Asia Health Century International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asia Health Century International Bundle

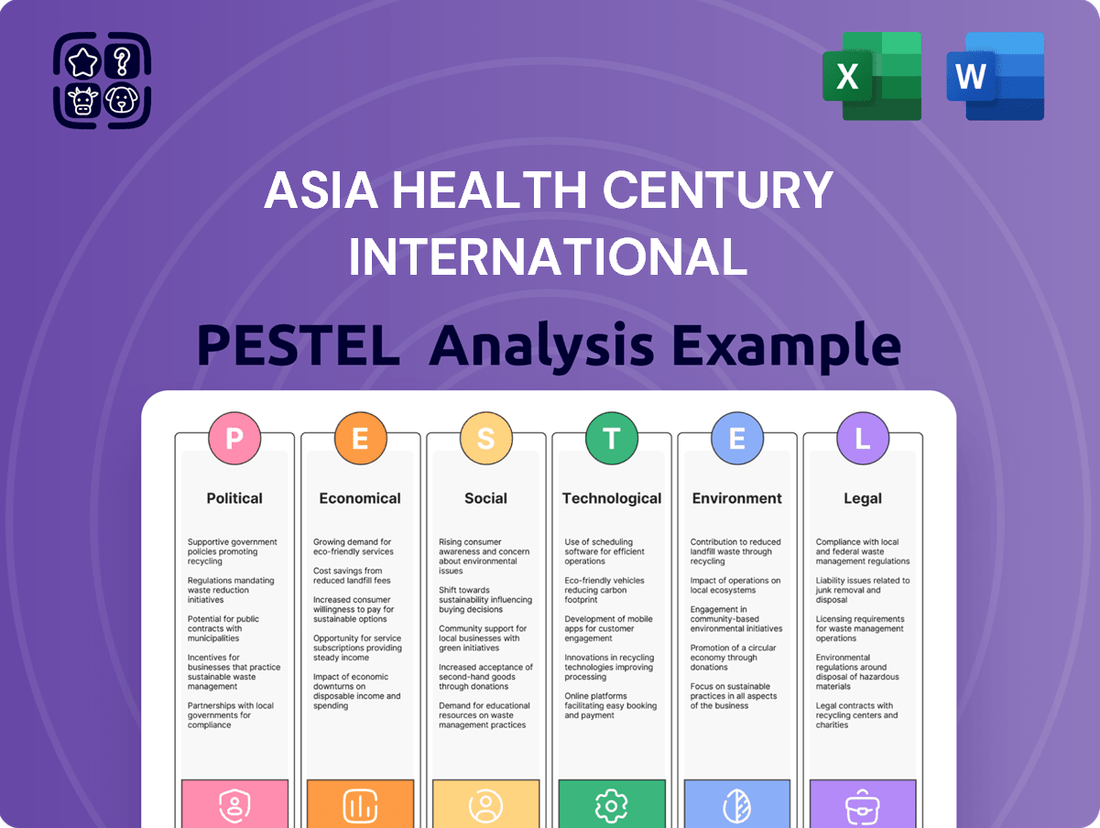

Unlock critical insights into Asia Health Century International's operating environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its future, and gain a strategic advantage. Download the full report for actionable intelligence to inform your decisions.

Political factors

China's government is significantly advancing its medical and healthcare reforms throughout 2024 and into 2025. This strategic push focuses on enhancing public healthcare accessibility, bolstering public hospitals, and overhauling medicine-related policies to create a more efficient and patient-centered system.

Key initiatives, such as expanding pediatric services and strengthening psychological support, are slated for full implementation by 2025, as detailed by the National Health Commission (NHC). These reforms are designed to lower healthcare costs for citizens and modernize the overall delivery of medical services.

China's healthcare sector has seen a notable easing of foreign investment rules, especially for hospitals and biotech. This move, effective from September 2024, allows foreign entities to fully own hospitals in key areas like Beijing, Shanghai, and Hainan.

This strategic opening aims to bring in international medical knowledge and funding, though some limitations persist. For instance, traditional Chinese medicine hospitals and the acquisition of existing public hospitals still face restrictions, indicating a targeted approach to liberalization.

Asia Health Century International faces heightened scrutiny due to the ongoing national anti-corruption campaign, which intensified in 2024-2025. This initiative, launched in mid-2023, is designed to boost transparency and adherence to regulations across the healthcare industry.

While the campaign primarily targets corrupt practices among public health officials, its ripple effects extend to businesses. Companies like Asia Health Century International can expect more rigorous compliance checks, potentially leading to slower procurement processes and delivery schedules as new regulations are implemented and enforced.

National Reimbursement Drug List (NRDL) Negotiations

The National Healthcare Security Administration (NHSA) is set to implement its latest National Reimbursement Drug List (NRDL) in 2025. These negotiations are designed to lower drug costs across the board.

However, the inclusion of more innovative drugs in the NRDL, supported by government policies and financial subsidies, presents a significant opportunity for the innovative drug sector. This dynamic directly influences market access and pricing strategies for pharmaceutical and biotech firms.

- NRDL Update: The latest NRDL revisions are scheduled for implementation in 2025, impacting drug pricing and market access.

- Innovation Focus: Increased coverage for innovative drugs within the NRDL is a key trend, driven by policy support and subsidies.

- Sector Impact: Pharmaceutical and biotech companies will see shifts in market access and pricing power due to these negotiations.

- Market Dynamics: For example, in 2023, China's NRDL negotiations resulted in 121 new drugs being added, with 29 of them being innovative therapies, highlighting the ongoing trend towards greater inclusion of novel treatments.

'Healthy China 2030' Initiative

The 'Healthy China 2030' initiative remains a cornerstone of China's public health policy, driving significant investment and reform across the healthcare landscape. This ambitious plan prioritizes strengthening primary healthcare services, promoting health equity, and fostering collaboration between different sectors to build a sustainable and people-centric healthcare system. The government's focus on developing 'new productive forces' is directly integrated into this initiative, aiming to boost the quality, efficiency, and sustainability of the healthcare industry.

This national strategy directly influences long-term investment and development priorities within the healthcare sector, signaling a robust future for health-related industries. For instance, in 2024, China's healthcare spending was projected to reach approximately $1.5 trillion USD, a testament to the government's commitment to the 'Healthy China 2030' agenda. This aligns with the broader economic objective of modernizing industries through innovation and improved productivity.

- Primary Care Enhancement: Increased funding and policy support for grassroots medical institutions.

- Health Equity Focus: Efforts to reduce disparities in healthcare access and outcomes across urban and rural areas.

- Cross-Sector Collaboration: Integration of health considerations into policies affecting food, environment, and lifestyle.

- Innovation in Healthcare: Promotion of digital health, AI in diagnostics, and biopharmaceutical advancements.

China's ongoing healthcare reforms, particularly those focusing on accessibility and medical policy overhauls through 2024-2025, create a dynamic regulatory environment. The National Health Commission's push for enhanced pediatric and psychological services by 2025 aims to modernize healthcare delivery and reduce patient costs.

The government's anti-corruption drive, intensified in 2024-2025, means companies like Asia Health Century International face stricter compliance checks, potentially impacting operational timelines. Simultaneously, the National Reimbursement Drug List (NRDL) updates for 2025 will influence drug pricing and market access, with a notable trend of including more innovative therapies, as seen with 29 innovative drugs added in the 2023 NRDL negotiations.

| Policy Area | 2024-2025 Focus | Impact on Asia Health Century International | Key Data Point |

|---|---|---|---|

| Healthcare Reform | Accessibility, hospital upgrades, medicine policies | Modernized operational landscape, potential for new service opportunities | National Health Commission initiatives by 2025 |

| Anti-Corruption Campaign | Increased transparency and regulation | Heightened compliance scrutiny, potential process delays | Intensified mid-2023 onwards |

| NRDL Updates | Drug pricing, market access for innovative drugs | Shifts in pricing power and market entry for pharmaceuticals | 2025 implementation, 29 innovative drugs added in 2023 NRDL |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Asia Health Century International across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by detailing how these factors present both challenges and opportunities for the organization's growth and sustainability.

A concise, actionable summary of the Asia Health Century International PESTLE analysis, designed to quickly identify and address critical external factors impacting strategic decisions.

Economic factors

Growing healthcare expenditure in Asia, particularly in China, presents a significant economic factor. China's healthcare spending is expected to see a steady increase from 2024 to 2028, with an estimated compound annual growth rate of around 4.65%. This upward trend suggests a dynamic market with expanding opportunities.

Government investment is a key driver, with public health expenditure projected to reach 65.8% of total current health expenditure by 2028. This substantial government commitment underscores the sector's importance and signals continued financial backing for healthcare development.

Private health expenditure per capita in China is projected to grow steadily from 2024 to 2028, with an estimated compound annual growth rate (CAGR) of around 2.92%. This upward trend is driven by advancements in healthcare technology, shifts in insurance policies, and changing demographics.

The expansion of commercial medical insurance, potentially bolstered by tax incentives, is poised to channel new financial resources into high-quality, innovative medical treatments and services.

China's proactive fiscal stimulus, exemplified by a significant package in September 2024, is poised to invigorate the healthcare industry. This injection of funds is anticipated to drive up domestic consumption, directly benefiting segments like medical services and drug retail chains.

Despite prevailing global economic headwinds, China demonstrated resilience with a 5% GDP growth in 2024. The nation's economic strategy for 2025 remains firmly anchored on rekindling domestic demand, a trend that will likely continue to support the healthcare sector's expansion.

Medical Equipment Upgrade Program

The Chinese government's Medical Equipment Upgrade Program, initiated in late 2024, is poised for significant expansion in the first quarter of 2025. This initiative is projected to inject substantial capital into the healthcare sector, directly benefiting domestic manufacturers.

Large-scale investments are anticipated in advanced medical imaging and radiotherapy equipment, areas where Chinese manufacturers have been steadily increasing their capabilities. This program represents a key economic driver for the sector, aiming to modernize healthcare infrastructure across the nation.

- Program Launch: Late 2024, with anticipated momentum in Q1 2025.

- Key Investment Areas: Medical imaging and radiotherapy equipment.

- Projected Impact: Significant revenue growth for Chinese healthcare equipment manufacturers.

- Economic Driver: Modernization of national healthcare infrastructure.

Market Opportunities for Private Hospitals

China's growing middle class is increasingly prioritizing health and well-being, driving demand for enhanced healthcare services. This demographic shift fuels significant market opportunities for private hospitals and clinics seeking to offer more personalized and efficient care. For instance, by 2023, China's healthcare spending was projected to reach over $1.4 trillion, with private healthcare expected to capture a larger share.

While public hospitals remain crucial, the sheer volume of private institutions highlights the market's expansion potential. As of late 2023, China had over 360,000 registered medical institutions, with private entities representing a substantial portion, offering a fertile ground for investment and service innovation.

- Growing Health Consciousness: An increasing number of Chinese citizens are willing to pay for higher quality and more convenient healthcare.

- Expansion of Private Sector: The number of private medical institutions continues to rise, outnumbering public facilities in many regions.

- Government Support: Policies encouraging private sector participation in healthcare are creating a more favorable investment climate.

- Technological Integration: Private hospitals are leveraging advanced medical technology and digital platforms to offer specialized services.

China's economic resilience, evidenced by its 5% GDP growth in 2024, directly fuels healthcare sector expansion. The government's focus on domestic demand in 2025, coupled with fiscal stimulus measures like the September 2024 package, is expected to boost consumption in medical services and drug retail.

The Medical Equipment Upgrade Program, launched late 2024 and gaining traction in Q1 2025, will inject capital into medical imaging and radiotherapy, benefiting domestic manufacturers. This program is a significant economic driver for modernizing national healthcare infrastructure.

The growing middle class's prioritization of health drives demand for enhanced services, particularly from private hospitals. By late 2023, China's healthcare spending exceeded $1.4 trillion, with private entities increasingly capturing market share among the over 360,000 registered medical institutions.

| Economic Factor | 2024 Data/Projection | 2025 Outlook | Impact on Healthcare |

|---|---|---|---|

| China GDP Growth | 5% (2024) | Continued growth driven by domestic demand | Supports increased healthcare spending |

| Healthcare Spending Growth (China) | CAGR ~4.65% (2024-2028) | Continued upward trend | Expands market opportunities |

| Medical Equipment Upgrade Program | Launched late 2024 | Momentum in Q1 2025 | Boosts domestic manufacturers, modernizes infrastructure |

| Private Healthcare Expenditure per Capita (China) | CAGR ~2.92% (2024-2028) | Steady growth | Increases demand for private services |

Preview Before You Purchase

Asia Health Century International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Asia Health Century International covers all key political, economic, social, technological, legal, and environmental factors impacting the sector. You'll gain immediate access to this detailed report, enabling you to make informed strategic decisions.

Sociological factors

China's demographic landscape is rapidly evolving, with projections indicating nearly 28% of its population will be over 60 by 2040. This substantial aging trend, a result of increased life expectancy and lower birth rates, is a significant driver for healthcare demand.

This demographic shift directly translates to a heightened need for geriatric care, chronic disease management, and long-term care facilities. Consequently, existing healthcare infrastructure faces increased strain, necessitating expansions and upgrades to meet the growing patient needs and ensure affordability of services.

A significant shift is underway in China, with the burgeoning middle class increasingly prioritizing their health. This heightened awareness translates into a demand for superior, tailored healthcare experiences, fueling growth in private medical facilities and the adoption of cutting-edge medical innovations.

By 2023, China's healthcare market was valued at approximately $1.3 trillion, with projections indicating continued robust expansion driven by these evolving consumer expectations. This surge in demand is particularly evident in specialized medical fields and the uptake of advanced diagnostic and treatment technologies.

Despite ongoing healthcare reforms, significant disparities in access to quality medical services persist across Asia, particularly between bustling urban centers and more remote rural regions. This uneven distribution remains a critical challenge for healthcare systems throughout the continent.

Governments are actively working to bridge this gap. A key strategy involves directing high-quality medical resources and expertise towards central, western, and northeastern areas, aiming to bolster healthcare infrastructure where it's most needed. Simultaneously, there's a concerted effort to strengthen community-level healthcare services, making primary care more accessible and effective for all citizens.

Shortage of Healthcare Professionals

China's healthcare system is grappling with a significant shortage of medical professionals, particularly impacting rural regions. This deficiency translates into extended wait times for patients and contributes to high burnout rates among the dedicated staff who remain.

To address this, initiatives are underway to incentivize medical graduates to serve in community health settings and to enhance operational efficiency. Leveraging digital health services is a key strategy in this effort, aiming to streamline patient care and alleviate pressure on existing resources.

- Rural Healthcare Gap: Reports indicate a substantial disparity in doctor-to-patient ratios between urban centers and rural areas in China, exacerbating access issues for a large segment of the population.

- Burnout Statistics: Studies from 2024 highlighted that over 60% of primary care physicians in underserved Chinese provinces reported experiencing moderate to severe burnout due to heavy workloads and limited support.

- Digital Health Adoption: By the end of 2025, China aims to have over 80% of its community health centers equipped with basic digital diagnostic and telemedicine capabilities to improve service delivery.

Changing Patient Engagement and Preferences

Patients are no longer passive recipients of care; they are actively engaging in their health decisions. This trend is amplified by a strong preference for digital health solutions. For instance, by the end of 2024, it's projected that over 70% of healthcare consumers will have utilized at least one form of telehealth service, reflecting a significant leap from previous years.

This evolving patient dynamic is largely fueled by the desire for greater accessibility and convenience, coupled with rapid technological advancements. Remote patient monitoring, for example, saw a significant uptake, with market research indicating a 25% year-over-year growth in adoption for chronic condition management in the Asia-Pacific region during 2024.

The shift towards digital engagement is reshaping healthcare delivery models. This includes:

- Increased demand for teleconsultations: Patients seek convenient access to medical advice without geographical barriers.

- Growth in remote monitoring adoption: Wearable technology and connected devices are enabling continuous health tracking.

- Patient empowerment through information access: Online resources and patient portals allow individuals to research conditions and treatment options.

- Preference for personalized health experiences: Consumers expect tailored communication and care plans based on their individual needs and preferences.

Sociological factors significantly shape healthcare demand and delivery across Asia. China's aging population, projected to have nearly 28% over 60 by 2040, drives demand for geriatric and chronic care services. This demographic shift strains existing infrastructure, necessitating expansions and upgrades to meet growing patient needs and ensure service affordability.

The rising middle class in China increasingly prioritizes health, fueling demand for premium private facilities and advanced medical innovations. By 2023, China's healthcare market reached approximately $1.3 trillion, with strong growth anticipated due to these evolving consumer expectations, particularly in specialized medical fields.

Persistent disparities in healthcare access between urban and rural areas across Asia remain a critical challenge. Governments are actively working to bridge this gap by directing resources to underserved regions and strengthening community-level primary care services to improve accessibility and effectiveness for all citizens.

A notable trend is the increasing patient engagement in health decisions, amplified by a strong preference for digital health solutions. By the end of 2024, over 70% of healthcare consumers are projected to have used telehealth services, reflecting a significant shift towards convenience and accessibility.

| Factor | Trend | Impact | Data Point |

|---|---|---|---|

| Aging Population | Increasing proportion of elderly citizens | Higher demand for geriatric and chronic care | China: ~28% over 60 by 2040 |

| Rising Middle Class | Increased disposable income and health consciousness | Demand for premium healthcare and innovation | China Healthcare Market: ~$1.3 trillion (2023) |

| Digital Health Adoption | Growing use of telehealth and remote monitoring | Improved accessibility and patient convenience | Telehealth Use: >70% of consumers by end of 2024 |

| Rural-Urban Disparity | Uneven distribution of quality medical services | Access challenges in remote areas | Doctor-to-patient ratios significantly lower in rural China |

Technological factors

China's digital health sector is rapidly evolving, fueled by urban innovation and strong government backing. This transformation centers on enhancing data management through widespread adoption of Electronic Health Records (EHR) and Health Information Exchange (HIE) platforms. The implementation of unique patient identifiers is a key strategy to streamline data flow and improve patient care coordination.

The digital health market in China is poised for substantial expansion, with projections indicating a compound annual growth rate (CAGR) of 17.5% between 2024 and 2032. This robust growth underscores the increasing investment and adoption of digital technologies within the healthcare industry, promising significant opportunities for innovation and improved healthcare delivery.

Artificial Intelligence and smart technologies are revolutionizing healthcare, impacting everything from research to patient care. AI's use in life sciences R&D is expected to surge, growing from 16% in 2024 to 42% by 2029, demonstrating its increasing importance in drug discovery and development.

These advancements are enhancing precision in manufacturing processes and enabling more patient-centric operations. This integration of AI is a key technological driver shaping the future of healthcare delivery and innovation.

The growth of telemedicine and remote patient monitoring is significantly reshaping healthcare delivery across Asia. Following the pandemic, these services have seen a surge, with global telehealth consultations rising by over 35% in 2024 alone. This expansion directly fuels the demand for digital health technologies and wearable devices.

This digital shift is crucial for Asia Health Century International, as it enhances access to medical care, particularly in remote areas, while also driving down overall healthcare costs. The efficiency gains are especially notable in managing chronic conditions, making remote monitoring a key strategy for improving patient outcomes and operational effectiveness.

Medical Equipment Innovation and Localization

China's robust manufacturing base is increasingly channeled into the medical equipment sector, with a strong national directive to prioritize locally developed technologies. This drive is evident in the growing adoption of domestic medtech products across the healthcare system.

Despite continued reliance on imported advanced medical technologies, domestic innovation remains a cornerstone of China's strategy. Initiatives like Made in China 2025 underscore this commitment, aiming to significantly decrease dependence on foreign suppliers.

The Chinese government has actively supported domestic medtech firms, leading to notable advancements. For instance, by the end of 2023, China's medical device market was projected to reach approximately $150 billion, with domestic brands capturing an increasing share.

- Manufacturing Prowess: China's established manufacturing capabilities provide a strong foundation for producing a wide range of medical equipment.

- Localization Drive: A clear policy push favors the adoption and development of local medtech solutions.

- Innovation Focus: Strategic initiatives like Made in China 2025 are accelerating domestic R&D in advanced medical technologies.

- Market Growth: The Chinese medical device market is expanding rapidly, offering significant opportunities for both domestic and international players, with local firms gaining traction.

Data Connectivity and Interoperable Platforms

Greater data connectivity and interoperable, secure platforms are poised to redefine healthcare delivery in China. The nation is actively working to overcome fragmented IT systems and complex regulations to achieve seamless data integration, which is crucial for enhancing medical record accuracy. For instance, by 2025, China aims to have a significant portion of its healthcare data accessible through integrated platforms, improving diagnostic capabilities and patient care efficiency.

These advancements are critical for Asia Health Century International as they facilitate better data management and analysis, leading to more informed strategic decisions. The push for interoperability means that disparate systems within hospitals and across regions can communicate, creating a more holistic view of patient health. This technological evolution is expected to drive significant investment in health tech infrastructure throughout the region.

- Improved Data Accuracy: Interoperable platforms reduce manual data entry errors, leading to more reliable patient information.

- Enhanced Efficiency: Seamless data flow streamlines administrative processes and clinical workflows.

- Better Patient Outcomes: Access to comprehensive patient histories supports more accurate diagnoses and personalized treatment plans.

- Growth Opportunities: The demand for secure, connected health platforms creates new market opportunities for technology providers.

Technological advancements are fundamentally reshaping healthcare in Asia, driven by digital health adoption and AI integration. China's digital health market, projected to grow at a 17.5% CAGR from 2024-2032, exemplifies this trend, with Electronic Health Records and Health Information Exchange platforms becoming standard. AI's role in life sciences R&D is set to skyrocket, from 16% in 2024 to 42% by 2029, enhancing precision in manufacturing and patient-centric care.

Telemedicine and remote patient monitoring are expanding rapidly, with global telehealth consultations up over 35% in 2024, boosting demand for digital health tech and wearables. China's manufacturing strength supports a growing domestic medtech sector, aiming to reduce reliance on imports, with its medical device market expected to reach $150 billion by end-2023.

Greater data connectivity and interoperable platforms are crucial for improving healthcare delivery. China aims for significant healthcare data accessibility through integrated platforms by 2025, enhancing diagnostic capabilities and patient care efficiency.

| Key Technological Trend | 2024 Status/Projection | Impact on Asia Health Century International |

| Digital Health Market Growth (China) | 17.5% CAGR (2024-2032) | Increased demand for digital health solutions and infrastructure. |

| AI in Life Sciences R&D | 16% (2024) to 42% (2029) | Opportunities in AI-driven drug discovery and advanced diagnostics. |

| Telehealth Consultations | >35% rise (2024) | Growth in demand for remote monitoring and telemedicine platforms. |

| China Medical Device Market | ~$150 billion (end-2023 projection) | Opportunities in manufacturing and supplying medical equipment, with a focus on domestic innovation. |

Legal factors

Recent policy shifts in September and November 2024 by China's MOFCOM, NHC, and NMPA have notably eased foreign investment rules for the healthcare sector. These changes permit wholly foreign-owned hospitals in designated pilot zones, signaling a significant opening for international players in the hospital market.

This relaxation, however, comes with specific stipulations. For instance, investments in traditional Chinese medicine hospitals remain restricted, and the acquisition of existing public hospitals is still prohibited, creating a nuanced landscape for foreign capital.

In early 2025, China's State Administration for Market Regulation (SAMR) issued new 'Compliance Guidelines for Healthcare Companies to Prevent Commercial Bribery Risks'. This initiative is a key component of the nation's sustained anti-corruption efforts, directly impacting Asia Health Century International by intensifying regulatory oversight.

These guidelines mandate that healthcare businesses, including Asia Health Century International, must significantly bolster their internal compliance structures. The aim is to proactively identify and reduce the potential for commercial bribery, a move that reflects a broader trend of increased accountability within the sector.

China's National Medical Products Administration (NMPA) is actively refining its drug and medical device safety and quality oversight. New standards, such as the 'Medical Device Manufacturing Quality Management Standards' released in January 2025, signal a proactive approach to product integrity.

These updates also include provisions for whistleblowers, encouraging the reporting of quality concerns, which is crucial for maintaining high safety benchmarks in the rapidly evolving healthcare sector.

Healthcare Insurance System Reforms

China's ongoing healthcare insurance system reforms are a significant legal factor for Asia Health Century International. These reforms aim to enhance coverage and manage medical expenses more effectively. For instance, the expansion of the National Reimbursement Drug List (NRDL) is a key element, influencing which innovative treatments become accessible and affordable for a larger population.

Commercial medical insurance is also evolving, with potential tax deductions being explored. These incentives could unlock new avenues for funding advanced medical technologies and specialized healthcare services. In 2024, China's National Healthcare Security Administration (NHSA) continued to refine its policies, impacting drug pricing and market entry for pharmaceutical companies.

The NRDL negotiations are pivotal, directly affecting drug pricing and market access. Companies that successfully negotiate inclusion on the list can see substantial sales growth. By the end of 2023, the NRDL included over 300 drugs, with ongoing reviews and updates expected to incorporate more innovative therapies in 2024 and 2025, reflecting a dynamic regulatory landscape.

- Policy Focus: China's government is actively reforming its healthcare insurance to improve accessibility and control costs.

- Commercial Insurance Growth: Potential tax deductions for commercial medical insurance could boost investment in new healthcare solutions.

- NRDL Impact: Inclusion on the National Reimbursement Drug List is critical for drug pricing and market penetration.

- Regulatory Evolution: Expect continued policy adjustments in 2024 and 2025 impacting drug access and healthcare service provision.

Data Privacy and Cybersecurity Regulations

Data privacy and cybersecurity are becoming increasingly critical. Regulatory bodies in North America and Europe significantly tightened data privacy laws throughout 2024 and into 2025. This heightened scrutiny impacts global operations, including those of companies in China, by necessitating a stronger focus on secure device design and data handling practices.

While China's specific data privacy regulations are in constant flux, the overarching global trend toward greater data protection is undeniable. Companies must prioritize secure and compliant digital solutions to navigate this evolving landscape. For instance, the global cybersecurity market was projected to reach over $200 billion in 2024, underscoring the significant investment and attention this area is receiving.

- Global Cybersecurity Market Growth: Projected to exceed $200 billion in 2024, reflecting increased regulatory and consumer demand for data protection.

- North American and European Regulatory Tightening: Significant increases in data privacy law enforcement and penalties observed during 2024-2025.

- Impact on Chinese Companies: Need to adapt global product development to meet stringent international data privacy standards.

- Evolving Chinese Regulations: Continuous updates to China's Personal Information Protection Law (PIPL) and related cybersecurity measures require ongoing compliance efforts.

China's legal landscape for healthcare is dynamic, with policy shifts in late 2024 and early 2025 impacting foreign investment and regulatory oversight. New compliance guidelines from SAMR in early 2025 intensify scrutiny on commercial bribery, requiring robust internal controls.

The NMPA's updated standards, like the January 2025 'Medical Device Manufacturing Quality Management Standards,' emphasize product integrity and include whistleblower protections.

Reforms to China's healthcare insurance system, including NRDL expansion, directly influence drug pricing and market access, with the NRDL covering over 300 drugs by late 2023 and undergoing continuous updates. Data privacy regulations are also tightening globally, necessitating compliance with international standards.

| Regulatory Area | Key Developments (2024-2025) | Impact on Asia Health Century International |

|---|---|---|

| Foreign Investment | Easing of rules for wholly foreign-owned hospitals in pilot zones (Sept/Nov 2024) | Opens new avenues for market entry, but restrictions on TCM hospitals and public hospital acquisitions remain. |

| Compliance & Anti-Corruption | SAMR's 'Compliance Guidelines for Healthcare Companies to Prevent Commercial Bribery Risks' (Early 2025) | Requires enhanced internal compliance structures and increased regulatory oversight. |

| Product Quality & Safety | NMPA's 'Medical Device Manufacturing Quality Management Standards' (Jan 2025) | Mandates higher product integrity and safety benchmarks. |

| Healthcare Insurance & Pricing | NRDL expansion and potential tax deductions for commercial insurance (Ongoing 2024-2025) | Critical for drug pricing and market penetration; inclusion on NRDL is vital for sales growth. |

| Data Privacy & Cybersecurity | Global tightening of data privacy laws (2024-2025); China's PIPL updates | Necessitates strong focus on secure data handling and compliant digital solutions to meet international standards. |

Environmental factors

China's commitment to sustainable healthcare systems is a key environmental driver, emphasized by initiatives like the 'Healthy China 2030' plan. This strategy aims to integrate environmental considerations into healthcare infrastructure and practices, promoting a healthier population and planet.

The push for 'new productive forces' in China's healthcare sector is directly linked to environmental sustainability. This involves adopting advanced technologies and efficient processes to minimize waste and energy consumption, thereby reducing the industry's carbon footprint. For instance, the adoption of digital health records and telemedicine reduces the need for paper and physical travel, contributing to a greener healthcare ecosystem.

By 2025, China aims to significantly reduce the carbon emissions intensity of its healthcare sector. While specific figures for 2024/2025 are still emerging, the trend indicates a strong focus on energy efficiency in hospitals and clinics, with investments in renewable energy sources and eco-friendly building materials becoming more prevalent.

Hospitals are increasingly focused on resource efficiency, driven by both environmental responsibility and the economic imperative to manage costs. This trend is evident in the growing adoption of energy-saving technologies, such as LED lighting and smart building management systems, which can significantly reduce operational expenses. For instance, many healthcare facilities are investing in renewable energy sources, aiming to lower their carbon footprint while also hedging against volatile energy prices.

Optimizing operational workflows is another key aspect of resource efficiency in healthcare. This involves strategies to minimize waste, from reducing single-use plastics and improving inventory management to implementing robust recycling programs. The global healthcare sector's waste generation is substantial, and initiatives to curb this are gaining momentum.

In 2024, the healthcare industry continued to see a push for sustainability, with many organizations setting ambitious targets for waste reduction and energy consumption. For example, some hospital networks reported achieving double-digit percentage reductions in energy use per patient day through targeted efficiency upgrades and behavioral changes among staff. This focus on sustainability not only addresses environmental concerns but also contributes to long-term financial resilience.

Climate change poses a significant threat to public health across Asia, potentially altering disease patterns and increasing the burden on healthcare systems. For instance, rising global temperatures are linked to the expansion of vector-borne diseases like dengue fever, with the World Health Organization reporting a 30-fold increase in incidence between 1970 and 2019. This surge necessitates enhanced preparedness and robust infrastructure to manage growing healthcare demands.

Waste Management in Medical Institutions

Effective waste management is a paramount environmental concern for medical institutions across Asia, directly impacting public health and ecological balance. Adherence to stringent disposal regulations, such as those mandated by the World Health Organization (WHO) and national environmental protection agencies, is crucial to prevent the spread of infections and contamination. For instance, in 2024, many Asian countries are updating their medical waste management protocols to align with global best practices, emphasizing segregation at source and the use of advanced treatment technologies.

The implementation of practices that minimize environmental contamination is a key focus. This includes investing in technologies like autoclaving, incineration with emission controls, and chemical disinfection for hazardous medical waste. A 2025 report indicated that healthcare facilities investing in modern waste treatment methods saw a reduction in their environmental footprint by up to 30% compared to older, less regulated disposal methods.

- Regulatory Compliance: Hospitals must comply with national and international standards for medical waste disposal, which are becoming increasingly rigorous.

- Technology Adoption: Investment in advanced waste treatment technologies, such as autoclaves and controlled incineration, is essential for minimizing environmental impact.

- Waste Reduction Strategies: Implementing practices like waste segregation at the point of generation and promoting the use of reusable medical supplies can significantly reduce overall waste volume.

- Environmental Monitoring: Regular monitoring of air and water quality around healthcare facilities is necessary to ensure no harmful substances are being released due to waste management practices.

Green Building and Infrastructure Development

As new medical facilities are constructed and older ones are renovated across Asia, there's a significant push towards green building and sustainable infrastructure. This trend is driven by a desire for reduced operational costs and a commitment to environmental responsibility.

This focus translates into designing healthcare spaces that are energy-efficient, often incorporating features like advanced insulation and smart HVAC systems. The use of sustainable and recycled materials is also becoming a standard practice in these developments.

For instance, by 2025, it's projected that the global green building market will reach over $370 billion, with Asia being a key growth driver. Many new hospital projects in countries like Singapore and South Korea are targeting LEED Platinum or equivalent certifications.

- Energy Efficiency: Hospitals are implementing technologies to reduce energy consumption, a major operational cost.

- Sustainable Materials: The use of recycled steel, low-VOC paints, and sustainably sourced wood is increasing.

- Water Conservation: Rainwater harvesting and low-flow fixtures are becoming common in new construction.

- Improved Air Quality: Advanced filtration systems and natural ventilation are prioritized for patient and staff well-being.

Asia's healthcare sector faces growing pressure from climate change, with rising temperatures potentially expanding vector-borne diseases like dengue fever, as noted by the WHO's reported increase in incidence. This escalating health risk demands enhanced preparedness and robust infrastructure to manage increased healthcare demands.

Effective medical waste management is critical for public health and ecological balance across Asia. Many Asian nations are updating their protocols in 2024 to align with global best practices, emphasizing source segregation and advanced treatment technologies. For example, facilities adopting modern waste treatment methods saw up to a 30% reduction in their environmental footprint by 2025.

The push for green building in Asian healthcare infrastructure is significant, with new projects in Singapore and South Korea targeting high LEED certifications. This trend aims to reduce operational costs and environmental impact through energy efficiency and sustainable materials, reflecting a broader market growth projected to exceed $370 billion globally by 2025.

| Environmental Factor | Impact on Healthcare | Key Initiatives/Trends (2024-2025) | Data/Statistics |

|---|---|---|---|

| Climate Change & Disease Patterns | Increased burden from vector-borne diseases, altered disease prevalence. | Enhanced public health surveillance, climate-resilient infrastructure planning. | WHO reported a 30-fold increase in dengue fever incidence between 1970-2019. |

| Medical Waste Management | Risk of infection spread, environmental contamination. | Stricter adherence to disposal regulations, adoption of autoclaving and controlled incineration. | Up to 30% reduction in environmental footprint for facilities using modern waste treatment (by 2025). |

| Green Building & Infrastructure | Reduced operational costs, improved air quality, lower energy consumption. | Use of sustainable materials, energy-efficient designs, advanced filtration systems. | Global green building market projected over $370 billion by 2025; LEED Platinum targets in new Asian hospitals. |

PESTLE Analysis Data Sources

Our Asia Health Century PESTLE Analysis is built on a robust foundation of data from reputable international organizations like the WHO and World Bank, alongside government health ministries and leading market research firms across key Asian nations. This ensures comprehensive insights into the political, economic, social, technological, legal, and environmental factors shaping the healthcare landscape.