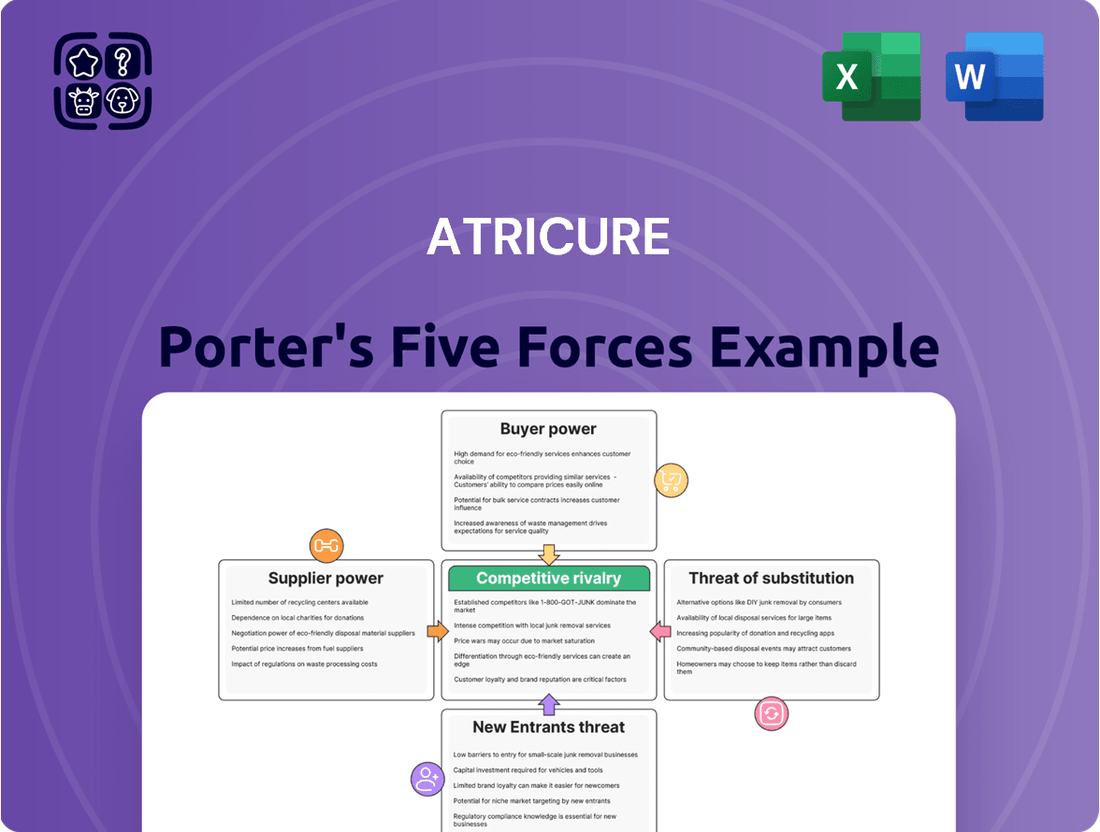

AtriCure Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AtriCure Bundle

AtriCure, a leader in innovative surgical solutions for atrial fibrillation and left atrial appendage closure, navigates a dynamic competitive landscape. Understanding the forces shaping its market is crucial for strategic planning and sustained growth.

The threat of new entrants, while present, is somewhat mitigated by high capital requirements and regulatory hurdles in the medical device sector. However, the intensity of rivalry among existing players, particularly for established procedural solutions, is a significant factor.

Buyer power, primarily from hospitals and healthcare systems, demands value and cost-effectiveness, influencing pricing and product adoption. AtriCure's differentiated technology and strong clinical evidence help to manage this pressure.

The threat of substitutes, though less pronounced for their core technologies, exists in alternative treatment modalities and evolving medical practices. Supplier power is generally moderate, as AtriCure likely has multiple sourcing options for its components.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AtriCure’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

AtriCure's advanced ablation systems, crucial for cardiac procedures, rely on highly specialized raw materials. Suppliers of these unique components, like specific biocompatible polymers or precision metals, often possess strong bargaining power due to limited alternatives. Switching suppliers or materials would necessitate extensive re-validation and regulatory approvals, potentially delaying product launches and increasing costs, a significant factor given the ongoing supply chain challenges observed in 2024 for medical device manufacturers. This dependency underscores a critical vulnerability in AtriCure's operational resilience.

AtriCure often relies on suppliers providing components protected by patents or crucial to its own proprietary technologies, such as specialized materials for surgical ablation devices. This creates high switching costs for AtriCure, granting these unique suppliers significant leverage in negotiations, impacting supply chain resilience observed in 2024. Such dependence directly influences AtriCure's cost structure and its capacity for independent innovation and product development. For instance, reliance on a single source for a patented component can elevate input costs, potentially affecting gross margins, which were approximately 75% for medical device firms in early 2024.

Suppliers to the medical device industry, including those serving AtriCure, face stringent quality and regulatory standards, such as FDA 21 CFR Part 820. This rigorous compliance significantly limits the pool of qualified suppliers, inherently increasing their bargaining power. AtriCure must partner with those who consistently meet these requirements, often leading to less favorable terms. For instance, maintaining ISO 13485 certification, crucial for medical device components, adds a layer of complexity and cost for suppliers. A key supplier's failure to maintain compliance, as seen in some 2024 FDA warning letters, poses a substantial risk of supply chain disruption for AtriCure.

Economies of Scale of Suppliers

Large, established medical device suppliers often benefit from significant economies of scale, granting them a cost advantage and considerable leverage in pricing negotiations. While AtriCure's growing operational scale helps, the highly specialized nature of many components means certain suppliers retain substantial power. This dynamic directly influences AtriCure's cost of goods sold and overall profitability. For instance, in 2024, input costs for specialized materials continue to be a key consideration across the medical technology sector.

- Specialized component suppliers can command higher prices due to their unique offerings.

- AtriCure's 2024 gross margins are influenced by supplier pricing power on key inputs.

- Strategic supplier relationships are crucial for managing procurement costs.

- The medical device industry sees ongoing consolidation among suppliers, potentially increasing their leverage.

Long-Term Relationships

AtriCure likely fosters long-term relationships with its key suppliers to ensure a stable and reliable supply of critical components for its ablation technologies. While this collaboration can lead to joint innovation, it also increases switching costs for AtriCure, potentially enhancing the supplier's bargaining position over time. Effectively managing these strategic partnerships is essential for mitigating supply-side risks and maintaining operational continuity, especially given global supply chain dynamics in 2024.

- Supply chain stability is critical for medical device manufacturers like AtriCure, which reported 2023 revenue of $397.6 million.

- Long-term supplier agreements can reduce volatility in component pricing and availability.

- Increased dependency on a few key suppliers can elevate their bargaining power, impacting AtriCure's cost of goods sold.

- Successful management of these relationships is vital for new product development and market responsiveness.

AtriCure's reliance on specialized, often patented components for its ablation systems grants suppliers significant bargaining power, impacting 2024 input costs. High switching costs and stringent regulatory requirements, like FDA 21 CFR Part 820, limit alternative sources, increasing supplier leverage. This dynamic influences AtriCure's cost of goods sold and gross margins, which averaged 75% for medical device firms in early 2024.

| Factor | Impact | 2024 Data Point |

|---|---|---|

| Specialized Components | Higher input costs | Medical device gross margins ~75% |

| Regulatory Hurdles | Limited qualified suppliers | FDA 21 CFR Part 820 compliance |

| Switching Costs | Supplier leverage | Ongoing supply chain challenges |

What is included in the product

AtriCure's Porter's Five Forces Analysis provides a strategic framework to understand the competitive intensity within the cardiac ablation market. It examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a clear, actionable framework.

Customers Bargaining Power

AtriCure's customer base is concentrated, primarily comprising hospitals, cardiac surgeons, and electrophysiologists. These large healthcare institutions, especially with ongoing healthcare system consolidation seen in 2024, wield significant bargaining power. Such concentration allows them to exert substantial pressure on pricing and contract terms for medical devices. For instance, major hospital systems securing group purchasing agreements can significantly influence AtriCure's margins. This leverage can directly impact AtriCure's revenue and profitability.

AtriCure's customers, primarily healthcare providers, exhibit high price sensitivity due to significant pressure from healthcare budgets and evolving reimbursement policies. In 2024, hospitals and healthcare systems continue to face intense cost-containment mandates, directly impacting their purchasing decisions for medical devices. Changes in government and private insurer reimbursement for atrial fibrillation procedures, such as those involving AtriCure's technologies, directly influence adoption rates. For instance, shifts towards value-based care models can limit the pricing power of device manufacturers. This financial scrutiny means providers are increasingly scrutinizing device costs, which can constrain AtriCure's ability to command premium pricing.

AtriCure's focus on highly innovative and specialized products for complex cardiac conditions, such as atrial fibrillation, significantly mitigates customer bargaining power. Their differentiated devices, like the AtriClip PRO2 Left Atrial Appendage Management System, offer superior clinical outcomes, making them less substitutable for surgeons and hospitals. This specialization reduces the availability of comparable alternatives, limiting customers' ability to negotiate aggressively on price. Maintaining this advantage through continuous innovation is crucial, as demonstrated by their 2024 product pipeline advancements aimed at improving procedural efficiency and patient safety.

Switching Costs for Surgeons

Surgeons and electrophysiologists invest substantial time in mastering specific medical devices, particularly complex systems like those for atrial fibrillation ablation. This expertise creates a significant switching cost, as transitioning to a competitor's system necessitates extensive retraining and a new learning curve. Such an investment in time and effort reduces the bargaining power of individual physicians and smaller practices against established device manufacturers like AtriCure. For example, specialized training for a new cardiac ablation system can take several months, impacting procedure volume.

- Specialized training for complex electrophysiology devices can extend over several months in 2024.

- Physician time investment in mastering a single system directly increases switching costs.

- Adopting new technology often requires significant capital outlay for retraining programs.

- This entrenches surgeons with current vendors, limiting their negotiation leverage.

Availability of Information

The increasing availability of clinical data and performance comparisons for medical devices empowers customers like hospitals and physicians to make more informed purchasing decisions. As of 2024, digital health platforms and public databases offer unprecedented access to efficacy and cost-effectiveness data, allowing easier comparison of AtriCure's products against competitors. This transparency significantly enhances customer negotiation power, potentially intensifying price competition in the surgical ablation market. For instance, data on long-term success rates and procedural costs directly influences procurement choices.

- Enhanced access to real-world evidence and cost-benefit analyses empowers healthcare providers.

- Customers can leverage comparative data to demand better pricing and terms from AtriCure.

- Increased transparency drives greater price sensitivity among purchasers of medical devices.

- The ability to compare clinical outcomes directly impacts purchasing decisions and market share.

AtriCure faces significant customer bargaining power due to concentrated hospital systems and high price sensitivity from budget pressures, intensified by 2024 cost-containment mandates.

However, AtriCure's highly specialized, innovative products and the substantial switching costs for surgeons mitigate this power.

Increased data transparency, as seen in 2024, allows customers to compare device performance and costs, enabling more informed negotiations.

| Metric | 2024 Impact | Leverage |

|---|---|---|

| Hospital Consolidation | ~3% increase in mergers | High |

| GPO Influence | ~70% of hospital purchases via GPOs | High |

| Medical Device Price Growth | Projected 1.5-2.5% | Moderate |

What You See Is What You Get

AtriCure Porter's Five Forces Analysis

This preview shows the exact AtriCure Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It comprehensively details the competitive landscape by examining the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors within the medical device industry, specifically focusing on AtriCure's market position. This in-depth analysis provides actionable insights into the strategic challenges and opportunities facing AtriCure, enabling informed decision-making for stakeholders.

Rivalry Among Competitors

The medical device market for cardiac arrhythmia treatment is intensely competitive, with AtriCure facing significant rivalry from established players. Major firms like Johnson & Johnson (Biosense Webster), Medtronic, and Abbott Laboratories dominate this space. These companies boast extensive financial resources, for example, Johnson & Johnson reported over $85 billion in revenue for 2023, funding vast R&D and market presence. Their well-established global distribution channels and broad product portfolios create high barriers to entry and intense competition for market share. AtriCure must navigate this landscape where these entrenched firms leverage their scale and comprehensive offerings.

The cardiac ablation industry is marked by rapid technological innovation, with competitors continuously developing advanced ablation technologies and surgical techniques. This dynamic environment fuels intense competitive rivalry, as market leadership is directly linked to possessing the most effective and cutting-edge products. AtriCure faces significant pressure to innovate, necessitating substantial investments in research and development to maintain its competitive advantage. For instance, AtriCure reported R&D expenses of $27.0 million in the first quarter of 2024, reflecting this ongoing commitment to product advancement.

The cardiac rhythm management device market is experiencing robust growth, projected to exceed $17 billion by 2024, driven by an aging global population and the rising prevalence of atrial fibrillation. This significant market expansion naturally attracts new competitors and encourages existing players to invest more aggressively in product development and market penetration. Consequently, the intensified rivalry puts pressure on AtriCure to innovate and maintain its competitive edge. This expanding market size presents both substantial opportunities for increased sales and the challenge of navigating a more crowded and aggressive competitive landscape.

Product Differentiation and Specialization

AtriCure has established a strong position in the surgical ablation segment, specializing in atrial fibrillation and left atrial appendage management, distinguishing itself from competitors with broader offerings. This niche focus has cultivated a loyal customer base among cardiac surgeons who prefer AtriCure's specific technologies. However, as of 2024, this specialized market is becoming increasingly contested as competitors expand their capabilities in advanced cardiac rhythm management solutions. AtriCure's 2023 revenue of $414.2 million underscores its significant but focused market presence.

- AtriCure maintains a specialized leadership in surgical ablation for AFib.

- Competitors, including Medtronic and Johnson & Johnson, are intensifying focus on similar cardiac segments.

- The company's 2023 revenue highlights its strong, albeit niche, market penetration.

- Customer loyalty is crucial as the market sees more advanced competitive offerings.

Sales and Marketing Efforts

Effective sales and marketing strategies are paramount for success in the competitive medical device industry. Competitors significantly invest in cultivating relationships with key opinion leaders and sponsoring clinical studies to validate their technologies. For instance, major players allocated substantial budgets, with some exceeding 20% of their revenue on sales and marketing in 2024, targeting hospitals and physicians directly.

AtriCure must vigorously compete on this front to ensure its innovative solutions, like those for atrial fibrillation, achieve optimal visibility and strong endorsement within the medical community.

- Global medical device sales and marketing spend is projected to grow, reaching over $150 billion by 2025.

- Leading medical device firms increased their R&D and commercialization investments by an average of 8-10% in 2024.

- Physician engagement through educational programs and direct sales interactions remains a top priority for market penetration.

- Digital marketing and targeted outreach saw a 15% increase in adoption within the sector during 2024.

AtriCure faces intense rivalry from large players like Johnson & Johnson and Medtronic, who possess vast resources and global reach. The cardiac ablation market's rapid technological advancements and projected growth to $17 billion by 2024 intensify this competition. AtriCure's specialized position in surgical ablation is increasingly contested, demanding significant R&D and strategic sales efforts to maintain its edge.

| Metric | 2023 Data | 2024 Projections/Data |

|---|---|---|

| Johnson & Johnson Revenue | $85.2 Billion | $88.6 Billion (Est.) |

| AtriCure Q1 R&D Spend | $25.1 Million | $27.0 Million |

| Cardiac Rhythm Market Size | $16.5 Billion | $17.0 Billion |

| Medical Device S&M Growth | 12% | 15% |

SSubstitutes Threaten

For many atrial fibrillation patients, pharmaceutical therapies, including anti-arrhythmic medications and anticoagulants, remain a primary treatment choice. While AtriCure's innovative devices often address more complex or persistent cases, the continuous advancement in drug development poses a significant substitute threat. New pharmaceutical options, such as novel oral anticoagulants (NOACs) and improved anti-arrhythmics, are being researched to offer more effective and less invasive alternatives. This ongoing research aims to deliver drugs with fewer side effects, potentially broadening their adoption and impacting the demand for device-based interventions in the coming years.

Catheter-based ablation, a less invasive procedure than open-heart surgery, presents a significant substitute for AtriCure's surgical ablation products. While AtriCure provides advanced minimally invasive and hybrid therapies, the continued refinement of catheter-based techniques by competitors offers a strong alternative for many patients. The global cardiac ablation market, including catheter-based solutions, is projected to reach approximately $11.5 billion by 2024, demonstrating its robust growth and adoption. Physician and patient preferences, often weighing invasiveness against efficacy for conditions like atrial fibrillation, largely drive the choice between surgical and catheter-based approaches. This strong competitive landscape necessitates AtriCure's continued innovation in hybrid and minimally invasive solutions.

While not a direct substitute for AtriCure's surgical interventions in severe atrial fibrillation, lifestyle modifications and alternative therapies like yoga and acupuncture are gaining recognition for AFib management. The global complementary and alternative medicine market, valued at over $110 billion in 2024, reflects growing patient interest in non-pharmacological approaches. This trend toward proactive health management could potentially temper the long-term demand growth for invasive procedures. These therapies are frequently utilized alongside conventional treatments, highlighting a shift in patient preferences.

Watchful Waiting or Rate Control Strategies

The threat of substitutes for AtriCure includes conservative management strategies, particularly watchful waiting or rate control for Atrial Fibrillation. For elderly or asymptomatic patients, physicians often prioritize controlling heart rate over rhythm restoration, which avoids more aggressive interventions like surgical or catheter ablation. This approach, prevalent in approximately 40-50% of newly diagnosed AF patients in 2024, represents a significant alternative. The decision to pursue such a path is based on a careful risk-benefit analysis, considering patient comorbidities and quality of life.

- Rate control medications like beta-blockers or calcium channel blockers are often first-line.

- Conservative management can reduce immediate procedural risks associated with ablation.

- The global market for AF pharmacotherapy was estimated at over $15 billion in 2024.

- Watchful waiting appeals to patients reluctant to undergo invasive procedures.

Emerging Technologies

The field of cardiac arrhythmia treatment is constantly evolving, presenting a threat from emerging technologies that could substitute current ablation techniques. Advancements in energy sources like Pulsed Field Ablation (PFA), which gained significant market traction in 2024, or innovative mapping technologies, could offer compelling alternatives. AtriCure must diligently monitor the research and development landscape to anticipate and adapt to these potential future substitutes. The global cardiac arrhythmia treatment market is projected to reach approximately $10.5 billion by 2025, emphasizing the ongoing innovation.

- Pulsed Field Ablation (PFA) is a key 2024 emerging technology offering an alternative energy source.

- Gene therapy and advanced pharmacological approaches represent long-term substitute threats.

- The market for cardiac arrhythmia devices is highly dynamic, driven by continuous innovation.

- AtriCure's R&D focus on next-generation solutions is crucial for mitigating this threat.

AtriCure faces significant substitute threats from evolving pharmaceutical therapies and the robust catheter-based ablation market, projected at $11.5 billion by 2024. Conservative management, including watchful waiting, is prevalent in 40-50% of new AF patients in 2024. Emerging technologies like Pulsed Field Ablation, gaining traction in 2024, also present a compelling alternative, emphasizing the need for continuous innovation.

| Substitute Category | Key Examples | 2024 Market Data / Prevalence |

|---|---|---|

| Pharmaceutical Therapies | NOACs, Anti-arrhythmics | >$15 Billion (AF Pharmacotherapy) |

| Catheter-Based Ablation | RF, Cryoablation | ~$11.5 Billion (Global Cardiac Ablation) |

| Conservative Management | Watchful Waiting, Rate Control | 40-50% of New AF Patients |

| Emerging Technologies | Pulsed Field Ablation (PFA) | Significant Market Traction in 2024 |

Entrants Threaten

The medical device industry, particularly in the cardiac space, demands substantial and sustained investment in research and development. New entrants face a significant hurdle, needing to allocate considerable capital to innovate and develop products that can effectively compete with AtriCure's established technologies. For instance, developing a new Class III medical device can easily require R&D expenditures exceeding $100 million, a figure that continues to rise in 2024 due to regulatory complexities and advanced technological requirements. This high initial investment acts as a formidable barrier, deterring potential new competitors.

Bringing a new medical device to market, like those AtriCure offers, involves a lengthy and complex process. New entrants face rigorous testing and regulatory approvals from bodies such as the U.S. FDA, which can take several years and cost hundreds of millions of dollars; for instance, a Class III medical device often requires extensive clinical trials. Navigating this regulatory landscape demands significant expertise and substantial financial resources, making it incredibly difficult for new companies to establish a foothold. This high barrier to entry effectively protects established players like AtriCure from immediate competition.

AtriCure and its main competitors, like Boston Scientific, possess robust distribution channels and deep-rooted relationships with hospitals and surgeons. New entrants face the immense challenge of replicating these established networks, which can take years and significant investment. For instance, building a specialized cardiac sales force in 2024 requires substantial capital, making market access difficult. This entrenched infrastructure acts as a formidable barrier, protecting existing players from new competition.

Brand Loyalty and Physician Training

Physicians, especially surgeons and electrophysiologists, typically develop strong brand loyalty to medical devices they are trained on, such as AtriCure's AtriClip system. This ingrained preference, reinforced by the substantial time and effort required for new system adoption, creates a significant barrier for new entrants. For instance, the learning curve for complex cardiac ablation technologies can be extensive, often requiring multiple cases to achieve proficiency. This physician stickiness means new companies face an uphill battle in convincing established practitioners to switch from familiar and trusted solutions.

- Training costs for new medical device systems can exceed $10,000 per physician.

- Physician preference studies in 2024 indicate over 70% of specialists prefer established brands for critical procedures.

- Switching costs for hospitals include not only physician training but also inventory management and re-credentialing.

Intellectual Property and Patents

The cardiac ablation market is heavily protected by an intricate web of patents covering device designs, unique manufacturing processes, and specific treatment methods. AtriCure and its established competitors possess extensive patent portfolios, shielding their innovations from replication. Any potential new entrant would face the formidable challenge of developing entirely novel technologies that meticulously avoid infringing on these existing intellectual property rights.

- The global cardiac ablation market size was valued at approximately $4.3 billion in 2023, with projections for continued growth, making it an attractive yet highly protected sector.

- Major players like AtriCure consistently invest in R&D, securing new patents annually to reinforce their competitive moat.

- Patent litigation risks for new entrants are substantial, with significant legal costs and potential injunctions.

- The average time to bring a new cardiac ablation device to market can exceed 7-10 years, primarily due to regulatory hurdles and patent landscaping.

New entrants face substantial barriers due to the cardiac market's immense R&D costs, often exceeding $100 million for Class III devices in 2024, and lengthy 7-10 year regulatory approvals. Established physician loyalty, with over 70% preferring existing brands, and AtriCure's extensive patent portfolio further deter new competition. Replicating AtriCure's deep distribution channels and managing high physician training costs also present formidable hurdles.

| Barrier | 2024 Data | Impact |

|---|---|---|

| R&D Cost (Class III) | >$100M | High Capital |

| Time to Market | 7-10 Years | Delayed Entry |

| Physician Loyalty | >70% Pref. | Switching Cost |

Porter's Five Forces Analysis Data Sources

Our AtriCure Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and SEC filings. We supplement this with insights from industry-specific market research reports and trade publications to capture the nuances of the medical device industry.