Asymchem Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asymchem Bundle

Curious about Asymchem's strategic positioning? This glimpse into their BCG Matrix reveals how their products stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture; purchase the complete report for actionable insights and a clear path to optimizing your portfolio.

Stars

Asymchem's commitment to advanced manufacturing technologies like continuous reactions, synthetic biology, and enzyme engineering places them at the forefront of high-growth sectors. These innovations are crucial for increasing production capacity and reducing costs, leading to significant market traction and a competitive edge.

The company's substantial investment in these areas is underscored by its portfolio of over 300 patents, creating a robust intellectual property barrier. This technological leadership is a key differentiator in the competitive landscape of pharmaceutical manufacturing.

Asymchem is aggressively expanding its peptide and oligonucleotide manufacturing capabilities, positioning this segment as a major growth engine. The company anticipates its total solid-phase peptide synthesis capacity will reach 30,000 liters by the second half of 2025.

This expansion is fueled by surging demand, evidenced by a projected doubling of oligonucleotide projects. Such robust growth highlights Asymchem's strategic focus on high-value therapeutic modalities within the CDMO market.

The Antibody-Drug Conjugate (ADC) market is experiencing rapid expansion, projected to reach over $15 billion by 2027, driven by their targeted therapeutic approach. Asymchem's comprehensive, end-to-end capabilities, spanning antibody production, linker and payload synthesis, and the critical conjugation process, place them as a key facilitator in this burgeoning field. This integrated service model is crucial for navigating the complexities of ADC development.

Asymchem's unique strength lies in its fusion of advanced small molecule chemistry expertise with robust monoclonal antibody (mAb) manufacturing capabilities. This synergy is vital for ADC production, where both components must be precisely manufactured and expertly combined. This strategic positioning allows Asymchem to capture significant market share in a high-growth sector, offering a distinct advantage to pharmaceutical partners.

Global Expansion in Key Markets

Asymchem is actively pursuing global expansion, with a significant focus on high-growth regions. The inauguration of a new development and pilot manufacturing site in the UK in 2024 underscores this strategy, aiming to bolster its presence in key European markets.

This strategic move, alongside existing operations in multiple countries and plans for further international market entry, highlights Asymchem's commitment to capturing market share in burgeoning geographical segments.

- European Foothold: Asymchem's UK facility, operational in 2024, represents a direct investment in expanding its European footprint.

- Global Network: The company currently operates in several countries, with ongoing initiatives to penetrate new international markets.

- Market Share Growth: This expansion is designed to increase Asymchem's presence and competitive standing in growing global pharmaceutical manufacturing sectors.

- Targeted Investment: The UK site targets high-growth regions, aligning with Asymchem's strategy to capitalize on emerging market opportunities.

Integrated End-to-End CDMO Services

Asymchem's integrated end-to-end CDMO services, covering everything from early-stage research to large-scale commercial manufacturing for both drug substances and drug products, position it strongly in the market. This comprehensive offering is a key differentiator.

The CDMO industry is increasingly consolidating around providers that can offer a full spectrum of services. Asymchem's ability to be a one-stop shop aligns perfectly with this trend, enabling them to attract and retain clients seeking streamlined outsourcing solutions.

This integrated approach allows Asymchem to capture a greater portion of the expanding pharmaceutical outsourcing market. For instance, the global CDMO market was valued at approximately $19.1 billion in 2023 and is projected to grow significantly, with integrated service providers expected to benefit the most.

- Comprehensive Service Offering: Supports clients from preclinical to commercial stages.

- Industry Trend Alignment: Caters to the growing demand for integrated CDMO solutions.

- Market Share Capture: Positions Asymchem to gain a larger slice of the expanding outsourcing market.

- Competitive Advantage: Differentiates Asymchem through its end-to-end capabilities.

Asymchem's advanced peptide and oligonucleotide manufacturing capabilities, coupled with its expansion into the Antibody-Drug Conjugate (ADC) market, firmly place it in the Stars category of the BCG Matrix. The company's significant investments in cutting-edge technologies and its robust intellectual property portfolio further solidify its position as a market leader in high-growth segments of the pharmaceutical CDMO industry.

The projected doubling of oligonucleotide projects and the rapid growth of the ADC market, expected to exceed $15 billion by 2027, indicate strong future revenue potential. Asymchem's integrated, end-to-end service model, from small molecule synthesis to antibody production and conjugation, allows it to capture substantial value in these expanding therapeutic areas.

The company's strategic global expansion, including its 2024 UK facility launch, aims to capitalize on these growth opportunities and increase market share. Asymchem's commitment to innovation and its comprehensive service offering are key drivers for its continued success in the dynamic pharmaceutical outsourcing landscape.

| Category | Asymchem's Position | Market Growth | Competitive Strength |

|---|---|---|---|

| Peptides & Oligonucleotides | Star | High (projected doubling of projects) | Leading capacity and technological expertise |

| Antibody-Drug Conjugates (ADCs) | Star | High (projected >$15 billion by 2027) | End-to-end capabilities, integrated service model |

| Advanced Manufacturing Tech | Star | High (driving innovation and cost reduction) | Continuous reactions, synthetic biology, enzyme engineering, 300+ patents |

| Integrated CDMO Services | Star | High (global CDMO market ~$19.1 billion in 2023) | One-stop shop, comprehensive offering from research to commercial |

What is included in the product

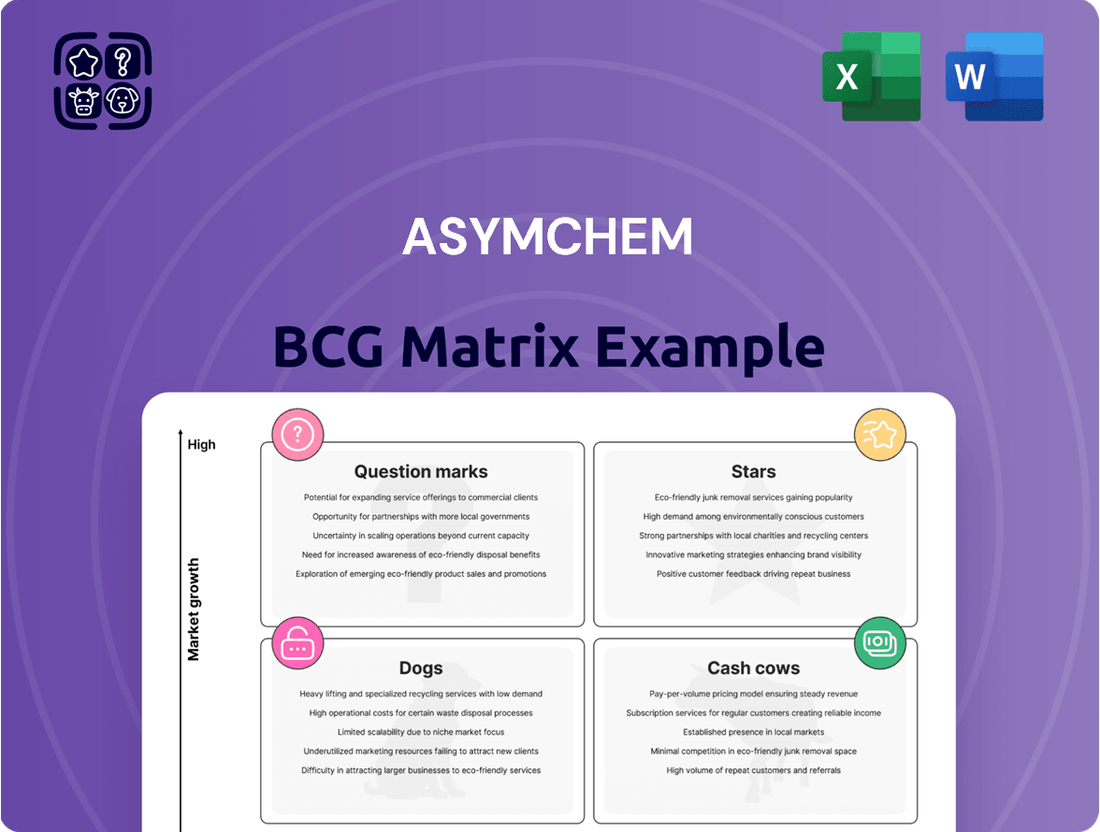

Asymchem's BCG Matrix provides a framework for analyzing its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide strategic resource allocation.

Asymchem's BCG Matrix offers a clear, one-page overview, instantly clarifying business unit positioning to alleviate strategic confusion.

Cash Cows

Asymchem's commercial-stage small molecule CDMO services are a cornerstone of their business, consistently contributing a substantial portion of revenue. This segment benefits from the company's deep-rooted expertise and established relationships with a broad client base.

Despite potentially slower market growth compared to emerging areas like biologics, the mature small molecule sector offers robust profitability. Asymchem's efficient operational model and scale allow for high profit margins, generating reliable and significant cash flow for the company.

For instance, in 2024, Asymchem reported that its small molecule segment continued to be a primary driver of earnings, underscoring its role as a stable cash generator. This segment’s consistent performance provides the financial foundation for Asymchem to invest in and expand its more dynamic growth areas.

Asymchem's established API manufacturing services are a clear cash cow. With a portfolio exceeding 250 APIs, the company operates in a mature market segment where its strong position allows for consistent revenue generation. This specialization in high-quality API production taps into a persistent demand, enabling Asymchem to generate substantial cash flow with minimal need for additional investment.

Routine Drug Product Manufacturing, a core offering for Asymchem, functions as a cash cow within its business portfolio. The consistent demand for services such as blending, encapsulation, and granulation ensures a stable and predictable revenue stream.

This segment benefits from operating in a mature market with well-defined processes, which typically translates to high profit margins and reliable cash generation for the company. Asymchem's established presence in this area allows for efficient operations and a strong competitive position.

Long-term Client Relationships and Repeat Business

Asymchem's success in retaining over 1,100 active clients highlights its strength in cultivating long-term relationships. This extensive client base, actively engaged in numerous ongoing commercial projects, signifies a deep level of trust and satisfaction.

These enduring partnerships are particularly concentrated in Asymchem's more mature service areas. Such established relationships act as a consistent and dependable source of revenue and cash flow, reducing the need for substantial new business acquisition efforts.

- Client Retention: Over 1,100 active clients demonstrate robust long-term partnerships.

- Project Volume: A large number of ongoing commercial projects signifies sustained demand and trust.

- Revenue Stability: Mature service areas with established clients provide a reliable revenue stream.

- Reduced Investment: These "cash cow" segments require less aggressive promotional spending due to existing demand.

Quality and Regulatory Compliance Services

Asymchem's Quality and Regulatory Compliance Services are a true cash cow within their portfolio. In the highly regulated pharmaceutical industry, a spotless record with regulatory bodies is paramount. Asymchem boasts an impressive history, having successfully navigated over 65 regulatory inspections, demonstrating their unwavering commitment to quality assurance. This track record significantly de-risks projects for their clients, making Asymchem a highly sought-after partner.

This consistent performance in a mature market translates into predictable, high-margin revenue streams. Clients are willing to pay a premium for the assurance that their drug development and manufacturing processes meet the strictest global standards. Asymchem's established quality systems are not just a service; they are a fundamental pillar of their client relationships and a reliable source of profit.

Key aspects of their cash cow status include:

- Proven Regulatory Success: Over 65 successful inspections underscore their reliability.

- Risk Mitigation for Clients: Their compliance reduces the likelihood of costly delays or rejections.

- Mature Market Dominance: In a stable, regulated sector, their quality leadership commands consistent demand.

- High-Margin Revenue Generation: The value placed on compliance allows for strong profitability.

Asymchem's small molecule API manufacturing and routine drug product services are prime examples of cash cows. These segments benefit from established client relationships, with over 1,100 active clients and a portfolio exceeding 250 APIs, ensuring consistent revenue generation in mature markets.

The company's strong track record in quality and regulatory compliance, evidenced by over 65 successful inspections, further solidifies these offerings as reliable, high-margin profit centers. This stability allows Asymchem to fund investments in growth areas.

In 2024, these mature segments continued to be the primary drivers of earnings, demonstrating their role as dependable cash generators for the company.

The consistent demand for Asymchem's established services, like blending and encapsulation, translates into predictable revenue streams and high profit margins. This operational efficiency and market position allow these areas to generate substantial cash flow with minimal additional investment.

| Service Segment | BCG Classification | Key Strengths | 2024 Performance Indicator |

| Small Molecule API Manufacturing | Cash Cow | Extensive API portfolio (>250), deep client relationships | Primary driver of earnings |

| Routine Drug Product Manufacturing | Cash Cow | Mature market, efficient operations, high profit margins | Stable and predictable revenue stream |

| Quality & Regulatory Compliance | Cash Cow | Proven success in over 65 inspections, risk mitigation for clients | High-margin revenue generation |

Delivered as Shown

Asymchem BCG Matrix

The Asymchem BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase. This comprehensive analysis is ready for immediate integration into your strategic planning, offering clear insights into Asymchem's product portfolio without any watermarks or demo content.

Dogs

Legacy small molecule projects, especially those not targeting current high-growth therapeutic areas, can become cash dogs. These might have a shrinking market share and face limited future growth, demanding resources without commensurate returns.

For instance, if Asymchem's 2024 financial reports indicated a dip in revenue from certain established small molecule product lines, it would signal these are likely candidates for the dog quadrant. This decline in profitability suggests these older projects might be consuming more capital than they are generating.

Non-core, low-margin services represent offerings that are peripheral to Asymchem's primary strategic objectives, such as highly commoditized or easily replicable services that don't utilize their advanced technological expertise. These segments often struggle with both low market share and limited growth potential, thereby making only a minor contribution to the company's overall profitability.

While specific examples of such services were not explicitly detailed, this category generally encompasses activities that do not leverage Asymchem's core competencies in advanced manufacturing and R&D. For instance, if Asymchem were to offer basic chemical synthesis without any value-added technological input, it might fall into this classification, especially if it competes in a crowded market with little differentiation.

If Asymchem possesses manufacturing capabilities for older drug classes or technologies that are no longer in high demand or have been surpassed by newer innovations, this could represent a 'Dog' in their portfolio. This underutilized capacity means capital is tied up in assets with minimal growth potential and low profitability.

For instance, if Asymchem has dedicated facilities for producing small molecule drugs that have largely been replaced by biologics, and these facilities are operating at significantly reduced capacity, they would fit the 'Dog' profile. This situation would lead to low returns on investment and could be a drag on overall financial performance.

Early-stage Clinical Projects with Stagnant Progress

Early-stage clinical projects at Asymchem that have hit roadblocks, such as demonstrating limited efficacy, raising safety flags, or facing funding gaps from their clients, can be categorized as Dogs in the BCG Matrix. These ventures tie up valuable research and development personnel and operational support without a clear path to market.

This stagnation means they generate minimal returns and possess a low potential for market share. For instance, if a significant portion of Asymchem's early-phase pipeline in 2024 experienced such delays, it would represent a drag on overall profitability and resource allocation.

- Resource Drain: Projects stuck in Phase I or II clinical trials consume R&D budgets and specialized personnel.

- Low Return Potential: Without progression, these projects offer no revenue and minimal future market prospects.

- Opportunity Cost: Resources allocated to stalled projects could be redirected to more promising ventures.

- Client Dependency: Funding issues from clients directly impact the progression of these early-stage projects.

Services in Highly Fragmented, Price-Sensitive Markets

Segments of the CDMO market that are highly fragmented with many small players and intense price competition could be a challenge for Asymchem if they participate without a clear differentiation. In such markets, achieving a high market share is difficult, and margins are often squeezed, leading to low profitability and growth.

For instance, the small molecule CDMO market, a segment Asymchem operates within, is characterized by numerous smaller contract manufacturers, particularly in Asia, that often compete aggressively on price. This can make it difficult for even larger players to command premium pricing unless they offer specialized services or superior quality.

- Price Sensitivity: In highly fragmented markets, customers often prioritize cost over other factors, putting pressure on Asymchem's pricing strategies.

- Low Margins: Intense competition can lead to reduced profit margins, impacting overall financial performance and reinvestment capacity.

- Difficulty Gaining Market Share: Without a distinct competitive advantage, it's challenging to capture significant market share in a crowded landscape.

- Limited Growth Potential: Squeezed margins and difficulty in differentiation can stifle the growth prospects of participating companies.

Dogs in Asymchem's portfolio represent business segments or projects with low market share and low growth potential. These are often legacy products or services that consume resources without generating significant returns. Identifying and managing these 'dogs' is crucial for optimizing capital allocation and focusing on more promising growth areas.

In 2024, Asymchem's financial performance might reveal specific small molecule product lines experiencing declining revenues and facing intense competition from newer therapeutic modalities. These could be candidates for the dog quadrant, requiring careful evaluation for divestment or restructuring to free up capital.

Non-core, low-margin services that do not leverage Asymchem's advanced manufacturing capabilities also fall into this category. These offerings, if present, would likely have limited growth prospects and contribute minimally to overall profitability, making them potential 'dogs'.

Underutilized manufacturing capacity for older drug classes or technologies that have been superseded by innovations represents another potential area for 'dogs.' This scenario ties up capital in assets with low returns and minimal future potential, impacting overall financial efficiency.

Asymchem's early-stage clinical projects that encounter significant setbacks, such as efficacy issues or funding challenges, can also be classified as dogs. These projects drain R&D resources and personnel without a clear path to commercialization, representing a drag on innovation and profitability.

Question Marks

Asymchem's strategic investment in synthetic biology, exemplified by their innovative STAR (Sequence Recommendation via Artificial Intelligence) system for protein design, positions them in a high-potential growth sector. This advanced AI platform is designed to accelerate the discovery and optimization of novel proteins, crucial for developing next-generation biologics and bio-based materials.

While the promise of synthetic biology is substantial, Asymchem's current market share in this nascent field is likely modest. As a relatively new entrant, this segment represents a classic Question Mark in the BCG matrix, demanding significant capital infusion and focused development to capture a meaningful market position and achieve profitability.

Asymchem's strategic move into emerging markets like Brazil, India, and Spain signifies a pursuit of significant growth opportunities. These regions, with their expanding economies and increasing demand for advanced pharmaceutical manufacturing services, present a compelling case for expansion.

However, these new ventures are characteristic of 'Question Marks' in the BCG matrix. Asymchem will likely face low initial market share in these territories. For instance, the Indian pharmaceutical contract manufacturing market, while growing rapidly, is also highly competitive, with established domestic and international players. Asymchem's entry will necessitate substantial investment in building local infrastructure, establishing robust supply chains, and executing targeted marketing campaigns to build brand awareness and secure initial clients.

The Contract Development and Manufacturing Organization (CDMO) sector is increasingly leveraging artificial intelligence to enhance drug development, streamline manufacturing, and bolster supply chain robustness. Asymchem is actively investing in AI-powered platforms, such as its STAR system, and integrating AI across its operational processes, positioning these as significant growth drivers.

While Asymchem's commitment to AI is clear, its current market standing in the realm of fully AI-driven CDMO solutions is likely in its nascent stages. This places AI-driven platforms in a 'Question Mark' category within the BCG matrix, necessitating ongoing strategic investment to solidify a leading market position.

High Potency API (HPAPI) and OEB5 Capacity Expansion

Asymchem's strategic expansion into high potency API (HPAPI) manufacturing, including a new OEB5 facility slated for 2025, directly addresses the burgeoning demand within the toxin-linker segment. This move positions them to capitalize on a high-growth market, crucial for oncology drug development. The company's investment underscores its commitment to securing a dominant share in this specialized, technologically demanding niche.

The expansion signifies Asymchem's recognition of HPAPI as a potential star or question mark in its BCG portfolio. While the market is expanding rapidly, with the global HPAPI market projected to reach USD 30.4 billion by 2028, Asymchem's current market share within this specific sub-segment is likely still developing. This necessitates ongoing investment to solidify its competitive standing and capture a larger portion of this lucrative market.

- HPAPI Market Growth: The global HPAPI market is experiencing significant expansion, driven by advancements in targeted therapies and oncology.

- OEB5 Capacity: The addition of an OEB5 plant in 2025 is a direct response to the increasing need for specialized containment capabilities for highly potent compounds.

- Toxin-Linker Projects: Asymchem's focus on toxin-linker projects highlights its strategic alignment with key growth drivers in the biopharmaceutical industry.

- Investment for Market Share: Continued investment is critical for Asymchem to transition from a growing player to a market leader in the highly specialized HPAPI sector.

New Formulation Technologies (e.g., pre-filled syringes, pen syringes)

Asymchem's strategic move into pre-filled syringes and pen syringes, with construction commencing for a 2025 operational launch, signifies a proactive entry into the expanding market for advanced drug delivery systems. This expansion targets a segment projected for substantial growth, driven by patient convenience and therapeutic efficacy.

Currently, Asymchem's market share within these specialized formulation technologies is nascent. Significant capital investment and robust market penetration are crucial for these ventures to transition from question marks to stars in the BCG matrix.

- Market Entry: Asymchem is investing in new production facilities for pre-filled and pen syringes, slated for operation in 2025.

- Market Potential: The advanced drug delivery systems market, including these technologies, is experiencing robust growth, indicating a promising future.

- Current Position: Asymchem's market share in pre-filled and pen syringes is currently low, classifying these as question mark products.

- Strategic Need: Substantial investment and successful market adoption are required to elevate these offerings to star status.

Asymchem's ventures into synthetic biology, emerging markets, AI-driven CDMO solutions, high potency API manufacturing, and pre-filled/pen syringes all represent potential growth areas. However, in each of these segments, the company is likely in the early stages of market penetration. This means their current market share is probably low, and they face significant competition.

These initiatives are classic examples of Question Marks in the BCG matrix. They require substantial investment and focused strategic efforts to gain traction and build a strong market presence. Success hinges on effectively navigating these nascent markets and converting potential into market leadership.

The company's investments in these areas, such as the STAR system for protein design and new OEB5 facilities planned for 2025, highlight a clear strategy to capture future market share. The success of these "Question Marks" will depend on their ability to secure significant capital and execute well-defined market penetration strategies.

The global CDMO market was valued at approximately USD 163.5 billion in 2023 and is projected to grow significantly. Asymchem's investments are aimed at capturing a slice of this expanding market, particularly in specialized areas like HPAPIs where growth is even more pronounced.

| Strategic Area | BCG Classification | Key Investment/Initiative | Market Context (2024/2025) | Strategic Imperative |

|---|---|---|---|---|

| Synthetic Biology (STAR System) | Question Mark | AI-driven protein design | Nascent but high-growth potential | Capital investment for market share |

| Emerging Markets (Brazil, India, Spain) | Question Mark | Market entry and infrastructure development | Expanding economies, increasing demand | Targeted marketing and client acquisition |

| AI-Driven CDMO Solutions | Question Mark | Integration of AI platforms | Growing adoption across CDMO sector | Solidify leading market position |

| High Potency API (HPAPI) | Question Mark | New OEB5 facility (2025) | Global HPAPI market projected to reach USD 30.4 billion by 2028 | Transition to market leader |

| Pre-filled and Pen Syringes | Question Mark | New production facilities (2025 launch) | Expanding market for advanced drug delivery | Capital investment for market penetration |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth projections, to accurately position each business unit.