Athene Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Athene Bundle

Athene's competitive landscape is shaped by powerful forces, from the bargaining power of buyers to the intensity of rivalry. Understanding these dynamics is crucial for any strategic decision-maker looking to navigate the insurance and retirement services sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Athene’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The reinsurance market, vital for Athene's risk and capital management, can exhibit concentration. This means a few large reinsurers might hold significant sway in pricing and terms. For instance, in 2024, the global reinsurance market continued to be dominated by a handful of major players, with the top 10 companies accounting for a substantial portion of global premiums. Athene’s reliance on these providers for managing its extensive liabilities and capital needs underscores the importance of these relationships.

Athene's reliance on a diverse, high-quality investment portfolio for its annuity products means the bargaining power of suppliers for these assets is a critical factor. The availability and cost of suitable investments, like corporate bonds and alternative assets, directly influence Athene's profitability.

For instance, in 2024, the yields on investment-grade corporate bonds, a key asset class for insurers, saw fluctuations influenced by Federal Reserve policy and economic outlook. Higher yields can increase Athene's investment income, but also reflect greater perceived risk or demand from other investors, potentially increasing the cost of acquiring these assets.

Athene's strategy of holding elevated allocations to less-liquid investments, while potentially offering higher returns, also exposes it to greater supplier power. If the market for these specialized assets tightens, or if the number of providers diminishes, suppliers can command higher prices or more favorable terms.

Suppliers of specialized financial talent, like actuaries and investment managers, wield considerable power in the retirement services and annuity sector. Athene, like its peers, relies on these highly skilled individuals whose expertise is crucial for product development and risk management. For instance, a report from The Bureau of Labor Statistics in 2024 projected a 6% growth for financial managers, underscoring the demand for such professionals.

A scarcity of these specialized professionals can directly impact Athene's operational costs, as competition to attract and retain top talent intensifies. This tight labor market means that companies may need to offer higher salaries and more attractive benefits packages, directly affecting profitability. The average salary for an actuary in the US, according to industry surveys from early 2024, often exceeded $120,000 annually, reflecting this specialized demand.

Technology and Data Service Providers

As the financial sector, including companies like Athene, leans heavily into digital transformation and artificial intelligence for client services and custom financial planning, the importance of technology and data service providers is escalating. The leverage these suppliers hold is amplified when their offerings are unique or provide a distinct edge in the competitive marketplace.

The increasing demand for specialized AI algorithms and cloud infrastructure in financial services means providers with proprietary technology or critical data integration capabilities can command higher prices. For instance, in 2024, the global market for AI in financial services was projected to reach over $25 billion, highlighting the significant investment and reliance on these tech partners.

- Proprietary Solutions: Suppliers offering unique AI models or data analytics platforms that are difficult for Athene to replicate internally or source elsewhere gain substantial bargaining power.

- Switching Costs: High costs associated with migrating data, retraining staff, or reconfiguring systems if Athene were to change technology providers further strengthen supplier leverage.

- Concentration of Suppliers: A limited number of providers offering essential, specialized services can lead to greater supplier power due to reduced competition among suppliers.

- Criticality of Service: The more integral a technology or data service is to Athene's core operations and competitive strategy, the greater the supplier's ability to influence terms.

Regulatory and Rating Agency Influence

Regulatory bodies and credit rating agencies exert significant influence, acting as de facto suppliers by dictating terms that affect Athene's operational capacity. For instance, upcoming solvency regulations, like the Insurance Capital Standard (ICS), will directly shape how Athene must structure its capital, impacting its flexibility and profitability. Failure to meet these requirements can lead to punitive measures, effectively limiting Athene’s ability to operate or attract capital.

The pronouncements of credit rating agencies are also pivotal. A downgrade by agencies like AM Best or S&P can increase Athene's cost of capital and deter potential investors and customers, especially in the annuity market where financial strength is paramount. In 2024, insurers are keenly aware of how rating agency actions can ripple through their balance sheets, affecting everything from investment strategies to product pricing.

- Regulatory Impact: Compliance with regulations like ICS 2.0, expected to be fully implemented by 2025, will mandate specific capital levels, potentially increasing operational costs for insurers.

- Rating Agency Leverage: A downgrade by a major rating agency can significantly increase an insurer's cost of debt and impact its ability to secure new business, as seen in past industry events.

- Capital Requirements: Stricter capital requirements directly limit an insurer's ability to deploy capital into growth initiatives or shareholder returns, essentially dictating operational parameters.

- Market Perception: The perceived financial strength, heavily influenced by ratings, affects customer trust and the competitive positioning of companies like Athene in the long-term savings and retirement market.

Suppliers to Athene, particularly reinsurers and providers of specialized financial talent, can exert significant bargaining power. This power is amplified by market concentration, high switching costs, and the critical nature of their services to Athene's operations and profitability. For instance, the demand for actuaries in 2024 remained high, with average salaries exceeding $120,000 annually, reflecting this supplier leverage.

What is included in the product

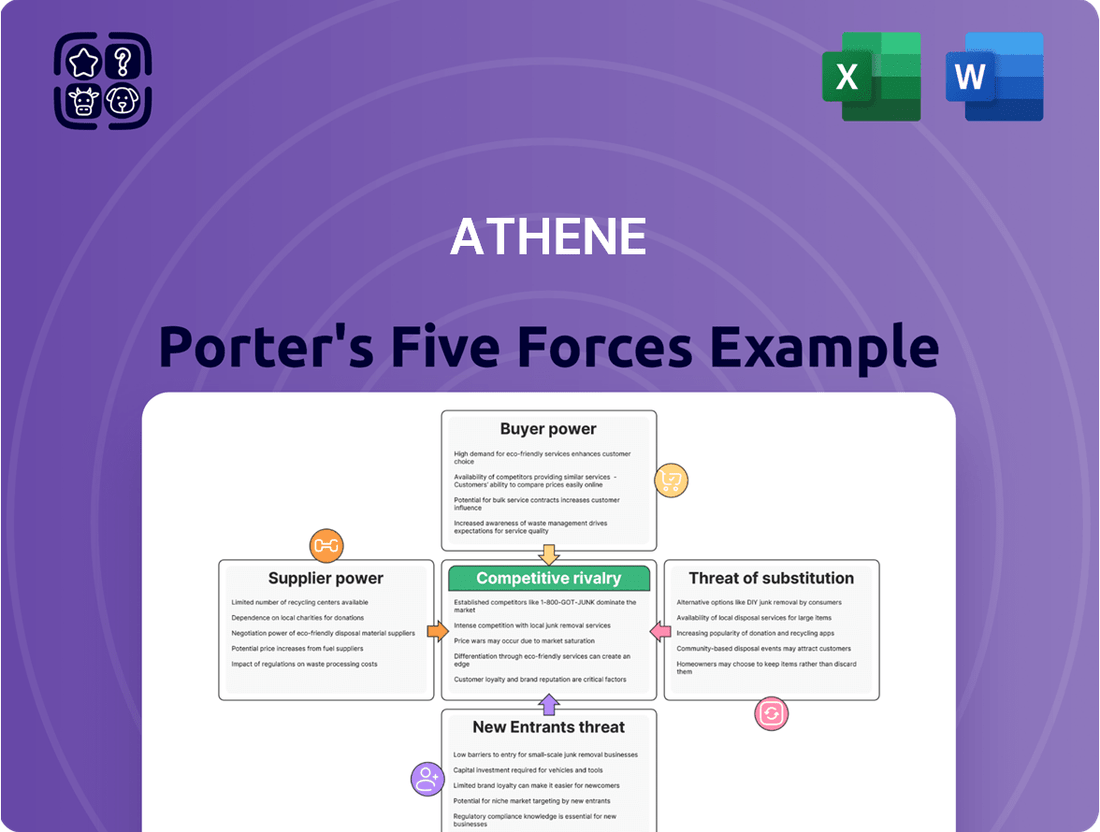

Analyzes the competitive landscape for Athene by examining the intensity of rivalry, the threat of new entrants, buyer and supplier power, and the threat of substitutes.

Identify and quantify competitive pressures so you can proactively mitigate risks and capitalize on opportunities.

Customers Bargaining Power

Individual annuity buyers, especially those focused on fixed annuities, are often quite sensitive to price. They actively shop around, comparing interest rates and contract terms from various companies. This comparison shopping directly impacts Athene, as competitive pricing and attractive product features are crucial for winning and keeping these customers.

Athene's dominant position in the fixed annuity market, evidenced by its significant market share, indicates a successful strategy in meeting this price sensitivity. For instance, in 2024, the fixed annuity market saw continued demand, with many consumers seeking guaranteed returns amidst economic uncertainty. Athene's ability to maintain its leadership suggests it offers compelling value propositions that resonate with these price-conscious buyers.

Corporate pension plan sponsors are incredibly savvy when it comes to pension risk transfer (PRT) solutions. They wield significant bargaining power because these are large, complex deals where they're actively seeking the best terms and security.

These sophisticated buyers typically shop around, engaging several insurers to solicit competitive bids. This competitive environment naturally drives down prices and improves contract terms for the sponsors.

The sheer size of these transactions means sponsors conduct extensive due diligence, meticulously examining an insurer's financial strength, claims-paying ability, and historical performance before committing.

For instance, in 2024, major PRT deals continued to see significant volume, with many corporate sponsors leveraging their informed position to secure favorable pricing and security features from insurers.

The proliferation of online comparison platforms and readily accessible product information significantly amplifies customer bargaining power in the annuity market. Customers can now effortlessly research features, fees, and performance across numerous providers, effectively lowering the perceived cost of switching for new annuity purchases. For instance, by mid-2024, a significant portion of annuity shoppers reported using online tools to compare options, indicating a clear shift in how decisions are made.

Impact of Financial Advisors and Distribution Channels

Many customers engage with annuities through financial advisors and institutions. These intermediaries can pool customer demand, giving them significant leverage in influencing product selection and pricing. This aggregated demand means a few key relationships can have a substantial impact on companies like Athene.

Athene's strategic focus on expanding its retail distribution capabilities highlights the critical role of these channels. Financial institutions, in particular, are a major contributor to Athene's retail sales volume, underscoring their power as a customer proxy. For instance, in 2023, a significant portion of Athene's retail annuity sales were channeled through these partnerships, demonstrating the concentrated nature of customer access.

- Financial advisors act as aggregators of customer demand, amplifying their bargaining power.

- Institutions, by channeling large volumes of business, can negotiate more favorable terms.

- Athene's reliance on financial institutions for a large share of its retail volume illustrates this dependency.

- The ability of these channels to influence product choice and pricing directly impacts profitability.

Customer Switching Costs for Existing Products

While new annuity purchases might see limited switching costs, particularly for simpler products, established annuity contracts often present more significant hurdles for policyholders looking to transfer their business. These costs can manifest as surrender charges, which are typically levied if a policy is cashed out within a certain timeframe, or the potential forfeiture of guaranteed benefits, such as fixed interest rates or death benefit enhancements that are tied to the original contract. For Athene, this translates into a degree of customer stickiness within its existing portfolio, as the financial implications of moving an annuity can outweigh the perceived benefits of a new product for many current policyholders. This dynamic somewhat mitigates the immediate bargaining power of existing customers, as the cost and complexity of switching reduce their ability to easily demand better terms or move to a competitor.

The bargaining power of customers regarding switching costs for existing products can be understood through several key points:

- Surrender Charges: Many annuity contracts impose penalties for early withdrawal, often tiered and decreasing over time. For instance, a common surrender charge schedule might start at 7-10% in the first year and gradually reduce to zero over 7-10 years.

- Loss of Guarantees: Existing policies may offer features like guaranteed minimum withdrawal benefits (GMWBs) or guaranteed lifetime income benefits that are lost upon surrender, representing a significant intangible cost.

- Complexity of Transfer: Moving an annuity can involve complex paperwork and may trigger taxable events, adding to the hassle and cost for the policyholder.

- Limited Market for Existing Policies: Unlike easily transferable assets, finding a buyer or a seamless transfer mechanism for a specific existing annuity contract can be challenging, further limiting customer options.

Customers, particularly those in the individual annuity market, exhibit considerable bargaining power due to price sensitivity and the ease of comparing offerings. This is amplified by sophisticated buyers like corporate pension plan sponsors who leverage large transactions for better terms. The increasing prevalence of online comparison tools and the influence of financial advisors as demand aggregators further enhance this power, allowing customers to negotiate more favorable conditions.

Same Document Delivered

Athene Porter's Five Forces Analysis

You're previewing the final version of Athene Porter's Five Forces Analysis—precisely the same document that will be available to you instantly after buying. This comprehensive report meticulously details each of Porter's five competitive forces: threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry among existing competitors. You'll gain invaluable insights into the competitive landscape and strategic positioning relevant to Athene Porter. This is the complete, ready-to-use analysis file, ensuring you receive exactly what you need to inform your business strategy.

Rivalry Among Competitors

The U.S. annuity market is a battleground dominated by a handful of major players, and Athene stands firm among them. In 2024, Athene consistently held its position as a top annuity provider, demonstrating significant market influence. This high degree of market concentration fuels fierce competition as these established firms vie for greater market share.

In the competitive fixed annuity market, insurers actively differentiate through crediting rates, product features, and distribution channels to attract and retain customers seeking principal protection and guaranteed returns. For instance, as of early 2024, crediting rates for multi-year guaranteed annuities (MYGAs) have shown variability, with some insurers offering competitive annual rates exceeding 4.5% to stand out.

The industry is witnessing a strategic shift towards simpler annuity products, making them more accessible and understandable to a broader range of investors. This simplification aims to reduce complexity and enhance customer experience, a key differentiator in a crowded marketplace.

Furthermore, a significant trend involves the integration of lifetime income solutions directly into retirement plans and offerings. This innovation addresses the growing concern of longevity risk among retirees, providing a valuable, differentiated feature that appeals to a large segment of the market.

The insurance sector is heavily regulated, and meeting substantial capital requirements acts as a significant hurdle for new companies. This robust regulatory framework, however, also fuels intense competition among established insurers who must constantly adjust to new solvency standards. For instance, European insurers are anticipating significant changes with the implementation of Solvency II reforms and new capital rules expected to be finalized for 2025, demanding greater financial resilience.

These evolving capital rules and supervisory approaches, particularly those being developed for 2025, compel existing players to maintain strong financial positions, often leading to strategic mergers and acquisitions as companies seek scale and efficiency to meet these demands. The pressure to comply with increasingly stringent capital adequacy ratios intensifies rivalry, as firms vie for market share while managing their risk-weighted assets effectively.

Industry Growth and Demographic Tailwinds

The retirement services and annuity market is seeing consistent growth, largely fueled by the aging demographic and a rising desire for secure income streams. This expansion naturally invites more players, intensifying competitive rivalry, yet it also presents significant avenues for established companies like Athene to broaden their reach.

As of 2024, the U.S. retirement market alone is projected to manage trillions of dollars in assets. This robust market size means that while competition is fierce, the sheer volume of potential customers ensures that even with many participants, there's still substantial room for growth. Companies are vying for market share through product innovation and competitive pricing strategies.

- Aging Population: The significant increase in individuals nearing or in retirement age creates a sustained demand for retirement income solutions.

- Guaranteed Income Demand: There's a growing preference among consumers for financial products that offer predictable, guaranteed payouts, a core offering of annuity providers.

- Market Size: The sheer scale of the retirement market provides ample opportunity for multiple companies to thrive and expand, even amidst intense competition.

- Competitive Strategies: Companies are differentiating themselves through specialized product offerings, technology adoption, and customer service to capture a larger share of this growing market.

Strategic Partnerships and M&A Activity

Competitive rivalry within the retirement services industry is intensifying, marked by a notable trend of consolidation and strategic partnerships. This consolidation is largely driven by persistent fee compression, which pressures recordkeeper firms to achieve greater scale and efficiency. In 2024, the financial services sector continued to see significant M&A activity, with specialized fintech and recordkeeping firms being prime targets as larger players seek to enhance their capabilities and market share.

Athene, leveraging its relationship with Apollo, is a proactive participant in this evolving landscape. They are actively pursuing strategic investments and collaborations designed to broaden their operational footprint and introduce a more diversified range of financial products to their client base. For instance, Apollo's acquisition of certain asset management businesses in late 2023 and early 2024 has provided Athene with enhanced capabilities in areas like alternative investments, which can be integrated into their retirement solutions.

- Consolidation Driver: Fee compression is a primary catalyst for recordkeeper firms to merge or acquire, aiming for economies of scale.

- Strategic Investments: Athene, through Apollo, actively engages in strategic investments to grow its market presence.

- Product Diversification: Partnerships and M&A are key to expanding Athene's product and service offerings in the retirement sector.

- Market Trend: The industry is characterized by ongoing M&A activity, with fintech and recordkeeping entities being central to these deals in 2024.

Competitive rivalry in the annuity market is intense, with established players like Athene actively differentiating their offerings through crediting rates, product simplicity, and integrated lifetime income solutions. Regulatory pressures, particularly evolving capital requirements anticipated for 2025, further fuel competition by necessitating scale and efficiency, often leading to industry consolidation. The substantial size of the U.S. retirement market, projected to manage trillions in assets as of 2024, ensures that while competition is fierce, opportunities for growth remain significant for those who can innovate and adapt to customer demands.

| Key Competitive Factors | 2024 Data/Trends | Impact on Rivalry |

| Crediting Rates (MYGAs) | Varied, with some exceeding 4.5% annually | Direct competition for customer deposits |

| Product Simplification | Growing trend towards accessible products | Reduces barriers to entry for some customer segments |

| Lifetime Income Integration | Increasing focus on longevity risk solutions | Differentiator for attracting retirees |

| Regulatory Capital Requirements | Anticipated changes for 2025 (e.g., Solvency II) | Drives consolidation and focus on scale/efficiency |

| Market Size (U.S. Retirement Assets) | Trillions of dollars managed | Sustains competition but offers growth opportunities |

SSubstitutes Threaten

Traditional investment vehicles like stocks, bonds, mutual funds, and certificates of deposit (CDs) pose a significant threat to annuities, especially those offering fixed rates. For instance, as of early 2024, the S&P 500 has shown robust performance, offering potential returns that can be more attractive than the guaranteed, albeit often lower, rates of fixed annuities. This direct comparison forces consumers to evaluate the trade-off between security and growth potential.

Individuals often view these traditional options as viable alternatives when seeking guaranteed principal protection coupled with a decent, predictable return, similar to what a fixed annuity might offer. The accessibility and familiarity of these instruments, coupled with varying risk appetites, mean many customers will naturally gravitate towards them if annuity benefits don't sufficiently outweigh the perceived risks or limitations.

The perceived risk associated with annuities, such as surrender charges or less liquidity, can further push investors towards more liquid and potentially higher-growth traditional markets. For example, while a 5-year CD might offer a competitive rate, the ability to access funds without penalty in a brokerage account holding a diversified ETF is a compelling substitute for many.

Individuals increasingly opt for self-managed retirement portfolios, often utilizing low-cost brokerage accounts or sophisticated robo-advisors. This trend directly competes with annuities by offering greater control over investment choices and potentially lower fees. For instance, the U.S. retirement market saw significant growth in self-directed IRAs, with assets managed independently by individuals continuing to climb well into 2024.

While self-management provides flexibility, it places the full burden of investment performance and longevity risk squarely on the individual. This contrasts with the guaranteed income streams often provided by annuities, which transfer these risks to the issuer. The accessibility of online investment platforms has democratized portfolio management, making it a viable alternative for a broader range of investors.

Companies considering de-risking their pension obligations have several alternatives to a full pension risk transfer (PRT) or buyout. These include continuing to manage defined benefit plans internally, implementing sophisticated asset-liability matching (ALM) strategies, or exploring other de-risking tools such as liability-driven investing (LDI) without a complete transfer. For instance, in 2024, many companies are opting for LDI strategies to better align their assets with future pension liabilities, aiming to reduce volatility without the upfront cost of a buyout. This approach allows for a more gradual reduction of risk, aligning with the company's evolving risk appetite and administrative capacity.

Changing Regulatory Landscape and New Product Development

The evolving regulatory environment, notably the SECURE 2.0 Act enacted in late 2022, is a significant driver of substitute products that could impact Athene. This legislation has actively encouraged the development of innovative retirement income solutions, particularly in-plan options that allow individuals to annuitize within their existing employer-sponsored retirement plans. These new offerings can directly compete with traditional annuities, which have historically been a core product for companies like Athene.

This regulatory push towards embedded retirement income means Athene faces increased competition from these emerging in-plan solutions. For instance, the growth of managed accounts offering guaranteed lifetime income features, often accessible directly within 401(k)s, presents a viable alternative for consumers seeking guaranteed income streams. The market for these types of solutions is expanding rapidly, with projections indicating substantial growth in the coming years as plan sponsors increasingly adopt them.

- SECURE 2.0 Act's Impact: Fostered development of in-plan retirement income solutions.

- Competitive Alternatives: In-plan solutions and managed accounts with guaranteed income features emerge as substitutes.

- Market Evolution: Athene must innovate to maintain competitiveness against these evolving product landscapes.

- Consumer Adoption: Growing availability and acceptance of in-plan options could shift consumer preference away from traditional annuities.

Perception of Value and Trust

The perceived value of guaranteed income and principal protection offered by annuities is a key factor in how easily they can be substituted. If investors believe they can achieve similar guarantees or higher returns elsewhere, they're more likely to look at alternatives. For instance, in 2024, the average yield on a 10-year U.S. Treasury note hovered around 4.5%, offering a benchmark for risk-free returns that competitors might try to match or exceed.

Trust in annuity providers significantly influences this substitution dynamic. Negative publicity, such as regulatory actions or lawsuits against specific companies, can erode consumer confidence. For example, a major insurer facing litigation in 2023 for alleged mis-selling practices could make consumers wary of similar products, driving them towards less scrutinized investment vehicles.

- Annuity Value Proposition: Guaranteed income and principal protection are core benefits, but their perceived value is benchmarked against prevailing market rates for similar safety.

- Competitive Returns: The potential for higher returns from alternative investments like dividend-paying stocks or balanced mutual funds directly challenges annuity attractiveness.

- Impact of Market Volatility: Periods of significant market downturns can increase demand for annuities' safety features, but conversely, strong market recoveries might pull investors towards growth-oriented assets.

- Trust and Provider Reputation: Litigation, regulatory fines, or solvency concerns related to annuity providers can create a significant threat of substitution as investors seek more reliable alternatives.

The threat of substitutes for annuities is substantial, as investors can achieve similar financial goals through various other investment vehicles. Traditional options like stocks, bonds, and mutual funds, especially those exhibiting strong performance like the S&P 500 in early 2024, offer growth potential that can rival or exceed annuity returns. Furthermore, the increasing popularity of self-managed retirement portfolios, facilitated by accessible robo-advisors and low-cost brokerages, directly competes by providing greater control and potentially lower fees. Regulatory changes, such as the SECURE 2.0 Act, are also spurring the development of in-plan retirement income solutions that can serve as direct substitutes for traditional annuities.

| Substitute Type | Key Features | 2024 Market Context/Data | Competitive Impact on Annuities |

|---|---|---|---|

| Traditional Investments (Stocks, Bonds, ETFs) | Potential for higher returns, diversification, liquidity | S&P 500 showed robust performance; 10-year Treasury yields around 4.5% | Attracts investors seeking growth over guaranteed, lower annuity rates. |

| Self-Managed Portfolios (Robo-advisors, Brokerages) | Control, lower fees, flexibility | Growth in self-directed IRAs and managed accounts | Offers a DIY alternative, appealing to tech-savvy investors prioritizing customization. |

| In-Plan Retirement Income Solutions | Embedded within employer plans, simplified access | SECURE 2.0 Act encourages development; growing adoption of guaranteed lifetime income features in 401(k)s | Directly competes by offering similar guaranteed income benefits within existing retirement structures. |

Entrants Threaten

The annuity and retirement services sector presents a formidable challenge for newcomers due to substantial capital demands and complex regulatory landscapes. Companies entering this market must possess significant financial reserves to meet rigorous solvency standards, a requirement that can easily run into hundreds of millions, if not billions, of dollars. For instance, in 2024, many established insurers maintain risk-based capital ratios well above regulatory minimums, signaling the high capital base needed for competitive operation.

Navigating the licensing and compliance maze is another significant barrier. Obtaining the necessary approvals from state and federal regulatory bodies is a protracted and costly process, often requiring extensive legal and actuarial expertise. These hurdles ensure that only well-funded and prepared entities can realistically consider entering the market, thereby limiting the threat of new entrants.

The significant investment required to build and maintain established distribution networks presents a formidable barrier for new entrants. Athene, for instance, relies on its deep-seated relationships with financial advisors, broker-dealers, and various financial institutions to reach its target markets effectively.

For newcomers, replicating these extensive networks requires substantial time, capital, and strategic partnerships, making immediate market penetration a considerable challenge.

In 2024, the insurance and annuity market continues to see established firms leverage their existing advisor networks, which are often built over decades, to maintain a competitive edge.

Gaining access to these distribution channels, which are critical for product sales and client acquisition, is not easily achieved by companies lacking a proven track record and widespread industry connections.

Trust and brand reputation are absolutely critical in the financial services sector, especially when dealing with retirement savings. People are entrusting their future security to these companies, so that credibility is a huge deal. New companies entering this space have a massive hurdle to overcome in building that same level of confidence that established players like Athene already possess.

For instance, a recent survey indicated that over 60% of consumers consider brand reputation a top factor when choosing a financial provider. This highlights the significant barrier to entry for newcomers who lack Athene's established track record and the associated customer loyalty. It takes time and consistent positive performance to cultivate such trust.

Complexity of Product Development and Risk Management

The development and ongoing management of intricate annuity products, alongside pension risk transfer solutions, demand a profound level of specialized expertise. This includes deep knowledge in actuarial science, sophisticated investment strategies, and robust risk management frameworks. New companies entering this market would face a significant hurdle in acquiring or building this essential institutional knowledge and the necessary sophisticated infrastructure.

Consider the substantial upfront investment required. For instance, building the actuarial models and IT systems to support complex guaranteed lifetime income products can easily run into tens of millions of dollars. Furthermore, a new entrant must demonstrate a proven track record in managing market volatility and longevity risk, which is crucial for securing regulatory approval and building client trust. The regulatory landscape for these products is also highly complex, requiring significant compliance resources.

- Specialized Expertise: Actuarial, investment, and risk management skills are non-negotiable.

- Infrastructure Costs: Significant investment needed for actuarial modeling and IT systems.

- Risk Management Track Record: Demonstrating ability to manage market and longevity risk is key.

- Regulatory Hurdles: Navigating complex regulations requires substantial compliance resources.

Integration with Existing Financial Ecosystems

New entrants face significant hurdles in integrating with the established financial ecosystem. This involves connecting with diverse platforms like investment management systems, insurance recordkeepers, and a wide array of advisory service providers. Such integration demands considerable technological investment and the formation of strategic alliances, both of which can be expensive and protracted processes.

For instance, a new fintech company aiming to offer retirement solutions would need to ensure seamless data exchange with existing 401(k) recordkeepers. In 2024, the average cost for a mid-sized company to implement a new financial technology solution, including integration, can range from $50,000 to $250,000, depending on the complexity and vendor. The need for these costly integrations acts as a substantial barrier, deterring many potential new market entrants.

- Technological Investment: New entrants must invest heavily in developing or acquiring the necessary technology to interface with existing financial infrastructure.

- Strategic Partnerships: Securing partnerships with established players is crucial for market access but often requires concessions or significant upfront investment.

- Data Interoperability: Ensuring seamless data flow between new and legacy systems is a complex technical challenge that adds to the cost and time-to-market.

- Regulatory Compliance: Integration must also adhere to strict financial regulations, adding another layer of complexity and cost for new participants.

The threat of new entrants in the annuity and retirement services sector is significantly low. This is primarily due to the immense capital requirements, complex regulatory environment, and the need for established distribution networks. New companies face substantial barriers in building trust and acquiring specialized expertise, making entry a formidable challenge.

For example, in 2024, the ongoing need for high risk-based capital ratios, often exceeding 300% of regulatory minimums for well-capitalized insurers, deters many aspiring players. Additionally, the cost of building a distribution network comparable to those of established firms, which can take decades to cultivate, represents a significant financial and time investment.

New entrants also grapple with the high costs associated with integrating with existing financial infrastructure, estimated between $50,000 to $250,000 for mid-sized companies in 2024 for new technology solutions. This, combined with the necessity of demonstrating a proven track record in managing complex financial risks, effectively limits the influx of new competition.

| Barrier | Estimated Cost/Effort | Impact on New Entrants |

| Capital Requirements | Hundreds of millions to billions of dollars (e.g., high risk-based capital ratios) | High barrier; requires substantial funding. |

| Regulatory Compliance | Protracted and costly licensing and approval processes | Significant time and resource drain. |

| Distribution Networks | Decades to build, substantial investment in relationships | Difficult to replicate, limits market access. |

| Specialized Expertise | Significant investment in actuarial, IT, and risk management talent | Requires deep domain knowledge and infrastructure. |

| Ecosystem Integration | $50,000 - $250,000 for technology integration (2024 estimate) | Costly and complex technical challenge. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating company annual reports, industry-specific market research, and public financial filings to accurately assess competitive intensity.