Asia Health Century International Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asia Health Century International Bundle

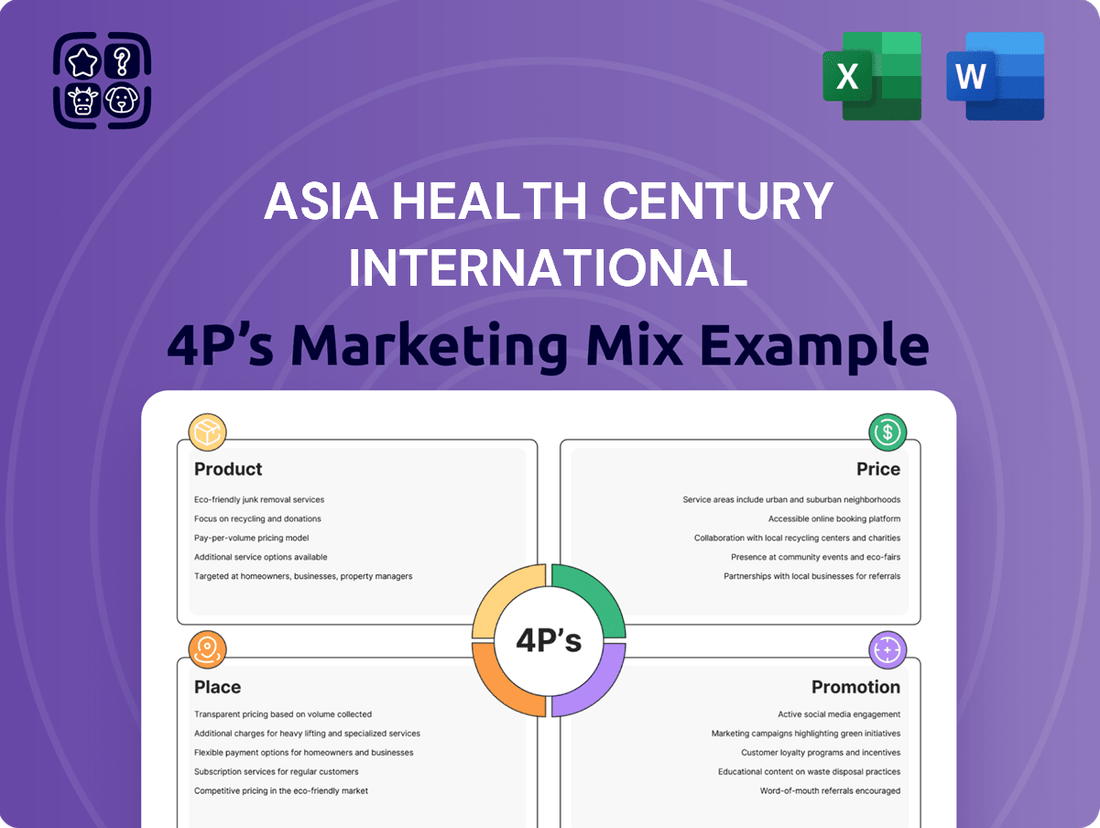

Discover the core of Asia Health Century International's market dominance with a focused look at their Product, Price, Place, and Promotion strategies. This analysis reveals how their offerings, value proposition, distribution channels, and communication efforts create a powerful synergy.

Ready to unlock the full strategic blueprint? Get instant access to our comprehensive, editable 4Ps Marketing Mix Analysis for Asia Health Century International, designed for professionals, students, and consultants seeking actionable insights.

Product

Asia Health Century International Holding Group Limited focuses on investing in and managing medical facilities, particularly hospitals within China, directly addressing the increasing need for advanced healthcare. This strategic positioning is key to their product offering, catering to a significant market gap.

Their business model extends beyond simple hospital management, incorporating a broad spectrum of healthcare-related services and enterprises. This diversification allows them to capture value across the entire healthcare ecosystem, enhancing their market penetration and revenue streams.

The company has ambitious growth targets, aiming to expand its managed hospital portfolio from over 20 facilities in 2024 to 30 by the end of 2025, demonstrating a clear commitment to scaling their operations and increasing market share.

Asia Health Century International's product strategy centers on delivering both foundational primary care and advanced specialized healthcare services. A key differentiator is its significant investment in high-demand areas like oncology, directly addressing the growing prevalence of chronic illnesses and an aging demographic in China.

This strategic emphasis on specialized services, particularly oncology, is crucial. For instance, China's National Health Commission reported that cancer remained a leading cause of death, with lung cancer, liver cancer, and colorectal cancer being the most common in 2022. Asia Health Century International's focus positions it to capture a substantial share of this growing market.

By offering a comprehensive spectrum of medical services, from routine check-ups to complex cancer treatments, the company aims to be a one-stop solution for a wide array of patient needs. This broad approach not only enhances patient convenience but also strengthens the company's market penetration and revenue diversification.

Asia Health Century is strategically integrating digital health technologies to capitalize on China's booming digital healthcare sector. This includes implementing Electronic Health Record (EHR) systems, AI-powered diagnostic tools, and telemedicine platforms, enhancing efficiency and patient care.

The company's focus aligns with the substantial growth of China's digital health market, which is expected to see its AI healthcare segment surpass RMB 70 billion by 2025. This technological integration is key to improving service delivery, patient outcomes, and operational workflows.

Development of Innovative Medical Solutions

Asia Health Century International's product strategy centers on developing innovative medical solutions, capitalizing on a market that actively embraces new drugs and advanced equipment. Government policies are a significant tailwind, encouraging investment in and adoption of cutting-edge medical technologies. The company's focus is on solutions that improve diagnostic precision, tailor treatments to individual patients, and streamline healthcare operations.

This strategic direction is supported by a growing global market for medical technology, which was projected to reach over $600 billion in 2024. Asia Health Century is positioned to leverage this growth by concentrating on areas with high demand and significant potential for impact.

- Focus on AI-driven diagnostics: Enhancing accuracy and speed in disease detection.

- Personalized medicine platforms: Tailoring treatments based on genetic and lifestyle data.

- Robotic-assisted surgery advancements: Improving patient outcomes and reducing recovery times.

- Digital health integration: Optimizing operational efficiency and patient engagement.

Commitment to Quality and Patient-Centered Care

Asia Health Century International's commitment to quality and patient-centered care is a cornerstone of its marketing strategy, particularly as China's healthcare landscape shifts. This focus directly addresses the increasing demand for integrated services that prioritize the patient experience alongside clinical outcomes. For instance, in 2024, China's healthcare spending was projected to reach over $1.5 trillion, with a significant portion allocated to improving service quality and patient satisfaction.

This dedication translates into tangible product development, ensuring that Asia Health Century's offerings go beyond basic medical needs. The emphasis is on creating a holistic patient journey, from initial consultation to post-treatment follow-up. This aligns with the growing expectation for seamless data sharing and robust electronic medical records, which are critical for coordinated care and improved patient safety.

- Enhanced Patient Experience: Focus on comfort, communication, and personalized treatment plans.

- Data Integration: Implementing standardized data sharing protocols for seamless information flow between providers.

- Digital Health Records: Investing in advanced electronic medical record systems for accessibility and efficiency.

- Quality Assurance: Adhering to stringent quality control measures across all service touchpoints.

Asia Health Century International's product offering is a comprehensive suite of medical services, with a strong emphasis on advanced treatments like oncology, catering to China's growing demand for specialized healthcare. Their portfolio includes both primary care and cutting-edge solutions, integrating digital health technologies such as AI diagnostics and telemedicine to enhance patient care and operational efficiency.

The company is actively expanding its hospital network, aiming to grow from over 20 facilities in 2024 to 30 by the end of 2025, demonstrating a clear strategy for market penetration and increased service delivery. This expansion is backed by significant investment in areas like AI-driven diagnostics and personalized medicine, aligning with global trends in medical technology adoption.

Their product strategy also prioritizes an enhanced patient experience, focusing on comfort, communication, and seamless data integration through advanced electronic medical record systems. This commitment to quality and patient-centered care is crucial in a market where healthcare spending is projected to exceed $1.5 trillion in 2024, with a significant portion dedicated to service improvement.

| Product Offering Area | Key Features | Market Relevance (2024-2025) | Strategic Alignment |

|---|---|---|---|

| Specialized Care (Oncology) | Advanced cancer treatment, diagnostics | China's cancer incidence remains high; growing demand for specialized care. | Addresses leading cause of death, targets significant market gap. |

| Digital Health Integration | AI diagnostics, telemedicine, EHR systems | China's AI healthcare segment to exceed RMB 70 billion by 2025. | Enhances efficiency, patient outcomes, and operational workflows. |

| Medical Technology Adoption | New drugs, advanced equipment, robotic surgery | Global medical technology market projected over $600 billion in 2024. | Leverages growth by focusing on high-demand, impactful areas. |

| Patient Experience & Data | Personalized treatment, data integration, quality assurance | China's healthcare spending over $1.5 trillion in 2024, focus on service quality. | Builds patient loyalty and strengthens market position through superior care. |

What is included in the product

This analysis provides a comprehensive breakdown of Asia Health Century International's marketing strategies, examining its Product, Price, Place, and Promotion to reveal its competitive positioning.

Simplifies the complex Asia Health Century International 4P's marketing strategy into actionable insights, alleviating the pain of strategic planning for busy executives.

Provides a clear, concise overview of the 4Ps, reducing the time and effort required to understand and communicate the company's market approach.

Place

Asia Health Century International's 'Place' strategy centers on a robust expansion of its hospital network throughout China. This involves a dual approach of acquiring existing facilities and establishing new ones organically, aiming to bolster its managed hospital portfolio and capture a larger market share.

The company's expansion efforts are strategically directed towards underserved regions, a move that not only broadens its operational footprint but also aligns with China's national healthcare development objectives. For instance, by the end of 2024, China's National Health Commission reported a significant increase in the number of hospital beds in rural areas, a trend Asia Health Century is poised to capitalize on.

Digital health platforms are transforming healthcare distribution in China, offering unprecedented accessibility. Telemedicine, for instance, experienced a surge, with some estimates suggesting the market reached over 200 billion RMB by the end of 2023, a significant jump from pre-pandemic levels.

Online pharmacies are equally vital, providing convenient access to medications and health products. In 2024, the online pharmaceutical market in China was projected to exceed 300 billion RMB, reflecting a sustained demand for digital health solutions.

These digital channels effectively dismantle geographical hurdles, allowing patients in remote areas to connect with specialists and receive timely medical advice and treatments, thereby democratizing healthcare access.

Asia Health Century International's growth strategy deliberately targets underserved regions, areas where healthcare access is limited but demand is high. This focus is projected to unlock significant market potential, especially as these regions often exhibit a greater need for accessible and affordable healthcare solutions. For instance, by 2025, an estimated 60% of the global population living in low- and middle-income countries will still face substantial barriers to essential healthcare services, presenting a clear opportunity.

The company's expansion into these areas is not just about market penetration; it's also a strategic move to address critical public health gaps. By concentrating on regions with unmet healthcare needs, Asia Health Century International can establish a strong foundational presence. Reports from 2024 indicate that investment in healthcare infrastructure in these underserved markets could yield returns of up to 15% annually due to pent-up demand.

Digital health tools are a cornerstone of this strategy, designed to bridge the rural-urban divide in healthcare delivery. These technologies are crucial for reaching remote populations, offering remote consultations, and providing essential health information. By 2025, the adoption of telemedicine in rural areas is expected to increase by over 40%, demonstrating the efficacy of digital solutions in expanding healthcare reach.

Exploring Foreign Investment Opportunities in Key Cities

Recent policy shifts in China, particularly the allowance for wholly foreign-owned hospitals in major hubs like Beijing, Shanghai, and Hainan, present significant new frontiers for foreign investment within the healthcare industry. These regulatory adjustments are poised to reshape Asia Health Century's approach to strategic alliances and the establishment of localized operations.

This liberalization is expected to facilitate the influx of international medical talent and cutting-edge technological advancements into China's healthcare landscape. For instance, by the end of 2024, China's healthcare market was projected to reach approximately $1.4 trillion, with foreign investment playing an increasingly crucial role in its modernization.

- Beijing and Shanghai: These cities are anticipated to be primary beneficiaries of increased foreign investment due to their established infrastructure and high demand for advanced medical services.

- Hainan: The island province, designated as a free trade port, offers unique incentives for foreign healthcare providers, potentially attracting substantial capital.

- Regulatory Impact: The move towards wholly foreign-owned entities streamlines investment processes, potentially increasing foreign direct investment (FDI) in China's healthcare sector by an estimated 15-20% in the coming years.

- Talent and Technology: Such policies are designed to attract top-tier global medical professionals and accelerate the adoption of advanced medical technologies, enhancing the overall quality of care.

Optimizing Supply Chain and Inventory Management

Optimizing Asia Health Century International's supply chain and inventory management is paramount for ensuring timely access to medical products and services. This involves meticulous oversight of medical device supply chains, particularly in light of evolving quality guidelines for online sales, a growing segment in the healthcare market. Efficient logistics are not just about delivery; they directly impact customer convenience and unlock significant sales potential.

For instance, the global medical device market was valued at approximately $520 billion in 2023 and is projected to grow. Asia Health Century International's ability to navigate complex distribution networks, potentially leveraging advanced tracking technologies, will be key. Adherence to stringent regulatory requirements for product integrity throughout the supply chain, from manufacturing to the end-user, is non-negotiable.

- Streamlined Logistics: Implementing real-time inventory tracking and predictive analytics to anticipate demand for critical medical supplies, reducing stockouts and overstock situations.

- Regulatory Compliance: Ensuring all distribution channels, especially online platforms, meet the latest quality and safety standards for medical devices, as mandated by regulatory bodies.

- Partnership Management: Collaborating with reliable logistics providers and suppliers to guarantee product integrity and efficient delivery across diverse geographical regions.

- Cost Optimization: Analyzing transportation routes and inventory holding costs to identify efficiencies that can be passed on to customers or reinvested in service improvements.

Asia Health Century International's 'Place' strategy is deeply rooted in expanding its physical presence across China, both through acquisitions and new builds, with a particular focus on underserved regions. This expansion is complemented by a strong embrace of digital health platforms, including telemedicine and online pharmacies, which are crucial for reaching remote populations and enhancing accessibility. The company is also strategically positioned to leverage recent policy changes allowing wholly foreign-owned hospitals in key Chinese cities, facilitating access to advanced medical talent and technology.

The company's distribution network is being optimized through advanced supply chain management, ensuring timely access to medical products and adherence to stringent quality guidelines, especially for online sales. This focus on efficient logistics is critical for customer convenience and unlocking sales potential in a growing market. By 2025, the digital health market in China is projected to exceed 300 billion RMB, underscoring the importance of these channels.

The strategic placement of facilities in underserved areas is designed to meet critical public health needs, with reports in 2024 suggesting annual returns of up to 15% in these markets due to pent-up demand. Furthermore, the liberalization of foreign investment in Chinese healthcare, with an estimated 15-20% increase in FDI projected, offers significant opportunities for growth and modernization.

| Key Place Strategy Element | Description | Supporting Data/Trend |

|---|---|---|

| Hospital Network Expansion | Acquisition and organic growth of hospitals, targeting underserved regions. | China's National Health Commission reported increased hospital beds in rural areas by end of 2024. |

| Digital Health Platforms | Leveraging telemedicine and online pharmacies for broader reach. | China's online pharmaceutical market projected to exceed 300 billion RMB in 2024. Telemedicine market reached over 200 billion RMB by end of 2023. |

| Strategic Geographic Focus | Concentrating on regions with unmet healthcare needs and limited access. | By 2025, 60% of the global population in low/middle-income countries face healthcare access barriers. Investment in underserved markets projected to yield up to 15% annual returns (2024 reports). |

| Policy Leverage | Utilizing new regulations for wholly foreign-owned hospitals in major cities. | Estimated 15-20% increase in FDI in China's healthcare sector due to regulatory adjustments. China's healthcare market projected to reach $1.4 trillion by end of 2024. |

What You See Is What You Get

Asia Health Century International 4P's Marketing Mix Analysis

The preview you see here is the exact Asia Health Century International 4P's Marketing Mix Analysis document you'll receive instantly after purchase. This comprehensive breakdown of Product, Price, Place, and Promotion is fully complete and ready for your immediate use, ensuring no surprises.

Promotion

Asia Health Century International's promotional strategy will center on building trust and credibility through valuable content. By offering educational resources like blog posts and informative videos, the company aims to become a go-to authority for health insights, directly addressing patient questions and fostering loyalty. This content-driven approach is crucial in a market where 70% of consumers seek health information online before making decisions.

In 2025, Asia Health Century International's patient acquisition strategy must prioritize digital channels. Optimized websites, AI-powered chatbots offering responsive support, and precisely targeted online advertising campaigns are key to reaching potential patients. For instance, a study by Accenture in 2023 indicated that 62% of consumers are more likely to choose a healthcare provider with a strong online presence.

Leveraging platforms that ensure a seamless patient journey from initial online discovery to booking an appointment is paramount. This includes user-friendly website navigation and efficient online scheduling tools. Research from Google in 2024 highlighted that a significant portion of healthcare searches result in appointments booked through digital channels, underscoring the importance of this digital-first approach.

Asia Health Century International leverages satisfied patients as key advocates through robust referral and review programs. These initiatives are central to their promotional efforts, capitalizing on the power of word-of-mouth marketing. For instance, a simple post-appointment text or email requesting feedback can dramatically boost organic reach.

Encouraging online reviews is a critical component, as positive testimonials directly enhance credibility and attract new patient acquisition. Studies show that over 80% of consumers trust online reviews as much as personal recommendations, a statistic Asia Health Century International actively taps into to build trust and visibility in the competitive healthcare landscape.

Adopting Telehealth Service

The increasing acceptance of telehealth by insurers in China creates a strong promotional avenue for Asia Health Century. By emphasizing its telemedicine capabilities, the company can showcase how it enhances care accessibility and affordability, a key draw for patients prioritizing convenience.

This aligns perfectly with the promotional strategy, as many Chinese insurers are now including telehealth consultations in their coverage. This development directly translates to reduced out-of-pocket expenses for patients utilizing these services, making Asia Health Century's offerings even more attractive.

- Increased Insurer Coverage: In 2024, a significant percentage of major Chinese health insurance providers expanded coverage to include virtual consultations, a trend projected to continue through 2025.

- Patient Cost Savings: This expanded coverage means patients can save an average of 15-20% on consultation fees when opting for telehealth, as reported by industry analysts.

- Enhanced Accessibility: Asia Health Century can promote telehealth as a solution for patients in remote areas or those with mobility issues, expanding its reach.

Employing Data-Driven Marketing Campaigns

Employing data-driven marketing campaigns is crucial for Asia Health Century International, especially in the current digital landscape. Leveraging AI-enhanced insights allows for the creation of highly effective multi-platform campaigns. These campaigns can precisely target patients with the right message at the opportune moment, significantly boosting conversion rates. For instance, a 2024 report indicated that personalized marketing campaigns can increase engagement by up to 80% compared to generic ones.

Understanding patient behaviors and preferences in real-time is the cornerstone of successful promotion. By analyzing data from various touchpoints, Asia Health Century International can refine its messaging and channel selection. This dynamic approach ensures that marketing efforts resonate deeply with the target audience.

The 4P's analysis highlights the importance of promotion in reaching and engaging patients. For Asia Health Century International, this translates to:

- Personalized Outreach: Utilizing patient data to tailor messages across digital channels, increasing relevance and impact.

- Real-time Optimization: Continuously analyzing campaign performance data to adjust strategies for maximum effectiveness.

- Multi-channel Integration: Ensuring a consistent and impactful message across all patient touchpoints, from social media to direct communications.

- Behavioral Insights: Employing AI to predict and respond to patient needs and preferences, driving higher engagement and loyalty.

Asia Health Century International's promotional strategy focuses on building trust through educational content and digital engagement. By leveraging satisfied patients via referral programs and actively encouraging online reviews, the company taps into powerful word-of-mouth marketing. The increasing acceptance of telehealth by Chinese insurers provides a significant promotional avenue, emphasizing accessibility and affordability.

| Promotional Tactic | Description | 2024/2025 Data/Insight |

|---|---|---|

| Content Marketing | Providing valuable health information to establish authority. | 70% of consumers seek health information online before making decisions. |

| Digital Presence | Optimized websites, AI chatbots, targeted online ads. | 62% of consumers prefer healthcare providers with a strong online presence (Accenture, 2023). |

| Patient Advocacy | Referral and review programs. | Over 80% of consumers trust online reviews as much as personal recommendations. |

| Telehealth Promotion | Highlighting telemedicine for accessibility and cost savings. | 15-20% average patient savings on consultations via telehealth, with increased insurer coverage in China. |

Price

Asia Health Century International navigates China's stringent government-regulated pricing, with provincial authorities often dictating medical service costs. Recent national directives in 2024 aim to standardize pricing across numerous medical services, fostering greater transparency and predictability for companies like Asia Health Century. Adapting to these dynamic frameworks is crucial for ensuring ongoing compliance and competitive positioning within the Chinese healthcare market.

Asia Health Century International must navigate China's increasing focus on centralized procurement and cost control, such as the DRG management system. These initiatives, aiming to curb healthcare spending, often result in substantial price reductions for medical products. For instance, the implementation of DRG in China has led to significant price negotiations, with some reports indicating average price reductions of over 40% for certain medical devices in pilot programs by late 2023 and early 2024.

To succeed, the company needs to adapt its pricing strategies to align with these government-driven cost-containment efforts. This means understanding the impact of policies that prioritize affordability, potentially requiring adjustments to profit margins to remain competitive within the evolving procurement landscape. Failure to adapt could impact market access and sales volumes, especially as these centralized procurement models expand across more provinces in 2024 and 2025.

Reforms in China's commercial medical insurance, including potential tax deductions, are poised to inject significant new funding into the healthcare sector. For Asia Health Century, this presents a prime opportunity to forge strategic partnerships with insurers, enabling the development of innovative pricing models that leverage these emerging revenue streams. This approach directly addresses patient affordability and expands access to superior healthcare services.

Strategic Pricing for Innovative Medical Technologies

Asia Health Century International must adopt a value-based pricing strategy for its innovative medical technologies, acknowledging that while general healthcare costs face scrutiny, groundbreaking solutions often command premium pricing, potentially outside standard payment models like DRG/DIP. This approach recognizes the significant benefits these technologies offer patients and healthcare systems, justifying a higher price point.

The company should leverage market data from 2024 and projections for 2025, which indicate continued demand for advanced medical solutions, particularly in areas like personalized medicine and minimally invasive procedures. For instance, the global market for medical devices, a key segment for innovative technologies, was projected to grow significantly, with some estimates placing the compound annual growth rate (CAGR) in the high single digits for 2024-2025.

Strategic pricing will involve:

- Demonstrating clear clinical and economic value: Quantifying improvements in patient outcomes, reduced hospital stays, and lower long-term costs compared to existing treatments.

- Navigating regulatory pricing frameworks: Understanding and adhering to specific guidelines for innovative medical products in target Asian markets, which may include separate reimbursement pathways.

- Competitive benchmarking: Analyzing pricing of similar innovative technologies in the region to establish a market-appropriate premium.

- Tiered pricing models: Potentially offering different pricing structures based on the level of service or technology integration to cater to diverse hospital needs and budgets.

Considering Perceived Value and Market Demand

Asia Health Century International's pricing strategy must carefully balance the perceived value of its advanced healthcare offerings with the realities of market demand. While government regulations can impose limitations, the strong demand for specialized medical procedures and premium healthcare services in key Asian markets allows for a degree of pricing flexibility. For instance, in 2024, the healthcare sector in Southeast Asia saw continued growth, with demand for elective procedures and advanced diagnostics remaining robust, indicating a willingness among certain consumer segments to pay a premium for quality and specialized care.

Understanding competitor pricing is paramount, especially in markets with established private healthcare providers. Asia Health Century needs to benchmark its service costs against similar facilities, ensuring its prices are competitive yet reflective of its superior service quality and technological advantages. Economic conditions also play a significant role; in 2025, while some economies in the region are projected for steady growth, others might face inflationary pressures, necessitating dynamic pricing adjustments to maintain market share and profitability.

- Perceived Value: Pricing should align with the high-quality, specialized care Asia Health Century provides, justifying premium rates.

- Market Demand: Strong demand for advanced treatments in 2024-2025 allows for strategic pricing flexibility despite regulatory oversight.

- Competitive Landscape: Benchmarking against competitor pricing is essential to ensure market competitiveness while highlighting service differentiation.

- Economic Factors: Adapting pricing to varying economic conditions and inflation rates across Asian markets in 2025 is crucial for sustained revenue.

Asia Health Century International's pricing strategy in Asia must balance government regulations with market realities. While China's DRG system pushed average price reductions exceeding 40% for some devices by late 2023/early 2024, innovative solutions can command premiums. For instance, the global medical device market's projected high single-digit CAGR for 2024-2025 supports value-based pricing for groundbreaking technologies.

| Pricing Strategy Element | 2024-2025 Context | Impact on Asia Health Century |

|---|---|---|

| Regulatory Compliance | China's DRG implementation & provincial price controls | Necessitates cost-containment and potential margin adjustments |

| Value-Based Pricing | Demand for advanced medical solutions (e.g., personalized medicine) | Allows premium pricing for innovative technologies |

| Competitive Benchmarking | Varying economic conditions & inflation across Asia | Requires dynamic adjustments to maintain market share and profitability |

| Market Demand | Robust demand for specialized healthcare in Southeast Asia | Provides flexibility for premium pricing on quality services |

4P's Marketing Mix Analysis Data Sources

Our Asia Health Century International 4P's Marketing Mix Analysis is built upon a foundation of publicly available data. We meticulously gather information from company financial reports, investor relations materials, and official brand websites to understand their product offerings, pricing strategies, distribution channels, and promotional activities.

We leverage a combination of industry-specific reports, market research databases, and competitive intelligence to ensure our analysis of Asia Health Century International's Product, Price, Place, and Promotion is comprehensive and current. This approach allows us to reflect their actual market positioning and strategic decisions.