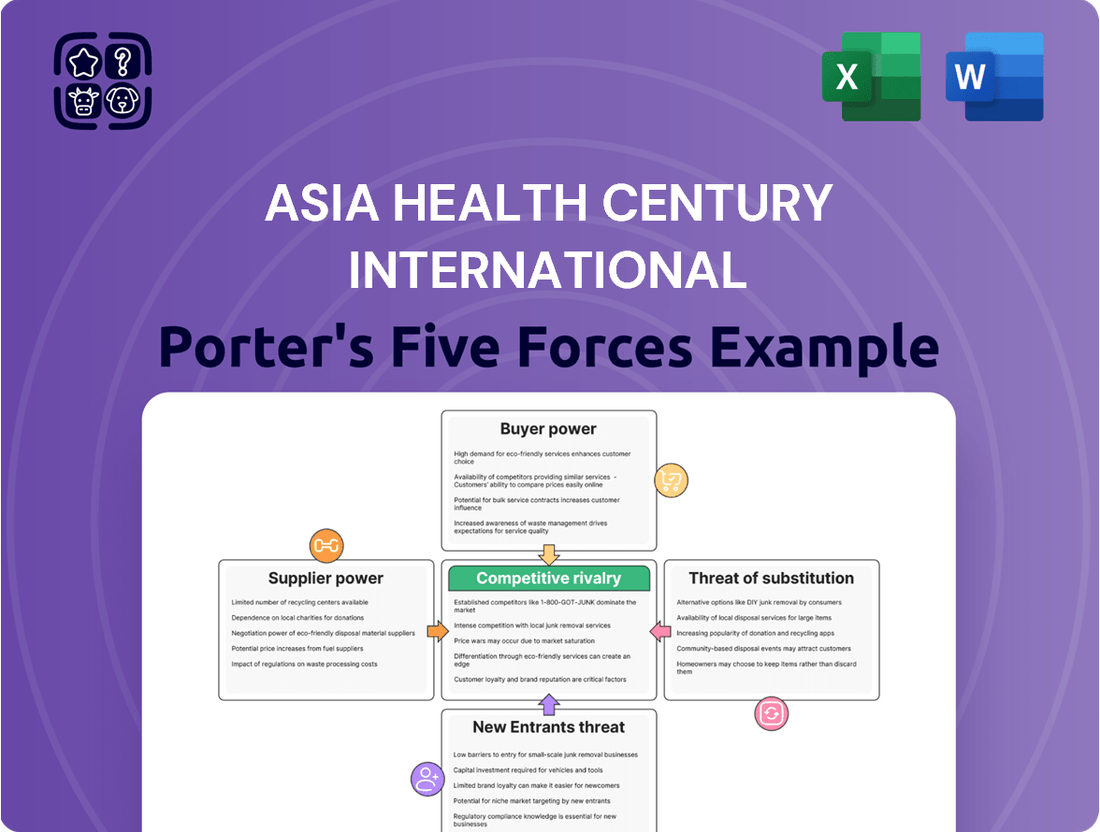

Asia Health Century International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asia Health Century International Bundle

Asia Health Century International operates in a dynamic landscape shaped by intense rivalry and evolving customer demands. Understanding the formidable power of buyers and the constant threat of substitutes is crucial for navigating this competitive arena.

The complete report reveals the real forces shaping Asia Health Century International ’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for highly specialized medical equipment and innovative pharmaceuticals grants these entities considerable bargaining power. When only a handful of companies manufacture essential, cutting-edge devices or patented drugs, Asia Health Century International faces limited alternatives, potentially driving up procurement costs.

This situation is particularly noteworthy as China actively promotes domestic innovation in medical devices and biopharmaceuticals. For instance, by 2024, China's investment in R&D for its domestic medical device sector is expected to reach significant figures, aiming to reduce reliance on foreign suppliers and potentially altering the existing supplier power balance.

China's government-led volume-based procurement (VBP) program, particularly for generic drugs and certain medical devices, directly influences supplier bargaining power. By consolidating demand from numerous hospitals, the VBP system enables aggressive price negotiations with manufacturers. This can significantly diminish the leverage of pharmaceutical and medical device suppliers, including those supplying Asia Health Century International.

For Asia Health Century International, this centralized purchasing approach presents a dual effect. On one hand, it offers the potential for reduced acquisition costs on frequently purchased medical supplies and pharmaceuticals. On the other hand, it requires the company to align its procurement strategies with these government-driven, bulk-buying initiatives, potentially impacting supplier relationships and product availability if not managed proactively.

The availability of substitute inputs significantly impacts supplier power for Asia Health Century International. For instance, if generic alternatives to patented drugs become widely available and are clinically proven, the bargaining power of the original patent holder diminishes. In 2024, the global pharmaceutical market saw continued growth in the generics sector, with an estimated market size of over $200 billion, indicating a strong availability of substitutes for many branded medications.

Conversely, when Asia Health Century International relies on highly specialized or unique medical technologies, such as advanced diagnostic equipment or novel surgical instruments, the availability of substitutes is often limited. This scarcity grants suppliers of these specialized inputs greater leverage, potentially leading to higher prices or less favorable contract terms. The market for specialized medical devices, while smaller than generics, often exhibits higher profit margins for suppliers due to these limitations.

Switching Costs for Essential Supplies

High switching costs for essential medical supplies significantly bolster supplier bargaining power for Asia Health Century International. The expense and time required to validate new medical equipment, retrain staff on its operation, or integrate new pharmaceutical supply chains can be substantial. For instance, in 2024, the average cost for a hospital to switch its primary electronic health record (EHR) system ranged from $20 million to over $100 million, illustrating the financial commitment involved in supply chain changes.

- Switching Costs: The financial and operational hurdles in changing suppliers for critical medical equipment or pharmaceuticals can be immense.

- Supplier Lock-in: Complex integration processes and retraining needs can lead to reliance on existing suppliers, even if better terms are available elsewhere.

- Impact on Asia Health Century International: This dynamic can limit negotiation leverage and potentially increase operational costs if suppliers exploit this dependency.

Supplier's Ability to Forward Integrate

Suppliers possessing the capability to forward integrate into healthcare services, such as establishing their own clinics or hospitals, can significantly enhance their bargaining power against entities like Asia Health Century International. This move allows them to directly compete for patient care, potentially offering integrated solutions that circumvent traditional procurement channels.

For instance, a medical technology supplier that also operates diagnostic centers could leverage its equipment sales to push its own service offerings, thereby dictating terms more forcefully. While this threat is more pronounced for integrated healthcare solution providers than for pure manufacturers, it represents a strategic consideration for Asia Health Century International.

Consider the trend in 2024 where several large medical device manufacturers have been investing in or acquiring telehealth platforms and outpatient care centers. This strategic shift aims to capture more of the healthcare value chain, directly impacting the leverage suppliers have over hospital systems and other service providers.

- Increased Competition: Suppliers moving into service provision can directly compete with their customers for patients.

- Bundled Offerings: Integrated suppliers may offer packages that include both equipment and services, potentially at more attractive terms than separate purchases.

- Control over Patient Pathways: Forward integration allows suppliers to influence patient flow and treatment decisions, potentially favoring their own integrated solutions.

The bargaining power of suppliers for Asia Health Century International is influenced by several factors, including supplier concentration, the availability of substitutes, switching costs, and the potential for supplier forward integration. In 2024, the medical supply landscape shows a mix of consolidated power for specialized items and increasing competition for more commoditized goods.

| Factor | Impact on Asia Health Century International | 2024 Data/Trend |

| Supplier Concentration (Specialized Equipment/Pharma) | High bargaining power for suppliers, potentially increasing costs. | Limited number of key suppliers for advanced medical technologies. |

| Availability of Substitutes (Generics) | Diminishes supplier power, leading to lower prices. | Global generics market projected to exceed $200 billion in 2024. |

| Switching Costs | Increases supplier power due to financial and operational hurdles. | EHR system switching costs range from $20M-$100M+ for hospitals. |

| Supplier Forward Integration | Potential for increased competition and bundled offerings. | Device manufacturers investing in telehealth and outpatient centers. |

What is included in the product

This Porter's Five Forces analysis for Asia Health Century International dissects the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes within the healthcare sector.

Understand the competitive landscape of the Asia Health Century with a clear, actionable breakdown of Porter's Five Forces, enabling strategic adjustments to mitigate market pressures.

Customers Bargaining Power

Asia Health Century International's customer base is largely fragmented, composed of individual patients who typically possess low bargaining power due to the essential nature of healthcare services. However, the growing influence of commercial medical insurance providers and the potential for large corporations to negotiate group purchasing agreements could consolidate certain customer segments, thereby increasing their leverage.

The sheer number of healthcare options available to consumers in China significantly amplifies their bargaining power. With a vast network of public and private hospitals, specialized clinics, and outpatient centers, patients have the freedom to shop around for the best care. In 2024, China's healthcare sector saw continued growth, with the number of registered hospitals exceeding 37,000, offering a wide array of choices.

This abundance of alternatives means Asia Health Century International cannot simply rely on its existence to attract patients. Instead, it must actively compete on factors that matter most to consumers, such as the quality of its medical staff, the efficiency of its patient services, and the overall value proposition. For instance, patient satisfaction surveys in 2024 highlighted that perceived quality of care and affordability were key drivers in patient choice, indicating a strong customer influence.

Customer price sensitivity in China's healthcare sector is heavily shaped by reimbursement policies like the National Reimbursement Drug List (NRDL). While basic public healthcare is common, patients opting for private facilities for better quality or specialized care face higher out-of-pocket expenses, making them quite responsive to pricing, particularly for uninsured services.

Access to Information and Digital Health Platforms

Customers are increasingly empowered by digital health platforms and online medical services, enabling them to readily compare services, prices, and hospital ratings. This access to information significantly boosts their ability to negotiate better terms.

Telemedicine and online consultations offer convenient alternatives, reducing reliance on traditional in-person visits for many health concerns. This convenience further strengthens the customer's position.

- Informed Choices: Digital platforms provide vast amounts of data, allowing patients to research conditions and treatment options, making them more discerning consumers.

- Price Transparency: Online portals often display pricing for procedures and consultations, fostering a more competitive market and giving customers leverage.

- Convenience Factor: Telehealth services, which saw a significant surge in adoption, offer accessibility that rivals or surpasses traditional healthcare settings for certain needs. For instance, by mid-2024, an estimated 76% of US hospitals offered telehealth services, indicating widespread customer access.

- Global Reach: Patients can access medical opinions and services from providers beyond their immediate geographical area, expanding their options and bargaining power.

Switching Costs for Patients

Switching costs for patients in the healthcare sector are typically low, allowing individuals to readily select alternative hospitals or clinics for their medical needs. This low barrier to entry means patients can easily change providers if they are dissatisfied or find a better option.

However, for patients managing chronic conditions or undergoing long-term treatments, the cost and complexity of switching can increase. Establishing new patient-doctor relationships and transferring comprehensive medical histories can be time-consuming and potentially disruptive to care continuity. For instance, a patient on a specific chemotherapy regimen might face significant hurdles in finding a new oncologist willing and able to immediately take over their complex treatment plan.

Asia Health Century International recognizes this dynamic and focuses on cultivating strong patient loyalty. By consistently delivering high-quality care, fostering trust through empathetic interactions, and offering integrated, comprehensive services, the company aims to create a sticky patient experience. This strategy helps to mitigate the inherent low switching costs by making the value proposition of remaining with Asia Health Century International compelling enough to outweigh the perceived benefits of switching.

- Low General Switching Costs: Patients can often switch healthcare providers with relative ease for routine or episodic care.

- Increased Costs for Chronic Care: For ongoing conditions, switching involves establishing new relationships and transferring medical records, raising barriers.

- Asia Health Century International's Strategy: Focuses on quality, comprehensive services, and patient loyalty to counter low switching costs.

Asia Health Century International faces significant customer bargaining power due to the vast number of healthcare providers in China, with over 37,000 registered hospitals in 2024. This abundance allows patients to easily compare services and prices, driving competition. The increasing availability of digital health platforms further empowers customers by providing price transparency and access to service comparisons, making them more informed and assertive in their choices.

While generally low, switching costs can increase for patients with chronic conditions requiring complex treatment continuity. Asia Health Century International counters this by building patient loyalty through high-quality care and integrated services, aiming to make remaining with the company more attractive than switching.

| Factor | Impact on Asia Health Century International | Supporting Data (2024) |

|---|---|---|

| Provider Choice Abundance | High Customer Bargaining Power | Over 37,000 registered hospitals in China |

| Digital Health Platform Usage | Increased Price Transparency & Service Comparison | Growing adoption of online medical services and patient review sites |

| Switching Costs (General) | Low, favoring customer choice | Ease of accessing alternative providers for routine care |

| Switching Costs (Chronic Care) | Moderate to High | Complexity of transferring medical histories and establishing new patient-doctor relationships |

Preview the Actual Deliverable

Asia Health Century International Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of the Asia Health Century International, detailing the competitive landscape and strategic implications for the healthcare sector. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering immediate actionable insights.

Rivalry Among Competitors

The Chinese healthcare market is incredibly crowded, with a vast array of competitors. Asia Health Century International navigates this complex environment, facing off against both established public hospitals and a rapidly expanding private sector.

Public hospitals still handle the lion's share of patient care in China, representing a significant competitive force. In 2023, public hospitals accounted for roughly 85% of all inpatient visits, underscoring their dominance.

However, the private healthcare segment is growing at an impressive pace, introducing more sophisticated and specialized competitors. By the end of 2024, it's projected that private hospitals will increase their market share by an additional 1.5%, adding further pressure on existing players like Asia Health Century International.

China's healthcare market is booming, projected to reach $1.3 trillion by 2025, up from $823 billion in 2020. This rapid expansion, fueled by an aging demographic and growing middle class, intensifies competition. Asia Health Century International is strategically expanding its hospital network, aiming to capture a larger share of this burgeoning market.

Competitive rivalry in healthcare, particularly for Asia Health Century International, is heavily shaped by how well providers can make their services stand out. This differentiation can come through offering unique treatments, using cutting-edge medical tech, providing an exceptional patient journey, or simply being in a more accessible spot.

The private healthcare sector, where Asia Health Century International likely operates, often distinguishes itself through a commitment to quality and tailored patient care. This is a significant advantage when compared to the often-strained capacity and longer wait times experienced in many public healthcare systems. For instance, in 2024, the private healthcare market in many Asian countries continued to grow, with patient satisfaction scores often cited as a key metric for success, reflecting the importance of superior patient experience.

Exit Barriers for Hospitals and Medical Institutions

High exit barriers, like the substantial capital sunk into specialized medical infrastructure and advanced equipment, make it challenging for hospitals to leave the market. In 2024, the average cost to build a new hospital in developed Asian markets often exceeded $100 million, with specialized equipment alone accounting for a significant portion.

These considerable investments, coupled with long-term employment contracts for highly skilled medical professionals, mean that hospitals are often compelled to continue operations even when profitability wanes. This situation can fuel intense price competition and contribute to overcapacity in certain healthcare segments.

- High Capital Investment: Significant financial commitment to infrastructure and technology.

- Specialized Equipment Costs: Advanced medical machinery represents a substantial sunk cost.

- Employment Contracts: Long-term commitments to medical staff create ongoing obligations.

- Regulatory Hurdles: Navigating complex regulations for closure can be time-consuming and costly.

Regulatory Environment and Government Policies

China's healthcare sector, where Asia Health Century International operates, is heavily influenced by government policies. Recent reforms, such as the Healthy China 2030 initiative, aim to improve public health and expand access to care, which can intensify competition by encouraging more players, both domestic and international, to enter the market. The government's focus on cost containment, including price controls on drugs and medical services, directly impacts the revenue potential for private providers.

Anti-corruption campaigns within the healthcare system, while aimed at improving transparency and efficiency, can also create a more challenging operating environment by increasing scrutiny on business practices. Furthermore, policies promoting public-private partnerships (PPPs) offer opportunities for growth but also necessitate navigating complex regulatory frameworks and aligning with government objectives. For instance, in 2023, China continued to emphasize reforms aimed at reducing out-of-pocket expenses for patients, a trend that will likely persist and affect profitability models.

- Healthcare Reforms: China's ongoing healthcare reforms focus on improving quality, accessibility, and affordability, creating a dynamic competitive landscape.

- Cost Control Measures: Government policies targeting cost reduction in medical services and pharmaceuticals directly influence pricing strategies and profit margins for providers.

- Public-Private Partnerships: Initiatives encouraging collaboration between public and private entities present both opportunities for expansion and challenges in regulatory compliance.

- Domestic Innovation Push: Policies supporting local pharmaceutical and medical device manufacturers can lead to increased competition from domestic players.

Competitive rivalry for Asia Health Century International is intense, driven by a fragmented market with numerous public and private providers vying for patients. The sheer volume of hospitals, both government-funded and increasingly private, means that differentiation through service quality and specialized offerings is paramount. For instance, by the end of 2024, the private healthcare sector in Asia is expected to see continued growth, with patient satisfaction scores becoming a key differentiator, highlighting the emphasis on superior patient experience.

The market's rapid expansion, projected to reach $1.3 trillion by 2025, attracts new entrants and intensifies competition among existing players. This growth, fueled by demographics and rising incomes, creates a dynamic environment where strategic positioning and service innovation are crucial for market share. Asia Health Century International's expansion efforts are a direct response to this heightened rivalry.

| Metric | 2023 Value | 2024 Projection | Trend |

| Public Hospital Share of Inpatient Visits | ~85% | ~84% | Slight Decline |

| Private Hospital Market Share Growth | N/A | +1.5% | Increasing |

| China Healthcare Market Size | $1.1 Trillion (est.) | $1.3 Trillion (proj.) | Significant Growth |

SSubstitutes Threaten

Traditional Chinese Medicine (TCM) poses a substantial threat of substitution for Western-style healthcare services in China, a market where Asia Health Century International operates. A significant portion of the Chinese population continues to favor TCM treatments, such as herbal remedies and acupuncture, either as their initial healthcare choice or as an adjunct to conventional medicine. For instance, the TCM industry in China was valued at approximately 770 billion yuan in 2022, indicating its widespread adoption and continued relevance.

The rise of home-based care and self-medication presents a significant threat to formal healthcare providers like Asia Health Century International. For minor ailments or ongoing chronic conditions, individuals increasingly turn to over-the-counter medications or lifestyle changes instead of professional medical attention. This trend is amplified by the widespread availability of pharmacies and easily accessible health information online, which makes self-care a more viable and often preferred option.

In 2023, the global over-the-counter (OTC) drug market was valued at approximately $150 billion, demonstrating a clear preference for self-treatment for common health issues. Furthermore, telehealth platforms and health apps that offer symptom checkers and basic advice further lower the barrier to self-management, potentially diverting patients who might otherwise seek consultation from Asia Health Century International.

The increasing emphasis on preventative care and wellness programs presents a significant threat of substitutes for Asia Health Century International. As individuals prioritize proactive health management, they may opt for lifestyle changes, fitness regimes, and early detection screenings, thereby reducing their reliance on traditional, hospital-centric medical services.

This shift is evidenced by the global wellness market’s projected growth, with reports indicating it could reach over $7 trillion by 2025. For instance, in 2024, many Asian countries saw a surge in digital health platforms offering personalized wellness plans and remote monitoring, directly competing with Asia Health Century International's core service offerings by addressing health needs before they escalate into conditions requiring extensive treatment.

Digital Health Solutions and Telemedicine

The increasing accessibility and adoption of digital health solutions, such as telemedicine and AI-driven diagnostics, pose a substantial threat of substitution for traditional healthcare services offered by Asia Health Century International. These digital platforms provide convenient, often cost-effective, alternatives for routine medical advice, prescription management, and remote patient monitoring. For instance, the global telemedicine market was projected to reach USD 396.9 billion by 2027, indicating a strong shift towards remote care options.

These substitutes can directly compete for patient volume, particularly for non-critical care needs, potentially impacting Asia Health Century International's patient traffic and revenue streams. The ease of access and reduced waiting times offered by these digital solutions make them an attractive option for a growing segment of the population. By 2024, it's estimated that over 60% of healthcare organizations will be using telehealth in some capacity.

- Growing Telemedicine Adoption: Telemedicine platforms offer convenient alternatives for consultations and prescription refills.

- AI-Powered Diagnostics: AI tools are increasingly capable of providing diagnostic insights, reducing reliance on in-person visits.

- Cost-Effectiveness: Digital health solutions often present a more affordable option for routine medical needs.

- Patient Preference Shift: A significant portion of patients, especially younger demographics, are showing a preference for digital healthcare access.

Informal Care Networks and Unlicensed Practitioners

Informal care networks and unlicensed practitioners present a significant threat of substitutes for formal healthcare providers like Asia Health Century International. In many parts of Asia, especially rural and underserved areas, these informal options can be more appealing due to lower costs and easier access. For instance, in regions where formal healthcare infrastructure is weak, community-based traditional healers or informal caregiver networks may fill the gap, offering services that, while unregulated, meet immediate needs.

This substitution is driven by economic factors and convenience. A 2023 report indicated that in some Southeast Asian nations, out-of-pocket healthcare expenses can be prohibitively high, pushing individuals towards cheaper, albeit less regulated, alternatives. This trend is expected to continue as economic disparities persist, making it challenging for formal institutions to compete solely on price.

- Cost Sensitivity: Lower out-of-pocket expenses for informal care are a primary driver, especially in lower-income segments of the population.

- Accessibility Gaps: In remote or geographically challenging areas, informal networks often provide the only available care, bypassing the need for travel to formal facilities.

- Perceived Effectiveness: For certain conditions, traditional or informal practices may be perceived as more effective or culturally appropriate by local communities.

- Regulatory Loopholes: The lack of stringent regulation around informal practitioners allows them to operate with lower overheads, further enhancing their cost advantage.

The increasing prevalence of over-the-counter (OTC) medications and self-care practices directly substitutes for professional medical consultations, particularly for common ailments. In 2023, the global OTC drug market reached approximately $150 billion, highlighting a strong consumer preference for self-treatment.

Digital health solutions, including telemedicine and AI-powered diagnostics, offer convenient and often more affordable alternatives to traditional in-person visits. By 2024, it's estimated that over 60% of healthcare organizations will incorporate telehealth, diverting patients from conventional services.

Traditional Chinese Medicine (TCM) remains a significant substitute, with China's TCM industry valued at 770 billion yuan in 2022, indicating its continued cultural relevance and patient preference for alternative treatments.

Informal healthcare networks and unlicensed practitioners present a cost-effective substitute, especially in underserved regions where accessibility to formal healthcare is limited. This trend is exacerbated by high out-of-pocket expenses in some Asian nations, pushing individuals towards cheaper, albeit less regulated, options.

| Substitute Type | 2022/2023/2024 Data Point | Impact on Asia Health Century International |

|---|---|---|

| OTC Medications | Global OTC market valued at ~$150 billion (2023) | Reduces demand for consultations for minor ailments. |

| Digital Health (Telemedicine) | Over 60% of healthcare organizations using telehealth (2024 est.) | Captures patient volume for routine care and remote monitoring. |

| Traditional Chinese Medicine (TCM) | China's TCM industry valued at 770 billion yuan (2022) | Offers culturally preferred alternatives, impacting patient choice. |

| Informal Healthcare Networks | High out-of-pocket costs in some Asian nations drive adoption (2023 report) | Attracts price-sensitive patients, particularly in rural areas. |

Entrants Threaten

The healthcare sector, especially for hospitals, demands massive upfront investment. Think about building facilities, buying sophisticated medical gear, and implementing cutting-edge technology. For instance, establishing a new, fully equipped hospital can easily cost tens of millions, if not hundreds of millions, of dollars, making it a formidable hurdle for any aspiring competitor.

These high capital requirements significantly deter new players from entering the market. It’s not just about having a good business plan; it’s about having the financial muscle to even get started, which effectively shields established companies.

Asia Health Century International benefits greatly from its established network of hospitals and existing investment capacity. This financial strength and operational footprint create a powerful competitive advantage, making it much harder for new entrants to match their scale and resources.

China's healthcare sector presents significant barriers to entry due to its highly regulated nature. New companies must contend with rigorous licensing for everything from hospitals to pharmaceuticals and medical devices.

These regulatory complexities, including obtaining approvals and adhering to strict quality and safety standards, represent a substantial time and financial investment for any new player aiming to enter the market.

For instance, in 2023, the average time to obtain approval for a new medical device in China could extend to several years, with associated costs often exceeding hundreds of thousands of dollars, deterring many potential entrants.

For Asia Health Century International, the threat of new entrants is significantly mitigated by the immense value placed on brand reputation and patient trust within the healthcare industry. Building this trust is a long, arduous process, and established entities like Asia Health Century International already possess a loyal patient base, a testament to years of quality service. In 2024, healthcare providers with strong brand recognition often see higher patient retention rates, sometimes exceeding 80% for those with decades of positive patient experiences.

Access to Skilled Medical Professionals

A significant hurdle for new entrants in the healthcare sector, like Asia Health Century International, is securing a sufficient pool of skilled medical professionals. This includes not only general practitioners and nurses but also highly specialized doctors and surgeons, whose expertise is crucial for comprehensive patient care and hospital reputation.

The global shortage of healthcare workers, a trend continuing into 2024, presents a substantial barrier. For instance, the World Health Organization has projected a shortfall of 10 million health workers by 2030, with a disproportionate impact on low- and middle-income countries, which often comprise key Asian markets.

New hospitals face intense competition for talent, as established institutions already have strong recruitment networks and offer competitive compensation and benefits. This makes it difficult for newcomers to attract and retain the necessary medical staff, impacting their ability to offer a full range of services and maintain high standards of care.

- Shortage of Specialists: Difficulty in recruiting niche medical specialists, impacting service breadth.

- Recruitment Costs: High expenses associated with attracting and onboarding qualified medical personnel.

- Retention Challenges: New facilities struggle to retain staff against established competitors offering better career progression.

- Geographic Disparities: Uneven distribution of medical talent across different regions exacerbates entry barriers.

Government Support and Policy for Existing Players

While China is progressively opening its healthcare sector to foreign investment, established domestic companies in Asia Health Century International's operational landscape often hold a distinct advantage. These existing players typically boast robust, long-standing relationships with government entities, providing them with preferential access and insights into regulatory frameworks. This deep understanding of local policies and market intricacies can act as a significant barrier to entry for newcomers.

Furthermore, government-backed initiatives, such as those focused on enhancing public hospital infrastructure or fostering domestic healthcare technology innovation, can inadvertently bolster the position of well-entrenched domestic firms. For instance, in 2024, China's National Health Commission continued to emphasize the development of national medical centers and regional hubs, projects that often favor established providers with existing operational capacity and government accreditation. This policy direction can indirectly create a more challenging environment for new entrants attempting to penetrate the market.

- Established Government Relationships: Domestic players benefit from deep-rooted ties with Chinese government bodies, facilitating smoother navigation of regulations and policy.

- Policy Nuance Understanding: Existing companies possess a superior grasp of local market dynamics and the intricacies of Chinese healthcare policies.

- Government Initiatives Favoring Incumbents: Policies promoting public hospital upgrades or domestic innovation often align with the capabilities of established, integrated healthcare providers.

The threat of new entrants for Asia Health Century International is considerably low due to substantial capital requirements, with new hospital establishments often costing tens to hundreds of millions of dollars. Furthermore, stringent regulatory hurdles in China, including lengthy approval processes for medical devices that can take years and cost hundreds of thousands of dollars in 2023, act as significant deterrents.

The intense competition for skilled medical professionals, exacerbated by a projected global shortage of 10 million health workers by 2030, makes it difficult for newcomers to attract and retain talent. Established players like Asia Health Century International also benefit from strong brand reputation and patient trust, with high retention rates often exceeding 80% in 2024 for those with long-standing positive patient experiences.

Finally, deep-rooted government relationships and a nuanced understanding of local policies provide established domestic companies with a distinct advantage, particularly as government initiatives in 2024 continue to favor existing providers with operational capacity and accreditation.

| Barrier to Entry | Estimated Cost/Timeframe (Illustrative) | Impact on New Entrants | Asia Health Century International Advantage |

|---|---|---|---|

| High Capital Investment | Hospital establishment: $50M - $500M+ | Significant financial hurdle | Existing infrastructure, financial capacity |

| Regulatory Compliance (China) | Medical device approval: 2-5 years, $100K+ (2023) | Time-consuming and costly | Established compliance processes, government relations |

| Talent Acquisition & Retention | Global health worker shortage projected to 2030 | Difficulty attracting and keeping staff | Strong recruitment networks, competitive benefits |

| Brand Reputation & Patient Trust | High patient retention for established brands (>80% in 2024) | Long process to build trust | Existing loyal patient base, decades of service |

| Government Relations & Policy Understanding | Favors incumbents in policy initiatives (2024) | Navigating complex local dynamics | Deep-rooted ties, superior policy insight |

Porter's Five Forces Analysis Data Sources

Our Asia Health Century International Porter's Five Forces analysis is built upon a robust foundation of data, including financial reports from key industry players, insights from leading healthcare market research firms, and government health statistics across various Asian nations.

We leverage data from reputable sources such as the World Health Organization, national health ministries, industry-specific trade publications, and economic databases to provide a comprehensive understanding of the competitive landscape.