Athene PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Athene Bundle

Navigate the complex external environment impacting Athene with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that are shaping the company's strategic landscape. Gain a distinct advantage by understanding these forces and their potential influence on Athene's future performance and market position. Equip yourself with the knowledge needed to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and unlock actionable intelligence to inform your strategic decisions.

Political factors

Government policies significantly shape the retirement savings landscape, directly impacting demand for Athene's annuity products. For instance, the SECURE 2.0 Act, enacted in late 2022, introduced several provisions aimed at boosting retirement savings, including expanded catch-up contributions for those aged 50 and over and automatic enrollment for new retirement plans. These measures are designed to encourage greater participation and accumulation in retirement accounts, potentially increasing the pool of individuals seeking to annuitize their savings later in life.

Tax incentives are a cornerstone of these policies. The preferential tax treatment of retirement accounts like 401(k)s and IRAs, allowing for tax-deferred growth, makes them attractive vehicles for long-term savings. Athene's annuity products, often purchased within these tax-advantaged accounts or as standalone deferred annuities, benefit from this favorable tax environment. Any potential reforms to these tax structures, whether increasing contribution limits or altering tax rates on retirement income, could directly influence the attractiveness and uptake of annuity solutions.

Broader policy trends, such as the increasing focus on financial literacy and retirement security, also play a crucial role. Government initiatives promoting education on retirement planning can lead to a more informed consumer base, better equipped to understand and consider products like annuities. As of early 2024, discussions continue around potential further enhancements to retirement savings frameworks, reflecting an ongoing commitment to ensuring individuals have adequate provisions for their post-work years, which generally supports the long-term demand for retirement income solutions.

Governmental and quasi-governmental bodies, such as state insurance departments and federal agencies like the SEC, play a crucial role in overseeing financial services. These entities establish rules that impact Athene's compliance, product design, and how it interacts with customers in the market.

Changes in regulations, for instance, new capital requirements or altered rules on annuity sales, could significantly reshape Athene's business strategy and, consequently, its profitability. In 2024, the NAIC continued to focus on consumer protection and solvency standards, which directly influence how insurance companies like Athene operate.

For example, evolving cybersecurity mandates require substantial investment in compliance and data protection, impacting operational costs. Furthermore, shifts in accounting standards or capital adequacy ratios, as seen in ongoing discussions around solvency modernization, directly influence Athene's financial reporting and risk management practices.

Geopolitical stability is a critical factor for Athene, as global political shifts can directly impact its investment portfolio. For instance, rising tensions in regions like Eastern Europe or the Middle East could trigger market volatility, affecting asset values and potentially increasing the cost of capital. Athene’s investment strategy must account for these risks, particularly in 2024 and 2025, where ongoing conflicts and shifting alliances are likely to persist.

Trade policies also play a significant role. Changes in tariffs or the renegotiation of trade agreements, such as those involving major economies like the United States, China, or the European Union, can alter the economic landscape. A more protectionist global trade environment, potentially seen in the lead-up to and during 2024, could slow global growth and impact sectors where Athene has substantial investments, requiring adaptive risk management.

Pension Reform Initiatives

Governmental initiatives to reform defined benefit pension plans can significantly shape the landscape for Athene's pension risk transfer (PRT) solutions. Policies encouraging plan sponsors to de-risk their pension obligations, by shifting liability away from their balance sheets, directly create opportunities for Athene. For instance, the Pension Protection Act 2006 in the UK, and similar legislative trends in the US, have historically driven demand for PRT by providing a framework for such transfers.

Changes in pension funding requirements can also influence Athene's market. Stricter regulations or actuarial assumptions that increase the perceived cost of maintaining defined benefit plans can incentivize companies to explore PRT as a way to manage these growing liabilities. This is particularly relevant as interest rates and longevity assumptions are continually reassessed by regulators and actuaries.

Regulatory incentives, such as tax advantages or streamlined processes for pension obligation transfers, can further accelerate market growth for Athene. These incentives make PRT a more financially attractive option for plan sponsors. For example, in 2024, discussions around potential changes to corporate tax structures could indirectly impact the attractiveness of pension funding strategies.

The extent to which these reforms drive the market for Athene's specialized services is substantial. As of early 2025, the global PRT market is projected to continue its robust growth, with estimates suggesting it could reach hundreds of billions of dollars annually, driven by a confluence of regulatory pressures and corporate de-risking strategies. Athene, as a leading player, is well-positioned to capitalize on this trend.

- Increased regulatory scrutiny on pension funding gaps

- Government encouragement of pension de-risking strategies

- Potential for tax incentives related to pension transfers

- Global pension risk transfer market projected for continued expansion into 2025

Consumer Protection Legislation

Consumer protection legislation is a significant political factor influencing Athene. Increased scrutiny and potential new regulations around annuity sales practices and product disclosures, particularly concerning suitability for consumers, could necessitate adjustments to Athene's product development and marketing strategies. For instance, the Securities and Exchange Commission's (SEC) Regulation Best Interest, implemented in 2020, already mandates a higher standard of care for broker-dealers when making recommendations, impacting how firms like Athene engage with potential clients. The compliance burden associated with evolving consumer protection mandates can lead to increased operational costs.

Stricter enforcement of existing laws or the introduction of new legislation aimed at enhancing transparency and fairness in financial product sales could directly affect Athene's sales processes and product design. For example, proposals for enhanced fiduciary duties or clearer risk disclosure requirements for complex financial instruments would require careful navigation. The potential for reputational damage stemming from non-compliance or perceived unfair practices remains a critical consideration.

- Increased Regulatory Scrutiny: Regulators globally are focusing on consumer protection in financial services, potentially leading to new rules for annuity products.

- Disclosure Requirements: Stricter mandates on product disclosures and sales practices could impact Athene's marketing and client interaction protocols.

- Compliance Costs: Adapting to new or strengthened consumer protection laws will likely increase operational and compliance expenditures for Athene.

- Reputational Risk: Failure to adhere to consumer protection standards can lead to significant reputational damage and loss of consumer trust.

Government policies significantly influence the retirement savings landscape, directly impacting demand for Athene's annuity products. The SECURE 2.0 Act, enacted in late 2022, expanded catch-up contributions and automatic enrollment, aiming to boost retirement savings. As of early 2024, ongoing discussions aim to further enhance retirement savings frameworks, generally supporting long-term demand for retirement income solutions. Athene's products benefit from favorable tax treatment of retirement accounts, and any reforms to these structures could alter their attractiveness.

What is included in the product

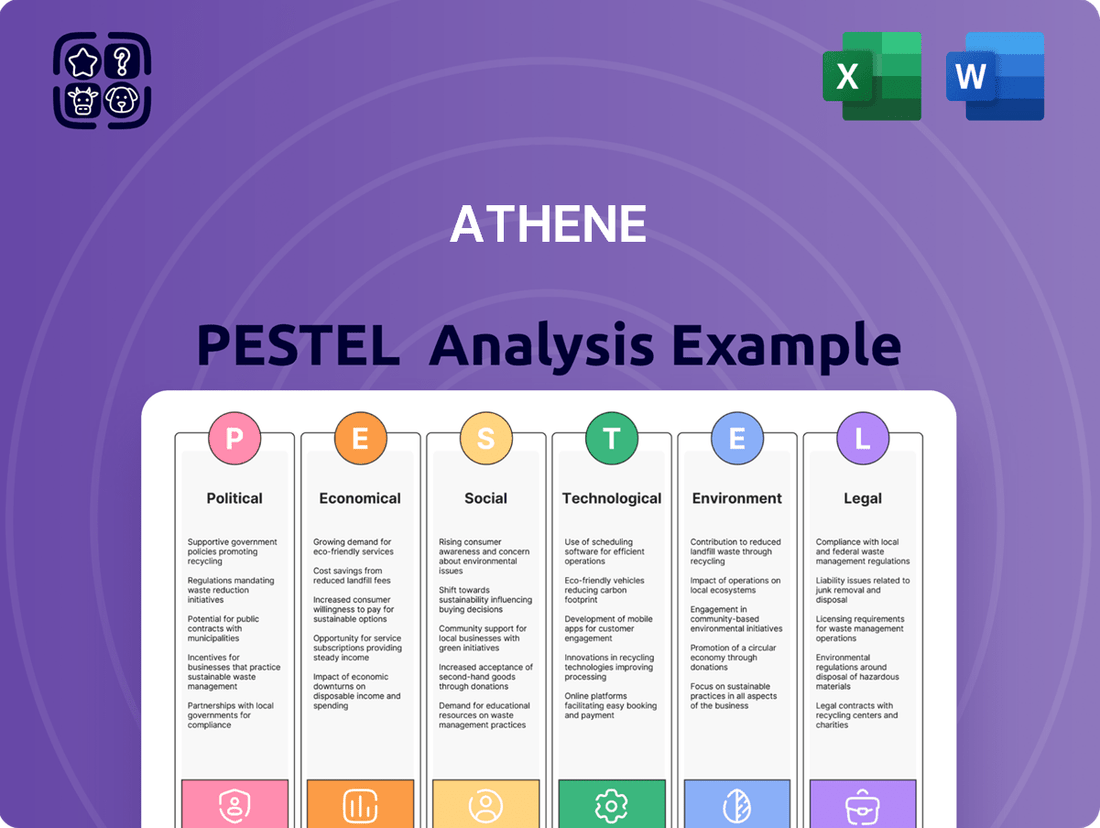

The Athene PESTLE analysis provides a comprehensive understanding of the external forces impacting the company, examining Political, Economic, Social, Technological, Environmental, and Legal factors.

This detailed evaluation equips stakeholders with actionable insights to navigate the complex business landscape and inform strategic decision-making.

The Athene PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of navigating complex and uncertain market landscapes by offering clear insights into opportunities and threats.

Economic factors

The prevailing interest rate environment significantly impacts Athene's profitability, especially through its extensive investment portfolio. For instance, in the first quarter of 2024, Athene reported a strong performance partly driven by a favorable rate environment. Higher long-term interest rates generally boost the returns Athene can achieve on its fixed-income investments, which are crucial for backing its annuity products. This can also make its annuity offerings more appealing to consumers seeking guaranteed income streams.

Conversely, a sustained period of low interest rates, like those experienced in prior years, can compress Athene's profit margins. Lower yields on new investments mean less income generated to cover future obligations. This environment also presents reinvestment challenges as maturing assets must be replaced with lower-yielding alternatives, potentially straining profitability and requiring careful asset-liability management strategies to mitigate risks.

Athene's product pricing and its overall asset-liability management are highly sensitive to interest rate fluctuations. Changes in rates affect the present value of future liabilities and the expected returns on assets. For example, a sudden rise in rates could devalue existing bond holdings, while a drop could necessitate repricing products to remain competitive and profitable, underscoring the need for robust hedging and dynamic portfolio adjustments.

Inflation significantly impacts Athene's product demand and investment strategy. High inflation erodes the purchasing power of fixed annuity payments, making inflation-protected products more attractive to consumers seeking to maintain their real income, especially as the US CPI reached 3.4% in April 2024.

For Athene, this necessitates a focus on offering annuity options with inflation-adjustment features or those invested in assets that historically perform well during inflationary periods. The company's investment strategy must prioritize generating returns that consistently outpace rising costs to ensure the long-term value of its liabilities and client payouts.

The need to combat inflation's corrosive effect on savings means Athene must actively manage its investment portfolio to achieve yields exceeding inflation benchmarks, ensuring its products remain competitive and deliver on their promises to policyholders. This is crucial for maintaining client trust and market share in a challenging economic environment.

Economic growth directly influences consumer confidence and disposable income, impacting Athene's annuity sales. In 2024, global economic growth is projected to be around 3.2%, a slight slowdown from previous years, which could temper immediate annuity demand but also increase interest in stable, long-term savings products.

Recessionary periods, however, can significantly affect both individual savings and corporate pension funding. During a downturn, individuals might draw down savings, reducing their capacity to purchase new annuities, while companies facing financial strain may accelerate efforts to de-risk their pension obligations, potentially benefiting Athene's liability-driven investment solutions.

The Federal Reserve's interest rate policies, often reacting to growth and inflation cycles, are critical. Higher interest rates, generally seen in periods of controlled economic expansion or to combat inflation, can enhance Athene's investment returns on its fixed-income portfolio, a significant component of its business.

For instance, in early 2025, if interest rates remain elevated due to persistent inflation concerns, Athene's ability to generate income from its substantial investment portfolio, which stood at over $260 billion in assets under management as of Q3 2024, would be positively impacted, supporting its financial strength and product offerings.

Market Volatility and Investment Performance

Market volatility significantly impacts Athene's investment portfolio. When equity markets experience sharp swings, it can affect the valuation of Athene's assets. For instance, in periods of heightened volatility, the demand for guaranteed products like fixed annuities often rises as investors seek principal protection. However, prolonged market downturns, as seen in some periods of 2022-2023, can put pressure on the asset values backing these guarantees.

Athene employs diversified investment strategies to navigate these market fluctuations. By spreading investments across various asset classes, including public equities, fixed income, and alternative investments, the company aims to mitigate the impact of any single market's underperformance. This diversification is crucial for maintaining stable returns and meeting its long-term obligations to policyholders. As of the first quarter of 2024, Athene reported a strong capital position, benefiting from its diversified asset allocation which includes a significant portion in investment-grade fixed income.

- Diversification Benefits: Athene's strategy of investing across public equities, fixed income, and alternatives helps cushion against specific market shocks.

- Annuity Demand: Increased market uncertainty in 2023 and early 2024 saw a greater consumer interest in fixed annuities, which offer protection against principal loss, aligning with Athene's product offerings.

- Asset Valuation Impact: While diversification helps, sustained equity market declines can still affect the overall valuation of Athene's investment portfolio, requiring careful management.

- Performance Metrics: Athene’s investment income for Q1 2024 was reported at $3.1 billion, reflecting the performance of its diversified portfolio amidst varying market conditions.

Demographic Shifts and Wealth Accumulation

Demographic shifts, particularly the aging population, significantly expand Athene's market for retirement solutions. By 2024, the U.S. population aged 65 and older is projected to reach over 56 million, a substantial increase from previous years. This growing demographic represents a larger pool of individuals seeking financial security and income streams, directly benefiting Athene's annuity and pension risk transfer offerings.

Wealth accumulation patterns also play a crucial role. As Baby Boomers continue to transition into retirement, their accumulated wealth fuels demand for products that can provide stable income. Simultaneously, younger generations are experiencing varying levels of wealth accumulation, influencing their approach to retirement planning and product preferences. For instance, in 2023, the median net worth for households headed by individuals aged 55-64 was considerably higher than for younger age groups, highlighting the wealth disparity that shapes product targeting.

- Aging Population Growth: Over 56 million Americans expected to be 65+ by 2024, a key demographic for retirement products.

- Wealth Disparities: Significant wealth differences across age cohorts, with older generations holding more accumulated assets.

- Demand for Income Solutions: Increasing demand for annuities and pension risk transfer as retirees seek predictable income.

- Shifting Retirement Needs: Evolving wealth distribution influences the types of retirement products favored by different age groups.

Economic factors like interest rates and inflation heavily influence Athene's financial performance and product demand. Elevated interest rates, as seen in early 2025, bolster Athene's investment income, with its portfolio exceeding $260 billion in assets under management as of Q3 2024. Conversely, high inflation, with the US CPI at 3.4% in April 2024, drives demand for inflation-protected annuities, necessitating investment strategies that outpace rising costs.

Full Version Awaits

Athene PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive Athene PESTLE Analysis. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Athene. You will gain immediate access to this expertly crafted analysis upon completion of your purchase. No surprises, just the complete PESTLE breakdown you need.

Sociological factors

The global population is undeniably getting older, and people are living longer than ever before. This fundamental sociological shift is a direct boon for companies like Athene, as it significantly expands their core market. More people reaching retirement age and living well into their later years means a sustained and growing demand for the very products Athene specializes in: retirement income solutions and managing pension risks.

This demographic trend directly translates into a continuous need for financial products that provide security and income during extended retirements. For instance, in 2023, the proportion of the global population aged 65 and over reached approximately 10.5%, a figure projected to climb steadily. This sustained demand influences how Athene designs its offerings, pushing for products that offer reliable, long-term income streams and robust pension risk management strategies to ensure financial well-being throughout longer lifespans.

Societal views on retirement are undergoing a significant transformation. Gone are the days when most people relied solely on traditional defined benefit pensions; now, the onus is increasingly on individuals to manage their own retirement savings. This shift means more people are actively seeking financial products that offer security and predictable income streams for their later years.

Consumer preferences are also diversifying. Many individuals now desire greater flexibility in their retirement plans, while others prioritize guaranteed income or protection against rising inflation. This evolving demand directly influences the types of annuity products that are most attractive, with a growing interest in options that can adapt to changing economic conditions and personal needs.

In response, Athene is adapting its product portfolio to align with these evolving societal expectations. For instance, the company is focusing on offering a range of accumulation and income solutions designed to provide individuals with greater control and security over their retirement finances. As of the first quarter of 2024, Athene reported a strong pipeline of new business, reflecting the ongoing demand for retirement solutions that address these changing attitudes.

The general level of financial literacy significantly influences how consumers understand and adopt sophisticated financial products like annuities. In 2024, a substantial portion of the adult population still struggles with basic financial concepts, making complex retirement planning tools a challenge. For instance, a 2023 study indicated that only 57% of Americans could answer three basic financial literacy questions correctly.

There's a clear societal demand for straightforward, easy-to-understand information regarding retirement planning, a gap Athene can address. By offering accessible educational resources and clear product explanations, Athene can build trust and empower individuals to make informed decisions about their financial futures. This commitment to consumer education could position Athene as a leader in the retirement solutions space.

Enhancing financial literacy directly correlates with expanding the market for Athene's annuity products. As more people grasp the benefits of long-term savings vehicles and understand how annuities fit into a diversified retirement portfolio, demand is likely to increase. Data from 2024 suggests that individuals with higher financial literacy are more confident in their retirement savings, indicating a potential for greater product adoption.

Trust in Financial Institutions

Societal trust in financial institutions significantly impacts consumer behavior, particularly concerning long-term savings like retirement. Following economic downturns or market scandals, public confidence can erode, leading to increased caution. For instance, a 2023 survey indicated that only 45% of Americans expressed high confidence in their banks, a sentiment that could extend to annuities and other retirement products offered by companies like Athene.

This diminished trust directly affects individuals' willingness to entrust substantial sums, such as retirement savings, to financial companies. A lack of perceived trustworthiness can deter potential clients, even when products offer competitive returns or security. Athene, like its peers, must actively work to rebuild and maintain this faith through clear communication and dependable performance.

Transparency and robust corporate governance are paramount in fostering and retaining public trust. Consumers are increasingly demanding to understand how their money is managed and protected. Companies that demonstrate ethical practices and open disclosure are better positioned to attract and retain customers in the competitive financial services landscape.

Key factors influencing trust include:

- Recollection of past financial crises: Events like the 2008 financial crisis continue to shape public perception.

- Media portrayal of the financial industry: Negative press regarding executive compensation or market manipulation can damage overall trust.

- Regulatory oversight and enforcement: Strong regulatory bodies that hold institutions accountable can bolster public confidence.

- Customer service and complaint resolution: Positive individual experiences with financial firms contribute to broader trust.

Intergenerational Wealth Transfer Trends

Intergenerational wealth transfer is significantly reshaping the landscape of investable assets. As baby boomers, holding a substantial portion of global wealth, begin to pass down assets, the pool available for retirement planning and new investments is evolving. For instance, estimates suggest that trillions of dollars are expected to transfer between generations in the coming decades, with a significant portion directed towards heirs. This trend directly impacts the availability of capital for financial institutions like Athene.

This shift in wealth distribution can profoundly influence consumer demand for financial products. As wealth moves through families, beneficiaries may have different financial needs and risk appetites compared to the wealth creators. This could lead to increased demand for products designed to preserve capital, generate income, or manage complex estates, potentially boosting the appeal of annuities and other structured financial solutions. Athene can strategically position its offerings to cater to these evolving needs.

Athene has a clear opportunity to engage with this growing demographic of inheritors. By understanding the preferences and financial goals of those receiving wealth, the company can tailor its product suite and marketing strategies. This might involve developing educational resources on wealth management or offering flexible annuity options that align with the long-term financial planning horizons of younger generations.

- Estimated Trillions in Wealth Transfer: Projections indicate over $80 trillion in wealth could transfer in the United States alone over the next few decades, impacting retirement planning and investment markets.

- Shifting Financial Needs: Beneficiaries often have different financial priorities than donors, potentially increasing demand for capital preservation and income-generating products like annuities.

- Product Innovation Opportunity: Athene can develop specialized retirement income solutions and educational tools to attract and serve the next generation of wealth holders.

- Market Segmentation: Understanding the specific financial behaviors and preferences of different age groups receiving inheritances is key to successful market penetration.

The aging global population and evolving societal views on retirement directly fuel demand for Athene's core offerings. As individuals increasingly manage their own retirement savings and seek secure, long-term income, the need for robust financial solutions grows. This demographic shift, with the proportion of those aged 65 and over continuing to rise globally, presents a sustained opportunity for companies specializing in retirement income and pension risk management.

Financial literacy remains a critical factor, as a significant portion of the population struggles with complex financial products. By providing clear educational resources, Athene can bridge this gap, fostering trust and empowering consumers to make informed decisions about their retirement. Enhancing this understanding is key to unlocking greater market potential for annuity products.

Societal trust in financial institutions, though sometimes fragile, is essential for long-term investment. Events and media portrayal can impact confidence, making transparency and dependable performance crucial for Athene. Building and maintaining this trust through ethical practices and clear communication is vital for customer acquisition and retention.

Intergenerational wealth transfer is a significant trend, with trillions expected to change hands. This presents Athene with an opportunity to engage with new wealth holders, tailoring products and education to their evolving financial needs and preferences. Strategically addressing the preferences of inheritors can drive future growth.

Technological factors

The financial services sector is rapidly embracing digitalization, transforming how companies like Athene interact with clients and manage operations. Athene leverages sophisticated online portals and mobile applications to offer seamless policy management and customer service, a crucial move in today's tech-driven landscape. This digital push is not just about convenience; it’s about efficiency and reaching a broader audience.

By investing in digital advisory tools, Athene enhances the customer experience and streamlines its distribution channels. For instance, in 2024, a significant portion of new business acquisition in the annuity market, where Athene is a major player, is expected to originate from digital channels, reflecting a broader industry trend. This focus on digital presence is vital for connecting with modern consumers who expect accessible and user-friendly financial solutions.

Advanced data analytics and AI are fundamentally reshaping the insurance industry, particularly in risk assessment and customer engagement. These technologies allow for deeper insights into policyholder behavior, enabling more accurate risk modeling and the development of highly personalized products. For instance, AI algorithms can analyze vast datasets to identify subtle patterns, leading to more precise pricing and improved underwriting.

Athene leverages these powerful tools to gain a significant competitive edge. By understanding policyholder behavior through data analytics, the company can better predict market trends and optimize its investment portfolios for its annuity and pension risk transfer solutions. This data-driven approach also allows Athene to refine pricing strategies, ensuring competitiveness and profitability in a dynamic market.

The competitive advantage derived from these data-driven insights is substantial. Companies like Athene that effectively harness AI and data analytics can achieve superior risk management, more efficient operations, and enhanced customer satisfaction. This leads to a more robust financial performance and a stronger market position, especially in specialized areas like pension risk transfer, where precise forecasting is crucial.

Robust cybersecurity and data privacy technologies are paramount for Athene, given its handling of sensitive financial and personal information. The company's commitment to protecting customer data from breaches and ensuring regulatory compliance is demonstrated through ongoing investments in advanced security protocols, sophisticated encryption methods, and proactive threat detection systems.

In 2024, the global cost of data breaches was estimated to reach $9.5 trillion annually, underscoring the significant financial and reputational risks associated with cyber vulnerabilities. Athene's proactive stance in deploying cutting-edge security measures is crucial to mitigating these threats and maintaining customer trust in an increasingly digital landscape.

Automation and Operational Efficiency

Athene is leveraging automation, including Robotic Process Automation (RPA), to streamline its internal operations. This technology is particularly impactful in areas like claims processing, underwriting, and various administrative tasks, where repetitive actions can be handled by bots.

By implementing automation, Athene aims to significantly boost operational efficiency. This translates into lower operational costs, as fewer manual resources are required, and a marked improvement in the speed and accuracy of service delivery to clients. For instance, automation in claims processing can reduce turnaround times by up to 70% compared to manual methods.

The adoption of automation directly impacts Athene's scalability. It allows the company to handle a growing volume of business without a proportional increase in headcount, optimizing resource allocation. This ensures that as Athene expands its market reach, its operational capacity can readily adapt.

- RPA in Claims: Automating data extraction and validation for claims processing.

- Underwriting Efficiency: Bots assisting in data gathering and initial risk assessment.

- Cost Reduction: Aiming for a 15-20% reduction in processing costs for automated tasks.

- Scalability: Enabling a 30% increase in processing capacity without adding staff.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) present significant opportunities for enhancing security and efficiency in financial services. Athene could leverage DLT for more transparent and tamper-proof record-keeping, particularly beneficial for managing complex liabilities like pension obligations. The technology's ability to automate processes through smart contracts could streamline annuity payments and pension risk transfers, potentially reducing operational costs and the risk of errors.

The potential for DLT to reduce fraud and increase transparency is a key consideration. In 2024, the global blockchain in insurance market was valued at approximately $1.5 billion, with projections indicating substantial growth. By 2029, it's expected to reach over $10 billion, highlighting the increasing adoption and perceived value of these technologies. Athene could benefit from this trend by integrating DLT to improve data integrity and client trust.

The long-term disruptive potential for Athene is considerable. DLT could fundamentally alter how financial transactions are recorded and executed, leading to new business models and competitive advantages. For instance, smart contracts could automate claim payouts, manage escrow for risk transfers, and provide immutable audit trails, significantly improving operational workflows. By 2025, the financial services sector is anticipated to see continued investment in DLT-based solutions, aiming for greater regulatory compliance and cost savings.

- Enhanced Security: DLT offers a decentralized and immutable ledger, making record-keeping highly secure and resistant to fraud, which is critical for annuity and pension data.

- Smart Contracts: Automation of agreements, such as annuity payouts or pension risk transfer settlements, can reduce administrative overhead and speed up transaction times.

- Increased Transparency: DLT can provide a shared, auditable record of transactions, improving transparency for all stakeholders involved in financial agreements.

- Efficiency Gains: Streamlining complex processes like pension risk transfers can lead to significant cost reductions and operational efficiencies for Athene.

Athene's technological strategy focuses on digital transformation and data-driven insights to enhance customer experience and operational efficiency. The company is actively investing in digital platforms and advanced analytics, including AI, to streamline processes like underwriting and customer service. This commitment to technology is crucial for remaining competitive in the evolving financial services landscape.

Legal factors

Athene operates within a dense framework of state and federal insurance regulations, dictating capital adequacy, reserve requirements, and investment restrictions. Compliance with these rules, including NAIC model laws and specific state mandates, is crucial for maintaining financial stability and shaping product development and risk management strategies.

The solvency requirements, such as risk-based capital (RBC) standards, directly influence Athene's ability to absorb losses and ensure policyholder protection. For instance, as of year-end 2023, the U.S. life insurance industry's aggregate RBC ratio remained robust, providing a benchmark for Athene's own capital management.

Changes in these regulations, such as potential updates to solvency frameworks or investment limitations, can significantly impact Athene's business strategy. Adapting to new compliance demands might necessitate adjustments in product design, investment portfolio allocation, or even market entry strategies to maintain competitive positioning and financial health.

Consumer protection laws, like the SEC's Regulation Best Interest (Reg BI) which became effective in June 2020, mandate that financial professionals act in the best interest of their clients. For Athene, this translates to rigorous suitability standards for its annuity products, ensuring they align with customer needs and financial situations. Failure to comply can lead to significant penalties, including fines and reputational damage, underscoring the need for strong internal compliance frameworks.

Disclosure requirements are equally critical, compelling companies like Athene to provide clear and comprehensive information about annuity features, fees, and risks. For instance, the SEC's Form ADV, which registered investment advisers must file and update, provides transparency to investors. Athene's adherence to these disclosure mandates is vital for fostering trust and mitigating legal exposure, as misrepresentation or omission of material facts can result in severe regulatory action.

The legal landscape for pension risk transfer, a core business for Athene, is heavily shaped by regulations like the Employee Retirement Income Security Act (ERISA) in the U.S. This act sets stringent standards for retirement plans, influencing how Athene structures its pension buy-out and buy-in transactions to ensure compliance and protect plan participants. Navigating these requirements is paramount for successful operations in this sector.

Compliance with ERISA and Department of Labor mandates directly impacts the operational framework of pension buy-out and buy-in deals. These regulations dictate everything from fiduciary responsibilities to reporting requirements, demanding meticulous adherence to ensure the legality and smooth execution of Athene's pension liability assumption strategies. The complexity of these legal requirements underscores the specialized expertise needed in this market.

Assuming pension liabilities involves significant legal complexities, particularly concerning the transfer of defined benefit obligations. Athene must adhere to specific legal protocols to ensure that the rights and benefits of plan participants are preserved, while also managing the inherent risks associated with these long-term commitments. This intricate legal web is a defining characteristic of the pension risk transfer industry.

Data Privacy and Security Laws

Athene operates within a complex web of data privacy and security laws. Regulations like the GDPR, enacted in 2018, and the CCPA, effective in 2020, impose strict requirements on how personal data is collected, stored, and processed. For instance, the GDPR mandates explicit consent for data processing and grants individuals rights to access and erase their data. Fines for non-compliance can be substantial, reaching up to 4% of global annual turnover or €20 million, whichever is greater. This necessitates Athene to maintain robust data governance policies and invest in advanced security technologies to safeguard customer information and avoid significant penalties.

The global landscape of data privacy legislation is continually shifting, with new regulations emerging and existing ones being updated. For example, by mid-2025, several US states are expected to have comprehensive privacy laws similar to California's. Athene must remain agile, continuously monitoring these changes to ensure ongoing compliance across all its operating regions. This proactive approach is crucial for maintaining customer trust and operational integrity.

- GDPR Fines: Non-compliance can lead to fines of up to 4% of global annual turnover or €20 million.

- CCPA Impact: The CCPA grants California consumers rights such as the right to know and the right to delete personal information.

- Global Evolution: Athene must adapt to an increasing number of national and regional data privacy laws being enacted worldwide.

- Data Governance: Implementing strong data governance frameworks is essential for managing data ethically and securely.

Tax Laws Affecting Annuities and Retirement Savings

Tax laws are a critical consideration for Athene, directly influencing the appeal of its annuity and retirement savings products. For instance, changes in the deductibility of contributions or the tax treatment of distributions can significantly alter consumer demand. As of 2024, the U.S. federal tax code generally allows for tax-deferred growth on annuities, a key selling point.

Potential future tax legislation, such as adjustments to ordinary income tax rates or capital gains taxes, could impact the net returns realized by annuity holders. If tax rates increase, the tax-deferred nature of annuities becomes even more attractive compared to taxable investment vehicles. Conversely, a reduction in tax rates might lessen the relative advantage of tax deferral.

Athene's product design and marketing strategies must therefore be highly attuned to tax efficiency. This includes highlighting the tax-deferred growth benefits and ensuring that withdrawal strategies align with favorable tax outcomes for policyholders. For example, understanding the implications of the SECURE 2.0 Act, enacted in late 2022, which introduced changes to retirement savings rules, is crucial for ongoing product development and communication.

- Tax-Deferred Growth: Annuities offer tax-deferred growth, meaning earnings are not taxed until withdrawn. This is a significant advantage, especially for long-term savings.

- Withdrawal Taxation: Withdrawals from annuities are typically taxed as ordinary income, with earnings portion being taxable. Early withdrawals (before age 59½) may also incur a 10% IRS penalty.

- Contribution Deductibility: Unlike some other retirement accounts, direct contributions to annuities are generally not tax-deductible.

- Impact of Tax Rate Changes: Increases in future income tax rates would enhance the attractiveness of annuities' tax-deferred status.

Athene's operations are heavily influenced by evolving legal and regulatory frameworks, particularly concerning solvency and consumer protection. For example, the company must adhere to risk-based capital (RBC) standards, with the U.S. life insurance industry's aggregate RBC ratio remaining strong as of year-end 2023, providing a benchmark for Athene's capital management.

The pension risk transfer market, a key area for Athene, is governed by laws like ERISA, mandating fiduciary responsibilities and reporting requirements for pension buy-out and buy-in transactions. Compliance with these stringent rules is essential for ensuring the legality and smooth execution of Athene's strategies, safeguarding plan participants' rights.

Data privacy laws, such as GDPR and CCPA, impose significant obligations on Athene regarding the handling of personal information, with potential fines for non-compliance reaching up to 4% of global annual turnover. The company must maintain robust data governance and invest in security to navigate the increasing number of global privacy regulations, with several US states expected to enact comprehensive laws by mid-2025.

Environmental factors

Climate change presents significant physical and transition risks to Athene's investment portfolio. Physical risks, such as extreme weather events like floods and wildfires, could directly impact the value of real estate and infrastructure assets, potentially leading to substantial losses. For instance, a study by S&P Global Ratings in 2024 highlighted that climate-related events could cost the global economy trillions of dollars by mid-century, with infrastructure assets being particularly vulnerable.

Transition risks arise from the shift towards a low-carbon economy. Investments in carbon-intensive industries, such as fossil fuels, could face devaluation due to new regulations, carbon pricing mechanisms, or changing consumer preferences. By 2025, many energy companies are already seeing increased pressure from investors and regulators to disclose their climate-related financial risks and develop transition plans.

Athene actively assesses these climate-related financial risks through scenario analysis and stress testing of its investment holdings. The company aims to identify assets that are vulnerable to both physical impacts and regulatory changes. For example, by 2024, many institutional investors were increasing their allocation to green bonds and sustainable infrastructure projects to mitigate these risks.

Mitigation strategies include diversifying the portfolio away from high-carbon assets and increasing investments in climate-resilient and renewable energy sectors. Athene's approach involves engaging with portfolio companies to encourage sustainable practices and advocating for climate-friendly policies. The firm's commitment in 2025 to achieving net-zero emissions across its investment portfolio by 2050 underscores its proactive stance on managing climate-related financial risks.

Environmental, Social, and Governance (ESG) factors are increasingly shaping investment decisions, with global sustainable investment assets reaching an estimated $37.8 trillion in 2024, according to the Global Sustainable Investment Alliance. This growing emphasis reflects a fundamental shift in how investors assess risk and opportunity, moving beyond traditional financial metrics to include a company's impact on the planet and society.

Athene, like many forward-thinking financial institutions, is integrating ESG considerations into its investment strategies. This involves a careful evaluation of environmental impact, social responsibility, and corporate governance within its portfolio companies, potentially influencing asset allocation and driving engagement to encourage more sustainable practices. For instance, in 2024, Athene continued to assess the carbon footprints of its major investments, aiming to align its holdings with net-zero targets.

Stakeholders, including institutional investors, regulators, and the public, are exerting significant pressure on companies to adopt sustainable and responsible investing practices. This pressure is evident in the rise of ESG-focused funds and shareholder activism, with many asset managers now mandating ESG reporting from their investee companies. By 2025, it's projected that over 70% of major asset managers will have integrated ESG criteria into their investment processes.

Regulatory bodies globally are increasingly mandating climate-related disclosures for financial institutions. This trend, exemplified by frameworks like the Task Force on Climate-related Financial Disclosures (TCFD), pushes companies like Athene to be more transparent about their climate risks and strategic responses. For instance, the SEC's proposed climate disclosure rules in the US aim to standardize reporting, which could require significant data collection and verification efforts from insurers.

Resource Scarcity and Operational Sustainability

Athene's commitment to operational sustainability is a key environmental consideration. The company actively pursues initiatives to minimize its direct environmental footprint, focusing on reducing energy consumption within its offices and managing waste generation effectively. These efforts align with broader corporate social responsibility goals and can lead to tangible cost savings.

Specific actions include implementing energy-efficient technologies and promoting recycling programs across its facilities. By conserving resources and adopting eco-friendly practices, Athene aims to operate more efficiently and responsibly. For instance, a focus on reducing paper usage through digital transformation efforts directly impacts resource conservation.

- Energy Efficiency: Implementing smart building technologies and promoting energy-saving behaviors among employees to reduce office energy consumption.

- Waste Reduction: Enhancing recycling programs and minimizing single-use plastics within corporate operations.

- Carbon Footprint: Tracking and aiming to reduce greenhouse gas emissions associated with business travel and office utilities.

- Sustainable Procurement: Prioritizing vendors and suppliers with strong environmental track records.

Natural Disasters and Business Continuity

The increasing frequency and intensity of natural disasters pose a significant threat to Athene's business continuity and its client base. Events like severe storms, floods, and wildfires can disrupt operations, impact investment portfolios, and lead to a surge in policyholder claims, potentially straining financial resources. For instance, the economic losses from natural disasters globally reached an estimated $232 billion in 2023, underscoring the growing financial risks.

Robust disaster recovery plans and resilient infrastructure are therefore paramount for Athene to ensure uninterrupted service delivery. This includes having geographically dispersed data centers, redundant communication systems, and well-rehearsed emergency protocols. The company's ability to maintain operational integrity during and after a catastrophic event directly influences client trust and its long-term financial stability.

Such events can also have a ripple effect on regional economic stability, which is directly relevant to Athene's investment strategies and the financial health of its policyholders. A widespread economic downturn following a major disaster could impact asset values and the ability of clients to meet premium obligations. For example, the economic cost of Hurricane Ian in 2022 was estimated to be between $50 billion and $65 billion, highlighting the substantial economic impact on affected regions.

- Increased Claims: Natural disasters can lead to a significant uptick in life insurance and annuity claims, impacting Athene's liquidity and profitability.

- Investment Volatility: Disasters can cause market downturns, affecting the value of Athene's investment portfolio and the assets backing its policies.

- Operational Disruption: Physical damage to infrastructure or widespread power outages can halt business operations, hindering claim processing and customer service.

- Reputational Risk: Inadequate disaster preparedness or slow response times can damage Athene's reputation, leading to customer attrition and difficulty attracting new clients.

Environmental factors significantly influence Athene's operations and investment strategies, with climate change posing both physical and transition risks. The global economy faced an estimated trillions of dollars in climate-related costs by mid-century as of 2024, with infrastructure assets being particularly vulnerable. Athene actively manages these risks through scenario analysis and stress testing, aiming to align its portfolio with a net-zero emissions goal by 2050, a commitment made in 2025.

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data, drawing from official government reports, reputable financial institutions like the IMF and World Bank, and leading industry research firms. This multi-faceted approach ensures comprehensive and accurate insights into the political, economic, social, technological, legal, and environmental factors impacting Athene.