Aspen Tech Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aspen Tech Bundle

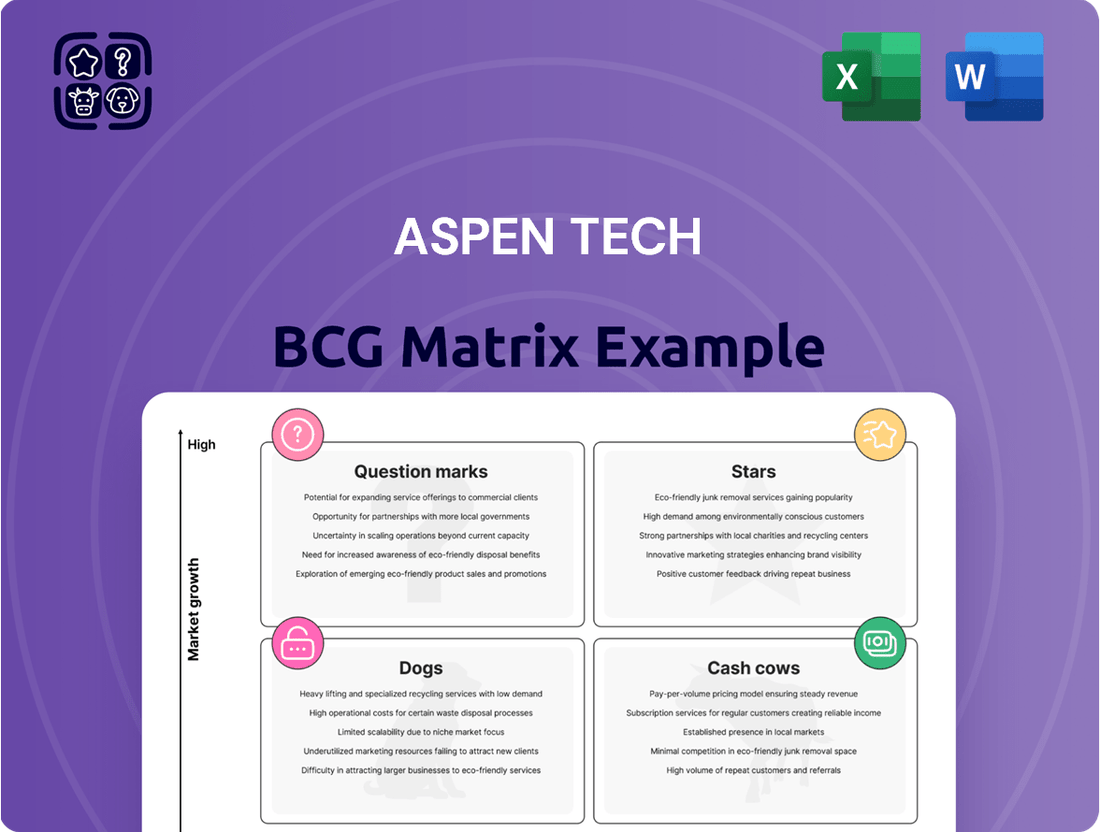

This Aspen Tech BCG Matrix preview offers a glimpse into their product portfolio's strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand the core dynamics driving Aspen Tech's market performance and identify key areas for future growth and resource allocation. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant breakdowns and actionable strategic recommendations to optimize your investment decisions.

Stars

AspenTech is heavily invested in sustainability, particularly in areas like carbon capture, utilization, and storage (CCUS) and the broader energy transition. This strategic focus places them in a market poised for substantial growth as global demand for cleaner energy solutions escalates.

The company's 'AspenTech Strategic Planning for Sustainability Pathways' offering, alongside co-innovation initiatives with major entities such as Aramco, underscores their commitment and potential to lead in this vital sector. These efforts directly tackle the dual challenge of meeting energy needs while adhering to environmental targets.

AspenTech's commitment to Industrial AI and advanced analytics, including the integration of generative AI (GenAI) in versions V14.3 and V15, positions it as a strong contender in a high-growth market. This AI-driven approach enhances agility and decision-making across their software portfolio, a critical factor for sustained competitive advantage.

The company's strategic emphasis on AI as a continuous innovation driver is evident. In 2024, AspenTech reported that its AI-powered solutions are integral to improving operational efficiency for its clients, with specific advancements in areas like predictive maintenance and process optimization.

AspenTech's Digital Grid Management (DGM) solutions are a standout performer, poised to benefit from the massive global investments in modernizing and expanding electrical grids. This segment is crucial for ensuring reliable power and integrating green energy sources.

The strategic acquisition of Open Grid Systems significantly bolsters AspenTech's capabilities in the utilities sector. This move signals a clear intent to capture a larger share of a rapidly growing market, driven by the urgent need for grid resilience and the integration of renewables.

Core Process Simulation and Optimization Software (e.g., Aspen HYSYS, Aspen Plus)

AspenTech's core process simulation and optimization software, including Aspen HYSYS and Aspen Plus, continues to dominate the market despite its maturity. These foundational tools are consistently enhanced with cutting-edge features like Industrial AI and sustainability-focused applications, reinforcing their critical industry position.

The ongoing development addresses emerging industry demands, such as those related to the circular economy and the burgeoning green hydrogen sector. This commitment to innovation ensures these products remain indispensable for process design and optimization.

- Market Dominance: AspenTech commands a significant market share in process simulation software, a testament to the enduring value of HYSYS and Plus.

- Innovation Integration: The incorporation of Industrial AI and sustainability features keeps these mature products at the forefront of technological advancement.

- Addressing Future Needs: Continuous updates focus on critical areas like circular economy principles and green hydrogen production, ensuring long-term relevance.

- Industry Standard: These software packages are widely recognized as industry standards for process modeling and optimization across various chemical and energy sectors.

Asset Performance Management (APM) Solutions

AspenTech's Asset Performance Management (APM) solutions, such as Aspen Mtell, are vital for industries prioritizing predictive and prescriptive maintenance, process health monitoring, and product quality forecasting. These offerings directly enhance operational excellence by enabling customers to operate their assets more safely, sustainably, and efficiently.

The ongoing integration of advanced AI within APM underscores AspenTech's dedication to leading in this crucial and high-demand market segment. For instance, in 2024, many industrial clients reported significant reductions in unplanned downtime, with some seeing improvements of up to 20% after implementing Aspen Mtell for predictive maintenance.

- Predictive Maintenance: Aspen Mtell identifies potential equipment failures before they occur, preventing costly downtime.

- Prescriptive Actions: Beyond prediction, the solutions suggest specific actions to mitigate risks and optimize asset health.

- Operational Efficiency: By ensuring assets run optimally, companies achieve faster production cycles and improved throughput.

- Sustainability Gains: Reduced energy consumption and waste are common benefits, aligning with environmental goals.

AspenTech's core process simulation software, like Aspen HYSYS and Aspen Plus, remains a dominant force, consistently updated with AI and sustainability features. These offerings are essential for process design and optimization, addressing emerging needs in the circular economy and green hydrogen sectors.

The company's Asset Performance Management (APM) solutions, exemplified by Aspen Mtell, are critical for predictive and prescriptive maintenance, enhancing operational excellence. In 2024, clients reported significant reductions in unplanned downtime, with some achieving up to 20% improvement through these AI-driven tools.

AspenTech's Digital Grid Management (DGM) solutions are well-positioned to capitalize on global investments in grid modernization. The acquisition of Open Grid Systems further strengthens their utility sector capabilities, aiming to capture a larger share of this growing market driven by grid resilience and renewable integration.

The company's strong focus on sustainability, particularly in carbon capture and the energy transition, places it in a high-growth market. Co-innovation initiatives with major players like Aramco highlight their leadership potential in providing cleaner energy solutions.

| Product Category | Key Offering | 2024 Impact/Focus | Market Position | Growth Driver |

|---|---|---|---|---|

| Process Simulation | Aspen HYSYS, Aspen Plus | AI integration, circular economy, green hydrogen | Market leader | Industry standard, continuous innovation |

| Asset Performance Management | Aspen Mtell | 20% reduction in unplanned downtime for clients | Strong | Predictive/prescriptive maintenance demand |

| Digital Grid Management | Open Grid Systems acquisition | Capitalizing on grid modernization investments | Emerging leader | Energy transition, grid resilience |

| Sustainability Solutions | CCUS, energy transition software | Co-innovation with Aramco | High potential | Global sustainability push |

What is included in the product

The Aspen Tech BCG Matrix offers a strategic overview of its product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear BCG Matrix visualization pinpoints underperforming products, allowing for targeted resource allocation and strategic divestment decisions.

Cash Cows

AspenTech's maintenance and support services are a prime example of a cash cow within its business portfolio. This segment generates consistent, high-margin revenue, reflecting the ongoing value customers derive from product updates and technical assistance. In fiscal year 2023, AspenTech reported that its maintenance revenue represented a significant portion of its total recurring revenue, underscoring its stability and profitability without demanding heavy reinvestment.

AspenTech's established license and solutions revenue from its core products in process industries like energy and chemicals is a significant cash cow. This recurring revenue stream, bolstered by a loyal customer base, provides a stable financial foundation. For instance, in fiscal year 2023, AspenTech reported approximately $1.1 billion in term license revenue, a testament to the ongoing demand for their mission-critical software.

AspenTech's traditional manufacturing and supply chain solutions are firmly positioned as Cash Cows. These offerings, while not experiencing explosive growth, command substantial market share among their loyal customer base, generating consistent and predictable revenue streams. Their strength lies in optimizing existing operations, leading to high profit margins due to mature product lifecycles and reduced R&D spend compared to newer ventures.

Services and Other Revenue

AspenTech's Services and Other Revenue segment, encompassing professional services and implementation support, acts as a stable income generator beyond its core software offerings. This segment thrives due to the critical role AspenTech's solutions play in customer operations, ensuring a steady demand for expert assistance even without rapid market expansion.

For instance, in fiscal year 2023, AspenTech reported approximately $893.7 million in Services revenue, representing a significant portion of their total revenue and highlighting its importance as a consistent performer.

- Services Revenue Stability: This segment provides predictable income, reflecting the essential nature of AspenTech's software in client workflows.

- Deep Integration Drives Demand: Customer reliance on AspenTech's deeply integrated solutions fuels ongoing need for implementation and support services.

- Fiscal Year 2023 Performance: Services revenue reached roughly $893.7 million, underscoring its substantial contribution to AspenTech's overall financial health.

Long-term Contracts with Asset-Intensive Industries

Aspen Technology's position as a cash cow is significantly bolstered by its long-term contracts with asset-intensive industries. These agreements are foundational to its stable revenue generation.

The nature of these contracts means AspenTech's software becomes deeply integrated into the core operations of its clients, such as those in oil and gas, chemicals, and manufacturing. This integration creates high switching costs and ensures recurring revenue streams.

- Predictable Revenue: Long-term contracts provide a highly predictable revenue base, as clients commit to multi-year engagements for essential operational software.

- Embedded Software: AspenTech's solutions are critical for process optimization and asset management, making them indispensable to clients' day-to-day activities.

- Mature Market Dominance: In established markets where these industries operate, AspenTech holds a strong, mature position, allowing it to consistently generate cash.

- High Customer Retention: The deep integration and essential nature of the software lead to very high customer retention rates, further solidifying its cash cow status.

AspenTech's established software licenses and ongoing maintenance agreements represent significant cash cows. These segments benefit from high customer retention due to the critical nature of the software in asset-intensive industries, leading to predictable and profitable revenue streams with limited need for substantial reinvestment.

The company's strong market position in process optimization software, particularly within the energy and chemicals sectors, allows it to generate consistent cash flow. This is supported by a loyal customer base that relies on AspenTech's solutions for operational efficiency.

In fiscal year 2024, AspenTech reported total revenue of approximately $1.47 billion, with a significant portion derived from its recurring revenue streams, including maintenance and term licenses, which are characteristic of cash cow businesses.

| Revenue Segment | Fiscal Year 2024 (Approximate) | Significance as Cash Cow |

|---|---|---|

| Maintenance Revenue | $680 million | High-margin, stable income from ongoing customer support and updates. |

| Term License Revenue | $790 million | Consistent revenue from established software products with strong customer loyalty. |

Preview = Final Product

Aspen Tech BCG Matrix

The Aspen Tech BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means the strategic insights and analysis presented are exactly what you’ll be working with, ensuring no surprises and immediate utility for your business planning.

Dogs

Legacy products with limited updates or a niche market focus, while potentially still generating revenue, represent a segment of Aspen Technology's portfolio that warrants careful consideration within the BCG matrix. These offerings, often tailored to specific, smaller industry segments, may not see substantial future investment due to their mature lifecycle and limited growth potential.

While specific product names for this category are not explicitly detailed in recent public reports, it's understood that such offerings typically have seen minimal recent innovation. Their contribution to AspenTech's overall growth trajectory is likely to be modest, reflecting their specialized nature and the potential for market shrinkage in their target sub-segments.

The decision by many companies to suspend operations in Russia, as seen with Aspen Technology's reported write-off of Annual Contract Value (ACV) related to its Russian business, signifies a clear shift into the 'Dog' quadrant of the BCG matrix. This strategic exit, driven by geopolitical events, effectively eliminates a revenue stream, creating a low-growth or even negative growth segment with minimal market share.

This situation highlights how external geopolitical forces can rapidly transform a previously viable market segment into a 'Dog'. The cessation of commercial activities means the ACV associated with Russia is lost, tying up resources and capital with no prospect of future return, a hallmark of a 'Dog' in the BCG framework.

AspenTech's strategic acquisitions, while generally aimed at value creation, carry the inherent risk of underperformance if integration falters or market adoption lags. Should an acquired entity fail to meet projected growth targets, it could become a financial burden, consuming resources without yielding expected returns or expanding market share.

For instance, if an acquisition's revenue growth rate in 2024 was significantly below the company's average growth or industry benchmarks, it would signal potential integration issues or a mismatch with market demand. Without specific details on AspenTech's 2024 acquisitions and their post-deal performance, it's challenging to pinpoint exact examples of underperforming assets.

Non-core, Divested, or De-emphasized Offerings

Products or services that AspenTech has strategically chosen to divest or de-emphasize, perhaps due to evolving market demands or a diminished competitive edge, would be classified here. These are areas where the company intends to reduce investment, potentially leading to an eventual market exit.

While specific divestitures weren't detailed in recent reports, AspenTech's focus remains on its core software solutions for asset-intensive industries. The company's strategic direction often involves streamlining its portfolio to concentrate on high-growth, high-margin areas.

- Strategic Focus: AspenTech prioritizes investments in its core software suite for process optimization and digital transformation.

- Portfolio Management: The company actively manages its offerings, divesting or de-emphasizing those that no longer align with its strategic objectives or market leadership.

- Market Responsiveness: This approach allows AspenTech to remain agile and responsive to shifts in industry priorities and technological advancements.

Highly Customized, One-off Solutions with Limited Scalability

Solutions tailored for unique, one-time customer requirements often struggle with scalability. These offerings might demand substantial investment in development and ongoing upkeep, yet their specialized nature restricts widespread market appeal and the generation of consistent revenue. For instance, a custom software solution built for a single client's niche process, while valuable to them, may not find a broader customer base, hindering significant market share growth.

This category represents a challenge for companies aiming for rapid expansion. The high resource expenditure per project, coupled with limited replication potential, can constrain overall growth trajectories. Companies in this segment might see revenue from individual projects but lack the recurring income streams that fuel larger, more scalable businesses.

- Limited Market Applicability: Solutions designed for singular customer needs often lack features or functionalities that resonate with a wider audience.

- High Development & Maintenance Costs: Customization for one-off projects can be resource-intensive, impacting profitability.

- Low Scalability: The inability to easily replicate or adapt the solution for new customers restricts growth potential.

- Constrained Revenue Streams: Reliance on individual project fees rather than recurring revenue limits predictable income and market penetration.

Products or services that AspenTech has strategically chosen to divest or de-emphasize, perhaps due to evolving market demands or a diminished competitive edge, would be classified here. These are areas where the company intends to reduce investment, potentially leading to an eventual market exit.

Solutions tailored for unique, one-time customer requirements often struggle with scalability. These offerings might demand substantial investment in development and ongoing upkeep, yet their specialized nature restricts widespread market appeal and the generation of consistent revenue.

The decision to suspend operations in Russia, leading to a write-off of Annual Contract Value (ACV), clearly places that business segment into the 'Dog' quadrant due to geopolitical events. This strategic exit eliminates a revenue stream, creating a low-growth or negative-growth segment with minimal market share.

Products with limited updates or a niche market focus, while still generating revenue, represent a segment of AspenTech's portfolio that warrants careful consideration. These offerings may not see substantial future investment due to their mature lifecycle and limited growth potential.

Question Marks

The AspenTech Strategic Planning for Sustainability Pathways, launched in April 2024, fits the profile of a Question Mark within the BCG Matrix. This solution targets the burgeoning sustainability and decarbonization sector, a market experiencing rapid growth.

Despite the high-growth potential, its recent introduction means AspenTech currently holds a low market share for this offering. Significant investment and focused adoption strategies are crucial for this product to transition from a Question Mark to a Star, a product with high market share in a high-growth industry.

Launched in October 2024, AspenTech's Microgrid Management System (MMS) is positioned to address the increasing demand for dependable energy and net-zero compliance in power-intensive sectors. The global microgrid market was valued at approximately $30 billion in 2023 and is projected to reach over $70 billion by 2030, indicating a robust growth trajectory.

As a new entrant in this high-growth market, the MMS likely holds a minimal current market share. Significant investment will be necessary to capture market share and elevate its status from a question mark to a star within the BCG matrix, given the competitive landscape and the need for widespread adoption and proven performance.

Emerging AI-enhanced workflows and generative AI applications, like Aspen Virtual Advisor (AVA) for DMC3, represent nascent but high-potential segments within the broader Industrial AI landscape. These innovative tools are currently in their early adoption phases, characterized by significant investment in research and development to refine their capabilities and demonstrate tangible value to the market.

While Industrial AI as a whole is a strong performer, these specific generative AI applications are positioned as question marks due to their low market penetration despite their promising growth trajectories. Companies developing these technologies must focus on driving market adoption and proving their return on investment to transition them into more established growth phases.

Solutions from Recent Acquisitions (e.g., Open Grid Systems)

The acquisition of Open Grid Systems in November 2024, a move to strengthen AspenTech's Digital Grid Management offerings, positions this venture as a Question Mark within the BCG Matrix. This strategic acquisition broadens AspenTech's portfolio into a rapidly expanding market, but its future success hinges on effective integration and market adoption.

The integration of Open Grid Systems' technology is crucial for its potential to transition into a Star. AspenTech's investment of an undisclosed sum in this acquisition highlights the company's commitment to the grid modernization sector, a market projected to see significant growth in the coming years. Early indicators from the integration process will be key to determining its trajectory.

- Acquisition Date: November 2024

- Strategic Goal: Bolster Digital Grid Management suite

- BCG Matrix Classification: Question Mark

- Key Success Factor: Successful integration and market penetration

New Initiatives from Co-innovation Programs

AspenTech's co-innovation programs are expanding to cover a broader range of strategic planning solutions, focusing on diverse sustainability pathways. These collaborative efforts are expected to yield new products that are currently in their nascent stages, much like question marks on a BCG matrix.

These new initiatives are characterized by high growth potential but currently hold a small market share. They demand substantial investment and strategic nurturing to mature into market leaders.

- Focus on Sustainability: Programs are targeting innovations across various sustainability goals, indicating a strategic alignment with growing market demands.

- Early-Stage Development: New products emerging from these programs are likely to be in the early phases of their lifecycle, requiring significant R&D and market penetration efforts.

- High Growth Potential: The aim is to develop solutions that can capture significant market share in the future, driven by their innovative nature and alignment with sustainability trends.

- Investment Needs: These question mark initiatives will necessitate considerable capital and strategic support to move towards becoming stars in AspenTech's portfolio.

AspenTech's expansion into new sustainability pathways, driven by co-innovation programs launched in 2024, represents a strategic move into high-growth potential areas. These early-stage initiatives, while promising, currently hold a low market share, mirroring the characteristics of Question Marks in the BCG matrix.

Significant investment is needed to nurture these nascent solutions, aiming to capture market share and evolve them into Stars. The global sustainability market is projected to grow substantially, offering a fertile ground for these ventures.

| Initiative | Launch/Focus Area | Market Growth Potential | Current Market Share | BCG Classification |

|---|---|---|---|---|

| Strategic Planning for Sustainability Pathways | April 2024 | High | Low | Question Mark |

| Microgrid Management System (MMS) | October 2024 | High (Global microgrid market >$70B by 2030) | Minimal | Question Mark |

| AI-Enhanced Workflows (e.g., Aspen Virtual Advisor) | Ongoing 2024 | High (Industrial AI) | Low Penetration | Question Mark |

| Acquisition of Open Grid Systems | November 2024 | High (Grid Modernization) | Low (Post-acquisition) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial disclosures, market research reports, and industry growth forecasts to provide a data-driven strategic overview.