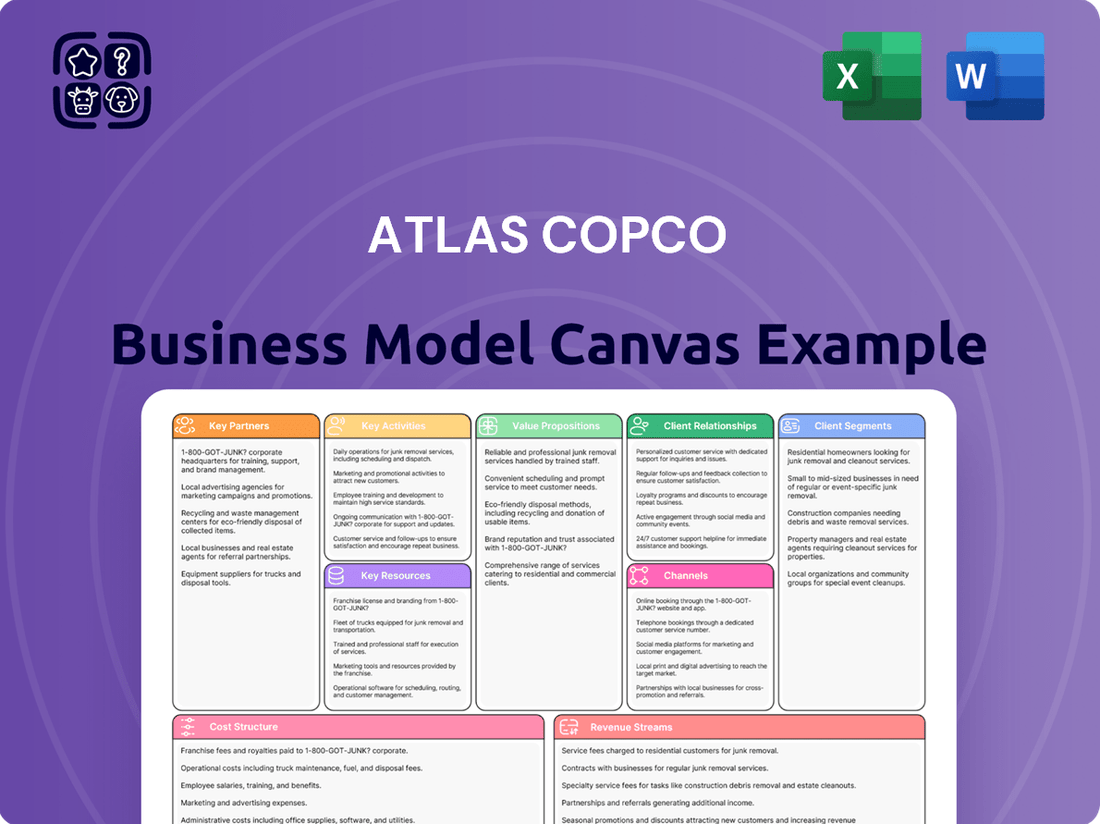

Atlas Copco Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Copco Bundle

Discover the core of Atlas Copco's operational excellence with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Unlock the full strategic blueprint behind Atlas Copco's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Atlas Copco’s strategic acquisition approach is a cornerstone of its business model, driving growth and technological advancement. In 2025, notable acquisitions such as ABC Compressors, Kyungwon Machinery, and National Tank & Equipment significantly bolstered their presence in critical areas like hydrogen infrastructure, industrial pumps, and specialized dewatering solutions. This consistent M&A activity allows Atlas Copco to rapidly enter high-potential markets and solidify its leadership in niche segments.

Atlas Copco actively engages in technology and innovation collaborations, partnering with universities, research institutions, and other companies. These alliances are crucial for advancing their capabilities in areas such as sustainable energy solutions, leveraging their commitment to reducing energy consumption in their equipment, a key focus for 2024 as global sustainability targets intensify.

These partnerships enable Atlas Copco to tap into specialized knowledge and accelerate the creation of innovative products and services, particularly in digitalization. For instance, their investments in smart connected solutions aim to enhance operational efficiency for customers, a trend that saw significant adoption in 2024, with many industrial clients seeking data-driven performance improvements.

Atlas Copco's global supplier network is crucial, providing essential components and raw materials for their manufacturing. In 2024, purchased components represented a substantial portion of their production costs, underscoring the need for dependable partnerships to maintain material flow and quality across their extensive product lines.

Distribution and Service Channels

Atlas Copco leverages a dual strategy for its distribution and service channels, combining direct sales with an extensive network of distributors and service partners. This hybrid model is crucial for achieving broad market penetration, particularly in diverse geographical regions where a direct presence might be less cost-effective or efficient. For instance, in 2024, their commitment to expanding this network continued, aiming to bolster local support and product accessibility.

These partnerships are not merely about sales; they are integral to delivering comprehensive aftermarket services, including maintenance, repairs, and spare parts. This ensures customers receive timely and localized support, enhancing overall customer satisfaction and product lifecycle management. The strategic selection of partners allows Atlas Copco to tap into local market expertise and customer relationships.

The effectiveness of this channel strategy is evident in Atlas Copco's ability to serve a global customer base across various industries. By working with trusted partners, they can offer tailored solutions and support, reinforcing their market position. This approach allows for greater flexibility and responsiveness to regional market demands, a key factor in their sustained growth.

- Global Reach: Partnerships enable Atlas Copco to access markets where direct operations are not feasible, significantly expanding their customer base.

- Local Expertise: Distributors and service providers offer invaluable local market knowledge and customer relationships, facilitating tailored solutions.

- Aftermarket Support: These collaborations are vital for providing efficient and localized maintenance, repair, and spare parts services, enhancing customer loyalty.

- Market Penetration: The hybrid approach ensures efficient product delivery and service, driving deeper market penetration and competitive advantage.

Academic and Research Institutions

Atlas Copco actively cultivates collaborations with academic and research institutions. These partnerships are crucial for driving fundamental research and nurturing future talent. For instance, in 2024, Atlas Copco continued its engagement with leading universities on projects focused on advanced materials for compressor technology and next-generation energy-efficient motor designs.

These alliances bolster Atlas Copco's long-term innovation pipeline, ensuring the company stays ahead in technological advancements. Such collaborations have historically led to significant breakthroughs, particularly in areas like improved lubrication systems and noise reduction technologies, directly impacting the performance and sustainability of their industrial equipment.

The benefits extend to talent acquisition and development. By working closely with universities, Atlas Copco gains access to a pool of highly skilled graduates and researchers, fostering a continuous influx of expertise in fields like mechanical engineering, materials science, and automation. This strategic approach ensures they remain at the cutting edge of innovation.

- Fundamental Research: Collaborations fuel exploration into new materials and energy-saving technologies.

- Talent Development: Partnerships provide access to skilled graduates and researchers.

- Innovation Pipeline: These alliances ensure long-term technological leadership and competitive advantage.

- Breakthrough Potential: Focus areas include materials science, energy efficiency, and advanced automation for industrial applications.

Atlas Copco's key partnerships are crucial for its operational efficiency and market reach. Strategic acquisitions, like those in 2025, rapidly expand its capabilities in emerging sectors such as hydrogen infrastructure. Collaborations with research institutions fuel innovation, particularly in sustainable energy and digitalization, with a strong focus in 2024 on data-driven customer solutions.

What is included in the product

A comprehensive, pre-written business model tailored to Atlas Copco’s strategy, focusing on their industrial equipment and solutions. It details customer segments, value propositions, and revenue streams, reflecting real-world operations.

Atlas Copco's Business Model Canvas acts as a pain point reliever by providing a clear, visual map of their value proposition and customer segments, enabling them to efficiently address market needs and operational inefficiencies.

Activities

Atlas Copco's commitment to product development and innovation is a cornerstone of its business model. In 2024, the company continued its robust investment in R&D, channeling significant resources into creating cutting-edge solutions. This focus is primarily on enhancing energy efficiency, integrating advanced connectivity features, and leveraging data-driven insights to better serve customer needs.

This dedication to innovation directly translates into tangible benefits for their clients. By developing products that improve productivity and operational effectiveness, Atlas Copco empowers customers across diverse sectors to achieve greater success. This forward-thinking approach ensures their offerings remain relevant and valuable in a constantly evolving industrial landscape.

Recent advancements highlight this commitment, with notable launches including expanded ranges of containerized energy storage systems and the introduction of next-generation dewatering pumps. These new products underscore Atlas Copco's drive to push technological boundaries and deliver solutions that address current and future market demands.

Atlas Copco's core activities revolve around the manufacturing of diverse industrial equipment. This includes essential items like air compressors, advanced vacuum solutions, robust industrial tools, and innovative power technique products. Their commitment to quality and efficiency underpins their global operations.

The company strategically places its production facilities near major customer bases. This decentralized approach enhances their ability to react swiftly to market needs and capitalize on localized production advantages. For instance, in 2023, Atlas Copco reported a significant portion of its revenue generated from its industrial technique segment, reflecting the strength of its manufacturing output.

Atlas Copco's global sales and marketing engine operates in roughly 180 countries, employing a hybrid model of direct sales and a network of distributors. This expansive reach is crucial for penetrating diverse industrial markets and ensuring their innovative solutions are accessible worldwide.

Marketing activities are strategically designed to showcase the unique value propositions of their many brands, such as Atlas Copco, Chicago Pneumatic, and Dynapac. They emphasize efficiency, sustainability, and productivity gains for customers across sectors like manufacturing, mining, and infrastructure.

In 2023, Atlas Copco reported net sales of SEK 141 billion (approximately $13.5 billion USD based on average exchange rates), underscoring the significant impact of their robust global sales and marketing efforts in driving revenue and maintaining market leadership.

Aftermarket Service and Support

Atlas Copco's aftermarket service and support is a cornerstone of its operations. This involves delivering essential maintenance, readily available spare parts, and advanced remote monitoring solutions. These activities are crucial for ensuring the extended lifespan and peak performance of their installed equipment, fostering strong customer loyalty and generating consistent, recurring revenue streams.

The company's commitment to aftermarket services is reflected in its consistent growth. For instance, in 2023, Atlas Copco reported a significant increase in its service revenues, underscoring the increasing reliance customers place on these offerings. This trend is expected to continue as more sophisticated equipment is deployed, requiring ongoing expert support.

- Maintenance: Proactive and reactive maintenance programs to minimize downtime.

- Spare Parts: Ensuring availability of genuine parts for optimal equipment function.

- Remote Monitoring: Utilizing digital tools for performance tracking and predictive maintenance.

- Customer Support: Providing technical assistance and expertise to maximize equipment value.

Strategic Mergers and Acquisitions Management

Strategic Mergers and Acquisitions Management is a crucial activity for Atlas Copco. It involves a disciplined approach to identifying, acquiring, and integrating companies that either strengthen their existing business areas or open doors to new, rapidly expanding markets. This proactive strategy ensures continuous portfolio enhancement and market position improvement.

Atlas Copco’s M&A strategy is characterized by acquiring specialized companies, often niche players, and seamlessly integrating them into their broader operations. This approach has historically been effective in expanding their product and service offerings and solidifying their market share across various segments. For instance, in 2023, Atlas Copco completed several acquisitions, including the acquisition of the vacuum technology business of HMB, a German company, further strengthening their industrial vacuum solutions.

- Disciplined M&A Strategy: Focus on acquiring companies that align with strategic goals and offer synergistic benefits, ensuring careful evaluation and integration to maximize economic value.

- Portfolio Enhancement: Actively seek and integrate niche players to broaden the product and service portfolio, thereby increasing market reach and competitive advantage.

- Market Expansion: Target acquisitions that provide entry into high-growth sectors or emerging markets, diversifying revenue streams and driving long-term growth.

- Integration Success: Emphasize thorough post-acquisition integration to realize expected synergies, operational efficiencies, and cultural alignment, ensuring a positive contribution to overall business performance.

Atlas Copco's key activities center on the design, manufacturing, and distribution of industrial equipment. This includes a wide array of products such as air compressors, vacuum pumps, and power tools, alongside specialized solutions for mining and infrastructure. Their operations are underpinned by a commitment to innovation and customer-centric service.

The company's robust R&D efforts in 2024 focused on enhancing energy efficiency and connectivity in their product lines, aiming to provide customers with more sustainable and intelligent solutions. This dedication to technological advancement is a driving force behind their market leadership.

Furthermore, Atlas Copco actively engages in strategic mergers and acquisitions to expand its technological capabilities and market reach. A notable example from 2023 was the acquisition of HMB's vacuum technology business, reinforcing their position in industrial vacuum solutions.

Their global sales and marketing network, operating in approximately 180 countries, ensures broad accessibility to their innovative products. This expansive reach is vital for serving diverse industrial sectors and maintaining strong customer relationships through comprehensive aftermarket support.

What You See Is What You Get

Business Model Canvas

The Atlas Copco Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive business model analysis you'll gain access to. Upon completing your transaction, you will download this identical, fully detailed document, ready for your strategic planning.

Resources

Atlas Copco's robust patent portfolio and proprietary technologies in compressed air, vacuum, and industrial tools are central to its competitive edge. These innovations, protected by intellectual property, drive their advanced product development and market leadership.

In 2023, Atlas Copco's commitment to innovation was evident with significant R&D investments, contributing to the continuous expansion and safeguarding of their technological assets. This focus ensures their offerings remain at the forefront of efficiency and performance.

Atlas Copco’s global manufacturing and R&D facilities form a vital backbone, allowing for production and innovation tailored to local market needs. This extensive network, featuring plants and research centers across the globe, ensures efficient operations and strengthens supply chain resilience.

The company’s commitment to localized development is underscored by significant investments, such as the inauguration of a new campus in Wuxi, China, in May 2025. This expansion directly bolsters both production capacity and innovative output, reflecting a strategic focus on key growth regions.

Atlas Copco's operational prowess is built upon a foundation of skilled professionals. Their engineers, technicians, and sales teams possess deep application and process knowledge, crucial for innovation and customer support.

In 2024, Atlas Copco continued to invest in its global talent pool, recognizing that expertise drives product development and manufacturing quality. This human capital is a cornerstone of their ability to deliver exceptional service and maintain market leadership.

Strong Brand Portfolio

Atlas Copco’s business model thrives on its robust portfolio of strong brands, each meticulously cultivated to hold leading positions within its specific market segment. This strategic approach ensures they can effectively address a wide array of customer needs and capture diverse market niches. For instance, brands like Atlas Copco itself (for compressors), Epiroc (for mining and infrastructure), and Oerlikon (for vacuum technology) are well-recognized leaders.

The inherent strength of these brands translates directly into significant customer loyalty and widespread market recognition, a crucial element for sustained growth and competitive advantage. This brand equity supports premium pricing and facilitates easier market penetration for new products and services. In 2023, Atlas Copco reported vacuum solutions revenue of SEK 36,949 million, showcasing the market’s embrace of their specialized offerings.

- Brand Diversification: Atlas Copco operates multiple distinct brands, each targeting specific customer segments and applications within the industrial equipment sector.

- Market Leadership: Each brand within the portfolio is strategically positioned to be a leader in its respective market niche, reinforcing competitive strength.

- Customer Loyalty: The strong brand equity built over years fosters deep customer loyalty, leading to repeat business and reduced customer acquisition costs.

- Revenue Contribution: In 2023, Atlas Copco's Compressor Technique segment, a core area for many of its brands, generated SEK 77,296 million in revenues, highlighting the commercial success of its brand strategy.

Financial Capital and Cash Flow Generation

Atlas Copco's financial capital and cash flow generation are cornerstones of its business model, enabling significant investments in research and development, strategic acquisitions, and ongoing operational enhancements. This financial fortitude not only bolsters their resilience against economic fluctuations but also underpins their long-term expansion strategies.

- Financial Strength: Atlas Copco maintains a robust financial position, characterized by strong cash flow generation.

- Investment Capacity: This financial health allows for substantial capital allocation towards innovation, market expansion, and efficiency improvements.

- Resilience and Growth: The company's financial stability provides a buffer against economic downturns and supports sustained growth ambitions.

- Q2 2025 Performance: Evidence of this strength is seen in their Q2 2025 operating cash flow, reflecting a healthy financial standing.

Atlas Copco's intellectual property, including a substantial patent portfolio and proprietary technologies in areas like compressed air and vacuum solutions, forms a critical key resource. These innovations are protected and drive their product development, ensuring market leadership.

Their global network of manufacturing and R&D facilities is another vital asset, enabling localized production and innovation. This extensive infrastructure, supported by significant investments like the Wuxi campus inaugurated in May 2025, enhances operational efficiency and supply chain resilience.

The company's skilled workforce, comprising engineers and technicians with deep process knowledge, is fundamental to their success. In 2024, Atlas Copco continued to invest in this human capital, recognizing its importance for product development and customer support.

Atlas Copco's strong financial capital and consistent cash flow generation are essential for funding R&D, strategic acquisitions, and operational improvements. This financial strength, evident in their Q2 2025 operating cash flow, provides resilience and supports long-term growth.

Value Propositions

Atlas Copco offers solutions that boost customer productivity while championing environmental stewardship, emphasizing energy efficiency and lower emissions. This focus directly supports customers in meeting their environmental objectives, aligning with widespread sustainability movements.

Their dedication to sustainability is exemplified by innovations like the ZBC 1000-1200 energy storage system, designed to substantially cut emissions. In 2023, Atlas Copco reported a 10% reduction in CO2 emissions from their own operations compared to 2022, demonstrating their commitment to a greener future.

Atlas Copco's commitment to energy efficiency is a cornerstone value proposition, directly translating into tangible cost savings for its customers. By offering advanced technologies like Variable Speed Drive (VSD) compressors, the company empowers businesses to significantly reduce their energy consumption.

These highly efficient products are designed to optimize compressed air generation, leading to substantial reductions in electricity bills for manufacturers. For instance, Atlas Copco's VSD technology can deliver energy savings of up to 50% compared to traditional fixed-speed compressors, a critical factor in lowering operational expenditures.

Customers consistently choose Atlas Copco for its equipment's robust construction and enduring performance, even in the toughest industrial settings. This unwavering dependability directly translates to reduced operational interruptions and minimized costly downtime for businesses.

Atlas Copco's reputation for quality and forward-thinking innovation is built on decades of delivering reliable solutions. In 2023, for instance, the company's commitment to product excellence was reflected in strong customer satisfaction scores across its industrial compressor portfolio.

Customized Solutions and Application Expertise

Atlas Copco's value proposition hinges on its Customized Solutions and Application Expertise, enabling them to craft tailored offerings that precisely match unique customer requirements across a wide array of industries. This deep understanding of specific applications ensures seamless integration of their equipment into sophisticated industrial processes.

This expertise allows Atlas Copco to not only meet but exceed customer expectations by providing solutions that are inherently designed for optimal performance within a given operational context. Their ability to adapt and innovate based on application knowledge is a key differentiator.

- Tailored Equipment: Atlas Copco designs and configures machinery, such as compressors and vacuum pumps, to meet the exact specifications of diverse industrial applications, from food and beverage production to semiconductor manufacturing.

- Process Optimization: Their application experts possess in-depth knowledge of customer processes, allowing them to recommend and implement solutions that enhance efficiency, reduce energy consumption, and improve product quality. For example, in 2024, their energy-efficient VSD+ compressors contributed to significant energy savings for clients, with some reporting reductions of up to 40% in energy costs for their compressed air systems.

- Niche Market Penetration: The company's broad product portfolio and specialized knowledge enable effective service delivery to niche markets, ensuring that even highly specialized industrial needs are met with appropriate technological solutions.

- Integrated Service Offerings: Beyond equipment, Atlas Copco provides comprehensive service packages, including predictive maintenance and remote monitoring, leveraging their application expertise to ensure maximum uptime and operational reliability for their customized solutions.

Global Service and Support

Atlas Copco's commitment to global service and support is a cornerstone of its value proposition. This extensive network ensures customers worldwide receive prompt assistance, crucial maintenance, and readily available spare parts. For instance, in 2023, Atlas Copco reported that its Service division accounted for a significant portion of its total revenues, demonstrating the economic impact of this offering.

This robust service infrastructure directly translates into minimized operational downtime for clients. By proactively addressing maintenance needs and quickly resolving issues, Atlas Copco helps customers maintain peak equipment efficiency and extend the operational life of their investments. This focus on continuity and performance is a key driver of customer loyalty and satisfaction.

- Global Reach: A worldwide network of service technicians and parts distribution centers.

- Minimized Downtime: Proactive maintenance and rapid response to keep operations running smoothly.

- Maximized Efficiency: Ensuring equipment operates at its optimal performance level.

- Customer Satisfaction: Fostering long-term relationships through reliable support.

Atlas Copco's value proposition is built on delivering energy-efficient solutions that reduce operational costs and environmental impact for customers. Their advanced technologies, like Variable Speed Drive (VSD) compressors, can slash energy consumption by up to 50%, directly lowering electricity bills. This commitment to sustainability is evident in their own operations, with a 10% CO2 reduction in 2023 compared to 2022.

Customers rely on Atlas Copco for the robust construction and enduring performance of their equipment, minimizing costly downtime. This unwavering dependability, backed by strong customer satisfaction scores in 2023, ensures operational continuity and extends the life of customer investments.

The company excels in providing customized solutions and application expertise, tailoring offerings to unique industrial needs. This deep understanding allows for seamless integration and optimal performance, as seen in 2024 when their VSD+ compressors helped clients achieve up to 40% energy cost reductions.

Atlas Copco's extensive global service network ensures prompt assistance, crucial maintenance, and readily available spare parts, minimizing operational downtime. Their Service division significantly contributed to total revenues in 2023, underscoring the economic importance of this reliable support.

| Value Proposition | Key Feature | Customer Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Energy Efficiency & Sustainability | VSD technology, ZBC 1000-1200 system | Reduced energy costs, lower emissions | 10% CO2 reduction in own operations (2023) |

| Reliability & Durability | Robust construction, proven performance | Minimized downtime, extended equipment life | Strong customer satisfaction scores (2023) |

| Customized Solutions & Expertise | Tailored equipment, process optimization | Enhanced efficiency, improved product quality | Up to 40% energy savings reported by clients (2024) |

| Global Service & Support | Worldwide network, proactive maintenance | Maximized uptime, operational continuity | Service division significant revenue contributor (2023) |

Customer Relationships

Atlas Copco cultivates long-term partnerships by acting as a trusted advisor, going beyond a simple supplier role. This involves a deep understanding of customer needs and providing ongoing support and tailored solutions.

In 2023, Atlas Copco's service revenue, a key indicator of customer engagement and long-term relationships, represented a significant portion of their total sales, demonstrating their commitment to post-sale support and value creation.

Atlas Copco's dedicated sales and service teams are the backbone of their customer relationships, offering direct engagement and unparalleled technical expertise worldwide. These teams are instrumental in understanding unique customer needs, crafting customized solutions, and ensuring seamless after-sales support, which is vital for building lasting loyalty.

Atlas Copco is heavily investing in digital platforms and remote monitoring to deepen customer relationships. These technologies allow for proactive service and efficient problem-solving, directly impacting customer satisfaction and equipment uptime.

By leveraging AI-driven service models, Atlas Copco can offer predictive maintenance, a significant value-add for customers. This focus on digitization is a core strategy, aiming to optimize equipment performance and provide a seamless support experience.

In 2024, Atlas Copco reported a strong uptake in their digital service offerings, contributing to a 10% increase in service revenue year-over-year. This growth underscores the effectiveness of their remote monitoring solutions in enhancing customer loyalty and operational efficiency.

Aftermarket Service Agreements

Atlas Copco's aftermarket service agreements are a cornerstone of their customer relationships, offering comprehensive maintenance, repair, and spare parts packages. These long-term contracts are designed to guarantee consistent equipment performance and provide customers with predictable operational expenses. This focus on service agreements is a key driver for the company's growth.

These agreements foster a strong, ongoing connection by ensuring customers rely on Atlas Copco for their continued operational success. This creates a stable, recurring revenue stream, significantly contributing to the company's financial stability. The service business is a major strategic priority for Atlas Copco.

- Recurring Revenue: Service agreements provide a predictable and stable income stream, enhancing financial forecasting.

- Customer Loyalty: By offering essential ongoing support, these agreements build strong customer reliance and loyalty.

- Operational Efficiency: Customers benefit from guaranteed equipment uptime and managed maintenance costs.

- Growth Focus: Atlas Copco actively prioritizes the expansion of its service business segment.

Technical Training and Education

Atlas Copco offers comprehensive technical training and educational programs designed to equip customers with the knowledge to effectively operate and maintain their advanced equipment. This initiative directly boosts customer proficiency, ensuring they achieve peak performance and longevity from their Atlas Copco investments.

By providing these resources, Atlas Copco solidifies its position as a trusted partner and a leading authority in technical expertise within its industry. For instance, in 2024, Atlas Copco reported a significant increase in customer engagement with its online training modules, indicating a strong demand for such educational support.

- Enhanced Equipment Optimization: Customers gain skills to maximize efficiency and uptime.

- Increased Customer Value: Ensuring customers derive the most benefit from their purchases.

- Knowledge Leadership: Positioning Atlas Copco as a go-to source for technical insights.

- Strengthened Customer Loyalty: Building deeper relationships through valuable educational services.

Atlas Copco's customer relationships are built on a foundation of proactive engagement and value-added services, extending far beyond initial sales. They act as trusted advisors, offering tailored solutions and continuous support to foster long-term partnerships.

Digitalization plays a crucial role, with investments in remote monitoring and AI-driven service models enhancing customer experience through predictive maintenance and optimized equipment uptime. This digital focus is a key differentiator.

The company's aftermarket service agreements are central to customer loyalty, providing comprehensive maintenance and repair packages that ensure consistent performance and predictable costs. These agreements are a significant driver of recurring revenue and strategic growth.

| Metric | 2023 Value | 2024 Projection/Actual | Impact on Customer Relationships |

|---|---|---|---|

| Service Revenue as % of Total Sales | Significant Portion | Increased by 10% YoY (2024) | Demonstrates commitment to post-sale support and value creation. |

| Digital Service Uptake | Growing | Strong Uptake (2024) | Enhances customer satisfaction and operational efficiency through remote solutions. |

| Customer Engagement with Online Training | High | Significant Increase (2024) | Boosts customer proficiency and positions Atlas Copco as a knowledge leader. |

Channels

Atlas Copco leverages a dedicated direct sales force to connect with major industrial customers, providing expert advice and customized solutions. This hands-on approach fosters a deep understanding of client needs, crucial for negotiating intricate deals and large-scale projects.

This direct engagement is particularly vital for their high-value offerings, such as specialized industrial equipment and complex project installations. In 2024, Atlas Copco continued to emphasize this channel to build strong, long-term relationships and secure significant business.

Atlas Copco maintains a robust global distributor and dealer network, a cornerstone of its market penetration strategy. This expansive network, comprising independent entities, allows the company to effectively serve a diverse and geographically dispersed customer base.

These local partners are crucial for providing on-the-ground sales, technical service, and aftermarket support. In 2024, Atlas Copco continued to rely heavily on this decentralized model to ensure accessibility and responsiveness to customer needs across various regions, enhancing market reach and customer satisfaction.

Atlas Copco is significantly expanding its digital footprint, enhancing its online platforms to serve as a primary hub for product information and customer inquiries. This strategic move aims to streamline the customer journey, making it easier and faster for clients to access crucial details and engage with the company. The company reported a substantial increase in digital engagement across its websites and portals in 2024, reflecting a growing reliance on these channels for initial customer contact and product discovery.

For certain product lines and spare parts, Atlas Copco is actively developing and implementing e-commerce capabilities. This allows for direct online transactions, improving efficiency and providing customers with a convenient purchasing option. This focus on digital sales channels is a key component of their investment strategy, as they recognize the growing demand for online procurement in the industrial sector.

The company's investment in digitalization is a clear indicator of its forward-looking approach, aiming to leverage technology for enhanced customer accessibility and operational efficiency. By prioritizing these digital channels, Atlas Copco is positioning itself to better serve a global customer base and adapt to evolving market expectations for seamless online interactions and transactions.

Service Centers and Field Technicians

Atlas Copco's extensive network of service centers and highly trained field technicians forms a crucial part of its customer value proposition. These physical touchpoints are vital for delivering essential aftermarket support, encompassing everything from initial equipment installation to ongoing preventative maintenance and swift repairs.

This commitment to robust service ensures maximum equipment uptime for customers, directly contributing to the reliability and performance they expect. For instance, in 2024, Atlas Copco reported that its service revenue continued to grow, underscoring the importance of this channel in their overall business strategy. This focus on dependable service is a significant competitive advantage.

- Service Centers: Strategically located to provide localized support and parts availability.

- Field Technicians: Highly skilled professionals offering on-site installation, maintenance, and repair.

- Uptime Assurance: Direct impact on customer productivity by minimizing equipment downtime.

- Service Agreements: Key revenue driver and customer retention tool, built on reliable service delivery.

Trade Shows and Industry Events

Atlas Copco leverages major international trade shows and industry-specific events as a vital channel to connect with its audience. These events are instrumental in unveiling new products, fostering direct engagement with potential clients, and significantly boosting brand recognition within the sector. For instance, participation in events like IFAT Brazil in 2025 represents a strategic opportunity to highlight technological advancements and underscore the company's dedication to sustainable solutions.

These gatherings provide a tangible platform for demonstrating the value proposition of Atlas Copco's offerings. They facilitate face-to-face interactions that build trust and allow for immediate feedback on innovations. The company’s presence at such events is a key component of its go-to-market strategy, ensuring it remains at the forefront of industry conversations and trends.

- Product Showcase: Demonstrating new compressors, vacuum pumps, and industrial tools.

- Customer Engagement: Networking with existing and prospective clients to understand their needs.

- Brand Visibility: Reinforcing Atlas Copco’s position as an industry leader in efficiency and sustainability.

- Market Intelligence: Gathering insights on competitor activities and emerging market demands.

Atlas Copco utilizes a multi-channel approach, blending direct sales for key accounts with an extensive distributor network for broader market reach. Digital platforms are increasingly important for information dissemination and e-commerce, while service centers and field technicians ensure robust aftermarket support. Industry events serve as crucial touchpoints for product launches and customer engagement.

Customer Segments

Atlas Copco's manufacturing segment is incredibly broad, supplying vital equipment for everything from automotive assembly lines to food processing plants. These businesses depend on Atlas Copco for tools that boost efficiency, ensure accuracy, and drive automation, making their solutions integral to modern production.

In 2024, the industrial manufacturing sector continued to be a cornerstone of Atlas Copco's revenue. For instance, their vacuum solutions are critical in electronics manufacturing, where precise vacuum levels are paramount for semiconductor production, a market that saw significant investment and growth throughout the year.

Construction and infrastructure companies are key users of Atlas Copco's robust equipment, including portable compressors and generators essential for powering on-site operations. These customers rely on durable machinery for challenging outdoor work, from building roads to developing critical infrastructure. In 2024, the global construction market was valued at over $13 trillion, highlighting the significant demand for reliable equipment that Atlas Copco provides for these vital projects.

Atlas Copco's Mining and Natural Resources segment, even after the Epiroc spin-off, continues to offer vital equipment and services. This sector requires robust, high-performance machinery designed for the demanding conditions of resource extraction and processing, focusing on efficiency and durability to maximize recovery rates.

In 2024, the global mining market was projected to reach approximately $2.5 trillion, highlighting the immense scale of operations Atlas Copco serves. The company's solutions are critical for customers facing challenges like deep-level mining and complex processing, where reliability and operational uptime are paramount for profitability.

Semiconductor and Electronics Industry

The semiconductor and flat panel display industry represents a crucial customer segment for Atlas Copco's Vacuum Technique business area. This sector relies heavily on sophisticated vacuum solutions to enable critical manufacturing processes, driving a consistent demand for specialized and high-precision equipment.

Atlas Copco's Vacuum Technique division is actively realigning its strategies and product development to meet the evolving and future demands of this high-growth sector. The company is investing in innovation to provide cutting-edge vacuum technology essential for advanced chip fabrication and display manufacturing.

- Semiconductor and Electronics Industry Demand: This sector is a significant revenue driver for Atlas Copco's Vacuum Technique.

- Precision and Specialization: The industry requires highly specialized vacuum solutions for complex manufacturing steps.

- Future Demand Alignment: Atlas Copco is strategically positioning its Vacuum Technique business to capitalize on anticipated growth in this market.

- Technological Advancement: Continued investment in R&D is vital to support the industry's relentless pursuit of smaller, faster, and more efficient electronic components.

Energy Sector (including Renewable Energy and Hydrogen)

Atlas Copco is actively expanding its presence in the energy sector, recognizing it as a key growth driver. This includes providing essential equipment for both traditional energy sources and the burgeoning renewable energy market, such as solar and wind power generation.

The company's strategic focus on the energy transition is evident in its commitment to solutions supporting renewable energy production and the development of hydrogen infrastructure. This aligns with a global shift towards cleaner energy sources.

Atlas Copco's acquisition of ABC Compressors in 2023, for instance, significantly bolstered its capabilities in the hydrogen sector, particularly in gas compression solutions crucial for hydrogen production, storage, and distribution.

The energy segment represents a significant opportunity, with the global hydrogen market alone projected to reach over $300 billion by 2030, highlighting the substantial growth potential for Atlas Copco's offerings in this area.

- Renewable Energy Solutions: Providing compressors and gas handling equipment for various renewable energy applications.

- Hydrogen Infrastructure: Supplying critical compression technology for hydrogen production, transport, and refueling stations.

- High-Growth Market: Tapping into the expanding global demand driven by energy transition initiatives.

- Strategic Acquisitions: Enhancing capabilities through targeted purchases like ABC Compressors to strengthen market position.

Atlas Copco serves a diverse range of industrial customers, each with unique needs for compressed air, vacuum, and power solutions. These segments are crucial for their operational efficiency and productivity.

In 2024, the company continued to see strong demand from manufacturing, construction, and mining sectors. The semiconductor industry, in particular, relies on Atlas Copco's advanced vacuum technology for critical processes.

The energy sector is a growing focus, with solutions for both traditional and renewable energy sources, including a significant push into hydrogen infrastructure following strategic acquisitions.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Industrial Manufacturing | Efficiency, automation, precision tools | Cornerstone of revenue, high demand for vacuum in electronics |

| Construction & Infrastructure | Durable, reliable portable equipment | Essential for on-site operations in a $13 trillion global market |

| Mining & Natural Resources | Robust, high-performance machinery for extraction | Serves a market projected at $2.5 trillion, demanding reliability |

| Semiconductor & Electronics | Specialized, high-precision vacuum solutions | Critical for advanced chip fabrication, driving innovation |

| Energy Sector | Equipment for renewables, hydrogen infrastructure | Growing focus, significant potential in the expanding hydrogen market |

Cost Structure

Manufacturing and production are major cost drivers for Atlas Copco, encompassing everything from sourcing raw materials to the final assembly of complex industrial machinery. These expenses include the cost of acquiring necessary metals, plastics, and specialized components, as well as the internal processes for creating parts and putting the equipment together. Labor involved in these operations also contributes significantly to the overall outlay.

A substantial part of Atlas Copco's production expenses, roughly 75%, is attributed to the purchase of components from external suppliers. This highlights the company's reliance on a robust supply chain to provide the specialized parts needed for its wide array of products, from compressors to vacuum solutions.

Atlas Copco's commitment to innovation is reflected in its significant Research and Development (R&D) expenses, a crucial element of its cost structure. This investment fuels the creation of advanced technologies and sustainable productivity solutions, reinforcing its market leadership.

In 2024, Atlas Copco's dedication to R&D is evident, with R&D expenses representing a notable portion of its revenue. This strategic spending is vital for developing next-generation products and maintaining a competitive edge in the global market.

Atlas Copco's Sales, General, and Administrative (SG&A) expenses are substantial due to its global operations, encompassing sales force compensation, extensive marketing initiatives, and corporate overhead. These costs are essential for driving revenue and maintaining brand presence across diverse markets. For instance, in 2023, Atlas Copco reported SG&A expenses of SEK 4,662 million, highlighting the significant investment required to support its worldwide business activities.

Service and Distribution Network Costs

Atlas Copco’s commitment to a robust global service and distribution network forms a significant part of its cost structure. This includes the operational expenses for numerous service centers, the salaries and training of a vast team of field technicians, and the complex logistics involved in managing spare parts inventory worldwide. These expenditures are fundamental to providing comprehensive aftermarket support, a key area of focus for the company, and directly impact customer satisfaction and retention.

The company's strategic emphasis on its service business means substantial investment in maintaining this infrastructure. For instance, in 2023, Atlas Copco reported that its Service business area generated revenues of SEK 46,109 million, underscoring its importance and the associated operational costs. This focus ensures that customers receive timely and effective support, which is critical for the uptime and performance of their equipment.

- Global Network Maintenance: Costs associated with operating and maintaining service centers and distribution hubs across various regions.

- Field Technician Operations: Expenses related to employing, training, and deploying a skilled workforce of field service technicians.

- Spare Parts Logistics: Investment in inventory management, warehousing, and transportation of spare parts to ensure availability for customers.

- Service Business Investment: Allocation of resources to enhance service offerings and support, reflecting the company's strategic priority in this segment.

Acquisition-Related Costs and Integration Expenses

Atlas Copco’s aggressive acquisition strategy means significant investment in identifying, evaluating, and closing deals. These acquisition-related costs include extensive due diligence, legal and advisory fees, and the often substantial expenses tied to integrating new businesses into their existing operations. For instance, in 2023, Atlas Copco completed several acquisitions, which, while fueling growth, inherently added to their cost base through these transaction and integration activities.

The integration phase itself can be a major cost driver. It involves harmonizing IT systems, aligning corporate cultures, streamlining operations, and sometimes, restructuring acquired entities to fit Atlas Copco’s model. These efforts, while crucial for realizing synergies, can lead to one-off restructuring charges. For example, following the acquisition of a new business unit, there might be costs associated with workforce adjustments or facility consolidations, impacting profitability in the short to medium term.

- Due Diligence and Transaction Fees: Costs incurred in assessing potential acquisition targets, including legal, financial, and operational reviews.

- Integration Expenses: Costs related to merging acquired companies, such as IT system integration, rebranding, and organizational restructuring.

- Restructuring Costs: Expenses arising from streamlining operations within acquired businesses, which may involve employee severance or asset write-downs.

- Impact on Profitability: While acquisitions drive top-line growth, these upfront and ongoing integration costs can temporarily depress profit margins.

Atlas Copco’s cost structure is heavily influenced by its manufacturing operations, with component purchases making up a significant portion. The company’s investment in research and development is also a key expense, driving innovation and market competitiveness. Furthermore, substantial costs are associated with its global sales, administrative functions, and extensive service network.

In 2023, Atlas Copco’s commitment to its service business was evident, generating SEK 46,109 million in revenue, which implies significant underlying operational costs for maintaining this global support infrastructure. The company’s SG&A expenses were SEK 4,662 million in the same year, reflecting the investment in its worldwide sales and administrative presence.

| Cost Category | 2023 (SEK million) | Notes |

| Component Purchases (External Suppliers) | N/A (Approx. 75% of production costs) | Critical for manufacturing diverse industrial equipment. |

| Sales, General & Administrative (SG&A) | 4,662 | Supports global operations, sales force, and marketing. |

| Research & Development (R&D) | N/A (Significant portion of revenue in 2024) | Fuels innovation and development of new technologies. |

| Service Business Operations | N/A (Implied by SEK 46,109 million revenue) | Covers network maintenance, technicians, and spare parts logistics. |

Revenue Streams

Atlas Copco's most significant revenue source is the sale of its diverse industrial equipment. This includes essential machinery like air compressors, vacuum pumps, and various industrial tools, alongside their Power Technique products. These equipment sales represent the bedrock of their financial performance.

In 2024, Atlas Copco reported substantial revenue from these sales, reaching BSEK 177. This figure underscores the critical role of equipment manufacturing and distribution in the company's overall business model and its ability to generate substantial income.

Atlas Copco's aftermarket services, encompassing maintenance, repairs, spare parts, and consumables, form a significant and expanding recurring revenue stream. This segment is typically characterized by high profitability and fosters enduring customer relationships.

In 2023, Atlas Copco reported that its Service business unit achieved order growth across all its operational areas, underscoring the strength of this revenue stream. This consistent performance highlights the value customers place on ongoing support and genuine parts.

Atlas Copco's Rental Solutions segment offers flexible equipment access for diverse industrial and construction demands, allowing customers to avoid outright purchases. This includes specialized rentals like dewatering solutions, a strategic area reinforced by their acquisition of National Tank & Equipment.

Digital Services and Software

Atlas Copco's commitment to digitalization is a significant driver for its revenue, with digital services and software becoming increasingly important. These offerings, such as remote monitoring and predictive maintenance solutions, are designed to enhance customer value and establish new, often recurring, revenue streams. This trend is not only continuing but accelerating for the company.

These digital services represent a strategic shift, moving beyond traditional equipment sales to a more service-oriented model. By leveraging data analytics and IoT capabilities, Atlas Copco provides customers with insights that improve operational efficiency and reduce downtime. This focus on value-added services is a key component of their evolving business strategy.

- Digital Services Revenue Growth: While specific figures for digital services as a standalone revenue stream are often embedded within broader reporting, the company has highlighted the increasing contribution of these offerings. For instance, during 2023, Atlas Copco noted a strong performance in its Service business area, which includes many of these digital solutions.

- Predictive Maintenance Adoption: The adoption of predictive maintenance software is crucial. By analyzing equipment data, these systems can anticipate failures, allowing for scheduled maintenance rather than costly reactive repairs. This directly translates to customer savings and fosters stronger, ongoing relationships with Atlas Copco.

- Remote Monitoring Capabilities: Advanced remote monitoring systems provide real-time performance data and diagnostics. This allows Atlas Copco to offer proactive support and troubleshooting, further enhancing customer satisfaction and creating opportunities for service contracts.

- Recurring Revenue Models: The shift towards software-as-a-service (SaaS) and subscription-based models for these digital tools creates predictable, recurring revenue. This stability is highly valued by investors and contributes to the company's long-term financial health.

Sales of Consumables and Accessories

Atlas Copco generates significant revenue through the sale of consumables and accessories, essential for the ongoing operation of their machinery. These items, including specialized lubricants, high-performance filters, and various attachments, are crucial for maintaining equipment efficiency and longevity.

This segment of their business model fosters continuous customer relationships and provides a predictable, recurring revenue stream. For instance, in 2023, Atlas Copco reported strong performance in their aftermarket business, which heavily relies on the sale of such consumables and accessories, contributing substantially to their overall profitability.

- Consumables: Lubricants, filters, sealants, and other wear-and-tear items.

- Accessories: Specialized tools, adapters, hoses, and upgrade kits designed to enhance equipment functionality.

- Customer Retention: These sales encourage repeat business and lock-in customers to the Atlas Copco ecosystem.

- Revenue Stability: Provides a consistent income source, less susceptible to large capital expenditure cycles.

Beyond equipment sales and aftermarket services, Atlas Copco also generates revenue through its Rental Solutions segment, offering flexible access to machinery. This strategic move, bolstered by acquisitions like National Tank & Equipment, caters to varied industrial and construction needs without requiring outright purchase.

The company's increasing focus on digitalization is creating new revenue streams through software and digital services. These include remote monitoring and predictive maintenance, enhancing customer value and establishing recurring income models.

Atlas Copco's revenue is also significantly supported by the sale of consumables and accessories, such as lubricants and filters. These essential items ensure equipment efficiency and longevity, fostering continuous customer engagement and providing a stable, recurring income.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Equipment Sales | Sale of industrial equipment like compressors, vacuum pumps, and tools. | BSEK 177 in 2024 |

| Aftermarket Services | Maintenance, repairs, spare parts, and consumables. | Order growth across all operational areas in 2023. |

| Rental Solutions | Flexible equipment access for industrial and construction needs. | Acquisition of National Tank & Equipment to strengthen this segment. |

| Digital Services | Software, remote monitoring, and predictive maintenance. | Increasing contribution, embedded within strong Service business performance in 2023. |

| Consumables & Accessories | Lubricants, filters, tools, and upgrade kits. | Strong performance in aftermarket business in 2023, reliant on these sales. |

Business Model Canvas Data Sources

The Atlas Copco Business Model Canvas is built upon a foundation of robust financial reports, extensive market research, and internal strategic planning documents. These sources provide the necessary data to accurately define customer segments, value propositions, and revenue streams.