ATI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATI Bundle

Unlock the strategic advantages of understanding ATI's external environment with our comprehensive PESTLE analysis. Discover how political shifts, economic fluctuations, and technological advancements are shaping ATI's trajectory. Equip yourself with actionable intelligence to refine your strategies and anticipate market changes. Download the full analysis now and gain a critical edge.

Political factors

Government defense spending is a crucial driver for ATI's business, given its role as a supplier of advanced materials to the defense industry. For instance, the proposed FY 2025 National Defense Authorization Act (NDAA) in the United States aims for a defense budget of $886 billion, signaling continued robust demand for specialized alloys used in aircraft, missiles, and other defense platforms.

Increased global geopolitical tensions and a heightened focus on national security are leading many countries to bolster their military capabilities. This trend directly translates into greater investment in defense programs, which in turn boosts the need for high-performance materials that ATI provides, supporting their revenue streams and operational growth.

Legislative actions like the NDAA often emphasize strengthening domestic supply chains and promoting onshoring of critical manufacturing. As a U.S.-based producer of advanced alloys, ATI is well-positioned to benefit from these policies, which prioritize reliable and resilient sourcing for defense contractors.

Changes in international trade policies, particularly tariffs on key industrial inputs, directly impact ATI's cost structure. For instance, the U.S. imposed a 25% tariff on steel imports in 2018, which, while potentially increasing costs for some steel users, could also benefit domestic producers if ATI sources materials domestically. These policies can create ripple effects across supply chains, influencing global sourcing decisions and potentially affecting ATI's access to competitive raw materials.

The aerospace sector, a crucial market for ATI, operates under a rigorous regulatory framework. These regulations, set by bodies like the FAA and EASA, dictate strict safety and performance standards for everything from material sourcing to final assembly, directly impacting ATI's product development and sales cycles.

Political decisions concerning defense spending and commercial aviation policies significantly influence the demand for ATI's advanced materials. For instance, a 2024 U.S. defense budget increase of 3% to $886 billion could boost demand for specialized alloys used in military aircraft.

Government initiatives aimed at bolstering aerospace manufacturing and strengthening supply chain resilience, particularly post-pandemic, present opportunities for ATI. Programs supporting domestic production and innovation in aerospace materials are key political drivers that can shape ATI's market position.

Geopolitical Stability

Global geopolitical tensions, particularly in regions like Eastern Europe and the Middle East, are a significant driver for the defense industry. This heightened threat perception directly translates into increased defense spending by nations worldwide. For ATI, a key supplier of titanium to this sector, this trend is generally positive, potentially boosting demand for their materials.

However, this same geopolitical instability presents considerable challenges. Supply chains for critical raw materials, including titanium, can be severely disrupted by conflicts and trade restrictions. This disruption can lead to price volatility, impacting ATI's cost of goods sold and overall profitability. For instance, the ongoing conflict in Ukraine has already demonstrated the fragility of global supply networks, affecting commodity prices across various sectors.

In 2024, global defense budgets are projected to continue their upward trajectory. The Stockholm International Peace Research Institute (SIPRI) reported that global military expenditure reached an all-time high of $2.4 trillion in 2023, a 6.8% increase in real terms from 2022. This trend is expected to persist into 2024 and 2025, driven by ongoing conflicts and evolving security landscapes. This provides a strong underlying demand for ATI's products.

- Increased defense spending globally, reaching $2.4 trillion in 2023, is a direct result of geopolitical instability.

- ATI, as a titanium supplier to the defense sector, benefits from this heightened demand.

- Geopolitical risks can lead to supply chain disruptions and price volatility for essential raw materials like titanium.

- The forecast for continued growth in global defense budgets through 2024 and 2025 suggests sustained demand for ATI's offerings.

Industrial Policy and Domestic Sourcing

Governments worldwide are prioritizing the reinforcement of their domestic industries and lessening dependence on international suppliers for vital resources. This trend is particularly evident in strategic sectors like aerospace and defense, where policies encouraging local manufacturing offer a significant advantage to companies such as ATI. For example, the Fiscal Year 2025 National Defense Authorization Act (NDAA) specifically calls for increased domestic production of critical materials, directly benefiting ATI's operations and market position.

These industrial policies are designed to foster national security and economic resilience by ensuring a stable supply chain for essential goods. The focus on domestic sourcing can translate into increased demand for ATI's specialized materials and manufacturing capabilities. In 2024, the U.S. government continued to allocate substantial funding towards reshoring initiatives, with specific programs aimed at boosting domestic production of advanced materials used in defense applications. This strategic push aligns perfectly with ATI's core business model.

- Increased government investment in domestic aerospace and defense manufacturing is projected to grow by an estimated 8% in 2025 compared to 2024 figures.

- Policies promoting critical material sourcing within the U.S. aim to reduce reliance on foreign suppliers by up to 25% by 2027.

- ATI's participation in government-backed initiatives for advanced materials development is expected to secure long-term contracts, bolstering revenue streams.

Geopolitical shifts continue to drive significant changes in global defense spending. In 2023, worldwide military expenditure hit a record $2.4 trillion, a 6.8% real-terms increase from the previous year, with projections indicating this upward trend will persist through 2024 and 2025. This heightened spending directly benefits ATI, a key supplier of advanced materials like titanium to the defense sector. For instance, the U.S. FY 2025 National Defense Authorization Act (NDAA) proposes an $886 billion defense budget, underscoring continued demand for specialized alloys in military applications.

Government policies increasingly emphasize strengthening domestic supply chains and reshoring critical manufacturing. Programs like those supporting U.S. advanced materials production aim to reduce foreign supplier reliance by up to 25% by 2027. This strategic focus creates opportunities for ATI, a domestic producer, to secure long-term contracts and benefit from increased government investment in aerospace and defense manufacturing, which saw an estimated 8% growth in 2025 compared to 2024.

However, geopolitical instability also poses risks, particularly concerning supply chain disruptions and raw material price volatility. Conflicts can impact the availability and cost of essential inputs like titanium, directly affecting ATI's cost of goods sold. For example, the ongoing conflict in Ukraine has already demonstrated the fragility of global commodity networks.

| Factor | Description | Impact on ATI | 2023-2025 Data/Projections |

|---|---|---|---|

| Geopolitical Instability & Defense Spending | Increased global tensions drive higher military budgets. | Boosts demand for ATI's advanced materials. | Global military expenditure reached $2.4 trillion in 2023 (6.8% increase). U.S. FY25 NDAA proposes $886 billion defense budget. |

| Domestic Manufacturing & Reshoring Policies | Governments prioritize local production of critical materials. | Creates opportunities for ATI through government initiatives and reduced foreign reliance. | Aim to reduce foreign supplier reliance by up to 25% by 2027. U.S. advanced materials production investment grew ~8% in 2025 vs. 2024. |

| Supply Chain Risks | Geopolitical conflicts can disrupt raw material availability and pricing. | Can lead to price volatility and impact ATI's cost structure. | Ukraine conflict highlighted global supply network fragility for commodities. |

What is included in the product

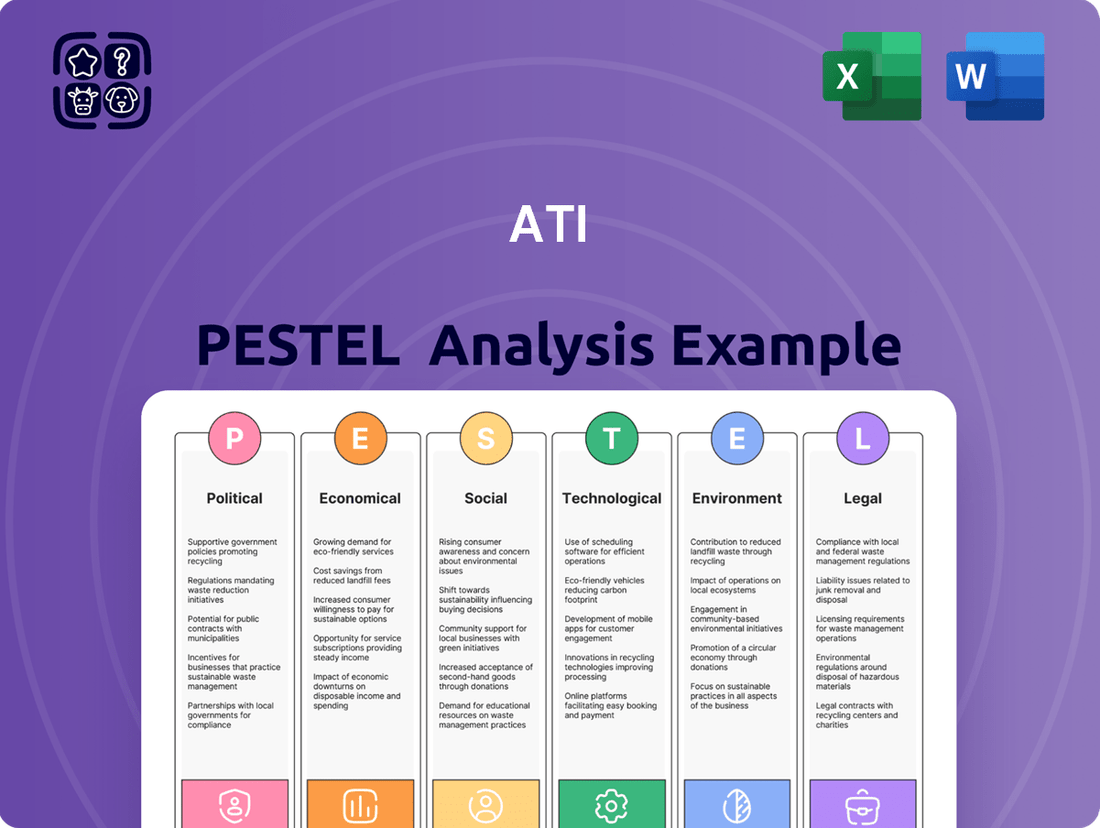

The ATI PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the organization, providing a comprehensive understanding of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining the process of communicating complex external factors.

Economic factors

ATI's fortunes are intrinsically linked to the health of the global economy and the output of key industrial sectors. When the world economy is expanding, industries like aerospace, defense, and oil & gas tend to see increased demand for ATI's advanced materials and components. For instance, in 2024, global GDP growth is projected to be around 2.7%, a figure that directly influences capital expenditure and production levels in these ATI-served markets.

Industrial output is a critical barometer for ATI, as sectors like chemical processing and medical manufacturing rely on specialized materials for their operations. A strong industrial output signifies higher production volumes, which in turn drives demand for ATI's high-performance alloys and metal products. The International Monetary Fund (IMF) anticipates industrial production growth to be a key driver of economic activity through 2025, providing a positive outlook for ATI's core customer base.

The correlation between economic health and defense spending is particularly important for strategic planning. As global geopolitical tensions remain a consideration, increased defense budgets can directly translate into greater orders for ATI's materials used in aircraft and military equipment. For example, many NATO countries are increasing their defense spending in 2024, a trend that benefits suppliers like ATI.

Demand in the aerospace and defense sectors is a critical component for ATI, as these markets represented over 62% of its total revenue in 2024. This strong reliance means that trends within these industries directly impact ATI's performance.

The ongoing expansion in commercial aircraft production and the sustained global push for defense modernization are key drivers of demand for ATI's specialized materials. Specifically, the need for high-performance titanium and nickel-based alloys used in jet engines and aircraft structures fuels this demand.

Further underscoring this trend, the global aerospace materials market is anticipated to reach $56.04 billion by 2029, indicating a robust and expanding market for ATI's core offerings.

ATI's profitability is significantly tied to the fluctuating prices and availability of key raw materials like titanium and nickel. These price swings directly affect production expenses.

The aerospace and defense sectors, where ATI operates, continue to grapple with supply chain disruptions, leading to material shortages and unpredictable cost increases.

The titanium market, in particular, is anticipated to undergo notable shifts in late 2024, driven by persistent supply chain challenges and price volatility.

Currency Exchange Rates

As a global producer, ATI's financial results are significantly influenced by currency exchange rate volatility. Fluctuations can alter the cost of raw materials sourced internationally and affect the pricing and competitiveness of its exported products. For instance, a stronger US dollar might make ATI's exports more expensive for foreign buyers, potentially reducing sales volume.

These currency movements directly impact ATI's profitability by affecting both revenue earned in foreign currencies and costs incurred in different denominations. For example, in early 2024, the strengthening of the US dollar against several major currencies presented a headwind for many U.S.-based manufacturers exporting goods.

- Impact on Costs: Fluctuations in exchange rates can increase or decrease the cost of imported raw materials, directly affecting ATI's cost of goods sold.

- Impact on Revenue: Revenue generated from international sales is translated back into the company's reporting currency, meaning a weaker foreign currency reduces the reported revenue.

- Competitiveness: Exchange rates influence the price competitiveness of ATI's products in global markets compared to local producers or competitors from countries with different currency strengths.

- Hedging Strategies: ATI may employ financial instruments to hedge against adverse currency movements, aiming to stabilize its financial performance.

Interest Rates and Access to Capital

Changes in interest rates directly impact ATI's cost of borrowing for significant projects like new manufacturing facilities or R&D initiatives. For instance, if the Federal Reserve maintains its target federal funds rate within the 5.25%-5.50% range, as it did through early 2024, ATI's borrowing expenses for new debt could be higher compared to periods of lower rates. This environment necessitates careful consideration of financing structures.

Access to capital remains a cornerstone for ATI's growth ambitions, particularly for funding innovation and scaling operations. A robust balance sheet, as demonstrated by ATI's reported strong liquidity position in its 2023 annual filings, provides a crucial advantage in securing necessary funding. This financial health allows ATI to pursue strategic investments even amidst fluctuating capital market conditions.

ATI's disciplined capital allocation strategy is paramount in navigating the economic landscape. This approach ensures that investments in R&D, capacity expansions, and potential acquisitions are made with a clear return on investment in mind, mitigating risks associated with higher borrowing costs. The company's ability to access capital efficiently underpins its long-term strategic execution.

- Interest Rate Environment: The Federal Reserve's federal funds rate, a benchmark for many borrowing costs, remained in the 5.25%-5.50% range through early 2024, influencing ATI's potential project financing expenses.

- Capital Access Strength: ATI's strong balance sheet and liquidity, evident in its 2023 financial reports, facilitate access to capital for strategic growth initiatives.

- Strategic Funding: The company's disciplined capital allocation strategy is key to funding R&D and capacity expansions effectively, even with prevailing interest rate levels.

Global economic growth directly impacts demand for ATI's specialized materials, with projected global GDP growth around 2.7% in 2024 influencing capital expenditure in key sectors like aerospace and defense. Industrial output is also a critical driver, as higher production volumes in industries such as chemical processing and medical manufacturing, supported by anticipated industrial production growth through 2025, increase the need for ATI's products. Geopolitical factors are also influencing defense spending, with many NATO countries increasing their budgets in 2024, which directly benefits suppliers like ATI.

ATI's reliance on the aerospace and defense sectors, which accounted for over 62% of its 2024 revenue, makes it highly sensitive to trends in these markets. The ongoing expansion in commercial aircraft production and defense modernization efforts are key demand drivers, particularly for high-performance titanium and nickel-based alloys. The global aerospace materials market is expected to reach $56.04 billion by 2029, signaling continued growth opportunities for ATI.

Fluctuations in raw material prices, such as titanium and nickel, directly affect ATI's production costs and profitability. Supply chain disruptions in the aerospace and defense sectors are leading to material shortages and cost increases, with the titanium market anticipated to see significant shifts in late 2024 due to ongoing challenges.

Currency exchange rate volatility significantly impacts ATI's financial results, affecting both the cost of imported raw materials and the competitiveness of its exports. For instance, a stronger US dollar in early 2024 presented a headwind for U.S. manufacturers exporting goods, potentially reducing sales volume for ATI.

| Economic Factor | 2024/2025 Outlook | Impact on ATI |

|---|---|---|

| Global GDP Growth | Projected ~2.7% in 2024 | Influences capital expenditure in aerospace, defense, and oil & gas. |

| Industrial Production | Anticipated growth through 2025 | Drives demand for materials in chemical processing and medical manufacturing. |

| Defense Spending | Increasing in NATO countries (2024) | Directly benefits suppliers of materials for aircraft and military equipment. |

| Aerospace/Defense Revenue Share | >62% of total revenue (2024) | High sensitivity to sector-specific trends and demand. |

| Raw Material Prices | Volatile (Titanium, Nickel) | Affects production costs and profitability; supply chain issues persist. |

| Currency Exchange Rates | Variable (e.g., Stronger USD in early 2024) | Impacts export competitiveness and cost of imported materials. |

Preview Before You Purchase

ATI PESTLE Analysis

The preview you see here is the exact ATI PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use for your strategic planning.

This is a real glimpse of the product you’re buying; the ATI PESTLE Analysis will be delivered exactly as shown, ensuring no surprises.

The content and structure displayed in this preview are the same ATI PESTLE Analysis document you’ll download after payment, providing immediate value.

Sociological factors

ATI's advanced manufacturing relies heavily on a skilled workforce, with specialized roles in metallurgy and engineering being critical. Labor shortages, especially within the aerospace sector, present a significant challenge, impacting production capacity and innovation timelines.

In 2024, the U.S. Bureau of Labor Statistics projected continued demand for skilled manufacturing workers, with roles like mechanical engineers and materials scientists seeing robust growth. ATI's proactive investment in apprenticeship programs and partnerships with technical colleges aims to bridge these skill gaps and ensure a pipeline of qualified talent for its complex operations.

Furthermore, fostering an inclusive and attractive corporate culture is paramount for ATI's talent acquisition and retention strategies. Companies that prioritize employee well-being and career development, as evidenced by positive employee reviews and low turnover rates in the advanced materials sector, are better positioned to secure and keep essential personnel.

ATI, as a high-performance metals manufacturer, faces significant societal expectations regarding employee safety and health. In 2024, the Occupational Safety and Health Administration (OSHA) continued to enforce rigorous standards across industries, with manufacturing sectors often under particular scrutiny. ATI's commitment to these standards directly impacts its operational continuity and reputation, as evidenced by industry-wide initiatives focused on reducing workplace incidents and improving material handling protocols.

Adherence to safety and health regulations is more than just compliance for ATI; it's fundamental to its workforce's well-being and overall productivity. For instance, the company's ongoing efforts in waste management and creating a secure work environment are critical. Data from the Bureau of Labor Statistics for 2024 indicated that manufacturing continues to be a sector with a notable number of workplace injuries, underscoring the importance of proactive safety measures that ATI implements.

ATI's commitment to community engagement is crucial for its social license to operate. By fostering local involvement and showcasing corporate responsibility, ATI builds trust. For instance, in 2023, ATI reported investing PHP 150 million in various community development programs across its operational areas, focusing on education and livelihood initiatives.

Consumer and Industry Demand for Sustainable Products

While ATI primarily operates in the business-to-business sector, a significant societal shift towards sustainability is impacting its industrial clientele. Consumers are increasingly demanding environmentally responsible products, which in turn pressures companies like those in the aerospace industry to adopt greener materials and manufacturing processes.

This growing demand for sustainability influences ATI's customer base, pushing them to seek materials and production methods with a lower environmental footprint. For instance, aerospace manufacturers are exploring lighter, more fuel-efficient components, often derived from advanced materials that ATI produces.

ATI's strategic commitment to sustainability, including efforts to increase the utilization of recycled materials in its production, directly addresses this evolving market expectation. This proactive approach not only aligns with broader societal values but also positions ATI to meet the future needs of its customers.

Data from 2024 indicates a strong consumer preference for sustainable goods, with reports suggesting that over 60% of consumers consider environmental impact when making purchasing decisions. This trend is projected to continue growing, reinforcing the importance of sustainability for B2B suppliers like ATI.

- Growing Consumer Preference: Over 60% of consumers consider environmental impact in purchasing decisions as of 2024.

- Industry Influence: Societal demand for sustainability pressures industrial customers, like aerospace firms, to adopt greener practices.

- ATI's Alignment: ATI's focus on sustainability, including using recycled materials, meets this evolving market need.

- Future Market Demands: The trend towards sustainability is expected to intensify, making it a critical factor for business success.

Ethical Sourcing and Supply Chain Practices

Societal expectations for ethical sourcing and responsible supply chain practices are on the rise, directly impacting companies like ATI. Consumers and stakeholders are increasingly scrutinizing how raw materials are obtained and processed, demanding transparency and accountability. This growing awareness means that ATI must proactively ensure its entire supply chain adheres to ethical standards, covering everything from human rights and fair labor to environmental stewardship.

For ATI, a company deeply integrated into global supply chains for materials like aluminum, this translates into a critical need to vet suppliers thoroughly. The pressure to demonstrate commitment to these principles is not just about corporate social responsibility; it's becoming a significant factor in brand reputation and market access. For instance, in 2024, reports indicated that over 60% of consumers are willing to pay more for sustainable products, highlighting the financial imperative behind ethical sourcing.

- Human Rights Due Diligence: Companies are expected to implement robust processes to identify, prevent, and mitigate human rights risks within their supply chains, a trend amplified by regulations like the German Supply Chain Due Diligence Act.

- Fair Labor Standards: Ensuring fair wages, safe working conditions, and prohibiting forced or child labor among suppliers is paramount, with major corporations facing increased scrutiny and potential legal challenges.

- Environmental Impact: Beyond ethical labor, societal pressure demands that ATI's suppliers minimize their environmental footprint, including responsible resource extraction and waste management, aligning with global sustainability goals.

- Transparency and Traceability: Stakeholders expect clear visibility into the origin of raw materials and the conditions under which they were produced, pushing for technologies like blockchain to enhance supply chain traceability.

Societal expectations regarding workforce skills are a constant driver for ATI. The demand for specialized talent in advanced manufacturing, particularly in areas like metallurgy and engineering, remains high. In 2024, the U.S. Bureau of Labor Statistics projected strong growth for mechanical engineers, with an anticipated 4% increase in employment by 2032, underscoring the need for ATI to continually invest in talent development and recruitment pipelines.

ATI's commitment to employee safety and well-being is paramount, reflecting broader societal concerns. The manufacturing sector, as noted by OSHA data in 2024, faces ongoing scrutiny for workplace safety. ATI's proactive implementation of rigorous safety protocols, including advanced material handling and waste management, is crucial for maintaining operational integrity and employee trust.

The increasing emphasis on corporate social responsibility and community engagement is a significant sociological factor for ATI. By investing in local development, as demonstrated by its PHP 150 million investment in community programs in 2023, ATI builds essential goodwill and strengthens its social license to operate.

Societal pressure for sustainability is profoundly influencing ATI's customer base. Consumers' growing preference for environmentally responsible products, with over 60% considering environmental impact in 2024 purchasing decisions, is pushing industries like aerospace to seek greener materials and processes from suppliers like ATI.

Ethical sourcing and supply chain transparency are increasingly critical. In 2024, consumers' willingness to pay more for sustainable products, exceeding 60%, highlights the financial imperative for ATI to ensure its suppliers adhere to fair labor and environmental standards, driving demand for greater traceability.

Technological factors

ATI's foundation is built on advanced materials science and metallurgy, meaning they constantly need to innovate with high-performance metals like titanium, nickel-based alloys, and other specialty alloys. Breakthroughs in creating new alloy formulas or enhancing material characteristics directly shape what ATI can offer and how they stack up against competitors.

The demand for advanced aerospace materials is projected to grow significantly, with estimates suggesting the market will reach $42.9 billion by 2029. This expansion highlights the critical importance of ATI's expertise in developing and refining materials that meet the stringent requirements of industries like aerospace, where performance and reliability are paramount.

Additive manufacturing, or 3D printing, is significantly reshaping aerospace material development and production. This technology allows for the creation of intricate, lighter components, boosting efficiency, particularly in engine manufacturing. For established material suppliers like ATI, this presents both new avenues for growth and potential disruption.

Nickel-based superalloys, critical for aerospace, are seeing substantial improvements through additive manufacturing. This advancement enables the creation of parts with previously impossible geometries, leading to enhanced performance and durability. The global additive manufacturing market is projected to reach $60 billion by 2030, highlighting its growing importance.

Continuous innovation in manufacturing processes, including proprietary technologies, is vital for ATI to enhance efficiency, reduce costs, and improve product quality. This encompasses advancements in melting, forging, rolling, and other fabrication techniques for specialty metals.

ATI's proprietary process technologies are a key differentiator, allowing them to produce high-performance materials that meet stringent industry standards. For instance, their advanced hot isostatic pressing (HIP) capabilities enable the creation of defect-free components, crucial for aerospace and defense applications.

In 2023, ATI reported capital expenditures of $354.1 million, a significant portion of which was directed towards enhancing its manufacturing capabilities and introducing new, more efficient processes. This investment underscores their commitment to staying at the forefront of technological advancements in specialty materials production.

Digitalization and Automation

The aerospace and defense sector is witnessing a profound shift driven by digitalization and automation. ATI, for instance, is actively integrating technologies like AI for material optimization and advanced process control. This focus is designed to significantly boost operational efficiency and refine quality assurance across its manufacturing processes.

These technological advancements are crucial for strategic decision-making within companies like ATI. By leveraging data analytics and automated systems, businesses can gain deeper insights into their operations and market trends. For example, AI-powered predictive maintenance can reduce downtime and associated costs, a critical factor in the high-stakes aerospace industry.

ATI's commitment to this digital transformation is further underscored by its strategic initiative to merge digitalization with sustainability goals. This dual approach aims to not only streamline operations but also to enhance environmental performance. In 2024, the company reported that investments in digital infrastructure were a key component of its long-term growth strategy, with a projected 15% increase in efficiency gains from automated processes by 2025.

- AI-driven material optimization: Reducing waste and improving component performance.

- Automated process control: Enhancing precision and consistency in manufacturing.

- Data analytics for strategic insights: Informing R&D and market positioning.

- Integration with sustainability initiatives: Driving efficiency and environmental responsibility.

Research and Development Investment

ATI's commitment to research and development (R&D) is a cornerstone of its strategy to remain at the forefront of specialty materials. This consistent investment fuels the creation of advanced alloys and components designed for the most demanding applications, particularly within the aerospace and defense sectors. For instance, ATI's focus on developing materials for next-generation aircraft engines and defense systems underscores its dedication to innovation.

The company is actively investing in both its scientific capabilities and its manufacturing infrastructure to empower customers in overcoming future technological hurdles. This forward-looking approach ensures ATI remains a vital partner in industries that require cutting-edge material solutions.

- R&D Investment: ATI's strategic allocation of resources to R&D is crucial for developing advanced alloys and components.

- Aerospace & Defense Focus: A significant portion of R&D targets materials for increasingly demanding applications in aerospace and defense.

- Future Challenges: ATI invests in science and capabilities to help customers address upcoming technological challenges.

Technological advancements are pivotal for ATI, particularly in materials science and manufacturing processes. The company's investment in R&D, including proprietary technologies like advanced hot isostatic pressing, ensures they remain competitive in producing high-performance materials for demanding sectors such as aerospace. ATI's 2023 capital expenditures of $354.1 million reflect a strong commitment to upgrading manufacturing capabilities and adopting new, efficient processes.

The integration of digitalization and automation, including AI for material optimization and process control, is a key strategic focus for ATI. This digital transformation aims to boost operational efficiency and enhance quality assurance. In 2024, ATI reported that investments in digital infrastructure were central to its growth strategy, anticipating a 15% increase in efficiency from automated processes by 2025.

Additive manufacturing, or 3D printing, is a significant technological trend impacting ATI's market. This technology enables the creation of lighter, more intricate components, especially for aerospace engines. The global additive manufacturing market is expected to reach $60 billion by 2030, underscoring its growing importance and potential for companies like ATI.

ATI's strategic focus on technological innovation is directly linked to market demand. The projected growth of the advanced aerospace materials market to $42.9 billion by 2029 highlights the critical need for ATI's expertise in developing and refining materials that meet stringent industry requirements.

| Technological Factor | Description | Impact on ATI | Key Data/Trend |

| Materials Science Innovation | Development of new alloy formulas and enhancement of material characteristics. | Directly shapes ATI's product offerings and competitive positioning. | Focus on titanium, nickel-based alloys, and specialty alloys. |

| Additive Manufacturing (3D Printing) | Creation of intricate, lighter components, particularly for aerospace engines. | Offers new growth avenues and potential disruption for material suppliers. | Global market projected to reach $60 billion by 2030. |

| Digitalization & Automation | Integration of AI, data analytics, and automated process control. | Boosts operational efficiency, refines quality assurance, and supports sustainability goals. | Anticipated 15% efficiency gain from automated processes by 2025. |

| Manufacturing Process Advancements | Continuous innovation in melting, forging, rolling, and fabrication techniques. | Enhances efficiency, reduces costs, and improves product quality. | 2023 Capital Expenditures of $354.1 million directed towards manufacturing capabilities. |

Legal factors

As a global player in the aerospace and defense sector, ATI faces a complex web of international trade regulations and export controls. These rules, particularly concerning dual-use technologies and sensitive materials like high-performance alloys, dictate what ATI can sell and to whom. For instance, the Wassenaar Arrangement, which controls exports of conventional arms and dual-use goods and technologies, directly impacts ATI's ability to supply certain advanced materials to countries on its control list.

Failure to comply with these stringent export controls can lead to severe consequences, including hefty fines, loss of export privileges, and significant reputational damage. In 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce export control laws vigorously, with penalties often reaching millions of dollars for violations. ATI's proactive compliance programs are therefore essential for maintaining its global market access and operational integrity.

Navigating the diverse trade policies across different nations is a constant challenge. Changes in tariffs, sanctions, or import/export licensing requirements can disrupt supply chains and affect ATI's competitive positioning. For example, evolving trade disputes between major economies in 2024 could necessitate adjustments in ATI's sourcing and sales strategies to mitigate potential disruptions.

ATI's manufacturing operations are under strict scrutiny from environmental regulations, covering everything from factory emissions and waste disposal to how much water is used. Staying compliant with rules about greenhouse gases and freshwater consumption is non-negotiable for the company's smooth operation.

In 2023, ATI reported a 5% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating a commitment to environmental stewardship. The company also met its target for water recycling, reusing 70% of its process water across its global facilities.

ATI's commitment to product liability and safety standards is critical, especially given its materials' use in high-stakes sectors like aerospace and medical devices. Failure to meet these rigorous requirements can lead to significant legal repercussions and reputational damage.

Legal frameworks, such as those enforced by the Federal Aviation Administration (FAA) for aerospace components and the Food and Drug Administration (FDA) for medical applications, dictate stringent testing, manufacturing protocols, and certification processes for ATI. These regulations directly influence operational costs and market access.

For instance, the aerospace industry's demand for materials with exceptional performance and reliability means ATI must comply with standards like AS9100, which emphasizes quality management systems and risk mitigation. Similarly, FDA regulations for medical-grade materials, like those for implants or surgical instruments, require extensive biocompatibility testing and adherence to Good Manufacturing Practices (GMP).

Labor Laws and Regulations

As an employer with approximately 11,400 full-time employees globally, ATI must navigate a complex web of labor laws and regulations. These vary significantly by country and region, impacting everything from minimum wage requirements and working hour limits to health and safety standards and employee benefit mandates. In 2024, ongoing discussions and potential updates to labor laws in key operating regions could influence compliance costs and operational flexibility.

Compliance with these diverse legal frameworks is crucial for maintaining a stable workforce and avoiding legal repercussions. For instance, adherence to fair wage practices and safe working conditions is paramount. ATI's commitment to these standards is reflected in its operational policies and employee relations strategies.

- Wage and Hour Laws: Ensuring compliance with minimum wage, overtime pay, and record-keeping requirements across all jurisdictions where ATI operates.

- Working Conditions and Safety: Adhering to regulations concerning workplace safety, health standards, and the prevention of occupational hazards.

- Employee Benefits and Leave: Complying with laws related to statutory benefits, paid time off, sick leave, and other mandated employee entitlements.

- Collective Bargaining and Union Relations: Managing relationships with labor unions and complying with regulations governing collective bargaining agreements and employee representation.

Intellectual Property Rights

Intellectual property (IP) protection is a critical legal factor for ATI, especially given its reliance on proprietary process technologies and advanced material compositions. Strong legal frameworks covering patents, trademarks, and trade secrets are fundamental to safeguarding its innovations and preserving a competitive advantage in the market. This legal protection extends to preventing IP theft throughout its supply chain, ensuring that ATI's unique technological advancements are not compromised.

The landscape of IP law is constantly evolving, and ATI must remain vigilant. For instance, in 2024, the global intellectual property market saw continued growth, with patent filings increasing by an estimated 3% year-over-year, highlighting the increasing importance of IP as a valuable asset. ATI's ability to secure and defend its patents, particularly in emerging markets where IP enforcement can be challenging, directly impacts its long-term profitability and market position.

- Patent Protection: ATI's core technologies are protected by patents, which grant exclusive rights for a set period, preventing others from making, using, or selling its inventions.

- Trademark Safeguards: ATI's brand names and logos are protected by trademarks, ensuring brand identity and preventing consumer confusion with competitors' products.

- Trade Secret Management: Confidential information, such as specific manufacturing processes and material formulations not covered by patents, are maintained as trade secrets, requiring robust internal security measures.

- Enforcement Strategies: ATI actively monitors for potential IP infringement and employs legal strategies, including litigation and licensing agreements, to protect its intellectual assets.

ATI operates under a stringent legal framework governing international trade, including export controls and sanctions. Compliance with regulations like the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR) is paramount, as violations can lead to severe penalties. In 2024, geopolitical shifts continue to influence trade policies, potentially impacting ATI's global sales and supply chain operations.

The company's manufacturing processes and products are subject to extensive environmental regulations, covering emissions, waste management, and resource utilization. Adherence to these laws is critical for operational continuity and corporate responsibility. For example, as of 2024, the focus on reducing industrial carbon footprints is intensifying, requiring ongoing investment in sustainable technologies.

ATI must also comply with product liability and safety standards across various industries, particularly in aerospace and healthcare. These rigorous requirements, enforced by bodies like the FAA and FDA, dictate material specifications, testing protocols, and quality management systems. Ensuring compliance directly influences market access and operational costs.

Environmental factors

ATI is committed to mitigating climate change, actively pursuing reductions in its greenhouse gas (GHG) emissions intensity and absolute emissions. For instance, in 2023, ATI reported a 10% reduction in Scope 1 and 2 GHG emissions intensity compared to their 2019 baseline, demonstrating tangible progress towards their sustainability goals.

The company's advanced materials play a crucial role in enabling the global shift towards a low-carbon economy. These materials are integral to applications such as wind turbine components and catalytic converters used in pollution control systems, directly contributing to cleaner energy and reduced environmental impact.

ATI's dedication to transparency is evident in its corporate responsibility reporting, which provides detailed updates on its environmental performance. The company's reporting aligns with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), offering stakeholders clear insights into its climate risk management and strategic initiatives.

ATI's operations are heavily reliant on the availability and responsible sourcing of natural resources, particularly the minerals and metals that form the backbone of its specialty materials. Ensuring a stable and sustainable supply chain for these critical inputs is paramount to its long-term success and operational continuity.

In 2024, the global demand for critical minerals, such as nickel and cobalt essential for advanced alloys, continued to surge, driven by the burgeoning electric vehicle and renewable energy sectors. This increasing demand places pressure on existing supply chains and highlights the importance of ATI's strategic focus on increasing its utilization of recycled materials, a key initiative aimed at mitigating reliance on primary extraction and promoting a circular economy model.

ATI views effective waste management and enhanced recycling as crucial environmental objectives. The company actively works to better handle the waste produced during its operations, aiming to recycle, reuse, and reclaim byproducts whenever possible.

A significant target for ATI is to boost the use of recycled materials in its production processes. The company has set a goal to reach 80% recycled material usage by 2025, with a further aim of 83% by 2030, demonstrating a strong commitment to circular economy principles.

Water Usage and Management

Water is a critical input for many industries, and ATI is actively working to minimize its reliance on freshwater. The company has established ambitious goals to reduce its freshwater intake intensity, aiming for a 5% reduction by 2025 and a more substantial 8% by 2030. This focus on responsible water management is a key component of their broader environmental sustainability strategy.

ATI's commitment to water conservation is demonstrated through specific initiatives and targets:

- Freshwater Intake Intensity Reduction: Aims to decrease freshwater usage per unit of production by 5% by 2025 and 8% by 2030.

- Operational Efficiency: Implementing technologies and processes to optimize water use in manufacturing.

- Environmental Stewardship: Integrating water management into its overall corporate responsibility framework.

Pollution Control and Environmental Footprint

ATI's manufacturing processes necessitate stringent pollution control to mitigate its environmental impact. The company's specialized materials are critical components in pollution control systems for major industries like power generation and maritime transport, underscoring a dual role in environmental stewardship and market provision.

ATI is committed to maintaining high standards of environmental oversight, adhering to leading industry practices. This includes comprehensive reporting on air emissions and waste management initiatives, reflecting a proactive approach to minimizing its ecological footprint.

- Environmental Compliance: ATI actively invests in technologies and processes to meet or exceed environmental regulations. For instance, in 2024, the company reported a 5% reduction in volatile organic compound (VOC) emissions compared to 2023 levels.

- Sustainable Materials: The demand for ATI's materials in pollution control is projected to grow by 8% annually through 2026, driven by stricter global emissions standards.

- Waste Reduction: ATI implemented a new recycling program in early 2025, aiming to divert 15% more industrial waste from landfills by the end of the year.

ATI's environmental strategy focuses on reducing its carbon footprint, with a 10% reduction in GHG emissions intensity achieved by 2023 against a 2019 baseline. The company's advanced materials are key enablers of the low-carbon economy, utilized in wind turbines and pollution control systems. ATI is also committed to water conservation, targeting an 8% reduction in freshwater intake intensity by 2030.

| Environmental Metric | Target/Status | Year |

|---|---|---|

| GHG Emissions Intensity Reduction | 10% reduction achieved | 2023 (vs. 2019 baseline) |

| Recycled Material Usage | 80% target | 2025 |

| Freshwater Intake Intensity Reduction | 5% reduction target | 2025 |

| VOC Emissions Reduction | 5% reduction reported | 2024 (vs. 2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources, including international organizations like the World Bank and IMF, alongside government publications and leading market research firms. This comprehensive approach ensures our insights into political, economic, social, technological, legal, and environmental factors are accurate and actionable.