Atlas Copco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Copco Bundle

Understand the strategic positioning of Atlas Copco's product portfolio with a clear view of its Stars, Cash Cows, Dogs, and Question Marks. This initial glimpse highlights key areas for growth and potential divestment. Purchase the full BCG Matrix for a comprehensive breakdown and actionable strategies to optimize your investments and product development.

Stars

Atlas Copco's Variable Speed Drive (VSD) compressors represent a significant technological advancement, automatically adjusting motor speed to precisely match fluctuating demand. This innovation directly translates to substantial energy savings and reduced wear on equipment, solidifying their position in the expanding market for sustainable industrial solutions.

The company's commitment to enhancing energy efficiency across its air and gas compression portfolio is a primary driver of growth. For instance, Atlas Copco reported that its VSD technology can achieve energy savings of up to 50% compared to traditional fixed-speed compressors, a crucial benefit for customers aiming to lower operational costs and meet ambitious environmental targets.

Smart Integrated Assembly Solutions, featuring connected industrial power tools and advanced machine vision, are key enablers of the smart factory concept. These solutions drive efficiency by optimizing resource allocation, minimizing waste, and reducing energy consumption, reflecting the growing industry focus on digitalization and automation. Atlas Copco's MTRwrench, a recipient of the Red Dot Design Award 2025, showcases the company's commitment to developing innovative, sustainable, and high-performance assembly technology.

Atlas Copco's vacuum solutions are particularly well-positioned within high-growth industries like semiconductor manufacturing and flat panel display production. These sectors are experiencing robust demand for advanced vacuum technology, driven by innovation and increasing production volumes, especially in key Asian markets.

While the semiconductor industry has seen some cyclicality, the long-term trend for vacuum equipment remains positive, fueled by the ongoing need for sophisticated chip manufacturing processes. Similarly, the flat panel display market continues its expansion, requiring reliable and efficient vacuum systems.

Atlas Copco's strategic moves, such as acquiring New Star Technology, a Chinese abatement company, underscore its commitment to strengthening its presence in these technologically demanding and rapidly growing markets. This acquisition, completed in 2023, bolsters Atlas Copco's capabilities in providing integrated vacuum and abatement solutions, crucial for environmental compliance and process efficiency in these advanced manufacturing environments.

Specialty Rental Solutions (Dewatering Market)

Atlas Copco's acquisition of National Tank & Equipment, LLC (NTE) in July 2025 signifies a significant expansion into the US specialty dewatering market. This move broadens their existing rental solutions, specifically targeting crucial sectors such as energy, infrastructure, municipal services, industrial operations, and mining. The company is poised to leverage the increasing demand driven by infrastructure projects and specialized industrial requirements.

The dewatering market is experiencing robust growth, with projections indicating continued expansion. For instance, the global dewatering pump market was valued at approximately $1.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030. This growth is fueled by increased construction activities, particularly in emerging economies, and the need for efficient water management in various industrial processes.

- Market Entry: Atlas Copco entered the US specialty dewatering market via the July 2025 acquisition of NTE.

- Portfolio Expansion: This acquisition enhances Atlas Copco's specialty rental solutions, catering to high-demand sectors.

- Target Sectors: Key industries served include energy, infrastructure construction, municipal, industrial, and mining.

- Strategic Positioning: The move capitalizes on growing infrastructure development and specialized industrial needs in the US.

Hydrogen and Renewable Energy Compression Technologies

Atlas Copco's strategic acquisition of ABC Compressors in June 2025, a specialist in reciprocating compressors, significantly bolsters its presence in the booming gas compression sector for renewable energy and hydrogen storage.

This move is particularly timely as global hydrogen demand is anticipated to triple by 2030, positioning Atlas Copco to capture a vital segment of the energy transition by providing essential technology for managing gaseous fuels.

The integration of ABC Compressors' expertise allows Atlas Copco to offer advanced solutions for hydrogen compression, a critical component for efficient storage and transportation.

- Market Growth: The hydrogen economy is expanding rapidly, with significant investment flowing into infrastructure and storage solutions.

- Technological Advantage: Reciprocating compressors are crucial for achieving the high pressures required for safe and efficient hydrogen storage.

- Strategic Positioning: The acquisition strengthens Atlas Copco's portfolio in sustainable energy technologies, aligning with global decarbonization efforts.

- Future Demand: Projections indicate a substantial increase in the need for reliable and advanced compression systems to support the growing hydrogen market.

Atlas Copco's vacuum solutions are a strong contender in the Stars category, particularly within the semiconductor and flat panel display industries. These markets are experiencing consistent demand for advanced vacuum technology due to ongoing innovation and production growth, especially in Asia. The company's strategic acquisition of New Star Technology in 2023 further solidified its position by enhancing integrated vacuum and abatement capabilities, crucial for these high-tech manufacturing sectors.

What is included in the product

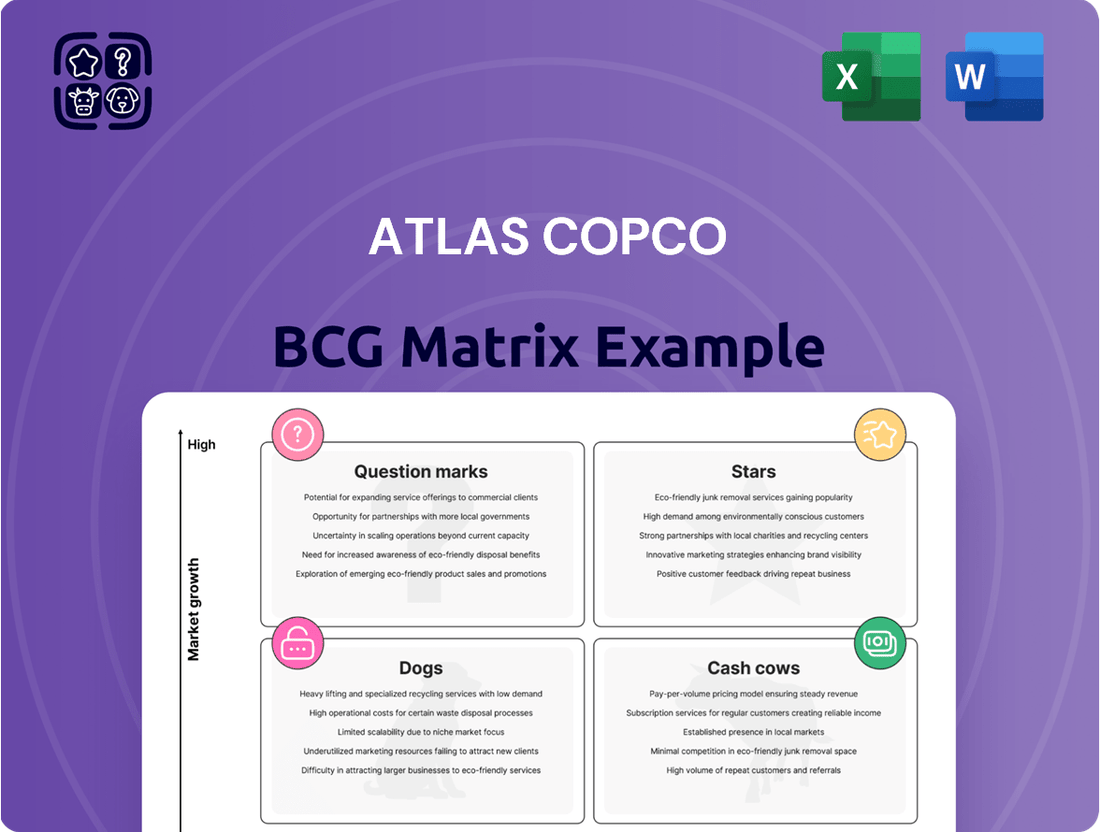

The Atlas Copco BCG Matrix analyzes its business units based on market growth and share, guiding investment decisions.

A clear BCG Matrix visual instantly clarifies business unit positioning, easing the pain of strategic uncertainty.

Cash Cows

Atlas Copco's traditional industrial air compressors are firmly positioned as Cash Cows. This segment represents a significant portion of the company's profitability, contributing around 50% to its Earnings Before Interest and Taxes (EBIT).

Despite some regional flatness in industrial compressor orders during 2024, the overall demand for Atlas Copco's equipment and services held steady. This stability, coupled with their dominant market share in a fundamental industrial sector, generates reliable and substantial cash flows for the group.

Atlas Copco's service business is a powerhouse, showing robust order intake growth across every segment. This consistent performance is fueled by a vast installed base of their equipment worldwide, which naturally demands regular maintenance, spare parts, and expert support.

The high-margin nature of these services contributes significantly to stable revenue streams. For instance, in 2023, Atlas Copco reported that their Service division's revenue grew by 12% in local currencies, highlighting the ongoing demand and profitability of this segment.

A major strategic focus for Atlas Copco is to organically expand the scope of their service offerings. This involves not just traditional maintenance but also value-added solutions and digital services, further solidifying their position as a cash cow.

Atlas Copco's industrial power tools segment, particularly in mature areas like automotive assembly, represents a classic Cash Cow. Despite some softening demand in specific niches, the overall market remains robust and predictable, allowing Atlas Copco to leverage its strong brand and extensive product portfolio for consistent revenue generation.

The company's deep roots in industrial applications ensure a steady stream of cash flow from these established product lines. For instance, in 2023, Atlas Copco reported that its Industrial Technique segment, which includes many of these power tools, generated substantial operating profit, demonstrating the enduring strength of these mature businesses.

Portable Energy Solutions (Generators)

Atlas Copco’s portable energy solutions, primarily generators, cater to mature sectors such as construction and mining. These markets, while established, demonstrate a consistent need for dependable power sources, particularly in demanding environments.

In 2024, Atlas Copco observed a decrease in orders for their power and flow equipment compared to previous peaks. This segment operates within a mature market, indicating stable, albeit potentially slower, growth. The demand remains robust for durable and reliable generators essential for various industrial operations.

- Market Maturity: Construction and mining represent established, mature markets for generators.

- Demand Consistency: Despite order fluctuations in 2024, there's ongoing demand for reliable portable power.

- Product Focus: Atlas Copco's generators are designed for robustness and dependability in industrial applications.

Dewatering and Industrial Pumps (Established Applications)

Dewatering and industrial pumps represent Atlas Copco’s established Cash Cows. This segment serves foundational needs across construction, infrastructure, and various industrial applications, ensuring a stable and predictable revenue flow. These pumps are essential for many operational processes, contributing reliably to the company's financial performance.

While the overall market for these pumps is mature, Atlas Copco's strategic moves, such as the acquisition of NTE, bolster its position. Though NTE might be classified as a 'Star' for its specialized dewatering capabilities, this acquisition simultaneously strengthens Atlas Copco's broader portfolio in the industrial pumping solutions market.

- Market Maturity: The dewatering and industrial pumps segment operates in well-established markets with consistent demand.

- Revenue Stability: These applications provide a reliable, albeit moderate, revenue stream due to their critical nature in various industries.

- Acquisition Impact: The NTE acquisition enhances Atlas Copco's standing in specialty dewatering, reinforcing its overall strength in pumping solutions.

Atlas Copco’s industrial air compressors are a prime example of their Cash Cows, consistently generating substantial profits. This segment, a cornerstone of their business, accounted for approximately 50% of the company's Earnings Before Interest and Taxes (EBIT) in recent reporting periods. Despite some regional fluctuations in industrial compressor orders during 2024, the overall demand for Atlas Copco's equipment and services remained stable, underscoring their dominant market share in a fundamental industrial sector and their ability to produce reliable cash flows.

The service business is another significant Cash Cow for Atlas Copco, experiencing robust order intake growth across all segments. This ongoing success is driven by a vast global installed base of their equipment, which necessitates continuous maintenance, spare parts, and expert support. The high-margin nature of these services contributes significantly to stable revenue streams, with the Service division reporting a 12% revenue growth in local currencies in 2023, demonstrating consistent demand and profitability.

Atlas Copco’s portable energy solutions, particularly generators, serve mature sectors like construction and mining. These markets, while established, have a consistent need for dependable power. In 2024, orders for power and flow equipment saw a decrease from previous peaks, reflecting the mature nature of this market, yet demand for durable and reliable generators remains robust for essential industrial operations.

| Segment | BCG Category | Key Characteristics | 2023 Performance Highlight | 2024 Market Trend |

|---|---|---|---|---|

| Industrial Air Compressors | Cash Cow | Dominant market share, fundamental industrial demand, stable revenue | Contributed ~50% to EBIT | Steady overall demand despite regional flatness |

| Service Business | Cash Cow | High-margin, recurring revenue from installed base, expanding digital services | 12% revenue growth (local currency) | Robust order intake across all segments |

| Portable Energy (Generators) | Cash Cow | Mature markets (construction, mining), consistent need for reliable power | Strong demand for dependable power sources | Decreased orders from previous peaks, stable underlying demand |

Preview = Final Product

Atlas Copco BCG Matrix

The Atlas Copco BCG Matrix preview you're currently viewing is the identical, fully completed document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content; you'll get the exact strategic analysis, ready for immediate implementation in your business planning.

Dogs

Atlas Copco's Specific Industrial Assembly & Vision Solutions segment faced headwinds in 2024, primarily due to softened automotive demand, especially in the European market. This resulted in a noticeable dip in new orders for the company's specialized assembly and vision systems.

The sustained pressure on this sub-segment, if not countered by strategic adjustments or a rebound in automotive production, positions it as a potential 'Dog' in the BCG matrix. This classification stems from its current low growth trajectory and the risk of market share erosion in key applications within the wider industrial tools landscape.

Older, less energy-efficient compressor models from Atlas Copco might be categorized as Dogs in the BCG matrix. These units, often fixed-speed, consume more power than their Variable Speed Drive (VSD) counterparts, leading to higher operating expenses for users. For instance, while VSD compressors can reduce energy consumption by up to 50%, older models lack this efficiency, making them less attractive as energy costs rise.

Niche or outdated vacuum equipment lines, particularly those not supporting high-growth industries like semiconductor or flat panel display manufacturing, can be categorized as Dogs in the BCG Matrix. These product segments often exhibit low market growth and low relative market share, meaning they contribute minimally to revenue and profitability. For example, older industrial vacuum pumps used in less dynamic manufacturing processes might fall into this category.

These Dog products can tie up valuable capital and resources that could be better allocated to more promising areas of the business. In 2023, Atlas Copco’s vacuum solutions segment, while strong overall, likely had specific product groups within this niche that demonstrated stagnant or declining demand. Focusing on divesting or phasing out these underperforming assets is a common strategy to streamline operations and improve overall financial performance.

Certain Regional Markets with Sustained Weakness

Atlas Copco's near-term outlook indicates weakening customer activity, with a notable organic revenue decline in Q1 2025. Order intake has also seen a downturn in key regions like North America and Europe.

If specific regional markets for certain product lines face prolonged weakness without signs of recovery, these underperforming segments could be reclassified. This sustained underperformance might necessitate a strategic re-evaluation, potentially leading to scaling back operations or divesting those particular regional product sales.

- Regional Weakness: Q1 2025 saw organic revenue decline, with order intake falling in North America and Europe.

- Sustained Decline: Prolonged weakness in specific regional product markets could signal a need for strategic adjustment.

- Potential Reclassification: These markets might be considered 'Dogs' if the decline persists, requiring careful consideration of future investment.

Standardized, Low-Differentiation Industrial Tools

Standardized, low-differentiation industrial tools often find themselves in a challenging market position. In the highly competitive landscape of general industrial equipment, products that don't offer distinct advantages in technology or efficiency can struggle to maintain their footing. For instance, basic pneumatic drills or standard wrenches, if not integrated into a larger system or used in a niche, high-value application, risk losing market share.

Competitors frequently introduce more innovative or cost-effective alternatives, putting pressure on these less differentiated offerings. This dynamic can lead to a gradual erosion of market share, pushing these products towards a 'Dog' classification within the BCG matrix. A key factor here is the absence of proprietary technology or unique selling propositions that would command premium pricing or foster customer loyalty.

- Market Share Erosion: In 2024, the industrial tools market saw intense competition, with companies focusing on value-added services and smart technologies. Standardized tools without these features faced price wars, impacting profitability.

- Lack of Innovation: Products lacking significant technological advancements or unique features are particularly vulnerable. For example, basic air compressors without variable speed drives or advanced energy-saving modes are increasingly being outperformed.

- Cost-Effectiveness Pressure: As global supply chains stabilize, the emphasis shifts back to performance and innovation. Manufacturers of low-differentiation tools must compete heavily on price, which can squeeze margins significantly.

- Integration as a Differentiator: Tools that are part of a larger, integrated solution (e.g., automated assembly lines) can retain value. However, standalone, undifferentiated tools are more susceptible to becoming 'Dogs'.

Certain older, less efficient industrial tools and equipment lines within Atlas Copco's portfolio may be classified as Dogs. These products typically operate in mature or declining markets with low growth and possess a low relative market share. For example, basic pneumatic tools or older generation compressor models that lack advanced features like variable speed drives (VSDs) can fall into this category. These items often struggle against newer, more energy-efficient, and technologically advanced alternatives, leading to reduced sales and profitability.

The specific industrial assembly & vision solutions segment, particularly those tied to the automotive sector, faced challenges in 2024 due to softened demand, especially in Europe. This led to a dip in new orders, potentially positioning these specialized systems as Dogs if market conditions do not improve or if they cannot be adapted to emerging high-growth areas. Similarly, niche or outdated vacuum equipment not serving high-growth industries like semiconductors can also be considered Dogs due to low market growth and share.

Atlas Copco's Q1 2025 performance indicated weakening customer activity, with organic revenue declining and order intake falling in key regions like North America and Europe. If specific regional markets for certain product lines experience prolonged weakness without recovery signs, these underperforming segments might be reclassified as Dogs, necessitating strategic adjustments such as scaling back or divestment.

Standardized, low-differentiation industrial tools, particularly those without unique technological advantages or integration into larger solutions, are vulnerable to market share erosion in the competitive 2024 landscape. These products often face price wars and are outperformed by more innovative or cost-effective alternatives, making them susceptible to becoming Dogs.

| Product Category | BCG Classification | Market Trend | Atlas Copco Performance Indicator (2024/Q1 2025) | Strategic Consideration |

| Older Compressor Models (non-VSD) | Dog | Mature/Declining (focus on energy efficiency) | Lower demand vs. VSD models; higher operating costs for users | Phase-out or upgrade incentives |

| Niche Vacuum Equipment (non-high-growth) | Dog | Low Growth (e.g., older industrial processes) | Low market growth, low relative market share | Divestment or repurposing |

| Specific Industrial Assembly & Vision Solutions (Automotive-tied) | Potential Dog | Softening Demand (especially automotive) | Dip in new orders in 2024 | Diversification or market adaptation |

| Standardized Industrial Tools (low differentiation) | Potential Dog | Highly Competitive (focus on value-added/smart tech) | Risk of market share erosion, price wars | Focus on integration or niche applications |

Question Marks

Atlas Copco is actively expanding its AI-driven service models, a strategic move that positions them to capitalize on the growing demand for predictive maintenance and smart factory solutions. This focus on digitization signifies a commitment to future-proofing their offerings and enhancing customer value through advanced analytics and automation.

These innovative service models, while holding considerable growth potential, are likely in their nascent stages of market penetration, placing them in the question mark category of the BCG matrix. The increasing adoption of Industry 4.0 principles across various sectors fuels the demand for such intelligent solutions, suggesting a promising future trajectory.

The development and scaling of these AI-driven services necessitate substantial investment. For instance, companies investing heavily in AI for predictive maintenance, like GE Aviation, have reported significant savings, with some estimating up to a 20% reduction in maintenance costs. Atlas Copco's commitment to this area in 2024 and beyond will be crucial for achieving meaningful market share and realizing the full potential of these emerging offerings.

Emerging machine vision solutions, while housed within Atlas Copco's Industrial Technique business area, represent potential Stars or Question Marks. These advanced technologies, particularly those designed for novel or niche industrial applications, are experiencing rapid growth fueled by the global push for enhanced automation and quality control. For instance, the industrial machine vision market was valued at approximately $3.5 billion in 2023 and is projected to reach over $7 billion by 2030, demonstrating a significant growth trajectory.

While these solutions are in a burgeoning market, their current market share within Atlas Copco's extensive product range may be modest. This positions them as potential Question Marks, requiring strategic investment and development to capitalize on their growth potential and transition them into market leaders, or Stars, as their adoption increases across various specialized sectors.

Atlas Copco is actively investing in carbon capture and decarbonization technologies, a strategic move aligning with the global push for sustainability. Their development of mechanical vapor recompression (MVR) systems, designed to reduce wastewater and potentially other carbon-intensive processes, exemplifies this commitment. These innovations are positioned within a rapidly expanding market fueled by stringent environmental regulations and corporate sustainability targets.

The market for decarbonization solutions is experiencing significant growth, with projections indicating continued expansion driven by international climate agreements and a growing awareness of climate change impacts. While Atlas Copco's specific market share and profitability in this nascent sector are still developing, the high-growth potential places these technologies in the "Question Mark" category of the BCG matrix, signifying substantial upside but also inherent uncertainty.

Advanced Dewatering Solutions for New Applications

Atlas Copco is actively investigating advanced dewatering technologies for emerging applications, potentially targeting niche markets with significant future growth. These new frontiers could be driven by increasingly stringent environmental mandates or the evolution of industrial processes requiring specialized water management. While currently representing a small market share for the company, these areas offer substantial upside potential.

The company's strategic focus on expanding its dewatering portfolio, exemplified by the recent NTE acquisition for specialty dewatering, signals a commitment to innovation. This proactive approach suggests Atlas Copco is positioning itself to capitalize on evolving demands in sectors such as advanced wastewater treatment or dewatering for critical infrastructure projects, where tailored solutions are paramount.

- Exploration of advanced filtration and membrane technologies for highly contaminated industrial wastewater.

- Development of compact, energy-efficient dewatering units for remote or temporary construction sites.

- Focus on dewatering solutions for emerging industries like battery recycling or advanced materials manufacturing.

Products Leveraging Recycled Materials and Circularity Principles

Atlas Copco is actively integrating circularity principles into its product design, with a goal for 100% of new products to meet these standards by 2027. They have already been recognized with an award for a tool built using recycled plastic, showcasing tangible progress in this area.

These innovative products, emphasizing sustainability and the circular economy, are entering a market segment experiencing significant growth driven by environmentally aware consumers and businesses. For instance, the global market for sustainable packaging, a related sector, was valued at approximately USD 285.6 billion in 2023 and is projected to grow substantially.

- Market Growth: The demand for eco-friendly products is expanding rapidly.

- Product Innovation: Atlas Copco is pioneering tools made from recycled materials.

- Target Achievement: Aims for 100% of new products to incorporate circularity by 2027.

- Current Status: These products are considered Stars or Question Marks due to developing market adoption and share.

Atlas Copco's AI-driven service models and emerging machine vision solutions are prime examples of Question Marks. These innovative offerings are tapping into high-growth markets, such as predictive maintenance and industrial automation, which saw significant expansion in 2023. However, their current market share and profitability within Atlas Copco's portfolio are still developing, necessitating strategic investment to capture their full potential.

The company's investments in decarbonization technologies, including MVR systems, also fall into the Question Mark category. This sector is experiencing robust growth driven by global sustainability initiatives and regulatory pressures. While Atlas Copco is actively developing these solutions, their market penetration and financial contribution are in the early stages, highlighting the need for continued focus and resource allocation.

Furthermore, advanced dewatering technologies for niche applications, like those for battery recycling or specialized construction, are positioned as Question Marks. The acquisition of NTE for specialty dewatering underscores Atlas Copco's strategic intent to grow in these areas. These ventures are characterized by substantial future market potential but currently represent a smaller portion of the company's overall business, requiring careful nurturing.

Products incorporating circularity principles, such as tools made from recycled plastic, are also considered Question Marks. While the market for sustainable products is growing, and Atlas Copco aims for 100% of new products to meet circularity standards by 2027, their current market share in this specific segment is still being established. This requires ongoing innovation and market development to transition them into Stars.

| Category | Examples | Market Growth Potential | Current Market Share | Strategic Focus |

| Question Marks | AI-driven Service Models | High (Predictive Maintenance, Smart Factory) | Developing | Investment in R&D, Market Penetration |

| Question Marks | Machine Vision Solutions | High (Industrial Automation, Quality Control) | Modest | Targeted Development, Niche Application Focus |

| Question Marks | Decarbonization Technologies (MVR) | Very High (Sustainability, Environmental Regulations) | Nascent | Strategic Investment, Scaling Operations |

| Question Marks | Advanced Dewatering Technologies | High (Environmental Mandates, Emerging Industries) | Small | Acquisitions, Portfolio Expansion |

| Question Marks | Circularity-focused Products | Growing (Eco-conscious Consumers & Businesses) | Developing | Product Innovation, Market Adoption |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of internal financial data, market share reports, and competitive landscape analysis to provide a comprehensive view of product portfolio performance.