ATI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATI Bundle

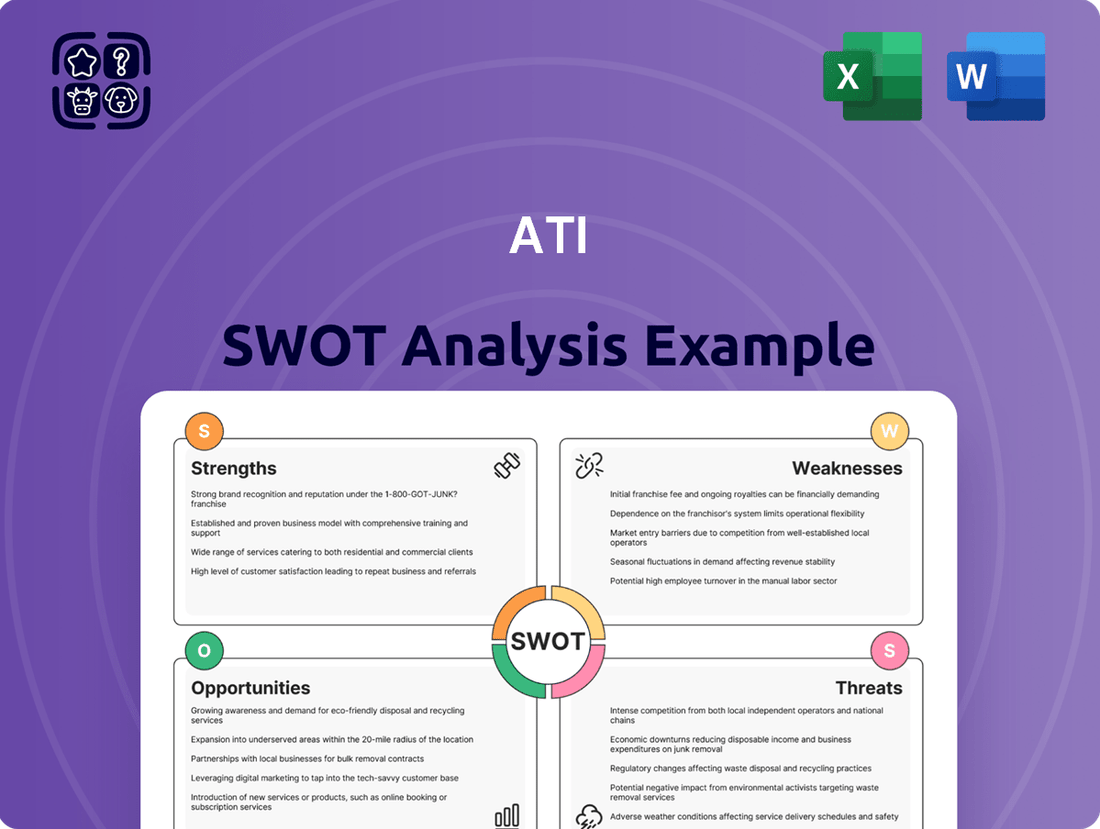

Uncover the strategic advantages and potential challenges facing ATI with our comprehensive SWOT analysis. This detailed report provides a critical look at their internal capabilities and external market dynamics, offering a solid foundation for informed decision-making.

Ready to dive deeper and gain a competitive edge? Purchase the full ATI SWOT analysis for actionable insights, expert commentary, and an editable format perfect for strategic planning, investor pitches, and in-depth market research.

Strengths

ATI holds a commanding presence in the aerospace and defense (A&D) sector, a testament to its specialized, high-performance materials. This market segment is a cornerstone of ATI's business, accounting for over 65% of its revenue in the first quarter of 2025.

The widespread integration of ATI's materials across the aviation landscape, from jet engines to airframes, underscores its critical and deeply embedded role. Indeed, its products are found on nearly every commercial aircraft currently in operation, highlighting an unparalleled market penetration.

ATI's strength lies in its manufacturing of highly specialized materials, including titanium, nickel-based, and other specialty alloys. These advanced materials are critical for industries facing extreme operational demands.

The company's proprietary process technologies, coupled with a strong focus on innovation, enable ATI to address complex material science challenges. This technological edge allows them to develop solutions for applications subjected to intense heat, pressure, and corrosive environments, a key differentiator in the market.

For instance, ATI's advanced materials are integral to the aerospace sector, a market that saw significant recovery and growth in 2024, with aircraft production ramping up. This demand directly benefits ATI's specialized alloy offerings, as evidenced by their strong order book in this segment.

ATI has showcased impressive financial strength, with first quarter 2025 sales climbing 10% compared to the previous year. This growth was complemented by a significant 53% year-over-year increase in adjusted net income, underscoring the company's profitability.

The company's consistent ability to exceed earnings expectations is a key strength. ATI has achieved five consecutive quarters of positive EPS surprises, with an average beat of 23%, demonstrating reliable operational execution and forecasting accuracy.

Looking ahead, ATI projects robust financial performance for the entirety of 2025. The company anticipates strong adjusted EBITDA and free cash flow generation, signaling continued financial resilience and efficient capital management.

Long-Term Customer Agreements and Strategic Partnerships

ATI's strength lies in its robust long-term customer agreements and strategic partnerships, which provide a foundation of predictable revenue. The company has secured an estimated $4 billion in sales commitments extending through 2040, primarily for high-demand nickel alloys crucial for the jet engine sector. This deep integration into critical aerospace supply chains offers significant competitive advantage and revenue visibility.

Further solidifying its market position, ATI has entered into a multi-year agreement with Airbus for titanium products. Additionally, a recent extension of its long-term purchase agreement with Rolls-Royce for essential materials underscores the continued trust and reliance placed upon ATI's capabilities. These sustained relationships are vital for ensuring stable demand and reinforcing ATI's leadership in specialized materials markets.

- Long-term Sales Commitments: Over $4 billion secured through 2040 for nickel alloys.

- Aerospace Partnerships: Multi-year agreement with Airbus for titanium products.

- Supplier Reliability: Extended purchase agreement with Rolls-Royce for critical materials.

- Market Leadership: These agreements solidify ATI's position in key aerospace material markets.

Diversified High-Growth End Markets

ATI's strength lies in its diversified customer base, extending beyond its traditional aerospace and defense sectors into high-growth areas like electronics, medical, and specialty energy. This strategic expansion allows ATI to capitalize on demand for its advanced materials in applications requiring high performance and reliability, such as sophisticated microchips, advanced medical implants, and critical energy infrastructure. For instance, the company's materials are integral to the semiconductor industry's push for smaller, faster chips, a market projected to reach $1 trillion by 2030.

This diversification into "aero-like" markets provides crucial additional revenue streams and robust growth opportunities. By leveraging its expertise in developing and manufacturing high-performance materials, ATI is well-positioned to benefit from trends in these expanding sectors. The medical device market alone is anticipated to grow significantly, with projections indicating a compound annual growth rate of over 7% through 2027, highlighting the potential for ATI's specialized alloys.

Key benefits of this diversification include:

- Reduced reliance on any single industry: Spreading revenue across multiple sectors mitigates risks associated with cyclical downturns in aerospace or defense.

- Access to new growth engines: Tapping into rapidly expanding markets like semiconductors and medical technology offers significant upside potential.

- Leveraging core competencies: ATI's advanced material science expertise is directly transferable and highly valued in these adjacent industries.

- Enhanced market resilience: A broader market presence strengthens ATI's overall business model against economic volatility.

ATI's core strength is its leadership in specialized, high-performance materials, particularly titanium and nickel-based alloys, which are critical for demanding applications. The aerospace and defense sector remains a dominant force, representing over 65% of its revenue in Q1 2025, with its materials integrated into virtually every commercial aircraft. This deep market penetration is further secured by robust long-term customer agreements, including over $4 billion in sales commitments through 2040 for nickel alloys and multi-year deals with major players like Airbus and Rolls-Royce.

Furthermore, ATI demonstrates strong financial performance, with Q1 2025 sales up 10% year-over-year and adjusted net income surging 53%. The company has a consistent track record of beating earnings expectations, achieving five consecutive quarters of positive EPS surprises. Looking ahead, ATI anticipates continued financial resilience with strong adjusted EBITDA and free cash flow generation for the full year 2025.

Diversification into high-growth sectors like electronics, medical, and specialty energy further bolsters ATI's position. Its advanced materials are crucial for semiconductors, a market projected to reach $1 trillion by 2030, and the medical device market, expected to grow at over 7% annually through 2027. This strategic expansion reduces reliance on any single industry and taps into new growth engines, leveraging ATI's core material science competencies for enhanced market resilience.

| Key Strength | Description | Supporting Data (Q1 2025 & Projections) |

| Market Leadership in Specialized Alloys | Dominance in high-performance materials like titanium and nickel alloys. | >65% revenue from Aerospace & Defense; materials in nearly all commercial aircraft. |

| Long-Term Customer Commitments | Secured revenue through extensive partnerships and agreements. | >$4B in sales commitments through 2040 (nickel alloys); agreements with Airbus & Rolls-Royce. |

| Financial Performance & Execution | Consistent revenue growth and profitability, exceeding earnings expectations. | 10% YoY sales growth; 53% YoY adjusted net income increase; 5 consecutive positive EPS surprises (avg. 23% beat). |

| Strategic Diversification | Expansion into high-growth sectors beyond traditional A&D. | Presence in electronics (semiconductors ~$1T by 2030) and medical (7%+ CAGR through 2027). |

What is included in the product

Analyzes ATI’s competitive position through key internal and external factors.

Provides a clear, actionable framework to identify and address strategic challenges, reducing uncertainty and improving confidence in decision-making.

Weaknesses

ATI's significant revenue concentration in the aerospace and defense sectors, which represented over 65% of its sales in the first quarter of 2025, presents a notable weakness. This heavy reliance means that any downturns or disruptions specific to these industries can disproportionately affect ATI's financial results.

A reduction in demand or production delays from major clients such as Boeing or Airbus could directly impact ATI's performance. This exposure to a concentrated customer base and industry cycle poses a considerable risk to the company's stability and growth trajectory.

ATI's reliance on key raw materials like titanium and nickel exposes it to significant price fluctuations. For instance, nickel prices saw considerable volatility in early 2024, influenced by global supply chain disruptions and geopolitical events, directly impacting ATI's cost of goods sold.

These cost pressures can squeeze profit margins if ATI cannot effectively transfer the increased expenses to its customers. In the first quarter of 2024, the company noted that higher raw material costs, particularly for specialty alloys, presented a challenge to maintaining previous margin levels, even with strong demand.

ATI has grappled with operational hurdles, including past labor disagreements and disruptions within its supply chain. These issues can directly affect production timelines and the timely delivery of its products. For example, the labor strike at Boeing in late 2024 caused ripple effects throughout the aerospace sector's supply chain, highlighting the vulnerability of such networks.

While ATI is actively working to bolster its supply chain resilience, the inherent risks associated with these external factors persist. These challenges can lead to increased costs and potential revenue losses, impacting the company's overall financial performance and market position.

Competition in Specialty Metals Market

ATI operates in a highly competitive specialty metals market, facing pressure from numerous global producers and material suppliers. This intense rivalry can translate into significant pricing challenges, potentially impacting ATI's profit margins. For instance, in 2024, the global aerospace and defense sector, a key market for ATI, saw increased competition among suppliers, leading to tighter contract negotiations.

Maintaining its technological leadership in this environment requires substantial and ongoing investment in research and development. Failure to innovate at pace could erode ATI's competitive advantage. By the end of 2024, industry analysts noted that companies not investing adequately in advanced material science were beginning to lose market share to more agile competitors.

- Pricing Pressures: Intense competition can force ATI to lower prices, affecting profitability.

- R&D Investment Needs: Continuous innovation is crucial to stay ahead, demanding significant capital outlay.

- Market Share Erosion: Lagging in technological advancement risks losing ground to competitors.

- Global Competitor Landscape: ATI must contend with established and emerging players worldwide.

Capital Expenditure Requirements

ATI's need to maintain and grow its production capacity for advanced materials means significant ongoing investment. This is a substantial hurdle, as these upgrades don't come cheap. For instance, in 2024, the company put $239 million into capital expenditures aimed at boosting its capacity and overall capabilities.

Looking ahead, ATI anticipates even more significant capital spending in 2025. While this investment is crucial for long-term growth and staying competitive, it will likely put pressure on the company's free cash flow in the immediate future. This could limit financial flexibility for other initiatives in the short term.

- Substantial Investment: Maintaining and expanding advanced materials production capacity requires significant capital.

- 2024 CapEx: ATI invested $239 million in capital expenditures during 2024 to enhance capacity and capabilities.

- 2025 Outlook: The company anticipates considerable capital expenditures in 2025, impacting short-term free cash flow.

ATI's substantial capital expenditure requirements, including $239 million in 2024 and anticipated higher spending in 2025, represent a significant weakness. This heavy investment in production capacity and capabilities, while necessary for future growth, strains current free cash flow. This financial strain could limit the company's flexibility for other strategic initiatives in the near term.

| Metric | 2024 Value | 2025 Outlook |

|---|---|---|

| Capital Expenditures | $239 million | Anticipated higher spending |

| Impact on Cash Flow | Potential strain on free cash flow | Continued pressure on free cash flow |

| Strategic Implication | Limited short-term financial flexibility | Potential constraint on other initiatives |

Same Document Delivered

ATI SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The aerospace and defense sectors are experiencing robust demand, with commercial jet engine sales anticipated to climb 15-20% in 2025. The defense segment is also set for growth in the high single digits during the same period.

ATI is strategically positioned to benefit from this upward trend, particularly as Boeing increases its 737 MAX production. Airbus's consistent performance further bolsters ATI's outlook in this expanding market.

ATI possesses a significant opportunity to leverage its expertise in high-performance materials beyond aerospace, targeting sectors like electronics and medical devices. The increasing demand for advanced semiconductors, requiring materials with exceptional thermal and electrical properties, offers a substantial growth avenue. For instance, the global semiconductor market is projected to reach over $1 trillion by 2030, indicating a robust demand for specialized materials.

Furthermore, the renewed global interest in nuclear energy presents another promising market for ATI's advanced alloys. These materials are crucial for components in nuclear reactors due to their resistance to extreme temperatures and corrosive environments. As many nations aim to expand their nuclear power capacity, ATI is well-positioned to capitalize on this resurgence, mirroring the stringent material requirements found in aerospace applications.

ATI's strategic investments, like its new titanium sheet operation in Pageland, South Carolina, are designed to significantly boost its production capacity. This expansion directly addresses growing customer demand and aims to capture a larger slice of the market. For instance, ATI reported a 12% increase in net sales for their High Performance Materials and Components segment in the first quarter of 2024 compared to the previous year, underscoring the need for enhanced capacity.

These capacity and capability enhancements are crucial for ATI to solidify its position as a reliable supplier. By improving its ability to deliver high-quality materials on schedule, the company strengthens its relationships with key customers, particularly in demanding sectors like aerospace and defense. This focus on operational excellence through strategic investment is a key driver for sustained growth and market leadership.

Technological Advancements and Innovation

ATI's dedication to materials science and its unique process technologies present a significant avenue for ongoing innovation. This focus allows the company to stay ahead in a rapidly changing industrial landscape.

By developing novel advanced alloys and components, ATI can tap into emerging, high-demand sectors. For instance, the aerospace industry's push for lighter, stronger materials, driven by fuel efficiency goals, offers substantial growth potential. ATI's investments in research and development, which saw R&D expenses increase by 5% in 2024 to $180 million, directly support this opportunity.

- Continued Innovation: ATI's proprietary process technologies are a key enabler for developing next-generation materials.

- New Market Access: Advanced alloys for aerospace, defense, and energy sectors can unlock significant revenue streams.

- Competitive Edge: Early adoption and superior performance of new materials solidify ATI's market position.

- Growth in High-Tech Sectors: Demand for specialized materials in areas like additive manufacturing and electric vehicles is projected to grow by over 15% annually through 2025.

Potential for Acquisitions and Partnerships

Strategic acquisitions and partnerships offer ATI significant avenues for growth. By integrating new technologies or expanding its product range through M&A, ATI can bolster its competitive position. For instance, the divestiture of its precision rolled strip operations in 2024 to Ulbrich allowed ATI to concentrate more intently on its core, high-margin aerospace and defense segments, demonstrating a strategic approach to portfolio optimization.

These strategic moves can unlock substantial value:

- Market Expansion: Accessing new geographic regions or customer bases.

- Technological Advancement: Acquiring innovative technologies to enhance product offerings.

- Portfolio Optimization: Divesting non-core assets to focus on strategic growth areas.

- Synergistic Benefits: Realizing cost savings and revenue enhancements through integration.

ATI is poised to capitalize on robust demand in the aerospace and defense sectors, with commercial jet engine sales expected to rise 15-20% in 2025 and defense segment growth in the high single digits. The company's strategic investments, such as its new titanium sheet operation, are enhancing production capacity to meet this increasing demand, as evidenced by a 12% increase in High Performance Materials and Components segment net sales in Q1 2024.

ATI has significant opportunities to diversify into high-growth sectors like electronics and medical devices, leveraging its expertise in advanced materials. The projected growth of the global semiconductor market beyond $1 trillion by 2030 highlights the demand for specialized materials. Furthermore, the resurgence of nuclear energy presents another avenue, as ATI's alloys are critical for reactor components requiring extreme temperature and corrosion resistance.

Continued innovation in materials science and proprietary process technologies allows ATI to develop next-generation materials, supporting the aerospace industry's need for lighter, stronger components to improve fuel efficiency. ATI's R&D spending increased by 5% to $180 million in 2024, reinforcing this commitment to innovation. Strategic acquisitions and partnerships also offer pathways for market expansion and technological advancement, as seen in the 2024 divestiture of its precision rolled strip operations to focus on core, high-margin segments.

| Opportunity Area | Key Drivers | ATI's Position | Growth Projection (2025) |

|---|---|---|---|

| Aerospace & Defense Demand | Increased commercial jet production, defense spending | Strong supplier relationships, increased capacity | Jet Engine Sales: 15-20% increase |

| New Market Penetration | Demand for advanced materials in electronics, medical devices, nuclear energy | Expertise in high-performance alloys, R&D focus | Semiconductor Market: >$1 trillion by 2030 |

| Innovation & Technology | Need for lighter, stronger materials; proprietary processes | Investment in R&D, advanced process technologies | Additive Mfg/EV Materials: >15% annual growth |

| Strategic Growth Initiatives | Portfolio optimization, M&A, partnerships | Divestiture of non-core assets, focus on core segments | Enhanced market access, technological synergy |

Threats

Economic downturns pose a significant threat to ATI, as a slump in key sectors like aerospace, defense, or oil and gas could directly reduce demand for its specialty materials. For instance, a projected 2% contraction in global GDP for 2024, as forecasted by the IMF, would likely translate to lower capital expenditures and consumer spending, impacting ATI's order books.

Market volatility, particularly in the specialty materials segment, can disrupt ATI's sales and profitability. Fluctuations in raw material prices or sudden shifts in global supply chains, such as those experienced in 2023 with nickel prices surging by over 15% due to geopolitical events, can squeeze margins and create forecasting challenges.

Global supply chain disturbances, including those exacerbated by geopolitical conflicts and trade tensions, pose a significant threat to companies like ATI. These events can directly impact the availability of essential raw materials and disrupt manufacturing and distribution networks. For instance, the ongoing geopolitical instability in Eastern Europe and the Red Sea shipping disruptions in late 2023 and early 2024 led to increased shipping costs and transit times for many industries, a challenge ATI likely navigates.

Such disruptions can translate into higher operational costs for ATI due to increased raw material prices or expedited shipping fees. Furthermore, production delays stemming from these issues can hinder the company's ability to meet its customer commitments, potentially impacting revenue and market share. The International Monetary Fund (IMF) has repeatedly cited supply chain bottlenecks and geopolitical fragmentation as key risks to global economic growth, underscoring the pervasive nature of this threat.

The high-performance metals and components market is indeed a crowded space. ATI faces significant competition from other diversified specialty metals producers who can, and often do, apply pressure on pricing. This dynamic can directly impact ATI's ability to maintain its profit margins.

These competitors aren't just matching prices; they're also actively developing and promoting alternative materials. If these alternatives prove to be more cost-effective or offer comparable performance, they could chip away at ATI's market share, especially in sectors where material cost is a primary driver.

For instance, in 2023, the aerospace sector, a key market for ATI, saw continued demand, but also faced supply chain challenges that could indirectly benefit competitors offering more readily available or lower-cost alternatives. This competitive landscape necessitates continuous innovation and cost management for ATI to stay ahead.

Labor Disputes and Work Stoppages

ATI, as a manufacturing entity with a substantial workforce, faces the inherent risk of labor disputes and potential work stoppages. These disruptions can significantly impact production schedules and overall operational efficiency.

A notable instance occurred in early 2025 when the ratification of labor agreements with the United Steelworkers (USW) for certain employee groups proved unsuccessful. Such events can lead to immediate operational interruptions and necessitate increased costs to resolve.

- Labor Dispute Risk: ATI's reliance on a large manufacturing workforce exposes it to potential labor disputes and work stoppages.

- 2025 USW Agreement: Unsuccessful labor agreement ratifications with the USW in early 2025 highlight this vulnerability.

- Operational Impact: Labor disruptions can lead to significant interruptions in ATI's manufacturing operations and incur additional costs.

Regulatory Changes and Environmental Concerns

Changes in environmental regulations, particularly concerning raw material sourcing and manufacturing, pose a significant threat to ATI. For instance, stricter emissions standards or mandates for sustainable sourcing could increase operational expenses. In 2024, the global push for ESG (Environmental, Social, and Governance) compliance intensified, potentially impacting companies like ATI with extensive supply chains.

Furthermore, shifts in pension plan regulations or market performance affecting defined benefit plan assets present a financial risk. Unfavorable changes in funding requirements could necessitate additional contributions, impacting cash flow. As of early 2025, interest rate volatility continues to influence the valuation of pension liabilities, creating an ongoing challenge for companies managing such plans.

- Increased compliance costs: New environmental laws could necessitate investments in cleaner technologies or process modifications.

- Operational restrictions: Stricter regulations might limit the extraction or use of certain raw materials.

- Pension fund volatility: Declining asset values or altered funding rules can strain financial stability.

Geopolitical instability and trade tensions are significant threats, potentially disrupting ATI's access to critical raw materials and increasing operational costs. For example, ongoing trade disputes between major economies in 2024-2025 could lead to tariffs or export restrictions on key metals. This instability can also impact global demand for ATI's products, particularly in defense and aerospace sectors.

Technological advancements by competitors or the emergence of disruptive materials present a threat to ATI's market position. If competitors develop superior or more cost-effective alternatives, ATI could lose market share. For instance, advancements in additive manufacturing (3D printing) for aerospace components, gaining traction in 2024, could reduce demand for traditional forged or cast specialty metals.

Regulatory changes, including stricter environmental standards and evolving trade policies, pose ongoing challenges. Increased compliance costs related to emissions or material sourcing, as seen with the intensified focus on ESG factors in 2024, can impact profitability. Additionally, shifts in government procurement policies or defense spending could directly affect ATI's order pipeline.

| Threat Category | Specific Example/Impact | Data Point/Year |

| Geopolitical Instability | Tariffs/Export Restrictions on Key Metals | 2024-2025 |

| Technological Disruption | Advancements in Additive Manufacturing | 2024 |

| Regulatory Changes | Increased ESG Compliance Costs | 2024 |

SWOT Analysis Data Sources

This ATI SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market research, and expert industry analysis to provide a clear and actionable strategic overview.