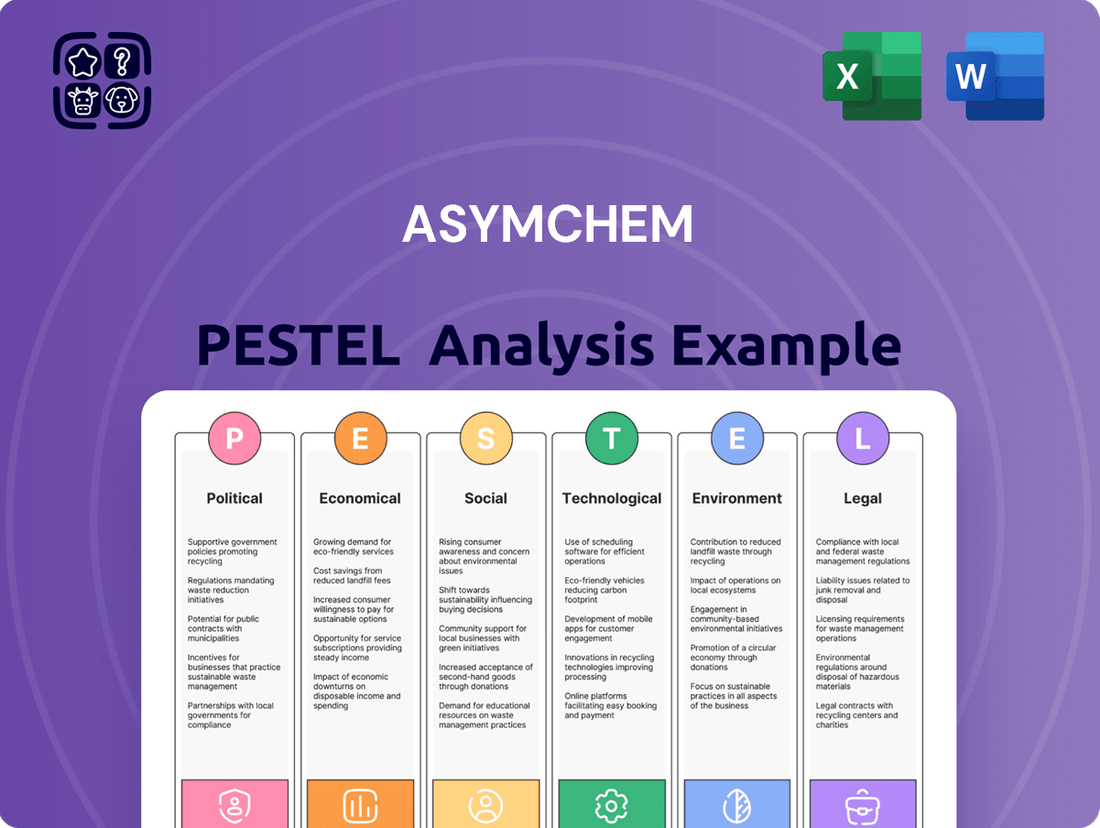

Asymchem PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asymchem Bundle

Unlock the full potential of Asymchem's market position with our comprehensive PESTLE analysis. Understand the intricate political, economic, social, technological, legal, and environmental factors shaping its trajectory. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the complete report now and gain a decisive competitive advantage.

Political factors

Governments globally are prioritizing the biopharmaceutical industry, recognizing its critical role in public health and economic growth. For instance, the United States' Inflation Reduction Act of 2022, while impacting drug pricing, also includes provisions aimed at accelerating innovation. This creates a fertile ground for contract development and manufacturing organizations (CDMOs) like Asymchem.

This political support translates into tangible benefits for CDMOs. Increased government funding for R&D, such as the National Institutes of Health (NIH) grants, fuels a pipeline of novel drug candidates. In 2023, the NIH allocated over $47 billion to biomedical research, a significant portion of which supports early-stage development that often requires specialized outsourced manufacturing.

Furthermore, favorable regulatory environments, including expedited review pathways for breakthrough therapies, shorten the time-to-market for new drugs. This efficiency directly benefits CDMOs by increasing demand for their services as more innovative treatments progress through clinical trials and towards commercialization.

Global geopolitical tensions are increasingly shaping pharmaceutical manufacturing. The ongoing push for supply chain resilience, highlighted by discussions around initiatives like the BIOSECURE Act, is prompting a re-evaluation of production strategies, with a focus on reducing reliance on single geographic regions.

Contract Development and Manufacturing Organizations (CDMOs) that can offer diversified manufacturing capabilities are gaining an advantage. Asymchem's strategic expansion into the United Kingdom, for instance, positions them to address the growing demand for secure, localized pharmaceutical production, thereby mitigating risks associated with global supply chain disruptions.

Governmental policies concerning healthcare spending and drug pricing are pivotal for companies like Asymchem. These regulations directly influence the profitability of pharmaceutical companies, which in turn affects their willingness to invest in research and development. This R&D investment is a key driver for the demand of Contract Development and Manufacturing Organizations (CDMOs) like Asymchem.

While some policies might exert downward pressure on drug prices, potentially impacting certain market segments, the overarching trend of increasing global health needs continues to fuel sustained investment in innovative drug development. This sustained investment is precisely where Asymchem’s expertise in high-quality drug development and manufacturing plays a crucial role.

For instance, in 2024, many governments are focusing on cost containment measures within their healthcare systems. The Inflation Reduction Act in the United States, for example, continues to negotiate prices for certain high-cost drugs, a factor that could influence R&D budgets. However, global health expenditure is projected to grow, with the World Health Organization estimating it could reach $10 trillion by 2040, indicating continued opportunities for CDMOs supporting new drug pipelines.

International Regulatory Harmonization Efforts

Asymchem, as a global Contract Development and Manufacturing Organization (CDMO), is significantly impacted by international regulatory harmonization. Efforts by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) to align drug approval processes and quality standards are critical. This convergence simplifies market access and reduces the complexity of compliance for companies operating across multiple regions.

For Asymchem, staying ahead of these evolving global standards is paramount. The company's successful EU Qualified Person (QP) audit in February 2024 exemplifies its commitment to meeting these harmonized requirements, which is essential for seamless international operations and robust client service. This proactive approach ensures Asymchem can efficiently support its clients' global drug development and manufacturing needs.

- FDA and EMA collaboration: Ongoing initiatives aim to create more unified pathways for drug approvals.

- Asymchem's EU QP Audit (Feb 2024): Demonstrated adherence to stringent European Good Manufacturing Practice (GMP) standards, a key aspect of harmonization.

- Impact on Global CDMOs: Harmonization reduces redundant testing and documentation, streamlining supply chains and market entry for companies like Asymchem.

Political Stability in Key Operating Regions

Political stability in China, Asymchem's home base, and the United Kingdom, a key expansion area, directly impacts its operational continuity and investment attractiveness. A stable political landscape minimizes disruptions to supply chains and manufacturing, crucial for a company like Asymchem that relies on global logistics.

The predictability fostered by stable governance reduces regulatory risks and ensures that policies affecting the pharmaceutical and chemical industries remain consistent. For instance, China's ongoing focus on developing its biopharmaceutical sector, as evidenced by government initiatives and investment in R&D, creates a favorable environment for Asymchem's growth.

Conversely, political uncertainties or shifts in policy in either region could introduce significant operational challenges. Asymchem's reliance on cross-border collaborations and its international supply chains mean that geopolitical stability is paramount for maintaining its competitive edge.

Key considerations for Asymchem include:

- China's regulatory environment: Continued government support for the life sciences sector, including tax incentives and streamlined approval processes, bolsters Asymchem's domestic operations.

- UK's trade agreements: The UK's post-Brexit trade relationships and its commitment to fostering innovation in advanced manufacturing are critical for Asymchem's European market access and supply chain resilience.

- Geopolitical tensions: Any escalation of international disputes could impact global trade flows and investment sentiment, affecting Asymchem's international business development.

Governments worldwide are increasingly recognizing the strategic importance of the biopharmaceutical sector, leading to supportive policies and increased R&D funding. For example, the U.S. government's commitment to advancing biotechnology, coupled with initiatives like the National Cancer Moonshot, signals continued opportunities for CDMOs. In 2024, many nations are also focusing on strengthening domestic pharmaceutical manufacturing capabilities to enhance supply chain security.

Regulatory harmonization, such as the ongoing collaboration between the FDA and EMA, streamlines market access for companies like Asymchem. Asymchem's successful EU Qualified Person audit in February 2024 highlights its ability to meet these converging global standards, crucial for efficient international operations.

Political stability in key operational regions like China and the UK is vital for Asymchem's business continuity and investment appeal. China's continued investment in its life sciences sector, and the UK's focus on advanced manufacturing, create a favorable operational environment.

Geopolitical tensions and trade policies can significantly influence global supply chains and market access. Asymchem's strategic diversification, including its UK expansion, aims to mitigate risks associated with global trade disruptions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Asymchem, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version of Asymchem's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable insights.

Economic factors

The global pharmaceutical Contract Development and Manufacturing Organization (CDMO) market is on a significant upward trajectory, with projections indicating it will reach approximately USD 197.4 billion by 2025. This robust expansion is largely driven by the persistent trend of pharmaceutical and biotechnology firms outsourcing critical development and manufacturing processes. This economic environment creates a powerful tailwind for companies like Asymchem.

Asymchem benefits directly from this burgeoning market as more pharma and biotech companies choose to leverage external expertise and advanced capabilities. This reliance on CDMOs for specialized skills, cutting-edge technologies, and essential infrastructure allows these companies to focus on core research and development, ultimately accelerating drug discovery and bringing new therapies to market more efficiently.

The biotech funding landscape in 2024 showed a degree of caution, with investment leaning towards companies with more mature assets. However, projections for 2025 suggest a potential uptick in venture capital, particularly for early-stage biotechs focusing on high-demand areas such as oncology and gene therapy.

This anticipated resurgence in R&D investment directly influences Asymchem's project flow, especially considering its integrated service model that spans preclinical development through to commercial manufacturing.

For instance, industry reports in late 2024 indicated that while overall biotech IPOs were down compared to previous years, the average deal size for successful early-stage financings in key therapeutic areas remained robust, signaling investor appetite for promising science.

Pharmaceutical firms are consistently looking for ways to cut costs and boost efficiency. This persistent drive is fueling the ongoing shift towards outsourcing drug development and manufacturing to Contract Development and Manufacturing Organizations (CDMOs). This trend directly benefits companies like Asymchem, as clients aim to utilize the CDMO's established infrastructure and specialized expertise, thereby sidestepping significant capital investments and speeding up their journey to market.

The global pharmaceutical outsourcing market was valued at approximately $77.5 billion in 2023 and is projected to grow substantially. For instance, the demand for outsourced manufacturing services for small molecules, a core area for Asymchem, saw robust growth in 2024, with many companies prioritizing external partners to manage complex supply chains and regulatory hurdles.

Inflation and Interest Rate Impact

Inflationary pressures and shifting interest rates significantly shape the landscape for Contract Development and Manufacturing Organizations (CDMOs) like Asymchem and their clientele. Higher interest rates, as observed in 2024, can constrain venture capital funding, making it harder for life sciences companies to secure the capital needed for drug development and manufacturing. This directly impacts the demand for CDMO services.

Looking ahead to 2025, a projected easing of interest rates could reignite investment activity. Lower borrowing costs typically encourage more robust M&A transactions and increased R&D spending within the pharmaceutical and biotechnology sectors. This positive shift has the potential to boost order pipelines and strategic partnerships for Asymchem.

- 2024 Interest Rate Environment: The US Federal Reserve maintained a hawkish stance through much of 2024, keeping benchmark interest rates elevated, which demonstrably tightened liquidity for early-stage biotech firms.

- 2025 Interest Rate Outlook: Consensus forecasts for 2025 suggest a gradual reduction in interest rates by major central banks, aiming to support economic growth.

- Impact on Life Sciences Funding: Historically, periods of declining interest rates have correlated with increased venture capital deployment into the life sciences, often leading to higher demand for CDMO capacity.

- Operational Cost Considerations: While client funding is key, Asymchem's own operational costs, including raw materials and energy, are also sensitive to inflation and interest rate environments, impacting overall profitability.

Consolidation and Strategic Alliances in the CDMO Sector

The Contract Development and Manufacturing Organization (CDMO) sector is experiencing significant consolidation, with major players actively pursuing mergers and acquisitions to broaden their service portfolios and provide seamless, end-to-end solutions. This trend is driven by the increasing complexity of drug development and manufacturing, requiring CDMOs to offer a wider range of specialized capabilities.

In 2024, the global CDMO market size was estimated to be around $250 billion, with projections indicating continued growth driven by outsourcing trends in the pharmaceutical and biotechnology industries. This consolidation creates a more competitive environment, pushing companies to innovate and expand their offerings to remain relevant.

- Increased M&A Activity: Leading CDMOs are acquiring smaller, specialized firms to integrate new technologies and expand capacity.

- Focus on Integrated Services: Companies are prioritizing the ability to offer a full spectrum of services, from early-stage development to commercial manufacturing.

- Strategic Partnerships: Collaborations are becoming crucial for accessing new markets, technologies, and customer bases.

- Impact on Asymchem: Asymchem can leverage this trend by pursuing strategic acquisitions, forming alliances, or focusing on organic growth to enhance its integrated service model and competitive positioning.

Economic factors significantly influence the pharmaceutical CDMO market. The global CDMO market was valued at approximately $250 billion in 2024, with projections for continued growth driven by outsourcing trends.

While 2024 saw elevated interest rates potentially tightening liquidity for biotech firms, the outlook for 2025 suggests a gradual reduction in rates, which could reignite investment and increase demand for CDMO services.

The trend of pharmaceutical companies seeking cost efficiencies and faster market entry through outsourcing directly benefits CDMOs like Asymchem, especially in specialized areas like small molecule manufacturing, which saw robust demand in 2024.

The biotech funding landscape in 2024 favored mature assets, but 2025 projections indicate a potential uptick in venture capital for early-stage companies in high-demand areas, directly impacting Asymchem's project pipeline.

| Metric | 2024 (Approx.) | 2025 (Projected) |

|---|---|---|

| Global CDMO Market Value | $250 billion | $197.4 billion (by 2025) |

| Pharmaceutical Outsourcing Market | $77.5 billion | Significant growth |

| Interest Rate Environment | Elevated (hawkish stance) | Gradual reduction (easing) |

Preview Before You Purchase

Asymchem PESTLE Analysis

The preview shown here is the exact Asymchem PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers all Political, Economic, Social, Technological, Legal, and Environmental factors impacting Asymchem, providing valuable strategic insights.

Sociological factors

Societal shifts are increasingly prioritizing personalized medicine and advanced therapies, such as cell and gene treatments. This trend fuels significant innovation across the pharmaceutical sector.

Asymchem, as a Contract Development and Manufacturing Organization (CDMO) adept at handling complex drug substances and products, is strategically positioned to capitalize on this demand. The company is set to support the manufacturing needs for high-growth areas including Antibody-Drug Conjugates (ADCs) and peptides, reflecting a market where specialized manufacturing capabilities are paramount.

The world is getting older, and with that comes more chronic diseases. This trend is a big deal for companies like Asymchem because it means people will need more medicines and treatments for conditions like diabetes, heart disease, and cancer. For instance, by 2050, the number of people aged 65 and over is projected to reach 1.6 billion globally, a significant increase from around 700 million in 2019. This demographic shift directly translates into a sustained and growing demand for pharmaceutical products and the advanced drug development and manufacturing services Asymchem provides.

This aging population and the rise in chronic illnesses create a fundamental, long-term demand for Asymchem's core business. As more people require ongoing medical care, the need for new drugs and efficient manufacturing processes will only increase. This provides a stable foundation for Asymchem's growth across a wide range of therapeutic areas, ensuring a consistent market for their expertise in drug development and production.

Societal pressure for wider access to critical medicines and the ongoing debate around drug pricing directly impact the pharmaceutical industry. This includes expectations that life-saving treatments should be within reach for more people, creating a demand for cost-effective solutions throughout the supply chain.

Contract Development and Manufacturing Organizations (CDMOs) such as Asymchem play a crucial role in addressing these expectations. By focusing on manufacturing process optimization, Asymchem can enhance efficiency and reduce production costs, enabling their pharmaceutical partners to offer therapies at more affordable price points. For instance, in 2024, the global pharmaceutical market saw continued scrutiny on drug pricing, with many governments implementing measures to control costs, reinforcing the need for efficient manufacturing.

Public Health Priorities and Disease Focus

Public health priorities are increasingly focused on chronic diseases and unmet medical needs, driving significant investment in areas like oncology, rare diseases, and metabolic disorders. For instance, the burgeoning demand for GLP-1 based therapies for obesity has become a major area of pharmaceutical research and development.

Asymchem's strategic alignment with these trends is evident in its participation in global polypeptide projects targeting obesity. This focus positions the company to capitalize on the growing market for weight management solutions, a critical public health concern.

- Increased R&D in Oncology: Global oncology drug development spending is projected to reach over $250 billion by 2026, highlighting a key public health priority.

- Growth in Rare Disease Therapies: The market for rare disease treatments is expected to grow at a CAGR of over 10% through 2027, reflecting a focus on addressing significant unmet medical needs.

- Obesity Treatment Market Expansion: The global obesity drug market is anticipated to exceed $60 billion by 2030, driven by rising obesity rates and the success of new therapeutic classes.

Talent Acquisition and Workforce Development

The pharmaceutical sector, especially advanced therapies, demands highly specialized skills. Asymchem, like other Contract Development and Manufacturing Organizations (CDMOs), faces a critical need to attract and retain this talent to stay competitive and ensure high-quality services.

Industry-wide talent shortages are a significant challenge. For instance, a 2024 report indicated a growing gap in skilled biopharmaceutical professionals, with an estimated deficit of 10-15% in key roles by 2026. This necessitates robust workforce development strategies.

- Talent Demand: High demand for specialized skills in areas like cell and gene therapy manufacturing.

- Retention Challenges: CDMOs must invest in training and career progression to combat high turnover rates.

- Skill Gaps: Addressing shortages in areas such as process development, quality control, and regulatory affairs is crucial.

- Workforce Investment: Companies are increasing training budgets, with some reporting a 20% rise in learning and development spend in 2024 to upskill existing staff.

Societal trends are increasingly focused on personalized medicine and advanced therapies, driving demand for specialized manufacturing. The aging global population, with projections of 1.6 billion people aged 65+ by 2050, fuels a sustained need for treatments for chronic diseases, directly benefiting CDMOs like Asymchem. Furthermore, public pressure for affordable access to life-saving drugs necessitates manufacturing efficiency, a key area where Asymchem can provide value.

Technological factors

Artificial intelligence is fundamentally reshaping the pharmaceutical landscape, from the initial spark of drug discovery to the intricacies of manufacturing. By speeding up processes, refining molecular designs, and boosting overall efficiency, AI is a game-changer. For instance, AI-powered simulations can reduce the time needed for preclinical testing.

Asymchem is actively integrating this technological wave through its proprietary STAR platform, designed for protein sequence recommendation. This AI-driven approach significantly bolsters Asymchem's capacity to assist clients in their innovative endeavors, particularly in the complex field of biologics. The company's investment in such advanced platforms underscores its commitment to staying at the forefront of pharmaceutical technology.

Continuous manufacturing is revolutionizing the pharmaceutical sector, offering faster production cycles, enhanced product uniformity, and reduced operational expenses compared to traditional batch methods. Asymchem is at the forefront of this shift, actively commercializing continuous reaction technology and showcasing its dedication to cutting-edge, efficient manufacturing.

The pharmaceutical landscape is rapidly evolving with a surge in complex modalities like Antibody-Drug Conjugates (ADCs), peptides, oligonucleotides, and cell and gene therapies. These advanced treatments require highly specialized manufacturing capabilities, a trend that Asymchem is actively addressing.

Asymchem's strategic investments, including a new OEB5 plant designed for high-potency compounds and the implementation of automated peptide production lines, directly align with this technological evolution. This focus positions them to capitalize on the growing demand for manufacturing these intricate and cutting-edge therapies.

Digital Transformation and Automation

The pharmaceutical sector is rapidly embracing digital transformation, integrating automation, real-time monitoring, and sophisticated data analytics. This shift is crucial for boosting operational efficiency, ensuring stringent quality control, and building more resilient supply chains. Asymchem's strategic investments, such as its fully automated peptide production lines, directly reflect this industry-wide push towards advanced manufacturing technologies. These advancements are key to streamlining production processes and minimizing the potential for human error, ultimately leading to higher quality outputs and more predictable manufacturing outcomes.

Asymchem's commitment to automation is a significant technological advantage. For instance, in 2023, the company highlighted its ongoing expansion of automated manufacturing capabilities, aiming to further enhance production speed and accuracy. This focus on digital tools and automated systems is not just about efficiency; it's about setting new benchmarks for quality and reliability in complex pharmaceutical manufacturing. The company's strategy aligns with broader industry trends where digital integration is becoming a primary differentiator.

Key aspects of this technological evolution include:

- Increased Automation: Implementing robotic systems and AI-driven processes in manufacturing and quality assurance.

- Data-Driven Operations: Leveraging real-time data analytics for predictive maintenance, process optimization, and enhanced decision-making.

- Advanced Manufacturing Technologies: Adopting continuous manufacturing, advanced process control, and digital twins to improve efficiency and product quality.

- Supply Chain Digitization: Utilizing blockchain and IoT for greater transparency, traceability, and resilience in the pharmaceutical supply chain.

Emerging Manufacturing Technologies (e.g., 3D Printing)

Emerging manufacturing technologies, like 3D printing of pharmaceuticals, are paving the way for highly personalized medicines and more efficient production runs. While not yet mainstream for large Contract Development and Manufacturing Organizations (CDMOs), these advancements hold significant future promise for tailored drug delivery and minimizing waste, directly supporting the industry’s push for greater efficiency and patient-focused care.

The adoption of additive manufacturing in pharma is expected to grow, with market projections indicating a substantial increase in its application. For instance, the global 3D printing in the pharmaceutical market was valued at approximately $215 million in 2023 and is forecasted to reach over $1 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 25%. This growth underscores the potential for CDMOs like Asymchem to leverage these technologies for niche applications and future scalability.

- Personalized Medicine: 3D printing allows for the creation of pills with specific dosages and combinations of active pharmaceutical ingredients tailored to individual patient needs, a significant shift from traditional mass production.

- Optimized Production: This technology enables on-demand manufacturing, reducing the need for large inventories and minimizing the risk of drug obsolescence or spoilage, especially for specialized or low-volume drugs.

- Waste Reduction: By printing only what is needed, the pharmaceutical industry can significantly cut down on material waste, contributing to more sustainable manufacturing practices.

- Future CDMO Opportunities: While currently more suited for clinical trials and niche markets, the increasing sophistication of 3D printing presents a long-term opportunity for CDMOs to offer highly customized manufacturing services.

Technological advancements are profoundly transforming pharmaceutical manufacturing, with AI and automation at the forefront. Asymchem leverages AI through its STAR platform for protein sequence recommendation, enhancing biologics development. Continuous manufacturing is also a key focus, offering improved efficiency and reduced costs compared to traditional batch methods.

The industry's shift towards complex modalities like ADCs and cell/gene therapies necessitates specialized capabilities, which Asymchem is actively developing. The company's investment in high-potency compound facilities and automated peptide lines directly addresses this trend, positioning them to capitalize on the growing demand for these advanced treatments.

Digital transformation is critical for efficiency and quality control, with Asymchem integrating automation and data analytics. Their automated peptide production lines exemplify this commitment, aiming to boost speed, accuracy, and reliability. These digital tools are becoming a primary differentiator in the competitive CDMO landscape.

Emerging technologies like 3D printing offer future potential for personalized medicine and on-demand production, with market projections showing significant growth. While currently niche, this technology could unlock new opportunities for CDMOs in tailored drug delivery and waste reduction.

| Key Technological Trends in Pharma Manufacturing | Impact | Asymchem's Focus |

| Artificial Intelligence (AI) | Accelerated drug discovery, process optimization, improved efficiency | STAR platform for protein sequence recommendation |

| Continuous Manufacturing | Faster production, enhanced product uniformity, reduced costs | Commercializing continuous reaction technology |

| Automation & Digitalization | Increased speed, accuracy, quality control, data-driven operations | Automated peptide production lines, digital integration |

| Advanced Modalities (ADCs, Cell & Gene Therapy) | Demand for specialized manufacturing capabilities | Investment in OEB5 plant, advanced process development |

| 3D Printing | Personalized medicine, on-demand production, waste reduction | Exploring future opportunities for niche applications |

Legal factors

Regulatory bodies such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) are actively refining their frameworks for Advanced Therapy Medicinal Products (ATMPs). These updates are crucial given the novel nature of gene and cell therapies, which present unique manufacturing and safety challenges.

As a Contract Development and Manufacturing Organization (CDMO) supporting these cutting-edge treatments, Asymchem must remain agile in its compliance strategies. The company can leverage regulatory pathways like the EMA's PRIME (PRIority MEdicines) scheme, which aims to accelerate the development and approval of medicines offering a significant therapeutic advantage. For instance, in 2023, the FDA approved a record number of novel cell and gene therapies, highlighting the dynamism of this sector.

Regulatory bodies worldwide are intensifying their focus on quality and compliance, particularly Good Manufacturing Practices (GMP). This trend directly impacts contract development and manufacturing organizations (CDMOs) like Asymchem, as adherence to these elevated standards is crucial for drug safety and efficacy.

For Asymchem, demonstrating robust quality control is not just about meeting requirements; it's a business imperative. Successfully passing audits, such as their EU QP audit in February 2024, directly influences their ability to secure and maintain valuable client contracts and ensures continued access to key markets.

The burgeoning field of digital health and the growing integration of AI in pharmaceutical research and development demand stringent data privacy and cybersecurity frameworks. Asymchem, by engaging with digital R&D and manufacturing processes, must navigate a complex web of evolving data protection laws.

Compliance with regulations like the EU AI Act, expected to be fully implemented in 2025, and the Medical Device Regulation is critical. These laws aim to protect sensitive client and patient data, a core responsibility for Contract Development and Manufacturing Organizations (CDMOs) operating in this space.

Intellectual Property Protection and Patent Expirations

Intellectual property (IP) laws are paramount in the pharmaceutical sector, safeguarding novel drug discoveries and manufacturing processes. Contract Development and Manufacturing Organizations (CDMOs) like Asymchem are entrusted with protecting their clients' sensitive IP throughout the complex development and production stages. This protection is vital for maintaining competitive advantage and ensuring the exclusivity of groundbreaking treatments.

The pharmaceutical landscape is significantly influenced by the 'patent cliff,' a phenomenon where patents for blockbuster drugs expire, opening doors for generic and biosimilar competition. This shift can dramatically alter market dynamics, impacting the demand for CDMO services as companies pivot towards producing off-patent medications or developing new biosimilar alternatives. For instance, the expiration of patents for major drugs in 2024 and 2025 is expected to continue reshaping the market, potentially increasing demand for efficient manufacturing of generics and biosimilars.

- IP Protection: CDMOs are critical partners in safeguarding pharmaceutical innovations, ensuring the confidentiality and integrity of client intellectual property from early-stage development through commercial manufacturing.

- Patent Expirations: The impending expiration of patents for several high-value drugs in 2024-2025 creates a significant 'patent cliff,' potentially driving demand for generic and biosimilar production services.

- Market Dynamics: This patent cliff can lead to increased competition and price erosion for originator drugs, while simultaneously creating opportunities for CDMOs specializing in cost-effective manufacturing of generics and biosimilars.

- CDMO Role: Asymchem's ability to navigate these IP complexities and adapt to changing market demands by supporting both innovative drug development and the efficient production of off-patent medicines is key to its strategic positioning.

Environmental Regulations and Sustainability Mandates

Governments worldwide are intensifying environmental regulations and sustainability mandates for the pharmaceutical sector. This includes stricter rules on waste management, emissions, and the use of hazardous materials. For instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting chemical production processes.

Contract Development and Manufacturing Organizations (CDMOs) like Asymchem must adapt to these evolving legal frameworks. Compliance often necessitates investments in cleaner technologies and more sustainable sourcing of raw materials. These regulations can increase operational costs but also drive innovation in green chemistry, a core focus for Asymchem.

Asymchem's commitment to green chemistry, as highlighted in its sustainability reports, positions it to navigate these regulatory shifts. For example, the company has invested in technologies that reduce solvent usage and improve energy efficiency in its manufacturing sites. Such proactive measures are crucial for maintaining market access and reputation in an increasingly environmentally conscious global market.

Key regulatory trends impacting CDMOs include:

- Increased scrutiny on pharmaceutical waste disposal and recycling.

- Mandates for reduced carbon footprint in manufacturing operations.

- Stricter controls on the sourcing and use of chemicals with environmental impact.

- Growing emphasis on life cycle assessments for pharmaceutical products.

Asymchem operates within a highly regulated pharmaceutical landscape, where compliance with evolving legal frameworks is paramount. The company must navigate stringent quality and safety standards set by bodies like the EMA and FDA, particularly for advanced therapies. Demonstrating adherence to Good Manufacturing Practices (GMP) is crucial, as evidenced by successful audits like their February 2024 EU QP audit, which directly impacts market access and client trust.

Environmental factors

The pharmaceutical sector is under increasing scrutiny to minimize its environmental impact, driving a push for sustainable manufacturing. This trend is particularly relevant for companies like Asymchem, which are investing in greener technologies.

Asymchem’s strategic focus on green chemistry, incorporating methods such as electrochemistry, flow chemistry, biocatalysis, and photochemistry, directly addresses this environmental pressure. For instance, their adoption of flow chemistry can lead to reduced solvent usage and waste generation compared to traditional batch processes.

By embracing these advanced, environmentally conscious techniques, Asymchem is well-positioned to not only meet evolving regulatory requirements but also to capitalize on the growing demand for sustainable pharmaceutical production, a market segment projected for significant growth through 2025 and beyond.

The pharmaceutical industry, a significant source of global carbon emissions, faces increasing pressure to decarbonize. For instance, the European pharmaceutical sector has set an ambitious goal to reduce its emissions by 55% by 2030, highlighting the sector-wide commitment to environmental stewardship.

Contract Development and Manufacturing Organizations (CDMOs) like Asymchem are actively addressing this challenge. By adopting advanced manufacturing techniques such as continuous manufacturing, which often uses less energy and generates less waste than traditional batch processes, Asymchem is working to lower its environmental footprint. Furthermore, investments in renewable energy sources are a key strategy to power operations more sustainably.

Minimizing waste generation, including the recycling and reuse of solvents and catalysts, is a significant environmental focus for the pharmaceutical industry. Companies like Asymchem are increasingly prioritizing these efforts as they align with broader sustainability goals and regulatory pressures.

Through process intensification and efficient manufacturing techniques, Asymchem can significantly contribute to reducing waste. For example, advancements in continuous manufacturing can lead to a substantial decrease in solvent usage and byproduct formation compared to traditional batch processes. This aligns directly with circular economy principles, where resources are kept in use for as long as possible, extracting maximum value and then recovering and regenerating products and materials at the end of each service life.

Asymchem's commitment to these initiatives can enhance its environmental performance, potentially leading to cost savings through reduced material consumption and waste disposal fees. The global pharmaceutical contract manufacturing market, valued at approximately $160 billion in 2023, is seeing a growing demand for environmentally conscious partners. By embracing waste reduction and circular economy models, Asymchem can differentiate itself and attract clients who prioritize sustainability in their supply chains.

Water and Energy Consumption Optimization

Pharmaceutical manufacturing is notoriously demanding on resources, particularly energy and water. Optimizing these vital inputs is no longer just a cost-saving measure but a strategic imperative. Advanced technologies are key; for instance, continuous manufacturing systems have demonstrated the potential to cut energy consumption by as much as 50% compared to traditional batch processes. This shift is driven by a need for greater efficiency and reduced environmental impact.

Asymchem's commitment to process innovation and automation directly aligns with these resource optimization efforts. By streamlining operations and implementing smarter technologies, the company is positioning itself to meet the growing demand for sustainable pharmaceutical production. This focus not only addresses environmental concerns but also enhances operational resilience and cost-effectiveness in a competitive global market.

Key aspects of water and energy consumption optimization in pharmaceutical manufacturing include:

- Adoption of Continuous Manufacturing: These systems often require less energy per unit of output due to more efficient heat transfer and reduced downtime.

- Water Recycling and Reuse: Implementing closed-loop systems for water usage can significantly decrease overall water withdrawal.

- Energy-Efficient Equipment: Upgrading to modern, energy-saving machinery, such as variable speed drives on pumps and optimized HVAC systems, contributes to substantial savings.

- Process Intensification: Redesigning processes to be more compact and efficient can inherently lower energy and water requirements.

Eco-Friendly Packaging and Supply Chain Decarbonization

Environmental regulations are increasingly pushing for eco-friendly packaging and the decarbonization of supply chains. This means a shift towards biodegradable materials and less plastic in pharmaceutical packaging. Asymchem, offering end-to-end services, must integrate these sustainable practices throughout its operations and partnerships.

The pharmaceutical industry, including contract development and manufacturing organizations like Asymchem, faces mounting pressure to reduce its environmental footprint. This extends beyond the manufacturing floor to encompass the entire supply chain, from raw material sourcing to final product delivery. For instance, by 2025, many companies are aiming for significant reductions in single-use plastics within their packaging. Asymchem's commitment to sustainability means actively seeking out and implementing greener packaging alternatives and collaborating with suppliers who share these environmental goals.

- Sustainable Packaging Initiatives: Asymchem is exploring biodegradable and compostable packaging materials to minimize waste and reliance on traditional plastics.

- Supply Chain Decarbonization Targets: The company is working with its partners to set and achieve ambitious targets for reducing greenhouse gas emissions across its entire pharmaceutical supply chain by 2025.

- Reduced Plastic Usage: Efforts are underway to decrease the amount of plastic used in product packaging, with a focus on innovative material science and design.

- Supplier Collaboration: Asymchem actively engages with its suppliers to ensure they adhere to environmental standards, promoting a shared responsibility for sustainability.

The pharmaceutical sector is increasingly focused on sustainability, with a growing emphasis on reducing waste and optimizing resource consumption. Asymchem's adoption of green chemistry principles, such as flow chemistry and biocatalysis, directly addresses these environmental pressures, aiming for reduced solvent use and waste generation.

The industry faces significant pressure to decarbonize, with ambitious targets set for emission reductions. Asymchem is addressing this by investing in advanced manufacturing techniques like continuous manufacturing and exploring renewable energy sources to power its operations.

Minimizing waste, including solvent and catalyst recycling, is a key environmental focus. Asymchem's efforts in process intensification and efficient manufacturing, such as continuous manufacturing, contribute to reducing waste and aligning with circular economy principles.

Resource optimization, particularly for energy and water, is crucial. Continuous manufacturing systems, for example, can significantly cut energy consumption, with potential reductions of up to 50% compared to traditional batch processes.

| Environmental Focus | Asymchem's Approach | Industry Trend/Data (2024-2025) |

|---|---|---|

| Green Chemistry & Waste Reduction | Adoption of flow chemistry, biocatalysis, electrochemistry. | Growing demand for CDMOs with strong ESG credentials. |

| Decarbonization & Energy Efficiency | Investment in continuous manufacturing, renewable energy. | European pharmaceutical sector targets 55% emission reduction by 2030. |

| Resource Optimization (Water & Energy) | Process intensification, automation, energy-efficient equipment. | Continuous manufacturing can reduce energy consumption by up to 50%. |

| Sustainable Packaging & Supply Chain | Exploring biodegradable materials, reducing plastic usage. | Aiming for significant reductions in single-use plastics by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Asymchem is meticulously crafted using data from leading pharmaceutical industry associations, global regulatory bodies like the FDA and EMA, and reputable market research firms specializing in the life sciences sector. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Asymchem's operations and strategic direction.