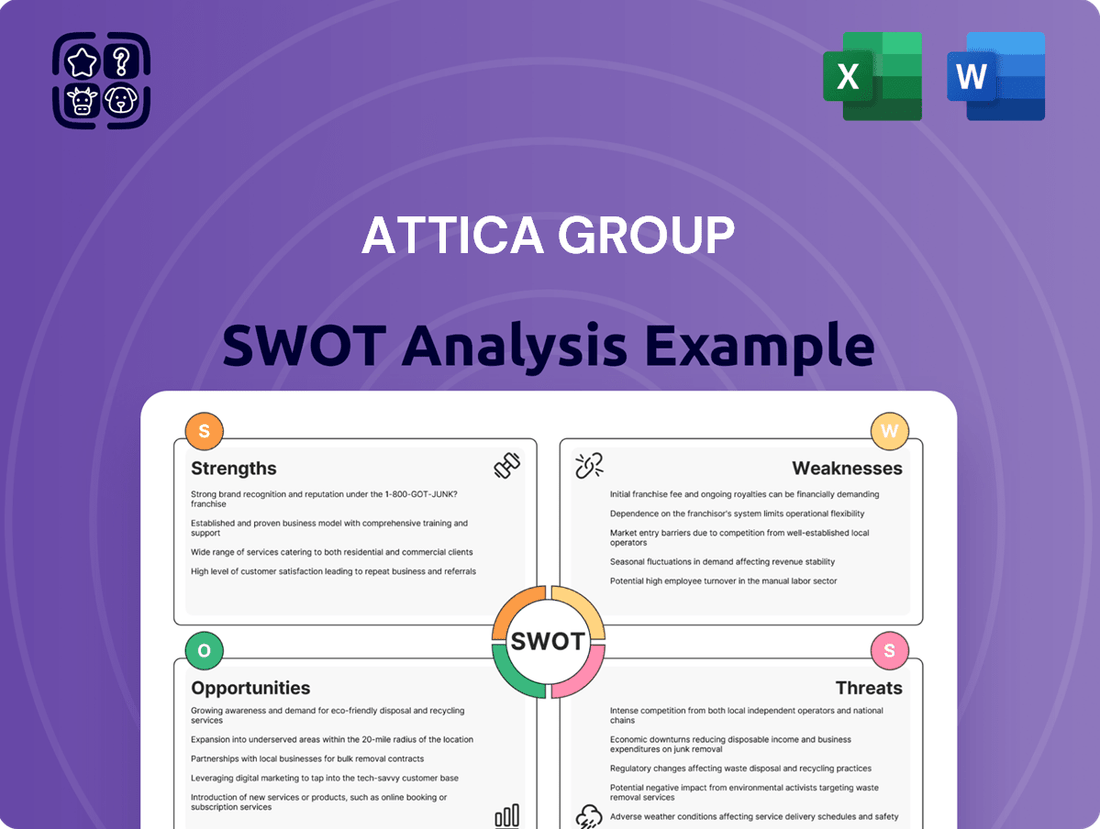

Attica Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Attica Group Bundle

Attica Group's strengths lie in its established brand and robust ferry network, but it faces challenges from increasing competition and fluctuating fuel costs. Understanding these dynamics is crucial for any investor or strategist looking to navigate the maritime sector.

Want the full story behind Attica Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Attica Group solidified its market leadership in the Eastern Mediterranean passenger shipping sector following the December 2023 full integration of ANEK Lines. This strategic move has propelled the company to become one of the largest global operators of Ro-Pax vessels, measured by passenger capacity, with the combined entity now boasting a significant presence.

The expanded network, bolstered by the ANEK Lines acquisition, now offers extensive connectivity between mainland Greece and a multitude of Greek islands, alongside crucial international routes in the Adriatic Sea. This broad reach is further amplified by operating under highly recognized brands such as Superfast Ferries, Blue Star Ferries, Hellenic Seaways, and now ANEK Lines, ensuring strong brand recognition and customer loyalty across its services.

Attica Group showcased exceptional financial strength in 2024, achieving record revenues of €747.8 million. This impressive 27% year-over-year growth was significantly bolstered by the successful integration of ANEK, highlighting strategic execution and synergy realization.

The company's operational performance in 2024 was equally robust, with substantial increases across key metrics. Passenger numbers rose by 12.3%, private vehicle transport grew by 25%, and freight unit volumes surged by 26.2%. These figures underscore strong market demand and Attica Group's ability to effectively meet it.

Attica Group boasts a modern and diverse fleet of 42 vessels, encompassing conventional Ro-Pax, high-speed ferries, and Ro-Ro carriers. A significant strength is that the majority of these vessels are owned outright by the Group, providing greater financial flexibility and control.

The company is proactively investing in fleet renewal and environmental sustainability. This is evident in their acquisition of new, eco-friendly vessels like the E-Flexer series, which are designed to be methanol and battery-ready. These advancements are projected to slash greenhouse gas emissions by an impressive 60% when compared to their current fleet.

Strategic Investments and Diversification

Attica Group is actively pursuing strategic investments, notably enhancing its fleet with modern, eco-friendly vessels and embracing digital transformation. This proactive approach is designed to improve operational efficiency and customer experience.

A key aspect of their strategy involves diversification into complementary sectors, exemplified by their expansion into hospitality. The acquisition of a second hotel complex in Naxos during the first half of 2024 underscores this commitment, aiming to generate new revenue streams and bolster their overall market presence.

- Fleet Renewal: Investments in new, more sustainable vessels.

- Digitalization: Enhancing operational efficiency through technology.

- Hospitality Expansion: Acquisition of a second hotel in Naxos in H1 2024.

- Diversification Goal: Strengthening competitive position and ensuring sustainable growth.

Commitment to Sustainability and ESG

Attica Group showcases a robust dedication to Environmental, Social, and Governance (ESG) factors, evidenced by its consistent publication of Responsibility & Sustainability Reports. This commitment is translating into tangible actions for a greener future.

The company is actively pursuing a green transition, as seen in the installation of scrubbers and energy-saving devices across its fleet. Furthermore, Attica Group is strategically planning for future vessel acquisitions to be methanol and battery-ready, anticipating industry shifts and regulatory demands.

- ESG Reporting: Regular publication of Responsibility & Sustainability Reports highlights Attica Group's transparency and commitment to ESG principles.

- Green Transition Initiatives: Investment in scrubbers and energy-saving devices demonstrates a proactive approach to reducing environmental impact.

- Future-Ready Fleet: Plans for methanol and battery-ready new vessels position the company to meet evolving environmental standards and customer preferences.

- Operational Efficiency: These initiatives are designed to optimize vessel performance while significantly reducing the company's environmental footprint.

Attica Group's strengths are highlighted by its market leadership in the Eastern Mediterranean, significantly boosted by the 2023 ANEK Lines integration. This expansion makes it a major global Ro-Pax operator. The company achieved record 2024 revenues of €747.8 million, a 27% increase, driven by strong operational performance with passenger numbers up 12.3% and freight volumes up 26.2%.

A key strength is its modern, largely owned fleet of 42 vessels, coupled with a strategic focus on fleet renewal with eco-friendly, methanol and battery-ready vessels. This commitment to sustainability, evidenced by ESG reporting and investments in green technology, positions Attica Group for future growth and regulatory compliance.

The company is also diversifying into hospitality, acquiring a second hotel in Naxos in H1 2024, which aims to create new revenue streams and enhance its overall market presence.

Attica Group's brand portfolio, including Superfast Ferries, Blue Star Ferries, Hellenic Seaways, and ANEK Lines, provides strong customer recognition and loyalty.

What is included in the product

Delivers a strategic overview of Attica Group’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable roadmap by highlighting Attica Group's competitive advantages and areas for improvement.

Weaknesses

While the merger with ANEK Lines significantly increased Attica Group's revenue, it also brought substantial non-recurring expenses. In 2024, these costs amounted to €28.2 million, covering integration, employee exits, fleet improvements, and training.

These integration costs directly affected the company's bottom line. Consolidated earnings after tax saw a sharp decline, dropping to €17.5 million in 2024 compared to €61.2 million in the previous year, highlighting the immediate profitability impact of the merger.

Attica Group's profitability is significantly impacted by fluctuating fuel prices, a critical component of its operating expenses. This exposure creates a vulnerability to market volatility.

Furthermore, the implementation of the European Union Emissions Trading System (EU ETS) on January 1, 2024, introduces additional costs. In 2024, the company incurred €18.9 million for emission allowances, directly increasing its overhead.

The first half of 2024 also saw operating costs rise due to higher average fuel prices, compounding the financial pressure from these environmental regulations.

Attica Group's operations are significantly influenced by the seasonal nature of passenger shipping, especially on its core Greek domestic routes. Peak demand typically falls between July and September, with a noticeable downturn from November through February. This creates inherent revenue volatility, demanding careful financial planning and resource allocation to navigate the less busy months effectively.

High Investment Outflows

Attica Group's ambitious fleet renewal, green transition, and digitization initiatives necessitate significant capital expenditure. In 2024 alone, the company projects investment cash outflows totaling €162 million. While these investments are vital for future competitiveness and sustainability, they represent a substantial drain on current liquidity and cash reserves.

This high level of investment, though strategically sound for long-term benefits, presents a short-to-medium term weakness by potentially straining the company's financial flexibility. The sheer scale of these outflows could impact the group's ability to respond to unforeseen market challenges or pursue other immediate opportunities without potentially compromising its financial stability.

- Fleet Renewal & Green Transition: €162 million in projected investment cash outflows for 2024.

- Liquidity Pressure: Significant capital deployment can temporarily reduce available cash.

- Short-to-Medium Term Impact: Potential strain on financial flexibility due to extensive investment plans.

Operational Integration Challenges

The full operational integration of ANEK Lines, finalized in December 2023, presents significant challenges for Attica Group. This complex process touches everything from managing the combined fleet and harmonizing human resources to merging IT systems and aligning operational practices. Successful integration is crucial for realizing expected synergies, but the sheer scale of this undertaking means potential disruptions and cultural alignment hurdles are very real concerns.

Attica Group faces the intricate task of weaving ANEK Lines' operations into its own framework. This includes standardizing fleet management protocols and integrating diverse human resource structures, a process that can be lengthy and resource-intensive. The successful merging of disparate IT systems and operational methodologies is paramount to avoid service interruptions and ensure efficiency gains are realized. For instance, the integration of ticketing and booking systems across the combined ferry network is a critical, yet complex, step.

- Fleet Harmonization: Integrating ANEK's fleet into Attica's operational and maintenance schedules requires careful planning to ensure consistent service quality and cost-effectiveness.

- Human Resources Alignment: Merging workforces necessitates addressing differing labor agreements, corporate cultures, and training needs to foster a unified team.

- System Interoperability: Ensuring seamless operation across combined IT infrastructure, including booking platforms and operational management software, is vital for customer experience and efficiency.

Attica Group's profitability is heavily influenced by external factors like fluctuating fuel prices and the cost of complying with new environmental regulations, such as the EU ETS, which added €18.9 million in 2024. The company also faces significant liquidity pressure due to a substantial €162 million projected investment cash outflow in 2024 for fleet renewal and green transition initiatives. Furthermore, the complex integration of ANEK Lines, impacting fleet, human resources, and IT systems, poses operational challenges and potential disruptions.

| Weakness | Description | Financial Impact (2024 Data) |

|---|---|---|

| Integration Costs | Expenses related to the merger with ANEK Lines. | €28.2 million in non-recurring expenses. |

| Fuel Price Volatility | Operating costs are sensitive to changes in fuel prices. | Contributed to higher average operating costs in H1 2024. |

| Environmental Compliance Costs | Costs associated with new emissions regulations. | €18.9 million for emission allowances under EU ETS. |

| Capital Expenditure | High investment needs for fleet renewal and green transition. | €162 million in projected investment cash outflows. |

| Operational Integration Complexity | Challenges in merging ANEK Lines' operations. | Impacts fleet harmonization, HR alignment, and system interoperability. |

Preview the Actual Deliverable

Attica Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Attica Group SWOT analysis, highlighting key Strengths, Weaknesses, Opportunities, and Threats. The full, detailed report is available immediately after purchase.

Opportunities

The ongoing operational integration of ANEK Lines offers significant opportunities for Attica Group to unlock further cost efficiencies. By streamlining operations, rationalizing overlapping routes, and leveraging shared resources like port facilities and maintenance, the combined entity can achieve substantial savings. For instance, a consolidated fleet management strategy can reduce overheads and improve vessel utilization.

Beyond cost reduction, the integration presents avenues for revenue optimization. Attica Group can leverage the combined network to offer more attractive ticketing packages and loyalty programs, potentially increasing passenger and freight volumes. The expanded market presence allows for more targeted marketing campaigns and the development of new service offerings, enhancing overall profitability beyond initial merger-driven revenue growth.

Attica Group's strategic investments in its green transition, including the acquisition of methanol and battery-ready E-Flexer vessels and the implementation of energy-saving devices, are well-timed to align with tightening environmental regulations and growing consumer preference for sustainable maritime travel. For instance, the company's 2023 financial report highlighted a significant portion of its fleet modernization program dedicated to these eco-friendly upgrades.

These forward-thinking initiatives are projected to yield substantial operational efficiencies, primarily through reduced fuel consumption and lower emissions. This not only enhances Attica Group's environmental credentials but also directly translates into cost savings, making its services more competitive and appealing to an increasingly eco-conscious customer base.

Attica Group's strategic move into hospitality, marked by its acquisition of a second hotel complex in Naxos in 2024, presents a significant growth opportunity. This diversification allows the company to create a more comprehensive travel offering, blending its ferry services with accommodation.

By integrating hospitality, Attica Group can enhance customer loyalty and capture a greater portion of the lucrative island tourism market. This expansion into Naxos, a popular Cycladic destination, is projected to contribute to increased revenue streams beyond its core ferry operations.

Growth in Greek Tourism and Freight Transport

Greece's ongoing economic rebound and a booming tourism industry create a fertile ground for Attica Group's primary operations. The sustained influx of tourists and vehicles, coupled with a steady demand for freight services connecting the Greek islands and international routes, presents substantial avenues for expansion.

In 2023, Greece welcomed a record 32 million tourists, a significant increase from previous years, driving demand for ferry services. This trend is expected to continue into 2024 and 2025, directly benefiting Attica Group's passenger and vehicle transport segments.

Key opportunities include:

- Expanding capacity to meet rising tourist numbers: Attica Group can leverage the projected 5% annual growth in Greek tourism through 2025 by increasing ferry frequencies and potentially adding new routes.

- Capitalizing on increased freight volumes: The growth in e-commerce and inter-island trade, with freight volumes to the Cyclades alone seeing a 7% year-over-year increase in early 2024, offers Attica Group opportunities to enhance its cargo services.

- Developing premium offerings: As disposable incomes rise with economic recovery, there's potential to introduce and market higher-yield premium services for both passengers and freight.

Digital Transformation and Service Enhancement

Attica Group's commitment to digital transformation is a significant opportunity. By continuing to digitize operations, from online booking systems to onboard services, the company can streamline processes and offer a more engaging customer experience. This digital push, for instance, aims to attract a broader audience and potentially lower operational overheads through increased efficiency.

The Group's ongoing digital initiatives are designed to unlock new revenue streams and improve customer loyalty. For example, enhancing digital platforms can lead to better data collection for personalized marketing and service improvements. This strategic focus is crucial for staying competitive in the evolving travel industry, where digital integration is becoming a key differentiator.

Attica Group is actively investing in digital solutions to optimize its fleet management and route planning. This includes advanced analytics for fuel efficiency and predictive maintenance, which can contribute to cost savings and more reliable service delivery. Such advancements are vital for maintaining profitability and operational excellence in the current market climate.

- Digital Platforms: Continued development of user-friendly online booking and information portals.

- Onboard Services: Integration of digital payment, entertainment, and connectivity options for passengers.

- Operational Efficiency: Leveraging data analytics for optimized scheduling, route planning, and maintenance.

- Customer Engagement: Utilizing digital channels for personalized offers, feedback collection, and loyalty programs.

Attica Group is poised to benefit from Greece's robust tourism sector, with projections indicating continued growth. In 2023, Greece welcomed a record 32 million tourists, a figure expected to rise further into 2024 and 2025, directly boosting passenger and freight demand for Attica's ferry services. This upward trend presents a clear opportunity to expand capacity and enhance service offerings to cater to the increasing number of travelers and the associated rise in cargo volumes. The company can strategically increase ferry frequencies and explore new routes to capitalize on this sustained demand, ensuring it captures a larger share of the market.

The ongoing integration of ANEK Lines offers substantial opportunities for cost efficiencies and revenue optimization. Streamlining operations, rationalizing routes, and leveraging shared resources can lead to significant savings. For instance, a consolidated fleet management strategy can reduce overheads and improve vessel utilization. Furthermore, the combined network allows for more attractive ticketing packages and loyalty programs, potentially increasing passenger and freight volumes and enhancing overall profitability.

Attica Group's strategic investments in its green transition, including eco-friendly vessel upgrades, align with increasing environmental regulations and consumer preferences. These initiatives are projected to yield operational efficiencies through reduced fuel consumption and lower emissions, enhancing the company's environmental credentials and making its services more competitive. The Group's diversification into hospitality, with the acquisition of a second hotel complex in Naxos in 2024, also presents a significant growth opportunity, allowing for a more comprehensive travel offering and increased revenue streams beyond core ferry operations.

Digital transformation is another key opportunity for Attica Group. By digitizing operations, from online booking systems to onboard services, the company can streamline processes, offer a more engaging customer experience, and unlock new revenue streams. Enhancing digital platforms can lead to better data collection for personalized marketing and service improvements, crucial for staying competitive in the evolving travel industry.

| Opportunity Area | Description | Supporting Data/Projections (2023-2025) |

|---|---|---|

| Tourism Growth | Capitalize on increasing tourist arrivals in Greece. | Record 32 million tourists in 2023; projected continued growth in 2024-2025. |

| ANEK Integration | Achieve cost efficiencies and revenue synergy. | Streamlining operations, rationalizing routes, shared resources. |

| Green Transition | Leverage eco-friendly investments. | Acquisition of methanol/battery-ready vessels; reduced fuel consumption and emissions. |

| Hospitality Expansion | Diversify revenue streams through hotels. | Acquisition of second hotel complex in Naxos (2024); capturing island tourism market. |

| Digital Transformation | Enhance customer experience and operational efficiency. | Digitizing booking, onboard services, and operational planning; data analytics for optimization. |

Threats

The Eastern Mediterranean passenger shipping sector is undeniably competitive. Attica Group, while a dominant player, faces the constant threat of new companies entering the market or existing rivals employing more aggressive tactics. This dynamic could erode Attica Group's market share and its ability to set competitive prices.

To counter this, Attica Group must remain committed to innovation and differentiating its services. For instance, in 2024, the company continued to invest in modernizing its fleet and enhancing onboard passenger experiences, aiming to provide superior value compared to competitors. This focus on differentiation is crucial for maintaining its strong market position.

Attica Group's substantial reliance on tourism makes it vulnerable to shifts in travel patterns. For instance, the Greek tourism sector, a key market for Attica, experienced a robust recovery in 2023, with arrivals exceeding pre-pandemic levels, but the ongoing global economic climate presents a persistent threat to sustained demand.

Economic downturns, geopolitical tensions, or unexpected events like pandemics can severely curtail tourism, directly impacting passenger and vehicle volumes for Attica. This can lead to a noticeable dip in revenue and profitability, as seen in periods of global uncertainty affecting travel confidence.

Beyond the volatility of fuel prices and the EU Emissions Trading System (ETS), Attica Group faces increasing operating costs. Crew wages, essential maintenance, and rising port fees are all contributing factors that could squeeze profit margins. For instance, in 2023, the company reported that operating expenses, excluding fuel, saw an upward trend due to inflation impacting various service and supply costs.

Furthermore, the intensifying regulatory landscape, particularly concerning environmental standards, presents a significant threat. Stricter emissions targets and upcoming regulations necessitate substantial capital expenditure for fleet modernization and the adoption of cleaner technologies. Failure to comply or adapt swiftly could lead to penalties and a competitive disadvantage.

Infrastructure and Port Limitations

Despite ongoing infrastructure improvements in the Attica region, existing limitations in port facilities and potential delays in development projects pose a threat to Attica Group's ferry operations. Congestion or inefficiencies at key ports could directly impact sailing schedules, potentially leading to operational disruptions and a decline in customer satisfaction due to delays. For instance, while the Piraeus Port Authority has seen investments, the sheer volume of traffic, including a projected 10% increase in container throughput for 2024, can still strain capacity during peak seasons.

These infrastructure constraints can translate into tangible financial impacts. Delays can increase fuel consumption and crew costs, while a reputation for unreliability might deter passengers and cargo. Attica Group's reliance on efficient port turnaround times means that any bottleneck, such as those experienced during periods of high seasonal demand where port congestion can add 15-20 minutes to berthing times, directly affects profitability and competitive standing.

- Port Congestion: Increased ferry traffic and cargo volumes can lead to longer waiting times for vessels, impacting schedules.

- Development Delays: Slowdowns in planned port upgrades or new terminal constructions could hinder operational efficiency.

- Operational Costs: Delays caused by infrastructure issues can escalate fuel, crew, and maintenance expenses.

- Customer Dissatisfaction: Inconsistent punctuality due to port limitations can negatively affect passenger experience and loyalty.

Environmental and Climate-Related Risks

Attica Group, like all players in the maritime sector, faces significant environmental and climate-related risks. Extreme weather events, amplified by climate change, pose a direct threat to vessel safety and can cause substantial disruptions to sailing schedules, leading to increased operational costs and potential revenue loss. For instance, the increasing frequency of severe storms in key shipping lanes can necessitate rerouting or temporary service suspensions.

The industry is under mounting pressure to decarbonize its operations. This is driven by both public opinion and increasingly stringent regulations. Attica Group must anticipate and adapt to these demands, which could necessitate accelerated investment in cleaner fuels and more efficient vessel technologies. This transition might require capital expenditures exceeding current projections, impacting profitability if not managed proactively. For example, the International Maritime Organization (IMO) 2023 GHG Strategy aims to reach net-zero GHG emissions by or around 2050, a target that will require substantial fleet upgrades and operational shifts across the industry.

- Increased operational costs due to extreme weather disruptions.

- Accelerated investment needs for decarbonization technologies and alternative fuels.

- Potential for regulatory penalties or market disadvantages for slower adopters of green shipping practices.

- Reputational damage if environmental commitments are not met.

Attica Group faces intense competition from both established rivals and potential new entrants, threatening market share and pricing power. Its heavy reliance on tourism makes it vulnerable to economic downturns and shifts in travel demand, as evidenced by the sensitivity of travel patterns to global economic conditions. Rising operating costs, including crew wages and maintenance, coupled with stricter environmental regulations requiring significant capital investment for fleet modernization, further pressure profit margins.

| Threat Category | Specific Threat | Impact on Attica Group | 2024/2025 Data/Context |

|---|---|---|---|

| Competition | New market entrants or aggressive tactics by existing rivals | Erosion of market share, reduced pricing power | Continued robust demand in Eastern Mediterranean routes, attracting potential new players. |

| Market Dependence | Vulnerability to tourism sector fluctuations | Reduced passenger and vehicle volumes, impacting revenue | Global economic uncertainty in 2024 could temper travel spending, despite strong post-pandemic recovery in 2023. |

| Operating Costs | Increasing costs for wages, maintenance, and port fees | Squeezed profit margins | Inflationary pressures in 2023 and 2024 continue to drive up general operating expenses beyond fuel. |

| Regulatory Environment | Stricter environmental regulations (e.g., emissions targets) | Need for substantial capital expenditure on fleet upgrades, potential penalties for non-compliance | IMO 2023 GHG Strategy targets net-zero emissions by 2050, requiring accelerated adoption of cleaner technologies. |

SWOT Analysis Data Sources

This Attica Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary. These reliable sources ensure a data-driven and accurate assessment of the company's strategic position.