ATI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATI Bundle

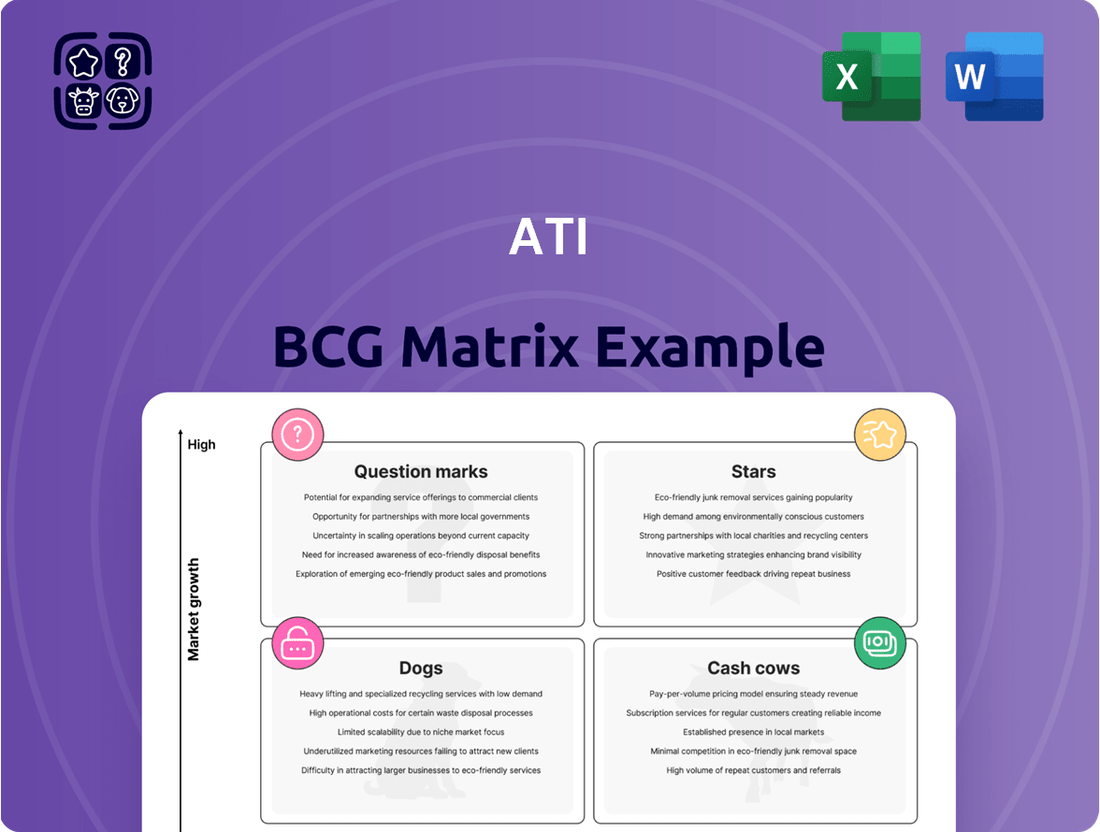

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth rate. This strategic framework helps businesses make informed decisions about resource allocation and future investments.

Ready to move beyond the basics? Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

ATI's dedicated focus on high-performance alloys for aerospace and defense applications positions this sector as a strong Star within its business portfolio. These specialized materials are critical for jet engines and airframes, demanding cutting-edge metallurgical solutions.

This segment demonstrated robust performance, making up a significant 66% of ATI's total sales in Q1 2025. The aerospace and defense sector experienced substantial growth, with sales climbing 23% year-over-year, underscoring its market strength and ATI's competitive edge.

Next-Generation Commercial Jet Engine Components are a clear Star for ATI. Sales in this high-growth area jumped an impressive 35% in the first quarter of 2025. This surge is driven by ATI's unique position as a sole-source supplier for five of the seven essential advanced nickel alloys used in today's sophisticated jet engines.

ATI's strategic positioning in titanium and nickel alloys is solidified by approximately $1.2 billion in new sales commitments, extending through 2040. This substantial backlog highlights the company's dominant market share and the robust, sustained demand for these critical materials in the aerospace and defense sectors.

These long-term agreements underscore the growing market for advanced alloys, essential for next-generation aircraft and defense systems. The significant value of these commitments, particularly for nickel and titanium, directly supports ATI's standing as a leader in these high-growth, technologically advanced markets.

Additive Manufacturing Products

The commissioning of ATI's new Additive Manufacturing Products facility in February 2025 positions these offerings as a Stars in the BCG Matrix, reflecting a high-growth, high-market-share potential. This strategic move leverages advanced capabilities in a burgeoning market, targeting sectors like aerospace, defense, and space with complex, high-performance components.

The global additive manufacturing market is projected to reach $75.7 billion by 2030, growing at a CAGR of 21.0% from 2023, underscoring the significant growth trajectory for ATI's new venture.

- High Growth Potential: The facility's focus on aerospace, defense, and space aligns with sectors experiencing substantial technological advancements and demand for innovative solutions.

- Market Leadership: ATI's investment in cutting-edge additive manufacturing capabilities aims to capture a significant share of this expanding market.

- Component Specialization: The production of high-performance, complex components caters to niche but high-value applications, driving revenue and market penetration.

Strategic Expansion in Titanium Alloy Sheet Production

ATI's strategic expansion into titanium alloy sheet production for the aerospace sector, announced in June 2025, is a significant move. This bolsters its position in a high-growth market, directly addressing the increasing demand for advanced materials in aviation. The company's investment in this area is expected to yield substantial returns as aerospace manufacturers continue to prioritize lightweight, high-strength components.

This expansion aligns perfectly with the stars quadrant of the BCG matrix, indicating high market growth and a strong competitive position for ATI. The aerospace industry, a key consumer of titanium, saw its market size reach approximately $900 billion in 2024, with titanium alloys representing a crucial segment. ATI's proactive approach ensures it capitalizes on this robust demand.

- Market Growth: The aerospace titanium market is projected to grow at a compound annual growth rate of over 5% through 2030.

- ATI's Position: ATI is a leading integrated producer of high-performance specialty materials, including titanium.

- Strategic Alignment: Expansion into titanium alloy sheets reinforces ATI's leadership in critical aerospace materials.

- Financial Impact: This move is expected to enhance ATI's revenue streams and profitability in the coming years.

ATI's advanced alloys for aerospace and defense are Stars, driven by a 23% year-over-year sales increase in Q1 2025, representing 66% of total sales. Next-generation jet engine components, a high-growth area, saw a 35% sales jump in the same quarter, bolstered by ATI's sole-source status for critical nickel alloys.

The company's additive manufacturing facility, operational since February 2025, is positioned as a Star. This venture targets the booming additive manufacturing market, projected to reach $75.7 billion by 2030, with ATI focusing on high-performance components for aerospace and defense.

ATI's expansion into titanium alloy sheet production for aerospace, announced in June 2025, further solidifies its Star status. This move capitalizes on the aerospace industry's significant demand for titanium, a market that reached approximately $900 billion in 2024.

| Business Segment | BCG Category | Key Growth Driver | Market Share Indicator | Q1 2025 Sales Growth |

|---|---|---|---|---|

| Aerospace & Defense Alloys | Star | Critical materials for jet engines and airframes | Dominant market share | 23% |

| Next-Gen Jet Engine Components | Star | Sole-source supplier for essential advanced nickel alloys | High | 35% |

| Additive Manufacturing Products | Star | Emerging market with high-tech applications | Targeting significant share | N/A (New Facility) |

| Titanium Alloy Sheet (Aerospace) | Star | Increased demand for lightweight, high-strength aerospace materials | Leading producer | N/A (Recent Expansion) |

What is included in the product

The ATI BCG Matrix offers strategic insights by categorizing business units as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

A clear visualization of your portfolio's strengths and weaknesses, simplifying complex strategic decisions.

Cash Cows

ATI's established titanium and specialty alloys business serves as a solid cash cow. These materials are crucial for mature industries, including specific industrial applications, where ATI has built a reputation for unwavering quality and dependability.

While these markets may not experience rapid expansion, ATI's consistent high market share is a testament to its long-standing expertise and customer trust. For instance, in 2023, ATI reported that its Specialty Materials segment, which includes many of these alloys, generated approximately $1.3 billion in sales, highlighting its significant contribution to the company's revenue stability.

Materials supplied for the maintenance, repair, and overhaul (MRO) of commercial aircraft are a dependable cash cow for ATI. This segment benefits from a stable, recurring demand as airlines must maintain their existing fleets. In 2023, the global commercial aviation MRO market was valued at approximately $95 billion, with projections indicating continued growth.

ATI's extensive reach, with its materials found on nearly every commercial aircraft, ensures consistent demand and robust cash flow. This mature market segment, while not experiencing explosive growth, offers a predictable revenue stream due to the essential nature of aircraft maintenance. The ongoing need to keep aircraft airworthy fuels this reliable income.

ATI's specialized materials for the medical industry, encompassing those used in equipment, devices, and implants, represent a significant cash cow for the company. This segment benefits from a consistent demand underpinned by the essential nature of healthcare services.

Despite some market volatility, the medical materials sector demonstrates resilience. ATI's established reputation for providing biocompatible and corrosion-resistant materials solidifies its strong market position, ensuring a steady revenue stream.

Specialty Energy Market Alloys

Alloys designed for the specialty energy market represent a significant cash cow for ATI. These advanced materials are crucial components in demanding applications such as nuclear reactors, renewable energy infrastructure, land-based turbines, and the oil and gas sector. Their use in these critical areas underscores a consistent demand for high-performance materials, which translates into reliable and steady revenue for the company.

The enduring need for robust and specialized alloys in energy production and distribution solidifies this segment's position as a cash cow. For instance, the ongoing development and maintenance of nuclear power facilities, coupled with the expansion of wind and solar energy projects, require materials that can withstand extreme temperatures and pressures. Similarly, the oil and gas industry continues to rely on these alloys for drilling and extraction operations in challenging environments.

- Segment Contribution: Specialty energy market alloys are a core contributor to ATI's cash cow quadrant, reflecting stable demand.

- Market Drivers: Continued investment in critical energy infrastructure, including nuclear, renewables, and traditional oil & gas, fuels the need for these high-performance materials.

- Revenue Stability: The essential nature of these alloys in ensuring the safety and efficiency of energy operations provides predictable and consistent revenue streams for ATI.

- ATI's Performance (2024 Data): While specific segment revenue figures for 2024 are proprietary, ATI's overall performance in specialty materials, which includes energy applications, demonstrated resilience. For example, in the first quarter of 2024, ATI reported net sales of $1.1 billion, with a significant portion attributed to its Advanced Materials segment, which encompasses these critical alloys.

Electronics Market Alloys

ATI's specialized alloys, including hafnium, niobium, and zirconium, are critical components in the booming electronics sector, particularly for high-performance chip manufacturing. These materials are classified as cash cows within the ATI BCG Matrix due to their consistent and substantial revenue generation in a mature, stable market. The demand for these alloys remains robust, driven by the continuous need for advanced semiconductors that power everything from consumer electronics to complex data centers.

The unique properties of these ATI alloys—exceptional electrical conductivity, specific magnetic characteristics, and superior corrosion resistance—make them indispensable for demanding electronic applications. This inherent value proposition solidifies ATI's market position, ensuring predictable sales and profitability. For instance, the global semiconductor market was valued at approximately $600 billion in 2023 and is projected to grow steadily, underscoring the sustained demand for the materials ATI provides.

- Hafnium Alloys: Essential for high-k dielectric layers in advanced transistors, improving performance and reducing power consumption.

- Niobium Alloys: Utilized in capacitors and superconducting magnets for electronic devices, offering excellent electrical properties.

- Zirconium Alloys: Employed for their corrosion resistance and high melting points in various electronic components and manufacturing processes.

Cash cows represent business segments with a high market share in a low-growth industry, generating more cash than they consume. ATI's established titanium and specialty alloys business, along with materials for commercial aircraft MRO, medical applications, and the specialty energy sector, all fit this description. These segments benefit from consistent demand and ATI's strong market position, providing stable revenue streams.

| Segment | Market Share | Growth Rate | Cash Flow Generation |

|---|---|---|---|

| Specialty Alloys (Industrial) | High | Low | Strong Positive |

| Commercial Aircraft MRO Materials | High | Low | Strong Positive |

| Medical Alloys | High | Low | Strong Positive |

| Specialty Energy Alloys | High | Low | Strong Positive |

| Electronics Alloys (Hafnium, Niobium, Zirconium) | High | Low | Strong Positive |

Preview = Final Product

ATI BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully completed report you will receive upon purchase. This means no watermarks, no introductory text, and no demo content—just the comprehensive strategic analysis ready for immediate application. You can be confident that the file you see is the exact, professionally formatted BCG Matrix that will be delivered to you, enabling seamless integration into your business planning and decision-making processes.

Dogs

Within the conventional energy market, ATI's Advanced Alloys & Solutions (AA&S) segment experienced a notable sales decline in Q4 2024. This downturn suggests that certain products within this segment might be facing headwinds from reduced demand or intensified competition, potentially impacting ATI's market share and future growth trajectory.

ATI's strategic decision to exit lower-value metal products since 2020 places these offerings in the Dogs category of the BCG Matrix. This divestiture of non-core or low-growth business units reflects a focus on higher-margin, more strategic segments. These products likely operate in mature or declining markets with limited competitive advantage, consuming resources without substantial returns.

The Albany, New York plant's closure in 2022 serves as a prime example of a past Dog within ATI's portfolio. This facility primarily manufactured titanium for Boeing, a significant customer. Its closure indicates that this specific operational segment, despite its involvement with a core product like titanium, had become a financial burden or strategically unviable.

Certain Commercial Airframe Products

Within the broader aerospace sector, which generally performs as a Star, certain commercial airframe products have shown a slight dip in sales during the fourth quarter of 2024. This trend might indicate potential Dog status for these specific offerings.

If these particular airframes operate with low profit margins or lack significant competitive differentiation, they could indeed be classified as Dogs in the BCG matrix. This classification necessitates a strategic review, potentially involving cost reduction measures or a reassessment of their long-term viability.

For instance, a hypothetical scenario could involve a specific regional jet model that saw a 5% decrease in order intake in Q4 2024 compared to Q3 2024. If its profit margin is below the sector average of 8%, and it faces strong competition from newer, more fuel-efficient models, its position as a Dog becomes more pronounced.

- Specific commercial airframe products may exhibit declining sales in Q4 2024.

- Low-margin or less differentiated products are candidates for Dog classification.

- A 5% order intake decline in a regional jet model, with an 8% profit margin, exemplifies a potential Dog.

- Careful management or re-evaluation of investment is required for such products.

Undifferentiated Standard Alloys

Any ATI portfolio holdings in highly commoditized, undifferentiated standard alloys would likely reside in the Dog quadrant of the BCG matrix. These products typically encounter fierce price competition and experience sluggish market growth, resulting in thin profit margins. For instance, in 2024, the global market for basic steel alloys saw price volatility, with some commodity grades trading at levels that offered minimal returns after production costs.

These types of alloys tie up valuable capital and operational resources for ATI without offering a significant strategic advantage or potential for future expansion. The low growth environment means these assets are unlikely to appreciate in value or generate substantial cash flow. In 2024, companies focusing on undifferentiated alloys often struggled to differentiate their offerings, leading to a reliance on cost leadership, which is difficult to sustain in a competitive market.

- Low Growth Market: Facing limited expansion opportunities in 2024.

- Intense Price Competition: Profitability squeezed by market dynamics.

- Minimal Profit Margins: Returns are often just above break-even points.

- Capital Tie-Up: Resources are committed to low-return assets.

Products classified as Dogs within ATI's portfolio are characterized by their presence in low-growth markets with intense price competition, leading to minimal profit margins and significant capital tie-up. These are typically undifferentiated standard alloys that struggle to gain market share or command premium pricing, making them a drain on resources without substantial strategic benefit.

ATI's strategic divestment of non-core, low-growth businesses, such as the Albany plant closure in 2022, directly addresses the management of these Dog assets. By exiting these segments, ATI aims to reallocate capital and operational focus towards higher-potential Stars and Cash Cows, thereby improving overall portfolio efficiency and profitability.

The potential classification of certain commercial airframe products as Dogs, evidenced by a hypothetical 5% drop in order intake for a regional jet with an 8% profit margin in Q4 2024, underscores the need for continuous portfolio assessment. Such products require careful strategic review, including potential cost reductions or divestiture, to mitigate their negative impact on ATI's financial performance.

| Product Category | Market Growth | Competitive Intensity | Profit Margin | Strategic Implication |

|---|---|---|---|---|

| Undifferentiated Standard Alloys | Low | High | Low | Capital Tie-Up, Divestment Consideration |

| Specific Regional Jet Model (Hypothetical) | Low/Declining | High | Below Sector Average (e.g., 8%) | Re-evaluation of Investment, Cost Reduction |

| Albany Plant Titanium (Historical) | N/A (Closed) | N/A | N/A | Past Dog, Divested Operation |

Question Marks

While ATI's new additive manufacturing facility is a Star, specific, nascent applications in the high-growth space market represent Question Marks. These areas demand substantial investment to capture market share, as buyers are still exploring the full potential and precise uses of these highly complex components. For instance, the demand for 3D printed satellite components, such as intricate fuel injectors and heat exchangers, is projected to grow significantly, with the global space additive manufacturing market expected to reach $17.5 billion by 2030, according to some industry forecasts.

The Advanced Air Mobility (AAM) materials segment positions itself as a significant Question Mark for ATI. This rapidly evolving sector, driven by innovation in electric vertical takeoff and landing (eVTOL) aircraft, demands cutting-edge materials for lightweighting and performance. While ATI's expertise in advanced composites and alloys is highly relevant, its current penetration in this nascent AAM market is likely minimal, necessitating substantial R&D and market development investment to secure future market share.

The development of novel alloys using AI-driven processes, a high-growth technological frontier in materials science, fits squarely into the Question Mark category of the BCG matrix. This is because it’s a rapidly evolving area with significant potential but currently uncertain market adoption and profitability.

ATI's strategic investment in R&D for new alloy powders, especially those tailored for additive manufacturing, underscores this classification. For instance, the additive manufacturing market, a key application for these advanced alloys, was projected to reach approximately $20 billion globally by 2023, with significant growth expected in aerospace and medical sectors, indicating a nascent but expanding market where ATI is positioning itself.

Materials for Emerging Defense Technologies

As global defense spending climbs, driven by a demand for cutting-edge technologies like autonomous systems and advanced robotics, ATI's specialized materials are positioned for significant growth. These emerging defense applications represent a high-potential market, demanding substantial investment and strategic market entry. For instance, the global defense market was projected to reach approximately $2.2 trillion in 2024, with a notable portion allocated to R&D for next-generation capabilities.

ATI's materials are crucial for developing these advanced defense systems, offering enhanced performance and durability. The company's focus on materials science directly addresses the evolving needs of military modernization. The market for advanced materials in defense is expected to see robust expansion, with projections indicating a compound annual growth rate (CAGR) of over 5% in the coming years, reaching tens of billions of dollars by the end of the decade.

- Autonomous Systems: ATI's lightweight and high-strength composites are ideal for unmanned aerial vehicles (UAVs) and ground robots, improving endurance and payload capacity.

- Advanced Robotics: Specialized alloys and polymers from ATI enable the development of more agile and resilient robotic platforms for reconnaissance and combat support.

- Cybersecurity Materials: While not traditional materials, ATI's focus on material integrity can indirectly support secure hardware components crucial for defense networks.

- Directed Energy Systems: The company's expertise in high-temperature materials is relevant for components in advanced laser and microwave weapon systems.

Expansion into New Geographies or Niche Markets

Expansion into new geographies or niche markets for ATI, aligning with the Question Marks segment of the BCG Matrix, signals a strategic move into areas with high growth potential but currently low market share. These ventures are critical for future revenue streams. For instance, if ATI were to target the burgeoning renewable energy component market in Southeast Asia, a region projected to see significant growth in solar and wind power installations, it would represent such a move.

These initiatives require significant investment in market research, product localization, and establishing distribution channels. ATI's success here hinges on its ability to adapt its offerings and marketing strategies to the unique demands of these new environments. For example, entering a niche market like advanced medical device components might necessitate obtaining specific regulatory approvals and building relationships with key industry players, a process that can take considerable time and resources.

- Geographic Expansion: Targeting emerging markets with high GDP growth, such as India or Brazil, where demand for ATI's core products is expected to rise significantly. In 2024, India's manufacturing sector alone was projected to grow by over 7%, presenting a substantial opportunity.

- Niche Market Entry: Focusing on specialized applications within existing industries, like high-performance materials for the aerospace sector or sustainable packaging solutions for the food industry. The global market for sustainable packaging was estimated to reach over $400 billion by 2025, indicating a strong growth trajectory.

- Investment in R&D and Marketing: Allocating substantial capital towards tailoring products for new markets and building brand awareness through targeted campaigns. For new geographic entries, this could involve setting up local sales offices and distribution networks, a process that might require an initial investment of 10-15% of projected revenue in the first two years.

- Partnership Strategies: Collaborating with local businesses or distributors to navigate regulatory landscapes and gain market access efficiently. Such partnerships can reduce market entry costs and accelerate adoption.

Question Marks in ATI's portfolio represent areas with high growth potential but currently low market share, demanding significant investment to capture future opportunities. These segments are characterized by emerging technologies or markets where ATI is still establishing its presence and market traction.

For example, the burgeoning market for advanced materials in additive manufacturing for space applications, such as 3D printed satellite components, is a prime Question Mark. While the global space additive manufacturing market is projected to reach $17.5 billion by 2030, ATI's current penetration requires substantial R&D and market development to capitalize on this growth.

Similarly, the Advanced Air Mobility (AAM) sector, driven by eVTOL innovation, presents another significant Question Mark. ATI's expertise in advanced materials is relevant, but its minimal current market penetration necessitates considerable investment to secure a foothold in this rapidly evolving space.

ATI's strategic focus on developing novel alloys through AI-driven processes also falls into the Question Mark category. This area holds immense potential, but market adoption and profitability remain uncertain, requiring ongoing R&D and market validation.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including historical sales figures, market share data, and industry growth rates, to accurately position business units.