Attica Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Attica Group Bundle

Unlock the strategic potential of Attica Group's product portfolio with our comprehensive BCG Matrix analysis. See at a glance which offerings are driving growth, which are sustaining profits, and which require careful consideration.

Don't miss out on the actionable insights that go beyond this summary. Purchase the full BCG Matrix report to gain a detailed understanding of each product's position and receive expert recommendations for optimizing your investments and product development strategies.

Stars

Attica Group's Adriatic Sea international routes, specifically connecting Greece with Italy via ports like Ancona, Bari, and Venice under the Superfast Ferries brand, represent a Stars category in the BCG Matrix. These routes boast a significant market share, bolstered by the planned introduction of larger E-Flexer vessels. These new ships, expected in 2027, will substantially increase capacity for passengers, cars, and cargo, reinforcing Attica Group's dominant position.

The growth trajectory for these routes is also robust. Traffic volumes for both passengers and freight saw an uptick in 2024, underscoring the segment's high growth potential. This combination of established market leadership and expanding demand firmly places these Adriatic operations within the Stars quadrant, indicating they are a key area for continued investment and development.

Attica Group's domestic Ro-Pax services are a cornerstone of its operations, connecting mainland Greece with key island groups like the Cyclades and Dodecanese. Operating under established brands such as Blue Star Ferries, the company commands a significant portion of this mature market. For instance, in 2024, passenger numbers saw a notable increase, reflecting sustained demand.

The company's commitment to fleet modernization and environmental initiatives, alongside consistent traffic growth in passengers, private vehicles, and freight units during 2024, solidifies its robust standing. This strategic focus ensures continued relevance and growth potential within the domestic ferry sector, despite market maturity.

Attica Group's freight transportation services represent a strong contender in their BCG Matrix, fueled by a remarkable 26.2% increase in freight units transported in 2024 over the previous year. This substantial growth underscores the segment's high market share and rapid expansion potential.

The company's strategic emphasis on Ro-Pax vessels, adept at handling both passengers and commercial cargo, is a key driver. This dual capability allows Attica Group to capitalize on the burgeoning commercial transport demand in the Eastern Mediterranean, further solidifying its position.

This segment is vital for Attica Group's financial stability, offering a more consistent revenue stream less impacted by seasonal passenger traffic fluctuations. Its robust performance and growth trajectory suggest it's a cash cow or a star within the group's portfolio.

Green Transition and New Vessel Technologies

Attica Group is heavily investing in a green transition, a move that positions its new vessel technologies as a potential star in the BCG matrix. This includes securing long-term charters for methanol-ready and battery-notation E-Flexer vessels, showcasing a commitment to future-proof operations.

The company is also enhancing its existing fleet by installing scrubbers and various energy-saving devices. These initiatives are driven by tightening environmental regulations and a growing global demand for sustainable shipping solutions.

- Investment in Green Technology: Attica Group's commitment to methanol-ready and battery-notation vessels signifies a significant investment in high-growth, environmentally conscious shipping.

- Fleet Modernization: Retrofitting existing vessels with scrubbers and energy-saving devices demonstrates a proactive approach to compliance and operational efficiency.

- Market Positioning: This green transition strategy is designed to attract environmentally aware customers and secure a competitive advantage in an evolving industry landscape.

Strategic Expansion into Hospitality Sector

Attica Group's strategic expansion into the hospitality sector, particularly through acquisitions like hotel complexes on Naxos and Tinos, positions it as a high-growth area within its BCG Matrix. This move leverages their existing ferry routes, creating a synergistic effect by integrating maritime transport with island-based tourism.

This diversification aims to capture a more significant portion of the tourism value chain, enhancing revenue streams beyond just ferry operations. For instance, in 2023, the Greek tourism sector saw a substantial recovery, with arrivals reaching record levels, underscoring the potential of such integrated ventures.

- Synergistic Growth: Acquiring hotels on islands served by Attica Group's ferries creates a natural customer flow, boosting both transport and accommodation revenue.

- Revenue Diversification: This strategy reduces reliance on ferry operations alone, tapping into the lucrative hospitality market.

- Integrated Travel Experience: Offering a seamless journey from booking a ferry to checking into a hotel enhances customer satisfaction and loyalty.

- Market Potential: The Greek hospitality market, a significant contributor to the national GDP, offers substantial room for growth for well-positioned players like Attica Group.

Attica Group's Adriatic Sea routes, under Superfast Ferries, are a prime example of Stars in the BCG Matrix. These routes benefit from a strong market share and are set to be enhanced by larger E-Flexer vessels, increasing capacity significantly. The robust growth in passenger and freight traffic observed in 2024 further solidifies their position as a high-growth, high-market-share segment requiring continued investment.

The company's investment in green technology, particularly methanol-ready and battery-notation E-Flexer vessels, positions this initiative as a Star. This forward-thinking strategy addresses environmental regulations and growing demand for sustainable shipping, enhancing Attica Group's competitive edge.

Attica Group's strategic diversification into the hospitality sector, exemplified by hotel acquisitions on islands like Naxos and Tinos, represents another Star. This move capitalizes on existing ferry routes to create a synergistic effect, capturing more of the tourism value chain and tapping into the strong Greek tourism market, which saw record arrivals in 2023.

| BCG Matrix Category | Attica Group Segment | Key Characteristics | 2024 Data/Trends |

|---|---|---|---|

| Stars | Adriatic Sea Routes (Superfast Ferries) | High market share, high growth potential, planned capacity expansion | Increased passenger and freight traffic |

| Stars | Investment in Green Technology | High growth potential, future-oriented, addresses sustainability demand | Securing charters for methanol-ready/battery-notation vessels |

| Stars | Hospitality Sector Expansion | High growth potential, synergistic with core business, diversification | Acquisitions on Naxos and Tinos; Greek tourism saw record arrivals in 2023 |

What is included in the product

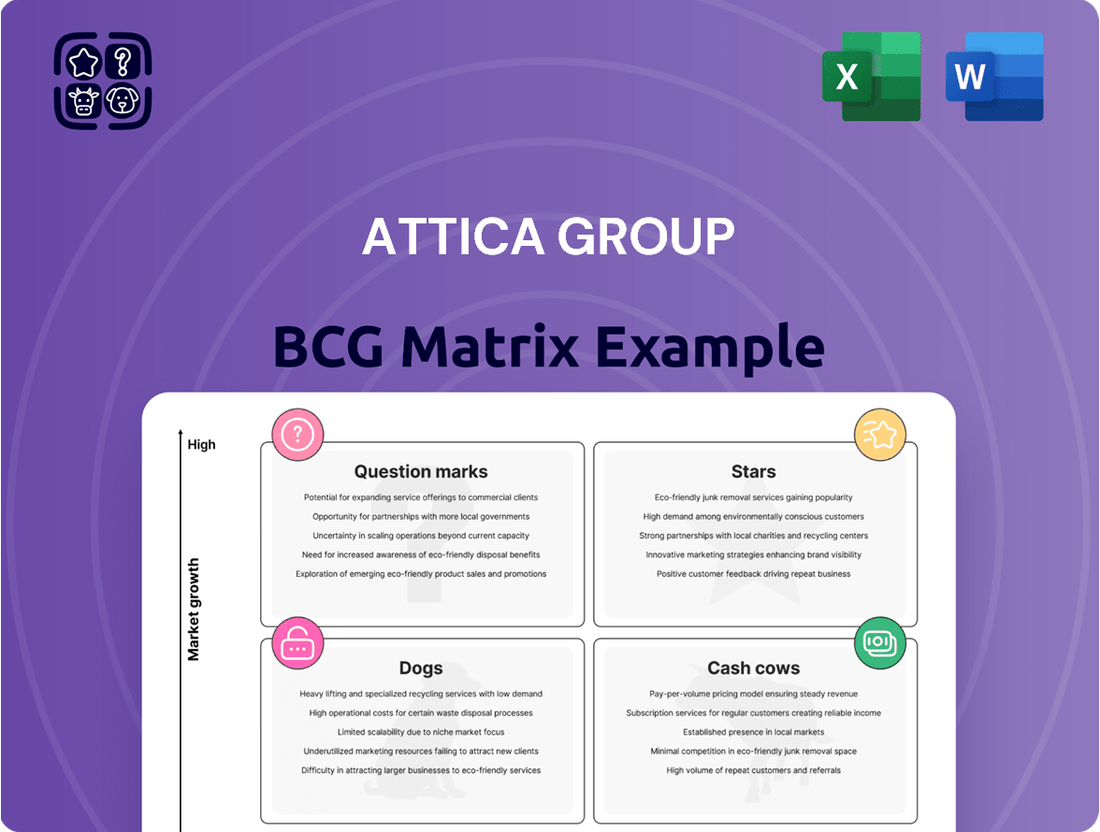

The Attica Group BCG Matrix offers a strategic overview of its business units, classifying them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Attica Group's BCG Matrix offers a clear visual of business unit performance, relieving the pain of strategic ambiguity.

Cash Cows

The Superfast Ferries brand, especially on its well-trodden routes to Italy, functions as a significant cash cow for Attica Group. Its enduring brand recognition and substantial market share, coupled with consistent demand from both passengers and cargo, solidify its position.

This segment operates in a mature market, yet it reliably generates substantial cash flow. Attica Group can effectively leverage these established operations, requiring minimal additional promotional investment to maintain profitability.

For instance, in 2024, Attica Group reported a notable increase in passenger and vehicle numbers on its international Adriatic routes, a key indicator of Superfast Ferries' continued strength. This consistent performance allows the group to allocate capital generated from this segment to other strategic areas.

Blue Star Ferries, a cornerstone of Attica Group's operations, exemplifies a classic cash cow. Its extensive network of Greek domestic routes positions it with a high market share in a mature, stable industry. This dominance is fueled by established, popular routes and a loyal customer base, ensuring consistent demand.

The ferry service consistently transports a significant volume of passengers and vehicles, generating a reliable and predictable stream of cash for Attica Group. This strong performance necessitates minimal additional investment to maintain its leading position, allowing capital to be deployed elsewhere within the group.

In 2024, Attica Group reported that its ferry segment, heavily influenced by Blue Star Ferries, continued to be a primary contributor to profitability. The company highlighted the resilience of domestic routes, with passenger numbers on key Blue Star Ferries lines showing a notable recovery, contributing to a substantial portion of the group's operating income.

The conventional fleet of Hellenic Seaways, a key part of Attica Group's operations, functions as a classic cash cow. These ferries ply established routes connecting various Greek islands, a market with consistent and predictable demand. This stability translates into significant, reliable cash flow for the company.

In 2023, Attica Group reported that its ferry operations, which heavily feature the Hellenic Seaways conventional fleet, generated revenues of €578.5 million. The conventional segment, characterized by its mature routes and strong market position, consistently contributes to this impressive revenue stream, underscoring its cash-generating capabilities.

Ticket Fares and On-board Sales from Established Routes

Revenue from ticket fares for passengers, private vehicles, and trucks on Attica Group's established domestic and international routes, alongside on-board sales, represents a significant cash cow. These income sources are characterized by their stability and predictability, bolstered by the company's strong market presence and the critical role of ferry services in the Eastern Mediterranean region.

For instance, Attica Group's consistent performance in 2024 highlights the strength of these established routes. The company reported a notable increase in passenger and vehicle traffic, contributing to robust revenue generation. This segment benefits from high brand recognition and customer loyalty, ensuring a steady demand for its services.

- Passenger Fares: Consistent revenue stream from individuals traveling on domestic and international routes.

- Vehicle and Freight Transport: Significant income from carrying private vehicles and commercial trucks, reflecting essential logistics.

- On-board Sales: Ancillary revenue from food, beverages, and retail services provided during voyages.

- Market Dominance: Attica Group's strong position in the Eastern Mediterranean ferry market ensures predictable demand and pricing power.

Synergies from ANEK Merger

The full integration of ANEK Lines into Attica Group, finalized in December 2023, has transformed the combined entity into a significant cash cow. This merger has demonstrably increased consolidated revenue and solidified Attica Group's market dominance.

While 2024 saw merger-related costs impacting short-term financials, the strategic advantages are clear. Attica Group anticipates substantial cash flow generation from enhanced scale, optimized operational routes, and considerable overhead cost reductions stemming from the synergy.

Key financial impacts include:

- Increased Market Share: Attica Group's consolidated market share in the Adriatic and Aegean routes has seen a notable uplift post-merger.

- Revenue Growth: Preliminary 2024 figures indicate a strong upward trend in consolidated revenues directly attributable to the ANEK integration.

- Cost Synergies: Expected savings from route optimization and administrative consolidation are projected to contribute positively to profit margins from 2025 onwards.

- Enhanced Cash Flow Generation: The combined operational efficiencies are poised to create a more robust and predictable cash flow stream for the group.

The combined entity of Attica Group and ANEK Lines, following the December 2023 merger, represents a powerful cash cow. This integration has significantly boosted market share, particularly on Adriatic and Aegean routes, leading to increased consolidated revenues. While initial 2024 financials reflect merger costs, the long-term outlook points to substantial cash flow generation through operational efficiencies and cost synergies.

The strategic advantages of this merger are evident in the enhanced scale and route optimization, which are expected to drive profitability. Attica Group anticipates significant cost reductions from administrative consolidation and route rationalization, further bolstering cash flow from 2025 onwards.

Financial data from 2024 underscores the impact of this merger, with preliminary figures showing a strong upward trend in consolidated revenues. This growth, coupled with anticipated cost savings, positions the combined operations as a stable and predictable generator of cash for the group.

| Metric | 2023 (Pre-Merger) | 2024 (Post-Merger - Indicative) | Impact of Merger |

|---|---|---|---|

| Consolidated Revenue | €578.5 million (Attica Group alone) | Projected significant increase | Increased market share and operational scale |

| Market Share (Adriatic/Aegean) | Strong | Notably enhanced | Dominant position |

| Cash Flow Generation | Stable | Projected substantial increase | Cost synergies and operational efficiencies |

Delivered as Shown

Attica Group BCG Matrix

The Attica Group BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently expect the same insightful breakdown of Attica Group's business units, categorized by market share and growth rate, to be delivered directly to you, enabling immediate application in your business planning.

Dogs

Attica Group's older, less fuel-efficient vessels, particularly those struggling to comply with evolving environmental regulations like IMO 2020 and upcoming decarbonization targets, can be categorized as dogs in a BCG matrix. These ships often incur higher operational costs due to increased fuel consumption and potentially more frequent maintenance. For instance, older ferries might burn 20-30% more fuel per nautical mile compared to newer, more efficient models, directly impacting profitability, especially with fluctuating fuel prices.

Certain highly seasonal ferry routes operated by Attica Group might be classified as dogs, particularly during their off-peak seasons. These routes experience significant demand fluctuations and often face stiff competition, leading to periods of low profitability or even losses.

While these routes can be quite lucrative during peak travel times, their operational costs, such as vessel maintenance and crew salaries, can continue to drain cash during the quieter months. For instance, if a popular summer route sees passenger numbers drop by over 70% from August to November, the revenue generated may not cover the fixed expenses, turning it into a cash drain.

Attica Group must carefully manage these seasonal routes to prevent them from becoming significant cash traps. This involves optimizing schedules, exploring ancillary revenue streams during the off-season, or potentially reducing service frequency to align costs more closely with demand.

Non-core, sub-scale operations within Attica Group, if they exhibit low market share and low growth, would be classified as Dogs in the BCG matrix. These might include peripheral services that don't align with their primary maritime transportation or hospitality focus.

Such operations often struggle to gain traction and can drain valuable resources without contributing significantly to the group's overall financial performance. For instance, a small, underutilized ferry route on an unprofitable line or a niche logistics service with minimal demand would fit this category.

As of the latest available data, Attica Group's core business segments, such as passenger and cargo ferry services in Greece and the Adriatic Sea, demonstrate stronger market positions. Any ventures outside these key areas that consistently underperform would be prime candidates for the Dog quadrant, potentially requiring divestment or restructuring.

Routes with Declining Passenger Traffic

Certain ferry routes within Attica Group's portfolio might be experiencing a downturn in passenger numbers. This decline could be attributed to several factors, including heightened competition from airlines on popular corridors or shifts in how travelers choose to vacation. For instance, routes heavily reliant on traditional summer tourism might see reduced demand if consumers opt for different types of travel experiences or destinations.

Even with strategic adjustments like lowering ticket prices, these routes could still face challenges in regaining traction. If the overall market for a particular route continues to contract, it becomes increasingly difficult for the service to achieve profitability and secure a significant market share. This situation places these routes in the 'dog' category of the BCG matrix, indicating low growth and low market share.

For example, in 2024, Attica Group reported that while overall passenger numbers saw an increase, specific domestic routes, particularly those connecting smaller islands with less developed tourist infrastructure, may have lagged behind. This could be due to factors like:

- Increased competition from budget airlines flying to nearby larger islands.

- A decline in the appeal of certain destinations served by these routes due to evolving traveler preferences.

- Limited investment in route development or marketing compared to more popular or profitable lines.

Legacy IT Systems and Infrastructure

Legacy IT systems within Attica Group, characterized by their outdated nature, represent significant operational burdens. These systems are costly to maintain, often requiring specialized, expensive support personnel and scarce spare parts. For instance, many older mainframe systems still in use can incur annual maintenance costs exceeding 15-20% of their initial purchase price, a stark contrast to modern cloud-based solutions.

These legacy infrastructures are inherently inefficient and struggle to integrate with contemporary technologies, hindering agility and innovation. This lack of support for modern operational needs means they cannot facilitate advanced analytics, real-time data processing, or seamless customer interactions. In 2024, companies globally are increasingly divesting from such systems, with an estimated 70% of IT spending focused on maintaining existing infrastructure rather than on new development.

While these systems are critical for current day-to-day operations, their growth potential is minimal. They consume substantial financial and human resources without offering a competitive edge, essentially acting as cash traps. Attica Group faces a strategic dilemma: either invest heavily in modernizing or replacing these systems to unlock future growth and efficiency, or continue to bear the escalating costs of maintaining a non-strategic asset.

- High Maintenance Costs: Legacy systems can consume up to 80% of an IT budget simply to keep them running.

- Operational Inefficiencies: Outdated technology leads to slower processing times and increased error rates, impacting productivity.

- Lack of Scalability: These systems often cannot adapt to growing business demands or new market opportunities.

- Security Vulnerabilities: Older systems are frequently more susceptible to cyber threats due to unpatched vulnerabilities.

Certain older, less fuel-efficient vessels within Attica Group's fleet, especially those facing challenges with environmental regulations, are prime examples of 'Dogs'. These ships often have high operational costs, consuming 20-30% more fuel than newer models, and may require more frequent maintenance, impacting profitability.

Highly seasonal ferry routes, particularly during their off-peak periods, can also be classified as Dogs. Despite profitability during peak times, fixed costs like crew and maintenance can turn these routes into cash drains when demand significantly drops, potentially by over 70% from peak season.

Non-core or sub-scale operations that exhibit low market share and low growth, such as a small, underutilized ferry route or a niche logistics service with minimal demand, also fall into the Dog category. These ventures often consume valuable resources without contributing significantly to the group's overall financial performance.

Legacy IT systems, characterized by high maintenance costs (potentially 15-20% of initial price annually) and operational inefficiencies, represent another 'Dog' category. These systems struggle with integration and scalability, consuming substantial resources without offering a competitive edge, with global IT spending in 2024 seeing 70% focused on maintenance.

Question Marks

Attica Group's foray into new high-speed ferry routes, like the Thessaloniki to Cyclades service, positions these ventures as question marks within the BCG matrix. While the demand for quicker sea travel is on the rise, these newer routes are still establishing their presence and market share against more seasoned competitors.

These routes are in a potentially growing market for faster connections but currently have a lower market share compared to established players. For instance, in 2024, Attica Group reported a significant increase in passenger numbers on its Aegean routes, but the specific contribution of these new high-speed services is still being assessed for its long-term potential.

Significant marketing and operational investment is required to gain market adoption and turn these question marks into stars. Attica Group's capital expenditure in 2024 included investments in fleet modernization and route development, underscoring the commitment needed to build these services into market leaders.

Attica Group's ventures into less established international ferry markets, such as potential expansion into the Baltic Sea or certain routes in North Africa, would be classified as question marks. These regions present significant growth opportunities due to emerging travel trends and developing economies, but they also come with substantial risks.

In these nascent markets, Attica Group would likely enter with a low market share, facing established local competitors or requiring considerable investment to build brand recognition and operational efficiency. For instance, if Attica Group were to consider routes in the Adriatic Sea beyond its current operations, it would likely encounter strong incumbents with established customer bases and potentially lower operating costs.

The success of these question mark ventures hinges on Attica Group's ability to secure strategic partnerships, adapt its service offerings to local demands, and make significant capital investments in new vessels or route development. The potential for high returns is present, but the path to profitability requires careful planning and execution, as evidenced by the high capital expenditure typically associated with establishing new international routes.

Attica Group could explore untapped niche passenger segments like adventure tourists or cultural tour groups. These segments may hold significant growth potential but currently represent a small portion of Attica's market share. Capturing these groups requires focused marketing and customized service packages.

Advanced Green Fuel Technologies Adoption

Attica Group's exploration of advanced green fuel technologies beyond methanol and batteries positions these initiatives as question marks within the BCG matrix. These technologies, while holding immense potential for future market share and environmental leadership, currently face significant hurdles in terms of unproven scalability and uncertain market demand. For instance, the development of ammonia-powered vessels, a key area of research, is still in its nascent stages, with limited operational data available.

The substantial upfront capital expenditure required for adopting these novel fuels, coupled with the ongoing development of bunkering infrastructure and regulatory frameworks, contributes to the uncertainty. While some early adopters are experimenting, widespread fleet-wide integration remains a distant prospect. For example, the International Maritime Organization’s (IMO) 2023 GHG Strategy aims for net-zero emissions by or around 2050, highlighting the long-term shift but underscoring the current developmental phase for many advanced fuels.

- Uncertainty in Scalability: Many advanced green fuel technologies, such as hydrogen fuel cells or synthetic fuels, are not yet proven at the scale required for a large fleet like Attica Group's.

- High Initial Investment: The cost of retrofitting or building new vessels with these unproven technologies can be prohibitive, making widespread adoption a financial question mark.

- Market Acceptance and Infrastructure: The availability of bunkering facilities and the broader market acceptance of these fuels are still developing, creating a risk for early adopters.

- Regulatory Landscape: Evolving international regulations for green shipping can impact the long-term viability and standardization of certain advanced fuel technologies.

Diversification into New Complementary Business Areas

Diversifying into entirely new, complementary business areas beyond Attica Group's established shipping and hospitality sectors would represent a question mark on the BCG Matrix. While these ventures could unlock significant growth potential by leveraging existing assets or market reach, they would necessitate substantial investment and a steep learning curve to gain market traction.

For instance, exploring adjacent markets like logistics technology or sustainable maritime solutions could offer synergistic benefits. However, success would hinge on Attica's ability to adapt its operational expertise and capital allocation strategies to unfamiliar competitive landscapes. In 2024, many established companies are looking at digital transformation and sustainability as key diversification drivers, with significant capital being deployed in these areas.

- Potential for High Growth: New sectors can offer avenues for exponential revenue expansion, moving beyond the mature shipping and hospitality markets.

- Leveraging Existing Strengths: Successful diversification would ideally capitalize on Attica's established brand, operational efficiencies, or customer base.

- Significant Investment and Learning: Entering new territories requires considerable financial outlay and the development of new skill sets and market knowledge.

- Market Share Acquisition: Building a competitive position in nascent or crowded new markets presents a considerable challenge, demanding strategic acumen and execution.

Question marks represent new ventures or products with low market share in high-growth industries. For Attica Group, this could include new, unproven ferry routes or innovative, yet unestablished, service offerings. These require careful analysis to determine if they have the potential to become stars or if they should be divested.

The success of these question marks hinges on significant investment and strategic execution to capture market share. For example, Attica Group's 2024 investments in fleet modernization and route development are crucial for nurturing these nascent areas. The company's ability to adapt to market demands and overcome competitive challenges will determine their future trajectory.

Attica Group's exploration into new international markets or niche passenger segments exemplifies question marks. These ventures, while offering high growth potential, currently possess low market share and face established competition. Strategic partnerships and tailored service packages are key to transforming these uncertain prospects into market leaders.

| Venture Type | Market Growth | Market Share | Strategic Focus |

| New High-Speed Ferry Routes | High | Low | Market Penetration, Brand Building |

| Emerging International Markets | High | Low | Partnerships, Operational Adaptation |

| Niche Passenger Segments | High | Low | Targeted Marketing, Customized Services |

| Advanced Green Fuel Technologies | High | Low | R&D, Infrastructure Development |

BCG Matrix Data Sources

Our Attica Group BCG Matrix leverages a blend of Attica Group's official financial reports, maritime industry growth forecasts, and competitor performance data to accurately position each business unit.