Aspen Tech Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aspen Tech Bundle

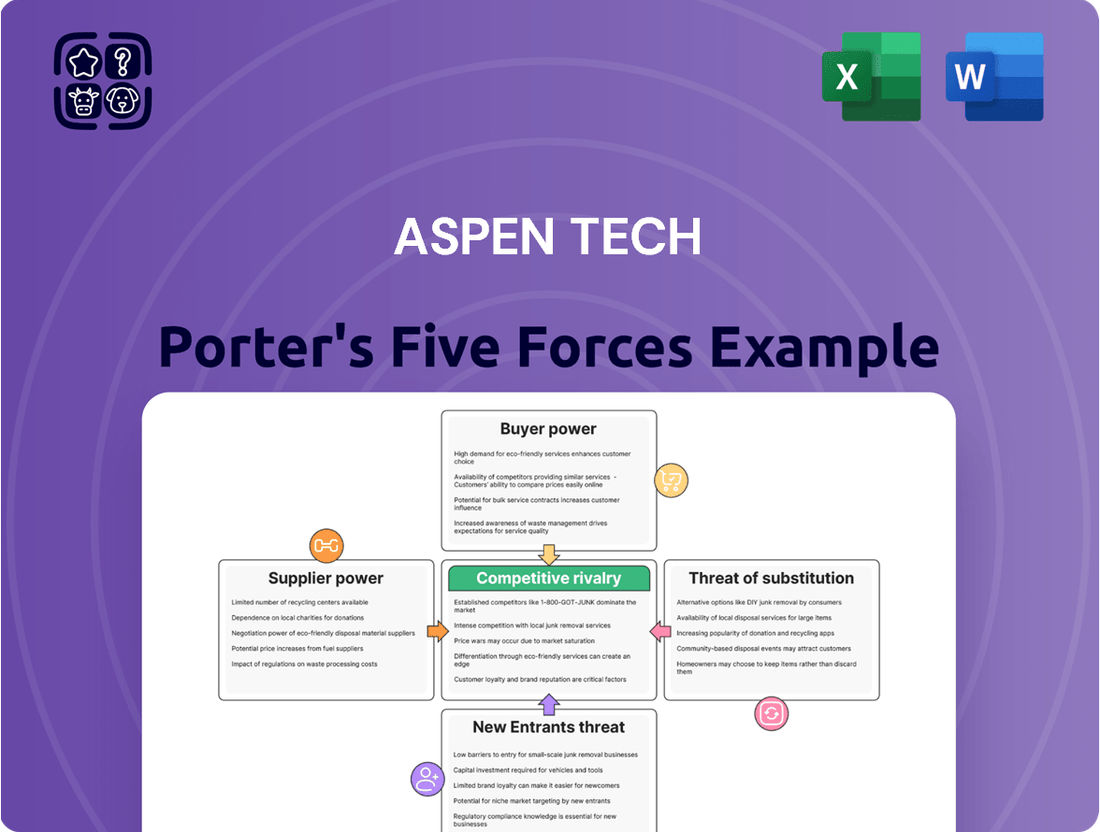

Aspen Tech operates within a dynamic industrial software landscape, facing significant competitive pressures. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of substitutes and new entrants is crucial for any strategic evaluation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Aspen Tech’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

AspenTech's reliance on highly specialized technical talent for software development and innovation grants significant power to skilled professionals in the market. The highly technical nature of their software, encompassing process modeling, manufacturing execution, and asset performance management, necessitates a workforce with specialized knowledge in engineering, chemicals, and energy industries.

This demand for niche expertise means that retaining and attracting top-tier engineers and developers is crucial for AspenTech's continued success and competitive edge. Companies in this sector often face challenges in finding individuals with the precise blend of software acumen and deep domain knowledge required for their complex solutions.

AspenTech's bargaining power with suppliers is significantly low due to its reliance on specialized, proprietary software and intellectual property. This means they are not dependent on generic components or easily replaceable technology providers. Their unique algorithms and software modules reduce their vulnerability to supplier price hikes or disruptions, as there are few, if any, direct substitutes for their core offerings.

The bargaining power of suppliers for AspenTech, particularly concerning general-purpose software development tools and cloud infrastructure, is relatively moderate. While AspenTech leverages its proprietary software, its reliance on underlying technology platforms means that the availability of alternative providers for these foundational elements can introduce some downward pressure on pricing and terms from specialized tool suppliers. For instance, the competitive landscape among major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) ensures that businesses, including AspenTech, have options that can influence negotiation leverage.

Supplier Power 4

The bargaining power of suppliers for Aspen Technology (AspenTech) is influenced by the specialized nature of its process simulation and optimization software components. A limited number of highly specialized vendors can provide niche industrial software components or data crucial for process industries, granting them leverage. This is especially true for unique simulation models or data sets that are challenging to replicate, potentially increasing costs for AspenTech if these suppliers exert their power.

AspenTech's reliance on certain intellectual property or proprietary data from a select few sources can amplify supplier influence. For instance, if a critical algorithm or a vast, unique dataset powering a core AspenTech product originates from a single or a very small group of providers, those suppliers hold significant sway. This can translate into higher licensing fees or less favorable contract terms for AspenTech.

While AspenTech's broad product portfolio might mitigate some supplier power overall, specific dependencies remain. For example, in 2024, the market for advanced AI-driven predictive maintenance modules for complex chemical plants might see a few key data providers or specialized algorithm developers with considerable bargaining power. If AspenTech integrates these into its flagship products, it could face increased input costs.

- Limited Vendor Pool: The market for highly specialized process industry software components often features a concentrated group of suppliers, potentially giving them greater pricing power.

- Proprietary Technology Dependence: AspenTech may rely on unique intellectual property or data from a few key suppliers, creating leverage for those suppliers.

- Data and Algorithm Specificity: The difficulty in replicating specialized simulation models or datasets used in process industries can enhance supplier bargaining power.

- Industry Consolidation: Consolidation among suppliers of critical industrial software or data could further strengthen their position relative to AspenTech.

Supplier Power 5

AspenTech's bargaining power with its suppliers is influenced by the concentration and uniqueness of the technologies it sources. While AspenTech's scale provides some leverage, the specialized nature of certain software components or intellectual property can give suppliers significant influence. For instance, if key AI or process simulation algorithms are only available from a limited number of providers, those suppliers hold considerable sway.

To counter this, AspenTech can pursue strategic partnerships and acquisitions to internalize critical technologies or expertise, thereby reducing its reliance on external suppliers. The company's track record of acquisitions, such as the integration of Open Grid Systems, demonstrates a proactive approach to securing essential functionalities and mitigating supplier power.

The potential for suppliers to forward integrate, by developing their own end-user solutions that compete with AspenTech, also represents a threat. However, the high R&D costs and established customer relationships of AspenTech often act as a deterrent to such moves.

Key considerations for AspenTech's supplier power include:

- Supplier Concentration: The number of suppliers offering critical components or technologies.

- Uniqueness of Inputs: The degree to which suppliers' offerings are differentiated and difficult to substitute.

- Switching Costs: The expense and effort involved for AspenTech to change suppliers.

- Threat of Forward Integration: The potential for suppliers to enter AspenTech's market.

AspenTech's bargaining power with suppliers is generally low due to its reliance on highly specialized, proprietary software and intellectual property. This means they are not dependent on generic components or easily replaceable technology providers, reducing vulnerability to price hikes. However, the company does face some supplier power concerning general-purpose software development tools and cloud infrastructure, where competitive landscapes among providers like AWS, Azure, and GCP can influence negotiation leverage.

The limited number of vendors providing niche industrial software components or unique simulation models and data crucial for process industries grants these suppliers significant leverage. For example, in 2024, the market for advanced AI-driven predictive maintenance modules might see a few key data providers with considerable bargaining power if AspenTech integrates their offerings.

AspenTech's reliance on specific intellectual property or proprietary data from a select few sources can amplify supplier influence, potentially leading to higher licensing fees or less favorable contract terms. To mitigate this, AspenTech actively pursues strategic partnerships and acquisitions to internalize critical technologies, as seen with the integration of Open Grid Systems.

Key factors influencing supplier power for AspenTech include the concentration of suppliers for critical components, the uniqueness of their offerings, the switching costs for AspenTech, and the potential threat of suppliers integrating forward into AspenTech's market.

What is included in the product

Tailored exclusively for Aspen Tech, analyzing its position within its competitive landscape by examining industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Instantly identify and address competitive threats with a dynamic, interactive Porter's Five Forces model that visualizes market pressures.

Customers Bargaining Power

AspenTech's customers, predominantly major players in the energy, chemicals, and engineering & construction sectors, often engage in substantial, long-term contracts. This significant commitment grants them considerable bargaining power. For instance, in 2023, AspenTech reported that its top 20 customers accounted for approximately 60% of its revenue, underscoring the concentrated nature of its client base and the leverage these large enterprises hold.

These large enterprises possess considerable procurement budgets and are strategically vital to AspenTech's business. This strategic importance allows them to negotiate favorable terms, including pricing and service level agreements, directly impacting AspenTech's profitability and market position.

The bargaining power of customers for AspenTech is relatively low due to the mission-critical nature of its asset optimization software. These solutions are essential for improving operational efficiency, cutting costs, and boosting profitability for companies in industries like manufacturing and energy. For example, AspenTech's software is vital for optimizing complex chemical processes, making it difficult for customers to switch to less specialized or integrated solutions without significant disruption.

Furthermore, the deep integration of AspenTech's software into a customer's core operational processes creates substantial switching costs. This means that moving to a competitor would involve not only the expense of new software but also the considerable effort and risk associated with reconfiguring critical systems and retraining personnel. In 2024, the continued demand for advanced industrial software that drives tangible efficiency gains reinforces this customer stickiness.

The bargaining power of customers for Aspen Technology is influenced by the availability of numerous alternative industrial software solutions. Competitors such as Honeywell, Rockwell Automation, SAP, and Siemens offer comparable platforms for manufacturing execution systems and other critical industrial software needs, giving customers significant leverage.

Customers can readily compare and contrast these competing offerings, evaluating features, pricing, and support. This competitive landscape allows buyers to demand better terms, potentially impacting Aspen Tech's pricing strategies and profit margins. For instance, the industrial automation software market is projected to reach $135.4 billion by 2028, indicating a highly competitive environment where customer choice is paramount.

Buyer Power 4

Industrial clients are increasingly adopting digital transformation and Industry 4.0, which boosts demand for industrial software. However, this also makes them more discerning, pushing for advanced features and seamless integration. Customers are actively seeking holistic solutions that enhance operational efficiency and facilitate data-driven decision-making.

The bargaining power of Aspen Tech's customers is significant due to several factors:

- Concentration of Buyers: While the industrial sector is vast, large enterprises represent a concentrated group of high-value customers for specialized software like Aspen Tech's. These major players have substantial purchasing power and can negotiate terms more effectively.

- Availability of Substitutes: Although Aspen Tech offers sophisticated solutions, the increasing maturity of the industrial software market means customers have access to a growing number of alternative providers, including in-house development or less specialized software that might meet some of their needs, thereby increasing competitive pressure.

- Switching Costs: While Aspen Tech's solutions often involve high switching costs due to integration and training, customers are becoming more adept at managing these transitions, especially with the rise of cloud-based solutions and standardized APIs, which can lower the barrier to change over time.

- Price Sensitivity: As digital transformation investments become more substantial, customers are increasingly focused on total cost of ownership and return on investment. This heightened price sensitivity empowers them to negotiate harder on licensing, implementation, and ongoing support fees.

Buyer Power 5

The bargaining power of customers for Aspen Technology (AspenTech) is generally low, particularly for its core asset optimization software. While customers possess the theoretical ability to develop in-house solutions or utilize open-source alternatives, the complexity and significant resource investment required for specialized industrial software make this a less viable option. For instance, developing a comparable process simulation or control system would demand substantial expertise and capital, far exceeding the cost of AspenTech's offerings for most organizations.

However, for certain peripheral functions or less critical software components, customers might explore internal development or open-source routes. This threat is more pronounced in areas where the proprietary nature and advanced capabilities of AspenTech's solutions are less critical. For example, a company might leverage open-source data analytics tools for reporting rather than a fully integrated AspenTech solution if the need is purely for basic data visualization.

AspenTech's strong market position and the high switching costs associated with its integrated software suites further diminish customer bargaining power. Once a company has invested in AspenTech's platforms and trained its personnel, migrating to a competitor or an in-house solution becomes a costly and disruptive undertaking. This lock-in effect reinforces AspenTech's pricing power and limits the extent to which customers can negotiate lower prices or demand significant concessions.

- Low Customer Bargaining Power: Customers face high switching costs and significant technical hurdles in developing in-house alternatives for AspenTech's specialized industrial software.

- Latent Threat of In-House/Open-Source: While not a primary concern for core asset optimization, some peripheral functions could be developed internally or via open-source, posing a minor threat.

- High Integration and Training Costs: The deep integration of AspenTech's software into customer operations and the associated training investment create substantial barriers to switching.

- Market Dominance: AspenTech's strong market share in critical industrial software segments limits customer leverage for price negotiations.

The bargaining power of AspenTech's customers is generally low due to the mission-critical nature and deep integration of its asset optimization software, which creates high switching costs. For example, the significant investment in training and system reconfiguration makes it difficult for clients to move to alternative solutions. In 2024, the ongoing need for enhanced operational efficiency in sectors like energy and chemicals further solidifies this customer stickiness.

While a concentration of large buyers exists, the specialized capabilities and complexity of AspenTech's offerings limit the readily available substitutes for core functions. The industrial software market, projected to grow, still sees AspenTech holding strong positions in niche areas, reducing customer leverage.

The threat of customers developing in-house solutions or opting for open-source alternatives is minimal for AspenTech's advanced process simulation and control software. The substantial expertise and capital required for such endeavors make it an impractical option for most clients, thus preserving AspenTech's pricing power.

AspenTech's strong market position in critical industrial software segments, coupled with high integration and training costs for its clients, significantly limits customer bargaining power. While some peripheral functions might offer alternatives, the core value proposition of AspenTech's integrated solutions creates considerable customer lock-in.

Preview the Actual Deliverable

Aspen Tech Porter's Five Forces Analysis

This preview showcases the complete Aspen Tech Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape for Aspen Technology. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and the bargaining power of substitutes.

Rivalry Among Competitors

The industrial software market is intensely competitive. Aspen Technology faces rivals like Honeywell, Rockwell Automation, SAP, and Siemens, each strong in different areas of industrial automation and optimization. This crowded landscape means companies constantly innovate to capture market share.

While AspenTech specializes in asset optimization for process industries, its competitive landscape includes broader enterprise asset management (EAM) and manufacturing execution systems (MES) providers. Companies such as Autodesk Construction, ARCHIBUS, and ServiceNow SAM Pro, though not direct competitors in every aspect, capture significant market share in adjacent areas, indicating a crowded software ecosystem.

Competitive rivalry in the industrial software sector, where Aspen Technology operates, is intense, with differentiation through advanced analytics, AI, and cloud-based solutions being a primary battleground. Companies are vying to offer superior insights and operational flexibility to their clients.

The market is witnessing a significant shift towards cloud-based solutions, with increasing integration of AI and machine learning to unlock enhanced capabilities and deliver more predictive and prescriptive analytics. This technological evolution is a key driver of competitive advantage.

For instance, in 2024, the global industrial software market is projected to reach over $70 billion, with a substantial portion of growth attributed to AI-driven solutions and cloud adoption, highlighting the critical nature of these differentiators in Aspen Tech's competitive landscape.

Competitive Rivalry 4

The competitive rivalry within the industrial software sector, particularly for companies like AspenTech, is fierce and often characterized by strategic maneuvers to gain market share and enhance capabilities. This environment is heavily influenced by the ongoing consolidation and integration of players within the industry.

AspenTech itself has actively participated in this trend, notably with its acquisition of Open Grid Systems, a move designed to bolster its asset performance management offerings. Furthermore, AspenTech's majority ownership by Emerson Electric significantly shapes its competitive stance, providing it with greater resources and market access, which in turn intensifies the rivalry with other major software providers and integrated solutions companies.

- Strategic Partnerships and Acquisitions: Companies frequently leverage these tactics to broaden their market reach and acquire new technologies, directly fueling competitive intensity.

- AspenTech's Acquisition Strategy: The acquisition of Open Grid Systems exemplifies AspenTech's proactive approach to enhancing its product portfolio and competitive edge.

- Emerson's Influence: AspenTech's majority ownership by Emerson Electric provides substantial financial backing and strategic alignment, impacting its competitive positioning within the industrial software landscape.

Competitive Rivalry 5

The global industrial software market is experiencing robust growth, fueled by the increasing adoption of automation and digital transformation initiatives across various sectors. This expansion, however, also means more companies are vying for a piece of the pie. For instance, the market was valued at approximately $70 billion in 2023 and is anticipated to climb to over $100 billion by 2029, indicating a significant increase in both opportunity and competitive intensity.

This heightened competition means that established players like Aspen Technology face pressure from both existing rivals and new entrants drawn by the market's lucrative growth prospects. Companies are investing heavily in R&D to develop advanced solutions, leading to a dynamic environment where innovation and market share are constantly being challenged.

- Market Growth: The industrial software market is projected to grow from an estimated $70 billion in 2023 to over $100 billion by 2029.

- Drivers of Competition: Automation and digital transformation are key drivers expanding the market and intensifying rivalry.

- Player Influx: The substantial market value attracts new players and increased investment, heightening competitive pressures.

- Innovation Race: Companies are compelled to innovate rapidly to maintain or gain market share in this evolving landscape.

Competitive rivalry is a defining characteristic of the industrial software market where AspenTech operates. The sector is populated by established giants like Honeywell, Rockwell Automation, SAP, and Siemens, all of whom possess significant capabilities in industrial automation and optimization. This intense competition forces companies to continuously innovate and refine their offerings to secure and expand their market share.

The battleground for market dominance increasingly centers on advanced analytics, artificial intelligence, and cloud-based solutions. Companies are striving to provide clients with superior insights and operational flexibility, recognizing these as crucial differentiators. For example, in 2024, the global industrial software market is projected to exceed $70 billion, with a substantial portion of this growth driven by AI and cloud adoption, underscoring the importance of these technological advancements in the competitive landscape.

| Competitor | Key Strengths | AspenTech's Overlap/Differentiation |

|---|---|---|

| Honeywell | Industrial automation, process control, building solutions | Process optimization, asset performance management |

| Rockwell Automation | Manufacturing automation, connected enterprise solutions | Process optimization, digital transformation |

| SAP | Enterprise resource planning (ERP), supply chain management | Manufacturing execution systems (MES), asset intelligence |

| Siemens | Digital industries, smart infrastructure, automation | Process simulation, asset optimization |

SSubstitutes Threaten

Traditional manual processes and legacy systems can act as a substitute for AspenTech's sophisticated optimization software. For smaller businesses or those not yet deeply invested in digital transformation, these older methods, despite their inefficiency, might still be perceived as adequate. This is particularly true when considering the significant upfront costs and implementation challenges associated with adopting advanced software solutions.

The threat of substitutes for Aspen Technology's specialized software solutions is moderate. While no direct, perfect substitutes exist for their advanced process optimization and asset management capabilities, generic enterprise resource planning (ERP) or manufacturing execution systems (MES) from larger software vendors can offer some overlapping functionalities. For instance, basic optimization needs within a manufacturing environment might be addressed by broader platforms like SAP, though they typically lack the depth and specialized algorithms AspenTech provides.

Large industrial companies, particularly those with significant IT departments and R&D budgets, might develop their own in-house software solutions or custom-built applications. These bespoke systems can be tailored to highly specific or proprietary processes, potentially offering a substitute for AspenTech's broader suite of offerings. For instance, a major oil and gas conglomerate might invest in developing proprietary simulation software for their unique refining operations, reducing their reliance on commercial solutions.

4

The threat of substitutes for Aspen Technology's offerings is currently moderate but has the potential to grow. While specialized industrial software for complex process optimization remains a significant barrier for many substitutes, the increasing maturity of open-source industrial software presents a long-term challenge. For instance, in 2024, adoption of open-source solutions in areas like industrial automation is steadily increasing, although these often require substantial in-house expertise for security and maintenance.

While not yet a direct replacement for AspenTech's core process simulation and optimization platforms, the expanding capabilities of open-source alternatives in adjacent areas of industrial IT could eventually erode market share. These emerging solutions, though often less sophisticated in deep process modeling, are becoming more viable for less critical functions within the industrial ecosystem.

Key considerations regarding substitutes include:

- Growing Open-Source Adoption: Initiatives like the Linux Foundation's efforts in industrial IoT and edge computing are fostering more robust open-source industrial software ecosystems.

- Cost-Effectiveness: Open-source solutions can offer a significantly lower total cost of ownership, appealing to companies seeking to reduce capital expenditures.

- Customization Potential: The inherent flexibility of open-source software allows for deep customization, which can be attractive for specific niche applications.

- Security and Support Concerns: A primary hurdle for widespread adoption of open-source in critical industrial processes remains the perceived or actual challenges with security patching, long-term support, and vendor accountability compared to established commercial providers like AspenTech.

5

The threat of substitutes for AspenTech's software solutions is a significant consideration. While not direct software competitors, consulting services and manual optimization efforts can act as substitutes by offering alternative ways for companies to achieve operational improvements. For instance, a chemical plant might hire external consultants to analyze its processes and recommend efficiency gains, bypassing the need for AspenTech's specialized analytical software.

These consulting engagements, though often project-based, can fulfill similar analytical and prescriptive needs. Companies may opt for these services if they perceive them as more cost-effective for specific, one-off challenges or if they lack the internal expertise to fully leverage advanced software. This approach allows businesses to gain insights and implement changes without the ongoing investment in software licenses and associated training.

The market for operational consulting is substantial, with many firms offering specialized services in areas like process optimization, energy efficiency, and supply chain management. For example, the global management consulting market was estimated to be worth over $300 billion in 2023, indicating a significant appetite for external expertise that can substitute for in-house software-driven solutions.

- Consulting Services: External experts can provide analysis and recommendations for operational improvements, serving as a substitute for AspenTech's software capabilities.

- Manual Optimization: Companies may undertake manual analysis and implement improvements without specialized software, especially for less complex issues.

- Cost-Benefit Analysis: Businesses might choose consulting or manual methods if the perceived cost or complexity of software solutions outweighs the benefits for their specific needs.

- Focus on Specific Problems: Consultants can offer targeted solutions for particular operational challenges, potentially negating the need for a comprehensive software suite.

The threat of substitutes for AspenTech's specialized industrial software is moderate, primarily stemming from alternative approaches rather than direct software competitors. While generic ERP or MES systems offer some overlapping functions, they typically lack the deep, specialized optimization capabilities that AspenTech provides. Companies might also develop proprietary in-house solutions, especially those with substantial R&D budgets, tailoring them to unique operational needs.

The increasing maturity of open-source industrial software presents a growing, albeit still moderate, threat. While these solutions often require significant in-house expertise for security and maintenance, their lower total cost of ownership and customization potential are increasingly attractive in 2024. For instance, the Linux Foundation's initiatives are bolstering open-source ecosystems in industrial IoT and edge computing, making them more viable for less critical functions.

Consulting services and manual optimization efforts also act as substitutes, offering companies alternative paths to operational improvements. Businesses may opt for these if they perceive them as more cost-effective for specific challenges or if they lack the internal expertise for advanced software. The global management consulting market, valued at over $300 billion in 2023, highlights the significant demand for external expertise that can fulfill similar analytical needs.

| Substitute Type | Description | Key Considerations | Potential Impact on AspenTech |

|---|---|---|---|

| Legacy/Manual Processes | Traditional methods and older systems | Perceived adequacy for smaller businesses, significant upfront costs of advanced software | Low to moderate, depending on company size and investment capacity |

| Generic ERP/MES | Broader enterprise software platforms | Overlapping functionalities but lack specialized optimization depth | Moderate, especially for companies with less complex needs |

| In-house Developed Software | Custom-built applications by large corporations | Tailored to highly specific or proprietary processes | Moderate, particularly for large conglomerates with significant IT resources |

| Open-Source Industrial Software | Emerging open-source solutions | Lower cost, high customization, but require in-house expertise for security and support | Growing, potential long-term challenge for market share |

| Consulting Services | External experts providing analysis and recommendations | Project-based, cost-effective for specific challenges, bypasses software investment | Moderate, especially for companies seeking targeted solutions |

Entrants Threaten

The threat of new entrants for Aspen Technology (AspenTech) is generally low due to the substantial barriers in the industrial software sector. Developing sophisticated asset optimization software requires immense capital investment, with companies needing hundreds of millions, if not billions, to establish a competitive presence. For instance, the extensive research and development (R&D) needed for complex process modeling, simulation, and optimization capabilities demands significant financial and intellectual resources, making it difficult for newcomers to compete with established players like AspenTech.

New entrants face significant hurdles in the process industries due to the critical need for deep domain expertise, particularly in sectors like energy and chemicals. AspenTech's advantage stems from decades of accumulated knowledge in understanding complex industrial workflows, making it difficult for newcomers to replicate this ingrained understanding. For instance, the development and implementation of sophisticated simulation and optimization software, a core offering of AspenTech, requires a nuanced grasp of chemical engineering principles and plant operations that takes years to cultivate.

The threat of new entrants in AspenTech's market is relatively low. Established relationships with large industrial clients and the high switching costs associated with integrated software solutions create a strong competitive moat for incumbents like AspenTech. For instance, the complexity and deep integration of AspenTech's Asset Performance Management software mean that once implemented, switching to a new vendor can be extremely disruptive and costly for customers, often running into millions of dollars in implementation and retraining expenses.

4

The threat of new entrants for Aspen Technology (AspenTech) is moderate, largely due to the significant barriers to entry in the specialized industrial software market. The rapid pace of technological advancements, especially in AI, machine learning, and cloud computing, demands continuous, substantial investment in research and development. New companies would need to quickly build expertise in these complex areas to offer competitive solutions, which is a considerable hurdle.

AspenTech's established reputation, deep customer relationships, and extensive intellectual property further solidify its position. Competitors entering the market would require not only advanced technological capabilities but also a proven track record and the ability to integrate with existing complex industrial systems. This integration challenge, coupled with the need for specialized domain knowledge, acts as a significant deterrent.

- High R&D Investment: AspenTech's commitment to innovation, with R&D spending often exceeding 15% of revenue, sets a high bar for new entrants.

- Complex Integration Needs: Industrial clients require software that seamlessly integrates with existing operational technology (OT) and IT infrastructure, a feat difficult for newcomers to achieve.

- Customer Lock-in: Long-term contracts and the specialized nature of AspenTech's solutions create a degree of customer loyalty and switching costs, discouraging new players.

- Talent Acquisition: Attracting and retaining highly skilled engineers and data scientists with expertise in both software development and specific industrial processes is a significant challenge for emerging companies.

5

The threat of new entrants in the industrial software sector, particularly for a company like AspenTech, is moderately high. Large, established technology firms can strategically acquire existing players, thereby gaining immediate market share and technological capabilities. This consolidation can introduce well-capitalized competitors with significant resources.

For instance, Emerson Electric's acquisition of AspenTech in 2022 for approximately $11 billion was a major consolidation event. This move not only removed AspenTech as an independent entity but also bolstered Emerson's position in the industrial software market. Such strategic acquisitions by major players can quickly alter the competitive landscape, bringing substantial financial backing and existing customer relationships to bear against smaller or emerging competitors.

- Consolidation through acquisition: Large technology companies can enter the industrial software market by acquiring established firms, instantly gaining market presence and technology.

- Capital infusion: Acquired entities benefit from the significant financial resources of their new parent companies, enabling aggressive R&D and market expansion.

- Reduced barriers for large players: For well-funded conglomerates, the cost and complexity of developing industrial software from scratch are mitigated through strategic buyouts.

- Impact on competition: These acquisitions can lead to fewer, but larger, competitors, intensifying the competitive environment for remaining independent players.

The threat of new entrants for AspenTech remains low, primarily due to the immense capital and expertise required to compete. Developing advanced industrial software demands significant R&D investment, often in the hundreds of millions of dollars, to create sophisticated solutions for complex processes. AspenTech's deep domain knowledge, accumulated over decades, is another formidable barrier, making it difficult for newcomers to replicate their understanding of intricate industrial workflows.

Customer lock-in, driven by high switching costs and the deep integration of AspenTech's software into clients' operations, further deters new entrants. For instance, the expense and disruption involved in migrating from AspenTech's integrated systems can run into millions, reinforcing customer loyalty. Furthermore, the need for specialized talent, combining software development with specific industrial process knowledge, presents a significant recruitment challenge for emerging companies.

The industrial software market has seen consolidation, with large players acquiring niche companies. This strategy allows established firms to quickly gain market share and technological capabilities, effectively raising the bar for independent startups. For example, the acquisition landscape suggests that while organic entry is difficult, strategic buyouts by well-capitalized conglomerates can introduce formidable competition.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D spending (e.g., AspenTech's R&D often exceeds 15% of revenue) and infrastructure costs. | Significant financial hurdle for startups. |

| Domain Expertise | Deep understanding of complex industrial processes (e.g., chemical engineering, energy). | Requires years of specialized experience, difficult to replicate quickly. |

| Customer Switching Costs | High costs and operational disruption associated with integrating and migrating complex software. | Creates customer loyalty and makes it hard for new vendors to gain traction. |

| Technology & IP | Proprietary algorithms, patents, and continuous innovation in areas like AI and cloud. | Requires substantial investment to match or surpass existing technological advantages. |

| Brand Reputation & Relationships | Established trust and long-term relationships with major industrial clients. | New entrants lack the credibility and established networks. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aspen Technology leverages data from their annual reports and investor presentations, alongside industry-specific market research from firms like IDC and Gartner, to assess competitive dynamics.