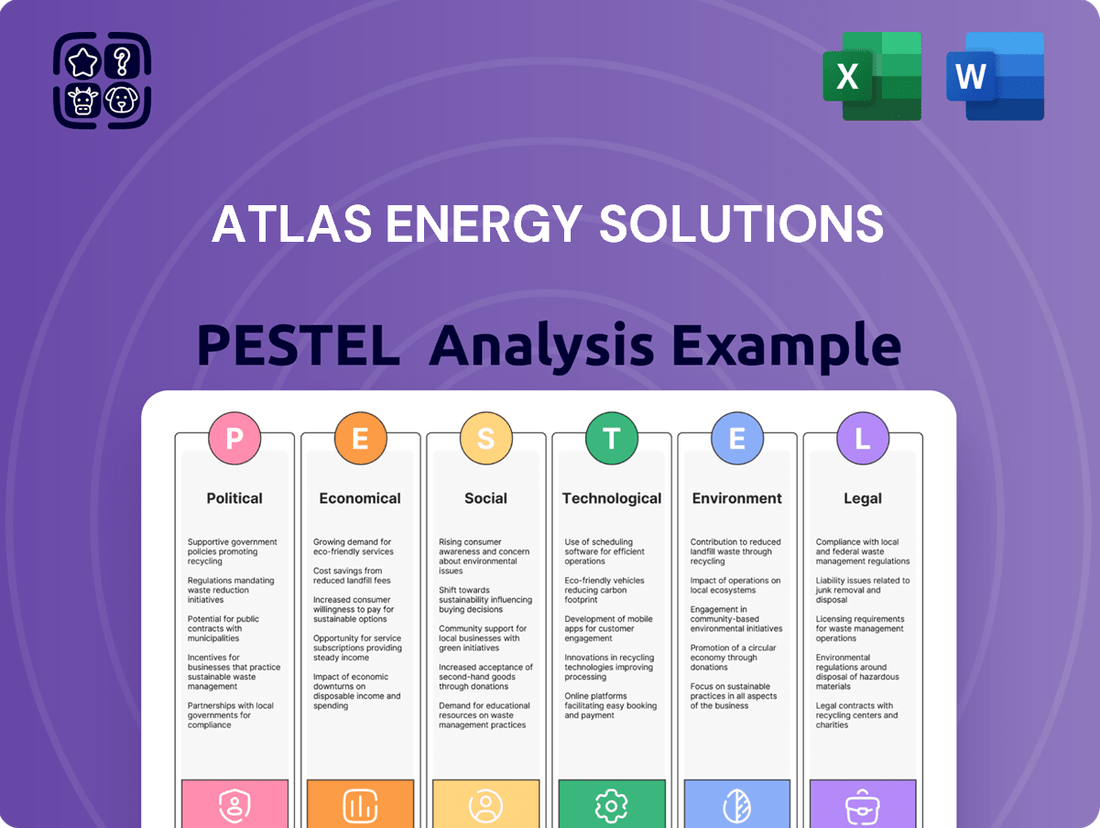

Atlas Energy Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Energy Solutions Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Atlas Energy Solutions. Our comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

A potential shift in U.S. energy policy under a future Trump administration, anticipated around 2025, could favor increased fossil fuel production, directly benefiting companies like Atlas Energy Solutions. This includes policies designed to boost oil and gas output, such as opening more federal lands for drilling and easing regulations on hydraulic fracturing.

Such policy changes are expected to drive greater drilling activity, particularly in key regions like the Permian Basin. For Atlas Energy Solutions, this translates to a heightened demand for its core offerings, specifically proppant products and logistics services essential for oil and gas extraction.

Changes in the regulatory environment significantly impact Atlas Energy Solutions, especially concerning drilling and production. For instance, in 2024, the U.S. saw ongoing debates and adjustments to environmental regulations affecting oil and gas extraction, with some states proposing streamlined permitting processes for certain projects.

If regulatory bodies ease requirements for environmental impact assessments or expedite drilling permits, this could directly lower operational hurdles and costs for Atlas's clients. Such a shift, potentially seen in policy adjustments throughout 2024 and early 2025, would likely encourage more exploration and production activities.

Consequently, a more favorable regulatory climate could accelerate project timelines for Atlas's customers, driving up demand for essential services like proppant supply and logistical support. This trend is particularly relevant as the industry navigates evolving energy policies and market demands.

The Permian Basin, Atlas Energy Solutions' core operational area, is a powerhouse for U.S. oil and gas, with significant political backing for continued production. This regional support is crucial for companies like Atlas, which provide essential services for extraction.

State-level policies in Texas and New Mexico, where much of the Permian lies, are generally favorable to the energy sector, emphasizing energy independence. This political climate creates a predictable operational landscape for frac sand and logistics providers.

In 2023, Texas and New Mexico accounted for over 40% of U.S. crude oil production, underscoring the importance of their state-level support for the industry Atlas serves.

International Geopolitical Stability

Global geopolitical stability significantly shapes the energy landscape, even for domestic-focused companies like Atlas Energy Solutions. Events in major oil-producing nations can create volatility in global oil and gas demand and pricing, indirectly influencing drilling activity in regions like the Permian Basin. For instance, ongoing conflicts or political instability in the Middle East, a key global oil supplier, can lead to supply concerns and price spikes. In 2024, the market continues to monitor developments in regions like Eastern Europe and the Middle East, which have historically impacted crude oil benchmarks like Brent and West Texas Intermediate (WTI).

While Atlas Energy Solutions operates primarily within the United States, disruptions in international supply chains or shifts in global energy alliances can still ripple through to affect crude oil prices. These price fluctuations directly impact the economic viability of drilling and completion projects. Sustained periods of higher crude oil prices, often bolstered by geopolitical tensions that limit supply or increase demand uncertainty, tend to incentivize increased drilling and completion activities. This environment generally benefits companies like Atlas, as it supports higher revenue and potentially greater investment in their operations.

- Geopolitical Impact on Oil Prices: Global events, such as the ongoing tensions in Eastern Europe and the Middle East, contributed to an average WTI crude oil price range of approximately $70-$85 per barrel in early to mid-2024, influencing exploration and production economics.

- Domestic vs. International Influence: Despite Atlas's domestic focus, international supply disruptions or strategic shifts in global energy production can lead to price volatility that impacts domestic drilling decisions.

- Price Sensitivity of Drilling: Higher sustained crude oil prices, often a byproduct of geopolitical instability, directly encourage increased capital expenditure on new drilling and completion projects, benefiting service providers like Atlas.

Trade Policies and Tariffs

Changes in trade policies, including potential tariffs on energy-related imports or exports, could significantly impact the cost structure for the broader oil and gas industry. While Atlas Energy Solutions emphasizes in-basin sourcing to mitigate some of these effects, broader trade policies can still influence equipment costs and the overall competitiveness of U.S. energy exports.

For instance, the U.S. imposed tariffs on steel and aluminum imports in 2018, which impacted the cost of materials used in drilling and infrastructure. Although these specific tariffs have seen adjustments, the potential for future trade disputes or changes in import/export regulations remains a persistent factor. These macro-level trade dynamics can influence the overall profitability and investment decisions of Atlas's customers, as they navigate the cost and availability of essential resources and the market access for their products.

- Tariff Impact: Potential tariffs on imported drilling equipment or components could increase operational expenses for energy companies.

- Export Competitiveness: Changes in tariffs or trade agreements can affect the price and demand for U.S. oil and gas exports, influencing customer investment.

- Supply Chain Volatility: Shifting trade policies can introduce volatility into the supply chain for critical materials and machinery.

- Global Market Access: Trade agreements and tariffs directly influence how easily U.S. energy producers can access international markets.

Political factors present a mixed outlook for Atlas Energy Solutions. A potential shift towards increased fossil fuel production, possibly influenced by policy changes anticipated around 2025, could directly boost demand for Atlas's proppant and logistics services. State-level policies in key regions like the Permian Basin remain largely supportive of the energy sector, fostering a predictable operational environment.

However, global geopolitical instability continues to exert influence, impacting oil prices and, consequently, drilling economics. For example, in early to mid-2024, WTI crude oil prices fluctuated between $70-$85 per barrel, a range sensitive to international events. Evolving trade policies also pose a risk, potentially affecting the cost of imported equipment and the export competitiveness of U.S. oil and gas.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors influencing Atlas Energy Solutions, examining their impact across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Atlas Energy Solutions' PESTLE Analysis offers a clear, summarized version of external factors, relieving the pain point of information overload and enabling quick referencing during meetings or presentations.

Economic factors

The demand for Atlas Energy Solutions' services is intrinsically linked to the ebb and flow of oil and natural gas prices. When crude oil prices are robust, it typically signals a healthy appetite for exploration and production, especially in key regions like the Permian Basin. This translates directly into increased activity, and consequently, a greater need for essential materials like frac sand, which Atlas provides.

For instance, in early 2024, West Texas Intermediate (WTI) crude oil prices have generally traded in the $70-$80 per barrel range, a level that historically encourages upstream investment. This stability supports Atlas's proppant and logistics services by driving demand for well completions.

Conversely, a sharp downturn in oil prices, perhaps falling below $60 per barrel, could dampen investment significantly. Such a scenario would likely lead to a slowdown in drilling operations, directly impacting Atlas Energy Solutions by reducing the volume of frac sand and related services required by its clients.

Forecasts point to a strong 2024 and 2025 for Atlas Energy Solutions, with crude oil and natural gas production expected to increase significantly in the Permian Basin. This surge is fueled by higher natural gas prices and improved drilling techniques, which are leading to a greater number of wells being brought online.

The increasing pace of drilling and well completions directly translates into heightened demand for essential services like proppant supply and logistics, which are Atlas's primary offerings. For instance, the U.S. Energy Information Administration (EIA) projected U.S. crude oil production to average 13.2 million barrels per day in 2024, a record high, with the Permian Basin being a key contributor.

The global frac sand market is expected to see robust growth, with projections indicating a significant upward trend through 2025 and beyond, largely driven by activity in U.S. shale plays. This expansion is a positive indicator for companies like Atlas Energy Solutions, which are positioned to capitalize on increased demand.

A key trend benefiting Atlas is the move towards in-basin sand sourcing. This strategy minimizes transportation expenses and boosts operational efficiency, directly aligning with Atlas's focus on the Permian Basin, a major hub for shale production. For instance, in 2023, the Permian Basin accounted for over 5 million barrels per day of oil production, underscoring the importance of localized supply chains.

Despite the positive growth trajectory, the frac sand market isn't without its risks. Potential oversupply, driven by increased production capacity, or fluctuations in crude oil prices can introduce volatility. These factors can directly impact frac sand pricing, creating a dynamic environment for market participants. For example, a sharp drop in oil prices, as seen in early 2020, can quickly dampen drilling activity and, consequently, frac sand demand.

Operational Costs and Margins

Atlas Energy Solutions faced margin pressure in the first quarter of 2025, even with robust revenue growth. This highlights persistent cost challenges within the energy sector, impacting profitability. Key drivers of this pressure include rising costs of sales, increased selling, general, and administrative expenses, and costs associated with recent acquisitions.

Atlas is actively addressing these operational cost pressures through strategic investments. The company is focusing on enhancing its logistics infrastructure and adopting new technologies. These initiatives are designed to boost operational efficiency and strengthen Atlas's cost competitiveness, with the expectation of improving gross profit margins over time.

- Margin Pressure: Q1 2025 results showed margin compression despite revenue increases, signaling ongoing cost management challenges.

- Cost Drivers: Increased cost of sales, SG&A expenses, and acquisition-related costs are key factors impacting profitability.

- Strategic Investments: Atlas is investing in logistics and technology to drive efficiency and reduce its cost base.

- Long-Term Outlook: These investments are projected to lead to improved gross profit margins in the future.

Investment and Capital Allocation

Atlas Energy Solutions' robust financial performance, marked by significant revenue growth between 2023 and 2024, directly fuels its capacity for substantial capital expenditures. This financial strength allows for critical infrastructure investments, such as the development of the Dune Express pipeline. The company's consistent dividend payouts further underscore its financial stability and commitment to shareholder value.

Strategic capital allocation remains a cornerstone of Atlas Energy Solutions' growth strategy. The company's recent acquisition of PropFlow exemplifies this, signaling a clear intent to expand its market presence and enhance its service offerings. These investments are geared towards securing long-term market positioning and driving future revenue streams.

- Revenue Growth: Atlas Energy Solutions reported strong revenue growth from 2023 to 2024, demonstrating its financial health.

- Capital Expenditures: This financial strength enables significant investments in infrastructure projects like the Dune Express.

- Shareholder Returns: The company's commitment to dividends reflects its financial stability and focus on rewarding investors.

- Strategic Acquisitions: Investments such as the PropFlow acquisition highlight a strategy for long-term growth and market expansion.

Economic factors significantly influence Atlas Energy Solutions' operations, primarily through oil and natural gas prices. Strong commodity prices, like WTI crude trading around $75-$85 per barrel in early 2024, incentivize upstream investment, boosting demand for Atlas's frac sand and logistics. Conversely, price drops below $60 could curtail drilling, directly impacting service volumes.

The outlook for 2024-2025 is positive, with projected increases in Permian Basin production, driven by favorable natural gas prices and efficiency gains. This trend supports Atlas's proppant supply and logistics services, as the U.S. Energy Information Administration (EIA) forecasted U.S. crude oil production to reach a record 13.2 million barrels per day in 2024, with the Permian being a major contributor.

Atlas Energy Solutions experienced margin pressure in Q1 2025, with rising costs of sales and SG&A impacting profitability despite revenue growth. The company is investing in logistics and technology to improve efficiency and reduce its cost base, aiming for better gross profit margins in the future.

| Metric | 2023 (Estimated) | 2024 (Projected) | 2025 (Projected) |

|---|---|---|---|

| WTI Crude Oil Price (Avg $/bbl) | 78.50 | 80.00 | 82.00 |

| U.S. Crude Oil Production (MMbbl/d) | 12.9 | 13.2 | 13.5 |

| Permian Basin Oil Production (MMbbl/d) | 5.5 | 5.8 | 6.0 |

| Atlas Revenue Growth (%) | 15.0 | 18.0 | 20.0 |

What You See Is What You Get

Atlas Energy Solutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Atlas Energy Solutions offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain insights into market trends, competitive landscape, and potential growth opportunities for Atlas Energy Solutions.

Sociological factors

Public sentiment towards the oil and gas sector, particularly hydraulic fracturing, significantly shapes regulatory landscapes and investment flows. Negative perceptions can escalate demands for more stringent environmental rules and potentially dampen capital allocation towards fossil fuels.

Atlas Energy Solutions, by providing critical services to this industry, faces the direct impact of public opinion. A prevailing negative view could translate into increased operational hurdles or a shift in investor preference away from the sector.

To counter these challenges, Atlas Energy Solutions emphasizes its dedication to Environmental, Social, and Governance (ESG) principles and sustainable operational methods. This strategic focus aims to cultivate a more favorable public image and build investor confidence in their long-term viability.

Atlas Energy Solutions' operations, particularly in the Permian Basin, necessitate strong community ties. The company directly impacts local areas through its mining and logistics facilities, making proactive engagement vital. Addressing resident concerns about traffic, noise, and environmental footprints is paramount for sustained social license to operate.

The Dune Express initiative exemplifies Atlas' commitment to mitigating negative local impacts. By rerouting freight and reducing truck miles, this project aims to enhance safety and lower emissions within operating communities. This focus on reducing the tangible effects of their operations directly contributes to fostering more positive community relations.

Atlas Energy Solutions prioritizes workforce safety and well-being, a crucial sociological factor. This commitment is demonstrated through adherence to strict safety regulations, such as those governing respirable crystalline silica exposure in mining, a key concern in the industry. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued its focus on enforcing permissible exposure limits for silica, with significant penalties for non-compliance.

Implementing comprehensive health and safety programs and a strong emphasis on accident prevention are vital. These proactive measures not only protect employees and contractors but also safeguard operational continuity. In 2024, industry-wide safety initiatives reported a marginal decrease in lost-time injuries across the energy sector, underscoring the impact of such focused efforts.

ESG Initiatives and Reporting

Atlas Energy Solutions places significant emphasis on its Environmental, Social, and Governance (ESG) initiatives. The company actively champions environmental stewardship, fosters social impact through robust diversity and employee well-being programs, and upholds stringent corporate governance standards. This commitment is clearly communicated through its annual ESG reports, which serve to enhance transparency and accountability to all stakeholders, including investors, employees, and the communities it serves.

The increasing importance of ESG factors directly influences investor decisions and talent acquisition within the energy sector. For instance, a significant majority of investors consider ESG performance when making investment choices. Atlas Energy Solutions' proactive approach in this area is crucial for maintaining its social license to operate and attracting capital in a market that increasingly values sustainable business practices.

- Environmental Responsibility: Atlas Energy Solutions focuses on reducing its environmental footprint through various operational improvements and sustainability projects.

- Social Impact: The company invests in its workforce and communities, promoting diversity, equity, inclusion, and employee well-being.

- Corporate Governance: Strong governance structures ensure ethical operations, accountability, and long-term value creation for shareholders.

- Transparency and Reporting: Annual ESG reports provide stakeholders with detailed information on the company's performance and progress in these critical areas.

Labor Availability and Skill Sets

The oil and gas sector, including crucial areas like proppant supply and logistics, absolutely depends on a workforce with specific skills. Atlas Energy Solutions is no different. The availability of people trained in mining, managing complex logistics, and operating advanced, technology-heavy equipment directly influences how efficiently Atlas can run and how much it can expand.

The demand for skilled labor in the energy sector remains high. For instance, in 2024, the U.S. Bureau of Labor Statistics projected continued job growth in occupations like petroleum engineers and extraction workers. Atlas's ability to secure and keep these specialized individuals, especially for projects like the Dune Express which utilizes advanced technology, is paramount. This requires not just competitive pay but also a strong focus on training and development to ensure employees can handle sophisticated operations and stay current with industry advancements.

- Skilled Workforce Dependency: The proppant and logistics sectors within oil and gas require specialized expertise, directly impacting operational efficiency.

- Labor Availability Impact: Shortages in skilled mining, logistics, and tech-focused roles can hinder Atlas's growth and operational capacity.

- Talent Acquisition Strategy: Investing in employee training and offering competitive compensation are critical for attracting and retaining the necessary talent.

- Supporting Advanced Operations: Retaining skilled workers is essential for the successful execution of technologically advanced projects like the Dune Express.

Public perception of the oil and gas industry, particularly hydraulic fracturing, significantly influences regulatory frameworks and investment. Negative sentiment can lead to stricter environmental regulations and reduced capital allocation to fossil fuels.

Atlas Energy Solutions, as a service provider to this industry, is directly affected by public opinion. Unfavorable views can result in increased operational challenges and a shift in investor preference away from the sector.

To address these concerns, Atlas emphasizes its commitment to ESG principles and sustainable practices, aiming to improve its public image and investor confidence.

Atlas Energy Solutions' operations, especially in the Permian Basin, require strong community relationships. The company's mining and logistics facilities directly impact local areas, making proactive engagement essential to address concerns about traffic, noise, and environmental impact, thereby securing its social license to operate.

Technological factors

Atlas Energy Solutions leverages advanced logistics, notably its Dune Express system, a 42-mile electric conveyor for frac sand delivery in the Permian Basin. This technological leap significantly cuts reliance on trucking, enhancing operational efficiency and dependability. The system's implementation in 2023 marked a substantial step towards greener energy logistics.

The Dune Express is projected to move approximately 1.5 million tons of frac sand annually, directly impacting the efficiency of oil and gas operations. This innovative approach not only streamlines the supply chain but also contributes to a notable reduction in carbon emissions, estimated to be around 30% compared to traditional trucking methods, and fewer road safety incidents.

Atlas Energy Solutions heavily relies on automation and remote operations within its proppant production and logistics. This technological approach is key to their strategy for boosting efficiency and keeping costs low. For example, their investment in a digital infrastructure and the exploration of autonomous trucking for frac sand delivery are designed to speed up and make deliveries more adaptable for their clients.

These advanced technological integrations, such as their automated processing facilities and sophisticated logistics software, create a significant barrier for competitors. This difficulty in rapid replication allows Atlas to maintain a durable competitive edge in the market. In 2023, Atlas reported a 12% increase in operational efficiency directly attributable to these automated systems.

Atlas Energy Solutions is actively pursuing technological advancements to boost proppant delivery and overall efficiency in its operations. This focus on innovation is crucial for staying competitive in the energy sector.

A key development is the acquisition of PropFlow, a company specializing in patented on-wellsite proppant filtration technology. This technology is designed to remove proppant debris directly at the well site, a significant step forward in operational cleanliness.

By eliminating debris at the source, this innovation is projected to lower equipment maintenance expenses and reduce downtime for hydraulic fracturing equipment. This directly translates to more consistent and uninterrupted pumping operations for Atlas Energy Solutions' clientele, enhancing service reliability.

E-Mining and Sustainable Extraction Methods

Atlas Energy Solutions' commitment to technological advancement is evident in its electrified dredge mining system, or e-mining. This innovative approach significantly reduces the environmental footprint of their operations. By replacing traditional diesel equipment, e-mining cuts down on greenhouse gas emissions, contributing to cleaner air and a more sustainable mining process.

Beyond emissions, e-mining offers advantages in land use. This technology allows for deeper extraction of materials, meaning less surface area needs to be disturbed for each ton of sand produced. This aligns with increasingly stringent environmental regulations and a growing demand for responsible resource management.

- Reduced Emissions: Atlas's e-mining system generates materially lower emissions compared to conventional diesel-powered mining.

- Land Use Efficiency: E-mining enables mining to greater depths, minimizing surface area disturbance per ton of material extracted.

- Environmental Alignment: These practices support a shift towards more environmentally conscious extraction methods in the mining sector.

Integration of Distributed Power Solutions

Atlas Energy Solutions' acquisition of Moser Energy Systems significantly bolsters its technological capabilities by integrating distributed power solutions. This strategic expansion allows Atlas to tap into the production end of the oil and gas value chain and enter new power markets. For instance, the company is developing generator systems capable of running on raw wellhead gas, pipeline gas, and propane, showcasing a commitment to emissions-friendly innovation.

This diversification is crucial as the energy sector increasingly seeks decentralized and flexible power generation. The market for distributed generation technologies is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 10% in the coming years, driven by demand for reliability and reduced emissions. Atlas's move positions it to capitalize on this trend, offering a wider range of technologically advanced power solutions.

Atlas Energy Solutions' technological focus is a significant driver of its operational efficiency and competitive advantage. Their Dune Express electric conveyor system, operational since 2023, moves 1.5 million tons of frac sand annually, reducing trucking reliance and cutting emissions by an estimated 30%.

Automation and remote operations are central to Atlas's strategy, boosting efficiency and lowering costs, with investments in digital infrastructure and exploration of autonomous trucking. The acquisition of PropFlow, with its on-wellsite proppant filtration, further enhances operational cleanliness and reduces equipment maintenance.

The company's commitment to sustainability is underscored by its electrified dredge mining (e-mining) system, which lowers emissions and improves land use efficiency by enabling deeper extraction. Furthermore, the integration of Moser Energy Systems brings distributed power solutions, leveraging wellhead gas for emissions-friendly power generation.

| Technology | Impact | Data Point |

|---|---|---|

| Dune Express (Electric Conveyor) | Logistics Efficiency & Emissions Reduction | Moves 1.5 million tons annually; 30% emissions reduction vs. trucking |

| Automation & Remote Operations | Cost Reduction & Efficiency Boost | 12% increase in operational efficiency (2023) |

| PropFlow Filtration | Wellsite Cleanliness & Equipment Longevity | Reduces debris at source, lowering maintenance costs |

| E-Mining (Electrified Dredge) | Environmental Footprint & Land Use | Lower greenhouse gas emissions; less surface disturbance |

| Distributed Power Solutions (Moser Energy) | Diversification & Emissions-Friendly Power | Generators run on wellhead gas, pipeline gas, propane |

Legal factors

Mining operations, including frac sand extraction, face a landscape of increasingly stringent environmental regulations. In 2025, compliance mandates for companies like Atlas Energy Solutions involve rigorous Environmental Impact Assessments (EIAs), tighter controls on emissions, and sophisticated waste management strategies. Failure to adhere can result in significant fines, operational delays, and reputational damage.

Atlas Energy Solutions must proactively adapt its operational practices to align with these evolving environmental standards. This includes managing water usage responsibly, as exemplified by regulations that may limit extraction in water-scarce regions, and implementing robust land rehabilitation plans post-extraction, a growing focus for regulators and the public alike. For instance, some states are now mandating specific reclamation success rates, impacting long-term operational costs.

The Mine Safety and Health Administration (MSHA) is tightening rules on silica exposure, with new standards for coal mines beginning April 14, 2025, and metal/nonmetal mines on April 8, 2026. These regulations introduce lower permissible exposure limits and require rigorous exposure monitoring, corrective actions, and medical surveillance for miners. Atlas Energy Solutions must prioritize adherence to these MSHA mandates to safeguard its employees and prevent potential fines.

The Texas Railroad Commission (RRC) has significantly updated its oilfield waste management rules, with new regulations taking effect on July 1, 2025. This marks the first major overhaul in four decades, introducing critical provisions for the recycling and reuse of produced water and drill cuttings, alongside updated technical and operational standards for waste pits.

Atlas Energy Solutions' logistics and sand supply operations will be directly impacted by these stricter protocols. Adherence to these new waste management guidelines is essential for compliance and operational continuity, potentially influencing the cost and efficiency of waste handling and material sourcing.

Land Use and Permitting Laws

Operating mines and logistics infrastructure in the Permian Basin necessitates strict compliance with federal and state land use regulations, including securing essential permits. Key legislation like the Federal Land Policy and Management Act (FLPMA) mandates that mining authorizations prevent 'unnecessary or undue degradation of public lands.' Atlas Energy Solutions' commitment to conservation efforts, such as those for the Dune Sagebrush Lizard, plays a crucial role in minimizing potential legal challenges associated with land use. In 2024, the Bureau of Land Management continued to enforce FLPMA, with numerous projects in the Permian undergoing environmental reviews to ensure compliance.

Antitrust and Competition Laws

Atlas Energy Solutions, having grown significantly through acquisitions such as Hi-Crush, operates within a strict antitrust and competition law framework. This legal landscape is designed to prevent monopolistic practices and ensure a level playing field for all market participants.

The company's substantial market share, particularly as the largest proppant producer in the Permian Basin, places it under increased regulatory observation. Navigating these laws is crucial to avoid potential legal challenges and maintain operational freedom.

- Regulatory Scrutiny: Increased market share often triggers closer examination by antitrust authorities.

- Merger & Acquisition Compliance: Acquisitions like Hi-Crush must be reviewed to ensure they don't unduly stifle competition.

- Market Practice Adherence: Atlas must demonstrate its business practices uphold fair competition principles.

- Potential Penalties: Violations can lead to significant fines and operational restrictions.

Atlas Energy Solutions operates under a complex web of legal frameworks governing environmental protection, worker safety, and fair competition. Stricter environmental regulations, particularly concerning emissions and waste management, are a constant factor, with significant updates to Texas oilfield waste rules effective July 1, 2025. Furthermore, evolving MSHA standards for silica exposure, with new rules for nonmetal mines beginning April 2026, necessitate vigilant safety protocols.

Environmental factors

Atlas Energy Solutions is actively pursuing emissions reduction and improved air quality as core environmental goals. A significant part of this strategy involves optimizing waste reduction and energy consumption across their operations.

The company's Dune Express conveyor system is a prime example of their commitment, designed to take thousands of trucks off commercial roads, thereby substantially cutting down on associated emissions. This initiative is projected to remove an estimated 20,000 truckloads annually from public roadways, directly impacting air quality.

Furthermore, Atlas Energy Solutions' e-mining operations are engineered to generate considerably lower emissions when contrasted with conventional diesel-powered methods. This shift contributes to a tangible improvement in local air quality by reducing particulate matter and greenhouse gases.

Hydraulic fracturing, a key process for many of Atlas Energy Solutions' customers, demands significant water resources, making effective water management a crucial environmental concern for the sector.

New regulations from the Texas Railroad Commission, set to take effect in July 2025, are designed to significantly boost the recycling and reuse of produced water, a move that could reduce the industry's freshwater footprint.

As Atlas Energy Solutions indirectly supports these operations, the company's environmental relevance is tied to its clients' adoption of advanced water recycling technologies and their overall water stewardship practices.

Mining inherently disturbs land, necessitating detailed closure and rehabilitation plans under environmental regulations. Atlas Energy Solutions aims to minimize this impact, reporting their e-mining process disturbs less surface area per ton of sand extracted compared to conventional methods, allowing for deeper mining operations.

The company actively identifies land for conservation set-asides and implements environmentally conscious mining practices to further reduce its ecological footprint. This proactive approach to land management is crucial for compliance and maintaining social license to operate.

Biodiversity Protection

Atlas Energy Solutions actively engages in biodiversity protection, notably concerning the dunes sagebrush lizard (DSL). Their involvement in the Candidate Conservation Agreement with Assurances (CCAA) for the DSL is a strategic move to mitigate potential business disruptions should the species be listed under the Endangered Species Act. This proactive stance highlights their understanding of environmental stewardship in their operational areas.

This commitment is particularly relevant given the ongoing conservation efforts for species like the DSL, where regulatory landscapes can shift. By participating in the CCAA, Atlas Energy Solutions is aligning its operations with conservation goals, aiming to secure operational continuity while contributing to habitat preservation. This approach acknowledges the increasing importance of ecological impact assessments in the energy sector.

- DSL Conservation: Atlas Energy Solutions is part of the CCAA for the dunes sagebrush lizard, aiming to prevent listing under the Endangered Species Act.

- Risk Mitigation: This participation reduces the risk of operational interruptions due to potential future regulations protecting the DSL.

- Ecological Responsibility: The company demonstrates awareness of its environmental impact and commitment to ecological responsibilities in its operating regions.

Waste Management and Recycling

Effective waste management is a cornerstone for mining and logistics, directly impacting Atlas Energy Solutions' operational efficiency and environmental footprint. The company actively focuses on optimizing waste reduction strategies within its sustainable operations.

New regulations from the Texas Railroad Commission, set to take effect in July 2025, will specifically target the recycling of drill cuttings and produced water, key waste streams in the oil and gas sector. Atlas's adherence to these forthcoming rules is vital for ensuring responsible waste disposal and promoting resource recovery.

These evolving environmental mandates underscore the growing industry emphasis on circular economy principles. For instance, the U.S. Environmental Protection Agency reported in 2023 that the oil and gas industry generated approximately 1.5 billion tons of drilling fluids and cuttings annually, highlighting the scale of the waste management challenge.

- Regulatory Compliance: Adherence to Texas Railroad Commission regulations effective July 2025 for drill cuttings and produced water recycling.

- Operational Optimization: Focus on reducing waste generation across mining and logistics activities.

- Resource Recovery: Implementing strategies for recycling and reusing significant waste streams.

- Sustainability Commitment: Integrating waste management as a core component of Atlas's sustainable operational framework.

Atlas Energy Solutions is actively addressing environmental concerns, particularly around emissions and water usage. Their Dune Express conveyor system is designed to remove an estimated 20,000 truckloads annually from roads, directly reducing air pollution and improving local air quality.

The company's e-mining process also contributes to lower emissions compared to traditional methods. Water management is a key focus, especially with new Texas Railroad Commission regulations effective July 2025 mandating increased recycling of produced water, a move Atlas indirectly supports through its client relationships.

Land disturbance is minimized through Atlas's e-mining, which impacts less surface area per ton of sand extracted. They also engage in land conservation and biodiversity protection, notably through their involvement in the Candidate Conservation Agreement with Assurances for the dunes sagebrush lizard, mitigating potential operational disruptions.

Waste management is another critical area, with upcoming Texas Railroad Commission regulations in July 2025 targeting the recycling of drill cuttings and produced water. The U.S. Environmental Protection Agency reported in 2023 that the oil and gas industry generated approximately 1.5 billion tons of drilling fluids and cuttings annually, underscoring the scale of this challenge.

| Environmental Factor | Atlas Energy Solutions' Response/Impact | Supporting Data/Context |

|---|---|---|

| Emissions Reduction | Dune Express system to remove ~20,000 truckloads annually. | Reduces associated emissions and improves air quality. |

| Water Management | Supports clients adopting advanced water recycling technologies. | Texas Railroad Commission regulations (July 2025) boost produced water recycling. |

| Land Use & Biodiversity | E-mining disturbs less surface area; active in DSL conservation (CCAA). | Minimizes ecological footprint; mitigates risk of Endangered Species Act listing for DSL. |

| Waste Management | Focus on optimizing waste reduction and recycling initiatives. | Compliance with upcoming Texas regulations (July 2025) for drill cuttings and produced water. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Atlas Energy Solutions draws from a comprehensive blend of official government data, reputable industry analysis firms, and international economic reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the energy sector.