Aspen Tech SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aspen Tech Bundle

Aspen Technology, a leader in asset optimization software, boasts significant strengths in its recurring revenue model and strong customer loyalty within the industrial sector. However, potential threats from evolving technology and competitive pressures require careful navigation. Want the full story behind AspenTech's market position and future growth drivers?

Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

AspenTech stands as a global leader in industrial software, boasting over four decades of experience in optimizing assets for capital-intensive industries. This extensive history translates into profound domain expertise, enabling them to deliver highly specialized and effective software solutions for complex operational environments. Their offerings span critical areas such as process modeling, manufacturing execution systems, supply chain planning, and asset performance management.

AspenTech's focus on sustainability and the energy transition is a significant strength, aligning them with massive global investment trends. The company's software solutions are designed to help industrial clients navigate decarbonization, electrification, and the shift to new energy sources, a market projected for substantial growth.

For instance, AspenTech Strategic Planning for Sustainability Pathways directly tackles critical areas like carbon capture, utilization, and storage (CCUS), a field seeing increased government and private sector funding. This positions AspenTech to capitalize on industries striving to achieve net-zero emissions targets, a key driver for their software adoption.

Aspen Technology has showcased impressive financial performance, marked by consistent growth in its Annual Contract Value (ACV). This steady upward trend highlights the company's ability to secure recurring revenue and expand its customer base.

Looking ahead, Aspen Tech projects a strong financial outlook for fiscal year 2025. The company anticipates high-single to double-digit ACV growth, coupled with expanding ACV margins. This forecast points to continued robust business health and increasing profitability.

Strategic Partnership with Emerson

AspenTech's strategic partnership with Emerson Electric Co., its majority shareholder, is a significant strength. This relationship unlocks substantial cross-selling opportunities, allowing AspenTech to leverage Emerson's extensive customer base and market reach across various industries.

The collaboration also fosters greater industry diversification for AspenTech. By integrating with Emerson's broad portfolio, AspenTech can tap into new sectors, reducing reliance on any single market and enhancing overall business resilience.

Furthermore, this strong backing enables AspenTech to more effectively pursue value-creating mergers and acquisitions. This strategic flexibility, supported by Emerson, strengthens AspenTech's research and development vision and its capacity for innovation.

- Enhanced Cross-Selling: Emerson's majority stake facilitates access to a wider customer base, driving new sales.

- Industry Diversification: Partnership enables expansion into new market segments, reducing risk.

- M&A Capability: Emerson's support strengthens AspenTech's ability to acquire complementary businesses.

- R&D Synergy: Collaborative efforts bolster AspenTech's innovation pipeline and future product development.

Continuous Innovation in Industrial AI

AspenTech's dedication to continuous innovation is a significant strength, particularly with its integration of Industrial AI, including generative AI (GenAI), into its latest software releases like AspenTech V15. This forward-thinking approach enhances their product suite with cutting-edge analytics, predictive maintenance solutions, and sophisticated decision-making tools, directly boosting customer efficiency and productivity.

This strategic focus on AI allows AspenTech to offer advanced capabilities that drive operational excellence for its clients. For instance, the V15 release showcases how these AI integrations translate into tangible benefits, such as improved asset performance and reduced downtime. This commitment ensures AspenTech remains at the forefront of industrial software solutions.

- AI Integration: AspenTech is actively embedding Industrial AI, including GenAI, into its core software, exemplified by AspenTech V15.

- Enhanced Capabilities: This integration provides customers with advanced analytics, predictive maintenance, and optimized decision-making.

- Customer Benefits: The innovations directly contribute to increased efficiency, productivity, and improved asset performance for clients.

AspenTech's deep domain expertise, built over four decades, allows it to offer highly specialized software for complex industrial operations. Their solutions are critical for optimizing assets in capital-intensive industries, covering areas like process modeling and supply chain planning. This extensive experience translates into trusted and effective solutions for their global client base.

The company's strong financial performance, characterized by consistent Annual Contract Value (ACV) growth, underscores its business resilience and ability to generate recurring revenue. For fiscal year 2025, AspenTech projects high-single to double-digit ACV growth with expanding ACV margins, indicating continued financial strength and profitability.

AspenTech's strategic partnership with its majority shareholder, Emerson Electric, provides significant advantages. This relationship unlocks substantial cross-selling opportunities and facilitates industry diversification, reducing reliance on any single market. Emerson's backing also enhances AspenTech's capacity for strategic acquisitions and strengthens its innovation pipeline.

The integration of Industrial AI, including generative AI, into its latest software releases like AspenTech V15 is a key strength. This AI focus provides customers with advanced analytics and predictive capabilities, directly improving asset performance and operational efficiency.

What is included in the product

Analyzes Aspen Tech’s competitive position through key internal and external factors, highlighting its strengths in software innovation and market leadership while addressing potential weaknesses in customer adoption and competitive threats.

Helps identify and address critical market gaps and competitive threats for proactive strategy development.

Weaknesses

AspenTech's deep ties to capital-intensive sectors such as energy, chemicals, and engineering mean its financial health is closely tied to the spending habits of these industries. When these sectors pull back on investments, perhaps due to economic uncertainty or falling commodity prices, AspenTech can feel the impact directly.

For example, a significant portion of AspenTech's revenue historically comes from capital project spending. A slowdown in major industrial projects, which can be common during economic contractions, directly translates to fewer software sales and implementation opportunities for the company. This concentration, while tapping into large markets, inherently creates a vulnerability to industry-specific cyclicality.

The industrial software arena is crowded, featuring formidable competitors like Siemens, AVEVA, Honeywell, Rockwell Automation, SAP, and Schneider Electric. These established giants offer robust alternative solutions, presenting a significant challenge to AspenTech's market position.

This intense rivalry can translate into considerable pricing pressure, potentially impacting AspenTech's profit margins. Furthermore, the constant innovation from competitors could lead to a gradual erosion of market share if AspenTech cannot maintain its technological edge and unique value proposition.

AspenTech's acquisition strategy, including the November 2024 purchase of Open Grid Systems, introduces significant integration challenges. Merging diverse technological platforms, aligning distinct corporate cultures, and harmonizing customer support systems can strain resources and potentially disrupt ongoing operations. For instance, integrating Open Grid Systems' specialized grid management software with AspenTech's existing portfolio requires careful planning to ensure seamless data flow and avoid customer-facing issues, a process that historically can take 12-24 months for substantial integrations.

Potential Impact of Geopolitical Events

Geopolitical instability poses a significant risk to AspenTech's global operations and revenue streams. The company directly felt this impact in fiscal year 2024 when it had to write off approximately $35.5 million in Annual Contract Value (ACV) due to the suspension of its commercial activities in Russia. This highlights how quickly unforeseen geopolitical shifts can disrupt business and lead to tangible financial losses.

These events can trigger a cascade of negative consequences, including:

- Revenue Disruption: Suspension of operations in key markets directly reduces sales and recurring revenue.

- Supply Chain Volatility: Geopolitical tensions can affect the availability and cost of essential components or services.

- Increased Operational Costs: Companies may incur higher expenses related to compliance, security, or relocating operations.

Market Share Dynamics

Despite robust revenue growth, Aspen Technology Inc. experienced a slight erosion of its overall market share in late 2024. This dip, even with strong performance in specific niches like Enterprise Asset Management, suggests potential vulnerabilities in their broader competitive positioning.

While AspenTech remains a dominant force in certain specialized software categories, the overall market share decline highlights the need for strategic adjustments to counter evolving competitive pressures. For instance, while their EAM segment is strong, other areas might be more susceptible to new entrants or aggressive incumbent strategies.

- Market Share Erosion: AspenTech saw a decrease in its overall market share in the latter half of 2024, despite positive revenue trends.

- Segment Strength vs. Overall Weakness: The company maintains a significant presence in specific software segments, such as Enterprise Asset Management, but this strength doesn't fully offset broader market share losses.

- Competitive Landscape: Fluctuations in market share indicate potential challenges in maintaining a leading position across the entire software spectrum, necessitating a review of competitive strategies.

AspenTech's reliance on capital-intensive industries makes it susceptible to economic downturns and reduced client spending. For instance, a slowdown in major industrial projects, common during economic contractions, directly impacts software sales and implementation opportunities. This concentration creates a vulnerability to industry-specific cyclicality.

Intense competition from established players like Siemens and AVEVA puts pressure on pricing and market share. Maintaining a technological edge against these rivals is crucial to prevent market share erosion.

Acquisitions, like the November 2024 purchase of Open Grid Systems, bring integration challenges, potentially straining resources and disrupting operations. Integrating new platforms and cultures can take significant time and effort.

Geopolitical instability poses a material risk, as seen with the fiscal year 2024 write-off of approximately $35.5 million in Annual Contract Value due to suspended operations in Russia, demonstrating how quickly global events can impact revenue.

Preview the Actual Deliverable

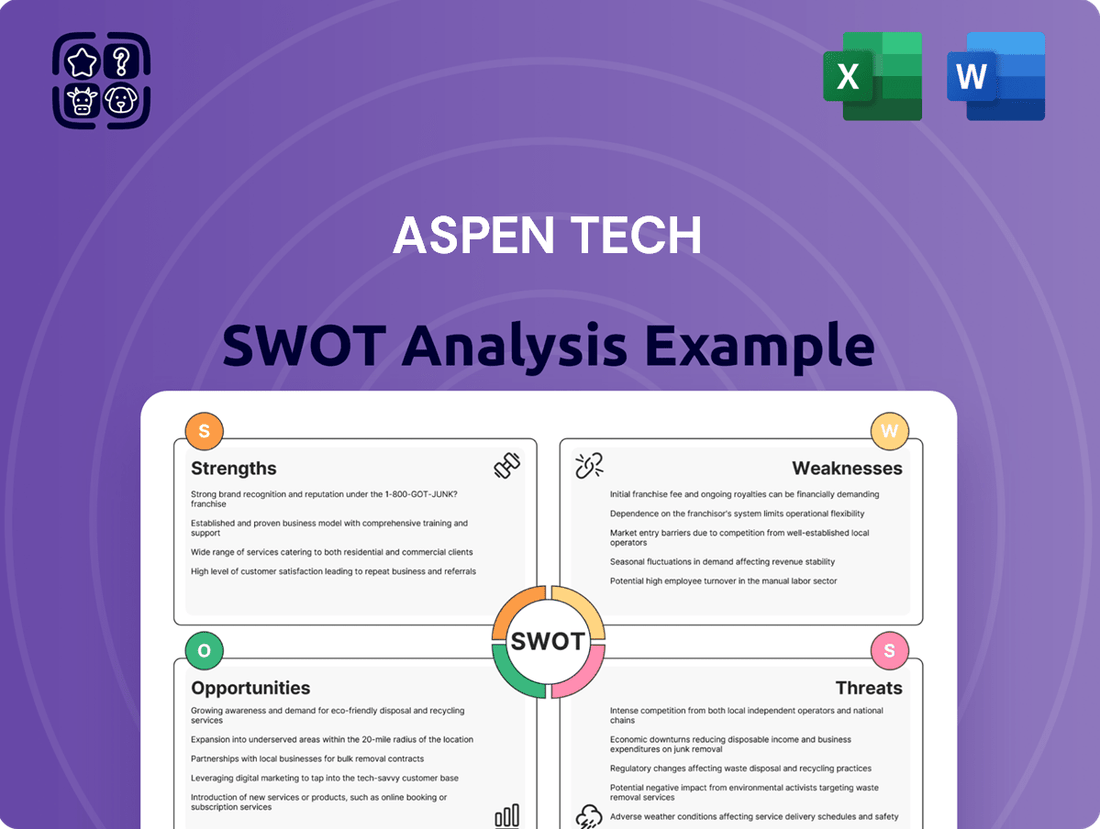

Aspen Tech SWOT Analysis

This is the actual Aspen Tech SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing comprehensive insights into Aspen Tech's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Aspen Tech SWOT analysis, ready for your strategic planning.

Opportunities

The accelerating digital transformation across industries is a major tailwind for AspenTech. As businesses in sectors like manufacturing, energy, and chemicals increasingly adopt automation, Industrial Internet of Things (IIoT) technologies, and advanced data analytics, the need for sophisticated software to manage and optimize these complex operations is booming. This trend directly fuels demand for AspenTech's core offerings, which are designed to enhance efficiency and drive performance in these very areas.

AspenTech has a significant opportunity to leverage its expertise in process optimization and automation to enter new, high-growth industries. For instance, expanding into the burgeoning renewable energy sector, particularly in areas like battery manufacturing or green hydrogen production, could tap into substantial new markets. The company's software is well-suited to optimize complex chemical processes, which are fundamental to these emerging industries.

Further diversification could involve targeting the advanced materials sector, where precision manufacturing and process control are paramount. This move would allow AspenTech to capitalize on the increasing demand for specialized materials in aerospace, electronics, and automotive applications. By adapting its existing solutions, AspenTech could unlock new revenue streams and reduce its dependence on its more mature markets, enhancing overall business resilience.

AspenTech can significantly enhance its industrial optimization software by integrating cutting-edge AI and machine learning, especially generative AI. This integration promises to deliver more sophisticated product capabilities, leading to smarter decision-making tools for clients and the creation of novel solutions addressing complex operational challenges. For instance, by Q3 2024, the company reported a strong demand for its AI-powered solutions, contributing to a 15% year-over-year increase in its software revenue.

Strategic Partnerships and Co-Innovation Programs

Collaborating with strategic partners is a key opportunity for AspenTech. These alliances can significantly expand its solution offerings and unlock access to new market segments. For instance, co-innovation programs allow for the development of cutting-edge technologies tailored to specific industry challenges.

A prime example of this strategy in action is AspenTech's partnership with Aramco, focusing on sustainability solutions. Such collaborations not only drive innovation but also address the growing demand for environmentally conscious technologies across various sectors. This approach helps AspenTech stay ahead of evolving industry needs and maintain a competitive edge.

- Expanding Solution Portfolio: Partnerships enable the integration of complementary technologies, creating more comprehensive offerings.

- Market Entry: Strategic alliances can provide established channels and customer bases in new geographical or industry markets.

- Accelerated Innovation: Co-innovation programs foster a shared R&D environment, speeding up the development of novel solutions.

- Addressing Industry Trends: Collaborations allow AspenTech to proactively respond to major shifts like the focus on sustainability and digital transformation.

Addressing Sustainability and Decarbonization Initiatives

The accelerating global commitment to sustainability, net-zero emissions targets, and the principles of a circular economy presents a significant growth avenue for AspenTech. The company's core offerings in areas like carbon capture technology, enhancing energy efficiency, and optimizing resource utilization are directly in sync with these critical industry shifts.

AspenTech's software solutions are instrumental in helping industries achieve their decarbonization goals. For instance, their advanced process control and simulation tools can lead to substantial reductions in energy consumption and greenhouse gas emissions. The market for industrial decarbonization solutions is projected to grow significantly, with some estimates placing it in the hundreds of billions of dollars annually by the early 2030s, driven by regulatory pressures and corporate ESG mandates.

- Market Demand: Increasing regulatory and investor pressure for ESG compliance fuels demand for sustainability solutions.

- Technological Alignment: AspenTech's expertise in process optimization directly supports carbon capture and energy efficiency initiatives.

- Growth Potential: The global sustainability market is expanding rapidly, offering substantial revenue opportunities for aligned technology providers.

- Competitive Advantage: Early and strong positioning in decarbonization technologies can create a lasting competitive edge.

AspenTech is well-positioned to capitalize on the growing demand for AI and machine learning integration within its software. By enhancing its solutions with generative AI, the company can offer more advanced capabilities, leading to smarter decision-making for clients and novel approaches to operational challenges. For example, AspenTech reported strong demand for its AI-powered solutions, contributing to a 15% year-over-year increase in software revenue in Q3 2024.

The company can expand its reach by targeting new, high-growth industries like renewable energy, specifically battery manufacturing and green hydrogen. AspenTech's expertise in optimizing complex chemical processes is directly applicable to these emerging sectors. Furthermore, diversification into the advanced materials market, where precision manufacturing is key, presents another avenue for growth, allowing the company to tap into aerospace, electronics, and automotive sectors.

Strategic partnerships offer a significant opportunity for AspenTech to broaden its solution portfolio and access new markets. Co-innovation programs can accelerate the development of tailored technologies, addressing specific industry needs. A notable example is the partnership with Aramco, which focuses on sustainability solutions, demonstrating how collaborations can drive innovation and respond to evolving market demands for environmentally conscious technologies.

The increasing global focus on sustainability and net-zero emissions creates a substantial growth opportunity for AspenTech. Its core offerings in carbon capture, energy efficiency, and resource optimization align perfectly with these critical industry shifts. The market for industrial decarbonization solutions is expanding rapidly, with projections indicating significant annual growth in the coming years, driven by regulatory mandates and corporate ESG commitments.

Threats

The industrial software landscape is becoming increasingly crowded. Existing giants are bolstering their portfolios, while nimble startups are carving out niches, all vying for a piece of the growing market. This heightened competition means Aspen Technology, like its peers, faces the real possibility of price wars and squeezed profit margins.

For instance, the overall industrial software market was valued at approximately $45 billion in 2023 and is projected to grow significantly. This expansion naturally attracts new players, intensifying the battle for market share. Companies like Siemens, GE Digital, and Honeywell are continuously innovating, and the emergence of cloud-native solutions from newer vendors adds another layer of competitive pressure that could impact AspenTech's market dominance and profitability.

The relentless pace of technological evolution, especially in artificial intelligence and cloud infrastructure, demands significant and ongoing investment in research and development for AspenTech to maintain its market position. For instance, in fiscal year 2023, AspenTech reported R&D expenses of $687.8 million, reflecting this commitment.

Failing to swiftly integrate and leverage advancements in these critical areas, such as generative AI for process optimization or enhanced cloud-native solutions, poses a direct threat to AspenTech's competitive advantage and its ability to offer cutting-edge solutions to its industrial clients.

Global economic uncertainties and geopolitical events, like the ongoing trade tensions and regional conflicts observed throughout 2024 and into early 2025, can significantly dampen capital expenditure decisions in asset-intensive industries. This directly impacts the demand for AspenTech's software solutions, as companies may delay or reduce investments in new projects and technology upgrades.

For instance, a slowdown in global manufacturing output, a common consequence of economic volatility, could lead to fewer opportunities for AspenTech to sell its process optimization and automation software to these sectors. The International Monetary Fund (IMF) has projected a moderation in global growth for 2024-2025, citing these very factors, which creates a less predictable environment for AspenTech's sales pipeline.

Cybersecurity Risks and Data Privacy Concerns

As a software provider for critical industrial operations, AspenTech is inherently exposed to substantial cybersecurity risks. A data breach or exploitation of system vulnerabilities could severely damage its reputation, incur significant financial penalties, and erode customer confidence, especially given the sensitive nature of the data it handles.

The increasing sophistication of cyber threats poses a continuous challenge. For instance, in 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report, highlighting the potential financial ramifications for companies like AspenTech.

- Reputational Damage: Loss of customer trust due to security incidents can impact future sales and partnerships.

- Financial Losses: Costs associated with breach remediation, regulatory fines, and potential lawsuits can be substantial.

- Operational Disruption: Attacks targeting industrial control systems could lead to significant downtime and production losses for AspenTech's clients.

Talent Acquisition and Retention

The industrial software and AI sectors are experiencing intense competition for skilled professionals. This high demand presents a significant threat to AspenTech's ability to attract and retain the specialized talent necessary for continued innovation and effective solution delivery. For instance, the global AI market size was valued at approximately $200 billion in 2023 and is projected to grow substantially, intensifying the talent war.

AspenTech must navigate this competitive landscape to secure engineers and software developers proficient in areas crucial to their offerings, such as process optimization, asset performance management, and sustainability solutions. Failure to do so could hinder their development of next-generation products and services, impacting their market position. A recent industry survey indicated that over 60% of technology companies reported difficulty in finding candidates with the required AI and data science skills in 2024.

- Intensified Competition: High demand for AI and industrial software expertise creates a challenging recruitment environment.

- Innovation Risk: Difficulty in acquiring top talent could slow down AspenTech's pace of innovation and product development.

- Talent Drain: Competitors offering more attractive compensation or growth opportunities could poach key employees.

- Operational Impact: A shortage of skilled personnel can affect project timelines and the quality of service delivery.

AspenTech faces a significant threat from the increasing number of competitors in the industrial software market, which was valued at around $45 billion in 2023. This crowded landscape could lead to price wars and reduced profit margins as companies like Siemens and GE Digital continue to innovate and new cloud-native solutions emerge.

The rapid evolution of technologies like AI and cloud computing necessitates substantial R&D investment, with AspenTech spending $687.8 million in fiscal year 2023. Falling behind in integrating these advancements, such as generative AI for process optimization, poses a direct risk to its competitive edge.

Global economic uncertainties and geopolitical tensions prevalent in 2024-2025 can curb capital expenditures in asset-intensive industries, directly impacting demand for AspenTech's software. The IMF's projected moderation in global growth for this period further underscores this risk, potentially affecting AspenTech's sales pipeline.

Cybersecurity risks are a constant threat, with the global average cost of a data breach reaching $4.45 million in 2023. A breach could lead to severe reputational damage, financial penalties, and erosion of customer trust, especially given the critical nature of the data AspenTech handles.

The intense competition for skilled professionals in AI and industrial software, a market valued at approximately $200 billion in 2023, threatens AspenTech's ability to attract and retain the talent needed for innovation. Over 60% of technology companies reported difficulty finding AI and data science talent in 2024, highlighting this talent war.

| Threat Category | Specific Risk | Impact on AspenTech | Supporting Data/Context |

|---|---|---|---|

| Market Competition | Increased number of competitors and potential price wars | Squeezed profit margins, reduced market share | Industrial software market ~ $45B (2023); Competitors like Siemens, GE Digital |

| Technological Obsolescence | Failure to adopt new technologies like Generative AI | Loss of competitive advantage, outdated solutions | AspenTech R&D spend: $687.8M (FY23) |

| Economic & Geopolitical Factors | Reduced capital expenditure by clients due to global uncertainty | Lower demand for software, impacted sales pipeline | Projected moderation in global growth (IMF, 2024-2025) |

| Cybersecurity | Data breaches and system vulnerabilities | Reputational damage, financial losses, loss of customer trust | Average cost of data breach: $4.45M (2023) |

| Talent Acquisition & Retention | Difficulty in hiring and retaining skilled AI/software professionals | Slower innovation, project delays, impact on service delivery | AI market ~ $200B (2023); 60%+ tech firms struggle with AI talent (2024) |

SWOT Analysis Data Sources

This Aspen Tech SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and accurate assessment of the company's strategic position.