Atlas Energy Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Energy Solutions Bundle

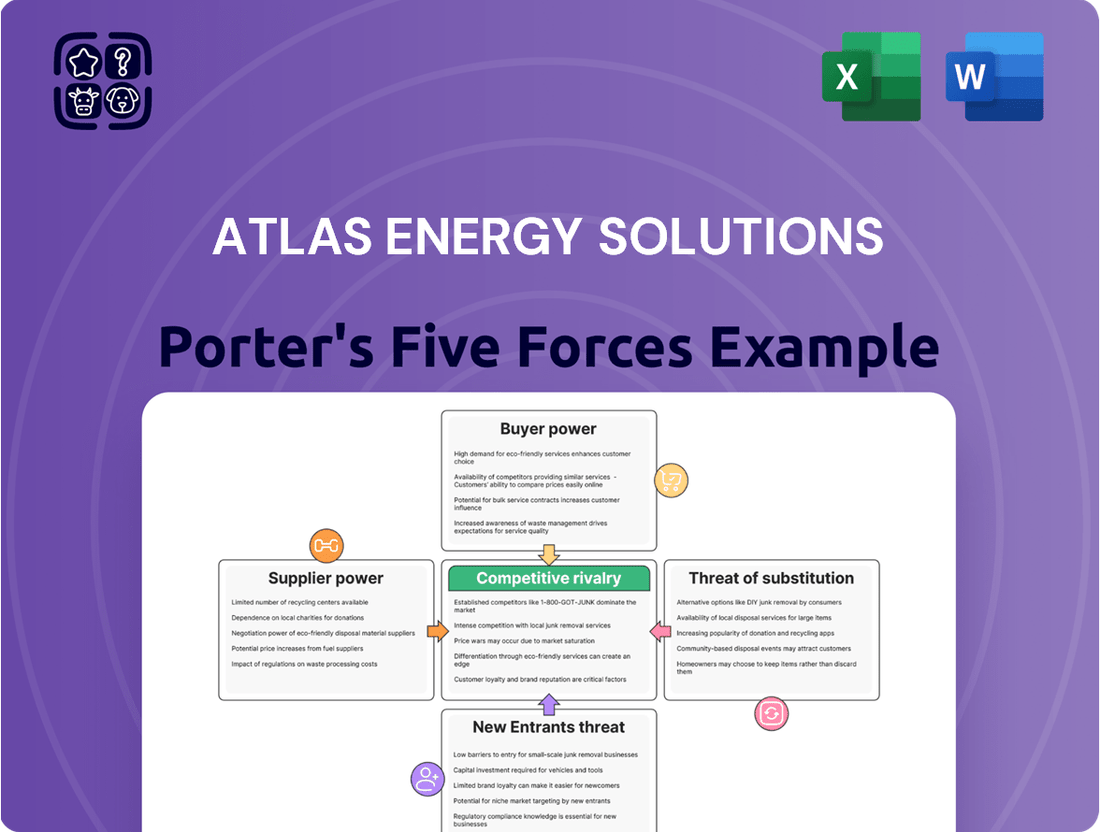

Atlas Energy Solutions operates within a dynamic energy sector, facing significant pressures from powerful buyers and a moderate threat of substitutes. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Atlas Energy Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Atlas Energy Solutions' bargaining power of suppliers is notably shaped by its internal frac sand production, which significantly reduces its dependence on external raw material providers for this crucial component. In 2023, Atlas reported that its frac sand operations provided a substantial portion of its needs, thereby limiting supplier leverage in this area.

However, the company still faces supplier power concerning specialized mining equipment, essential energy inputs for its operations, and advanced logistics technologies. The cost of acquiring and maintaining cutting-edge mining machinery can be substantial, and the availability of specialized components can be a factor. For instance, the energy sector's price volatility, as seen with fluctuating oil prices impacting operational costs throughout 2024, directly influences Atlas's input expenses.

The strategic acquisition of Moser Energy Systems in late 2023 diversifies Atlas into distributed power solutions. This move could potentially lessen their reliance on external energy providers for certain operational needs, thereby shifting the balance of power in that specific supplier relationship.

Atlas Energy Solutions' bargaining power with suppliers is significantly influenced by the availability of critical resources. The company holds substantial proven and probable reserves of high-quality frac sand, which directly reduces the leverage of land or mineral rights suppliers. This robust resource base provides a degree of insulation from price fluctuations or supply disruptions related to raw materials.

However, Atlas's reliance on innovative technologies introduces a different dynamic. The company depends on suppliers for advanced automation and autonomous trucking components, areas where specialized knowledge is key. The proprietary and specialized nature of these technological solutions can grant these suppliers considerable bargaining power, as alternatives may be limited or costly to implement.

Switching costs for Atlas's core mining equipment and specialized logistics technology are likely moderate to high. Integrating new systems or changing major equipment providers involves significant expense and operational disruption, granting existing suppliers a degree of bargaining power.

Atlas's strategic investments in its own infrastructure, exemplified by the Dune Express, are designed to bring crucial supply chain elements in-house. This vertical integration strategy aims to diminish reliance on external suppliers, thereby mitigating their bargaining leverage.

Supplier's Ability to Forward Integrate

The potential for Atlas Energy Solutions' equipment and technology suppliers to forward integrate into frac sand production or logistics is generally low. This is due to the substantial capital outlay and specialized operational know-how needed for such ventures. For instance, establishing a frac sand processing facility typically demands millions in investment for crushing, drying, and screening equipment, alongside logistics infrastructure.

However, large industrial equipment manufacturers could wield influence by offering or withholding critical long-term maintenance agreements or by controlling access to proprietary replacement parts. This leverage could impact Atlas's operational continuity and cost efficiency.

Atlas's own scale of operations and its integrated business model, which encompasses various stages of the hydraulic fracturing process, act as a significant deterrent against suppliers attempting to forward integrate. This integration provides Atlas with a competitive advantage and reduces its reliance on external service providers for key operational components.

- Low Likelihood of Supplier Forward Integration: Suppliers of specialized equipment and technology to Atlas Energy Solutions are unlikely to enter the frac sand production or logistics market due to high capital requirements and operational complexities.

- Potential Influence by Equipment Manufacturers: Major industrial equipment suppliers might exert power through exclusive long-term maintenance contracts or by controlling the supply of proprietary parts, impacting Atlas's operational costs and uptime.

- Atlas's Integrated Model as a Barrier: Atlas's existing scale and integrated operations, covering multiple aspects of the fracturing process, create a substantial barrier, discouraging suppliers from attempting forward integration into its core business areas.

Impact of Input Costs on Atlas's Profitability

Fluctuations in the cost of essential inputs like energy, specialized dredging equipment, and skilled labor can significantly influence Atlas Energy Solutions' operational efficiency and overall profitability. These cost variations grant suppliers a degree of bargaining power, as Atlas relies on their consistent provision of these critical resources.

However, Atlas actively mitigates this supplier power through strategic operational choices. Their commitment to low-cost production is evident in their utilization of electric dredges, which can offer more stable energy costs compared to traditional fuel-powered equipment. Furthermore, their investment in efficient logistics, such as the Dune Express, helps to control transportation and associated input costs.

- Energy Costs: Global energy prices, particularly for electricity, directly impact the operational expenses of Atlas's electric dredges.

- Equipment Procurement: The cost and availability of specialized dredging machinery and its maintenance are key factors influenced by equipment manufacturers.

- Labor Expenses: Wages for skilled operators and maintenance personnel represent a significant input cost, subject to market supply and demand for labor.

Atlas Energy Solutions's bargaining power with suppliers is a mixed bag, heavily influenced by its vertical integration and resource ownership. While owning frac sand reserves and investing in its own logistics, like the Dune Express, significantly reduces supplier leverage for these critical inputs, the company still faces considerable supplier power in other areas.

Specialized mining equipment, advanced technological components for automation, and essential energy inputs remain areas where suppliers can exert influence. For instance, the cost of specialized mining machinery and the availability of proprietary replacement parts can be significant. In 2024, continued volatility in energy markets directly impacted operational costs for Atlas, underscoring the power of energy input suppliers.

The company's strategic moves, such as acquiring Moser Energy Systems, aim to diversify and potentially reduce reliance on external energy providers. However, the high switching costs associated with specialized equipment and technology mean that existing suppliers retain a degree of bargaining power due to the expense and operational disruption involved in changing providers.

| Supplier Category | Atlas's Mitigation Strategies | Supplier Bargaining Power Factors | 2024 Impact/Observation |

|---|---|---|---|

| Frac Sand | Internal production, substantial reserves | Limited due to Atlas's resource control | Reduced reliance on external sand providers |

| Specialized Mining Equipment | Strategic procurement, long-term partnerships | High switching costs, proprietary parts, maintenance agreements | Ongoing cost considerations for equipment upgrades and maintenance |

| Energy Inputs | Electric dredges, logistics efficiency | Global energy price volatility | Fluctuations in electricity costs impacted Q1 2024 operational expenses |

| Advanced Technology (Automation, Logistics) | In-house development where feasible, strategic partnerships | Proprietary nature of solutions, limited alternatives | Dependence on key tech suppliers for autonomous trucking components |

What is included in the product

This analysis reveals the competitive intensity and profitability potential for Atlas Energy Solutions by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and address competitive threats with a dynamic, visual representation of all five forces.

Easily adapt to market shifts by updating key data points, ensuring your strategy remains agile and effective.

Customers Bargaining Power

Atlas Energy Solutions primarily serves a concentrated customer base of large oil and gas operators, with a significant focus on the Permian Basin, the nation's most active shale play. This concentration means a few key clients account for a substantial portion of Atlas's revenue.

The sheer volume of proppant needed for each well in today's hydraulic fracturing operations grants these major operators considerable purchasing power. For instance, a single horizontal well can require hundreds of thousands of pounds of proppant.

This scale and volume allow these large customers to negotiate more favorable pricing and terms with suppliers like Atlas Energy Solutions. Their ability to shift business to competitors if terms are not met is a strong lever.

Customer switching costs are a critical factor in Atlas Energy Solutions' market position. While customers can technically switch proppant providers, Atlas's unique integrated logistics, including the Dune Express conveyor system and sophisticated last-mile delivery, erect substantial barriers to switching. These efficiencies and cost savings are not easily replicated by competitors, thereby enhancing customer retention.

Oil and gas operators are acutely aware of their completion costs, with proppant representing a substantial portion of that expense. This makes them very sensitive to pricing, as they continually look for ways to boost well productivity while simultaneously slashing overall expenditures.

Atlas Energy Solutions' strategic focus on operating as a low-cost provider directly caters to this customer price sensitivity. By optimizing their operations for efficiency, Atlas aims to offer the most economical solutions available in the market.

For instance, in 2024, the average cost of a hydraulic fracturing job can range significantly, but proppant costs alone can represent 20-30% of the total. Companies like Atlas that can demonstrate cost savings in this area gain a distinct advantage.

Customer's Threat of Backward Integration

For Atlas Energy Solutions, the threat of customers backward integrating into frac sand mining is generally low. Oil and gas operators typically lack the specialized expertise and massive capital required for sand extraction and processing.

This lack of integration means customers are unlikely to become their own suppliers, strengthening Atlas Energy Solutions' position. For instance, the capital expenditure for a new frac sand facility can easily run into tens of millions of dollars, a barrier most E&P companies would rather avoid.

- Low Likelihood of Backward Integration: Oil and gas companies typically concentrate on exploration and production, not on the complex logistics and capital-intensive nature of frac sand mining.

- High Capital and Expertise Barriers: Establishing frac sand operations requires significant upfront investment and specialized knowledge in mining, processing, and logistics, which most E&P firms do not possess.

- Focus on Core Competencies: Customers generally prefer to outsource non-core activities like frac sand supply to specialized providers like Atlas Energy Solutions, allowing them to focus on their primary business objectives.

- Reduced Customer Bargaining Power: The difficulty in backward integration limits customers' ability to exert downward price pressure by threatening to produce their own sand.

Information Availability to Customers

Customers in the oil and gas sector, including those Atlas Energy Solutions serves, are typically quite informed. They have access to real-time market price data, can easily identify alternative suppliers, and understand the logistical costs involved in obtaining services. This transparency empowers them to shop around and negotiate better terms.

For instance, in 2024, the benchmark West Texas Intermediate (WTI) crude oil price saw significant fluctuations, with averages around $80 per barrel for much of the year. This kind of market intelligence allows customers to gauge the cost-effectiveness of various service providers, including those offering proppant and logistics. Atlas must therefore consistently highlight how its integrated solutions offer a tangible advantage over piecemeal approaches.

- Informed Customer Base: Oil and gas clients possess readily available data on market prices, competitor offerings, and transportation costs.

- Negotiating Leverage: This information empowers customers to compare Atlas's value proposition against alternatives and drive down prices.

- Value Demonstration: Atlas needs to continuously prove the efficiency and cost savings of its integrated proppant and logistics services to retain pricing power.

Atlas Energy Solutions faces considerable bargaining power from its large oil and gas customers due to their significant purchasing volumes and price sensitivity. These major operators, often concentrated in regions like the Permian Basin, require vast quantities of proppant, granting them leverage to negotiate favorable pricing and terms. Their ability to switch suppliers if dissatisfied further amplifies this power.

Customers' informed nature, with access to real-time market data and logistical costs, enables them to effectively compare Atlas's offerings and press for better deals. For example, in 2024, the price of proppant, a key component in hydraulic fracturing, can fluctuate significantly, impacting the overall completion costs for operators, which often represent 20-30% of the total job expenditure. This makes Atlas's ability to demonstrate cost savings through its integrated logistics, like the Dune Express, crucial for maintaining its competitive edge and mitigating customer pressure.

| Factor | Impact on Atlas Energy Solutions | Customer Leverage | 2024 Data Point/Example |

| Customer Concentration | High reliance on a few large operators | Significant | Permian Basin operators are key clients |

| Purchase Volume | Large orders for proppant | High | Hundreds of thousands of pounds of proppant per well |

| Price Sensitivity | Customers focus on completion cost reduction | High | Proppant costs can be 20-30% of frac job expenses |

| Information Availability | Customers track market prices and logistics | High | Awareness of WTI crude oil price fluctuations (avg. ~$80/bbl in 2024) |

What You See Is What You Get

Atlas Energy Solutions Porter's Five Forces Analysis

This preview displays the complete Atlas Energy Solutions Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within the industry. The document you see here is the exact, professionally formatted report you will receive instantly upon purchase, providing actionable insights into market dynamics.

Rivalry Among Competitors

The Permian Basin proppant market shows a trend toward consolidation, with Atlas Energy Solutions notably securing a dominant position through acquisitions, such as its purchase of Hi-Crush. This strategic move has positioned Atlas as a near-monopoly in certain segments of the market.

Despite Atlas's strong market presence, significant competitors like U.S. Silica Holdings Inc. and Smart Sand Inc. continue to operate, maintaining their own market share. The competitive landscape is thus defined by a mix of a few major, large-scale suppliers alongside a number of smaller, regionally focused companies.

The frac sand and oilfield services markets, especially within the Permian Basin, are seeing robust expansion. This surge is fueled by the escalating demand for unconventional oil and gas. For instance, Permian Basin oil production alone was projected to reach an average of 6.1 million barrels per day in 2024, a significant increase that directly translates to sustained demand for proppants like those supplied by Atlas Energy Solutions.

Atlas Energy Solutions stands out by offering integrated proppant supply and advanced logistics, notably its 42-mile Dune Express conveyor system. This unique infrastructure, coupled with investments in autonomous trucking, significantly enhances operational efficiency.

These logistical innovations create substantial switching costs for customers, as transitioning to another provider would mean disrupting a highly optimized supply chain. This integration makes price-based competition less impactful for Atlas.

The company's technological and infrastructural advantages are not easily replicated by competitors, further solidifying its competitive position. For instance, the Dune Express system represents a significant capital investment and a distinct operational capability.

Fixed Costs and Capacity Utilization

The frac sand industry is capital-intensive, with substantial fixed costs tied to mining operations, processing plants, and transportation networks. These significant investments mean companies are driven to maximize production to spread costs, potentially leading to price wars when demand softens.

Atlas Energy Solutions, with its considerable production capacity and streamlined logistics, is positioned to achieve high capacity utilization. This focus on efficiency helps mitigate the impact of high fixed costs and supports competitive pricing strategies.

- High Fixed Costs: Mines, processing facilities, and logistics infrastructure represent major upfront investments in the frac sand sector.

- Capacity Utilization Incentive: Companies with high fixed costs are motivated to operate at near-full capacity to lower per-unit costs.

- Pricing Pressure: Periods of oversupply can intensify competitive rivalry as companies seek to maintain sales volumes and cover fixed costs, leading to aggressive pricing.

- Atlas's Strategy: Atlas leverages its scale and logistics to pursue high utilization rates, aiming for cost advantages.

Exit Barriers

Exit barriers for Atlas Energy Solutions within the frac sand mining and logistics sector are notably high. This is primarily due to the significant capital outlay required for specialized fixed assets. Think of the extensive investments in mining sites, processing facilities, and dedicated transportation networks, like railcars and trucks, designed specifically for sand movement.

These assets are highly specialized and lack broad applicability outside the oil and gas industry. Consequently, selling them quickly or repurposing them for other uses is often impractical, forcing companies to absorb substantial losses if they attempt to exit the market. This immobility of capital can trap companies in the industry, even during downturns.

The high exit barriers contribute to sustained competitive intensity. Companies may continue operating at reduced capacity or lower margins rather than abandoning their investments altogether. For instance, in 2023, the average utilization rate for frac sand facilities in key U.S. basins hovered around 50-60%, indicating that even with lower demand, many players remained active due to the difficulty of exiting.

- Substantial Capital Investment: Mines, processing plants, and specialized logistics infrastructure represent significant, often illiquid, fixed assets.

- Asset Specialization: Equipment and facilities are typically designed for frac sand and have limited alternative uses, hindering quick divestment.

- Risk of Significant Losses: Companies face the prospect of substantial write-downs if forced to sell specialized assets below their book value upon exiting.

- Prolonged Competitive Pressure: High exit barriers can keep less profitable firms in the market, intensifying competition and potentially suppressing industry-wide profitability.

The competitive rivalry within the proppant market, particularly in the Permian Basin, is shaped by a few dominant players like Atlas Energy Solutions, alongside other significant entities such as U.S. Silica and Smart Sand. This dynamic is intensified by high fixed costs inherent in mining and logistics, driving companies to maintain high capacity utilization, even during periods of softer demand, to spread these costs. Atlas's strategic integration and logistical advantages, like its Dune Express conveyor, create substantial switching costs for customers, mitigating direct price competition for Atlas.

| Competitor | Market Position | Key Differentiator |

|---|---|---|

| Atlas Energy Solutions | Dominant, near-monopoly in segments | Integrated supply, advanced logistics (Dune Express) |

| U.S. Silica Holdings Inc. | Significant market share | Broad product portfolio, established network |

| Smart Sand Inc. | Key competitor | Focus on high-quality Northern White sand |

SSubstitutes Threaten

While Atlas Energy Solutions is a major player in frac sand, the market isn't limited to just one option. Other proppant types, like resin-coated sand and ceramic proppants, are readily available and can be used instead of traditional sand. These alternatives provide different performance levels and come with varying price tags, giving operators choices based on their specific needs.

The demand for proppants that can withstand higher pressures, particularly in challenging geological formations, is on the rise. This trend could see ceramic proppants gaining traction in certain scenarios where their superior strength is a critical factor. For instance, in 2024, the global proppants market experienced growth, with a notable segment focused on enhanced-strength materials to optimize well productivity in unconventional plays.

The threat of substitutes for Atlas Energy Solutions' frac sand hinges on whether alternative proppants can deliver better performance or lower overall costs. While traditional frac sand remains a cost-effective choice, newer ceramic proppants are being developed with enhanced properties like higher crush strength, which could lead to improved well productivity and justify a premium price. For instance, some advanced ceramic proppants boast crush strengths exceeding 7,000 psi, significantly higher than typical Northern White sand.

Atlas's strategy to mitigate this threat involves its integrated logistics services, which focus on reducing the total delivered cost of its sand. By optimizing transportation and handling, Atlas aims to make its frac sand more competitive even against potentially higher-performing, but more expensive, substitutes. In 2024, the average cost of frac sand delivered to a well site can range from $100 to $200 per ton, with logistics accounting for a substantial portion of this.

Technological advancements in hydraulic fracturing, such as slickwater fracturing techniques, are improving proppant placement efficiency. This innovation could lead to a reduced need for traditional proppants, potentially impacting demand for Atlas Energy Solutions' core offerings. Staying ahead of these evolving methods is crucial for Atlas to maintain its competitive edge.

Changes in Well Completion Methodologies

Evolving well completion techniques could present a threat if they reduce the need for proppant or require alternative materials. While current industry trends, as observed in late 2023 and early 2024, show an increase in proppant volume per well, future technological advancements might alter this demand. For instance, innovations in hydraulic fracturing design could lead to more efficient proppant use.

Atlas Energy Solutions' strategic diversification into power solutions via Moser Energy Systems is a key factor in mitigating this threat. This expansion broadens their service offerings, lessening the company's dependence on proppant demand alone. In 2023, Atlas reported a significant portion of its revenue derived from its proppant segment, highlighting the importance of this diversification strategy.

- Proppant Demand Shift: Innovations in completion methods could reduce proppant intensity per well, impacting a core revenue stream for companies like Atlas.

- Technological Adaptation: While proppant usage per well has generally increased in recent years, a future technological shift could reverse this trend, posing a threat.

- Diversification Strategy: Atlas Energy Solutions' expansion into power solutions through Moser Energy Systems, which saw increased operational activity in 2024, helps buffer against potential declines in proppant-specific demand.

Environmental and Regulatory Pressures

Increasing environmental regulations and a growing focus on sustainability within the oil and gas sector present a significant threat of substitutes for Atlas Energy Solutions. Stricter standards could accelerate the adoption of alternative fracturing methods or more environmentally friendly proppants, such as eco-friendly ceramic proppants, which offer a lower environmental footprint.

For instance, the U.S. Environmental Protection Agency (EPA) continues to refine regulations concerning hydraulic fracturing, impacting the types of chemicals and water usage permitted. This regulatory landscape directly influences the viability and attractiveness of existing proppant solutions compared to emerging, greener alternatives. Atlas must proactively assess and mitigate the environmental impact of its operations and product lifecycle to remain competitive.

- Environmental Scrutiny: Growing public and governmental pressure on the oil and gas industry to reduce its environmental impact.

- Regulatory Evolution: Anticipated tightening of regulations regarding water usage, chemical additives, and waste disposal in hydraulic fracturing.

- Sustainable Alternatives: Increased research and development into biodegradable or less impactful proppant materials and fracturing techniques.

The threat of substitutes for Atlas Energy Solutions' frac sand is moderate, primarily driven by the availability of alternative proppants like resin-coated sand and ceramics, which offer varying performance and cost profiles. While traditional sand remains cost-effective, advancements in ceramic proppants, boasting higher crush strengths exceeding 7,000 psi, present a performance-based substitute. Atlas mitigates this by optimizing logistics to reduce total delivered sand costs, a critical factor given that delivery can represent a significant portion of the $100-$200 per ton cost in 2024.

| Proppant Type | Typical Crush Strength (psi) | Relative Cost | Atlas Energy Solutions Relevance |

|---|---|---|---|

| Northern White Sand | 3,000-5,000 | Low | Core product, cost-competitive |

| Resin-Coated Sand | 5,000-7,000 | Medium | Alternative offering improved conductivity |

| Ceramic Proppants | 7,000+ | High | Performance substitute for challenging formations |

Entrants Threaten

The frac sand and logistics sector, particularly in the Permian Basin, necessitates considerable capital for mines, processing plants, and sophisticated logistics, including conveyor systems and trucking fleets. This high initial investment acts as a significant deterrent for potential new competitors.

Atlas Energy Solutions' Dune Express, a 42-mile conveyor system, exemplifies this barrier. The substantial cost and intricate nature of such infrastructure make it exceptionally difficult for newcomers to replicate, effectively limiting the threat of new entrants.

Securing access to high-quality, in-basin frac sand reserves presents a significant barrier to entry. Atlas Energy Solutions benefits from a large and established reserve base within the Permian Basin, a key advantage that new competitors would struggle to replicate.

The geological scarcity of prime locations boasting suitable sand quality further elevates the hurdle for any new players attempting to enter the market. This limited availability of prime assets makes it exceptionally challenging for new entrants to establish a comparable operational footprint and cost structure.

Atlas Energy Solutions' significant investment in proprietary technology, such as its patented drop-depot process and autonomous trucking, creates a substantial barrier to entry. This advanced automation and remote operations expertise, coupled with a highly integrated supply chain offering unique efficiencies, makes it difficult and expensive for new companies to match their operational capabilities. For instance, in 2024, Atlas reported a substantial portion of its revenue generated from services leveraging these advanced logistical solutions, underscoring their competitive moat.

Economies of Scale and Cost Advantages

Existing players in the sand and proppant market, like Atlas Energy Solutions, often possess significant economies of scale. This advantage is built through extensive experience in mining, processing, and logistics, leading to lower per-unit production costs. For instance, Atlas's substantial operational footprint allows for more efficient resource extraction and transportation, a feat difficult for newcomers to replicate without considerable upfront investment.

Atlas Energy Solutions's strategic investments in proprietary technology, such as its electric dredges and the Dune Express rail system, further solidify its cost leadership. These assets are designed to optimize operational efficiency and reduce variable costs, making it challenging for new entrants to match Atlas's pricing power. Without comparable infrastructure and scale, new companies would likely face higher operating expenses, hindering their ability to compete effectively on price.

- Economies of Scale: Atlas benefits from large-scale operations in mining, processing, and logistics, reducing per-unit costs.

- Cost Advantages: Investments in electric dredges and the Dune Express enhance Atlas's cost efficiency.

- Barrier to Entry: The significant capital required for similar infrastructure and scale creates a formidable barrier for new competitors.

Regulatory and Permitting Hurdles

New entrants into the energy solutions sector, particularly those focused on mining operations, encounter substantial regulatory and permitting challenges. These hurdles are amplified by stringent environmental impact assessments and the need for robust transportation infrastructure.

Navigating this intricate web of regulations and securing the necessary permits is a time-consuming and expensive undertaking, acting as a significant deterrent to potential competitors. For instance, in 2024, companies seeking to establish new mining operations often faced multi-year approval processes.

- Environmental Regulations: Increasingly stringent rules govern areas like silica dust emissions and water usage, impacting operational costs and feasibility.

- Permitting Delays: Obtaining permits for mining, processing, and transportation can stretch for years, creating significant upfront investment risk.

- Infrastructure Requirements: Compliance often necessitates substantial investment in specialized infrastructure, further raising the barrier to entry.

The threat of new entrants for Atlas Energy Solutions is significantly mitigated by the immense capital requirements for establishing mining, processing, and logistics operations, particularly in the Permian Basin. Atlas's substantial investments in infrastructure like the Dune Express conveyor system, coupled with proprietary technology and established reserves, create formidable barriers. Furthermore, navigating complex regulatory landscapes and securing permits presents a lengthy and costly challenge for potential new players, as evidenced by multi-year approval processes observed in 2024.

| Barrier Type | Description | Impact on New Entrants |

| Capital Investment | High costs for mines, plants, and logistics (e.g., Dune Express conveyor system). | Significant deterrent due to upfront financial burden. |

| Proprietary Technology | Patented processes (drop-depot) and automation (autonomous trucking). | Difficult and expensive for newcomers to replicate operational efficiencies. |

| Resource Access | Securing high-quality, in-basin frac sand reserves. | Challenging for new players to match Atlas's established advantage. |

| Regulatory Hurdles | Stringent environmental assessments and permitting processes. | Time-consuming and costly, with 2024 data showing multi-year approval timelines. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Atlas Energy Solutions is built upon a foundation of reliable data, including their annual reports, investor presentations, and industry-specific market research from reputable firms. We also incorporate publicly available information from regulatory filings and energy sector news outlets to capture a comprehensive view of the competitive landscape.