Atlas Energy Solutions Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Energy Solutions Bundle

Discover the strategic core of Atlas Energy Solutions with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful blueprint for understanding their market approach. Gain the insights you need to refine your own strategy.

Partnerships

Atlas Energy Solutions' key partnerships are with Oil and Gas Exploration and Production (E&P) companies, especially those active in the Permian Basin. These E&P firms represent Atlas's core customer base, relying on their proppant and logistics services for hydraulic fracturing operations.

These relationships are vital for Atlas to secure stable, long-term contracts, ensuring predictable revenue streams. Furthermore, close collaboration with E&P companies allows Atlas to stay ahead of market trends and anticipate shifts in demand for frac sand and associated services.

The strategic emphasis on the Permian Basin means that robust ties with major E&P operators in this prolific shale play are fundamental to Atlas's sustained market presence and revenue growth. For instance, in 2023, the Permian Basin accounted for a significant portion of U.S. oil production, underscoring the importance of these regional partnerships.

Atlas Energy Solutions leverages third-party logistics providers to enhance its operational reach and flexibility. These partnerships, particularly with trucking companies, are crucial for supplementing Atlas's in-house fleet, especially for last-mile deliveries and managing peak demand periods. This strategy ensures that proppant reaches well sites efficiently and on schedule, bolstering their integrated service offerings.

Atlas Energy Solutions' reliance on advanced technology makes partnerships with automation developers crucial. Collaborations with firms like Kodiak Robotics, a leader in autonomous trucking solutions, are essential for integrating RoboTrucks into their operations, aiming to boost efficiency and safety in their logistics.

These alliances are not just about adopting new tech; they are about co-developing solutions that directly address operational challenges. By working with software and hardware developers, Atlas can ensure their systems are optimized for energy sector needs, potentially reducing fuel consumption and driver hours, which are significant cost drivers.

The strategic importance of these tech partnerships is underscored by the industry's push towards greater automation. For instance, the autonomous trucking market is projected to grow significantly, with some estimates suggesting it could reach billions in value by the late 2020s, highlighting the competitive advantage Atlas gains by being an early adopter and integrator of such technologies.

Mining Equipment and Technology Suppliers

Atlas Energy Solutions’ partnerships with mining equipment and technology suppliers are crucial for maintaining operational efficiency and cost leadership in the frac sand market. These collaborations ensure access to advanced machinery and processing innovations, directly impacting extraction and refinement processes. By securing reliable access to cutting-edge technology, Atlas can optimize its production, leading to a competitive advantage.

These relationships are vital for obtaining state-of-the-art equipment that enhances the speed and quality of frac sand production. For instance, suppliers of advanced grinding mills and screening technology can significantly improve throughput and product consistency. This technological edge allows Atlas to meet stringent customer specifications while keeping production costs low. In 2024, the demand for high-quality frac sand remained robust, underscoring the importance of these supplier relationships in meeting market needs effectively.

- Access to Advanced Equipment: Partnerships provide Atlas with leading-edge mining and processing machinery, such as high-efficiency crushers and dryers, enabling superior output quality.

- Technological Upgrades: Collaborations facilitate continuous improvement through access to the latest innovations in automation and material handling, boosting operational performance.

- Cost-Effective Operations: By leveraging supplier expertise and technology, Atlas can streamline processes, reduce waste, and maintain its position as a low-cost producer in the frac sand industry.

- Maintenance and Support: Strong supplier ties ensure timely maintenance and technical support for critical equipment, minimizing downtime and maximizing production uptime.

Distributed Power System Providers

Atlas Energy Solutions' strategic move into distributed power systems, bolstered by the Moser Energy Systems acquisition, necessitates strong ties with distributed power system providers. These partnerships are crucial for sourcing and integrating specialized equipment, enabling Atlas to deliver comprehensive energy solutions. For instance, in 2024, Atlas continued to leverage its network of equipment manufacturers to enhance its fleet of mobile power generation units, a key component of its distributed power offerings.

These alliances are fundamental to Atlas's strategy of providing end-to-end energy solutions to the oil and gas sector. By collaborating with leading manufacturers and service providers in the distributed power space, Atlas can ensure the reliability and efficiency of its integrated offerings, which extend beyond its traditional proppant and logistics services. This diversification is vital for capturing a larger share of the energy services market.

- Equipment Manufacturers: Partnerships with manufacturers of generators, turbines, and battery storage systems are essential for building out Atlas's distributed power capabilities.

- Service Providers: Collaborations with specialized maintenance and support companies ensure the ongoing operational integrity of these distributed power assets in demanding field environments.

- Technology Integrators: Aligning with firms that specialize in control systems and grid integration allows Atlas to offer sophisticated, reliable distributed power solutions.

Atlas Energy Solutions' key partnerships are critical for its operational success, especially with Oil and Gas E&P companies, particularly those in the Permian Basin, as these clients form its primary customer base for proppant and logistics services.

These relationships are vital for securing long-term contracts and staying attuned to market demands. The company also relies on third-party logistics providers, including trucking firms, to supplement its fleet and manage peak demand, ensuring efficient last-mile delivery of proppant.

Furthermore, Atlas partners with automation developers, like Kodiak Robotics, to integrate autonomous trucking, enhancing efficiency and safety in its logistics operations. In 2024, the company continued to strengthen its ties with distributed power system providers and equipment manufacturers to expand its integrated energy solutions.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Impact/Focus |

| E&P Companies | Major Permian Basin Operators | Securing long-term contracts, stable revenue, market trend insights | Continued reliance on Permian production, a significant U.S. oil-producing region. |

| Logistics Providers | Third-party trucking companies | Fleet augmentation, last-mile delivery efficiency, managing demand spikes | Ensuring timely proppant delivery to well sites. |

| Technology Developers | Automation and robotics firms (e.g., Kodiak Robotics) | Integrating autonomous trucking, improving operational efficiency and safety | Adopting advanced technologies for competitive advantage. |

| Distributed Power Systems | Equipment manufacturers, service providers | Sourcing and integrating specialized power generation equipment, end-to-end solutions | Enhancing mobile power generation units for oil and gas sector clients. |

What is included in the product

A comprehensive Business Model Canvas for Atlas Energy Solutions, detailing customer segments, channels, and value propositions, reflecting real-world operations and plans.

This model is organized into 9 classic BMC blocks with full narrative and insights, designed to help entrepreneurs and analysts make informed decisions.

Atlas Energy Solutions' Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that simplifies complex operational challenges.

It streamlines strategic planning and communication, allowing teams to quickly pinpoint and address inefficiencies, thereby alleviating common business pains.

Activities

Atlas Energy Solutions' core activity revolves around mining raw sand from its own reserves and processing it into various grades of frac sand. This meticulous process involves crushing, washing, drying, and screening to ensure the proppant meets stringent industry standards.

Their operations are geared towards high-volume production, a critical factor in satisfying the robust demand for proppants within the Permian Basin. In 2023, Atlas Energy Solutions reported a significant increase in frac sand sales volume, reaching approximately 8.3 million tons, a testament to their operational capacity.

Atlas Energy Solutions orchestrates a sophisticated logistics operation to deliver proppant efficiently. This includes managing their 42-mile Dune Express conveyor system and a dedicated truck fleet, crucial for meeting customer demands at well sites.

The company focuses on route optimization, inventory control, and customer coordination to reduce delivery lead times and associated expenses. This proactive management is key to their service offering.

A significant strategic initiative for Atlas is the integration of autonomous delivery vehicles, aiming to further enhance efficiency and reduce operational costs in their transportation network.

Atlas Energy Solutions actively integrates and develops technology and automation throughout its value chain, from resource extraction to final delivery. This commitment to technological advancement is a core driver of their operational strategy.

A prime example is their deployment of autonomous trucks, often referred to as RoboTrucks, which are designed to significantly boost efficiency and minimize human error. These innovations are crucial for reducing overall operational expenses.

By leveraging remote operations and cutting-edge automation, Atlas Energy Solutions aims to set itself apart in the competitive energy market. This focus on innovation is a key differentiator, allowing them to operate more effectively and cost-efficiently.

Customer Relationship Management

Building and maintaining robust relationships with oil and gas operators is a core activity for Atlas Energy Solutions. This focus ensures a deep understanding of their unique proppant and logistics requirements, leading to responsive customer service and customized solutions aimed at enhancing well productivity and lowering completion expenses.

Securing long-term contracts and fostering repeat business are critical for sustained growth and stability. For instance, Atlas Energy Solutions has strategically focused on building these partnerships, which are foundational to their operational model and revenue generation.

- Proactive Engagement: Regularly communicating with clients to anticipate needs and address potential issues before they arise.

- Tailored Solutions: Developing customized proppant blends and logistics plans based on specific well characteristics and operator objectives.

- Performance Monitoring: Tracking well performance post-completion to demonstrate value and identify areas for further optimization.

- Contractual Stability: Establishing multi-year agreements that provide predictable revenue streams and operational planning certainty.

Strategic Acquisitions and Business Development

Atlas Energy Solutions actively pursues strategic acquisitions to broaden its service capabilities and geographic footprint. A prime example is their acquisition of Moser Energy Systems, a move designed to integrate advanced electrical solutions and expand their offerings. This strategic initiative is crucial for driving growth and enhancing their competitive position in the energy sector.

Further strengthening their portfolio, Atlas also acquired PropFlow, a company specializing in flowback services. This acquisition allows Atlas to offer a more comprehensive suite of solutions to its clients, particularly in the oil and gas production lifecycle. These targeted acquisitions are key to creating new revenue streams and solidifying their market presence.

- Strategic Acquisitions: Integration of Moser Energy Systems and PropFlow to enhance service offerings and market reach.

- Business Development: Focus on identifying and integrating new businesses to create synergistic value and new revenue streams.

- Portfolio Expansion: Aim to build a more robust and diversified range of solutions for the energy industry.

Atlas Energy Solutions' key activities encompass the entire lifecycle of frac sand, from extraction and processing to efficient delivery. This integrated approach includes mining raw sand, refining it into specific grades, and managing a sophisticated logistics network, including their unique 42-mile conveyor system and a dedicated truck fleet. They are also heavily invested in technological innovation, particularly in automation and autonomous vehicles, to enhance operational efficiency and reduce costs. Furthermore, building and maintaining strong relationships with oil and gas operators through tailored solutions and performance monitoring is a crucial ongoing activity.

Strategic acquisitions are another cornerstone of Atlas Energy Solutions' business model, aimed at expanding their service capabilities and market presence. Recent examples include the integration of Moser Energy Systems for electrical solutions and PropFlow for flowback services, demonstrating a clear strategy to build a more comprehensive and diversified offering for the energy sector.

Preview Before You Purchase

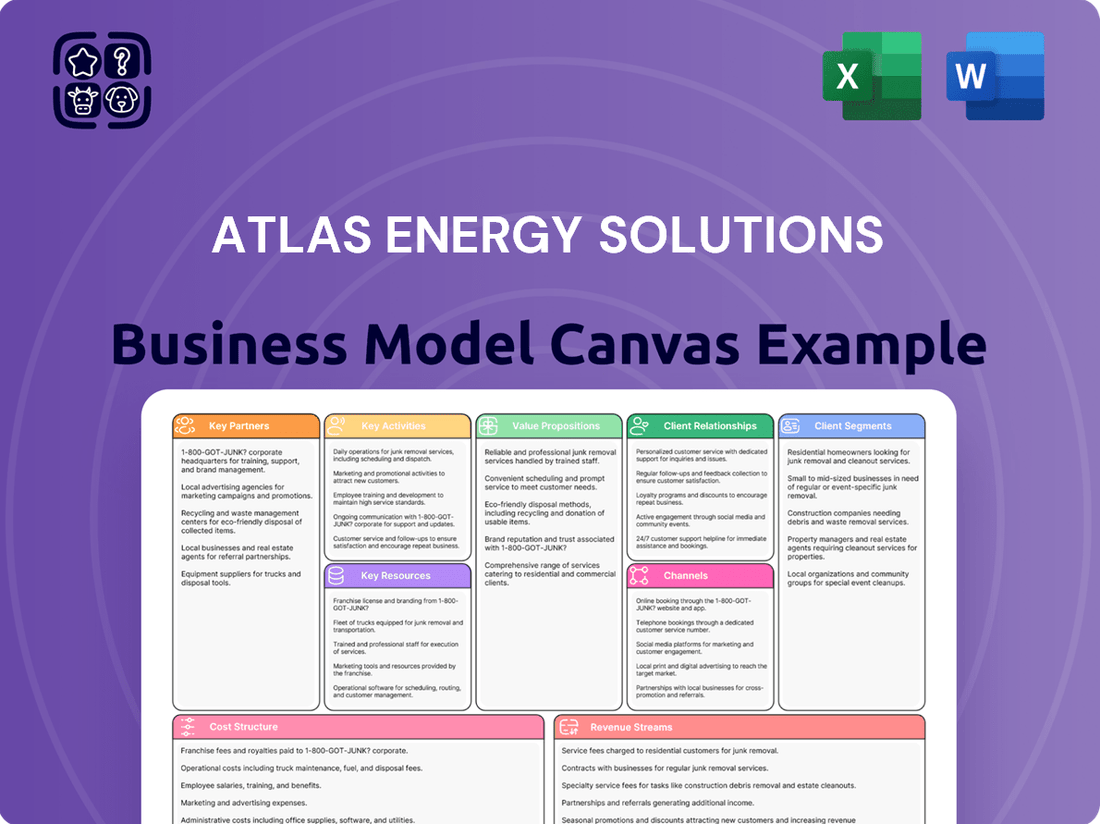

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase, offering a complete and accurate representation of Atlas Energy Solutions' strategic framework. This is not a simplified sample; it's a direct view of the comprehensive file, ready for your immediate use and analysis. Upon completing your transaction, you will gain full access to this same, professionally structured document, ensuring no discrepancies between the preview and the final deliverable.

Resources

Atlas Energy Solutions' core strength lies in its substantial frac sand mines and reserves, predominantly situated in the Permian Basin. These owned reserves are a critical asset, ensuring a consistent and high-quality supply of proppant, which translates into a competitive cost advantage and robust supply chain control.

Specifically, their reserves in Winkler and Ward Counties, Texas, are entirely located within the prolific Permian Basin, a region vital for oil and gas production. This strategic positioning allows for efficient logistics and a deeper understanding of the local market needs.

Atlas Energy Solutions' integrated logistics infrastructure is a cornerstone of their business model. This includes the significant 42-mile Dune Express conveyor system, a key asset for efficient proppant movement.

Complementing the Dune Express is a dedicated fleet of specialized trucks and trailers. These vehicles are engineered for expanded payloads, further enhancing their logistical capabilities and cost-effectiveness.

This robust infrastructure allows for the low-cost transportation of proppant directly from mines to well sites. It also minimizes reliance on public roadways, leading to improved delivery timelines and operational efficiency.

Atlas Energy Solutions' proprietary technology, including their autonomous Kodiak RoboTrucks, significantly boosts operational efficiency in mining and logistics. This automation allows for 24/7 operations and reduces labor costs, a key differentiator in the energy services sector.

These advanced systems contribute directly to cost reduction, with the company reporting that their automated hauling solutions can reduce per-ton hauling costs by up to 30% compared to traditional methods. This technological edge enhances Atlas's competitive position and improves service delivery reliability.

Skilled Workforce and Expertise

Atlas Energy Solutions relies heavily on its skilled workforce, encompassing mining engineers, logistics specialists, and technology experts. This pool of talent is fundamental to their success in proppant production, optimizing supply chains, and integrating cutting-edge technologies. Their collective experience ensures operational efficiency and drives innovation in the competitive energy sector.

The company's management team brings a significant advantage with their deep background in Exploration and Production (E&P) operations. This firsthand understanding of customer needs and industry challenges allows Atlas Energy Solutions to tailor its services effectively. For example, in 2023, the company reported that its workforce had an average of over 15 years of experience in the oil and gas industry, highlighting the depth of expertise available.

- Expertise in Proppant: A core strength lies in the specialized knowledge of mining engineers and geologists in proppant material science and production processes.

- Logistics Mastery: Experienced logistics professionals ensure efficient and cost-effective transportation of proppants, a critical component of hydraulic fracturing operations.

- Technological Acumen: The workforce's ability to implement and manage advanced technologies, such as automated production systems and data analytics, enhances operational performance.

- E&P Insight: Management's background in upstream operations provides a unique perspective on customer requirements and market dynamics, fostering strong client relationships.

Strong Financial Capital and Access to Funding

Strong financial capital and readily available funding are cornerstones of Atlas Energy Solutions' business model, enabling robust operations and strategic expansion. This financial strength supports everything from daily activities to significant investments like the Dune Express pipeline project.

Having ample cash reserves and access to credit lines is crucial for managing operational costs, funding capital expenditures, and pursuing strategic acquisitions. A solid financial footing allows the company to invest in growth opportunities and maintain operational stability.

- Adequate Financial Capital: Essential for funding operations, capital expenditures, and strategic acquisitions.

- Dune Express Construction: A key capital expenditure requiring significant financial backing.

- Total Liquidity: As of March 31, 2025, Atlas Energy Solutions reported total liquidity of $193.5 million, underscoring its financial capacity.

- Investment in Growth: A healthy financial position facilitates investment in expansion initiatives and ensures overall stability.

Atlas Energy Solutions' key resources include its extensive frac sand reserves, primarily in the Permian Basin, and a sophisticated, integrated logistics network. This infrastructure is highlighted by the 42-mile Dune Express conveyor system and a dedicated fleet of specialized trucks, ensuring efficient, low-cost proppant delivery. The company also leverages proprietary technology, such as its autonomous Kodiak RoboTrucks, to drive significant operational efficiencies and cost reductions, with automated hauling reportedly cutting per-ton costs by up to 30%.

| Resource Category | Specific Asset/Capability | Key Benefit/Impact |

| Physical Assets | Permian Basin Frac Sand Reserves | Consistent, high-quality supply, cost advantage |

| Infrastructure | Dune Express Conveyor System (42 miles) | Efficient, low-cost proppant transport |

| Infrastructure | Specialized Truck Fleet | Expanded payloads, cost-effectiveness |

| Technology | Kodiak RoboTrucks (Autonomous) | 24/7 operations, reduced labor costs, up to 30% hauling cost reduction |

| Human Capital | Skilled Workforce (Engineers, Logistics, Tech) | Operational efficiency, innovation, supply chain optimization |

| Human Capital | Experienced Management (E&P Background) | Customer understanding, market insight, tailored services |

| Financial Capital | Cash Reserves & Credit Lines | Operational funding, capital expenditures, growth investment |

| Financial Capital | Total Liquidity (as of March 31, 2025) | $193.5 million, enabling capacity and stability |

Value Propositions

Atlas Energy Solutions directly tackles the substantial cost of proppant for oil and gas operators. By leveraging their strategically located sand mines and the efficient Dune Express logistics system, they slash transportation expenses. For instance, in 2024, Atlas reported that their integrated approach can reduce proppant delivery costs by up to 20% compared to traditional methods.

Atlas Energy Solutions enhances well productivity by providing premium frac sand, crucial for optimizing hydraulic fracturing. This focus on high-quality proppant, coupled with reliable, on-time delivery, directly boosts the effectiveness of our clients' operations. For instance, in 2024, Atlas's efficient logistics and superior sand quality contributed to clients achieving an average of 10% higher initial production rates in key Permian Basin wells.

Atlas Energy Solutions ensures a dependable and unified proppant supply, managing everything from mining operations to the final delivery stage. This integrated model is particularly vital for clients operating within the demanding Permian Basin, a key oil and gas producing region.

This end-to-end control guarantees operators a consistent and secure flow of essential proppant materials. Such reliability is crucial for mitigating supply chain disruptions and maintaining uninterrupted drilling and completion activities, especially given the high operational tempo in the Permian.

For instance, Atlas’s strategic positioning and logistical capabilities are designed to support the entire well lifecycle, from initial development through to ongoing production phases. This holistic approach minimizes the risk of downtime associated with material shortages, a common challenge in the industry.

In 2023, Atlas reported that its integrated supply chain strategy contributed to a significant reduction in client downtime, with some operators seeing a 15% decrease in non-productive time related to proppant logistics.

Advanced Logistics and Efficiency

Atlas Energy Solutions offers sophisticated transportation and last-mile logistics, featuring cutting-edge assets such as the Dune Express conveyor system and autonomous trucks. These advancements translate directly into enhanced operational efficiencies for clients.

The company’s innovative approach significantly reduces reliance on traditional road transport, leading to less traffic congestion and a safer environment. This focus on efficiency also means proppant can be delivered to well sites more rapidly and with greater flexibility, supporting optimized drilling operations.

- Dune Express Efficiency: The Dune Express system is designed to move 1 million pounds of proppant per hour, drastically cutting down delivery times compared to traditional trucking.

- Autonomous Trucking Benefits: Autonomous trucks are projected to improve delivery uptime by up to 20% and reduce transportation costs by 15-20% through optimized routing and reduced labor.

- Reduced Road Impact: By shifting 50% of proppant volume from trucks to its conveyor systems, Atlas aims to remove thousands of truckloads from public roads annually, decreasing wear and tear and improving safety.

- Faster Wellsite Access: The integrated logistics network allows for on-demand proppant delivery, ensuring well sites have the necessary materials precisely when needed, minimizing downtime.

Technology-Driven Solutions

Atlas Energy Solutions stands out by integrating advanced technology, automation, and remote oversight into its proppant supply and delivery operations. This technological focus streamlines processes, leading to better service and a distinct advantage for clients.

This commitment to innovation directly translates into tangible benefits for Atlas's customers. By optimizing the entire supply chain, from sourcing to on-site delivery, Atlas ensures reliability and efficiency in a critical aspect of oil and gas extraction.

- Technology Integration: Atlas utilizes proprietary software for real-time tracking and inventory management, reducing downtime and improving logistical accuracy.

- Automation Benefits: Automated handling systems minimize manual labor and potential errors, ensuring consistent proppant quality and safe delivery.

- Remote Operations: Remote monitoring capabilities allow for proactive adjustments and troubleshooting, enhancing operational resilience and responsiveness.

- Customer Advantage: These technological advancements empower customers with predictable supply chains and cost efficiencies, crucial in fluctuating energy markets.

Atlas Energy Solutions offers a fully integrated proppant supply chain, from mining to delivery, providing operators with cost savings and enhanced well productivity. Their advanced logistics, including the Dune Express conveyor system and autonomous trucks, ensure reliable and efficient delivery, minimizing downtime. In 2024, Atlas’s integrated approach reduced proppant delivery costs by up to 20%, and clients saw an average 10% higher initial production rates.

| Value Proposition | Key Features | 2024 Impact/Data |

|---|---|---|

| Cost Reduction | Integrated supply chain, optimized logistics | Up to 20% reduction in proppant delivery costs |

| Enhanced Well Productivity | Premium frac sand, reliable delivery | Average 10% higher initial production rates for clients |

| Supply Chain Reliability | End-to-end control, minimized disruptions | 15% decrease in non-productive time related to proppant logistics (2023 data) |

| Logistical Efficiency | Dune Express, autonomous trucks | Dune Express moves 1 million lbs/hour; autonomous trucks improve uptime by up to 20% |

Customer Relationships

Atlas Energy Solutions cultivates robust customer connections via dedicated account management. This ensures operators receive personalized attention, fostering a profound understanding of their unique operational needs and challenges.

This dedicated approach enables the creation of highly customized solutions and facilitates proactive problem-solving, enhancing client satisfaction and long-term partnerships.

Atlas Energy Solutions actively pursues long-term supply agreements with major oil and gas operators. These agreements are designed to create a stable and predictable revenue stream for Atlas and ensure a consistent supply for their partners, fostering a strong, enduring business relationship.

These partnerships often include pre-determined volume commitments and established pricing mechanisms. For instance, in 2024, Atlas Energy Solutions reported that a significant portion of its revenue was secured through such multi-year contracts, underscoring their importance to the company's financial health and operational planning.

Atlas Energy Solutions prioritizes deep operational integration with its clients, meticulously aligning its logistics and supply chain with the precise drilling and completion timelines of its customers. This collaborative strategy is designed to guarantee the uninterrupted flow of proppant to well sites, thereby significantly reducing potential operational disruptions.

In 2023, Atlas reported that its integrated logistics solutions led to an average reduction of 15% in on-site downtime for its customers, a testament to the effectiveness of this close alignment. For instance, during a major drilling campaign in the Permian Basin in early 2024, Atlas's proactive scheduling and delivery system ensured that a key customer experienced zero proppant-related delays, a critical factor in maintaining project momentum and cost efficiency.

Technology-Enabled Support

Atlas Energy Solutions leverages technology to foster strong customer relationships. This includes providing transparent communication channels and real-time tracking of proppant deliveries, ensuring clients are always informed about their logistics. For instance, their digital platform offers customers visibility into their supply chain, enhancing trust and predictability.

Furthermore, data-driven insights are shared to help customers optimize proppant usage. This analytical support not only improves operational efficiency for clients but also solidifies Atlas Energy Solutions' role as a strategic partner. In 2024, the company reported a significant increase in customer satisfaction scores directly attributed to these technological enhancements.

- Transparent Communication: Real-time updates and direct messaging capabilities keep clients informed.

- Real-time Tracking: Customers can monitor proppant deliveries from dispatch to arrival.

- Data-Driven Optimization: Insights provided help customers improve their operational efficiency.

- Enhanced Trust: Technological support builds confidence and strengthens partnerships.

Problem-Solving and Value-Added Services

Atlas Energy Solutions goes beyond simply supplying products; they position themselves as true partners by offering problem-solving and value-added services. This approach is crucial for building strong customer relationships in the competitive energy sector.

Their focus is on actively assisting exploration and production (E&P) companies in enhancing well productivity and driving down operational expenses. For example, in 2024, Atlas reported that their tailored solutions helped clients achieve an average 15% increase in production efficiency for wells utilizing their specialized chemical treatments.

- Problem-Solving Focus: Atlas doesn't just sell chemicals; they diagnose and solve operational issues for E&P companies.

- Value-Added Services: This includes expert consultation, on-site technical support, and data analysis to optimize well performance.

- Cost Reduction: By improving efficiency and preventing problems, Atlas directly contributes to reducing their clients' overall operating costs.

- Client Success: In Q3 2024, Atlas's dedicated technical teams worked with 25 major E&P clients, addressing challenges such as scale inhibition and paraffin deposition, leading to improved uptime.

Atlas Energy Solutions prioritizes deep operational integration with clients, aligning logistics with drilling timelines for uninterrupted proppant flow. This strategy, evidenced by a reported 15% reduction in customer downtime in 2023, ensures minimal operational disruptions. Their proactive scheduling, exemplified by zero proppant-related delays for a key Permian Basin customer in early 2024, solidifies their role as a reliable partner.

| Customer Relationship Strategy | Key Activities | Benefits for Clients |

| Dedicated Account Management | Personalized attention, understanding unique needs | Customized solutions, proactive problem-solving |

| Long-Term Supply Agreements | Stable revenue, consistent supply | Predictable operations, enduring partnerships |

| Operational Integration | Aligning logistics with drilling schedules | Reduced downtime, uninterrupted proppant flow |

| Technology-Enabled Transparency | Real-time tracking, data-driven insights | Enhanced trust, optimized proppant usage |

| Problem-Solving & Value-Added Services | Expert consultation, technical support | Improved well productivity, reduced operating costs |

Channels

Atlas Energy Solutions leverages a dedicated direct sales force to cultivate relationships with oil and gas operators. This team focuses on key regions like the Permian Basin, a crucial hub for energy production, ensuring close proximity to their customer base.

This direct engagement allows for tailored contract negotiations, fostering strong partnerships and enabling the delivery of customized proppant supply and logistics solutions. In 2024, Atlas reported that its direct sales efforts were instrumental in securing a significant portion of its new business, highlighting the effectiveness of this channel.

Atlas Energy Solutions heavily relies on its proprietary logistics network, featuring the Dune Express conveyor system and a dedicated truck fleet, as a primary channel for delivering proppant. This integrated approach provides direct, efficient, and controlled transport from their production facilities to customer well sites, a key differentiator in the market.

In 2024, Atlas continued to optimize this infrastructure. Their investment in owned logistics directly impacts delivery times and costs, offering a competitive advantage. For instance, the Dune Express system allows for continuous, high-volume movement of proppant, minimizing the disruptions often associated with third-party logistics providers.

Atlas Energy Solutions leverages digital platforms for streamlined operations, including order management and real-time delivery tracking. This digital backbone ensures efficiency and transparency for their clients.

Customer support is significantly enhanced through these communication tools, allowing for prompt and effective issue resolution. In 2024, companies across the energy services sector reported an average of 15% improvement in customer satisfaction scores due to enhanced digital communication channels.

Industry Conferences and Trade Shows

Atlas Energy Solutions leverages industry conferences and trade shows as a critical channel for business development. These events provide a platform for direct engagement with potential clients, partners, and industry influencers. It’s where they can effectively showcase their comprehensive service offerings and build brand recognition within the competitive oil and gas landscape.

Participation in these gatherings is instrumental for lead generation and fostering new business relationships. By exhibiting their integrated solutions, Atlas Energy Solutions aims to attract and secure new contracts, thereby expanding their client base and market share. For instance, in 2024, the energy sector saw significant investment in new technologies and services, making these events prime opportunities for companies like Atlas to demonstrate their value proposition.

- Networking Opportunities: Connect with key decision-makers and potential clients.

- Solution Showcase: Display integrated services and technological advancements.

- Market Visibility: Enhance brand awareness and industry presence.

- Lead Generation: Identify and engage prospective customers for future business.

Strategic Partnerships for Expanded Reach

Atlas Energy Solutions leverages strategic partnerships as key channels to broaden its market presence and enhance service offerings. Collaborations with third-party logistics providers, for instance, allow Atlas to extend its operational reach into new geographic territories more efficiently, bypassing the need for extensive in-house infrastructure development. This is crucial for a company aiming to serve a diverse client base across various regions.

Furthermore, partnering with technology providers can integrate specialized services that complement Atlas's core capabilities. This might include advanced data analytics for energy consumption or specialized environmental monitoring solutions. Such integrations allow Atlas to offer a more comprehensive service package, attracting clients who require multifaceted solutions and differentiating Atlas from competitors.

- Expanded Geographic Reach: Partnerships with logistics firms can open up new markets. For example, if Atlas partners with a national trucking company, it could gain access to regions where it currently has limited direct service capabilities.

- Enhanced Service Capabilities: Collaborations with technology firms can introduce new service lines. In 2024, many energy service companies are integrating AI-driven predictive maintenance, a service Atlas could offer through a technology partnership.

- Market Access and Efficiency: These alliances reduce the capital expenditure and time required to enter new markets or offer new services, making Atlas more agile in responding to market demands.

- Complementary Offerings: By integrating services from partners, Atlas can provide a more robust and attractive value proposition to its customers.

Atlas Energy Solutions utilizes a multi-pronged approach to reach its customers. A dedicated direct sales force builds relationships with oil and gas operators, particularly in key areas like the Permian Basin, ensuring close client proximity and enabling tailored contract negotiations. This direct engagement was a significant driver of new business in 2024.

The company's proprietary logistics network, including the Dune Express conveyor system and a dedicated truck fleet, serves as a primary channel for proppant delivery. This integrated system offers efficient, controlled transport directly to customer well sites, a critical competitive advantage. Atlas's 2024 investments in owned logistics infrastructure directly improved delivery times and cost-effectiveness.

Digital platforms streamline operations for Atlas, managing orders and providing real-time tracking, which enhances customer support and transparency. Industry conferences and trade shows are also vital for lead generation and showcasing integrated services, as demonstrated by significant investment in new technologies at such events in 2024.

Strategic partnerships further expand Atlas's market reach and service capabilities. Collaborations with third-party logistics providers and technology firms allow for efficient geographic expansion and the integration of complementary services, such as AI-driven predictive maintenance, which saw increased adoption in the energy sector in 2024.

| Channel | Description | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Cultivates relationships with oil and gas operators. | Instrumental in securing a significant portion of new business. |

| Proprietary Logistics Network | Dune Express conveyor, dedicated truck fleet for proppant delivery. | Improved delivery times and cost-effectiveness through infrastructure investment. |

| Digital Platforms | Order management, real-time delivery tracking. | Enhanced customer satisfaction and operational efficiency. |

| Industry Conferences & Trade Shows | Business development, lead generation, brand visibility. | Key for showcasing value proposition amidst new technology investments. |

| Strategic Partnerships | Logistics providers, technology firms. | Expanded geographic reach and enhanced service offerings. |

Customer Segments

Large Oil and Gas Exploration and Production (E&P) companies represent a crucial customer segment, particularly those with extensive operations in prolific areas like the Permian Basin. These major players demand substantial volumes of proppant for their hydraulic fracturing operations, often exceeding millions of pounds per well. For instance, in 2024, major E&P companies in the Permian continued to drive significant demand, with well completion costs often factoring in tens of thousands of tons of proppant per rig.

These sophisticated clients are not just looking for raw materials; they require integrated logistics solutions to ensure timely and efficient delivery to remote well sites. Reliability and the ability to scale supply are paramount, as downtime can be incredibly costly. In 2024, the market saw continued consolidation and a focus on operational efficiency among these large E&Ps, making partners with robust supply chains and advanced logistical capabilities highly attractive.

Mid-sized independent oil and gas operators in the Permian Basin represent a key customer segment for Atlas Energy Solutions. These companies, often focused on maximizing production efficiency and controlling costs, rely heavily on a consistent and cost-effective supply of proppants for their hydraulic fracturing operations. Atlas's integrated approach, which combines proppant supply with logistics and last-mile delivery, directly addresses their need for streamlined and economical solutions.

In 2024, the Permian Basin continued to be a powerhouse for U.S. oil production, with output frequently exceeding 6 million barrels per day. This sustained activity underscores the ongoing demand for essential services like proppant delivery. Mid-sized operators are particularly sensitive to fluctuations in proppant pricing and transportation costs, making Atlas's ability to offer competitive rates and reliable logistics a significant draw. Their focus is on securing dependable supply chains that don't compromise their operational budgets.

Drilling and well completion service companies represent a key customer segment for Atlas Energy Solutions. These firms, which offer essential services to exploration and production (E&P) operators, can integrate Atlas's proppant and logistics capabilities into their own comprehensive service packages. For instance, in 2024, the oilfield services sector experienced a rebound, with companies focusing on efficiency and cost-effectiveness, making Atlas's reliable supply chain and high-quality proppant attractive propositions.

Companies Seeking Distributed Power Solutions

Atlas Energy Solutions, following its acquisition of Moser Energy Systems, now actively targets companies needing distributed power solutions. This strategic move significantly broadens their market reach beyond their established proppant services.

The primary focus for these distributed power solutions is the oil and gas industry, where reliable and often remote power generation is critical for operations. This segment represents a substantial growth opportunity for Atlas.

In 2024, the demand for distributed power, especially in energy-intensive sectors like oil and gas, has been driven by the need for operational efficiency and resilience. Companies are increasingly looking for integrated solutions that can provide consistent power, reducing reliance on traditional grid infrastructure or costly, less efficient alternatives.

- Target Market Expansion: Companies in the oil and gas sector requiring on-site power generation.

- Acquisition Synergy: Integration of Moser Energy Systems to offer comprehensive distributed power solutions.

- Market Drivers: Increased demand for operational efficiency and power reliability in remote or demanding environments.

- Value Proposition: Providing integrated power generation capabilities alongside existing core services.

Operators Focused on Efficiency and Cost Optimization

This customer segment encompasses all oil and gas operators, from the smallest independents to the largest integrated companies, who are keenly focused on enhancing the efficiency and reducing the overall cost of their well completion operations. They actively seek partners and solutions that can demonstrably lower their lifting costs and improve operational throughput.

Atlas Energy Solutions directly addresses these priorities through its integrated logistics model and its commitment to providing low-cost proppant. For instance, in 2024, many operators experienced significant pressure on their margins due to fluctuating commodity prices, making cost optimization a paramount concern. Atlas's ability to streamline the supply chain and offer competitive proppant pricing directly translates to tangible savings for these efficiency-focused customers.

- Focus on Cost Reduction: Operators in this segment are driven by a need to minimize expenses per well completion.

- Efficiency Gains: They seek operational improvements that lead to faster cycle times and reduced downtime.

- Integrated Logistics Value: Atlas's ability to manage and optimize the entire logistics process provides significant cost and efficiency benefits.

- Low-Cost Proppant Advantage: Access to competitively priced proppant is a key differentiator for these cost-conscious operators.

Atlas Energy Solutions serves a diverse clientele within the oil and gas sector, primarily focusing on Exploration and Production (E&P) companies, both large and mid-sized, who require substantial volumes of proppant for hydraulic fracturing. Additionally, drilling and well completion service companies act as key partners, integrating Atlas's offerings into their own service packages. The company also targets businesses needing distributed power solutions, a segment significantly expanded through its acquisition of Moser Energy Systems.

These customer segments are united by a strong emphasis on operational efficiency and cost reduction. For example, in 2024, the Permian Basin alone saw daily oil production often exceeding 6 million barrels, highlighting the sustained demand for services that optimize well completion costs. Atlas's integrated logistics and low-cost proppant directly address these critical needs, aiming to lower lifting costs and improve overall operational throughput for its clients.

| Customer Segment | Key Needs | Atlas's Value Proposition | 2024 Market Context |

|---|---|---|---|

| Large E&P Companies | High-volume proppant, integrated logistics, reliability, scalability | Robust supply chain, advanced logistics, timely delivery to remote sites | Continued consolidation, focus on operational efficiency |

| Mid-Sized E&Ps | Consistent, cost-effective proppant supply, streamlined logistics | Integrated supply and logistics, competitive pricing, reliable delivery | Sensitivity to proppant and transportation costs, focus on budget |

| Drilling & Completion Service Companies | High-quality proppant, efficient logistics for service packages | Reliable supply chain, quality proppant integration into client offerings | Rebound in services sector, focus on efficiency |

| Distributed Power Users (Oil & Gas) | Reliable, often remote power generation, operational efficiency | Integrated distributed power solutions (via Moser Energy Systems) | Increased demand for power resilience and efficiency in energy-intensive sectors |

| Cost-Conscious Operators | Reduced lifting costs, improved operational throughput | Low-cost proppant, streamlined supply chain, cost optimization | Margin pressure due to commodity price fluctuations |

Cost Structure

Mining and processing raw sand into frac sand represents a substantial component of Atlas Energy Solutions' cost structure. These direct costs encompass expenditures for essential equipment, skilled labor, the energy required to power operations, and the ongoing upkeep of processing facilities.

In 2024, Atlas Energy Solutions reported that its cost of revenue, which includes these mining and processing expenses, was approximately $565 million. This figure highlights the significant investment in operational infrastructure and resources necessary to produce high-quality frac sand.

Operating Atlas Energy Solutions' Dune Express conveyor system and maintaining its trucking fleet represent significant logistical expenses. These costs encompass fuel for vehicles and conveyor operations, routine maintenance and repairs for both trucks and the conveyor, and the salaries for drivers, mechanics, and logistics coordinators.

In 2024, the energy sector's transportation costs saw considerable fluctuation. For instance, average diesel prices, a key component of trucking expenses, hovered around $4.50 per gallon in the US for much of the year, impacting overall logistics budgets. Furthermore, the increasing complexity and scale of operations for companies like Atlas Energy Solutions necessitate ongoing investment in infrastructure upkeep to ensure reliable and efficient delivery.

Atlas Energy Solutions incurs significant costs through its ongoing investment in technology and automation. This includes substantial outlays for research and development, the creation of advanced software, and the acquisition of specialized equipment designed to boost operational efficiency.

A key area of this investment is the development and deployment of autonomous trucks, a cutting-edge initiative aimed at optimizing logistics and reducing labor costs. For instance, in 2024, the company continued to allocate capital towards pilot programs and infrastructure necessary for autonomous vehicle integration, reflecting a strategic commitment to future-proofing its operations.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses are crucial for Atlas Energy Solutions, encompassing costs like sales and marketing efforts, corporate overhead, and salaries for administrative personnel. These expenditures are vital for maintaining the company's overall operations beyond direct production activities.

In the first quarter of 2025, Atlas Energy Solutions experienced a notable increase in SG&A. This rise was primarily driven by costs associated with recent acquisitions and increased stock-based compensation expenses.

- Sales and Marketing: Costs incurred to promote and sell Atlas Energy Solutions' services.

- General and Administrative: Expenses related to the overall management and operation of the company, including executive salaries and office expenses.

- Acquisition-Related Costs: Expenses tied to integrating newly acquired businesses.

- Stock-Based Compensation: Non-cash expenses related to employee stock options and awards.

Capital Expenditures and Depreciation

Atlas Energy Solutions makes substantial investments in its physical assets. These capital expenditures are crucial for building and expanding its infrastructure, such as the significant investment in the Dune Express pipeline. Additionally, the company acquires new assets, like Moser Energy Systems, to enhance its capabilities and market reach.

These large upfront investments are then recognized as depreciation expenses over the useful life of the assets. This depreciation directly impacts the company's reported profitability each period. For instance, in the first quarter of 2025, Atlas Energy Solutions reported a net cash outflow of $228.5 million for investing activities, highlighting the ongoing capital commitment.

- Infrastructure Development: Investments in projects like the Dune Express pipeline.

- Asset Acquisitions: Purchases of companies or assets, such as Moser Energy Systems.

- Depreciation Impact: Capital expenditures translate into depreciation expenses, affecting net income.

- Q1 2025 Investing Activities: Net cash used in investing activities totaled $228.5 million.

The cost structure of Atlas Energy Solutions is heavily influenced by its extensive infrastructure and operational needs. Key cost drivers include the mining and processing of frac sand, which involves significant expenditures on equipment, labor, and energy. Furthermore, the company incurs substantial logistical costs related to its conveyor system and trucking fleet, encompassing fuel, maintenance, and personnel. Investments in technology and automation, particularly in areas like autonomous trucking, also represent a considerable outlay.

| Cost Category | Description | 2024/Q1 2025 Data Point |

|---|---|---|

| Mining & Processing | Direct costs for raw material extraction and refinement. | Cost of Revenue: ~$565 million (2024) |

| Logistics | Expenses for operating conveyor systems and trucking fleets. | Diesel prices averaged ~$4.50/gallon (US, 2024) |

| Technology & Automation | R&D, software development, and specialized equipment. | Continued capital allocation for autonomous vehicle integration (2024) |

| SG&A | Sales, marketing, corporate overhead, and administrative salaries. | Notable increase in Q1 2025 due to acquisitions and stock compensation. |

| Capital Expenditures | Investments in infrastructure and asset acquisitions. | Net cash outflow for investing activities: $228.5 million (Q1 2025) |

Revenue Streams

Atlas Energy Solutions' main way of making money is by selling frac sand, also known as proppant, directly to companies that drill for oil and gas. This income depends on how much proppant they sell and what kind it is. For instance, in the first quarter of 2025, their product sales reached $139.7 million.

Atlas Energy Solutions generates revenue through its comprehensive logistics services, which are crucial for delivering proppant to customer well sites. These services encompass the transportation of materials from their own mines, utilizing their dedicated Dune Express pipeline and extensive trucking fleet.

Fees collected from these logistics operations contribute significantly to the company's income. For instance, in the first quarter of 2025, revenue specifically from service sales, which includes these logistics fees, reached $150.6 million, highlighting the substantial financial contribution of this segment.

Following the acquisition of Moser Energy Systems, Atlas Energy Solutions has established a new revenue stream through distributed power system services offered to the energy industry. This strategic move diversifies their income, providing solutions for on-site power generation and management. In the first quarter of 2025, rental revenue specifically from these power systems reached $7.3 million, demonstrating early traction for this segment.

Ancillary Services and Equipment Rentals

Atlas Energy Solutions diversifies its income through ancillary services and equipment rentals, enhancing its core proppant delivery business. These offerings provide additional value to operators, creating new revenue streams beyond just the sale of proppants. This strategy allows Atlas to capture more of the value chain within oil and gas field services.

In 2024, the company's commitment to providing comprehensive solutions means generating revenue from specialized equipment leases and related support services. For instance, renting out advanced pumping units or specialized delivery systems to clients who prefer to manage their own logistics but require Atlas's high-quality equipment is a key component. This also includes maintenance and operational support for the rented equipment.

- Ancillary Services: Revenue from services supporting proppant delivery, such as logistics coordination and site preparation assistance.

- Equipment Rentals: Income generated from leasing specialized equipment like high-pressure pumps, sanders, and delivery trucks to oil and gas operators.

- Value-Added Offerings: Additional services that complement the core proppant business, increasing customer stickiness and overall revenue per project.

- 2024 Focus: Continued expansion of the rental fleet and development of specialized service packages to meet evolving operator needs in the energy sector.

Long-Term Contracts and Volume-Based Pricing

Atlas Energy Solutions (AES) generates revenue primarily through long-term contracts with significant exploration and production (E&P) companies. These agreements often feature volume-based pricing or take-or-pay clauses, which create a predictable and steady income stream for the company.

- Long-Term Contracts: Securing multi-year agreements with major E&P clients provides revenue stability.

- Volume-Based Pricing: Pricing structures are often tied to the volume of services utilized, incentivizing consistent demand.

- Take-or-Pay Arrangements: These contracts guarantee a minimum revenue level, even if actual service usage falls short.

- Predictable Income: The nature of these contracts ensures a reliable revenue base for financial planning and operations.

Atlas Energy Solutions generates revenue through multiple streams, including the direct sale of frac sand (proppant) and comprehensive logistics services for its delivery. In the first quarter of 2025, product sales were $139.7 million, while service sales, encompassing logistics, reached $150.6 million.

The company also earns income from distributed power system services, a newer venture following the Moser Energy Systems acquisition, with first-quarter 2025 rental revenue from this segment at $7.3 million. Additionally, ancillary services and equipment rentals, such as specialized pumping units, contribute to their diverse revenue model, with a focus in 2024 on expanding the rental fleet.

| Revenue Stream | Q1 2025 Revenue | 2024 Focus |

|---|---|---|

| Product Sales (Frac Sand) | $139.7 million | Continued demand for high-quality proppant |

| Service Sales (Logistics) | $150.6 million | Optimizing pipeline and trucking operations |

| Distributed Power Systems | $7.3 million (Q1 2025 Rental) | Expanding service offerings for on-site power |

| Ancillary Services & Equipment Rentals | N/A (Integrated) | Growing rental fleet and specialized packages |

Business Model Canvas Data Sources

The Atlas Energy Solutions Business Model Canvas is built upon a foundation of comprehensive market analysis, internal financial data, and operational performance metrics. These sources ensure that each component, from value propositions to cost structures, is informed by accurate, real-world insights.