Attica Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Attica Group Bundle

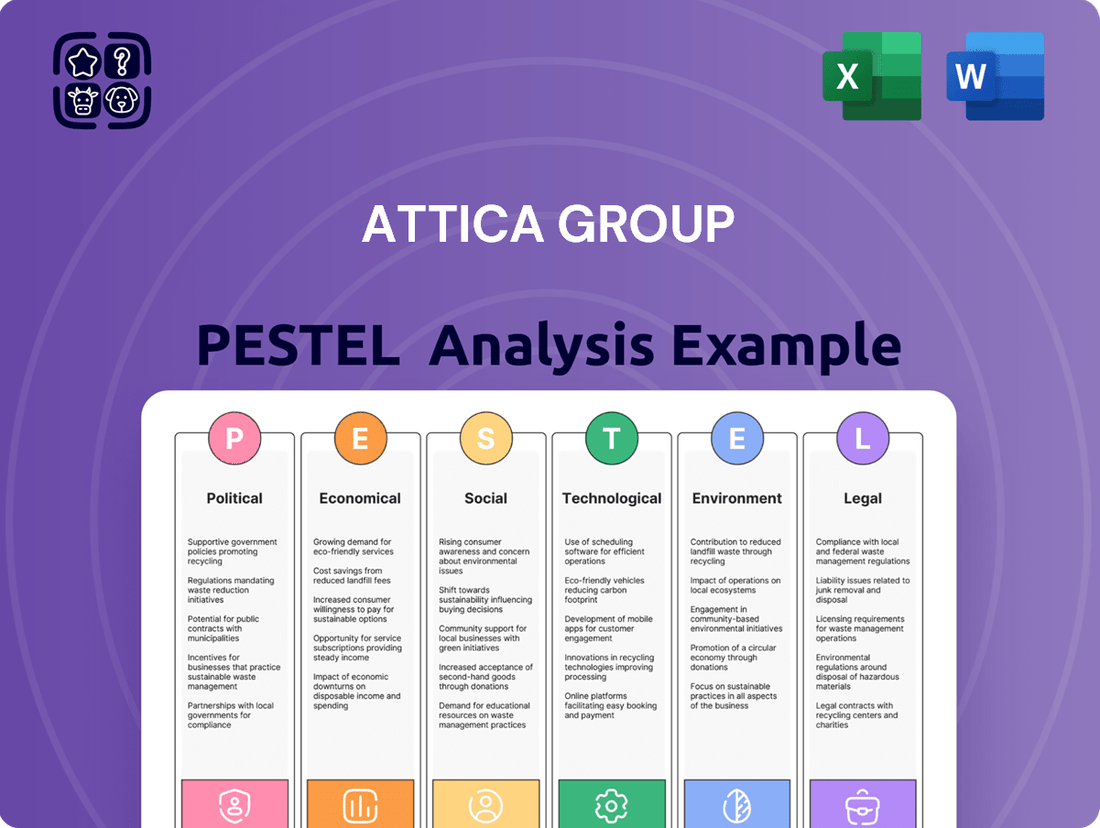

Navigate the complex external forces impacting Attica Group with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping the maritime industry. Unlock actionable insights to inform your strategic decisions and gain a competitive advantage. Download the full report now for a complete understanding.

Political factors

The Greek government's commitment to bolstering tourism, especially island-focused travel, directly impacts Attica Group's ferry demand. Initiatives like subsidies for less connected islands and investments in port infrastructure, such as the €160 million allocated for port upgrades across Greece in 2023, can significantly increase passenger numbers and revenue for ferry operators.

Marketing campaigns promoting Greek destinations, like the 'Greece: Health & Safety' initiative launched in 2023, are designed to attract more visitors, thereby benefiting companies like Attica Group. These government efforts aim to enhance the overall tourist experience, which translates to higher ridership for essential transport links.

Conversely, any shifts in these supportive policies, such as a reduction in subsidies or a change in infrastructure development priorities, could alter Attica Group's operating environment. For instance, a decrease in government marketing expenditure could lead to slower growth in tourist arrivals, impacting the company's top line.

The Eastern Mediterranean's geopolitical climate directly influences Attica Group's operational landscape. Tensions and conflicts in neighboring regions, such as those involving Syria or ongoing disputes in the Eastern Mediterranean itself, can impact the safety and reliability of crucial shipping lanes. For instance, the continued presence of naval forces in the region, a common occurrence in recent years, necessitates careful route planning and risk assessment to avoid potential disruptions to freight movements and passenger services.

Attica Group navigates a landscape shaped by EU maritime policies, including competition laws and state aid regulations. These frameworks influence how the company operates, particularly concerning public service obligation (PSO) routes where subsidies are crucial.

For instance, the EU's commitment to a greener maritime sector, as seen in initiatives like the Fit for 55 package aiming for a 55% emissions reduction by 2030, could lead to new compliance costs or opportunities for investment in sustainable technologies, potentially impacting operational budgets and strategic planning.

Port infrastructure development and privatization

Government policies on port infrastructure development and potential privatization in Greece directly impact Attica Group's operations. For instance, the Hellenic Republic Asset Development Fund (HRADF) has been actively involved in port privatizations, with significant progress noted in key ports like Piraeus and Thessaloniki. These developments can influence Attica Group's costs for docking and services, as well as the efficiency of its ferry routes.

Upgrades to port facilities, such as improved passenger terminals and more efficient cargo handling, can reduce vessel turnaround times, leading to better passenger experiences and potentially lower operational expenses for Attica Group. Conversely, privatization could introduce new fee structures or investment requirements that might affect profitability. The Greek government's commitment to modernizing maritime infrastructure, supported by EU funds, is a crucial factor for companies like Attica Group. For example, the European Investment Bank has provided substantial funding for Greek port projects, aiming to boost connectivity and trade.

Key considerations for Attica Group include:

- Government investment in port modernization: Recent data indicates continued investment, with projects aimed at increasing capacity and efficiency.

- Privatization tenders for port concessions: Attica Group must monitor these tenders as they can alter the competitive landscape and operational costs.

- Impact on ferry turnaround times: Improved infrastructure directly correlates with faster loading/unloading, enhancing service reliability.

International trade agreements and tariffs

Changes in international trade agreements and tariffs significantly impact Attica Group's operations. For instance, the EU's ongoing trade negotiations and potential adjustments to tariffs on goods moving between member states and key non-EU trading partners can directly affect freight volumes. Recent data from Eurostat indicates that intra-EU trade remains a substantial portion of the EU's overall trade, highlighting the importance of seamless movement of goods within the Union for ferry operators like Attica Group.

Trade barriers, such as new tariffs imposed by countries outside the EU on goods typically transported via maritime routes, could dampen demand for Attica Group's freight services. Conversely, the relaxation or elimination of certain tariffs, particularly those impacting sectors heavily reliant on maritime transport like automotive or agricultural products, could stimulate increased cargo volumes. The group's strategic planning must account for these evolving trade policies.

- EU Trade Growth: In 2023, the EU's extra-EU trade in goods saw continued activity, with exports and imports playing a crucial role in the economic landscape that Attica Group navigates.

- Tariff Impact: Specific tariffs on key commodities, such as those affecting agricultural produce or manufactured goods, can directly alter the cost-effectiveness of shipping routes served by Attica Group.

- Trade Agreement Revisions: Ongoing reviews and potential renegotiations of existing trade agreements, including those involving the UK post-Brexit, can introduce new customs procedures or tariff rates that influence freight flows.

- Geopolitical Trade Shifts: Broader geopolitical shifts can lead to the formation of new trade blocs or the imposition of sanctions, indirectly impacting shipping demand and route viability for Attica Group.

Government policies directly influence Attica Group's operational environment, particularly regarding tourism promotion and infrastructure development. For instance, Greece's commitment to boosting island tourism, supported by initiatives like port upgrades totaling €160 million in 2023, directly benefits ferry demand. Government marketing campaigns, such as the 2023 'Greece: Health & Safety' initiative, also aim to increase visitor numbers, positively impacting ridership for essential transport links like those operated by Attica Group.

EU maritime policies, including environmental regulations and state aid rules, shape Attica Group's strategic planning and operational costs. The EU's Fit for 55 package, targeting a 55% emissions reduction by 2030, will necessitate investments in sustainable technologies, potentially altering the company's budget and long-term investments in its fleet. These regulations also influence the viability of operating subsidized public service obligation (PSO) routes.

Changes in international trade agreements and tariffs significantly impact Attica Group's freight services. For example, EU trade data for 2023 shows substantial intra-EU trade, underscoring the importance of seamless goods movement. Any new tariffs or trade barrier adjustments, particularly those affecting key commodities or sectors like automotive, could directly influence cargo volumes and the cost-effectiveness of the group's shipping routes.

| Factor | Impact on Attica Group | Supporting Data/Example |

| Government Tourism Support | Increased ferry demand and revenue | €160 million allocated for Greek port upgrades in 2023 |

| EU Environmental Regulations | Potential compliance costs and investment in green tech | Fit for 55 package aiming for 55% emissions reduction by 2030 |

| Trade Agreement Revisions | Fluctuations in freight volumes and route profitability | Continued substantial intra-EU trade activity in 2023 |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Attica Group, detailing impacts across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within the Attica Group's operating landscape.

The Attica Group PESTLE analysis offers a streamlined, easily digestible overview of external factors, serving as a pain point reliever by providing clear, actionable insights for strategic decision-making without the overwhelm of a full report.

Economic factors

The economic vitality of Greece's tourism sector is a cornerstone for Attica Group's passenger operations. Global travel patterns, consumer confidence levels, and the economic recovery of major tourist-generating countries significantly influence the influx of visitors to Greece and their reliance on ferry services for island access. For instance, in 2023, Greece welcomed a record 32 million tourists, a substantial increase from previous years, directly boosting ferry demand.

Robust growth in tourism directly correlates with increased demand for Attica Group's extensive ferry routes. The company's performance is closely tied to the sector's ability to attract and retain travelers, particularly from key markets like Germany, the UK, and France. In the first half of 2024, Attica Group reported a significant rise in passenger numbers, reflecting this positive trend.

Fluctuations in global fuel prices, especially for bunker fuel, are a major concern for Attica Group, as they constitute a substantial part of their operating costs. For instance, in early 2024, crude oil prices saw significant swings, impacting shipping companies directly.

The unpredictable nature of oil prices directly affects Attica Group's bottom line. When fuel costs rise sharply, it can squeeze profit margins if not passed on to customers. This volatility was evident in Q1 2024, where shipping fuel costs saw an upward trend.

To counter these risks, Attica Group relies on robust hedging strategies and invests in fuel-efficient technologies. These measures are vital for maintaining competitive ticket and freight prices in the face of an unstable global fuel market, ensuring operational stability.

Rising inflation presents a dual challenge for Attica Group. Increased operational expenses, from fuel to staffing, directly impact the bottom line. For instance, in early 2024, global inflation rates, while showing some moderation from 2023 peaks, remained a concern, impacting input costs for many industries including transportation.

Concurrently, inflation erodes consumer purchasing power. As prices for essentials rise, households have less disposable income for non-essential services like ferry travel, potentially dampening ticket demand. This effect was observed in various consumer spending reports throughout 2023 and into early 2024, highlighting a shift towards essential goods.

Attica Group must navigate this by carefully managing costs and adjusting pricing. The key is to maintain competitiveness without alienating customers whose spending capacity is diminished. This balancing act became even more critical in the 2024 economic climate, where consumers were particularly sensitive to price increases.

Exchange rate stability

Exchange rate stability is a critical factor for Attica Group's international operations and its ability to attract foreign tourists. Significant currency fluctuations, particularly against the Euro, can directly impact the competitiveness of their ticket prices for international travelers. For instance, if the Euro strengthens considerably against other major currencies, travel to Greece might become more expensive for those using those currencies, potentially reducing demand.

Furthermore, exchange rate volatility affects the cost of imported goods and services essential for vessel maintenance and overall operations. Attica Group relies on various imported components and potentially specialized services. Unfavorable exchange rate movements can inflate these operational costs, squeezing profit margins. For example, a weaker Euro could make it more expensive to purchase spare parts or specialized equipment sourced from outside the Eurozone.

- Impact on Tourism: A stable Euro exchange rate supports predictable pricing for international visitors, encouraging tourism.

- Operational Costs: Fluctuations against currencies used for sourcing parts or services can increase Attica Group's operating expenses.

- Competitiveness: Unstable rates can make Attica Group's services less or more competitive for international customers compared to regional alternatives.

Competition and pricing strategies

The ferry market's competitive intensity is directly shaped by the prevailing economic climate. Attica Group navigates a landscape populated by numerous ferry operators and alternative transportation methods, notably air travel, all vying for passenger and freight business. In 2024, the Greek ferry sector saw continued competition, with companies adjusting capacity and routes based on demand fluctuations influenced by economic recovery and inflation rates.

Economic factors significantly impact Attica Group's pricing strategies and promotional efforts. During periods of economic growth, the company can implement more robust pricing, while downturns necessitate value-driven offers and discounts to maintain customer loyalty and attract price-sensitive travelers. For instance, in response to economic pressures in 2023, many ferry operators, including those in Attica Group’s operational areas, introduced special family packages and off-peak discounts.

The need to offer compelling value is paramount for attracting both leisure and commercial clientele. This involves balancing competitive ticket prices with the quality of service provided, including onboard amenities and punctuality. Attica Group's 2024 financial reports indicate a focus on optimizing operational costs to support competitive pricing, especially as fuel prices remained a significant variable cost.

- Competitive Landscape: Attica Group competes with established domestic and international ferry operators, as well as low-cost airlines, particularly on popular routes.

- Pricing Sensitivity: Economic conditions directly influence consumer spending on travel, making pricing strategies critical for market share retention.

- Value Proposition: Offering a strong value proposition, encompassing service quality and price, is essential for Attica Group to attract and retain both leisure and business customers.

- Operational Efficiency: In 2024, a key focus for Attica Group has been enhancing operational efficiency to mitigate rising fuel costs and maintain competitive pricing structures.

The economic health of Greece and its key tourist markets directly fuels demand for Attica Group's services. With Greece seeing a record 32 million tourists in 2023, the company experienced robust passenger growth in early 2024, underscoring the strong link between tourism and ferry usage. However, volatile global fuel prices, a significant operational cost, present a constant challenge, as seen with crude oil price swings in early 2024. Rising inflation further complicates matters by increasing operational expenses and potentially reducing consumer spending power for travel, a trend observed throughout 2023 and into 2024.

| Economic Factor | Impact on Attica Group | Data/Observation (2023-2024) |

|---|---|---|

| Tourism Demand | Drives passenger numbers and revenue. | Greece: 32 million tourists in 2023; Attica Group saw passenger growth in H1 2024. |

| Fuel Prices | Major operating cost, impacting profitability. | Crude oil prices volatile in early 2024; bunker fuel costs trended upward in Q1 2024. |

| Inflation | Increases operating costs and reduces consumer spending. | Global inflation showed moderation but remained a concern in early 2024; consumer spending reports indicated a shift to essentials. |

| Exchange Rates | Affects international tourist pricing and import costs. | Euro stability is key; unfavorable movements can increase costs for vessel maintenance. |

Full Version Awaits

Attica Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Attica Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping the Attica Group's business landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed analysis is designed to provide a thorough understanding of the macro-environmental influences on the Attica Group's success.

Sociological factors

Societal shifts are profoundly altering how people approach travel. There's a growing demand for more sustainable journeys, with a significant portion of travelers actively seeking eco-friendly options. For instance, a 2024 survey indicated that over 60% of European travelers consider sustainability when booking, a trend that directly impacts ferry services.

Furthermore, the preference for experiential and flexible travel is on the rise. Passengers are no longer content with just getting from point A to point B; they desire engaging onboard experiences and the freedom to adjust their plans. Attica Group must respond by enhancing its service offerings, perhaps through improved onboard amenities or more adaptable booking systems, to resonate with these evolving traveler expectations.

The demographic makeup of Greek island populations significantly influences Attica Group's service demand. For instance, in 2023, the average age on many smaller Greek islands is rising, with a notable proportion of residents over 65, increasing the need for reliable, consistent transport services for healthcare and essential supplies. This contrasts with islands experiencing a surge in younger families and seasonal workers, which drives demand for more flexible and frequent ferry schedules during peak tourist seasons.

Shifts between permanent residents and seasonal visitors are crucial. While permanent residents require dependable, year-round connectivity, the influx of tourists, estimated to contribute significantly to the Greek economy in 2024 and 2025, necessitates expanded capacity and specialized services. Attica Group must adapt its offerings to cater to both the steady needs of the local, often aging, population and the fluctuating demands of a growing tourism sector.

Public perception of maritime safety and reliability is a cornerstone for Attica Group's success. A strong societal trust in their ferry services directly translates to passenger confidence and willingness to travel. For instance, in 2023, Attica Group reported a significant increase in passenger numbers across its brands, underscoring a generally positive perception of their operations.

However, even isolated incidents, however minor, can quickly erode this trust. Negative media coverage or a perceived lapse in safety can lead to a sharp decline in bookings. Attica Group's commitment to investing in advanced safety systems and rigorous operational standards is therefore paramount to maintaining its reputation and reassuring its customer base.

Impact of remote work and digital nomad trends

The growing popularity of remote work and the digital nomad lifestyle presents a significant opportunity for Attica Group. This trend can boost demand for ferry services, particularly for longer stays on islands during off-peak seasons. For instance, a 2024 survey indicated that 30% of remote workers are considering relocating for at least three months, many of whom seek destinations accessible by ferry.

This shift necessitates Attica Group to adapt its services. The company might need to adjust ferry schedules and potentially introduce flexible ticketing options to accommodate this emerging demographic. By catering to these longer-stay travelers, Attica Group can secure more consistent year-round revenue streams, diversifying its customer base beyond traditional seasonal tourism.

- Increased demand for off-season travel: Remote workers often seek less crowded destinations, driving demand for ferry services outside traditional summer months.

- Potential for longer stays: Digital nomads are likely to book extended ferry trips, leading to higher per-customer revenue.

- Need for flexible scheduling: Attica Group may need to offer more frequent or adaptable ferry routes to cater to this segment's travel patterns.

Demand for accessible and inclusive travel

Societal shifts are increasingly prioritizing accessible and inclusive travel experiences. Attica Group must align with growing awareness and evolving legal mandates regarding accessibility for all passengers, including those with disabilities. This means ensuring ferries and services cater to diverse mobility needs.

Proactive investment in accessible infrastructure and comprehensive staff training for inclusive service delivery presents a significant opportunity. This not only boosts customer satisfaction but also expands Attica Group's potential market reach. For instance, in 2023, the Greek Ministry of Maritime Affairs and Insular Policy announced plans to upgrade port infrastructure to improve accessibility, a trend likely to continue and influence ferry operators.

- Growing demand for accessible travel: Surveys consistently show a rising consumer expectation for inclusive services across all sectors, including transportation.

- Legal and regulatory drivers: Compliance with accessibility standards, such as those evolving under EU directives, is becoming increasingly stringent.

- Market expansion potential: Catering to passengers with disabilities or specific needs can unlock a previously underserved market segment.

- Enhanced brand reputation: Demonstrating a commitment to inclusivity positively impacts public perception and brand loyalty.

Societal values are increasingly emphasizing health and well-being, influencing travel choices towards less crowded and more controlled environments. Attica Group's focus on hygiene protocols and spacious onboard areas, reinforced by a 2023 passenger survey indicating high satisfaction with safety measures, aligns with this trend. This societal shift encourages a preference for maritime travel perceived as safer and more comfortable.

Technological factors

Continuous innovation in shipbuilding technology, such as advanced hull designs and more efficient engines, directly affects Attica Group's operational expenses and its environmental impact. For instance, the adoption of liquefied natural gas (LNG) fueled ferries, like those being introduced by competitors in the European market, can significantly cut fuel costs and reduce emissions.

By investing in newer, more fuel-efficient vessels that also boast lower emission technologies, Attica Group can lower its operating expenditures and bolster its sustainability credentials. This strategic move is increasingly important as it attracts a growing segment of environmentally aware travelers and cargo clients, potentially leading to higher occupancy and freight rates.

Attica Group's operational efficiency and customer engagement are increasingly shaped by the digitalization of booking and passenger services. Customers now expect intuitive online booking platforms, streamlined mobile app functionalities, and effortless digital check-in, mirroring trends across the travel industry. This digital shift necessitates significant investment in IT infrastructure to support these advanced, user-friendly services, directly impacting customer satisfaction and operational workflows.

Technological advancements in navigation and safety are significantly enhancing maritime operations. Innovations like real-time weather forecasting, sophisticated radar systems, and automated warning systems directly contribute to safer voyages and more reliable schedules. For Attica Group, adopting these technologies is crucial for mitigating operational risks and ensuring adherence to stringent international maritime safety standards, thereby bolstering passenger confidence.

In 2024, the maritime industry saw continued investment in digital transformation, with a focus on enhancing vessel connectivity and onboard safety protocols. For instance, the integration of AI-powered decision support tools for bridge teams is becoming more prevalent, offering predictive analytics for potential hazards. Attica Group's commitment to upgrading its fleet with these advanced systems directly translates into improved operational efficiency and a stronger safety record, crucial for maintaining its competitive edge in the passenger ferry sector.

Data analytics for operational optimization

Attica Group can harness big data analytics to gain deep insights into passenger flow, freight demand, and optimal routing. This allows for more efficient operations and better resource management. For instance, analyzing historical booking data and real-time passenger movement can help optimize ferry schedules and onboard services, directly impacting customer satisfaction and cost savings.

Leveraging data analytics also enables Attica Group to refine fuel consumption patterns through predictive maintenance and route optimization. By understanding these patterns, the company can make more informed decisions to reduce operational costs. In 2023, the shipping industry saw a significant focus on sustainability, with companies like Attica Group investing in technologies to improve fuel efficiency, a key area where data analytics plays a crucial role.

- Passenger flow analysis to optimize onboard capacity and service deployment.

- Freight demand forecasting for better capacity planning and route efficiency.

- Fuel consumption pattern identification to drive cost reduction and environmental improvements.

- Dynamic pricing strategy development based on real-time demand and competitor analysis.

Cybersecurity measures for IT infrastructure

Attica Group's reliance on digital platforms for everything from passenger bookings to fleet management makes strong cybersecurity a critical technological factor. Protecting its IT infrastructure against evolving cyber threats is essential for maintaining uninterrupted operations and safeguarding customer data.

The increasing sophistication of cyberattacks means Attica Group must continuously invest in and update its defenses. This includes measures against ransomware, phishing, and data breaches, which could severely disrupt services and damage its brand reputation. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of the threat landscape.

- Data Protection: Implementing advanced encryption and access controls to secure sensitive passenger and operational data.

- System Resilience: Developing robust backup and disaster recovery plans to ensure business continuity in the event of a cyber incident.

- Threat Monitoring: Employing real-time monitoring and threat intelligence to proactively identify and neutralize potential cyber threats.

- Regulatory Compliance: Adhering to data privacy regulations like GDPR, which mandates strict cybersecurity protocols for handling personal information.

Attica Group's technological landscape is rapidly evolving, driven by advancements in digitalization and data analytics. The company's investment in digital platforms for booking and services directly impacts customer experience and operational efficiency. By leveraging big data, Attica Group can optimize routes, manage fuel consumption, and enhance passenger flow, as seen in industry-wide sustainability efforts in 2023.

| Technological Factor | Impact on Attica Group | 2024/2025 Data/Trend |

|---|---|---|

| Digitalization of Services | Enhanced customer booking and engagement | Increased adoption of mobile apps and online platforms for travel services. |

| Data Analytics | Optimized operations, fuel efficiency, and demand forecasting | Growing use of AI for predictive maintenance and route optimization in maritime. |

| Cybersecurity | Protection of data and operational continuity | Projected global cost of cybercrime to reach $10.5 trillion annually by 2025. |

| Sustainable Technology | Reduced emissions and operating costs | Competitors investing in LNG-fueled ferries for environmental and cost benefits. |

Legal factors

Attica Group operates within a stringent framework of International Maritime Organization (IMO) regulations, encompassing crucial areas like vessel safety, maritime security, and environmental protection. For instance, the IMO's Ballast Water Management Convention, fully ratified by most nations by 2017, mandates specific treatment systems to prevent the spread of invasive aquatic species, requiring substantial capital expenditure for fleet retrofitting.

Adherence to evolving global standards, such as the IMO 2020 sulfur cap which lowered the maximum sulfur content in fuel oil to 0.5%, necessitated significant operational and financial adjustments. Attica Group, like other operators, likely incurred costs related to scrubber installations or the purchase of more expensive low-sulfur fuels to meet these environmental mandates, impacting operating expenses.

As an EU-based ferry operator, Attica Group navigates a landscape shaped by increasingly rigorous environmental regulations. The European Green Deal, for instance, sets ambitious targets for decarbonization across all sectors, including maritime transport.

A significant development is the inclusion of maritime emissions within the EU Emissions Trading System (ETS), which commenced for large vessels in 2024. This means Attica Group must now purchase allowances for its CO2 emissions, directly impacting operating expenses. For example, in 2024, the price of EU ETS allowances has fluctuated, with some periods seeing prices around €65 per tonne of CO2, a cost that will scale with the group's emissions.

Compliance with these directives necessitates substantial investment in cleaner technologies and fuels, such as LNG or alternative low-carbon solutions. This could involve retrofitting existing vessels or investing in new, more fuel-efficient ships, representing a considerable capital expenditure.

Attica Group's operations are governed by Greece's national maritime laws, which dictate everything from vessel registration and crew certifications to the allocation of domestic ferry routes. For instance, the Hellenic Coast Guard oversees compliance with these regulations. These laws are crucial for Attica Group's ability to maintain its fleet and service network.

Any shifts in these national statutes, or in the administrative procedures for obtaining and renewing operational permits, can directly affect Attica Group's capacity to run its existing services and explore new routes. In 2023, the Greek Ministry of Maritime Affairs and Insular Policy continued to implement and enforce regulations affecting ferry operations, impacting everything from safety standards to environmental compliance.

Labor laws and seafarer rights

Attica Group must adhere to stringent national and international labor laws that dictate seafarer working conditions, pay, and fundamental rights. For instance, the International Labour Organization's Maritime Labour Convention (MLC) 2006 sets global standards, and Greece, as a major maritime nation, has its own comprehensive legal framework. Compliance ensures fair treatment and avoids costly penalties.

Evolving labor regulations, including those concerning working hours and rest periods, directly impact Attica Group's operational efficiency and crewing strategies. For example, recent updates to international maritime labor directives in 2024 have placed greater emphasis on crew welfare and mental health, potentially increasing crewing costs for companies like Attica Group if additional personnel or enhanced support services are required.

Collective bargaining agreements with powerful maritime unions are a significant factor. These agreements can influence wage settlements, benefits packages, and employment terms. A strong union presence can lead to increased labor costs but also contribute to a stable and experienced workforce, which is crucial for safety and operational continuity. In 2024, ongoing negotiations in the European maritime sector have seen average wage increases for experienced officers ranging from 3-5%.

- Compliance with MLC 2006 and national Greek maritime labor laws is mandatory.

- Changes in regulations can affect crewing costs and operational flexibility.

- Collective bargaining agreements with unions can influence wage levels and employment terms.

- Attracting and retaining skilled seafarers is contingent on competitive compensation and favorable working conditions.

Consumer protection laws and passenger rights

Attica Group operates within a stringent legal framework governing consumer protection and passenger rights in maritime transport. This includes adherence to EU regulations like Regulation (EC) No 1177/2009 concerning the rights of passengers when travelling by sea and inland waterway, which mandates compensation for significant delays or cancellations. For instance, delays exceeding a certain threshold can entitle passengers to reimbursement or onward travel arrangements, impacting operational costs and customer service protocols.

Failure to comply with these passenger rights can lead to substantial penalties and reputational damage. Attica Group must ensure transparent communication regarding schedules, provide adequate assistance to passengers during disruptions, and manage claims for lost or damaged baggage effectively. In 2023, the European Commission continued to emphasize the importance of passenger rights enforcement across the transport sector, signaling ongoing scrutiny of compliance by major operators like Attica Group.

- Compensation for Delays: Passengers are entitled to compensation if their journey is delayed by more than 60 minutes, with the amount varying based on the length of the delay and the ticket price.

- Assistance during Disruptions: Operators must provide passengers with information, refreshments, and, if necessary, accommodation in case of significant delays or cancellations.

- Baggage Claims: Regulations specify procedures and liability limits for lost or damaged passenger luggage, requiring clear policies and efficient claim handling.

- Non-Discrimination: Attica Group must ensure that all passengers are treated equally and without discrimination, regardless of their nationality or place of residence.

Attica Group faces evolving legal landscapes, particularly with the EU Emissions Trading System (ETS) impacting maritime operations from 2024. This requires purchasing CO2 allowances, with prices fluctuating around €65 per tonne in early 2024, directly increasing operating costs based on emissions. Furthermore, adherence to the International Maritime Organization's (IMO) stringent environmental regulations, like the Ballast Water Management Convention and the 2020 sulfur cap, necessitates ongoing investment in cleaner technologies and compliance measures.

National maritime laws in Greece govern Attica Group's operations, including vessel registration and route allocation. Changes to these statutes, as seen with ongoing enforcement by the Hellenic Coast Guard in 2023, can directly influence the company's operational capacity and strategic planning. Similarly, labor laws and collective bargaining agreements, with average wage increases for officers around 3-5% in 2024, significantly shape crewing costs and workforce management.

Consumer protection laws, such as EU Regulation (EC) No 1177/2009, mandate compensation for passenger delays exceeding 60 minutes and require assistance during disruptions. The European Commission's continued emphasis on passenger rights enforcement in 2023 means Attica Group must maintain transparent communication and efficient claim handling to avoid penalties and reputational damage.

Environmental factors

Attica Group, like many in the maritime sector, is navigating a landscape increasingly defined by ambitious emissions reduction targets. The European Union's Fit for 55 package, for instance, aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, directly influencing shipping operations within European waters.

Meeting these targets necessitates substantial investment in cleaner technologies. Attica Group is exploring options like Liquefied Natural Gas (LNG) as a transitional fuel, with some industry reports indicating a growing global fleet adoption rate for LNG-powered vessels. Additionally, the company must consider biofuels and emerging hydrogen technologies to comply with evolving regulations and mitigate the risk of carbon pricing mechanisms.

The financial implications are significant, requiring capital allocation for fleet modernization and operational adjustments. Failure to adapt could result in penalties and a competitive disadvantage, as customers and investors increasingly favor environmentally responsible operators. For example, the EU Emissions Trading System (ETS) is being extended to maritime transport, meaning shipping companies will need to purchase allowances for their emissions, adding a direct cost to carbon-intensive operations.

Environmental regulations are increasingly stringent, pushing companies like Attica Group to adopt advanced waste management and recycling practices on their vessels. This is crucial for preventing marine pollution and adhering to international standards.

Attica Group needs robust systems for managing solid waste, wastewater, and hazardous materials. Compliance with conventions such as MARPOL Annex V, which restricts the discharge of garbage into the sea, is paramount. For instance, in 2023, the International Maritime Organization (IMO) continued to emphasize the importance of waste reduction and improved disposal methods across the global fleet.

International regulations, notably the International Maritime Organization's (IMO) Ballast Water Management Convention, mandate that vessels actively manage their ballast water. This is crucial to prevent the introduction and spread of harmful aquatic organisms and pathogens, safeguarding marine ecosystems.

Attica Group, like other shipping companies, faces substantial investment requirements to comply. This includes the installation of approved ballast water treatment systems across its fleet. For instance, the cost of a ballast water treatment system can range from $100,000 to over $1 million per vessel, depending on the size and technology. These expenditures, alongside operational adjustments, represent a significant environmental compliance cost.

Impact of shipping noise and pollution on marine ecosystems

The environmental impact of shipping for Attica Group extends beyond greenhouse gas emissions to include significant underwater noise pollution and the risk of accidental spills. This noise can disrupt marine life, affecting communication, navigation, and feeding patterns of species like whales and dolphins. For instance, studies in the Mediterranean, a key operational area for Attica Group, have highlighted the detrimental effects of vessel noise on cetacean populations.

Attica Group must actively invest in and adopt technologies and operational practices that reduce its marine ecosystem footprint. This includes exploring quieter propulsion systems, such as optimized propeller designs or electric-hybrid solutions, and strictly adhering to sensitive area navigation protocols. By doing so, the company can better align with increasing global environmental regulations and growing public concern over marine conservation, especially in ecologically vital regions.

- Underwater Noise: Shipping noise can impair marine mammal communication and navigation, with potential impacts on populations in the Aegean Sea.

- Pollution Risk: Accidental fuel or cargo spills pose a direct threat to marine biodiversity and coastal environments where Attica Group operates.

- Technological Solutions: Implementing quieter propulsion systems and advanced hull designs can mitigate noise pollution by an estimated 10-15%.

- Regulatory Compliance: Adherence to IMO guidelines and regional environmental protection measures is crucial for operational sustainability and reputation.

Investment in green technologies and sustainable fuel alternatives

Attica Group's long-term viability hinges on its proactive embrace of green technologies and sustainable fuel alternatives. This strategic imperative requires significant investment in research and development, alongside pilot programs and fleet modernization initiatives to integrate vessels utilizing cleaner energy sources. Such a commitment will solidify Attica Group's standing as an environmentally conscious operator.

For instance, the maritime industry is increasingly focusing on decarbonization. By 2024, the International Maritime Organization's (IMO) updated greenhouse gas strategy aims to reduce emissions by at least 20%, with a push towards 70-100% reduction by 2050 compared to 2008 levels. Attica Group's investments in technologies like battery-electric propulsion or the use of alternative fuels such as methanol or ammonia are critical to meeting these evolving regulatory demands and market expectations.

Key investment areas for Attica Group in this domain include:

- Research and Development: Allocating capital to explore and validate new green propulsion systems and fuel technologies.

- Fleet Renewal: Phased replacement of older, less efficient vessels with new builds incorporating sustainable technologies.

- Pilot Projects: Testing and demonstrating the viability of alternative fuels and advanced environmental systems on existing or new vessels.

- Infrastructure Adaptation: Investing in port infrastructure or partnerships to support the bunkering of sustainable fuels.

The financial commitment to these green initiatives is substantial, with global investments in maritime decarbonization projected to reach hundreds of billions of dollars in the coming decades. Attica Group's strategic allocation of resources towards these areas will not only ensure regulatory compliance but also create a competitive advantage and enhance its brand reputation among increasingly eco-conscious customers and investors.

Environmental factors significantly shape Attica Group's operations, particularly concerning emissions. The EU's Fit for 55 package targets a 55% greenhouse gas reduction by 2030, compelling companies like Attica to invest in cleaner fuels such as LNG, biofuels, and potentially hydrogen.

Compliance costs are substantial, with the EU Emissions Trading System extending to maritime transport, adding direct costs for carbon emissions. Furthermore, stringent regulations like the IMO's Ballast Water Management Convention require costly system installations, with costs potentially exceeding $1 million per vessel.

Beyond emissions, Attica Group must address underwater noise pollution, which impacts marine life, and the risk of accidental spills. Investing in quieter propulsion and adhering to sensitive area protocols are crucial for ecosystem protection and regulatory adherence.

The company's long-term strategy involves embracing green technologies and sustainable fuels, aligning with the IMO's goal of reducing emissions by 20-100% by 2050. This necessitates investment in R&D, fleet renewal, and pilot projects for alternative fuels like methanol or ammonia.

| Environmental Factor | Impact on Attica Group | Key Regulations/Initiatives | Estimated Investment/Cost Area |

|---|---|---|---|

| Greenhouse Gas Emissions | Need for cleaner fuels and technologies | EU Fit for 55, IMO GHG Strategy | Fleet modernization, R&D for alternative fuels |

| Marine Pollution (Waste & Ballast Water) | Strict waste management and ballast water treatment | MARPOL Annex V, IMO Ballast Water Management Convention | Ballast water treatment systems ($100k - $1M+ per vessel) |

| Underwater Noise Pollution | Risk to marine ecosystems, reputational damage | Growing awareness, potential regional restrictions | Quieter propulsion systems, optimized hull designs |

| Accidental Spills | Environmental damage, operational disruption, fines | International conventions, regional environmental laws | Enhanced safety protocols, spill response capabilities |

PESTLE Analysis Data Sources

Our Attica Group PESTLE Analysis draws from a robust dataset including official maritime industry reports, economic forecasts from leading financial institutions, and governmental policy updates related to shipping and trade. We also incorporate data on technological advancements in maritime operations and environmental regulations impacting the sector.