content Overload

The digital era has unleashed a torrent of content, splintering audiences and overwhelming consumers. Audacy faces fierce competition not just from other audio platforms but from every digital distraction vying for a listener's limited attention span. This intense rivalry demands constant evolution in content creation, platform delivery, and advertising strategies to secure and maintain engagement in a saturated market.

In 2024, the challenge is amplified by the sheer volume of digital content available. For instance, platforms like Spotify and Apple Music continue to dominate the music streaming landscape, while podcasts have seen explosive growth, with estimates suggesting over 3 million active podcasts globally by mid-2024. This fragmentation means Audacy must differentiate itself significantly.

- Audience Fragmentation: The proliferation of digital media has led to a highly fragmented audience, making it harder for any single platform to capture a dominant share of listener attention.

- Content Overload: Consumers are inundated with an unprecedented amount of content across various platforms, from streaming services to social media feeds and countless podcasts.

- Competition for Attention: Audacy competes directly with virtually all forms of digital entertainment and information for a finite segment of consumer attention.

- Need for Innovation: Continuous innovation in content programming, user experience, and advertising technology is crucial for Audacy to attract and retain listeners in this crowded environment.

Audacy's competitive rivalry is intense across multiple fronts. Digital audio giants like Spotify and Apple Music, boasting hundreds of millions of users, directly challenge Audacy for listener attention and advertising revenue. Traditional radio broadcasters such as iHeartMedia and Cumulus Media also present formidable competition, particularly in local markets, intensifying the fight for advertising dollars and audience share.

The podcasting sector is particularly crowded, with millions of new podcasts launching annually, making it difficult for Audacy to stand out. Furthermore, Audacy competes for advertising budgets against a broad spectrum of digital media, including social media and online video platforms, which leverage advanced targeting capabilities. By mid-2024, global podcast numbers exceeded 3 million, highlighting this competitive pressure.

| Competitor Type | Key Competitors | Key Competitive Factors | 2024 Context/Data |

|---|---|---|---|

| Digital Audio Platforms | Spotify, Apple Music, SiriusXM | Vast catalogs, exclusive content, personalized experiences, user base size | Spotify had over 615 million monthly active users by Q1 2024. |

| Traditional Radio Broadcasters | iHeartMedia, Cumulus Media | Local market presence, on-air talent, listener loyalty, advertising revenue | Focus on retaining share in mature, competitive local markets. |

| Podcasting Market | Independent creators, specialized networks, media giants | Content variety, listener engagement, advertising monetization | Over 3 million active podcasts globally by mid-2024. |

| Cross-Media Advertising | Social media, search, online video, TV | Targeting precision, ROI demonstration, audience engagement metrics | Digital advertising spending projected in hundreds of billions globally in 2024. |

SSubstitutes Threaten

Video content platforms like YouTube, Netflix, and TikTok pose a substantial threat of substitution to audio-centric businesses. Consumers, particularly younger ones, are increasingly turning to visual media for entertainment, news, and education. This shift diverts significant attention and advertising revenue that might otherwise flow to audio platforms.

In 2024, the average global consumer spends over 6 hours daily on digital media, with video consumption making up a significant portion of this time. YouTube alone boasts over 2 billion monthly logged-in users, highlighting the sheer scale of engagement with video. This preference for visual content directly competes with audio-only services for consumer attention and marketing dollars.

Social media platforms increasingly serve as substitutes for traditional audio content, offering a diverse range of media experiences. Users can access short-form videos, live streams, news updates, and interactive features all within a single app, often replacing the need for dedicated audio listening. This broad appeal means platforms like TikTok and Instagram are now competing directly with Audacy for user attention and time. In 2024, social media usage continues to surge, with platforms like TikTok reporting over 1 billion monthly active users globally, demonstrating their significant reach as alternative entertainment hubs.

Despite the increasing popularity of audio content like podcasts, digital text and news websites continue to be powerful substitutes for information. Many individuals still gravitate towards reading articles and analyses for a deeper understanding of current events and complex topics. This preference means that a significant portion of the audience that might consume news could opt for written formats over Audacy's audio offerings.

Experiential Entertainment and Live Events

Experiential entertainment, like live concerts and sporting events, poses a significant threat of substitutes for Audacy's audio content. These immersive experiences directly compete for consumer attention and discretionary spending, drawing away potential listeners. For instance, the live music industry saw a substantial rebound in 2023, with U.S. ticket revenue reaching an estimated $12.2 billion, indicating a strong consumer appetite for in-person events.

This shift towards tangible, live experiences can divert consumers from passively listening to radio or streaming services. While Audacy might be involved in promoting some of these events, the core value proposition of a live concert or game offers a unique engagement that digital audio cannot replicate. The demand for such experiences is robust, with attendance at major sporting leagues like the NFL in 2023 averaging over 65,000 fans per game.

- Direct Competition: Live events offer a more engaging and memorable experience than passive audio consumption.

- Leisure Time Allocation: Consumers have limited leisure time, and choosing a live event means less time for audio platforms.

- Discretionary Spending: Ticket prices for popular events can be high, impacting budgets available for other entertainment forms.

- Market Growth: The live entertainment sector's strong recovery and growth, evidenced by increasing ticket sales, highlights its appeal as a substitute.

Integrated In-Car Infotainment Systems and Smart Devices

The rise of integrated in-car infotainment systems and smart devices poses a significant threat of substitution for traditional audio providers like Audacy. These advanced systems offer consumers direct access to a vast array of audio content, bypassing traditional broadcast radio entirely. For instance, by 2024, a substantial portion of new vehicles are equipped with sophisticated infotainment systems capable of seamless smartphone integration and direct app streaming.

This technological leap allows listeners to effortlessly switch between personalized audio experiences, such as music streaming services, podcasts, and satellite radio, directly within their vehicles or homes. This shift towards on-demand and personalized audio content directly competes with the scheduled programming of broadcast radio, particularly during key listening periods like commutes.

- Increased Accessibility: Modern infotainment systems and smart devices provide ubiquitous access to a diverse content library, diminishing reliance on traditional radio.

- Personalization Options: Consumers can curate their listening experience through streaming services and personal libraries, offering a more tailored alternative.

- Technological Integration: The seamless connectivity of these devices makes switching to alternative audio sources incredibly convenient for users.

- Market Penetration: By 2024, a significant majority of new car models feature advanced infotainment systems, increasing the reach of these substitute technologies.

The threat of substitutes for audio content providers like Audacy is multifaceted, encompassing visual media, social platforms, written content, live experiences, and integrated technology.

Consumers increasingly opt for video content, with global digital media consumption exceeding 6 hours daily in 2024, a significant portion of which is video. Social media platforms like TikTok, with over 1 billion monthly active users in 2024, also divert attention by offering diverse media experiences. Even traditional text-based news and experiential entertainment like live concerts, which saw U.S. ticket revenue hit $12.2 billion in 2023, compete for consumer time and spending.

Furthermore, the integration of advanced infotainment systems in vehicles by 2024 provides seamless access to personalized audio streaming, directly challenging broadcast radio's dominance, especially during commutes.

| Substitute Category | Key Platforms/Examples | 2024/Recent Data Point |

|---|---|---|

| Video Content | YouTube, Netflix, TikTok | Over 6 hours daily global digital media consumption |

| Social Media | TikTok, Instagram | TikTok: Over 1 billion monthly active users |

| Experiential Entertainment | Live Concerts, Sporting Events | U.S. Live Music Ticket Revenue: $12.2 billion (2023) |

| Integrated Technology | In-car Infotainment, Smart Devices | Majority of new car models feature advanced infotainment systems |

Entrants Threaten

New companies looking to break into traditional broadcast radio face a tough uphill battle. The sheer cost of setting up the necessary infrastructure, buying broadcast equipment, and securing valuable FCC licenses is a massive hurdle. For instance, acquiring a license in a major market can easily run into millions of dollars, making it a prohibitive expense for most startups. This high capital intensity acts as a significant deterrent, shielding established players like Audacy.

Furthermore, the regulatory environment for broadcast spectrum is both complex and restrictive. The limited availability of frequencies and the stringent licensing processes create a formidable barrier to entry. Navigating these regulations requires specialized knowledge and considerable time, further complicating matters for potential new entrants. This controlled landscape offers Audacy a substantial degree of protection within the terrestrial radio market.

The digital audio and podcasting landscape presents a significant threat of new entrants due to its considerably lower barriers to entry compared to traditional broadcasting. Independent creators and smaller entities can launch new ventures with relatively modest initial capital. For instance, in 2024, many successful podcasts were initiated with investments under $1,000, covering basic equipment and hosting fees.

This ease of access fuels a continuous stream of new content and specialized platforms, directly impacting established players like Audacy. The ability for anyone to produce and distribute audio content means a constant influx of competition for audience attention and advertising revenue. This dynamic makes it challenging for Audacy to differentiate its digital offerings and secure exclusive content rights or a substantial share of the listener base.

Audacy benefits immensely from its deeply entrenched brand recognition, built over decades across numerous radio stations and digital platforms. This established presence fosters trust with both consumers and advertisers, creating a significant barrier for any newcomers aiming to enter the market.

Furthermore, Audacy boasts long-standing, robust relationships with a vast network of national and local advertisers. These partnerships are crucial for revenue generation and provide a competitive advantage that new entrants would find exceptionally difficult and costly to replicate, requiring substantial investment in sales infrastructure and market penetration efforts.

For instance, in 2024, Audacy continued to leverage its extensive reach, with its audio platform reaching an estimated 170 million listeners monthly. This scale makes it challenging for new entities to offer a comparable audience size without significant marketing expenditure and time to build similar advertiser confidence.

Access to Premium Content and Talent Acquisition Challenges

New entrants face significant hurdles in securing premium content and attracting top talent, which are crucial for audience engagement. Established companies like Audacy leverage their existing financial clout and established relationships to lock down exclusive broadcast rights for major sports or acquire sought-after music catalogs. For instance, in 2024, the cost of major sports broadcasting rights continued to escalate, with NFL rights alone commanding billions annually, making it exceptionally difficult for newcomers to compete. This scarcity of high-value content limits a new player's ability to rapidly build a substantial and loyal listener base.

Audacy's established network and financial capacity allow it to outbid or partner for exclusive content, creating a formidable barrier. New entrants may find it prohibitively expensive to acquire comparable assets, thus struggling to offer a compelling alternative to existing services. The competitive landscape for talent is equally challenging, with established platforms able to offer lucrative contracts and greater exposure. This dynamic makes it difficult for emerging companies to lure away the podcast hosts, radio personalities, and music artists that draw significant audiences.

- Content Acquisition Costs: The escalating costs of premium content, such as sports rights, create a high barrier to entry.

- Talent Competition: Established players have an advantage in attracting and retaining renowned talent due to financial resources and existing platforms.

- Audience Building: Lack of access to premium content hinders new entrants' ability to quickly attract and retain a large audience.

- Network Effects: Existing relationships and infrastructure provide established companies like Audacy a significant advantage in securing exclusive deals.

Economies of Scale in Advertising Sales and Distribution

Audacy's established presence across numerous broadcast radio stations and its expanding digital footprint create significant economies of scale, particularly in advertising sales and content distribution. This scale allows for more effective management of advertising inventory and offers advertisers a wider audience reach, a crucial factor in securing premium ad rates.

New competitors entering the audio advertising market face a substantial hurdle in replicating this scale. They would need to invest heavily in building both a broad audience base and a robust sales infrastructure to effectively compete for significant advertising revenue. For instance, in 2024, the digital audio advertising market is projected to reach billions, but capturing a meaningful share requires substantial upfront investment in content and distribution, which Audacy already possesses.

- High Barrier to Entry: New entrants must overcome the significant capital and operational investment required to achieve comparable audience reach and sales capabilities.

- Advertising Sales Efficiency: Audacy's scale enables more efficient ad sales processes and potentially lower per-advertiser acquisition costs.

- Content Distribution Network: The existing network of broadcast and digital platforms provides a cost-effective means to distribute content widely, a cost new entrants would need to replicate.

- Economies of Scale in Advertising: Larger audience reach translates into greater pricing power and attractiveness for advertisers, creating a competitive advantage for Audacy.

The threat of new entrants for Audacy is moderate, primarily due to the high capital requirements and regulatory hurdles in traditional broadcasting, contrasted with the low barriers in digital audio. While established brand recognition and advertiser relationships offer a strong defense, the digital space remains susceptible to new, agile competitors.

New entrants face significant challenges in traditional radio due to the immense cost of broadcast licenses and infrastructure, making it difficult to compete with established players like Audacy. In the digital realm, however, lower entry costs mean a constant flow of new content creators, intensifying competition for audience attention and advertising revenue.

Audacy's substantial economies of scale in advertising sales and content distribution create a significant barrier for newcomers. Replicating Audacy's reach and sales infrastructure requires considerable investment, particularly in the competitive digital audio advertising market of 2024.

| Factor | Impact on New Entrants | Audacy's Advantage |

|---|---|---|

| Capital Requirements (Traditional Radio) | Very High | Established Infrastructure & Licenses |

| Regulatory Environment | Complex & Restrictive | Navigated Expertise |

| Digital Entry Costs | Low | Constant Influx of Competition |

| Brand Recognition & Relationships | Low | Decades of Trust & Advertiser Partnerships |

| Content Acquisition Costs | Very High | Financial Clout for Exclusive Rights |

| Economies of Scale | Low | Efficient Ad Sales & Broad Reach (170M monthly listeners in 2024) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Audacy is built upon a foundation of publicly available data, including Audacy's annual reports and SEC filings, alongside industry-specific research from leading media and advertising trade publications.