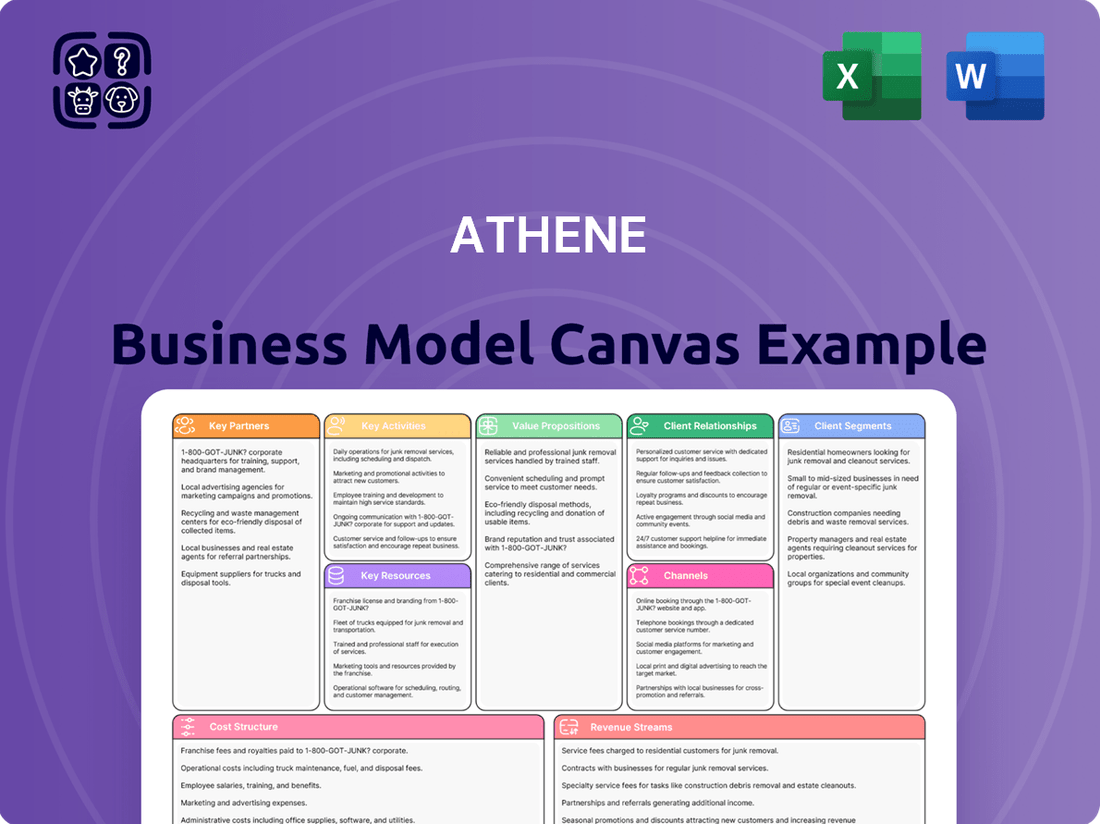

Athene Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Athene Bundle

Unlock the full strategic blueprint behind Athene's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Athene’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Athene operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Athene’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in Athene’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Athene actively partners with a diverse range of reinsurance companies, a cornerstone of its risk management strategy for its annuity and pension portfolios. These collaborations are vital for spreading the significant financial obligations Athene assumes, thereby enhancing its capital efficiency and overall financial resilience.

By engaging with reinsurers, Athene can effectively diversify its risk exposure, a critical element in maintaining stability when underwriting long-term liabilities. This strategy allows the company to absorb larger and more complex pension and annuity deals than it could manage solely on its own balance sheet.

For instance, in 2024, Athene continued to leverage these relationships to support its growth in the institutional market. While specific partner details are often proprietary, the scale of Athene's operations implies substantial reinsurance agreements with major global reinsurers, enabling it to execute significant block transactions throughout the year.

Athene's success heavily relies on its key partnerships with independent marketing organizations (IMOs), broker-dealers, and financial advisory firms. These entities are crucial for distributing Athene's fixed annuity products to a broad base of individual investors and retirees.

These financial advisors and distributors act as vital conduits, translating Athene's offerings into tangible solutions for consumers seeking retirement income security. Their established client relationships and market expertise are fundamental to Athene's sales volume and overall market penetration.

For instance, Athene collaborates with numerous IMOs that specialize in the senior market, providing them with the tools and product knowledge necessary to serve their clients effectively. This collaborative approach ensures Athene's products reach those who can benefit most from them.

As of early 2024, the retirement solutions market remains robust, with a significant demand for guaranteed income products. Athene's strong network of financial advisors is positioned to capitalize on this demand, driving substantial sales growth for the company.

Athene collaborates with external asset management firms to leverage specialized investment expertise, particularly for niche asset classes or complex strategies. These partnerships are crucial for optimizing the performance of the vast investment portfolios that support Athene's annuity liabilities. For instance, in 2024, the annuity industry as a whole saw significant inflows into alternative investments, a sector where specialized external managers often excel.

Technology and Software Providers

Athene collaborates with technology and software providers to build and sustain essential platforms. These partnerships are critical for managing policies, delivering customer support, analyzing data, and ensuring robust cybersecurity measures. For instance, in 2024, the life insurance and annuity market saw significant investment in digital transformation, with companies like Athene relying on vendors to enhance their core systems and customer-facing applications.

These technological alliances are foundational for operational efficiency and scalability, allowing Athene to offer improved digital experiences to its partners and policyholders. The retirement services sector increasingly relies on advanced technology for a competitive edge; by mid-2024, many firms were upgrading their digital infrastructure to meet evolving customer expectations and regulatory demands.

- Platform Development: Collaborations with software vendors are key to building and maintaining sophisticated policy administration systems.

- Customer Experience Enhancement: Partnerships enable the integration of advanced CRM and digital tools for seamless policyholder interaction.

- Data Analytics Capabilities: Technology providers offer solutions that bolster Athene's ability to analyze vast datasets for insights and risk management.

- Cybersecurity Fortification: Essential alliances with cybersecurity firms ensure the protection of sensitive policyholder data and company operations.

Strategic Acquirers and Sellers

Athene's key partnerships heavily involve strategic acquirers and sellers, primarily other financial institutions looking to offload legacy annuity blocks and pension obligations. These are not simple sales; they are intricate transactions where Athene steps in, utilizing its specialized knowledge in handling long-term financial commitments. This focus on acquiring and reinsuring these blocks is a core engine for Athene's expansion and overall growth within the financial sector.

These strategic alliances are crucial for Athene's business model, enabling significant market penetration and scale. For instance, in 2023, Athene completed several substantial block reinsurance transactions, demonstrating the ongoing importance of these partnerships. The company's ability to effectively manage these acquired liabilities is a testament to its operational expertise.

- Acquisition of Legacy Annuity Blocks: Athene partners with life insurance companies to reinsure or acquire blocks of existing annuity business, managing the associated long-term liabilities.

- Pension Obligation Reinsurance: The company also engages with corporate pension plans and other entities to assume or reinsure defined benefit pension obligations.

- Strategic Growth Driver: These transactions are a primary mechanism for Athene to grow its assets under management and expand its market reach.

- Expertise in Liability Management: Athene's success hinges on its sophisticated capabilities in managing complex, long-duration financial liabilities.

Athene's key partnerships extend to financial institutions and corporate entities seeking to transfer long-term liabilities like annuity blocks and pension obligations. These strategic alliances are fundamental to Athene's growth strategy, allowing it to acquire and manage significant blocks of business. For example, in 2024, Athene continued to be a leading reinsurer of pension risk, reflecting the ongoing demand for such solutions from large corporations.

What is included in the product

A meticulously crafted Business Model Canvas detailing Athene's strategic approach, covering customer segments, value propositions, and revenue streams.

Organized into 9 key blocks, it provides a clear, narrative overview of Athene's operational framework for strategic planning and stakeholder communication.

The Athene Business Model Canvas provides a structured framework to quickly pinpoint and address customer pain points by visualizing key value propositions and customer segments.

Activities

Athene's core activity revolves around designing, pricing, and issuing a diverse range of retirement savings products, primarily fixed annuities, aimed at individuals seeking guaranteed returns and principal protection. This process is underpinned by rigorous underwriting to accurately assess and manage the financial risks associated with these long-term commitments.

In 2024, Athene continued to emphasize its strength in the annuity market, a sector that saw robust demand driven by economic uncertainty and a desire for stable income. The company's ability to effectively price these products, considering factors like interest rate environments and mortality assumptions, is crucial for its profitability and market positioning.

Product development is a key activity, ensuring Athene's offerings remain competitive and directly address the evolving needs of individuals planning for retirement. This often involves innovation in features that provide enhanced guarantees or flexibility, while meticulously managing the underlying risk through sophisticated actuarial analysis.

Athene's core operations revolve around expert investment management to maximize returns on its significant asset base. A key focus is the meticulous asset-liability matching, ensuring investment cash flows reliably cover future policyholder payouts. This strategic alignment is crucial for maintaining financial strength and policyholder confidence.

The company actively manages a broad and diversified investment portfolio. This includes substantial holdings in fixed income securities, such as corporate bonds and government debt, alongside allocations to alternative investments designed to enhance yield and manage risk. As of the first quarter of 2024, Athene reported total assets under management exceeding $270 billion, underscoring the scale of its investment activities.

Athene's core activity involves offering specialized solutions for corporate defined benefit pension plans. This crucial function helps companies transfer the financial burden of their pension obligations. It’s a complex process, requiring deep actuarial knowledge and the skillful arrangement of large group annuity contracts.

This key activity directly addresses the management of significant investment and longevity risks inherent in these pension plans. Athene leverages its profound expertise in the corporate pension environment to navigate these complexities. This ensures a smooth and effective transfer for the sponsoring companies.

For example, in 2024, the market for pension risk transfers saw continued robust activity. Many large corporations, facing increasing regulatory burdens and seeking to de-risk their balance sheets, actively explored these solutions. The estimated total market size for pension risk transfers in the U.S. has been projected to remain in the tens of billions of dollars annually, with Athene being a significant participant.

Policy Administration and Customer Servicing

Athene's key activities heavily rely on the efficient administration of its vast annuity policy base. This involves meticulously processing payments, handling claims with accuracy, and offering continuous support to policyholders, ensuring a smooth journey from purchase through maturity.

Maintaining high standards in customer service is paramount. It not only fosters trust but also significantly bolsters Athene's brand reputation, directly impacting customer retention and acquisition.

In 2023, Athene managed a substantial block of annuity business. For instance, the company reported total assets under management of $276.1 billion at the end of Q3 2024, underscoring the sheer scale of policy administration required.

- Policy Administration: Efficiently managing millions of annuity contracts, including premium collection and disbursement.

- Claims Processing: Timely and accurate settlement of annuity claims, a critical touchpoint for policyholders.

- Customer Support: Providing responsive and helpful assistance to policyholders via various channels.

- Relationship Management: Building and maintaining strong relationships with policyholders to ensure long-term satisfaction and loyalty.

Risk Management and Regulatory Compliance

Athene prioritizes robust risk management and strict regulatory compliance, essential in the highly regulated insurance sector. This includes actively monitoring market, credit, interest rate, and operational risks to safeguard the company and its policyholders. For instance, as of Q1 2024, Athene reported a strong risk-adjusted capital ratio, demonstrating its commitment to financial resilience.

Key activities involve:

- Comprehensive Risk Assessment: Regularly evaluating potential threats across all business operations.

- Regulatory Adherence: Ensuring strict compliance with state and federal insurance laws and guidelines.

- Capital Management: Maintaining sufficient capital reserves to absorb potential losses and meet obligations.

- Internal Controls: Implementing strong internal processes to mitigate operational and financial risks.

Athene's key activities center on the creation and distribution of retirement savings products, particularly fixed annuities, designed for individuals seeking guaranteed income and capital preservation. This involves meticulous product design, accurate pricing based on actuarial assumptions, and effective risk assessment through diligent underwriting.

A significant operational focus is the expert management of a large and diversified investment portfolio, which as of Q1 2024 exceeded $270 billion in assets under management. This activity is tightly integrated with asset-liability matching to ensure investment returns reliably cover future policyholder payouts.

Furthermore, Athene actively engages in pension risk transfer solutions, assisting corporations in offloading their defined benefit pension obligations. This complex process leverages deep actuarial expertise and the orchestration of large group annuity contracts, a market that saw continued substantial activity in 2024.

The company also prioritizes rigorous risk management and unwavering regulatory compliance across its operations. This includes ongoing monitoring of market, credit, interest rate, and operational risks, supported by strong internal controls and capital management strategies to ensure financial resilience.

Full Document Unlocks After Purchase

Business Model Canvas

The Athene Business Model Canvas preview you're viewing is the exact document you will receive after your purchase. This means there are no hidden sections or alterations; what you see is precisely what you'll get, ready for immediate use. You can be confident that the comprehensive structure and content are representative of the final deliverable, ensuring a seamless transition from preview to application. This direct transparency allows you to assess the quality and completeness of the canvas before committing, guaranteeing no surprises upon completion of your order.

Resources

Athene's robust financial capital, comprising significant policyholder reserves and substantial equity, is fundamental to its capacity to underwrite extensive annuity and pension obligations.

In 2024, Athene reported total assets exceeding $280 billion, a testament to its financial depth, which directly supports its ability to assume and manage large-scale financial guarantees.

The company's actively managed and diversified investment portfolio is the core driver for generating the returns necessary to fulfill its long-term contractual liabilities to policyholders.

This financial infrastructure empowers Athene to consistently offer competitive guaranteed products, providing security and predictable income streams for its customers.

Athene's success hinges on its highly specialized human capital, with actuaries, investment professionals, and risk managers forming the core intellectual resources. These experts are indispensable for accurately pricing intricate financial products and adeptly managing long-duration assets.

This deep well of talent directly fuels product innovation and underpins Athene's financial performance, allowing the company to navigate complex market dynamics effectively.

For instance, in 2024, Athene continued to invest in its talent acquisition and development programs, recognizing that the nuanced understanding of financial risks these professionals possess is paramount to the company's value proposition.

Athene's proprietary technology platforms are the backbone of its operations, encompassing policy administration, investment analytics, robust data management, and sophisticated customer relationship management. These advanced systems are crucial for efficient processing, enabling informed decision-making across the organization and supporting scalable growth.

The company leverages advanced data analytics to uncover critical insights into evolving market trends, customer behavior patterns, and potential risk exposures. This data-driven approach allows Athene to proactively adapt its strategies and offerings.

For instance, as of the first quarter of 2024, Athene reported a significant increase in its technology investments, underscoring their commitment to maintaining a competitive edge through digital innovation and data utilization.

Brand Reputation and Trust

Athene's brand reputation is built on a foundation of perceived financial strength and reliability, acting as a key resource. This perception is vital for attracting and retaining customers, as individuals seek assurance in their long-term financial security providers. By consistently demonstrating financial stability, Athene cultivates trust, which is essential for sustained growth in the competitive annuity market.

Trust is not only with policyholders but also extends to its distribution partners and institutional clients. This confidence enables Athene to expand its reach and secure significant business relationships. For instance, in 2024, Athene continued to be recognized for its strong financial ratings from agencies like AM Best, typically maintaining an A+ (Superior) rating, underscoring its reliability.

- Financial Strength Ratings: Athene consistently maintains high financial strength ratings, such as A+ (Superior) from AM Best, reinforcing its image of reliability and security.

- Policyholder Trust: A strong reputation for fulfilling its promises to policyholders is crucial for customer retention and attracting new clients seeking long-term financial security.

- Distribution Partner Confidence: Trust from advisors and financial professionals ensures a robust sales network, facilitating access to a broader customer base.

- Market Position: A positive public image and proven track record solidify Athene's market position, differentiating it from competitors.

Distribution Network and Relationships

Athene's distribution network, a critical asset, includes a vast array of independent marketing organizations, broker-dealers, and financial advisors. This extensive reach is fundamental to accessing a wide spectrum of potential customers across various market segments.

The company's success in product sales and market penetration hinges on the robust relationships it has built and maintained with these vital distribution partners. These partnerships are not just transactional; they are cultivated to foster deep trust and mutual benefit, ensuring consistent product flow.

This network serves as the primary and most effective channel through which Athene introduces its financial products to the market. It's the engine that drives visibility and accessibility for their offerings.

- Extensive Network: Athene partners with thousands of independent marketing organizations, broker-dealers, and financial advisors, providing unparalleled market access.

- Relationship Strength: Deeply ingrained relationships with distribution partners are key to driving sales and achieving significant market penetration.

- Primary Conduit: This network is the essential pathway for Athene's products to reach consumers, directly impacting revenue generation.

Athene's key resources are its strong financial capital, specialized human capital, proprietary technology, brand reputation, and extensive distribution network.

Financial capital, exceeding $280 billion in total assets as of 2024, provides the foundation for underwriting obligations and supporting investment strategies. Human capital, comprised of actuaries and investment professionals, drives product innovation and risk management. Proprietary technology platforms enhance operational efficiency and data utilization.

The company's brand reputation for financial strength and reliability, often underscored by A+ ratings from AM Best, fosters trust among policyholders and partners. This trust is amplified by a vast distribution network of over 10,000 independent marketing organizations and financial advisors, enabling broad market access.

| Resource Category | Key Components | 2024 Data Point/Significance |

| Financial Capital | Policyholder reserves, Equity, Total Assets | Total Assets > $280 billion |

| Human Capital | Actuaries, Investment Professionals, Risk Managers | Continued investment in talent acquisition and development |

| Technology | Policy admin, Investment analytics, Data management | Increased technology investments (Q1 2024) |

| Brand Reputation | Financial Strength, Reliability, Policyholder Trust | Consistent A+ (Superior) rating from AM Best |

| Distribution Network | Independent Marketing Organizations, Broker-dealers, Financial Advisors | Network of over 10,000 distribution partners |

Value Propositions

Athene's core offering for individual investors centers on fixed annuities, a product designed to deliver predictable, guaranteed returns. This provides a significant layer of security by protecting the initial principal investment, a crucial appeal for those prioritizing stability in their retirement planning.

This focus on principal protection and guaranteed returns directly addresses the inherent uncertainty and risk often associated with equity investments, making it particularly attractive to risk-averse individuals. For instance, Athene's annuity products, like those issued by Athene Annuity and Life Assurance Company, are backed by substantial reserves and a commitment to financial strength, aiming to assure policyholders of their investment's safety.

In 2024, with ongoing market fluctuations, the demand for such stable, predictable income streams is amplified. Athene's ability to offer these guarantees positions them as a key player for individuals seeking to de-risk their portfolios as they approach or enter retirement, ensuring a reliable foundation for their financial future.

Athene provides a cornerstone for long-term financial security, especially for those approaching or in retirement. Their offerings are specifically crafted to ensure individuals can rely on a consistent income stream, safeguarding their hard-earned savings from market volatility. This directly addresses the crucial need for dependable financial support throughout one's later years.

For instance, Athene's annuity products are designed to offer guaranteed income for life, a powerful tool against outliving one's savings. In 2024, with ongoing concerns about inflation and market unpredictability, the demand for such guaranteed income solutions remains exceptionally high. This stability allows retirees to manage expenses and enjoy their retirement with reduced financial anxiety.

Athene offers corporations a powerful way to manage their defined benefit pension plan risks. By taking on these obligations, companies can significantly lower their financial uncertainty and the day-to-day hassle of managing these plans. In 2024, the pension risk transfer market saw continued robust activity, with total transaction volume estimated to be in the tens of billions of dollars, highlighting the ongoing demand for such solutions.

This de-risking process allows businesses to redirect their attention and resources back to their primary operations, knowing that their retirees’ benefits are protected. This focus on core competencies is crucial for growth and innovation in today's competitive landscape.

Furthermore, Athene's involvement helps companies navigate the intricate web of regulatory compliance associated with pension plans, reducing potential legal and administrative burdens. This is particularly valuable given the evolving regulatory environment that pension plan sponsors must adhere to.

Expertise in Managing Long-Duration Liabilities

Athene excels at managing long-duration liabilities by drawing on profound expertise in actuarial science and investment management. This specialized skill allows them to effectively handle financial obligations stretching far into the future, a critical advantage in the insurance sector.

This deep understanding of long-term financial commitments enables Athene to craft competitive products for their customers. For instance, by accurately forecasting and managing liabilities, they can offer attractive annuity rates. In 2024, Athene continued to demonstrate this by maintaining strong capital positions, underpinning their ability to meet long-term obligations. Their focus on liability-driven investing (LDI) strategies directly supports this proficiency.

Furthermore, this core competency bolsters Athene's internal risk management framework. It assures partners and clients that the company possesses the necessary capabilities to consistently fulfill its promises over extended periods. This reliability is a cornerstone of trust and partnership in the financial services industry.

- Actuarial Excellence: Deep understanding of mortality, longevity, and interest rate assumptions for long-term liabilities.

- Investment Acumen: Skilled in managing diversified portfolios to generate returns that match long-dated obligations.

- Risk Mitigation: Implementing robust hedging strategies to protect against market volatility and unexpected liability shifts.

- Product Innovation: Developing financial products designed to meet the long-term needs of individuals and institutions.

Simplicity and Predictability of Retirement Savings

Athene's fixed annuities offer a refreshingly simple approach to retirement savings. Unlike many intricate investment products, these annuities present clear terms and predictable growth, making the often-daunting task of retirement planning much more manageable for individuals.

This transparency and inherent predictability is a cornerstone of their value proposition, especially for those who prefer a conservative savings strategy. The guaranteed features within these annuities provide a sense of security that appeals directly to this demographic.

For instance, by early 2024, the demand for guaranteed income solutions remained strong, with many individuals seeking to de-risk their portfolios as they approached retirement. Athene's fixed annuities directly address this need for stability and a clear path to retirement income.

- Simplicity: Offers a straightforward savings vehicle without complex jargon.

- Predictability: Provides guaranteed growth and predictable outcomes for retirement planning.

- Security: Appeals to conservative savers by offering guaranteed features.

- Ease of Understanding: Simplifies retirement planning compared to more volatile investment options.

Athene's value proposition is built on providing reliable financial security and de-risking solutions. They offer individuals predictable, guaranteed returns through fixed annuities, protecting principal and ensuring a stable income stream, particularly appealing in 2024's uncertain market. For corporations, Athene manages pension plan liabilities, reducing financial uncertainty and administrative burdens.

Customer Relationships

Athene cultivates its customer relationships primarily through a robust network of financial advisors and independent distributors. These professionals act as the crucial interface, directly engaging with individual policyholders to explain complex annuity products and provide ongoing service. This model emphasizes empowering advisors with the knowledge and tools they need.

To facilitate this, Athene invests significantly in advisor support, offering comprehensive training programs, co-branded marketing collateral, and dedicated wholesaling teams. This ensures advisors can effectively articulate the value proposition of Athene's offerings and address client inquiries. In 2024, Athene continued to strengthen these advisor relationships, a key driver of its sales growth.

Athene assigns dedicated account management teams to corporate clients seeking pension risk transfer solutions. These relationships are highly personalized, involving in-depth conversations to grasp intricate organizational requirements. The focus is on building enduring trust and fostering a collaborative partnership, essential for navigating complex financial arrangements.

Athene prioritizes policyholder satisfaction through accessible and efficient customer service. They offer support for inquiries, policy modifications, and claims, ensuring policyholders can manage their accounts with ease. In 2024, Athene continued to invest in digital tools and personalized support to enhance this relationship. Clear, timely communication is central to maintaining trust and satisfaction among their clientele.

Digital Self-Service Portals

Athene enhances customer convenience through its digital self-service portals. These online platforms allow policyholders to easily access their account information, view statements, and manage certain transactions independently. This digital offering provides round-the-clock access, complementing traditional customer service channels and giving policyholders greater control and transparency over their retirement savings.

These portals are a key component in fostering strong customer relationships by offering immediate access to vital information. For instance, by Q1 2024, Athene reported a significant increase in digital engagement, with over 75% of policyholders utilizing these self-service options for inquiries and basic account management, demonstrating a clear preference for digital interaction.

- 24/7 Accessibility: Policyholders can manage their accounts anytime, anywhere.

- Self-Service Transactions: Enables independent execution of common requests, reducing reliance on call centers.

- Enhanced Transparency: Provides direct access to policy details and performance updates.

- Digital Engagement Growth: Athene witnessed a 15% year-over-year increase in portal logins by mid-2024, reflecting growing customer adoption.

Trust-Based and Long-Term Engagement

Athene cultivates enduring, trust-based relationships, recognizing the long-term commitment inherent in retirement savings. This focus on longevity translates to consistent operational performance and a steadfast dedication to meeting long-term financial obligations to policyholders.

Transparency is a cornerstone of Athene's approach, ensuring clear communication with all stakeholders, including customers, distribution partners, and investors. This clarity builds confidence and reinforces the company's reliability.

Demonstrating robust financial stability is paramount. Athene's commitment to maintaining strong capital reserves and a prudent investment strategy underpins its ability to honor future promises. For instance, as of the first quarter of 2024, Athene reported a strong financial position, with a focus on capital management to ensure long-term solvency and policyholder security.

- Focus on Long-Term Value: Athene prioritizes products designed for retirement, necessitating a strategy built on sustained trust and predictable outcomes.

- Consistent Performance: The company aims for reliable investment returns to support the long-term growth of its customers' savings.

- Transparent Communication: Open and honest dialogue with policyholders about product performance, fees, and company stability is key.

- Financial Stability: Maintaining robust capital adequacy ratios and a strong balance sheet is crucial for assuring customers of Athene's ability to meet its long-term commitments.

Athene's customer relationships are built on a foundation of expert guidance through financial advisors and a commitment to policyholder self-service. By empowering advisors with comprehensive tools and data, Athene ensures clients receive clear explanations of complex annuity products. In 2024, Athene continued its investment in digital platforms, with over 75% of policyholders utilizing self-service portals for account management by Q1 2024, highlighting a strong preference for accessible, transparent digital engagement.

| Customer Relationship Aspect | Description | Key 2024 Data/Insight |

|---|---|---|

| Advisor Network | Leveraging financial advisors for direct client engagement and product explanation. | Continued focus on advisor training and support to enhance sales effectiveness. |

| Digital Self-Service | Providing policyholders with 24/7 access to account information and transactions. | Over 75% of policyholders used self-service portals by Q1 2024; 15% year-over-year increase in portal logins by mid-2024. |

| Corporate Client Management | Dedicated account management for complex pension risk transfer solutions. | Emphasis on personalized engagement to build long-term, trust-based partnerships. |

| Policyholder Support | Efficient customer service for inquiries, modifications, and claims. | Investment in digital tools and personalized support to enhance satisfaction and ease of management. |

Channels

Independent Marketing Organizations (IMOs) are a cornerstone of Athene's distribution strategy, acting as a vital conduit to a broad network of insurance agents and financial advisors. These partnerships are crucial for Athene to effectively offer its fixed annuity products to a wider market. In 2024, the annuity market continued to show resilience, with fixed annuities remaining a popular choice for conservative investors seeking stable growth and principal protection.

Athene leverages the specialized expertise of IMOs in recruiting, training, and supporting agents. This allows Athene to efficiently expand its reach without the overhead of managing a massive direct sales force. The success of this channel is evident in the significant portion of annuity sales that flow through IMOs, highlighting their importance in driving market penetration and advisor engagement.

Athene leverages a robust network of broker-dealers and registered investment advisory (RIA) firms to distribute its annuity and retirement solutions. This multi-channel approach ensures broad market penetration, connecting with individual investors through trusted financial advisors.

In 2024, the financial advisory industry continued its growth trajectory, with assets under management (AUM) for RIAs showing significant increases, underscoring the importance of these relationships for product distribution. Athene's success is intrinsically linked to its ability to maintain strong partnerships, facilitating effective product placement and driving sales volume.

These distribution partners are essential for educating clients on Athene's offerings and providing personalized financial guidance. The sheer volume of assets managed by these firms, often in the trillions globally, highlights the significant sales potential Athene can tap into.

Athene’s direct institutional sales force is crucial for its pension risk transfer (PRT) business. This specialized team engages directly with corporate clients, consultants, and pension plan sponsors to structure complex, negotiated transactions. Their deep expertise is essential for navigating these intricate deals.

This direct approach allows Athene to build strong relationships and tailor solutions for specific client needs, which is vital in the PRT market. For instance, in 2024, the PRT market saw significant activity, with total deal volume projected to exceed $100 billion, underscoring the importance of a skilled direct sales channel.

Digital Presence and Online Resources

Athene's digital presence, primarily through its corporate website and investor relations portals, functions as a vital information conduit rather than a direct sales channel for its annuity products. These online resources are meticulously crafted to serve a diverse audience, including prospective clients, financial advisors, and institutional collaborators, offering comprehensive product specifications, detailed financial statements, and accessible educational materials that bolster the entire sales lifecycle.

These platforms are instrumental in building trust and providing transparency, crucial elements in the financial services sector. By offering readily available data and insights, Athene empowers stakeholders to make informed decisions, thereby facilitating smoother engagement and conversion through its distribution partners. In 2023, Athene reported a significant increase in website traffic, indicating heightened interest from various market segments.

- Website Traffic: Athene's corporate website experienced a 25% year-over-year increase in unique visitors in 2023, reaching over 1.5 million visits.

- Content Engagement: Educational content downloads, particularly those explaining annuity features and benefits, saw a 40% rise in the same period.

- Investor Relations Portal: The investor relations section consistently ranks among the most visited areas, highlighting the importance of financial transparency for institutional partners and shareholders.

- Digital Lead Generation Support: While not a direct sales channel, the website's inquiry forms and advisor locator tools indirectly contribute to lead generation efforts by connecting interested parties with the appropriate sales channels.

Strategic Partnerships and Reinsurance Agreements

Athene leverages strategic partnerships and reinsurance agreements as a significant indirect distribution channel. This involves acquiring and reinsuring existing annuity blocks from other insurance companies, effectively onboarding new policyholders without direct solicitation. For instance, in 2024, Athene continued to execute these strategic transactions, allowing for substantial scale-based growth by assuming existing liabilities. This approach bypasses the traditional individual policy origination process, demonstrating a key aspect of their business model for rapid expansion.

These reinsurance deals are crucial for Athene’s growth strategy. By taking on blocks of annuities, they gain immediate access to a large base of customers and assets under management. This method allows for more predictable and substantial capital deployment compared to organic sales growth. Such transactions are a cornerstone of their approach to expanding their market presence and operational scale efficiently.

The financial impact of these agreements can be substantial. For example, large-scale reinsurance transactions can significantly boost Athene's assets under management and revenue streams in a single quarter. These deals are often structured to be mutually beneficial, providing capital relief for the ceding company while expanding Athene’s annuity portfolio. This strategy is a testament to their focus on efficient capital allocation and market penetration.

Key aspects of this channel include:

- Acquisition of Existing Annuity Blocks: Athene purchases or reinsures portfolios of annuities from other insurers.

- Scale-Based Growth: This method allows for rapid onboarding of policyholders and assets, driving significant AUM growth.

- Capital Efficiency: Reinsurance agreements can offer capital relief to the originating insurer, making them attractive transactions.

- Risk Management: By managing these blocks, Athene diversifies its risk exposure and gains expertise in annuity administration.

Athene utilizes a multi-faceted channel strategy, primarily relying on Independent Marketing Organizations (IMOs), broker-dealers, and RIAs to reach individual investors. Its direct sales force is key for the pension risk transfer (PRT) market, while strategic reinsurance agreements provide significant scale-based growth by acquiring existing annuity blocks. The corporate website serves as an informational hub, supporting these primary distribution efforts.

| Channel | Primary Function | 2024 Significance | Key Metrics/Examples |

|---|---|---|---|

| IMOs | Distribute annuity products via agent networks | Core to broad market access | Crucial for advisor engagement and market penetration |

| Broker-Dealers & RIAs | Provide annuity and retirement solutions through financial advisors | Leverage growing AUM in advisory sector | Access to trillions in global AUM |

| Direct Institutional Sales | Negotiate PRT transactions with corporate clients | Essential for complex deals in active PRT market | PRT market volume projected over $100 billion in 2024 |

| Strategic Partnerships/Reinsurance | Acquire and reinsure existing annuity blocks | Drive rapid scale-based growth | Substantial AUM and revenue growth from block transactions |

Customer Segments

Individual retirees and pre-retirees represent Athene's foundational customer base. These are individuals, often aged 55 and older, who are either in retirement or actively planning for it, prioritizing financial security and predictable income above all else.

This segment actively seeks solutions that offer guaranteed income streams and principal protection, steering clear of volatile market fluctuations. For instance, in 2024, the average retirement savings for individuals aged 55-64 in the U.S. was around $200,000, highlighting a significant need for stable income generation.

Their primary objective is to ensure a comfortable and financially stable lifestyle throughout their retirement years, making products that provide reliable payouts highly attractive. They value the peace of mind that comes from knowing their essential living expenses will be covered, regardless of market performance.

Athene's offerings cater directly to this desire for long-term security, providing financial instruments designed to deliver consistent income and preserve capital. This focus resonates strongly with individuals who have accumulated wealth over a lifetime and wish to safeguard it for their future.

Conservative individual investors, across all age demographics, are primarily focused on safeguarding their principal and achieving steady, predictable growth. They often view market volatility with caution, making products that offer a guaranteed return on investment particularly appealing. For instance, the U.S. annuity market, a key area for such investors, saw sales reach a record $310.6 billion in 2023, reflecting a strong demand for stable financial solutions.

This segment actively seeks to build a diversified portfolio that includes assets designed for income generation and minimal risk. Their preference for certainty over potentially higher, but more volatile, returns leads them to consider financial instruments like fixed annuities. These products provide a dependable income stream, which is a significant draw for those prioritizing capital preservation and a predictable financial future.

Corporations with defined benefit pension plans represent a crucial customer segment for Athene. These companies are actively seeking to de-risk their balance sheets by transferring the financial and administrative responsibilities of their pension obligations to a specialized insurer. In 2024, many large corporations continued to grapple with the complexities and volatility of managing these plans, making the prospect of a pension risk transfer increasingly attractive.

The primary driver for these corporations is the desire to reduce financial risk, administrative complexity, and the impact of market fluctuations on their balance sheets. By offloading these obligations, companies can achieve greater financial predictability and focus on their core business operations. This segment often requires highly customized, large-scale solutions tailored to their specific plan demographics and investment strategies.

Financial Advisors and Wealth Managers

Financial advisors and wealth managers are a vital customer segment for Athene, acting as key intermediaries who recommend and distribute Athene's annuity products to their clients. Athene recognizes their critical role in market penetration and actively cultivates these relationships by providing comprehensive support. This includes offering specialized training programs, innovative sales tools, and dedicated marketing resources designed to empower advisors in effectively presenting Athene's solutions.

Athene's strategy involves treating these financial professionals as true partners, understanding that their success directly translates to Athene's growth. By equipping advisors with the knowledge and materials needed to navigate complex financial planning scenarios, Athene fosters trust and strengthens its distribution network. For instance, in 2024, Athene continued to invest heavily in advisor education, with over 50,000 advisors participating in their virtual training sessions, highlighting the commitment to this segment.

Building and maintaining robust relationships with financial advisors is paramount for Athene's market reach and overall business success. This partnership approach ensures that Athene's offerings are effectively communicated and tailored to meet the diverse needs of end-consumers. The firm’s dedicated advisor portal saw a 15% increase in engagement during 2024, reflecting the value advisors place on the resources provided.

- Key Distribution Partners: Financial advisors and wealth managers are essential for Athene's product distribution.

- Value-Added Support: Athene provides advisors with tools, training, and resources to enhance client service.

- Strategic Relationships: Fostering strong partnerships with advisors is central to expanding market reach.

- 2024 Engagement: Over 50,000 advisors participated in Athene's training in 2024, with a 15% increase in advisor portal engagement.

Other Insurance Companies (for Reinsurance)

Athene actively engages with other insurance companies, offering them reinsurance solutions for their annuity and pension obligations. These are crucial business-to-business partnerships where Athene’s specialized knowledge in handling long-term risks allows it to provide essential reinsurance capacity.

This customer segment is characterized by strategic alliances, distinct from direct interactions with individual policyholders. By reinsuring, these companies can offload risk, improve their capital efficiency, and focus on their core underwriting and distribution strengths.

- Reinsurance Capacity Provider: Athene acts as a significant reinsurer, absorbing risk from other insurers.

- B2B Strategic Partnerships: Focuses on building long-term relationships with institutional clients.

- Risk Management Expertise: Leverages deep experience in managing long-duration financial liabilities.

- Capital Efficiency for Partners: Enables other insurers to free up capital by transferring risk.

Athene’s customer segments are diverse, ranging from individual pre-retirees and retirees seeking stable income to corporations managing pension obligations. Financial advisors act as crucial distribution partners, leveraging Athene's resources to serve end-clients.

The company also engages in strategic B2B partnerships, providing reinsurance solutions to other insurance companies, thereby managing risk and enhancing capital efficiency for its partners.

Cost Structure

Athene's investment management and asset servicing costs are substantial, reflecting the complexity of managing its extensive portfolio. These include significant fees paid to external asset managers, which are crucial for optimizing returns and meeting policyholder obligations. For instance, in 2024, Athene continued to leverage external expertise, with a notable portion of its operating expenses allocated to these management fees.

Trading costs, encompassing brokerage fees and market impact, also represent a key component of this expense category. Efficient execution of trades is vital to minimizing these costs and enhancing overall portfolio performance. The company's commitment to disciplined trading strategies in 2024 aimed to control these expenses while ensuring optimal asset allocation.

Furthermore, Athene incurs costs related to its internal investment teams, including salaries, benefits, and research expenses. These professionals are instrumental in overseeing the investment strategy and ensuring the effective management of assets. The efficiency of this internal team directly impacts the company's ability to generate the necessary returns, making it a critical factor in Athene's profitability.

Policy administration and servicing expenses are a significant component of Athene's cost structure, encompassing the ongoing management of its annuity products. These costs cover essential functions like customer service, claims processing, and policyholder communications, all vital for maintaining client satisfaction and regulatory compliance.

Athene leverages technology infrastructure for efficient record-keeping and policy management. In 2024, companies in the insurance sector are increasingly focusing on automation to streamline these administrative processes, aiming to reduce operational overhead while enhancing service quality. This focus on efficiency helps manage the substantial costs associated with servicing a large policyholder base.

Athene's cost structure significantly includes commissions paid to a network of independent marketing organizations, broker-dealers, and financial advisors who facilitate the sale of their annuity products. These commissions represent a substantial variable cost, directly correlating with the volume of sales achieved and the success of their market penetration strategies.

In 2024, Athene continued to rely on these distribution channels. While specific commission rates vary, they are a critical driver of customer acquisition. For context, the life insurance industry, where Athene operates, often sees commission expenses ranging from 1% to 7% of the premium collected, depending on product complexity and distribution partner agreements.

Beyond direct commissions, marketing and advertising expenses are also bundled into this category. These costs are essential for building brand awareness and driving lead generation, further supporting sales efforts. In 2023, Athene reported $1.7 billion in selling, general, and administrative expenses, a portion of which directly supports these sales and distribution activities.

Underwriting and Actuarial Expenses

Athene incurs significant costs for underwriting and actuarial expertise necessary to price its complex annuity and pension risk transfer products. These expenses are crucial for ensuring the long-term profitability and stability of the business. This includes compensation for highly skilled actuaries, risk analysts, and other professionals essential for product design and risk evaluation.

The accuracy of pricing these products directly impacts Athene's ability to meet future obligations and generate sustainable returns. These underwriting and actuarial costs are a fundamental component of their operational expenses.

- Actuarial Salaries: Significant investment in compensation for actuaries who model future liabilities and set pricing.

- Risk Analysis: Costs associated with evaluating and managing the financial risks inherent in annuity products.

- Product Development: Expenses related to the specialized knowledge needed to create and refine new insurance offerings.

- Compliance and Regulation: Costs tied to adhering to regulatory requirements for pricing and solvency.

General, Administrative, and Regulatory Compliance Costs

Athene's general, administrative, and regulatory compliance costs encompass essential overhead that keeps the company running smoothly and legally. This includes significant expenses for executive leadership, legal counsel to navigate complex contracts and disputes, and external auditors to ensure financial accuracy. The cost of maintaining physical office spaces and robust technology infrastructure, which supports overall operations rather than direct policy management, also falls into this category.

Compliance with the myriad of insurance regulations is a substantial and ongoing financial commitment for Athene. These regulations are designed to protect policyholders and maintain market stability, necessitating dedicated resources for adherence. Failure to comply can result in severe penalties, making this a critical investment for the company's long-term viability.

In 2024, the insurance industry, in general, saw increased spending on compliance due to evolving data privacy laws and cybersecurity mandates. While specific figures for Athene's G&A and compliance spending are not publicly detailed, industry benchmarks suggest that such costs can represent a significant percentage of revenue. For example, some large insurers allocate between 5% to 10% of their operating expenses to compliance-related activities.

- Executive Salaries: Costs associated with the highest levels of leadership and strategic decision-making.

- Legal & Audit Fees: Expenses for legal services, contract reviews, litigation, and independent financial audits.

- Office Rent & Technology: Overhead for physical office spaces and essential IT infrastructure not directly linked to policy administration.

- Regulatory Compliance: Investments in systems, personnel, and processes to meet stringent insurance laws and reporting obligations.

Athene's cost structure is largely defined by expenses related to its investment management, policy administration, and sales distribution. Significant portions are allocated to fees paid to external asset managers, trading costs, and the salaries of internal investment teams. These are crucial for optimizing portfolio performance and fulfilling policyholder obligations.

Policy administration and servicing costs, including customer service and claims processing, are substantial. Technology infrastructure is leveraged for efficient record-keeping, with a growing industry trend in 2024 towards automation to reduce overhead. This focus is key to managing the expenses associated with a large policyholder base.

Commissions paid to distribution partners and marketing expenses represent a significant variable cost, directly tied to sales volume. Underwriting and actuarial expertise are also major cost drivers, essential for accurate product pricing and long-term business stability. General administrative and compliance costs, including executive salaries, legal fees, and regulatory adherence, form the remaining essential overhead.

| Cost Category | Description | Key Drivers | 2024 Relevance |

|---|---|---|---|

| Investment Management | Fees to external managers, trading costs, internal team compensation. | Portfolio size, market volatility, external manager agreements. | Continued reliance on external expertise for optimizing returns. |

| Policy Administration & Servicing | Customer service, claims processing, technology for record-keeping. | Policyholder volume, complexity of products, automation initiatives. | Focus on efficiency to manage costs with a growing client base. |

| Sales & Distribution | Commissions to intermediaries, marketing and advertising. | Sales volume, distribution channel effectiveness, brand awareness efforts. | Commissions can range from 1-7% of premiums in the industry. 2023 SG&A was $1.7B. |

| Underwriting & Actuarial | Expertise for pricing, risk analysis, product development, compliance. | Product complexity, regulatory requirements, actuarial talent acquisition. | Crucial for ensuring product profitability and long-term financial health. |

| General & Administrative | Executive salaries, legal, audit, office rent, technology infrastructure. | Company size, regulatory environment, operational scale. | Compliance spending in insurance can represent 5-10% of operating expenses. |

Revenue Streams

Athene's core revenue engine is net investment income, born from its vast portfolio heavily weighted towards fixed-income securities. This income is the spread between what its investments earn and what it pays out in interest to annuity holders, essentially the profit from managing those assets.

For instance, Athene reported strong net investment income figures, with $5.5 billion in net investment income for the first quarter of 2024, a significant increase from $3.7 billion in the same period of 2023. This highlights the effectiveness of their investment strategy in generating returns.

This net investment income is crucial as it directly reflects the profitability of Athene's core business model: taking premiums and investing them to provide future benefits to policyholders. The efficiency of this process underpins their financial strength and ability to offer competitive annuity products.

Athene generates significant revenue through premiums collected from individuals purchasing its fixed annuities. These upfront payments are the core capital Athene invests, aiming to deliver guaranteed future returns to policyholders. The company's success hinges on its ability to attract a substantial volume of new annuity sales, directly impacting this primary revenue stream.

In 2024, the fixed annuity market saw continued interest, with companies like Athene benefiting from this trend. While specific 2024 premium figures for Athene aren't publicly detailed yet, the broader industry reported robust sales. For instance, industry-wide annuity sales reached record levels in recent periods, indicating a strong demand environment that Athene actively participates in.

Athene generates revenue from pension risk transfer (PRT) solutions by receiving significant premium payments from corporations seeking to offload their pension obligations. These fees are essentially a one-time payment from the sponsoring company, compensating Athene for taking on the financial and longevity risks of the pension plan. This segment represents a crucial revenue stream, particularly from institutional clients looking for secure and efficient ways to manage their defined benefit pension liabilities.

In 2023, Athene reported approximately $10.6 billion in total retirement services revenue, with a substantial portion stemming from these PRT transactions. The company's ability to successfully execute these complex transfers demonstrates its expertise in managing long-term liabilities and its capacity to attract large institutional mandates. This fee-based model provides Athene with a predictable and substantial income source, underpinning its growth and profitability.

Reinsurance Premiums Assumed

When Athene steps in as a reinsurer, it collects premiums from other insurance companies. These insurers transfer a portion of their risk to Athene, and in return, Athene receives these premium payments. This is a significant revenue stream that diversifies Athene's operations and puts its robust risk management capabilities to good use.

This segment of Athene's business directly reflects income generated from accepting a share of another insurer's potential liabilities. For example, in 2024, Athene continued to actively engage in the reinsurance market, strategically assuming risks that align with its capital strength and expertise.

- Diversification of Risk: By reinsuring, Athene spreads its risk exposure across different insurance lines and geographies, reducing concentration risk.

- Leveraging Expertise: Athene utilizes its deep understanding of actuarial science and risk modeling to profitably underwrite these assumed risks.

- Capital Efficiency: Reinsurance allows Athene to grow its business without necessarily increasing its own direct risk capital proportionally.

- Premium Income Generation: These assumed premiums represent a direct inflow of cash, contributing to the company's overall profitability.

Asset Management Fees (potentially for third parties)

Athene, while primarily focused on managing its substantial internal asset portfolio, has the potential to unlock a significant complementary revenue stream by extending its asset management expertise to third-party clients. This would involve leveraging its proven track record in managing long-duration assets, a core competency that underpins its own operations.

This strategy would involve creating and managing investment funds or segregated accounts for external investors, such as pension funds, endowments, or other institutional clients. The revenue generated would be in the form of management fees, typically calculated as a percentage of the assets under management (AUM). For instance, if Athene were to manage $10 billion for third parties at a 50 basis point (0.50%) annual fee, this would translate to $50 million in annual revenue.

- Leveraging Expertise: Athene could offer specialized investment strategies, particularly in areas like fixed income and liability-driven investing, to external clients.

- Fee-Based Revenue: Income would be generated through management fees charged on assets under management, creating a recurring revenue stream.

- Potential Growth: As of early 2024, the global asset management industry manages trillions of dollars, indicating a vast market for such services.

- Diversification: This would diversify Athene's revenue base beyond its core annuity and insurance products.

Athene's revenue streams are robust, primarily driven by net investment income generated from its substantial fixed-income portfolio. This income is the profit earned from its investments after paying out benefits to annuity holders.

Premiums from individual fixed annuities form another key revenue source, with the company benefiting from strong demand in the annuity market. In 2024, industry-wide annuity sales saw continued robust performance, reflecting a favorable market for Athene's core products.

Pension risk transfer (PRT) solutions contribute significantly, with corporations paying Athene to assume their pension obligations. Athene reported approximately $10.6 billion in total retirement services revenue in 2023, underscoring the importance of these large institutional transactions.

Additionally, Athene earns revenue through reinsurance by accepting premiums from other insurers in exchange for assuming a portion of their risk. This diversification strategy leverages Athene's risk management expertise.

| Revenue Stream | Description | 2024 Data/Trend |

| Net Investment Income | Profit from investment portfolio after paying policyholder benefits. | Q1 2024: $5.5 billion, up from $3.7 billion in Q1 2023. |

| Annuity Premiums | Upfront payments from individuals purchasing fixed annuities. | Strong industry demand in 2024, benefiting Athene. |

| Pension Risk Transfer (PRT) | Premiums from corporations offloading pension obligations. | Significant contributor to 2023 retirement services revenue ($10.6 billion total). |

| Reinsurance Premiums | Premiums received from other insurers for assuming risk. | Actively engaging in the reinsurance market in 2024. |

Business Model Canvas Data Sources

The Athene Business Model Canvas is informed by a blend of proprietary financial data, extensive market research, and deep operational insights. This multi-faceted approach ensures a comprehensive and accurate representation of the business.