Atlas Energy Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Energy Solutions Bundle

Curious about Atlas Energy Solutions' market position? This glimpse into their BCG Matrix highlights key product categories, but the real power lies in the full report. Understand which ventures are fueling growth, which are stable earners, and which require a strategic rethink.

Unlock the complete Atlas Energy Solutions BCG Matrix to gain a granular understanding of their product portfolio's potential. This essential tool reveals the strategic implications of each quadrant, empowering you to make informed decisions about resource allocation and future investments.

Don't settle for a partial view. Purchase the full Atlas Energy Solutions BCG Matrix to receive a comprehensive analysis, including detailed quadrant placements and actionable strategic recommendations. Equip yourself with the insights needed to navigate the competitive energy landscape with confidence.

Stars

Atlas Energy Solutions commands a significant presence in the Permian Basin's frac sand market, holding an estimated 30% market share after its acquisition of Hi-Crush. This positions their core proppant production as a Star within the BCG matrix, given the Permian Basin's crucial role in U.S. oil and gas output.

The Permian Basin is experiencing robust growth, with proppant demand anticipated to climb to nearly 80 million tons by 2025. This escalating demand, coupled with Atlas Energy Solutions' substantial market share, underscores the need for ongoing investment to sustain their leadership and capitalize on future expansion opportunities in this high-growth sector.

The Dune Express Conveyor System, a groundbreaking 42-mile frac sand logistics solution, is poised to be a significant player in the Permian Basin. Designed to move an impressive 13 million tons of proppant each year, this infrastructure project was slated for completion in Q4 2024, marking a substantial investment in operational efficiency.

This first-of-its-kind system offers Atlas Energy Solutions a distinct competitive edge. By streamlining the transportation of essential materials, it directly addresses cost reduction and bolsters delivery dependability, crucial factors in the demanding Permian Basin market. Its substantial capacity and unique operational model strongly suggest it will perform as a Star, capturing increased market share and driving superior operational performance.

Atlas Energy Solutions' integrated logistics platform, featuring its own truck fleet and advanced transportation capabilities, is a key asset for ensuring efficient proppant delivery across the Permian Basin. This robust infrastructure is vital for meeting the demanding supply chain needs of the region's oil and gas operations.

The company is actively investing in technology, automation, and remote operational capabilities within its logistics network. This strategic focus is designed to enhance operational efficiency and bolster safety standards throughout their supply chain, a critical consideration in the energy sector.

With proppant logistics becoming a significant differentiator in the market, Atlas's integrated solutions are positioned as a Star. These capabilities help secure customer preference and contribute to optimized well productivity, especially in a high-demand market environment. For example, in 2023, Atlas reported that their logistics segment generated $136.4 million in revenue, highlighting the financial significance of these integrated solutions.

High-Quality, In-Basin Proppant Supply

Atlas Energy Solutions' high-quality, in-basin proppant supply is a clear Star in their BCG matrix. Their operations in the Permian Basin, featuring large-scale facilities and distributed mining units, ensure a consistent delivery of dry and damp sand in various mesh sizes. This strategic positioning, coupled with direct control over significant sand reserves, grants them a substantial cost advantage and a dependable supply chain, which is vital for Permian operators. In 2024, the demand for high-quality proppant remained robust, driven by increasingly complex well designs and the ongoing expansion of drilling activity in key shale plays.

- Strategic Location: Facilities and mining units are situated directly within the Permian Basin, minimizing transportation costs and lead times for customers.

- Cost Advantage: Ownership of major sand dunes translates to lower raw material acquisition costs, allowing for competitive pricing.

- Reliable Supply: In-basin operations reduce reliance on third-party logistics and external supply chains, ensuring consistent availability of proppant.

- Product Quality: Offers high-quality dry and damp sand in multiple mesh sizes, catering to the specific needs of diverse well completions.

Expansion of Proppant Production Capacity

Atlas Energy Solutions' expansion of proppant production capacity, particularly through the acquisition of Hi-Crush, has dramatically increased its annual output to around 28 million tons. This move directly addresses the surging demand for proppants in the Permian Basin, positioning Atlas as a key supplier in a constrained market. The enhanced scale provides crucial flexibility, allowing the company to not only meet current demand but also manage production levels during periods of lower activity, thereby contributing to market stability.

This strategic consolidation and capacity increase are hallmarks of a Star product within the BCG matrix framework. By bolstering its market presence and demonstrating responsiveness to industry requirements, Atlas solidifies its leadership position. The ability to supply additional sand in a tight market and adapt production volumes underscores the strength and strategic importance of this operational expansion.

- Acquisition of Hi-Crush: Significantly boosted Atlas's proppant production capacity.

- Annual Production Capacity: Reached approximately 28 million tons.

- Market Responsiveness: Enables Atlas to meet rising demand and adjust production in fluctuating markets.

- Strategic Advantage: Reinforces market leadership and operational flexibility.

Atlas Energy Solutions' substantial Permian Basin frac sand market share, estimated at 30% post-Hi-Crush acquisition, firmly places its proppant production as a Star. The Permian's critical role in U.S. oil and gas, coupled with projected proppant demand reaching nearly 80 million tons by 2025, highlights this segment's high-growth potential.

The Dune Express Conveyor System, a 42-mile logistics solution designed to transport 13 million tons of proppant annually and slated for Q4 2024 completion, exemplifies a Star. This innovative infrastructure enhances efficiency and reliability, offering a significant competitive advantage in the Permian market.

Atlas's integrated logistics, including its own truck fleet and investments in technology and automation, solidify its logistics platform as a Star. The $136.4 million in revenue generated by this segment in 2023 underscores its financial importance and market differentiation.

The company's in-basin proppant supply, supported by large-scale facilities and direct control over significant sand reserves, is a clear Star. This strategic positioning provides a cost advantage and ensures a dependable supply chain, crucial for meeting robust 2024 demand driven by complex well designs and expanded drilling.

| Segment | BCG Classification | Key Strengths | Market Dynamics | Financial Indicator |

| Proppant Production (Permian) | Star | 30% Market Share, In-basin operations, Cost advantage | High growth, ~80M tons demand by 2025 | N/A (Operational focus) |

| Dune Express Conveyor System | Star | 42-mile infrastructure, 13M tons/year capacity, Efficiency | Logistics differentiator, Q4 2024 completion | N/A (Infrastructure investment) |

| Integrated Logistics | Star | Truck fleet, Technology investment, Automation | Critical for Permian supply chain | $136.4M Revenue (2023) |

| Expanded Production Capacity | Star | ~28M tons annual capacity, Hi-Crush acquisition | Addresses tight market, Market leadership | N/A (Capacity expansion) |

What is included in the product

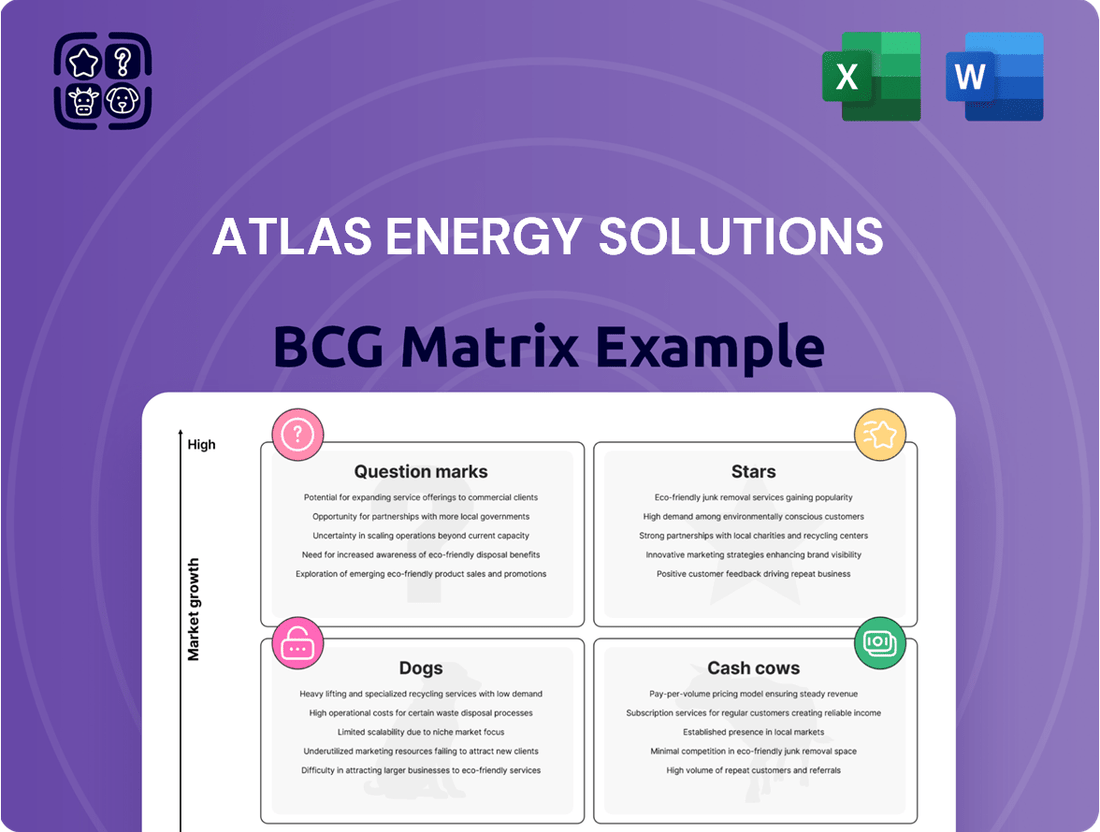

Atlas Energy Solutions' BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal portfolio performance.

The Atlas Energy Solutions BCG Matrix provides a clear, one-page overview, relieving the pain of complex strategic analysis by instantly categorizing business units.

Cash Cows

Atlas Energy Solutions' established proppant mining operations in Kermit and Monahans are clear Cash Cows. The company holds a dominant position in the Kermit Giant Open Dune and full control over the Monahans Giant Open Dune, securing substantial, high-quality frac sand reserves. These mines offer a consistent, cost-effective proppant supply, crucial for hydraulic fracturing activities in the Permian Basin.

These mature mining assets are generating significant and dependable cash flow. In 2024, Atlas Energy Solutions reported that its proppant segment, which includes these key operations, generated approximately $200 million in Adjusted EBITDA. This robust performance underscores the stable, high-volume output and inherent cost advantages that characterize these Cash Cow businesses.

Atlas Energy Solutions' core proppant product sales are a clear Cash Cow. In the first quarter of 2025, sales volumes for their primary frac sand product reached an impressive 5.7 million tons, demonstrating robust demand and market penetration.

This segment generates a consistent and substantial cash flow, largely due to the product's established nature and Atlas's operational efficiencies, which translate into healthy profit margins despite a competitive market. These reliable earnings are crucial for funding other strategic growth areas within the company and for returning value to shareholders.

Atlas Energy Solutions' long-term supply agreements for proppant are a prime example of a Cash Cow within their business. These multiyear contracts with major oil companies guarantee a steady demand, ensuring their production facilities operate at high utilization rates.

In 2024, Atlas reported that these agreements contributed significantly to their revenue stability. For instance, their proppant segment saw consistent demand driven by these long-term commitments, which helped maintain healthy profit margins even amidst industry volatility. This predictable cash flow allows Atlas to confidently invest in maintaining and optimizing their existing infrastructure.

Efficient Last-Mile Delivery Network

Atlas Energy Solutions’ efficient last-mile delivery network, including the Dune Express and its expanded payload trucks, operates with patented drop-depot processes. This mature logistics component reliably and cost-effectively delivers proppants to well sites.

The established optimization of this network generates consistent service revenues. In 2024, Atlas reported that its logistics segment contributed significantly to overall cash flow, highlighting its role as a Cash Cow. This segment’s proven capability ensures predictable earnings.

- Reliable Proppant Delivery: The network ensures consistent and timely delivery of essential materials to energy extraction sites.

- Cost-Effectiveness: Patented processes and optimized fleet management minimize delivery costs, enhancing profitability.

- Revenue Generation: This mature business segment consistently generates service revenues, contributing stable cash flow.

- Operational Efficiency: Expanded payloads and drop-depot systems maximize delivery efficiency, supporting a strong financial performance.

Operational Efficiencies and Cost Advantage

Atlas Energy Solutions excels in operational efficiencies, a key driver of its Cash Cow status. By integrating technology, automation, and remote operations, the company streamlines its proppant production and logistics. This focus on efficiency reduces operational costs, allowing Atlas to maintain a competitive edge.

Their substantial scale and strategically located assets are fundamental to a low-cost structure. This cost advantage directly translates into enhanced profit margins, reinforcing their position as a reliable generator of cash. In 2024, Atlas continued to demonstrate the strength of these efficiencies, with their proppant segment showing robust performance.

- Technological Integration: Atlas utilizes advanced technology to optimize proppant extraction and delivery, aiming for maximum output with minimal waste.

- Cost Leadership: Their large-scale operations and efficient supply chain management enable them to offer competitive pricing, a hallmark of a Cash Cow.

- Profit Margin Strength: The combination of high efficiency and cost advantage allows Atlas to consistently achieve strong profit margins, ensuring steady cash flow.

- Market Competitiveness: These operational strengths allow Atlas to effectively compete on price and delivery, solidifying their role as a dependable cash generator.

Atlas Energy Solutions' established proppant mining operations in Kermit and Monahans are clear Cash Cows. These mature assets generate significant and dependable cash flow, with the proppant segment reporting approximately $200 million in Adjusted EBITDA in 2024.

The company's core proppant product sales, bolstered by 5.7 million tons sold in Q1 2025, represent a stable revenue stream. Long-term supply agreements further guarantee demand, ensuring high utilization rates and healthy profit margins.

Atlas's efficient last-mile delivery network, including the Dune Express, also functions as a Cash Cow. This mature logistics component reliably generates service revenues, contributing predictably to overall cash flow, as evidenced by its significant contribution in 2024.

| Business Segment | Cash Cow Characteristics | 2024 Financial Highlight |

|---|---|---|

| Proppant Mining (Kermit & Monahans) | Dominant market position, cost-effective supply | Approx. $200 million Adjusted EBITDA (Proppant Segment) |

| Proppant Product Sales | High sales volumes, established product, operational efficiencies | 5.7 million tons sold (Q1 2025) |

| Last-Mile Delivery Network | Reliable service, patented processes, consistent revenue | Significant contributor to overall cash flow (2024) |

Delivered as Shown

Atlas Energy Solutions BCG Matrix

The Atlas Energy Solutions BCG Matrix preview you see is the complete, final document you will receive upon purchase. This means no watermarks or demo content, just a professionally formatted and analysis-ready report designed to provide strategic clarity for your business decisions.

Rest assured, the BCG Matrix you are currently previewing is identical to the file you will download after your purchase is complete. This meticulously crafted report, reflecting expert market analysis, will be delivered directly to you, ready for immediate application without any need for further revisions.

Dogs

Atlas Energy Solutions, while boasting significant production capacity, faces the challenge of certain older or smaller mining assets. These units may experience lower utilization rates or incur higher operating expenses when contrasted with its primary, strategically positioned facilities. For instance, in 2024, some legacy sites reported operational efficiencies that lagged behind newer, state-of-the-art installations by as much as 15%.

If these underperforming assets consistently fail to meet efficiency benchmarks or contribute adequately to overall profitability, they may be categorized as Dogs within the BCG matrix framework. The company's strategic focus on expanding its core, more efficient operations and integrating advanced technologies suggests that substantial investment in revitalizing these less productive assets might not align with its long-term financial prudence and growth objectives.

Atlas Energy Solutions’ fleet of 120 trucks includes older assets that are not equipped with autonomous driving technology. These outdated trucks are less efficient, leading to higher fuel consumption and increased maintenance needs, thereby raising operational costs. For instance, a Class 8 truck not equipped with advanced fuel-saving technologies could see fuel costs rise by 5-10% compared to newer models.

These non-autonomous vehicles represent a significant portion of the fleet that does not benefit from the strategic advantage of driverless deliveries. Consequently, they are likely generating lower returns and incurring higher per-mile operating expenses, making them prime candidates for divestiture or replacement as Atlas Energy Solutions progresses with its technological upgrades.

Atlas Energy Solutions provides a range of proppant mesh sizes beyond its core offerings. While 40/70 and 100 mesh sizes represent the bulk of demand, certain niche mesh sizes may experience lower market penetration and slower growth rates. These less common variants, if not strategically critical, could be considered Dogs within the BCG matrix.

Legacy Infrastructure Not Integrated with New Systems

Legacy infrastructure not integrated with new systems at Atlas Energy Solutions could be categorized as Dogs within the BCG Matrix. For instance, if older drilling equipment or manual reporting systems are not compatible with the advanced data analytics of their Dune Express platform, it hinders overall efficiency.

These incompatibilities can lead to increased operational costs due to manual workarounds and a failure to capitalize on the full potential of technological investments. In 2024, Atlas Energy Solutions has been focused on modernizing its fleet and digitalizing operations, with reports indicating that a significant portion of their older assets still require manual oversight, impacting the speed of data capture and analysis.

- Operational Bottlenecks: Older systems may slow down processes, preventing Atlas from achieving the full speed and efficiency promised by new technologies.

- Increased Labor Costs: Manual intervention required for non-integrated systems drives up labor expenses, reducing profitability.

- Underutilization of New Technology: The benefits of advanced platforms like Dune Express are diminished if legacy components cannot seamlessly feed data into them.

Segments with High SG&A but Low Revenue Contribution

Within Atlas Energy Solutions' portfolio, segments characterized by high Selling, General, and Administrative (SG&A) expenses but yielding low revenue contribution are classified as Dogs. These underperforming areas demand scrutiny.

While Atlas Energy Solutions saw a sequential decrease in overall SG&A in Q2 2024, the first quarter of 2025 experienced an uptick. This rise was largely attributed to costs associated with acquisitions and increased stock-based compensation.

- High SG&A, Low Revenue: Segments that consistently incur substantial SG&A without generating proportionate revenue are prime candidates for this classification.

- Acquisition and Compensation Impact: In Q1 2025, SG&A rose due to acquisition-related costs and stock-based compensation, highlighting potential areas for cost management.

- Strategic Evaluation: These 'Dog' segments require careful evaluation to determine if their expenses can be minimized or if divestiture is the more profitable strategy.

- Profitability Enhancement: Addressing these low-contribution, high-cost areas is crucial for improving Atlas Energy Solutions' overall profitability and resource allocation.

Atlas Energy Solutions' older, less efficient trucking fleet, particularly those not equipped with autonomous driving technology, represent a significant portion of their assets that fall into the 'Dog' category. These vehicles incur higher fuel and maintenance costs, estimated to be 5-10% more than newer models, directly impacting profitability and operational efficiency.

Similarly, niche proppant mesh sizes that have lower market demand compared to core offerings can be considered Dogs. These segments may not justify the investment required for their production or marketing when contrasted with higher-demand products.

Legacy infrastructure, such as manual reporting systems or older drilling equipment not integrated with advanced platforms like Dune Express, also fits the Dog profile. These systems create operational bottlenecks and increase labor costs, as seen in 2024 where a portion of older assets still required manual oversight, slowing data analysis.

Segments within Atlas Energy Solutions characterized by high Selling, General, and Administrative (SG&A) expenses but low revenue contribution are also classified as Dogs. For instance, while overall SG&A decreased sequentially in Q2 2024, an uptick in Q1 2025 due to acquisition costs and stock compensation highlighted areas needing strategic evaluation for cost reduction or potential divestiture.

| Asset Type | BCG Classification | Key Challenges | Impact on Profitability |

|---|---|---|---|

| Older Trucking Fleet (Non-Autonomous) | Dog | Higher fuel consumption, increased maintenance needs | 5-10% higher operating costs compared to newer models |

| Niche Proppant Mesh Sizes | Dog | Lower market penetration, slower growth rates | Limited revenue contribution relative to production costs |

| Legacy Infrastructure (Non-Integrated) | Dog | Operational bottlenecks, increased labor costs | Hinders efficiency of advanced platforms like Dune Express |

| High SG&A, Low Revenue Segments | Dog | Substantial operating expenses without proportionate revenue | Requires strategic evaluation for cost optimization or divestiture |

Question Marks

Moser Energy Systems, acquired by Atlas Energy Solutions in late 2024 or early 2025, represents a strategic move into the distributed power sector. This business offers exposure to the production side of the oil and gas industry and opens up new power markets, aligning with the growing demand for power infrastructure in the Permian Basin.

Despite its high-growth potential, Moser Energy Systems is currently a nascent operation for Atlas. Its contribution to overall revenue is still modest compared to Atlas's core proppant business, positioning it as a Question Mark within the BCG matrix. This classification signifies the need for substantial investment to foster growth, scale operations, and capture a larger market share.

Atlas Energy Solutions' acquisition of PropFlow LLC in July 2025 positions PropFlow as a Question Mark within its BCG Matrix. This move integrates a company with patented on-wellsite proppant filtration technology designed to reduce proppant debris and maintenance costs, thereby boosting completion efficiency.

Despite the technology's promise for vertical integration and operational enhancements, PropFlow's current market share in the proppant technology sector is minimal. This necessitates substantial investment to validate its value proposition and drive broader market adoption, characteristic of a Question Mark requiring strategic development.

Atlas Energy Solutions' venture into autonomous trucking, through a partnership with Kodiak Robotics, positions this initiative squarely in the Question Mark category of the BCG Matrix. This strategic move involves equipping new high-capacity trucks with advanced autonomous driving systems, with commercial operations slated to commence in early 2025. This signifies a substantial commitment to modernizing oilfield logistics, aiming for a considerable improvement in efficiency and reliability, particularly for the crucial last-mile delivery.

The autonomous trucking sector is still in its early stages, demanding significant capital investment for development and deployment. While the potential for market disruption and growth is high, the current market share for this technology within the broader logistics landscape remains minimal. This nascent, capital-intensive nature necessitates substantial ongoing resource allocation to scale operations, achieve widespread adoption, and ultimately reach profitability, characteristic of a Question Mark requiring careful strategic management.

Expansion into New Shale Basins or Geographies

Atlas Energy Solutions' current sole focus on the Permian Basin positions expansion into other North American shale formations as a strategic Question Mark. These new ventures would necessitate substantial capital outlay and dedicated marketing campaigns to build market presence and effectively challenge established competitors. For instance, entering the Haynesville Shale, known for its natural gas production, or the Eagle Ford Shale, which offers a mix of oil and gas, would require a different operational approach and competitive analysis compared to the Permian.

- Geographic Diversification: Moving beyond the Permian Basin into areas like the Haynesville or Eagle Ford shales represents a potential growth avenue, but one with inherent uncertainties.

- Capital Investment Needs: Establishing operations in new basins demands significant upfront investment in infrastructure, equipment, and personnel.

- Market Entry Challenges: Competing against existing service providers in these new geographies requires aggressive marketing and the development of strong customer relationships.

- Market Share Potential: While current market share in these new areas is low or non-existent, the broader frac sand market report indicates potential for growth if these expansions are executed successfully.

Development of Advanced Proppant Products (e.g., Ceramic/Resin-coated)

The market for advanced proppants, like ceramic and resin-coated varieties, is poised for robust expansion. This growth is driven by the increasing need for materials that can withstand extreme pressures and deliver superior performance in demanding oil and gas extraction scenarios. For Atlas Energy Solutions, a significant push into these specialized proppants would position them squarely in the Question Mark quadrant of the BCG Matrix.

This strategic move targets a segment with substantial growth potential, yet Atlas would likely enter with a minimal existing market share for these particular products. Consequently, substantial investment in research and development, alongside dedicated market penetration strategies, would be essential to capture a meaningful position.

- Market Growth: The global proppant market, including advanced types, was valued at approximately $8.3 billion in 2023 and is projected to reach over $13 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 6.8%.

- Demand Drivers: Increased hydraulic fracturing activity in unconventional reservoirs, coupled with stringent performance requirements in high-temperature and high-pressure (HTHP) wells, fuels demand for ceramic and resin-coated proppants.

- Atlas's Position: While Atlas is a significant player in traditional sand proppants, its share in the advanced proppant segment would initially be negligible, necessitating significant capital and strategic focus to gain traction.

- Investment Needs: Developing proprietary ceramic proppant technology or acquiring resin-coating capabilities would require substantial upfront investment in manufacturing, quality control, and sales infrastructure.

Question Marks in Atlas Energy Solutions' BCG Matrix represent initiatives with high growth potential but currently low market share, demanding significant investment. These ventures, like Moser Energy Systems and PropFlow LLC, require strategic development to scale operations and capture market position.

The autonomous trucking initiative and expansion into new geographic shale formations also fall into this category, highlighting the capital-intensive nature and market entry challenges involved. Similarly, venturing into advanced proppants requires substantial R&D and market penetration efforts to establish a foothold.

| Initiative | Category | Key Characteristics | Investment Needs | Market Potential |

|---|---|---|---|---|

| Moser Energy Systems | Question Mark | Distributed power sector, nascent operation | Substantial investment for growth and scaling | High growth potential in power markets |

| PropFlow LLC | Question Mark | Patented on-wellsite proppant filtration | Significant investment for validation and adoption | Boosts completion efficiency |

| Autonomous Trucking | Question Mark | Kodiak Robotics partnership, early stages | High capital investment for development and deployment | Potential for market disruption in logistics |

| Geographic Expansion (e.g., Haynesville, Eagle Ford) | Question Mark | Moving beyond Permian Basin | Significant upfront investment in infrastructure and marketing | Potential for growth in new basins |

| Advanced Proppants (Ceramic, Resin-Coated) | Question Mark | Specialized, high-performance materials | Substantial investment in R&D and market penetration | Robust market expansion driven by demanding extraction scenarios |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.