Aspen Tech PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aspen Tech Bundle

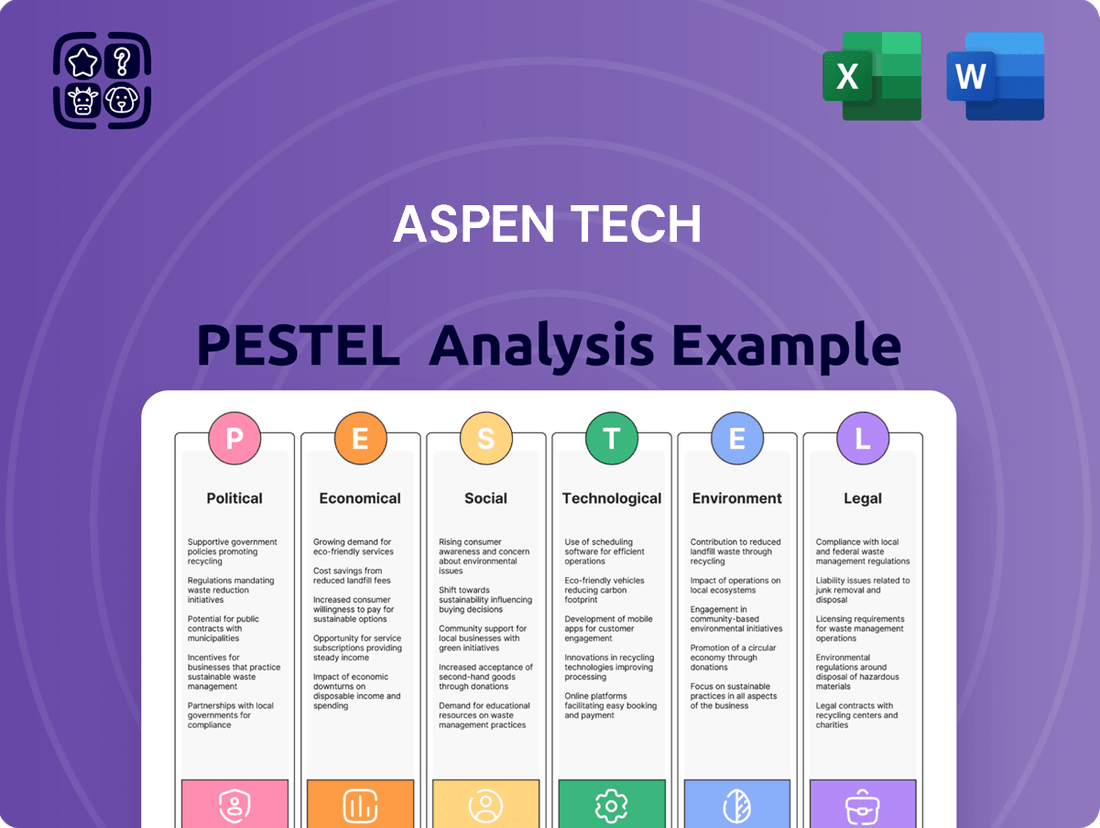

Unlock the strategic landscape surrounding Aspen Tech with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its operational environment and future growth. This detailed report is your key to identifying opportunities and mitigating risks.

Gain a crucial competitive advantage by delving into the external factors impacting Aspen Tech. Our expertly crafted PESTLE analysis provides actionable intelligence for investors, strategists, and business leaders. Download the full version now to make informed decisions and secure your market position.

Political factors

Governments globally are intensifying their drive towards decarbonization, a trend that directly benefits companies like AspenTech. Policies such as carbon pricing mechanisms, like the EU Emissions Trading System which saw allowances trade around €90-€100 per tonne of CO2 in late 2023 and early 2024, and stringent emissions reduction targets are compelling industries to seek solutions for environmental optimization.

This regulatory push creates a significant demand for AspenTech's software, which helps businesses reduce their environmental footprint and meet net-zero commitments. For instance, the International Energy Agency reported in 2024 that global investment in clean energy technologies reached a record $1.7 trillion in 2023, signaling a strong market for decarbonization solutions.

AspenTech is well-positioned to capitalize on this trend, having developed specialized planning tools for carbon capture, utilization, and storage (CCUS). These technologies are critical for industries aiming to decarbonize, aligning perfectly with the growing number of national and international climate agreements and initiatives being implemented.

Governments worldwide are implementing aggressive energy transition policies, including mandates for renewable energy adoption and subsidies for sustainable fuels. For instance, in 2024, the U.S. Inflation Reduction Act continues to drive significant investment in clean energy technologies, while the EU's Fit for 55 package aims for a 55% reduction in greenhouse gas emissions by 2030. These political shifts directly influence AspenTech's core markets, requiring clients to modernize operations and integrate new energy sources.

AspenTech's software is crucial for asset-intensive industries navigating this energy transition. The demand for advanced solutions to manage complex energy grids, optimize the integration of intermittent renewable resources like solar and wind, and streamline the production of sustainable aviation fuels (SAF) is growing. By 2025, the global SAF market is projected to reach over $15 billion, highlighting the urgent need for efficient production technologies that AspenTech's offerings can support.

Fluctuations in global trade policies and geopolitical tensions significantly influence AspenTech's international clientele, affecting their supply chains and investment strategies. For instance, the ongoing trade disputes between major economies in 2024 continue to create uncertainty, prompting businesses to re-evaluate their global operational footprints and seek technologies that bolster resilience.

AspenTech's core industries, like energy and chemicals, are particularly susceptible to these political dynamics. A surge in energy prices due to geopolitical instability, as seen in certain regions in early 2025, directly impacts the capital expenditure and operational budgets of these clients, influencing their adoption of new software solutions.

Companies are increasingly prioritizing software that enhances supply chain visibility and operational efficiency to navigate these volatile conditions. AspenTech's solutions, which offer advanced analytics and simulation capabilities, are well-positioned to address this demand, helping clients mitigate risks and optimize performance amidst global political uncertainties.

Industrial Digitalization Initiatives

Governments worldwide are prioritizing industrial digitalization, often termed Industry 4.0 or 5.0, aiming to sharpen national economic competitiveness and elevate productivity. These efforts frequently translate into direct financial backing and supportive policies for the adoption of cutting-edge manufacturing software, the Internet of Things (IoT), and artificial intelligence. This governmental push cultivates a conducive regulatory landscape and stimulates market appetite for specialized solutions like those offered by AspenTech, particularly in asset optimization and industrial AI.

For instance, the United States' CHIPS and Science Act of 2022, with its significant investment in advanced manufacturing and R&D, signals a broader trend. Similarly, the European Union's Digital Decade targets, aiming for widespread digital transformation by 2030, underscore this global commitment. These initiatives directly benefit companies like AspenTech by creating a more receptive market for their advanced software solutions.

- Governmental Support: Many nations are actively funding and incentivizing the adoption of Industry 4.0 technologies.

- Market Demand: These initiatives directly fuel demand for advanced industrial software and AI solutions.

- Regulatory Environment: Favorable policies and regulations simplify market entry and growth for digitalization providers.

Regulatory Compliance and Reporting

Process industries face escalating regulatory demands concerning operational safety, environmental impact, and data protection. AspenTech's software solutions are designed to assist clients in navigating these complex requirements by offering precise data management, advanced simulation tools, and continuous performance oversight. This heightened need for rigorous compliance directly fuels the market demand for AspenTech's specialized offerings.

For instance, the European Union's stringent General Data Protection Regulation (GDPR) and evolving environmental standards like the US EPA's Greenhouse Gas Reporting Program place significant burdens on companies. AspenTech's Asset Performance Management (APM) solutions, for example, can help track emissions and operational deviations, contributing to accurate reporting. In 2023, compliance-related spending in the industrial software sector saw a notable increase, reflecting this trend.

- Increased Scrutiny: Regulators globally are intensifying oversight of industrial operations, particularly in safety-critical sectors.

- Data Integrity: AspenTech's platforms ensure the accuracy and traceability of data essential for regulatory submissions.

- Environmental Mandates: Software aids in monitoring and reporting emissions and resource consumption to meet environmental targets.

- Cybersecurity Compliance: Solutions help safeguard sensitive operational data, aligning with data security regulations.

Governmental focus on energy security and transition is a significant driver for AspenTech. Policies promoting domestic energy production and the shift towards cleaner sources create demand for sophisticated operational software. For example, the US Department of Energy's 2024 initiatives to bolster domestic refining capacity and promote biofuels directly benefit companies needing to optimize complex industrial processes.

AspenTech's solutions are crucial for industries adapting to these political landscapes, enabling them to improve efficiency and meet evolving energy demands. The global push for energy independence, amplified by geopolitical events in 2024 and early 2025, underscores the need for resilient and optimized energy infrastructure, a core area for AspenTech's offerings.

Furthermore, government investments in digital infrastructure and advanced manufacturing, such as the UK's 2024 commitment to boost semiconductor manufacturing, create opportunities for AspenTech. These investments often mandate the use of advanced software for process control and optimization, aligning with AspenTech's core business.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Aspen Technology across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying emerging threats and opportunities within Aspen Tech's operating landscape.

A concise Aspen Tech PESTLE analysis summary that can be easily integrated into presentations or shared for quick team alignment on external market dynamics.

Economic factors

The global industrial software market is on a strong upward trajectory, with projections indicating it will reach approximately $70 billion by 2025. This growth is fueled by a widespread push for operational efficiency and digital transformation across various industries. AspenTech is well-positioned to capitalize on this expansion as businesses increasingly adopt advanced software solutions.

Within this burgeoning market, cloud-based industrial software solutions are seeing particularly impressive growth. Analysts predict the industrial cloud market could surpass $20 billion by 2026, highlighting a significant opportunity for companies like AspenTech offering cloud-native platforms and services.

Economic pressures are forcing asset-intensive industries to find smarter ways to spend money, both on building new things (CAPEX) and running day-to-day operations (OPEX). For instance, the oil and gas sector, a key market for AspenTech, saw global upstream CAPEX projected to reach around $500 billion in 2024, highlighting the significant investment involved and the need for efficiency.

AspenTech’s software plays a crucial role here by helping companies design better, run their facilities more smoothly, and maintain them effectively. This directly translates to lower costs and better financial performance for their clients, a value that remains strong even when the economy feels uncertain.

By optimizing processes, AspenTech solutions can lead to substantial savings. For example, improvements in energy efficiency alone, a common outcome of their software, can reduce operational costs significantly; some studies suggest potential OPEX reductions of 5-15% in chemical manufacturing through advanced process control.

AspenTech's core business heavily relies on the energy and chemical industries, making it inherently sensitive to swings in energy and commodity prices. For instance, crude oil prices, a key indicator for the sector, saw significant volatility in late 2023 and early 2024, fluctuating between the high $70s and low $90s per barrel. This directly impacts the spending power of AspenTech's client base.

While AspenTech's software solutions offer efficiency improvements irrespective of price environments, sustained periods of low commodity prices, such as those experienced in certain periods of 2023 where Brent crude dipped below $75, can constrain customers' capital expenditure budgets for new technology investments. This can slow down adoption rates for advanced optimization software.

Conversely, periods of high energy and commodity prices, like the spikes seen in 2022 and potential resurgences in 2024 due to geopolitical factors, often act as a catalyst for clients to invest more aggressively in optimization technologies. Companies aim to maximize output and profitability when margins are wider, making AspenTech's solutions for process efficiency and yield improvement particularly attractive during these times. For example, a 10% increase in a refinery's yield, facilitated by advanced software, can translate into millions in additional profit when crude prices are high.

Inflationary Pressures and Supply Chain Costs

Elevated material and labor costs continue to be a significant hurdle for manufacturing and process industries. For instance, the Producer Price Index (PPI) for manufacturing inputs saw a notable increase in late 2023 and early 2024, reflecting these persistent cost pressures. Supply chain disruptions, while showing some signs of easing, still contribute to higher operational expenses and lead times.

AspenTech’s software solutions are designed to directly address these inflationary pressures and supply chain challenges. By facilitating more robust supply chain planning and optimizing inventory levels, their platforms help clients minimize the impact of fluctuating material costs and reduce waste. Predictive maintenance capabilities also play a crucial role, extending asset life and preventing costly unplanned downtime.

These capabilities translate into tangible cost savings for AspenTech’s customers. For example, improved resource utilization and reduced waste can lead to substantial reductions in operational expenditure. In 2024, many companies reported that digital transformation initiatives, including those powered by AspenTech’s technology, were key to maintaining profitability amidst rising costs.

- Persistent Cost Increases: Manufacturing input costs, as measured by indices like the PPI, demonstrated ongoing upward trends through early 2024, impacting profitability for many industrial firms.

- Supply Chain Resilience: While improving, supply chain instability remained a factor, with companies actively seeking digital tools to enhance visibility and agility in their operations.

- Digital Mitigation: AspenTech's software aids clients by optimizing supply chains, managing inventory more effectively, and leveraging predictive maintenance to cut waste and operational expenses.

- Client Benefits: These solutions directly contribute to cost savings for businesses, helping them navigate inflationary environments and improve overall resource efficiency.

Mergers and Acquisitions Activity

The economic landscape for AspenTech is significantly shaped by mergers and acquisitions, with the most prominent event being its acquisition by Emerson. This deal, valued at $17.0 billion, underscores substantial economic activity and strategic realignments within the industrial technology sphere.

The integration of AspenTech into Emerson, anticipated to finalize in the first half of 2025, signals a move towards consolidation and potential market expansion. This merger is expected to unlock new avenues for growth and operational synergies by combining AspenTech's software expertise with Emerson's broader industrial solutions.

- $17.0 billion: The total valuation of AspenTech in its acquisition by Emerson.

- H1 2025: The projected timeframe for the closing of the Emerson-AspenTech acquisition.

- Industrial Technology Sector: The primary industry experiencing these strategic shifts.

The economic environment significantly influences AspenTech's market, driven by global growth trends and the need for operational efficiency in asset-intensive industries. The industrial software market is projected to reach around $70 billion by 2025, with cloud solutions expected to exceed $20 billion by 2026, indicating substantial opportunities.

AspenTech's core markets, such as oil and gas, are sensitive to commodity prices. For instance, crude oil prices fluctuated between $75 and $90 per barrel in late 2023 and early 2024, impacting client spending. Persistent cost increases, reflected in manufacturing PPI data, also pressure clients, making AspenTech's optimization solutions crucial for cost savings.

The $17.0 billion acquisition of AspenTech by Emerson, expected to close in the first half of 2025, represents a major economic event, consolidating the industrial technology sector and creating new growth synergies.

| Economic Factor | Impact on AspenTech | Supporting Data/Trend |

|---|---|---|

| Industrial Software Market Growth | Positive, drives demand for AspenTech's solutions | Projected to reach ~$70 billion by 2025 |

| Cloud Adoption | Positive, favors AspenTech's cloud-native offerings | Industrial cloud market to exceed $20 billion by 2026 |

| Commodity Price Volatility (e.g., Crude Oil) | Mixed; high prices incentivize investment, low prices constrain CAPEX | Crude oil prices ranged $75-$90/barrel (late 2023-early 2024) |

| Inflationary Pressures (e.g., PPI) | Positive; clients seek efficiency to mitigate rising costs | Manufacturing PPI showed ongoing upward trends in early 2024 |

| Mergers & Acquisitions | Transformative; Emerson acquisition ($17.0B, H1 2025 close) | Consolidation in the industrial technology sector |

Preview Before You Purchase

Aspen Tech PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Aspen Technology provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

Sociological factors

The increasing integration of advanced industrial software and AI across sectors like manufacturing and energy is creating a significant demand for digitally proficient workers. A 2024 report indicated that over 60% of industrial companies are investing in AI and automation, yet a substantial portion of their current workforce lacks the necessary digital competencies, highlighting a growing skill gap.

AspenTech addresses this by developing intuitive software interfaces and offering comprehensive training modules. These resources are designed to equip existing employees with the skills needed to operate and benefit from new technologies, thereby bridging the digital divide and ensuring smoother adoption. For instance, their recent training initiatives in 2024 saw a 25% improvement in user proficiency with new AI-driven process optimization tools.

This trend also fuels the need for solutions that enhance, rather than replace, human capabilities. By providing AI-powered assistants and augmented reality tools, AspenTech empowers workers to perform complex tasks more efficiently and safely. In 2025, early adopters of these augmentation technologies reported an average of 15% increase in operational efficiency and a 10% reduction in human error.

Societal expectations are increasingly pushing industries, especially asset-intensive ones, to prioritize operational safety and robust risk management. This trend is evident in stricter regulatory frameworks and a growing public demand for responsible industrial practices, influencing how companies operate and invest in technology.

AspenTech's software directly addresses these societal demands by enhancing operational safety. For instance, their solutions facilitate predictive maintenance, which in 2024 is projected to reduce unplanned downtime by up to 30% in key sectors, thereby preventing potential incidents and improving overall process reliability.

Furthermore, AspenTech's simulation capabilities empower engineers to rigorously test and optimize processes in virtual environments before implementation. This proactive approach to risk reduction, a critical aspect of safety, aligns with the broader societal imperative for industries to operate with minimal environmental and human impact.

Consumers and investors increasingly expect companies to act responsibly and sustainably. This trend significantly shapes what AspenTech's clients prioritize, pushing them to focus on environmental, social, and governance (ESG) factors. For instance, a 2024 report indicated that over 70% of investors consider ESG performance when making investment decisions, directly impacting the demand for solutions that address these concerns.

Companies are actively seeking ways to shrink their environmental impact and clearly communicate their sustainability progress. This includes reducing greenhouse gas emissions and optimizing resource usage. Many businesses are setting ambitious net-zero targets, with a significant portion of Fortune 500 companies having announced such goals by late 2024.

AspenTech's software solutions are directly aligned with these corporate objectives. By enabling clients to monitor and reduce emissions, improve energy efficiency, and manage resources more effectively, AspenTech helps them meet their sustainability commitments. For example, AspenTech's emissions management software has been shown to help clients achieve up to a 15% reduction in Scope 1 and Scope 2 emissions.

Generational Shift in Industrial Workforce

The industrial sector is experiencing a significant demographic shift, with a substantial number of experienced workers nearing retirement. This trend, particularly pronounced in 2024 and projected to continue into 2025, highlights a critical need for solutions that can effectively capture and transfer the deep institutional knowledge held by these seasoned professionals. For instance, a 2023 report indicated that over 40% of skilled trades workers in manufacturing are aged 55 or older, underscoring the urgency of this generational handover.

AspenTech's suite of digital transformation platforms is well-positioned to address this challenge. By centralizing operational data and leveraging intelligent analytics, these technologies can distill complex, often tacit, knowledge into accessible and actionable formats. This allows newer generations of engineers and operators to quickly gain the insights needed to manage intricate industrial processes, thereby mitigating the risk of knowledge loss and ensuring operational continuity.

- Knowledge Capture: AspenTech’s solutions enable the systematic documentation and digitization of operational best practices and troubleshooting expertise, crucial as experienced personnel depart.

- Skill Augmentation: Advanced analytics and AI-driven insights provided by AspenTech platforms can empower less experienced staff, bridging the skill gap created by retirements.

- Operational Efficiency: By making critical operational data readily available and interpretable, AspenTech helps maintain and even improve efficiency as the workforce evolves.

Community and Stakeholder Engagement

Industries AspenTech serves, like chemical manufacturing and energy, frequently encounter public and environmental group scrutiny. Software that clearly shows better environmental outcomes, less waste, and improved safety is crucial for building trust and a positive public perception. AspenTech's emphasis on sustainability solutions directly addresses this need.

For instance, the increasing global focus on Environmental, Social, and Governance (ESG) metrics means companies are under pressure to demonstrate tangible improvements. A 2024 report by McKinsey indicated that companies with strong ESG performance often see a 20% higher valuation compared to their peers. AspenTech's software can directly contribute to these ESG scores by optimizing processes for reduced emissions and resource efficiency.

- Improved Environmental Performance: AspenTech's solutions can help clients achieve targets for emissions reduction, a key concern for community engagement.

- Enhanced Safety Standards: Demonstrating commitment to operational safety reassures local communities and stakeholders.

- Sustainability Reporting: Software that provides data for sustainability reports aids companies in transparently communicating their environmental efforts.

- Stakeholder Trust: By enabling cleaner and safer operations, AspenTech indirectly helps its clients foster better relationships with their communities.

Societal expectations are increasingly pushing industries to prioritize operational safety and robust risk management, with a growing public demand for responsible industrial practices. AspenTech's software directly addresses this by enhancing operational safety through predictive maintenance, which in 2024 was projected to reduce unplanned downtime by up to 30% in key sectors.

Consumers and investors increasingly expect companies to act responsibly and sustainably, with over 70% of investors in 2024 considering ESG performance. AspenTech's solutions help clients meet these commitments by enabling them to monitor and reduce emissions, as demonstrated by up to a 15% reduction in Scope 1 and Scope 2 emissions for clients using their emissions management software.

The industrial sector faces a demographic shift, with many experienced workers nearing retirement by 2024-2025, creating a need for knowledge transfer. AspenTech's platforms centralize operational data and use analytics to distill tacit knowledge, allowing newer generations to quickly gain insights and ensuring operational continuity.

| Societal Factor | Impact on Industry | AspenTech's Role | Supporting Data (2024/2025) |

|---|---|---|---|

| Demand for Safety & Risk Management | Increased scrutiny on industrial operations | Enhances safety via predictive maintenance | Up to 30% reduction in unplanned downtime |

| Focus on ESG & Sustainability | Investor and consumer pressure for responsible practices | Enables emissions reduction and resource optimization | Up to 15% reduction in Scope 1 & 2 emissions |

| Workforce Demographics (Retirements) | Risk of knowledge loss and skill gaps | Facilitates knowledge capture and skill augmentation | 40%+ of skilled trades workers aged 55+ (2023) |

Technological factors

Artificial intelligence and machine learning are revolutionizing process optimization in manufacturing, allowing for real-time data analysis, predictive maintenance, and smarter decision-making. AspenTech is at the forefront of this industrial AI wave, consistently enhancing its offerings to embed these powerful capabilities.

AspenTech's commitment to industrial AI provides customers with superior tools for boosting efficiency and driving growth. The market for AI in process optimization is experiencing significant expansion, with projections indicating substantial growth in the coming years.

Cloud computing's integration into manufacturing is now a necessity for digital advancement, offering scalability, improved data access, and cost efficiencies. AspenTech is strategically utilizing cloud platforms to deliver its software, fostering better teamwork and real-time operational insights worldwide.

The manufacturing cloud market is experiencing robust growth, with projections indicating a substantial expansion. For instance, the global cloud in manufacturing market was valued at approximately $30 billion in 2023 and is expected to reach over $70 billion by 2028, demonstrating a compound annual growth rate of around 18%.

The shift towards Industry 4.0 and the emerging Industry 5.0 is fundamentally reshaping industrial operations, prioritizing smart factories, the Internet of Things (IoT), and enhanced human-machine collaboration. This evolution directly fuels the demand for sophisticated, integrated software solutions that can manage these complex, interconnected environments. For instance, the global Industrial IoT market was projected to reach $110.2 billion in 2023, highlighting the scale of this technological adoption.

AspenTech's portfolio is strategically positioned to capitalize on these transformative trends. By offering solutions that facilitate interconnected systems, advanced analytics, and automation, AspenTech empowers industries to optimize their entire value chain. This integration leads to significant gains in resource efficiency and a marked improvement in quality control, crucial for competitiveness in the modern industrial landscape.

Digital Twin and Simulation Technologies

The growing power of digital twin and simulation technologies is revolutionizing how industries operate. These advanced tools allow for virtual testing and fine-tuning of industrial processes before any physical changes are made. This significantly de-risks innovation and directly boosts operational efficiency.

AspenTech is at the forefront of this technological shift, with its process modeling and simulation software playing a crucial role. For instance, in 2023, companies utilizing advanced simulation saw an average reduction of 15% in pilot plant costs and a 10% acceleration in time-to-market for new products. These platforms enable businesses to refine designs, optimize existing operations, and ultimately improve their bottom line.

- Accelerated Innovation: Digital twins allow rapid iteration and testing of new process designs, speeding up the development cycle.

- Risk Reduction: Simulating potential scenarios virtually helps identify and mitigate operational risks before they occur in the physical world.

- Performance Optimization: Continuous simulation of operational data allows for real-time adjustments to maximize efficiency and output.

- Cost Savings: Virtual testing reduces the need for expensive physical prototypes and minimizes costly operational errors.

Cybersecurity Requirements for Operational Technology (OT)

As industrial systems increasingly connect, robust cybersecurity for Operational Technology (OT) is critical to safeguard essential infrastructure. The escalating sophistication of cyber threats means that protecting these interconnected systems is no longer optional but a core necessity. For companies like AspenTech, whose software underpins vital industrial operations, this translates into a non-negotiable focus on security from the ground up.

AspenTech's role as a provider of mission-critical industrial software means its solutions must be inherently secure. This involves not only protecting AspenTech's own intellectual property but, more importantly, enabling clients to shield their digital assets and maintain uninterrupted operations. The financial implications of OT breaches are substantial, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, underscoring the economic imperative for strong cybersecurity measures.

- Increased Connectivity Risks: The convergence of IT and OT environments expands the attack surface for industrial control systems.

- Regulatory Scrutiny: Governments worldwide are implementing stricter regulations, such as the NIS2 Directive in Europe, mandating enhanced OT cybersecurity.

- Supply Chain Vulnerabilities: Cybersecurity must extend to the entire software supply chain, as demonstrated by incidents where third-party vulnerabilities have impacted critical infrastructure.

- Economic Impact: Downtime from OT cyber incidents can result in billions of dollars in lost revenue and recovery costs for affected industries.

The increasing power and accessibility of advanced analytics, including AI and machine learning, are transforming industrial operations. These technologies enable real-time data interpretation, predictive maintenance, and more informed decision-making, directly impacting efficiency and output.

AspenTech is strategically integrating these capabilities into its software, allowing clients to leverage industrial AI for enhanced process optimization. The market for AI in process optimization is growing rapidly; for example, it was projected to reach over $20 billion globally by 2025, indicating a significant trend.

The ongoing digital transformation, marked by Industry 4.0 and the nascent Industry 5.0, emphasizes smart factories and interconnected systems. This shift necessitates sophisticated software solutions like those offered by AspenTech, which facilitate automation and data integration across value chains. The global Industrial Internet of Things (IIoT) market, a key enabler of this trend, was expected to exceed $110 billion in 2023.

Digital twin and simulation technologies are also revolutionizing industrial processes by enabling virtual testing and refinement. This reduces the risks associated with innovation and significantly improves operational efficiency. AspenTech's simulation software, for instance, helps companies achieve faster time-to-market and reduce development costs, with users reporting an average 15% reduction in pilot plant costs in 2023.

| Technology Trend | Impact on Industry | AspenTech's Role | Market Growth Indicator (2023-2025 est.) |

|---|---|---|---|

| Industrial AI & Machine Learning | Enhanced process optimization, predictive maintenance | Core to AspenTech's portfolio | AI in Process Optimization: ~$20B by 2025 |

| Industry 4.0/5.0 & IoT | Smart factories, interconnected operations | Enables integrated, automated solutions | IIoT Market: ~$110B in 2023 |

| Digital Twins & Simulation | Virtual testing, risk reduction, faster innovation | Key software offerings for simulation | Simulation Software Market: Significant growth |

Legal factors

Global data privacy regulations like GDPR and CCPA are increasingly stringent, directly affecting how AspenTech handles sensitive operational data. Compliance is paramount, especially concerning the proprietary process information and performance metrics collected from client industrial operations. For instance, GDPR fines can reach up to 4% of global annual revenue, a significant risk for software providers.

As a software company, AspenTech's competitive edge hinges on robust intellectual property (IP) protection, encompassing patents, copyrights, and trade secrets. This necessitates stringent legal measures to thwart unauthorized access, replication, or reverse engineering of its core algorithms and software solutions. For instance, in 2023, software companies globally saw a significant increase in IP-related litigation, underscoring the importance of proactive legal defense.

Companies in the energy and chemicals industries, key markets for AspenTech, operate under increasingly strict environmental regulations. These laws govern everything from greenhouse gas emissions and wastewater discharge to the responsible use of natural resources. For instance, the U.S. Environmental Protection Agency (EPA) continually updates regulations like the Clean Air Act and Clean Water Act, impacting operational requirements for many AspenTech clients.

AspenTech's software solutions are designed to help these companies navigate and comply with these complex legal frameworks. Their platforms offer advanced capabilities for real-time monitoring of emissions, efficient waste management, and process optimization to minimize environmental footprints. This directly supports adherence to mandates such as those related to Scope 1, 2, and 3 emissions, crucial for corporate sustainability reporting and avoiding penalties.

Antitrust and Competition Laws

Antitrust and competition laws are critical for AspenTech, especially given its significant market share in industrial software. Regulatory bodies worldwide scrutinize mergers and acquisitions to prevent monopolies and ensure a level playing field. For instance, the European Commission's Directorate-General for Competition actively monitors market concentration to safeguard consumer interests and innovation.

AspenTech's acquisition by Emerson, completed in 2022, required extensive review and approval from various competition authorities. These processes ensure that such consolidations do not stifle competition or lead to higher prices for customers. The ongoing enforcement of these laws means AspenTech must continually assess its market practices to remain compliant across its global operations.

- Global Scrutiny: AspenTech operates in a sector where market consolidation is common, drawing attention from antitrust regulators in the US, EU, and Asia.

- Merger Approvals: The Emerson acquisition, valued at $11 billion, necessitated clearances from numerous competition agencies, highlighting the complexity of global M&A.

- Compliance Focus: Ongoing compliance with antitrust regulations is essential to avoid fines and maintain market access, impacting product bundling and pricing strategies.

Product Liability and Software Licensing Agreements

AspenTech's operations are heavily influenced by legal frameworks governing product liability and software licensing. The company's asset optimization software, crucial for industrial processes, necessitates meticulously crafted licensing agreements to define usage rights, intellectual property, and service level commitments. Failure to do so could lead to disputes and financial penalties.

Product liability risks are particularly significant given the critical nature of AspenTech's solutions in preventing operational failures and ensuring safety. A flaw in their software could result in substantial damages, impacting client operations and potentially leading to costly litigation. For instance, in 2023, the software industry saw ongoing scrutiny regarding data security breaches and the reliability of AI-driven applications, highlighting the increasing importance of robust legal safeguards.

- Software Licensing Compliance: AspenTech must ensure its licensing terms are comprehensive and legally sound, covering aspects like intellectual property protection and usage restrictions, especially with the rise of cloud-based deployments.

- Product Liability Mitigation: Rigorous testing, quality assurance, and adherence to international standards like ISO 27001 for information security are vital to minimize product liability claims arising from software malfunctions.

- Regulatory Adherence: Staying abreast of evolving regulations concerning software, data privacy, and cybersecurity across different jurisdictions is paramount to avoid legal challenges and maintain market access.

- Contractual Clarity: Clear and unambiguous contractual language in licensing agreements is essential to manage expectations and reduce the likelihood of disputes related to software performance and support.

AspenTech's adherence to global data privacy laws, such as GDPR and CCPA, is crucial, with potential fines reaching up to 4% of global annual revenue for non-compliance. The company's intellectual property, including proprietary algorithms, requires strong legal protection against unauthorized use, a challenge amplified by a global rise in IP litigation in 2023.

Environmental regulations impact AspenTech's clients in key sectors like energy and chemicals, necessitating software solutions for compliance with mandates on emissions and resource management. Antitrust laws are also a significant consideration, particularly after its $11 billion acquisition by Emerson in 2022, which required extensive global regulatory review to ensure market competition.

AspenTech must also navigate product liability and software licensing complexities, with robust contracts and rigorous quality assurance essential to mitigate risks. The increasing scrutiny on software reliability and data security in 2023 underscores the need for strong legal safeguards and adherence to standards like ISO 27001.

Environmental factors

The global push for net-zero emissions is a significant tailwind for AspenTech, as industries heavily reliant on complex processes are actively seeking ways to decarbonize. AspenTech's software solutions are designed to directly address this need, enabling clients to enhance energy efficiency and lower their carbon footprint.

AspenTech itself has set a clear target, committing to achieve net-zero greenhouse gas emissions by 2045, aligning its internal operations with the external market demand for sustainable solutions.

The growing emphasis on Carbon Capture, Utilization, and Storage (CCUS) presents a significant market opening for AspenTech. As industries worldwide aim to reduce their carbon footprint, the demand for effective CCUS solutions is surging. For instance, the International Energy Agency (IEA) projects that CCUS capacity needs to grow substantially by 2030 to meet climate goals, indicating a robust expansion of this sector.

AspenTech is well-positioned to capitalize on this trend with its advanced strategic planning and optimization software tailored for CCUS projects. These solutions empower clients to meticulously plan their CCUS investments, ensuring efficient project execution and maximizing the return on substantial capital expenditures. This capability is crucial for navigating the complexities and financial stakes involved in large-scale CCUS deployments.

Environmental pressures are pushing industries toward greater resource efficiency and waste reduction, with a growing emphasis on circular economy models. AspenTech's solutions directly support these goals by enhancing process yields and minimizing material and energy usage throughout an asset's life. For instance, their software helps chemical manufacturers reduce waste by optimizing reaction conditions, leading to fewer byproducts and lower disposal costs.

Water Management and Conservation

Water scarcity is a significant environmental factor impacting process industries, leading to increased scrutiny and stricter regulations on industrial water discharge. These pressures drive demand for solutions that enhance water management and conservation within manufacturing operations.

AspenTech's core competencies in asset optimization and process modeling are directly applicable to addressing these challenges. By enabling detailed simulation and analysis of water usage and treatment, their software helps companies identify inefficiencies and implement strategies for reduced consumption and improved wastewater management.

For instance, the World Resources Institute reported in 2023 that over 2 billion people live in countries experiencing high water stress, a figure projected to rise. This underscores the growing imperative for industries to adopt more sustainable water practices, a need AspenTech's solutions can help fulfill.

- Global Water Stress: Over 2 billion people faced high water stress in 2023, highlighting the urgency for industrial water conservation.

- Regulatory Impact: Stricter regulations on industrial water discharge are compelling companies to invest in advanced water management technologies.

- AspenTech's Role: Process optimization software can significantly improve water efficiency and reduce wastewater in industrial facilities.

Transition to Sustainable Materials and Bio-based Products

The chemical and process industries are actively shifting towards sustainable and bio-based feedstocks, driven by both regulatory pressures and consumer demand for greener products. This transition is a significant environmental factor impacting companies like AspenTech.

AspenTech's process modeling and simulation software plays a crucial role in this shift. These tools are instrumental in the research, development, and efficient scaling-up of production processes for novel sustainable materials and bio-based products, thereby enabling companies to build more environmentally conscious product portfolios.

For instance, the global bio-based chemicals market was valued at approximately $235.5 billion in 2023 and is projected to reach $470.1 billion by 2030, growing at a compound annual growth rate of 10.3% according to some market analyses. This growth highlights the increasing investment and innovation in this sector.

- Market Growth: The bio-based chemicals market is experiencing robust growth, indicating a strong industry-wide push for sustainable alternatives.

- Technological Enablement: AspenTech's simulation tools are vital for optimizing the complex processes involved in producing these new materials.

- Environmental Impact: Facilitating the adoption of bio-based products directly contributes to reducing reliance on fossil fuels and lowering carbon footprints.

- Innovation Support: The software aids in accelerating the R&D cycle for sustainable materials, bringing greener solutions to market faster.

The increasing global focus on sustainability and decarbonization directly benefits AspenTech, as industries seek to optimize operations for reduced environmental impact. AspenTech's software is crucial for enhancing energy efficiency and lowering carbon emissions across various sectors.

The growing demand for carbon capture technologies presents a significant opportunity, with the IEA projecting substantial growth in CCUS capacity needed by 2030 to meet climate targets. AspenTech's advanced solutions aid clients in planning and executing these complex, capital-intensive projects effectively.

Water scarcity, exacerbated by increasing global water stress—affecting over 2 billion people as of 2023—is driving stricter regulations on industrial water discharge. AspenTech's process optimization tools help companies improve water management and reduce consumption, aligning with sustainability goals.

The shift towards bio-based feedstocks, with the bio-based chemicals market projected to grow significantly, is supported by AspenTech's simulation software. These tools are vital for developing and scaling up production processes for sustainable materials, reducing reliance on fossil fuels.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aspen Tech is built on a robust foundation of data from reputable sources, including industry-specific market research reports, government economic indicators, and leading technology publications. We meticulously gather information on political stability, economic growth forecasts, and emerging technological trends to provide a comprehensive view.