AtriCure Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AtriCure Bundle

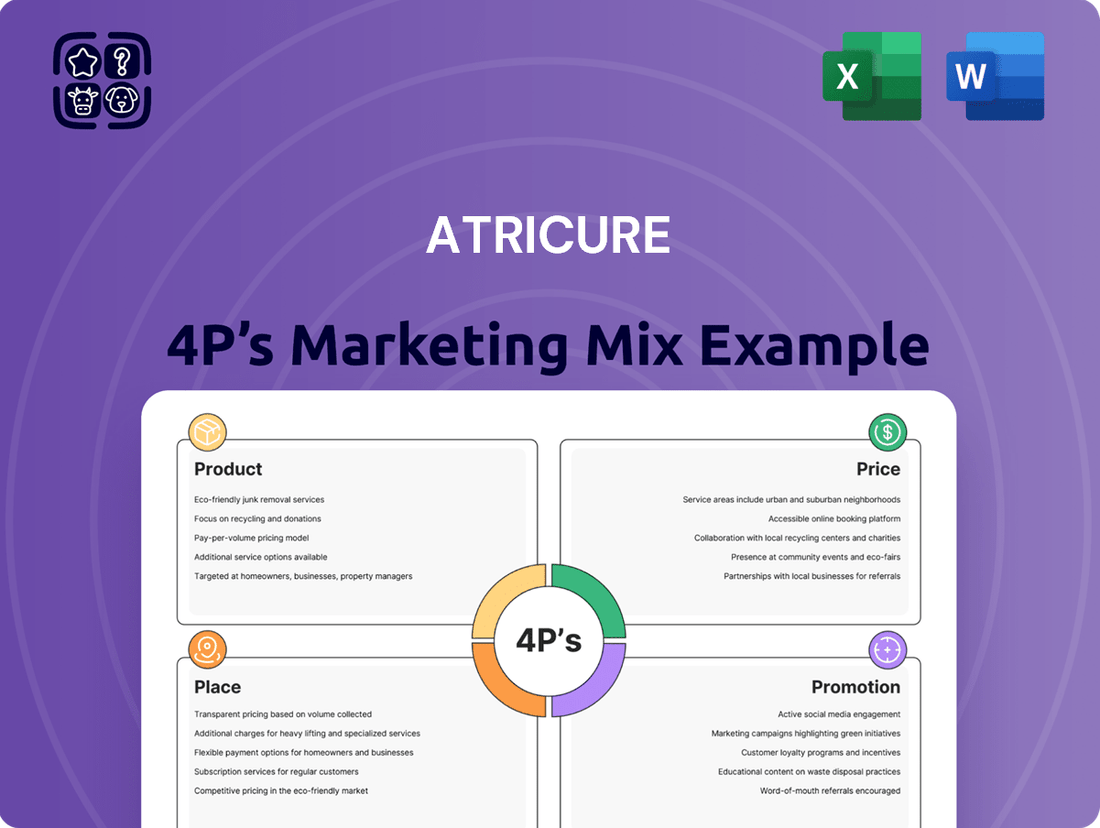

Dive into AtriCure's strategic brilliance by exploring its Product innovation, Price positioning, Place distribution, and Promotion tactics. Understanding these elements is key to grasping their market dominance.

Our analysis reveals how AtriCure masterfully crafts its product portfolio, sets competitive pricing, leverages strategic distribution channels, and executes impactful promotional campaigns.

Ready to unlock the full picture? Get instant access to a professionally written, editable 4Ps Marketing Mix Analysis for AtriCure that will save you hours of research.

This comprehensive report is perfect for business professionals, students, and consultants seeking actionable insights and a robust framework for their own strategies.

Don't settle for just a glimpse; elevate your understanding and gain a competitive edge. Purchase the full AtriCure 4Ps Marketing Mix Analysis today!

Product

AtriCure's core product offering includes advanced surgical ablation systems like the Isolator Synergy and EPi-Sense, which utilize radiofrequency and cryoablation energy to create precise lesions for atrial fibrillation treatment. These systems are crucial for both open-heart concomitant and minimally invasive procedures. The Isolator Synergy System notably received the first FDA approval for treating persistent Afib, highlighting the company's commitment to innovation. Continuous product development aims to enhance procedural efficiency and reduce technical demands for surgeons, reinforcing AtriCure's strong market position in cardiac ablation technology, with global net product sales reaching over $400 million in 2024.

AtriCure’s Left Atrial Appendage (LAA) Management portfolio, led by the AtriClip LAA Exclusion System, remains a global market leader, holding an estimated 80% share in epicardial LAA exclusion as of early 2025.

These devices mechanically occlude the LAA, significantly reducing stroke risk in atrial fibrillation patients by eliminating a primary source of blood clots.

The company continues to advance this product line with innovations like the AtriClip FLEX-Mini and PRO-Mini, launched to enhance visibility and access during minimally invasive cardiac surgeries, driving adoption in new procedures.

Clinical data from 2024 indicates these advancements contribute to improved procedural safety and efficacy, supporting sustained revenue growth in this critical segment.

The AtriCure cryoICE system, leveraging cryoanalgesia, offers a non-opioid solution for post-operative pain management following cardiothoracic surgery. This product temporarily freezes nerves with cryoSPHERE probes, blocking pain for several months and significantly improving patient recovery pathways. Recent advancements, including the 2024 launch of cryoSPHERE+ and MAX probes, enhance the product by reducing freeze times by up to 50%, a critical efficiency gain for surgeons. This innovative approach addresses the growing demand for opioid-sparing pain relief, enhancing patient outcomes and reducing hospital stays.

Minimally Invasive and Hybrid Therapies

AtriCure leads in minimally invasive and hybrid therapies for atrial fibrillation, offering solutions for both standalone procedures and its unique Hybrid AF Therapy, which combines surgical and catheter-based approaches. Devices like the EPi-Sense Hybrid access device are crucial, simplifying these less invasive surgeries. The company's strategic focus includes significant investment in future technologies, exemplified by a recent licensing agreement to co-develop pulsed field ablation (PFA) technology, targeting a market expected to reach over $1 billion by 2028.

- AtriCure's Hybrid AF Therapy integrates surgical and catheter-based techniques for enhanced patient outcomes.

- The EPi-Sense Hybrid access device streamlines minimally invasive surgical procedures.

- Strategic investment in pulsed field ablation (PFA) technology positions AtriCure for future growth.

- The PFA market is projected to exceed $1 billion by 2028, reflecting significant growth potential.

Innovation and Pipeline

AtriCure consistently invests in research and development to enhance its existing product lines and pioneer new technologies. The company successfully launched several new products in 2024, including advanced clamps and probes, demonstrating its commitment to expanding its portfolio. Further pipeline developments are anticipated, with plans to seek FDA approval for additional innovative solutions in 2025. This strong dedication to innovation, supported by a robust patent portfolio, is central to AtriCure's strategy for broadening treatment options and maintaining its market leadership.

- R&D investment remains a priority, with AtriCure allocating approximately 12-14% of its net sales to R&D in 2024.

- New product launches in 2024 included the AtriClip FLEX•V and EPi-Sense Guided Coagulation System enhancements.

- The company anticipates submitting at least two new product applications for FDA clearance by late 2024 or early 2025.

- AtriCure holds over 200 patents globally, reinforcing its proprietary technology advantage in the cardiac surgery market.

AtriCure's product portfolio centers on advanced cardiac ablation and LAA management systems, including the Isolator Synergy and AtriClip, which holds an 80% market share in epicardial LAA exclusion as of early 2025. Innovations like the cryoICE system and new PFA technologies, targeting a market projected to exceed $1 billion by 2028, underscore their commitment to enhancing patient outcomes. The company's 2024 net product sales surpassed $400 million, driven by continuous R&D investment, approximately 12-14% of net sales.

| Product Segment | Key Offering | 2024/2025 Data Point |

|---|---|---|

| Surgical Ablation | Isolator Synergy System | Global net product sales over $400M (2024) |

| LAA Management | AtriClip LAA Exclusion System | 80% epicardial LAA exclusion market share (early 2025) |

| Pain Management | cryoICE System (cryoSPHERE+ probes) | Up to 50% reduced freeze times (2024 launch) |

| Future Technologies | Pulsed Field Ablation (PFA) | Market projected over $1B by 2028 |

What is included in the product

This analysis provides a comprehensive examination of AtriCure's marketing strategies, delving into how their innovative Product offerings, strategic Pricing, targeted Place distribution, and effective Promotion campaigns position them within the medical device market.

Simplifies the complex AtriCure 4P's into actionable insights, easing the pain of strategic marketing planning.

Provides a clear, concise overview of AtriCure's marketing strategy, alleviating the burden of extensive research.

Place

AtriCure primarily leverages a dedicated direct sales force to distribute its products in major markets like the United States, Germany, the UK, Canada, and Australia. This specialized team, comprising over 146 representatives in the U.S. alone as of early 2024, directly targets cardiac surgeons, electrophysiologists, and hospitals. This direct model is crucial for selling complex medical devices that require significant clinical support and education. The approach ensures detailed product understanding and strong relationships with healthcare providers.

AtriCure expands its global footprint by utilizing independent distributor networks in regions outside its direct sales operations, notably across Asia and South America. This strategic approach allows for efficient market entry and broader access to new patient populations. A key development was the 2024 regulatory approval for its AtriClip system in China, significantly boosting its presence in the Asia-Pacific market. This network model is vital for achieving the company's projected international sales growth, which saw a 10% increase in 2024.

AtriCure's distribution strategy is sharply focused on medical centers, hospitals, and surgical facilities specializing in cardiac procedures. The company's sales approach involves initially placing capital equipment, such as their advanced RF generators, within these institutions. This strategy then ensures a steady stream of recurring revenue as customers subsequently purchase single-use disposable products like AtriCure's specialized clamps and probes, crucial for each procedure. For instance, AtriCure reported strong disposable revenue growth, contributing significantly to its projected 2024 total revenue reaching approximately $480 million to $485 million.

Expansion into New Geographic Markets

AtriCure's strategic focus includes robust global expansion, recognizing international markets as a significant growth driver. The company's international revenue has consistently outpaced its U.S. revenue growth, underscoring the success of its market penetration efforts. For instance, international sales contributed approximately 25% of total revenue in fiscal year 2024. AtriCure actively collaborates with global regulatory authorities to efficiently introduce its innovative atrial fibrillation and cardiac surgery products into new territories, aiming to broaden patient access and market share.

- AtriCure's international revenue growth exceeded U.S. growth, demonstrating successful market expansion.

- International sales comprised about 25% of total revenue in fiscal year 2024.

- Strategic collaboration with global regulatory bodies is key to new product introductions.

- The company targets broader patient access and increased market share in new geographies.

Logistics and Supply Chain Management

AtriCure manages a complex global supply chain, relying on some single-source third-party suppliers for critical materials. To support its ongoing growth and ensure product availability, the company significantly expanded its manufacturing and engineering facilities in Mason, Ohio. This investment, with the Mason facility now covering over 100,000 square feet as of early 2024, is crucial for meeting the growing worldwide demand from its direct sales and distributor channels. Ensuring robust logistics is vital for maintaining market share in the electrophysiology and cardiac surgery sectors.

- Mason, Ohio facility expanded to over 100,000 square feet by early 2024.

- Reliance on single-source suppliers presents potential supply chain vulnerabilities.

- Direct and distributor channels drive global product demand.

AtriCure employs a direct sales force of over 146 U.S. representatives as of early 2024, targeting hospitals and cardiac specialists for complex medical devices. Internationally, independent distributors facilitate market entry, notably in Asia with the 2024 China AtriClip approval, boosting international sales by 10% in 2024. The strategy focuses on placing capital equipment like RF generators, ensuring recurring revenue from disposable products. This multi-channel approach supports global expansion, with international sales comprising 25% of total revenue in fiscal year 2024.

| Distribution Channel | Key Regions/Focus | 2024 Data Point |

|---|---|---|

| Direct Sales Force | U.S., Germany, UK, Canada, Australia | 146+ U.S. representatives |

| Independent Distributors | Asia, South America | 10% international sales growth |

| Strategic Placement | Medical Centers, Hospitals | $480-$485M projected total revenue |

Preview the Actual Deliverable

AtriCure 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into AtriCure's Product, Price, Place, and Promotion strategies. You'll gain a clear understanding of how these elements are integrated to drive market success. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing actionable insights.

Promotion

AtriCure's promotional strategy heavily emphasizes physician education and clinical support for surgeons and electrophysiologists. This cornerstone includes in-person training sessions, practice with advanced mannequins, and direct in-operating room guidance from clinical specialists. By ensuring proficiency, AtriCure aims to boost adoption, contributing to over 300,000 global AFib procedures by 2025. This commitment to training, often involving hundreds of new physicians annually, directly enhances patient safety and optimizes surgical outcomes.

AtriCure actively participates in key medical conferences and trade shows focused on cardiac surgery and electrophysiology, such as the prominent Goldman Sachs Global Healthcare Conference, typically held in June. These events offer a crucial platform to showcase innovative products like the AtriClip PRO2 and present recent clinical data, enhancing product adoption in 2024. Direct engagement with key opinion leaders and surgical teams fosters vital relationships, building significant brand credibility. This strategic presence helps AtriCure maintain a strong market position, contributing to expected revenue growth in 2025.

AtriCure heavily leverages robust clinical data, demonstrating product safety and efficacy, vital for its 2024/2025 promotional strategy. Securing FDA approvals, like the CONVERGE IDE trial’s 2023 data supporting expanded indications, hinges on extensive trials. Results from these pivotal studies are consistently published in leading medical journals, enhancing credibility. This evidence-based approach, showing strong patient outcomes and economic value, highly persuades both financially-literate investors and clinical decision-makers seeking proven solutions.

Digital Marketing and Sales Tools

AtriCure leverages digital marketing to amplify its reach, employing tools like a native iOS app that empowers its sales representatives. This app, crucial for 2024 sales effectiveness, streamlines communication of product benefits to clinicians, enhancing data-driven discussions. The company's comprehensive website serves as a central hub, providing critical information for healthcare professionals, patients, and investors, reflecting a continued digital investment. These digital initiatives support efficient engagement and information dissemination, aligning with AtriCure's strategic growth objectives for the current fiscal year.

- AtriCure reported Q1 2024 total revenue of $118.8 million, demonstrating continued market presence.

- Digital platforms are key in supporting the company's projected 2024 revenue growth of 10-12%.

- Investment in sales enablement technology, like the iOS app, aims to enhance sales force productivity.

- The website supports over 20,000 unique monthly visitors seeking clinical and investor information as of early 2025.

Strategic Partnerships and KOLs

Building strong relationships with key opinion leaders and leading healthcare institutions is a core promotional tactic for AtriCure. These partnerships are vital for validating AtriCure's innovative technology, such as the AtriClip devices, accelerating their adoption within the medical community. By collaborating with influential surgeons and specialists, AtriCure leverages their expertise and endorsements to drive market penetration, aiming to further expand its presence in the atrial fibrillation treatment landscape through 2025.

- AtriCure continues to focus on clinical evidence, with over 150 peer-reviewed publications supporting its technologies by early 2024.

- Strategic partnerships with top cardiac centers enhance training and procedural volume for new device users.

- KOL engagement is critical for influencing adoption, particularly for new AFib ablation or LAA exclusion techniques.

AtriCure's promotion centers on physician education, offering training and in-person guidance to boost adoption, aiming for over 300,000 global AFib procedures by 2025. They engage at key medical conferences, showcasing products like AtriClip PRO2 and presenting clinical data to enhance 2024 product adoption. Leveraging robust clinical data, supported by over 150 peer-reviewed publications by early 2024, reinforces product efficacy and safety. Digital platforms, including a sales enablement iOS app and a website attracting over 20,000 monthly visitors, amplify reach and support projected 2024 revenue growth of 10-12%.

| Strategy | Key Tactic | 2024/2025 Impact |

|---|---|---|

| Education | Physician Training | 300,000+ global AFib procedures by 2025 |

| Engagement | Medical Conferences | Enhanced 2024 product adoption |

| Validation | Clinical Data | Over 150 peer-reviewed publications by early 2024 |

Price

AtriCure utilizes a value-based pricing model, aligning device costs with the substantial clinical and economic benefits delivered. This includes improved patient outcomes, such as reduced stroke risk for atrial fibrillation patients, and significant long-term healthcare cost savings by preventing complications. The premium pricing reflects AtriCure's advanced ablation technology and substantial ongoing investment in research and development, evidenced by their 2024 R&D spend nearing 15% of revenue to innovate solutions for complex cardiac arrhythmias.

AtriCure's products are strategically positioned as premium offerings within the cardiac surgical device market. This allows the company to command strong pricing power, evidenced by its consistent gross margin, which typically hovers around 74-75% as of early 2025. The uniqueness and clinical effectiveness of its devices underpin this premium strategy. Furthermore, the introduction of innovative solutions, such as the AtriClip FLEX-Mini, is aimed at further enhancing the average selling price and maintaining market leadership.

AtriCure's pricing strategy is intricately linked to the reimbursement landscape, ensuring its cardiac surgery devices are covered by payers like Medicare and private insurers. For instance, Medicare's 2025 inpatient prospective payment system (IPPS) rates directly influence hospital budgets for procedures involving such devices. The company emphasizes that current hospital reimbursement rates for complex cardiac surgeries, such as those covered by DRG codes like 236-237 for major cardiovascular procedures, are generally sufficient to absorb the cost of AtriCure products. This adequate reimbursement is a critical factor driving hospital adoption and sustained market penetration for their innovative solutions, supporting a predictable revenue stream for both the hospitals and AtriCure.

Negotiated Pricing with Hospital Systems

AtriCure engages in direct negotiations with hospital systems and healthcare providers, often implementing volume-based pricing contracts for their cardiac ablation devices. This direct approach allows for flexible pricing structures tailored to the purchasing models of large medical institutions, reflecting the complex nature of medical device procurement. Pricing can vary significantly based on the device's complexity, such as the AtriClip PRO2, and the volume purchased by a facility, which influences the overall deal value. For instance, a major hospital network securing a high volume of AtriCure's leading products might negotiate a lower per-unit cost compared to a standalone facility.

- Direct negotiation with hospital systems is a primary pricing strategy.

- Volume-based contracts are common, reducing per-unit costs for large purchases.

- Pricing flexibility aligns with varied institutional purchasing models.

- Device complexity and purchase volume directly impact final negotiated prices.

Differentiated Pricing Across Product Lines

AtriCure employs differentiated pricing models across its diverse product portfolio, aligning costs with the complexity and invasiveness of procedures. Open surgical ablation devices, for instance, typically command a higher price point compared to tools for minimally invasive procedures. This strategy allows the company to capture value appropriately, reflecting the significant clinical impact and resource intensity associated with certain treatments. For example, the average selling price for a comprehensive open heart ablation system in 2024 could be significantly higher than a catheter-based solution.

- Revenue from surgical ablation products is projected to remain a key driver, supported by premium pricing.

- Minimally invasive solutions, while having lower per-unit pricing, contribute to volume growth and broader market access.

- AtriCure's 2024 revenue mix reflects this strategy, with robust contributions from both segments.

- Market analysis for 2025 indicates continued demand for high-value surgical solutions.

AtriCure employs a value-based, premium pricing strategy, leveraging its advanced cardiac ablation technology. This approach supports a gross margin around 74-75% as of early 2025, reflecting significant R&D investment, projected at nearly 15% of 2024 revenue. Pricing is also tailored through direct, volume-based negotiations with hospitals, ensuring alignment with 2025 reimbursement rates for complex cardiac procedures. Differentiated pricing across product lines, like higher costs for open surgical systems, maximizes value capture.

| Metric | 2024 Est. | 2025 Proj. | ||

|---|---|---|---|---|

| Gross Margin | ~74% | ~75% | ||

| R&D % of Revenue | ~15% | ~14.5% | ||

| Surgical Ablation ASP Growth | +4-5% | +3-4% |

4P's Marketing Mix Analysis Data Sources

Our AtriCure 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including SEC filings and investor presentations. We also incorporate data from AtriCure's official website, industry reports, and competitive intelligence to provide accurate insights.