AtriCure PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AtriCure Bundle

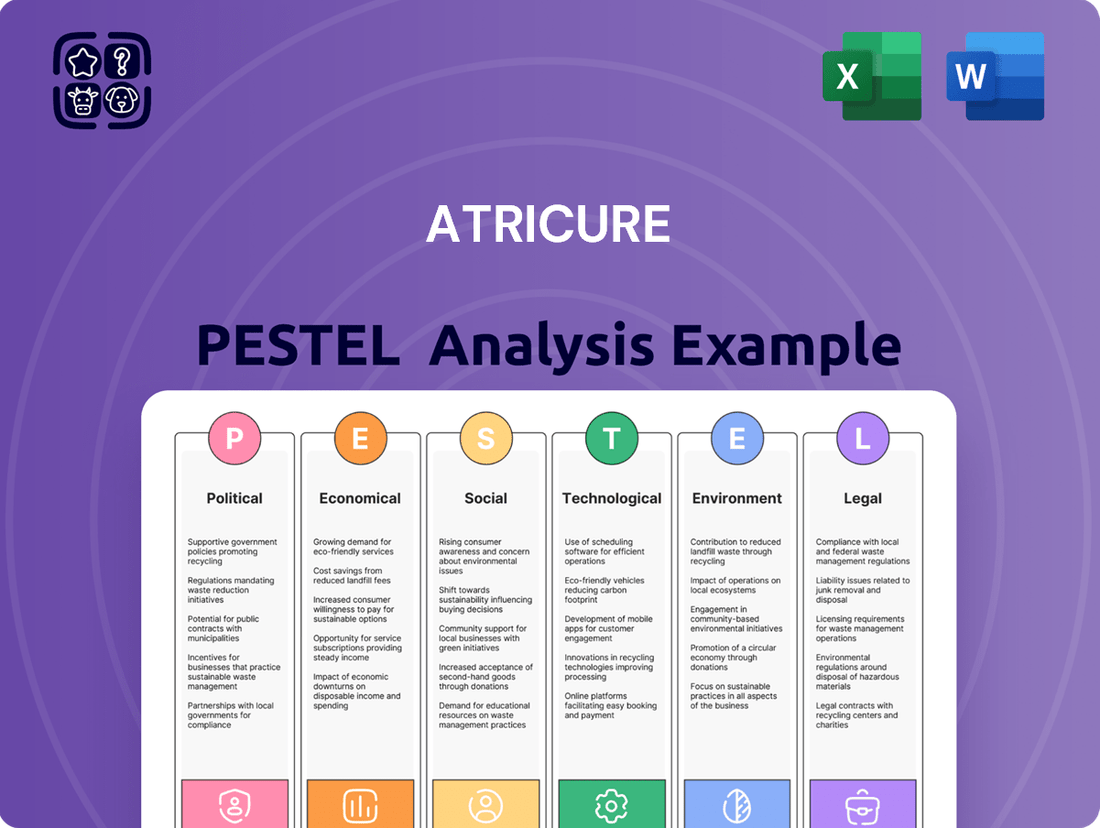

Navigate the complex landscape of the cardiac rhythm management market with our comprehensive AtriCure PESTLE Analysis. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping AtriCure's strategic decisions and future growth. This expertly crafted analysis provides actionable intelligence to inform your own market strategies and investment decisions. Don't be left behind; download the full version now to gain a decisive competitive edge.

Political factors

Government healthcare policies in the U.S. and other key markets profoundly influence AtriCure's revenue streams. Changes in Medicare reimbursement rates for cardiac ablation procedures, which for 2025 are projected to see a slight adjustment based on the proposed physician fee schedule, directly impact hospital purchasing power. Political shifts can introduce uncertainty in federal funding models, affecting the ability of health systems to invest in advanced medical technologies. For instance, federal funding for cardiovascular research, estimated at over $2.5 billion for 2024 by the NIH, underpins future product adoption. AtriCure's growth is inherently tied to political decisions that prioritize and support investment in innovative medical devices.

Global trade policies and tariffs significantly influence AtriCure, especially given its international sales footprint which accounted for approximately 25% of its total revenue in late 2024. New tariffs on medical devices or their components, such as those seen in recent U.S.-China trade dynamics, could elevate manufacturing costs, potentially impacting gross margins which stood around 75% in early 2025. Disruptions to the supply chain from complex customs regulations also pose a risk. AtriCure must expertly navigate these complexities to sustain its competitive pricing and profitability across diverse international markets.

AtriCure operates within a highly regulated medical device sector, with entities like the US Food and Drug Administration (FDA) and European Union regulatory bodies setting rigorous product approval benchmarks. Political shifts or new administrative priorities can significantly alter the pace and requirements for new device clearances, impacting product launches such as the anticipated 2025 production start for the AtriCure FLEX Mini. For instance, increased FDA scrutiny, as seen with some Class III devices in late 2024, could extend approval timelines. Any changes in leadership or regulatory philosophy within these agencies directly influence AtriCure's market access and innovation pipeline.

Government Lobbying Efforts

The medical device industry, including AtriCure, actively engages in lobbying to shape healthcare legislation and policy. AtriCure's reported lobbying expenditures, reaching approximately $40,000 in Q1 2024, reflect its efforts to influence the political landscape. These initiatives aim to secure favorable reimbursement policies and a supportive regulatory environment for cardiac arrhythmia treatments. The effectiveness of these lobbying activities directly impacts the company's market access and financial performance.

- AtriCure's Q1 2024 lobbying expenditure was approximately $40,000.

- Lobbying efforts target favorable reimbursement for cardiac procedures.

- The company seeks a supportive regulatory environment for its devices.

- Political influence directly impacts market access and financial results.

International Market Regulations

AtriCure's ambition to expand globally, notably with its EnCompass Clamp system in Europe, necessitates strict adherence to diverse international political and regulatory frameworks. Securing critical approvals, such as the CE mark, is a pivotal political factor directly enabling new revenue streams and market penetration. As of early 2025, the evolving landscape of medical device regulations globally, including the EU's Medical Device Regulation (MDR) implementation, significantly influences the company's operational timelines and costs. Political stability and efforts towards harmonizing medical device standards worldwide can either accelerate or impede AtriCure's strategic global expansion efforts.

- CE Mark approval remains essential for AtriCure's European market access, directly impacting 2024-2025 revenue projections.

- Navigating varying regulatory pathways in Asia-Pacific and Latin America is crucial for 2025 growth targets.

- Geopolitical stability in key expansion regions directly influences supply chain reliability and market entry feasibility.

- Compliance costs associated with global regulatory changes, like the EU MDR, are a significant operational consideration for AtriCure.

Government healthcare policies, including Medicare reimbursement changes projected for 2025 and federal research funding like NIH's $2.5 billion for 2024, directly impact AtriCure's revenue and market access. Global trade policies affect its international sales, which were approximately 25% of total revenue in late 2024, influencing manufacturing costs and supply chains. Regulatory shifts from bodies like the FDA can alter product approval timelines for devices such as the AtriCure FLEX Mini's anticipated 2025 production. Lobbying efforts, with Q1 2024 expenditures around $40,000, aim to secure favorable conditions and support global expansion, including CE mark approvals for products like the EnCompass Clamp system.

| Factor | Impact on AtriCure | 2024/2025 Data |

|---|---|---|

| Medicare Reimbursement | Directly influences hospital purchasing power for devices. | 2025 projected slight adjustment. |

| Federal Research Funding | Underpins future product adoption and innovation. | NIH cardiovascular research: >$2.5 billion (2024). |

| International Sales | Sensitive to trade policies and tariffs. | Approx. 25% of total revenue (late 2024). |

| Gross Margins | Affected by tariffs and manufacturing costs. | Approx. 75% (early 2025). |

| Product Approvals | Influenced by regulatory body scrutiny. | AtriCure FLEX Mini 2025 production start. |

| Lobbying Expenditures | Efforts to shape favorable healthcare legislation. | Approx. $40,000 (Q1 2024). |

What is included in the product

This PESTLE analysis comprehensively examines how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—impact AtriCure's operations and strategic positioning within the medical device industry.

It provides forward-looking insights and actionable recommendations to help AtriCure navigate challenges and capitalize on emerging opportunities.

The AtriCure PESTLE analysis provides a clear, summarized version of external factors, making it easy to reference during meetings to identify and address potential pain points for the business.

Economic factors

The overall economic climate directly influences healthcare spending by governments, private insurers, and individuals. Periods of economic uncertainty, like those observed in early 2025, can pressure healthcare budgets, potentially delaying hospital investments in new medical technologies. Despite short-term fluctuations, the global medical device market is projected to reach nearly $800 billion by 2030, indicating a robust long-term growth trend. This suggests a foundational demand for innovative solutions like those AtriCure offers.

AtriCure's financial performance is intrinsically linked to reimbursement policies from key payers like Medicare, Medicaid, and private insurance companies. The level of reimbursement for surgical ablation procedures, such as those utilizing AtriCure's technologies, directly dictates economic feasibility for hospital adoption. A favorable payer mix and adequate reimbursement rates, like those potentially influenced by CPT code changes for AFib procedures in 2024-2025, are crucial for driving sales and profitability. Demonstrating the cost-effectiveness of AtriCure's solutions, particularly as healthcare systems prioritize value-based care, remains key to securing and maintaining these vital reimbursement levels.

The global market for atrial fibrillation treatment is a significant economic driver for AtriCure, projected to reach $19.5 billion by 2032. This substantial market expansion provides a strong growth environment for the company. AtriCure's robust presence in both U.S. and international markets positions it well to capitalize on this trend. The company's revenue growth, particularly its increasing international revenue, directly reflects this expanding market opportunity.

Interest Rates and Cost of Capital

Fluctuations in interest rates directly influence AtriCure's cost of capital, impacting funding for crucial research and development, clinical trials, and strategic acquisitions. A favorable interest rate environment, like the expected declines in 2025, can make it more affordable for AtriCure to invest in innovation and expansion. Analysts anticipate the Federal Reserve's rate cuts in mid-2025 will significantly spur mergers and acquisitions within the medtech sector, potentially increasing AtriCure's strategic options or competitive landscape. For example, a 50-basis point reduction in borrowing costs can notably improve the economic viability of large-scale projects.

- Projected Federal Reserve rate cuts in mid-2025.

- Potential for increased medtech M&A activity by late 2025.

- Reduced cost of capital for R&D and acquisitions.

- Enhanced financial capacity for innovation and market expansion.

Supply Chain and Inflationary Pressures

Inflation directly impacts AtriCure's gross margins by increasing the cost of raw materials and specialized components for its medical devices. Navigating a complex global supply chain, the company faces volatility in shipping and component costs, like the 2024 average 3.5% increase in medical device raw material prices. Efficient supply chain management and strategic hedging against inflation are crucial to maintain profitability and ensure consistent product availability. AtriCure's ability to manage these pressures is vital given the ongoing global economic shifts.

- Medical device raw material costs saw an average 3.5% rise in 2024.

- Global shipping rates, while volatile, showed a 2024 Q4 average increase of 8% on key routes.

- AtriCure’s 2024 Q3 gross margin was 74.2%, influenced by production expenses.

- The company implemented new supplier diversification strategies in early 2025 to mitigate risk.

The global atrial fibrillation treatment market, projected to reach $19.5 billion by 2032, offers significant growth for AtriCure, especially with favorable 2024-2025 CPT code changes influencing reimbursement for surgical ablation. Expected Federal Reserve rate cuts in mid-2025 could lower AtriCure's borrowing costs, enhancing investment in R&D and potential medtech acquisitions. However, inflation increased medical device raw material costs by 3.5% in 2024, impacting gross margins, which were 74.2% in Q3 2024. Strategic supply chain management, including early 2025 diversification, is vital to mitigate these pressures.

| Economic Factor | 2024 Data | 2025 Projection |

|---|---|---|

| Global AFib Market Size | $17.8 Billion (Est.) | $18.5 Billion (Est.) |

| Medical Device Raw Material Cost Increase | 3.5% Average | 2.8% Average (Projected) |

| Federal Reserve Rate Changes | Stable/Minor Hikes | Multiple Cuts (Mid-Year) |

| AtriCure Q3 Gross Margin | 74.2% | N/A |

Preview Before You Purchase

AtriCure PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive AtriCure PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

Each section offers detailed insights, providing a thorough understanding of the external forces shaping AtriCure's market landscape.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you receive a complete and actionable report.

Sociological factors

The global aging population significantly boosts demand for AtriCure's products, as conditions like atrial fibrillation increase with age. By 2030, the U.S. population aged 65 and over is projected to reach approximately 73 million, up from 56 million in 2020, substantially expanding the patient pool. This demographic trend ensures a sustained and growing need for advanced cardiac surgery and arrhythmia treatment solutions. The rising prevalence of age-related cardiac diseases directly underpins AtriCure's market growth.

There is a rising public awareness about cardiovascular health and the availability of advanced treatment options, especially for conditions like atrial fibrillation. With an estimated 6.7 million Americans living with Afib in 2024, patients are increasingly proactive in seeking effective interventions to improve their quality of life. This trend, coupled with educational initiatives from companies like AtriCure, helps drive patient demand for innovative surgical ablation procedures and devices. Patients are now more informed and engaged in their treatment decisions, pushing for less invasive and more effective solutions. This heightened health consciousness is a key driver for market growth in advanced cardiac care.

Patients and healthcare providers increasingly favor minimally invasive surgical options due to benefits like reduced recovery times and smaller incisions, a trend projected to drive significant growth in the minimally invasive surgery market, estimated to reach over $30 billion globally by 2025. AtriCure has responded by developing and marketing products for minimally invasive ablation procedures, such as their Hybrid AF™ Therapy. This focus aligns directly with patient preferences for less invasive solutions, enhancing AtriCure's market competitiveness in the cardiac ablation sector. The ongoing shift towards outpatient procedures further reinforces this demand, with minimally invasive techniques being a key enabler for such transitions.

Geographic Disparities in Healthcare Access

Significant geographic disparities persist in access to specialized cardiac care, particularly in rural and underserved areas across the United States. For instance, over 60% of rural counties lack a cardiologist, presenting a substantial challenge for patients needing advanced procedures like those for atrial fibrillation. However, this situation also creates a market opportunity for medical technologies adaptable to diverse healthcare settings. AtriCure's development of efficient and user-friendly devices, such as those for hybrid AF ablation, can empower more surgeons to perform these critical procedures, potentially bridging these care gaps by 2025.

- Only 10.7% of US counties have electrophysiology services, highlighting significant access limitations for complex arrhythmias.

- The rural-urban gap for cardiovascular mortality remains pronounced, with rural areas experiencing higher rates.

- Telehealth and less invasive surgical techniques are projected to expand access to specialized cardiac care by 15-20% in underserved regions by mid-2025.

Focus on Quality of Life and Clinical Outcomes

The healthcare landscape increasingly emphasizes improving patients' long-term quality of life, not just disease treatment. AtriCure's innovative technologies, such as the EPi-Sense System, are specifically designed to offer lasting solutions for arrhythmias, which substantially enhance a patient's daily life by reducing debilitating symptoms and lowering the risk of complications like stroke. The company's significant investment in extensive clinical trials, with over 15,000 patients enrolled across various studies by early 2025, underscores its commitment to demonstrating superior patient outcomes and improved quality of life metrics.

- AtriCure's 2024 clinical pipeline focuses on long-term arrhythmia freedom.

- Improved patient quality of life often correlates with reduced healthcare utilization costs.

- The global burden of atrial fibrillation, affecting over 60 million people by 2025, drives demand for enduring solutions.

The global aging population, with 60 million people affected by atrial fibrillation by 2025, significantly boosts demand for AtriCure's solutions. Patients increasingly seek minimally invasive options, aligning with a market projected to exceed $30 billion by 2025. Rising health awareness and a focus on long-term quality of life further propel the adoption of advanced cardiac care. Addressing geographic disparities in care access also remains a key market consideration.

| Sociological Factor | 2024/2025 Data Point | Impact on AtriCure |

|---|---|---|

| Aging Population | 60M+ global Afib patients by 2025 | Increased patient pool and sustained demand |

| Minimally Invasive Preference | $30B+ minimally invasive market by 2025 | Aligns with product development, enhances competitiveness |

| Healthcare Access Disparities | 10.7% US counties with electrophysiology services | Opportunity for wider device adoption to bridge gaps |

Technological factors

AtriCure's sustained growth is fundamentally linked to its continuous ability to innovate and launch new products. The company maintains a robust pipeline, with plans to seek FDA approval for seven novel products in the near future. Recent advancements include the successful 2024 launch of devices like the AtriClip PRO-Mini® and the EnCompass Clamp, addressing critical unmet clinical needs. This consistent innovation ensures AtriCure sustains its competitive edge in the evolving medical device sector.

The field of cardiac ablation is rapidly advancing, with AtriCure maintaining a strong position through its innovative technologies. The company leads in both radiofrequency and cryoablation, offering a comprehensive suite of products for diverse surgical needs. AtriCure is actively investing in emerging technologies like pulsed field ablation (PFA), anticipating its significant market impact, with analysts projecting the PFA market to reach over $1.5 billion by 2027. This proactive approach ensures AtriCure remains at the forefront of cardiac rhythm management solutions, driving future growth and competitive advantage in 2024 and beyond.

Artificial intelligence and data analytics are increasingly vital in medtech, from product development to post-market surveillance. Regulators, like the FDA, are intensifying scrutiny on AI in medical devices, demanding robust data and transparent algorithms for approvals expected by late 2024. AtriCure can harness these technologies to refine device design and effectiveness, for instance, by analyzing vast clinical trial data. This could optimize outcomes for procedures like atrial fibrillation ablation, enhancing device precision.

Minimally Invasive and Robotic Surgery

The increasing adoption of minimally invasive cardiac surgery presents a significant technological driver for AtriCure, with this segment projected for continued growth through 2025.

AtriCure's strategic focus on developing specialized devices, such as the AtriClip PRO-Mini, directly addresses this market trend, enhancing patient recovery.

The global minimally invasive surgical instruments market is expected to reach approximately $35 billion by 2025, underscoring the importance of AtriCure's product alignment.

Future growth avenues include the potential integration of AtriCure's technologies with advanced robotic surgical platforms, optimizing procedural precision.

- Minimally invasive cardiac procedures grew significantly in 2024, driving demand for specialized tools.

- AtriCure's AtriClip PRO-Mini directly supports less invasive atrial fibrillation treatments.

- The global robotic surgery market is forecast to exceed $17 billion by 2025, offering integration opportunities.

- Technological advancements improve patient outcomes and reduce healthcare costs.

Digital Health and Remote Monitoring

The burgeoning digital health and remote patient monitoring trend significantly reshapes healthcare delivery, offering new avenues for patient management. While AtriCure primarily focuses on surgical ablation devices for atrial fibrillation, integrating smart features or connectivity into future products holds substantial potential. This innovation could enhance post-operative monitoring for patients, collecting crucial data on recovery and device performance. Such data provides invaluable insights for clinicians to optimize patient care and for AtriCure to inform future product development and strategic advancements in 2024 and beyond.

- The global remote patient monitoring market is projected to reach approximately $50 billion by 2025.

- Integration of data from wearables and implantable devices is enhancing post-operative insights.

- AtriCure's potential for connected devices aligns with evolving clinical needs for continuous patient data.

AtriCure's growth is driven by continuous innovation, with 2024 launches like the AtriClip PRO-Mini® and investment in Pulsed Field Ablation, projected to exceed $1.5 billion by 2027. The company leverages AI for device optimization and capitalizes on the minimally invasive surgery market, expected to reach $35 billion by 2025. Future integration with robotic surgery, a $17 billion market by 2025, and remote patient monitoring, projected at $50 billion by 2025, further enhance its technological advantage.

| Technological Factor | Key Trend/Focus | 2024/2025 Data Point |

|---|---|---|

| Product Innovation | New device launches, R&D pipeline | AtriClip PRO-Mini® launched 2024 |

| Ablation Technologies | PFA market growth, RFA/Cryo leadership | PFA market >$1.5B by 2027 |

| Minimally Invasive Surgery | Market expansion, specialized devices | Global market ~$35B by 2025 |

| Digital Health Integration | Remote monitoring, AI analytics | RPM market ~$50B by 2025 |

Legal factors

AtriCure must navigate stringent regulatory approval processes, particularly with the FDA for its Class III devices, which demand extensive clinical data. These premarket approvals are highly rigorous, often extending beyond the FDA's target review period of 180 days for original PMAs, and can significantly delay market entry. Any setbacks in securing these critical approvals directly impact revenue projections and market penetration for fiscal years 2024 and 2025. For instance, the average time for Class III PMA approval can exceed 300 days, highlighting the substantial time investment required.

Protecting its intellectual property through robust patent portfolios is crucial for AtriCure to sustain its competitive edge in the highly innovative medical device sector. The company actively manages its patent portfolio, which, as of early 2025, includes hundreds of issued and pending patents globally, safeguarding its proprietary ablation and occlusion technologies. Litigation related to patent disputes remains a significant legal risk, with the medical device industry seeing numerous high-stakes cases annually that can impact financial performance and market position. For instance, the average cost of patent litigation can range from $2 million to $5 million, underscoring the need for diligent IP defense.

As a manufacturer of high-risk medical devices, AtriCure faces significant product liability and litigation risks. Any device malfunction or adverse patient outcome, such as those impacting the 2024 estimated 200,000 global atrial fibrillation ablation procedures, could trigger costly lawsuits. Such litigation can lead to substantial financial penalties, with some medical device liability settlements exceeding $50 million, and severe damage to the company's market reputation. Therefore, maintaining rigorous quality control standards and collecting comprehensive, transparent clinical data for all product lines are crucial to effectively mitigate these inherent legal exposures through 2025 and beyond.

Compliance with Healthcare Laws

AtriCure must strictly adhere to a broad spectrum of healthcare laws, including anti-kickback statutes and rules governing medical device promotion. Non-compliance can lead to substantial financial penalties, potentially reaching tens of millions of dollars, and severe legal sanctions. For instance, recent enforcement actions in 2024 have shown the Department of Justice imposing significant fines on medical device firms for marketing violations. Therefore, a robust compliance program remains a critical legal function for AtriCure.

- Adherence to anti-kickback statutes is paramount.

- Strict rules govern medical device marketing and promotion.

- Violations can incur penalties exceeding $50 million, impacting profitability.

- A strong compliance program is essential to mitigate legal risks.

International Legal and Regulatory Harmonization

AtriCure's global operations necessitate strict adherence to diverse national legal and regulatory frameworks for medical devices. While the International Medical Device Regulators Forum (IMDRF) aims for global harmonization, significant jurisdictional differences persist, demanding careful legal navigation. For instance, the EU's Medical Device Regulation (MDR), fully enforced since May 2021, continues to impose rigorous compliance burdens, distinct from FDA requirements in the U.S. This fragmented landscape impacts product market entry and ongoing compliance costs, with an estimated 2024 global medical device regulatory compliance spend projected to exceed $15 billion.

- EU MDR compliance costs for companies can represent 5-10% of total revenue annually.

- FDA 510(k) clearances in the US remain a distinct pathway from EU CE Mark certification.

- IMDRF initiatives like the Medical Device Single Audit Program (MDSAP) aim to streamline audits across five participating countries, reducing redundancy by 2025.

AtriCure's global operations necessitate strict adherence to diverse national legal and regulatory frameworks for medical devices, creating a fragmented landscape. This disparity, particularly between the EU's stringent MDR and the U.S. FDA requirements, significantly impacts market entry and ongoing compliance costs. Global medical device regulatory compliance spend is projected to exceed $15 billion in 2024, with EU MDR compliance alone potentially representing 5-10% of annual revenue for some companies. While initiatives like IMDRF's MDSAP aim to streamline audits across five countries by 2025, distinct regional requirements will continue to pose challenges.

| Regulatory Aspect | Key Requirement/Impact | 2024/2025 Data Point |

|---|---|---|

| Global Compliance Spend | Overall industry cost to meet regulations | >$15 Billion (2024 projection) |

| EU MDR Compliance | Annual cost for EU market access | 5-10% of total revenue |

| MDSAP Streamlining | Reduced audit redundancy | Across 5 countries by 2025 |

Environmental factors

AtriCure's manufacturing operations, specifically in producing medical devices like its AtriClip PRO2, inherently generate waste, requiring strict adherence to evolving environmental regulations concerning disposal. Effective waste management is crucial, as the company must responsibly manage its environmental footprint, including the handling of materials and byproducts from its Mason, Ohio facility. Compliance with international standards such as ISO 13485, vital for medical device quality management, increasingly incorporates environmental considerations into its framework, influencing operational design for 2024-2025. This focus aligns with broader industry trends where global medical device waste generation, estimated at over 5.5 million tons annually, necessitates sustainable practices to mitigate environmental impact and ensure regulatory compliance.

The healthcare industry, including medical device manufacturers like AtriCure, faces increasing stakeholder pressure for sustainable sourcing and supply chain practices. By mid-2025, over 70% of global healthcare organizations are expected to have formal sustainability targets, driving demand for eco-friendly materials and reduced environmental impact. AtriCure must ensure its supply chain partners adhere to stringent environmental standards, such as those reducing Scope 3 emissions, which represent over 80% of a medical device company's total carbon footprint. This focus includes responsible waste management and energy-efficient logistics throughout its operations.

Environmental regulations, especially those restricting substances like PFAS or heavy metals in medical devices, significantly impact AtriCure's product design and manufacturing. The company must rigorously monitor evolving global standards, such as the EU's updated RoHS Directive or emerging US state-level chemical restrictions, to ensure compliance. This vigilance is crucial for their quality management systems and maintaining market access, directly affecting R&D and operational costs for 2024-2025.

Climate Change and Operational Resilience

Climate change poses evolving long-term risks to AtriCure's operations, potentially disrupting manufacturing and supply chains through extreme weather events. For instance, the 2024 Atlantic hurricane season forecasts suggest heightened activity, increasing potential for logistical challenges. AtriCure must integrate these climate-related risks into its 2025 strategic planning to fortify operational resilience. This aligns with a growing trend where over 70% of S&P 500 companies, by early 2025, are expected to formally incorporate climate risk into their business continuity frameworks.

- 2024 Atlantic hurricane season forecasts indicate above-average activity, raising supply chain disruption risks.

- By early 2025, over 70% of S&P 500 companies are expected to integrate climate risk into business continuity.

Corporate Social Responsibility and ESG Reporting

Corporate Social Responsibility and ESG Reporting

Investors and stakeholders are increasingly demanding comprehensive Environmental, Social, and Governance (ESG) performance reporting from companies. AtriCure actively publishes ESG reports, detailing its commitment to environmental stewardship and various social and governance initiatives. This transparency is crucial for maintaining a strong corporate reputation and attracting investment, aligning with the growing focus on sustainable practices in the 2024-2025 market. Companies like AtriCure demonstrating robust ESG frameworks are often viewed more favorably by capital markets.

- Growing investor focus on ESG metrics in 2024-2025.

- AtriCure's commitment to transparent ESG reporting.

- Enhanced corporate reputation through sustainability initiatives.

AtriCure must navigate stringent 2024-2025 environmental regulations concerning waste management and substance restrictions, such as PFAS, impacting product design and compliance. Growing stakeholder pressure, with over 70% of healthcare organizations setting sustainability targets by mid-2025, demands eco-friendly supply chains, particularly reducing Scope 3 emissions which comprise 80% of a medical device company's carbon footprint. Climate change risks, exemplified by the 2024 Atlantic hurricane season forecasts, necessitate integrating operational resilience into strategic planning, aligning with over 70% of S&P 500 companies by early 2025. This environmental focus and transparent ESG reporting are crucial for corporate reputation and investor relations.

| Environmental Factor | 2024-2025 Relevance | Impact on AtriCure |

|---|---|---|

| Global Medical Device Waste | Over 5.5 million tons annually | Strict waste management, regulatory compliance |

| Healthcare Org. Sustainability Targets | Over 70% by mid-2025 | Demand for eco-friendly supply chains, reduced Scope 3 emissions |

| Climate Risk Integration (S&P 500) | Over 70% by early 2025 | Operational resilience, supply chain fortification |

PESTLE Analysis Data Sources

Our AtriCure PESTLE Analysis is meticulously constructed using a diverse range of credible data sources, including regulatory filings from health authorities, economic reports from leading financial institutions, and industry-specific market research. This ensures a comprehensive and accurate understanding of the external factors influencing the cardiac surgery market.