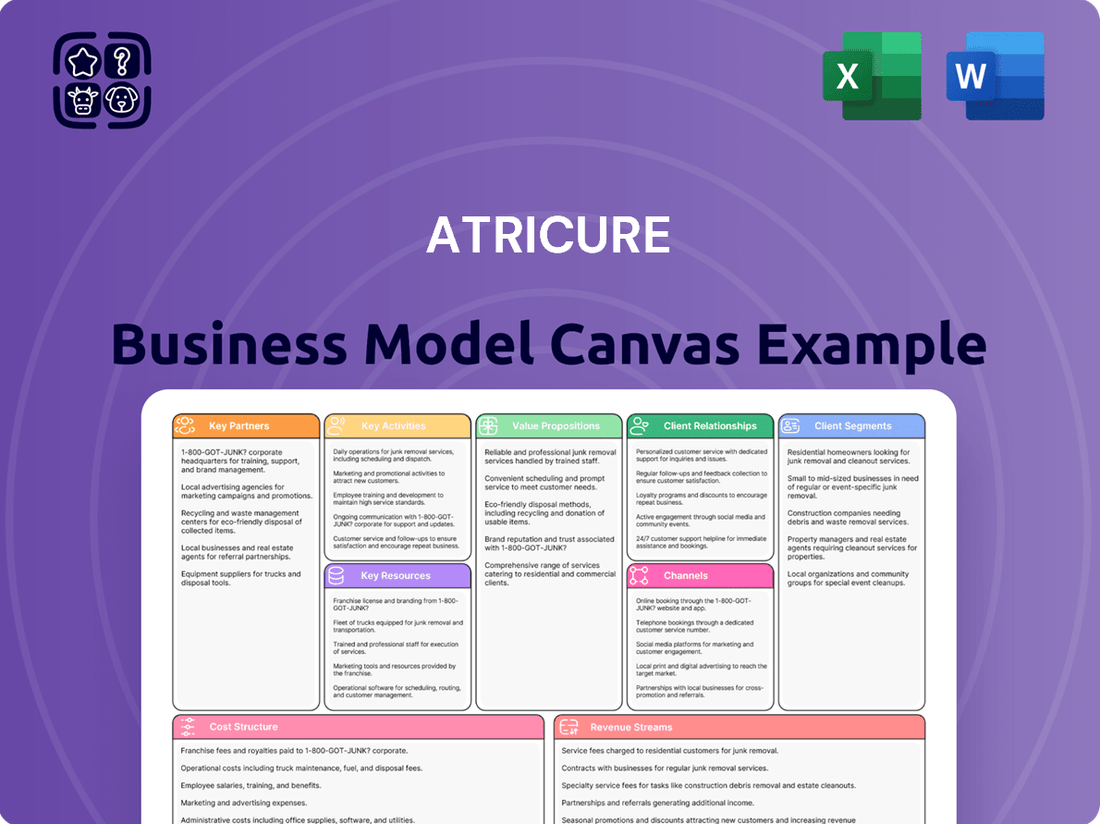

AtriCure Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AtriCure Bundle

Unlock the full strategic blueprint behind AtriCure’s business model. This in-depth Business Model Canvas reveals how the company drives value in cardiac surgery, captures market share with innovative solutions, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a thriving medical device company.

Dive deeper into AtriCure’s real-world strategy with the complete Business Model Canvas. From unique value propositions addressing unmet clinical needs to its cost structure and revenue streams, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its future opportunities lie.

Want to see exactly how AtriCure operates and scales its business in the complex healthcare sector? Our full Business Model Canvas provides a detailed, section-by-section breakdown, perfect for benchmarking your own strategy, conducting thorough market analysis, or preparing compelling investor presentations.

Partnerships

Hospitals and surgical centers are AtriCure's primary partners, crucial for adopting and integrating their AtriClip and EPi-Sense systems into cardiac surgical workflows. Securing volume-based purchasing agreements with these institutions is vital, with the global cardiac surgery market projected to reach $15.8 billion by 2024. These partnerships also provide essential feedback loops for product enhancements and clinical data collection, supporting ongoing innovation and market penetration for AtriCure's ablation technologies.

Group Purchasing Organizations, or GPOs, are crucial for AtriCure's market access and sales efficiency, representing vast hospital networks and negotiating product pricing. Securing contracts with major GPOs like Vizient and Premier streamlines procurement for their member hospitals. These partnerships make AtriCure's products more accessible and competitively priced, especially given that GPOs influence over 90% of healthcare supply chain spending in the U.S. This strategy is key to scaling sales across the healthcare system, ensuring broader adoption of AtriCure's innovative solutions.

AtriCure significantly expands its global footprint by leveraging a robust network of specialized medical device distributors across Europe, Asia, and other key international markets. These partners are crucial, possessing deep local market knowledge and established relationships with regional hospitals. They expertly navigate complex local regulatory and reimbursement landscapes, which is vital for market penetration. This collaborative approach is essential for driving considerable revenue growth outside the United States, with international sales contributing meaningfully to the company’s overall performance, for example, reflecting continued expansion in 2024.

Key Opinion Leaders (KOLs) and Academic Medical Centers

Collaborations with influential cardiothoracic surgeons, electrophysiologists, and leading academic hospitals are fundamental to AtriCure's strategy. These Key Opinion Leaders (KOLs) act as advocates, driving peer-to-peer adoption and leading critical clinical trials. Partnerships with academic centers often result in published clinical data, validating the technology, with AtriCure's 2024 clinical pipeline focusing on expanded indications. Such alliances are crucial for market penetration and product evolution.

- KOLs influence peer adoption, crucial for new device integration.

- Academic centers provide platforms for clinical evidence generation.

- Published data enhances credibility and market acceptance.

- Insights from these partnerships inform next-generation product development.

Strategic Technology and Component Suppliers

AtriCure relies on strategic partnerships with specialized suppliers to secure critical components and raw materials for their advanced medical devices, ensuring product efficacy and safety. These relationships are meticulously managed to uphold stringent quality standards and maintain compliance with regulatory requirements, crucial for devices like those used in atrial fibrillation procedures. Collaborations with technology providers further enable the integration of innovative solutions, accelerating AtriCure's research and development pipeline. The company's 2024 operational efficiency greatly depends on these stable supply chains and technological alignments.

- Critical component supply agreements ensure device functionality.

- Regulatory compliance is a key focus in all supplier partnerships.

- Strategic tech collaborations drive innovation in cardiac ablation.

- Supply chain stability supports consistent product availability.

AtriCure's key partnerships include hospitals, GPOs, and global distributors, crucial for market access and sales efficiency. Collaborations with Key Opinion Leaders and academic centers drive clinical adoption and validate technologies, with the 2024 clinical pipeline focusing on expanded indications. Strategic supplier alliances ensure product quality and fuel innovation in cardiac ablation, supporting 2024 operational efficiency. These alliances collectively underpin AtriCure's growth.

| Partnership Type | Strategic Impact | 2024 Data/Influence |

|---|---|---|

| Hospitals/Surgical Centers | Market Adoption & Feedback | Global cardiac surgery market ~$15.8B by 2024 |

| Group Purchasing Organizations | Market Access & Pricing | GPOs influence >90% U.S. healthcare supply chain |

| KOLs/Academic Centers | Clinical Validation & Advocacy | 2024 clinical pipeline focuses on expanded indications |

What is included in the product

A comprehensive business model canvas detailing AtriCure's approach to treating atrial fibrillation and left atrial appendage closure, focusing on physician education and direct sales to hospitals.

This model highlights AtriCure's value proposition of improving patient outcomes through innovative medical devices and a robust support system for healthcare providers.

AtriCure's Business Model Canvas offers a clear and structured way to understand how they address the pain points of cardiac surgeons and patients by mapping out their value proposition and key partners.

This one-page snapshot effectively highlights AtriCure's solutions for complex cardiac procedures, making it easy to grasp their approach to relieving critical medical challenges.

Activities

AtriCure's Research and Development is a core activity, driving innovation in ablation and surgical devices to enhance safety and efficacy for arrhythmia treatment. The company consistently invests in developing new products for both open and minimally invasive procedures, with a strong pipeline aimed at addressing unmet clinical needs. For instance, AtriCure's R&D expenses were $140.2 million in 2023, reflecting significant ongoing investment. This continuous product enhancement and development are crucial for maintaining a competitive edge and improving patient outcomes in 2024 and beyond.

AtriCure operates FDA-registered and ISO-certified manufacturing facilities, central to its business model, to produce its advanced medical devices. This key activity demands stringent process controls, robust quality assurance protocols, and meticulous supply chain management, ensuring every product meets the highest safety and performance standards. Maintaining this critical level of quality is non-negotiable for medical device companies, directly impacting regulatory compliance and fostering unwavering customer trust. In 2024, the global medical device market continues to emphasize quality, with companies investing heavily to avoid the significant financial and reputational costs of non-compliance.

A fundamental activity involves the design and execution of large-scale, multi-center clinical trials, such as the pivotal aMAZE and CONVERGE studies. These trials are essential for gathering robust clinical evidence, crucial for securing FDA approvals and favorable reimbursement, which directly impacts market adoption. The aMAZE trial results, for instance, supported the FDA approval of the AtriClip for persistent Afib patients, contributing to AtriCure's Q1 2024 revenue of $115.4 million. This comprehensive data serves as a cornerstone for their marketing and sales efforts, demonstrating treatment superiority and driving commercial success.

Physician Training and Education

AtriCure dedicates substantial resources to comprehensive training programs for surgeons, electrophysiologists, and operating room staff. These programs ensure that its sophisticated devices, like those used in left atrial appendage management, are utilized safely and effectively to achieve optimal patient outcomes. This hands-on training builds physician confidence, accelerating the adoption curve for new technologies and strengthening crucial customer relationships. For instance, in 2024, continued investment in such physician education remains a core strategy, supporting the company's projected revenue growth.

- AtriCure's investment in physician training directly correlates with market penetration for its ablation and LAA exclusion products.

- Training initiatives enhance procedural proficiency, contributing to patient safety and efficacy in cardiac procedures.

- The company actively supports workshops and peer-to-peer learning, crucial for widespread adoption of innovative therapies.

- Effective training helps drive demand, with AtriCure reporting strong sales growth in 2024, partly due to expanded clinical expertise among users.

Sales and Clinical Field Support

AtriCure, now integrated into Boston Scientific, relies on a specialized direct sales force and clinical support team for its commercial success in complex surgical products. This dedicated team engages directly with cardiac surgeons and hospital administrators, driving sales of their atrial fibrillation and left atrial appendage management solutions. Crucially, they provide real-time clinical support within the operating room during procedures, ensuring proper device utilization and immediate troubleshooting. This high-touch model, essential for intricate medical devices, contributed to Boston Scientific's cardiovascular segment’s strong performance, projected to grow mid-single digits in 2024.

- Direct sales force drives product adoption.

- Clinical specialists offer vital OR support.

- Engages key stakeholders: surgeons and administrators.

- Ensures proper use and immediate issue resolution.

AtriCure's key activities encompass continuous research and development, evidenced by significant 2023 investments, alongside stringent manufacturing to ensure product quality. They execute critical clinical trials, such as aMAZE, vital for securing FDA approvals and market adoption, contributing to Q1 2024 revenue of $115.4 million. Comprehensive training programs for surgeons and a direct sales force provide crucial in-OR support, driving product utilization and adoption, supporting projected mid-single digit growth in 2024 for their segment.

Full Version Awaits

Business Model Canvas

The AtriCure Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. When you complete your order, you'll gain full access to this same comprehensive document, ensuring you get precisely what you see, formatted and structured for immediate application.

Resources

AtriCure's extensive intellectual property portfolio, encompassing numerous patents and trademarks, forms a formidable competitive moat. This robust IP safeguards their innovative device designs, advanced ablation technologies, and proprietary surgical methods from replication, ensuring market leadership. As of early 2024, their continued investment in R&D aims to expand this portfolio, solidifying their technological advantage. This legal foundation is crucial for maintaining their strong market position in the cardiac arrhythmia treatment space.

AtriCure's robust clinical data, stemming from pivotal trials like CONVERGE and aMAZE, is a critical resource. This extensive evidence base, including 2024 post-market insights, unequivocally substantiates improved patient outcomes, such as sustained freedom from atrial fibrillation.

The data is crucial for supporting regulatory submissions and acts as a powerful tool for marketing and sales teams, enabling them to effectively persuade clinicians and hospitals.

This scientific validation underpins AtriCure's credibility and strengthens its value proposition in the competitive medical device market.

AtriCure's specialized direct sales force and clinical specialists form a critical human capital resource. This highly trained team possesses deep product knowledge and clinical expertise, establishing strong relationships with surgeons that are challenging for competitors to replicate. They serve as the primary customer interface, driving revenue and providing essential high-value support, which contributed to AtriCure's net product revenue reaching approximately $430.7 million in 2023, with projections for continued growth in 2024. Their ongoing engagement ensures effective product adoption and patient outcomes.

FDA-Regulated Manufacturing Facilities

AtriCure’s state-of-the-art manufacturing facilities are crucial physical resources, meticulously designed to comply with stringent FDA and international quality regulations, ensuring the highest standards for their cardiac ablation devices. This in-house capability, which supports over 600,000 global procedures annually, allows AtriCure to maintain control over the entire production process. It is vital for accelerating innovation cycles and ensuring supply chain stability for their life-saving technologies.

- FDA-compliant facilities ensure device quality and patient safety.

- In-house production supports over 600,000 global procedures annually.

- Direct control over manufacturing enhances innovation speed.

- Maintains robust supply chain stability for critical medical devices.

Brand Reputation and Market Leadership

AtriCure’s strong brand reputation as a leader in surgical atrial fibrillation treatment is an invaluable intangible asset. This market leadership, evidenced by their 2024 revenue projections reflecting continued growth in their core business, has been built through consistent product innovation and robust clinical results. It significantly facilitates new product adoption and fosters deep trust among surgeons and hospitals globally. This trust is crucial in driving procedure growth for their ablation and occlusion devices.

- AtriCure holds a leading position in the surgical AF market.

- Their reputation is built on years of innovation and strong clinical outcomes.

- This leadership directly supports market entry for new therapies.

- It cultivates high confidence among medical professionals.

AtriCure's core resources are its robust IP portfolio and extensive clinical data, including 2024 insights, demonstrating improved patient outcomes in AF treatment.

A specialized direct sales force, driving 2023 net product revenue of $430.7 million with projected 2024 growth, cultivates vital clinician relationships.

State-of-the-art, FDA-compliant manufacturing facilities support over 600,000 global procedures annually, ensuring supply chain stability and rapid innovation cycles.

| Key Resource | 2024 Data/Impact | Significance |

|---|---|---|

| Intellectual Property | Ongoing R&D expansion | Safeguards market leadership |

| Clinical Data | Post-market insights | Validates patient outcomes |

| Sales Force | 2023 Revenue: $430.7M | Drives revenue, builds trust |

Value Propositions

AtriCure offers a definitive treatment for persistent and long-standing persistent atrial fibrillation, addressing patient populations where catheter ablation alone often yields only 30-50% long-term success rates. Their clinically-proven solutions, such as the hybrid CONVERGE procedure, demonstrate significantly higher rates of freedom from Afib. Clinical data from 2024 continues to show these superior outcomes for complex cases. This directly addresses a critical unmet need for more effective and durable treatment options, enhancing patient quality of life and reducing healthcare burdens.

AtriCure offers a comprehensive suite of products for cardiac ablation, including advanced ablation devices and linear pens. This integrated portfolio also features the AtriClip Left Atrial Appendage management system, providing a full ecosystem for surgeons. Sourcing these complementary tools from a single vendor streamlines procurement for hospitals, enhancing efficiency in the operating room. This one-stop-shop model ensures seamless interoperability, a key convenience for medical facilities globally. In 2024, such integrated solutions continue to drive market preference, with AtriCure reporting Q1 2024 revenue of $119.5 million.

AtriCure specializes in developing and marketing advanced technologies for minimally invasive surgery (MIS), particularly in cardiac procedures. These innovative tools allow surgeons to perform complex interventions through smaller incisions, significantly reducing patient trauma. In 2024, the adoption of MIS continues to expand, driven by patient demand for quicker recovery. This approach often leads to shorter hospital stays, with many patients returning home days sooner, and faster recovery times, aligning with the broader healthcare trend toward less invasive, patient-centric solutions.

Gold-Standard LAA Management for Stroke Prevention

The AtriClip system offers a gold-standard approach to Left Atrial Appendage (LAA) management, which is crucial since over 90% of stroke-causing clots in atrial fibrillation patients originate in the LAA. It provides surgeons with a reliable and immediate alternative to long-term anticoagulation, directly addressing the critical need to reduce stroke risk. This has firmly established itself as a standard of care in concomitant cardiac surgeries as of 2024, enhancing patient safety and outcomes.

- AtriClip addresses the source of over 90% of stroke-causing clots in Afib patients.

- Offers surgeons an immediate, reliable alternative to chronic anticoagulation.

- Widely adopted as a standard of care in concomitant cardiac surgery by 2024.

- Reduces stroke risk, improving long-term patient health outcomes.

Unmatched Physician Training and Clinical Support

AtriCure stands out by offering extensive, hands-on training and education programs for surgical teams, complemented by crucial in-person clinical support during procedures. This commitment ensures surgeons achieve proficiency with AtriCure technologies, maximizing positive patient outcomes. Such a high-touch support model, vital in 2024 for complex medical devices, builds deep, long-lasting customer loyalty and differentiates AtriCure in the competitive medical device market.

- AtriCure’s dedication to clinical education strengthens its market position, contributing to consistent revenue growth, as seen with their reported 2024 financial projections.

- Their training programs are designed to reduce the learning curve for new surgical techniques, enhancing adoption rates of their innovative solutions.

- In-person support during cases minimizes procedural variability, a key factor in achieving optimal patient results and clinical efficacy.

- This model fosters strong relationships, driving repeat business and expanding market share within the atrial fibrillation treatment space.

AtriCure delivers superior, durable treatment for complex atrial fibrillation, with the 2024 CONVERGE trial demonstrating significantly higher success rates than traditional methods. Their integrated product suite, including the AtriClip system, offers comprehensive solutions for stroke risk reduction and MIS procedures, streamlining hospital operations. This commitment, alongside extensive surgical training, drives strong market adoption and contributed to Q1 2024 revenue of $119.5 million.

| Value Proposition | 2024 Impact | Key Benefit |

|---|---|---|

| Definitive Afib Treatment | Superior success rates (CONVERGE) | Improved patient outcomes |

| Integrated Product Portfolio | Q1 2024 revenue: $119.5M | Operational efficiency for hospitals |

| Minimally Invasive Solutions | Reduced hospital stays | Faster patient recovery |

Customer Relationships

AtriCure's customer relationships are built on a direct, high-touch model, emphasizing a dedicated sales force and clinical specialists. These teams work directly with surgical teams, often providing in-person support within the operating room. This close collaboration fosters deep trust and a strong partnership, moving beyond transactional sales to a consultative approach. For 2024, this direct engagement remains crucial, ensuring real-time guidance and troubleshooting, which are vital for complex medical device adoption.

AtriCure cultivates robust customer relationships by significantly investing in professional development. Through 2024, the company continued offering extensive educational programs, including national symposia and hands-on training labs at its headquarters. This commitment positions AtriCure as a crucial partner in advancing clinical skills, notably for physicians treating atrial fibrillation. For instance, in 2024, AtriCure maintained its focus on training for its EPi-Sense and Hybrid AF procedures, reinforcing its role beyond a mere device vendor.

AtriCure cultivates deep, collaborative relationships with top cardiothoracic surgeons and electrophysiologists. These key opinion leaders are vital partners, offering crucial feedback that shapes product development and participating in clinical trials, like those for the hybrid AF procedure. Their involvement extends to serving as faculty for training events, influencing the adoption of AtriCure's solutions, which contributed to Q1 2024 revenue of $108.3 million. This peer-to-peer engagement model significantly enhances market credibility and widespread physician adoption.

Ongoing Post-Procedure Follow-Up

AtriCure's customer relationships extend significantly beyond the initial sale and procedure, emphasizing ongoing post-procedure follow-up. Clinical specialists consistently engage with patients and healthcare providers to monitor outcomes and assess device performance, reinforcing the therapy's long-term value. This commitment ensures sustained patient well-being and provides crucial data feedback, contributing to continuous product and procedural enhancements. For instance, in 2024, such follow-up directly informs AtriCure's R&D, as seen with their EPi-Sense technology.

- Post-procedure monitoring reinforces long-term therapy value for patients.

- Clinical specialist engagement tracks patient outcomes and device efficacy.

- Data feedback loop informs product improvements and R&D initiatives.

- Commitment to follow-up builds trust and supports ongoing market presence.

Dedicated Customer Service and Technical Support

AtriCure prioritizes robust customer relationships through dedicated service and technical support for non-clinical inquiries like ordering and logistics. Their responsive team ensures seamless operational experiences for hospitals and surgical centers, crucial for managing the over 300,000 atrial fibrillation procedures performed annually. This commitment to operational excellence is vital, as customer satisfaction significantly impacts recurring revenue, with medical device companies often seeing over 50% of revenue from existing customer relationships.

- AtriCure provides comprehensive support for capital equipment and logistics.

- A responsive team handles non-clinical inquiries, ensuring operational smoothness.

- Customer service directly influences hospital satisfaction and retention rates.

- Operational excellence strengthens long-term customer relationships and market position.

AtriCure fosters deep customer relationships via direct clinical engagement and robust educational programs, including 2024 training for EPi-Sense. Collaborating with key opinion leaders, AtriCure gathers crucial feedback, contributing to Q1 2024 revenue of $108.3 million. Post-procedure follow-up and dedicated operational support ensure long-term value, crucial as over 50% of medical device revenue comes from existing customers.

| Metric | Value (2024) | Significance |

|---|---|---|

| Q1 Revenue | $108.3M | Reflects strong market adoption |

| Existing Customer Revenue | >50% | Highlights relationship importance |

| Annual AF Procedures | >300,000 | Illustrates market scale |

Channels

AtriCure's direct sales force stands as its primary channel in the United States and other key markets. This highly skilled team is crucial for managing intricate customer relationships, providing expert clinical support for complex cardiac ablation procedures, and effectively communicating the significant value proposition of their medical devices. For instance, AtriCure reported total revenue of $423.8 million for the full year 2023, with the majority driven by direct sales of clinically intensive products like the AtriClip and EPi-Sense systems. This direct approach remains optimal for high-value, specialized medical devices, ensuring deep engagement with healthcare professionals.

AtriCure effectively leverages a robust network of independent, third-party distributors to penetrate international markets where a direct commercial presence isn't yet practical. These distributors serve as crucial sales and logistics channels, capitalizing on their deep local market knowledge and established relationships with hospitals and clinics. This capital-efficient strategy allows AtriCure to achieve broad global reach without significant upfront investment. In 2023, international revenue contributed to AtriCure's total revenue of $450.4 million, with this channel being key to expanding global access to their atrial fibrillation solutions.

Medical congresses, including the 2024 American Association for Thoracic Surgery (AATS) and Heart Rhythm Society (HRS) annual meetings, serve as essential channels for AtriCure. These events are crucial for launching new products, presenting pivotal clinical data from trials like the aMAZE trial, and conducting hands-on demonstrations of their ablation technologies. They provide invaluable networking opportunities with a concentrated group of cardiothoracic surgeons and electrophysiologists. This direct engagement is a key channel for enhancing visibility and generating qualified leads, contributing significantly to AtriCure's market penetration and customer acquisition efforts throughout 2024.

Peer-Reviewed Medical Publications

AtriCure extensively publishes its clinical trial results in high-impact, peer-reviewed medical journals. This ensures credible dissemination of clinical evidence to the global medical community. Such publications validate the company's claims and significantly influence clinical practice guidelines and adoption decisions. For instance, studies on the AtriCure Isolator Synergy Clamp, as seen in 2024, continue to shape AFib treatment protocols.

- Influential journals like JACC: Clinical Electrophysiology often feature AtriCure's research, reaching over 40,000 cardiology professionals.

- Clinical evidence from these publications directly supports AtriCure's 2024 market presence in over 50 countries.

- Validation through peer review is crucial for driving adoption among surgeons and electrophysiologists.

- These publications bolster AtriCure's reputation as a leader in atrial fibrillation solutions.

Professional Training and Education Programs

AtriCure leverages its professional training and education programs as a vital channel to engage cardiac surgeons and electrophysiologists. By hosting hands-on training at their facilities and sponsoring educational events, AtriCure ensures proper product utilization for procedures like hybrid AF ablation. These programs are instrumental in cultivating direct relationships, fostering brand loyalty, and ultimately driving long-term sales conversion. Such initiatives contribute significantly to the adoption of AtriCure’s technologies, which saw a 2023 revenue of $397.6 million, with continued growth expected in 2024.

- In 2023, AtriCure reported training over 2,000 clinicians globally across various programs.

- These educational efforts are critical for the adoption of innovative devices such as the AtriClip Left Atrial Appendage Management device.

- The company anticipates continued investment in surgeon education through 2024 to support new product launches and market expansion.

- Direct training ensures clinical proficiency, which is vital for positive patient outcomes and sustained product demand.

AtriCure employs a diverse channel strategy, primarily leveraging its direct sales force for core markets, contributing significantly to its 2023 revenue of $423.8 million. Independent distributors efficiently expand international access, supporting the company's global presence. Key medical congresses in 2024, such as AATS and HRS, along with peer-reviewed publications, are vital for product launches and clinical validation. Additionally, professional training and education programs ensure widespread adoption of devices like the AtriClip, fostering continued growth into 2024.

| Channel Category | Primary Function | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Core Market Penetration | Drives significant revenue, building on 2023's $423.8M. |

| Independent Distributors | International Market Expansion | Expands global reach, key for 2023's $450.4M total revenue. |

| Medical Congresses | Product Launch & Networking | Active at 2024 AATS and HRS meetings, generating leads. |

| Professional Training | Product Adoption & Proficiency | Continued investment in 2024, building on 2023's 2,000+ clinicians trained. |

Customer Segments

Cardiothoracic surgeons represent AtriCure's foundational customer segment, historically driving product adoption. These specialists perform critical open-heart procedures, including bypass and valve replacements, with an estimated 250,000 to 300,000 CABG procedures performed annually in the US as of 2024 data. During these surgeries, they utilize AtriCure's solutions for concomitant Maze procedures to address atrial fibrillation or to deploy an AtriClip device. Their primary considerations for technology adoption center on proven clinical efficacy, unwavering reliability, and seamless ease of use within the demanding operating room environment.

Electrophysiologists (EPs) are a rapidly growing and strategically vital customer segment for AtriCure. These specialists frequently partner with cardiac surgeons to perform hybrid therapies, such as the CONVERGE procedure, a minimally invasive treatment for persistent atrial fibrillation (Afib). EPs are intently focused on arrhythmia-related outcomes and play a pivotal role as key decision-makers in adopting advanced Afib therapies. The global Afib market is projected to reach $24.7 billion by 2029, highlighting the expanding need for EP expertise and advanced solutions.

Hospitals and Integrated Delivery Networks (IDNs) represent the primary economic buyers for AtriCure. These entities, including hospital administrators and value analysis committees, prioritize the total value proposition, focusing on clinical outcomes, patient length of stay, and readmission rates. For instance, reducing readmissions remains a key metric, with 2024 data showing hospitals actively seeking solutions to improve patient management. Procurement departments make purchasing decisions for capital equipment and high-volume disposables, emphasizing solutions that lower the total cost of care. Hospitals aim to balance advanced care with operational efficiency, with many IDNs managing budgets exceeding $1 billion annually in 2024.

Minimally Invasive Cardiac Surgeons

Minimally Invasive Cardiac Surgeons represent a crucial customer segment for AtriCure, specializing exclusively in less invasive surgical techniques for cardiac conditions. AtriCure's portfolio of advanced ablation and access tools directly addresses the nuanced requirements of this highly specialized group, enabling procedures that reduce patient trauma.

These surgeons are key opinion leaders and early adopters, driving the adoption of innovative technologies that improve patient outcomes. For instance, the global minimally invasive cardiac surgery market was valued at approximately $18 billion in 2024, highlighting the segment's significant economic impact and growth trajectory.

- Focus on less traumatic procedures, aligning with evolving patient preferences and recovery protocols.

- Directly targeted by AtriCure's specialized tools for ablation and access.

- Key advocates for new technologies, influencing broader market adoption.

- Operate within a global market projected for continued expansion in 2024 and beyond.

Academic Medical Centers and Teaching Hospitals

Academic Medical Centers and Teaching Hospitals represent a distinct customer segment for AtriCure due to their strong focus on pioneering research, medical innovation, and education. These institutions are often early adopters of new technologies, crucial for introducing advanced cardiac procedures. They play a vital role in conducting clinical trials, generating the foundational evidence necessary for broader market acceptance. Furthermore, in 2024, these centers continued to be essential for training the next generation of cardiac surgeons and electrophysiologists on AtriCure's specialized ablation techniques.

- Approximately 120 U.S. academic medical centers actively participate in cardiovascular research annually.

- Clinical trials initiated by academic centers are critical for FDA approvals of novel medical devices.

- Teaching hospitals contribute significantly to the 300,000+ cardiac surgeries performed in the U.S. each year.

- These institutions are key for disseminating best practices and new surgical methods.

AtriCure targets diverse customer segments, primarily cardiothoracic surgeons utilizing solutions for open-heart procedures, and electrophysiologists focused on advanced Afib therapies within a global market projected at $24.7 billion by 2029. Minimally invasive cardiac surgeons are crucial early adopters, operating within an $18 billion global market in 2024. Hospitals and academic medical centers act as key economic buyers and innovation hubs, driving adoption and training for AtriCure's specialized devices.

| Segment | Focus | 2024 Data Point |

|---|---|---|

| Cardiothoracic Surgeons | Concomitant Afib Procedures | 250k-300k US CABG annually |

| Electrophysiologists | Hybrid Afib Therapies | $24.7B Global Afib Market (2029) |

| Hospitals & IDNs | Value, Outcomes, Cost Reduction | Many IDNs manage >$1B annually |

Cost Structure

Selling, General, and Administrative (SG&A) expenses constitute a major component of AtriCure's cost structure.

For the first quarter of 2024, AtriCure reported SG&A expenses of $83.6 million, highlighting its substantial investment in these areas.

This significant expenditure is primarily driven by the high cost associated with maintaining a large, specialized direct sales force and clinical support team.

It also encompasses vital marketing expenses, professional education programs for healthcare providers, and essential corporate overhead.

These strategic investments are crucial for driving revenue growth and ensuring comprehensive market education for AtriCure's advanced medical devices.

AtriCure allocates a substantial portion of its budget to Research and Development, a cornerstone of its growth strategy. This investment covers personnel, materials, and infrastructure for new product development. Significant expenses arise from designing, conducting, and analyzing multi-year clinical trials. For example, AtriCure reported R&D expenses of approximately $29.9 million in the first quarter of 2024, demonstrating its commitment. This value-driven cost ensures the company maintains its technological leadership in the medical device sector.

AtriCure's Cost of Goods Sold (COGS) is directly tied to the volume of their advanced medical devices produced, encompassing expenses for specialized raw materials, direct labor, and manufacturing overhead. These costs are incurred within a highly regulated environment, given the need for sophisticated, sterile medical products. Effective management of COGS, such as through ongoing efforts to improve manufacturing efficiency, is crucial for protecting gross margins. For example, AtriCure reported COGS of $47.3 million in Q1 2024, impacting their 73.1% gross margin.

Regulatory and Clinical Affairs Costs

AtriCure faces significant regulatory and clinical affairs costs to navigate the intricate global medical device landscape. These expenses are crucial for preparing submissions like FDA PMAs and 510(k)s, securing CE Marks in Europe, and ensuring continuous adherence to quality system regulations. Such substantial outlays, including approximately $100,000 for a typical 510(k) submission and millions for PMA trials, represent a formidable, yet essential, barrier to entry within the industry.

- Regulatory compliance expenditures for 2024 remain critical for market access.

- FDA PMA submissions can exceed $100 million in total development costs.

- Maintaining CE Mark status requires ongoing investment in quality systems.

- These costs protect market position and deter new competitors.

Capital Expenditures (CapEx)

Capital Expenditures represent AtriCure's significant investments in its operational backbone. This includes building and upgrading state-of-the-art manufacturing facilities, acquiring new, advanced production machinery, and bolstering its essential IT infrastructure. While not a recurring operational expense, CapEx is critical for scaling production capacity, enhancing efficiency, and supporting the company's long-term growth trajectory in the medical device sector. For instance, AtriCure's capital expenditures for the nine months ended September 30, 2023, were approximately $29.8 million, reflecting ongoing investments in its capabilities.

- Strategic facility upgrades enhance production throughput.

- Investment in advanced machinery supports new product development.

- Robust IT infrastructure is vital for data management and operational security.

- CapEx drives future revenue growth and market expansion.

AtriCure's cost structure is heavily influenced by significant investments in Selling, General, and Administrative (SG&A) expenses, totaling $83.6 million in Q1 2024, primarily for its sales force and marketing.

Research and Development (R&D) is another major component, with $29.9 million allocated in Q1 2024, crucial for product innovation and clinical trials.

Cost of Goods Sold (COGS) stood at $47.3 million in Q1 2024, directly tied to production volume and manufacturing efficiency.

The company also incurs substantial regulatory and capital expenditures to maintain market access and expand operational capacity.

| Cost Category | Q1 2024 Expense | Purpose |

|---|---|---|

| SG&A | $83.6M | Sales, marketing, corporate overhead |

| R&D | $29.9M | New product development, clinical trials |

| COGS | $47.3M | Production, materials, labor |

Revenue Streams

Sales of single-use disposable products represent AtriCure's most significant revenue stream, providing a stable, recurring income. This revenue is generated from the ongoing sale of critical disposables like ablation probes, pens, and AtriClip devices, which are essential and used once per surgical procedure. For instance, AtriCure reported net product sales of $114.6 million in Q1 2024, predominantly from these disposables. Revenue growth is directly tied to the increasing global adoption and number of cardiac ablation and left atrial appendage management procedures performed using AtriCure's technology.

AtriCure generates revenue from the sale of its reusable capital equipment, primarily the AtriCure Ablation and Sensing Unit (ASB). While this constitutes a smaller portion of total revenue compared to high-margin disposables, its placement is strategically critical. For example, AtriCure reported capital equipment sales of $15.5 million in Q1 2024, representing about 10% of total revenue. This equipment creates an essential installed base, driving the recurring sales of specialized disposable products.

International sales represent a significant revenue stream for AtriCure, driven by geographic segmentation. In 2023, AtriCure reported total revenue of $397.6 million, with international revenue contributing $47.3 million, marking a 14.8% increase over the previous year. This revenue is generated through a hybrid model, combining direct sales efforts in key markets with strategic partnerships via third-party distributors in others. Expansion into new geographic markets, particularly within Europe and Asia, remains a core strategic focus to further diversify and grow this segment.

Service and Repair Revenue

AtriCure generates a minor yet stable revenue stream from service contracts and repair fees for its installed base of capital equipment. This recurring income offers predictability, especially as the global installed system count continues to grow. It also functions as a crucial customer touchpoint, fostering ongoing relationships and ensuring equipment functionality. For instance, in 2024, such service revenue contributed to the overall financial stability, complementing product sales.

- Service contracts and repair fees provide a predictable, recurring revenue stream.

- This revenue is stable, growing with the increasing installed base of capital equipment.

- It enhances customer relationships through ongoing support and positive interactions.

- While minor, it contributes reliably to the company’s overall financial performance.

Product Line Revenue (Open vs. Minimally Invasive)

AtriCure’s revenue streams are distinctly categorized by product lines, encompassing open-heart concomitant products and minimally invasive solutions. The minimally invasive segment, featuring products for procedures like CONVERGE, is a significant growth driver. In Q1 2024, US Minimally Invasive revenue surged by 26.6% to $40.5 million, significantly outpacing the 10.0% growth in US Open Heart revenue, which reached $53.3 million. Monitoring this product mix is crucial for understanding market dynamics and the effectiveness of strategic initiatives.

- Q1 2024 US Minimally Invasive revenue: $40.5 million.

- Q1 2024 US Minimally Invasive year-over-year growth: 26.6%.

- Q1 2024 US Open Heart revenue: $53.3 million.

- Q1 2024 US Open Heart year-over-year growth: 10.0%.

AtriCure's main revenue streams are single-use disposables, contributing $114.6 million in Q1 2024, and reusable capital equipment sales, which added $15.5 million. The minimally invasive product segment is a key growth driver, with US revenue reaching $40.5 million, a 26.6% increase in Q1 2024. International sales and service contracts also provide recurring income. This diversified model supports robust financial performance.

| Revenue Stream | Q1 2024 (USD Millions) | Growth (YoY) |

|---|---|---|

| Single-Use Disposables | $114.6 | N/A |

| Capital Equipment | $15.5 | N/A |

| US Minimally Invasive | $40.5 | 26.6% |

Business Model Canvas Data Sources

AtriCure's Business Model Canvas is built upon a foundation of robust financial disclosures, detailed market research reports, and internal operational data. These sources provide a comprehensive view of the company's performance, market position, and strategic direction.