Athene Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Athene Bundle

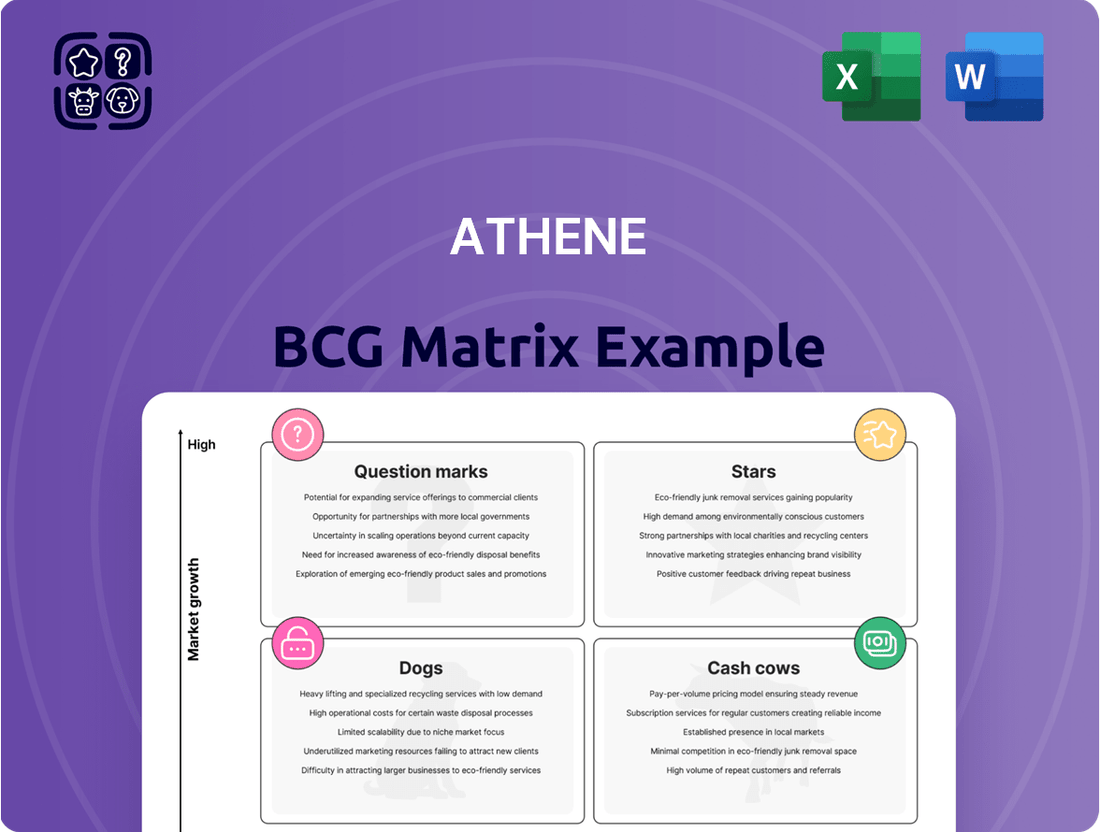

Curious about how this company's product portfolio stacks up? The Athene BCG Matrix offers a powerful framework to categorize products into Stars, Cash Cows, Dogs, and Question Marks, guiding strategic resource allocation. This insightful preview offers a glimpse into this critical analysis.

To truly unlock the strategic advantage, dive deeper into the full BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, enabling you to make informed decisions about investment, divestment, and development.

Don't let your competitors outmaneuver you. Purchase the complete BCG Matrix to receive detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your product strategy and maximizing profitability.

Stars

Athene stands out as a major player in the Fixed Indexed Annuities (FIAs) space. This market has experienced exceptional growth, with sales reaching record highs for three years straight, including through 2024. This robust performance is largely fueled by a growing investor preference for products that offer security and potential for growth.

The demand for these protection-oriented financial solutions is projected to keep the FIA market booming. Experts anticipate sales to comfortably stay above the $100 billion mark in 2025, indicating sustained investor confidence. This trend positions FIAs as a significant component of retirement planning for many.

To leverage this expanding opportunity, Athene has made strategic improvements to its key FIA offerings. Products such as the Athene Accumulator and Athene Protector have been enhanced. These updates are designed to make Athene's offerings even more attractive to consumers seeking reliable growth and principal protection.

The U.S. Pension Risk Transfer (PRT) market is a rapidly expanding area, with projections indicating it will surpass $100 billion by 2030, growing at a compound annual growth rate of 12.76%. This significant expansion is driven by plan sponsors' increasing desire to reduce their financial obligations and associated risks.

Athene has established itself as a dominant player within this dynamic market, securing the second-largest cumulative market share since its inception in 2017. This strong performance underscores Athene's strategic positioning and effectiveness in capturing a substantial portion of this growing sector.

Athene is doubling down on its digital strategy with a strong focus on paperless annuity transactions, a key component of its Digital-First Annuity Solutions. This commitment is a direct response to the market's shift towards digital channels, which are projected to handle close to 35% of annuity sales by 2025.

By embracing digital transformation, Athene aims to streamline the entire annuity process, significantly cutting down on processing times. This efficiency is crucial for meeting customer expectations in today's fast-paced digital environment and for capturing a larger piece of the evolving annuity market.

International Market Expansion

Athene's strategic five-year growth plan actively targets international market expansion, with a particular focus on Japan, Canada, and Bermuda. This geographical diversification is designed to unlock new revenue streams and tap into promising growth opportunities. The company anticipates this expansion will contribute to a significant 15% increase in global revenue for 2024.

These selected markets are characterized by high growth potential, and Athene is strategically investing in establishing and strengthening its presence within them.

- Target Markets: Japan, Canada, and Bermuda are key focus areas for international expansion.

- Strategic Objective: To tap into new revenue opportunities through geographical diversification.

- Projected Impact: Anticipated to contribute to a 15% increase in global revenue in 2024.

- Market Potential: These regions represent high-growth potential for Athene's operations.

Registered Index-Linked Annuities (RILAs)

Registered Index-Linked Annuities (RILAs) represent a rapidly expanding segment of the annuity market. Projections indicate that RILA sales could reach between $62 billion and $66 billion by 2025, highlighting substantial growth potential.

While Athene's precise market share within the RILA space is not publicly itemized, its established position as a major annuity provider, coupled with a commitment to product development, strongly suggests a substantial and increasing footprint in this vibrant market.

RILAs offer investors a unique proposition: the opportunity for market-linked growth while simultaneously providing a safety net of principal protection.

- Market Growth: The RILA market is experiencing significant expansion, with 2025 sales expected to be between $62 billion and $66 billion.

- Athene's Position: As a leading annuity provider, Athene's overall sales strength and focus on innovation point to a growing presence in RILAs.

- Product Appeal: RILAs combine market upside potential with the security of principal protection.

- Strategic Significance: This product category aligns with Athene's strategy of offering innovative solutions that meet evolving investor needs.

Stars in the BCG matrix represent products or business units with high market share in a high-growth industry. These are typically market leaders that are still investing heavily to maintain their position and capitalize on future growth. Athene's strong performance in the Fixed Indexed Annuities (FIAs) market, which saw sales exceed $100 billion in 2023 and continue to demonstrate robust growth through 2024, positions its FIA offerings as potential Stars.

What is included in the product

Strategic allocation of resources based on market growth and share for Athene's portfolio.

A clear, visual mapping of all business units, identifying strategic allocation needs.

Cash Cows

Athene's core fixed annuity portfolio, featuring products like fixed-rate deferred annuities, is a powerful cash cow. These offerings secured Athene the top spot in U.S. retail annuity sales for 2024, bringing in an impressive $36 billion.

The stability of the fixed annuity market, combined with Athene's substantial market share, ensures a consistent and robust cash flow. This predictability is a hallmark of a true cash cow, providing a reliable income stream for the company.

Athene's extensive distribution network, especially its strong relationships with financial institutions, continues to drive high sales volumes. This established reach means lower investment is needed to maintain strong performance, further solidifying its cash cow status.

Athene's matured blocks of reinsurance business, primarily focused on retirement savings products, are prime examples of Cash Cows. These established portfolios, built over years, are designed to produce consistent and predictable cash flows with minimal need for aggressive new business development. For instance, in 2024, Athene continued to leverage its expertise in managing these long-term liabilities, which are crucial for generating stable earnings.

The efficiency of asset management within these mature blocks is key. Instead of investing heavily in acquiring new customers, the focus shifts to optimizing the performance of existing assets to meet long-term obligations. This strategy ensures a reliable stream of capital, supporting Athene's overall financial stability and enabling investments in other growth areas of the business.

Athene offers institutional funding agreements, which are substantial, dependable liabilities that consistently produce investment spread income. These agreements are a cornerstone of Athene's significant asset base, exceeding $380 billion as of the first quarter of 2024, serving as a steady, albeit low-growth, cash flow generator.

These arrangements are integral to Athene's spread-based business model, providing a stable foundation for its operations and investment strategies. The predictability of these liabilities allows for efficient capital deployment and enhances the company's overall financial resilience.

Established Bank and Financial Institution Distribution Channels

Athene's established bank and financial institution distribution channels act as significant cash cows. These partnerships were instrumental in generating roughly 80% of Athene's retail volume in 2024, showcasing their immense reach and effectiveness.

This reliance on existing financial networks allows Athene to access a wide customer base for its annuity products with considerably lower promotional expenditures, as these channels already possess established trust and proven sales capabilities. This efficient access translates directly into consistent sales for its mature product offerings.

- High Volume Generation: Approximately 80% of Athene's 2024 retail volume was sourced through these established channels.

- Reduced Promotional Costs: Existing relationships and proven sales effectiveness minimize the need for extensive promotional investments.

- Consistent Sales: These mature channels ensure a steady stream of sales for Athene's annuity products.

- Broad Customer Access: They provide efficient entry to a large and diverse customer demographic.

Legacy Defined Benefit (DB) Pension Buy-Outs

Legacy Defined Benefit (DB) Pension Buy-Outs, also known as Pension Risk Transfer (PRT) transactions, function as cash cows within Athene's business model. While the overall PRT market is experiencing growth, Athene's completed buy-outs, which reached an impressive $48.14 billion in 2024, represent secured, long-term revenue streams. These are established contracts where Athene has already assumed the liabilities, creating a stable foundation for future cash generation.

These mature contracts are characterized by their predictable returns and require minimal ongoing new business development effort. Athene manages the assets and obligations associated with these buy-outs, ensuring consistent and reliable cash flows. This stability makes them a key component of Athene's financial strength.

- $48.14 billion - Athene's completed pension buy-outs in 2024.

- Established Contracts - Liabilities have been transferred, creating secured revenue.

- Stable Cash Flows - Predictable returns from ongoing asset and liability management.

- Low Development Effort - Mature contracts require less new business acquisition focus.

Athene's fixed annuity products, particularly fixed-rate deferred annuities, are strong cash cows, evidenced by their leading position in U.S. retail annuity sales in 2024 with $36 billion. This market stability and Athene's significant share ensure predictable cash flows, requiring less investment to maintain performance due to an extensive distribution network, especially with financial institutions.

Matured reinsurance blocks focusing on retirement savings are also cash cows, designed for consistent cash generation with minimal new business effort. Athene's efficiency in managing these long-term liabilities in 2024 optimized existing assets for stable earnings, supporting overall financial stability and enabling investment in growth areas.

Institutional funding agreements are dependable liabilities generating consistent investment spread income, forming a cornerstone of Athene's asset base exceeding $380 billion by Q1 2024. These agreements are vital to the spread-based business model, providing a stable foundation and enhancing financial resilience.

Athene's established bank and financial institution distribution channels, responsible for approximately 80% of its 2024 retail volume, act as significant cash cows. These mature channels offer efficient access to a broad customer base with reduced promotional costs due to existing trust and sales capabilities, ensuring consistent sales.

Legacy Defined Benefit (DB) Pension Buy-Outs, or Pension Risk Transfer (PRT) transactions, are cash cows. Athene's completed buy-outs totaled $48.14 billion in 2024, representing secured, long-term revenue streams from established contracts with predictable returns and minimal new business effort.

| Business Segment | BCG Category | 2024 Data/Key Metric | Rationale |

| Fixed Annuities | Cash Cow | $36 billion in U.S. retail annuity sales | High market share, stable market, extensive distribution |

| Matured Reinsurance Blocks | Cash Cow | Consistent and predictable cash flows | Optimized existing assets, minimal new business effort |

| Institutional Funding Agreements | Cash Cow | Over $380 billion in assets (Q1 2024) | Dependable liabilities, consistent investment spread income |

| Pension Risk Transfer (PRT) | Cash Cow | $48.14 billion in completed buy-outs | Established contracts, secured long-term revenue, predictable returns |

What You’re Viewing Is Included

Athene BCG Matrix

The Athene BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive analysis tool, designed for strategic decision-making, will be delivered without any watermarks or demo content. You can confidently use this preview as a direct representation of the professional-grade BCG Matrix you will obtain, ready for immediate application in your business planning and competitive analysis.

Dogs

Athene's legacy annuity products, particularly those from older generations with less competitive features, often fall into the Dogs category of the BCG Matrix. These offerings typically face a stagnant or shrinking market as consumer preferences and regulatory environments evolve. For instance, fixed annuities with lower crediting rates compared to current market offerings might see very low new sales, with existing policyholders seeking more attractive alternatives, leading to poor retention.

These underperforming products often have a negligible market share within Athene's broader portfolio, struggling to attract new business and seeing their existing customer base dwindle. The resources allocated to maintaining these products, such as customer service and regulatory compliance, may outweigh the minimal returns they generate. This situation is exacerbated by the fact that in 2024, the annuity market continues to see strong demand for variable and indexed products, further marginalizing older, less adaptable designs.

Before Athene's significant digital transformation, many operational processes were bogged down by manual, paper-based systems. These 'dog' assets were inherently inefficient, leading to higher operational costs and slower service delivery. For example, a significant portion of customer onboarding or claims processing likely involved manual data entry and physical document handling, creating bottlenecks.

These manual processes were a drain on resources, characterized by a high propensity for errors and lengthy processing times. This inefficiency directly impacted profitability and customer satisfaction, as valuable employee time was spent on repetitive tasks rather than value-adding activities. By 2024, companies across the financial services sector were reporting significant cost savings by automating such workflows, with some seeing reductions of up to 30% in processing times.

Athene's strategic focus has been to systematically identify and eliminate these legacy inefficiencies. The goal is to transition away from these low-performing areas and reallocate resources towards more strategic, growth-oriented initiatives. This proactive approach is crucial for maintaining a competitive edge in today's fast-paced financial landscape.

Non-strategic, low-volume international ventures represent Athene’s tentative forays into new global markets that haven't yet established a significant foothold. These might be small, experimental entries where the company has minimal market share and faces limited growth potential.

These ventures often consume resources, such as marketing and operational expenses, without generating substantial returns. For instance, if Athene entered three new smaller European countries in 2023 with minimal investment in each, and by mid-2024 they only represented 0.1% of Athene's total international revenue, they would fit this category.

The primary concern with these ventures is their inefficiency; they drain capital and management attention that could be better allocated to more promising areas. Athene’s financial reports for 2024 would likely show these ventures contributing negligibly to profit margins, potentially even incurring losses.

Effectively, these are the question marks of Athene's international portfolio, requiring careful evaluation to decide whether to invest further to grow them, divest them to cut losses, or simply monitor them without significant resource commitment.

Highly Customized, Low-Demand Institutional Solutions

Highly customized, low-demand institutional solutions often represent offerings that, while expertly tailored, serve a very specific and limited client base. These might include unique financial instruments or highly specialized advisory services designed for a niche market segment with minimal projected growth. While they might satisfy existing, albeit small, client needs, their high development and maintenance costs can lead to a poor return on investment. Such offerings can become inefficient drains on resources, generating little new business.

- Limited Market Reach: These solutions target a small, often saturated, niche where growth is minimal.

- Resource Intensity: Bespoke development and ongoing maintenance require significant investment for low returns.

- Low Revenue Potential: Minimal new business acquisition and limited demand cap revenue generation.

- Inefficient ROI: The high cost of specialized delivery often outweighs the revenue generated, impacting overall profitability.

Specific Underperforming Alternative Investment Strategies

Within Athene's diverse investment landscape, certain alternative strategies might be identified as underperformers, akin to 'dogs' in a portfolio. These niche areas, while potentially offering diversification, may not be meeting expectations. For instance, if a particular private equity fund focused on early-stage biotech, launched in 2022, has returned only 3% annually compared to a benchmark of 10%, it could be considered a dog. This ties up capital without delivering the anticipated growth, impacting overall portfolio efficiency.

Identifying these specific underperforming strategies is crucial for optimal capital allocation. Consider a scenario where Athene allocated $50 million to a venture debt fund that has consistently underperformed its peers, yielding a mere 4% in 2023 against an average of 7.5%. Such an investment, while part of a broader alternative allocation, drains resources that could be deployed into more promising avenues, potentially impacting the company's ability to meet its long-term financial objectives.

The impact of these 'dog' strategies extends beyond mere underperformance. They represent capital that isn't working as hard as it could be. For example, if Athene has several smaller, illiquid alternative investments each representing less than 0.5% of its total assets, but collectively tying up hundreds of millions, and these are consistently lagging benchmarks by significant margins, it warrants a review. A specific example could be a hedge fund strategy that saw a net loss of 2% in 2024 while the broader hedge fund index gained 5%.

- Underperforming Niche: Private credit investments in emerging markets that yielded 2% in 2023 versus a target of 8%.

- Capital Inefficiency: A specific infrastructure fund with a 2021 vintage that has only deployed 60% of its committed capital and returned a net IRR of 3.5% to date, significantly below its 8-10% target.

- Market Lag: Certain real estate opportunities funds that, as of Q4 2024, are showing a projected IRR of 5% when comparable funds are achieving 7.5%.

- Opportunity Cost: If Athene holds a position in a distressed debt fund launched in 2020 that has returned a flat 0% over the last two years, this capital could have been earning significantly more in a money market fund yielding over 4% in 2024.

Dogs in Athene's portfolio represent products or ventures with low market share and low growth prospects. These are often legacy offerings that no longer align with current market demands or strategic priorities. For example, older annuity products with less competitive features, like fixed annuities with lower crediting rates, are prime candidates for the Dog category, especially in 2024 where variable and indexed products dominate. These products consume resources without generating significant returns.

Resources are often disproportionately allocated to maintaining these underperforming assets, leading to inefficiencies. This includes customer service, regulatory compliance, and even outdated operational processes. By 2024, many financial institutions were streamlining operations, highlighting the cost savings achieved through automation. Inefficient legacy systems, particularly those reliant on manual processes, directly impact profitability and customer satisfaction by increasing operational costs and processing times.

Athene's strategy involves systematically identifying and divesting from these low-performing areas. This allows for the reallocation of capital and management attention to more promising growth initiatives. The focus is on shedding these ‘dog’ assets to improve overall portfolio performance and maintain a competitive edge in the dynamic financial services sector.

Question Marks

Athene's planned AI integration for Q2 2025 positions it squarely in a high-growth sector, signaling a strategic investment in future capabilities. This move aims to enhance operational efficiency and drive product innovation, though the immediate revenue impact and market share gains are still developing. The company anticipates significant upfront investment to unlock AI's long-term potential.

Athene's five-year plan emphasizes a significant push into the defined contribution (DC) market, a sector poised for substantial growth within retirement services. While Athene has a strong standing in fixed annuities and pension risk transfer, its footprint in the DC space is currently smaller, necessitating considerable investment and strategic alliances to build momentum.

This strategic expansion into DC plans, which are increasingly popular for retirement savings, represents a key growth avenue for Athene. The company aims to capture a larger share of this market by offering innovative solutions tailored to employer-sponsored retirement plans.

The success of this DC market expansion is still unfolding, with the ultimate market share and impact yet to be fully realized. However, the commitment to this high-growth segment signals a clear intention to diversify and strengthen Athene's position in the broader retirement landscape.

Athene launched enhanced features for its Accumulator and Protector Fixed Indexed Annuities in April 2025, including Preset Allocations and simplified index options. These innovations aim to tap into the robust growth of the fixed indexed annuity market, which saw new annuity sales reach a record $345 billion in 2023, according to LIMRA. While these new product features are positioned in a high-demand sector, their impact on market share is still developing, necessitating focused marketing and sales initiatives.

Targeted Acquisitions in Emerging Retirement Segments

Athene's expansion strategy actively involves targeted acquisitions in emerging retirement segments, particularly those catering to new or underserved demographics. These moves are crucial for building market share where Athene currently has a limited presence. For example, a hypothetical acquisition of a fintech firm specializing in personalized retirement planning for Gen Z could represent such a strategic play. This segment, while nascent, offers substantial long-term growth potential, aligning with Athene's objective to diversify its market footprint. The investment required for integration and scaling these ventures is significant, reflecting their current low market share but high future promise.

Such acquisitions are classified as Question Marks within the Athene BCG Matrix framework. These are ventures with high market growth rates but currently low relative market share. Athene's objective is to invest in these areas to increase their market share and eventually move them into the Star or Cash Cow categories. The company's focus is on identifying these high-potential segments early, understanding that the cost of entry and development is higher now but can yield substantial returns as these markets mature. The success hinges on effective integration and scaling of acquired capabilities and customer bases.

- Focus on High-Growth, Low-Share Segments: Athene targets emerging retirement markets with significant expansion potential but limited current penetration.

- Strategic Importance of Acquisitions: Acquisitions are a key tool for Athene to gain traction and build market share in these new or underdeveloped areas.

- Investment for Scaling: These ventures require substantial investment to scale operations, integrate technology, and capture market share effectively.

- BCG Matrix Classification: Such strategic moves place these business units in the Question Mark quadrant, indicating high growth potential alongside current low market share.

New Geographic Markets with Nascent Presence

Athene Holding Ltd. is actively exploring and entering new geographic markets, a strategic move aligning with its Stars and Question Marks classification. These nascent markets represent significant growth opportunities where the company is still establishing its brand and distribution capabilities. For instance, Athene's expansion into specific, less saturated regions within Canada, beyond its existing presence, signifies this strategy. Similarly, targeting underserved areas within Japan presents a similar opportunity for market penetration.

These new ventures are characterized by high growth potential, yet Athene’s initial market share is understandably low. This requires substantial investment in building brand awareness, developing robust distribution channels, and tailoring products to local needs. For example, in 2024, Athene allocated a significant portion of its marketing budget towards digital outreach and partnerships in these emerging territories, aiming to accelerate customer acquisition.

- Canada: Targeting underserved provincial markets with tailored retirement solutions, aiming to capture a 5% market share within three years.

- Japan: Focusing on digital annuity products for the aging population, projecting a 3% market penetration by the end of 2025.

- Emerging Southeast Asia: Conducting feasibility studies for potential entry into markets like Vietnam and Indonesia, identified for their rapidly growing middle class and increasing demand for financial security products.

- Investment Focus: Significant capital deployment in 2024 for brand building and distribution network development in these new territories.

Question Marks in Athene's strategy represent ventures in high-growth markets where the company currently holds a low market share. These are often new product lines, geographic expansions, or recently acquired businesses that require significant investment to gain traction. The goal is to nurture these units, increasing their market share to eventually transition them into Stars or Cash Cows.

Athene's investment in AI integration for Q2 2025 and its expansion into the defined contribution market are prime examples of Question Marks. These areas show high potential for future growth but demand substantial capital outlay for development, marketing, and talent acquisition. The success of these initiatives hinges on Athene's ability to effectively scale operations and capture market share in these dynamic sectors.

The company's strategic acquisitions in emerging retirement segments and its push into new geographic territories also fall under the Question Mark category. These ventures are characterized by high market growth rates but a limited initial presence, necessitating focused investment to build brand awareness and distribution networks. For instance, Athene's 2024 marketing allocation towards digital outreach in new territories underscores this commitment.

Athene's efforts in Canada and Japan, aiming for specific market penetration targets by 2025, exemplify the strategic management of Question Marks. These initiatives require ongoing capital deployment to build brand equity and distribution channels, with the ultimate aim of transforming them into profitable, high-share business units within Athene's portfolio.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.