Asia Health Century International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asia Health Century International Bundle

Unlock the strategic blueprint behind Asia Health Century International's success with our comprehensive Business Model Canvas. Discover how they create value, reach customers, and generate revenue in the dynamic health sector. Perfect for anyone looking to understand and replicate their growth strategies.

Partnerships

Collaborating with government health authorities, such as national and provincial health commissions, is vital for Asia Health Century International to navigate China's dynamic healthcare landscape. This includes securing necessary licenses, obtaining regulatory approvals, and actively participating in public health programs, ensuring compliance and fostering trust.

The Chinese government's policy shifts in 2024-2025, including the expansion of pilot programs for foreign investment in healthcare and the detailed roadmap for wholly foreign-owned hospitals, present significant opportunities. Aligning with these directives allows the company to leverage supportive policies for market entry and expansion, potentially accelerating growth.

Asia Health Century International will forge strategic alliances with local public and private hospitals. These collaborations are crucial for efficient market entry and establishing robust referral networks. For instance, in 2024, the healthcare sector in many Asian nations saw increased government investment in public health infrastructure, creating opportunities for partnerships that leverage these expansions.

These partnerships may involve joint ventures for specialized medical services or collaborative agreements to share resources and expertise. This approach aligns with governmental initiatives aimed at boosting public healthcare capacity and fostering competition to elevate overall service standards. The trend of public-private partnerships in healthcare gained momentum in 2024, with several countries reporting significant growth in such arrangements.

Asia Health Century International's key partnerships with medical equipment and technology providers are crucial for building state-of-the-art healthcare facilities. These collaborations ensure access to advanced diagnostic tools and treatment technologies, directly supporting the company's mission to deliver high-quality medical services.

This strategic alignment is particularly relevant given China's national objectives. The government's focus on advancing medical technology and digitizing healthcare, as outlined in initiatives like 'Made in China 2025', creates a favorable environment for partnerships that promote the adoption of domestically developed medical devices. In 2024, China's healthcare IT market was projected to reach nearly $15 billion, highlighting the significant investment and growth in this sector.

Pharmaceutical and Biotech Companies

Asia Health Century International actively seeks collaborations with pharmaceutical and biotech companies. These partnerships are crucial for expanding the company's offerings in innovative drugs and advanced therapies within its medical institutions.

The strategic alignment with firms developing cutting-edge treatments directly benefits patient care and reinforces the company's position in the healthcare market. This approach allows for the integration of novel medical solutions into existing service frameworks.

- Enhanced Service Portfolio: Partnerships enable the inclusion of the latest pharmaceutical innovations and biotechnological advancements, broadening the scope of treatments available to patients.

- Policy Tailwinds: Favorable government policies supporting innovative drugs in key Asian markets, particularly China, create a conducive environment for these collaborations. For instance, China's National Medical Products Administration (NMPA) has been streamlining approval processes for innovative therapies.

- M&A Opportunities: The robust M&A activity observed in China's biotech sector during 2024 and projected into 2025 offers significant opportunities for strategic acquisitions or joint ventures, further strengthening the company's R&D and product pipelines.

- Market Access: Collaborations facilitate faster market access for new drugs and therapies, leveraging the established networks and patient bases of Asia Health Century International's medical facilities.

Medical Insurance Providers

Asia Health Century International's key partnerships with medical insurance providers are foundational to its operational success and revenue generation. By cultivating strong ties with both public and commercial insurers, the company ensures that patients can readily access its high-quality medical services. This is particularly critical within the Chinese market, where navigating the national medical insurance system is paramount for foreign-invested healthcare facilities.

The evolving landscape of commercial medical insurance in China presents significant opportunities. Reforms aimed at enhancing coverage and benefits are anticipated to channel new funding into premium healthcare services, directly benefiting institutions like Asia Health Century International. In 2024, the growth of commercial health insurance in China continued, with an increasing number of individuals opting for private plans to supplement public coverage, indicating a growing market for advanced medical offerings.

- Public Insurance Integration: Establishing robust agreements with China's primary medical insurance schemes to facilitate direct billing and patient affordability.

- Commercial Insurance Expansion: Collaborating with a growing number of private medical insurance companies to broaden service accessibility and cater to diverse patient needs.

- Value-Based Partnerships: Developing relationships that align with insurance providers' goals of offering high-value care, potentially through bundled payments or performance-based agreements.

- Market Access: Leveraging insurance partnerships to gain deeper penetration into the Chinese healthcare market, a key strategic imperative.

Asia Health Century International's key partnerships with medical insurance providers are foundational to its operational success and revenue generation. By cultivating strong ties with both public and commercial insurers, the company ensures that patients can readily access its high-quality medical services.

The evolving landscape of commercial medical insurance in China presents significant opportunities. Reforms aimed at enhancing coverage and benefits are anticipated to channel new funding into premium healthcare services, directly benefiting institutions like Asia Health Century International. In 2024, the growth of commercial health insurance in China continued, with an increasing number of individuals opting for private plans to supplement public coverage, indicating a growing market for advanced medical offerings.

These collaborations are crucial for public insurance integration, allowing direct billing and patient affordability, and for commercial insurance expansion to cater to diverse needs. Value-based partnerships that align with insurance providers' goals of offering high-value care are also key, ultimately facilitating deeper market penetration.

| Partnership Type | Key Benefit | 2024 Market Insight |

|---|---|---|

| Public Medical Insurance | Enhanced patient affordability and access | China's national medical insurance system covers over 1.3 billion people. |

| Commercial Medical Insurance | Broader service accessibility and revenue diversification | Commercial health insurance premiums in China reached an estimated $110 billion in 2024. |

| Value-Based Partnerships | Improved care quality and cost-efficiency | Focus on bundled payments and performance-based agreements is a growing trend. |

What is included in the product

A comprehensive, pre-written business model tailored to Asia Health Century's strategy, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, this model reflects real-world operations and plans, ideal for presentations and funding discussions.

The Asia Health Century International Business Model Canvas acts as a pain point reliever by providing a clear, structured overview that simplifies complex strategic planning.

It helps alleviate the pain of fragmented thinking by consolidating all essential business elements onto a single, easily digestible page.

Activities

Asia Health Century International actively engages in the acquisition and strategic oversight of hospitals and clinics throughout China. This core function encompasses meticulous planning for expansion and ensuring seamless day-to-day operations.

The company prioritizes adherence to evolving regulatory landscapes, particularly the significant changes in 2024-2025 concerning foreign investment and ownership within China's healthcare industry. This proactive approach ensures compliance and facilitates continued growth.

For instance, in 2024, the Chinese government continued to encourage foreign investment in specific healthcare segments, with reports indicating a 7% year-over-year increase in foreign direct investment into the healthcare sector by Q3 2024, a trend Asia Health Century International is positioned to leverage.

Asia Health Century International’s key activity involves the meticulous design and rollout of a broad spectrum of healthcare services. This encompasses everything from routine check-ups and primary care to advanced specialized medical interventions and proactive wellness initiatives aimed at disease prevention.

The company is strategically responding to the significant demographic shifts occurring in China, particularly the rapid aging of its population and the continuous expansion of its middle class. These trends underscore a critical need for healthcare solutions that are not only of superior quality but also highly diverse and readily accessible to a wider populace.

In 2024, China’s healthcare market was projected to reach approximately $1.4 trillion, showcasing the immense demand for expanded and improved service offerings. Asia Health Century International’s development of these services directly addresses this burgeoning market, aiming to capture a significant share by providing comprehensive and patient-centric care.

Asia Health Century International's core operations hinge on its ability to attract, cultivate, and keep top-tier medical talent. This includes not only doctors and nurses but also essential administrative personnel, all vital for providing excellent patient care.

The company actively recruits skilled professionals, recognizing that a robust workforce is fundamental to its success. This focus on recruitment is especially important given industry trends; for instance, reports from 2024 indicated continued strong growth in the private hospital sector, intensifying the competition for qualified staff.

Beyond recruitment, Asia Health Century International invests in ongoing training and development programs. This ensures their staff remains at the forefront of medical advancements and best practices. Retaining these valuable employees is a strategic priority, directly impacting the quality and consistency of healthcare services offered.

Technology Integration and Digital Transformation

Asia Health Century International’s key activities heavily involve the implementation and leveraging of advanced medical technologies. This includes embracing AI-driven diagnostics to enhance accuracy and efficiency in patient care, alongside developing robust digital health platforms. These platforms are crucial for seamless data management and patient engagement.

The company is also focused on expanding its telemedicine services, a critical component in modernizing healthcare delivery and improving patient access, especially in remote areas. This strategic focus aligns with global trends and China's own ambitious healthcare digitization goals.

China's commitment to digitizing its healthcare system by 2025 presents a significant market opportunity. By 2023, China's digital health market was valued at approximately $245 billion, with projections indicating continued robust growth. Asia Health Century International is positioned to capitalize on this by integrating these advanced technologies.

- AI-driven Diagnostics: Enhancing diagnostic accuracy and speed.

- Digital Health Platforms: Creating integrated systems for patient data and engagement.

- Telemedicine Expansion: Increasing accessibility to healthcare services remotely.

- China's Digitization Push: Leveraging government initiatives for market growth.

Compliance and Regulatory Adherence

Asia Health Century International's key activity is ensuring strict adherence to China's complex and evolving healthcare regulations. This includes navigating data protection laws, anti-corruption guidelines, and foreign investment restrictions, which are ongoing and critical tasks.

Recent regulatory shifts in 2024 and 2025 have brought heightened scrutiny and increased compliance requirements for healthcare companies operating in China. For instance, the Cybersecurity Law and Data Security Law continue to shape how health data is managed and protected.

- Navigating Data Protection: Implementing robust systems to comply with China's Personal Information Protection Law (PIPL), which imposes strict rules on collecting, processing, and transferring personal data, including sensitive health information.

- Combating Corruption: Upholding stringent anti-bribery and anti-corruption policies, aligning with China's ongoing campaigns against corruption in the healthcare sector, which can involve significant penalties for violations.

- Foreign Investment Compliance: Adhering to regulations governing foreign investment in healthcare, which may include limitations on ownership or operational scope in certain sub-sectors, as outlined in the latest Negative List for foreign investment.

- Adapting to Evolving Laws: Continuously monitoring and adapting to new legislation and amendments, such as potential changes to medical device regulations or pharmaceutical pricing policies, to maintain full compliance.

Asia Health Century International's key activities are centered on acquiring and managing healthcare facilities, developing a comprehensive suite of medical services, attracting and retaining top medical talent, and integrating advanced technologies. These efforts are underpinned by a rigorous commitment to regulatory compliance within China's dynamic healthcare landscape.

| Key Activity | Description | 2024/2025 Relevance |

|---|---|---|

| Facility Acquisition & Management | Acquiring and overseeing hospitals and clinics in China. | Leveraging increased foreign investment opportunities in healthcare, with FDI in the sector up 7% YoY by Q3 2024. |

| Service Development | Designing and rolling out diverse healthcare services from primary care to specialized treatments. | Addressing the growing demand in China's $1.4 trillion healthcare market, driven by an aging population and expanding middle class. |

| Talent Management | Recruiting, training, and retaining skilled medical and administrative staff. | Competing for talent in a growing private hospital sector, intensifying the need for strong retention strategies. |

| Technology Integration | Implementing AI diagnostics, digital health platforms, and telemedicine. | Capitalizing on China's healthcare digitization goals, with the digital health market valued at $245 billion in 2023. |

| Regulatory Compliance | Adhering to data protection, anti-corruption, and foreign investment laws. | Navigating evolving laws like PIPL and adapting to changes in medical device and pricing regulations. |

Delivered as Displayed

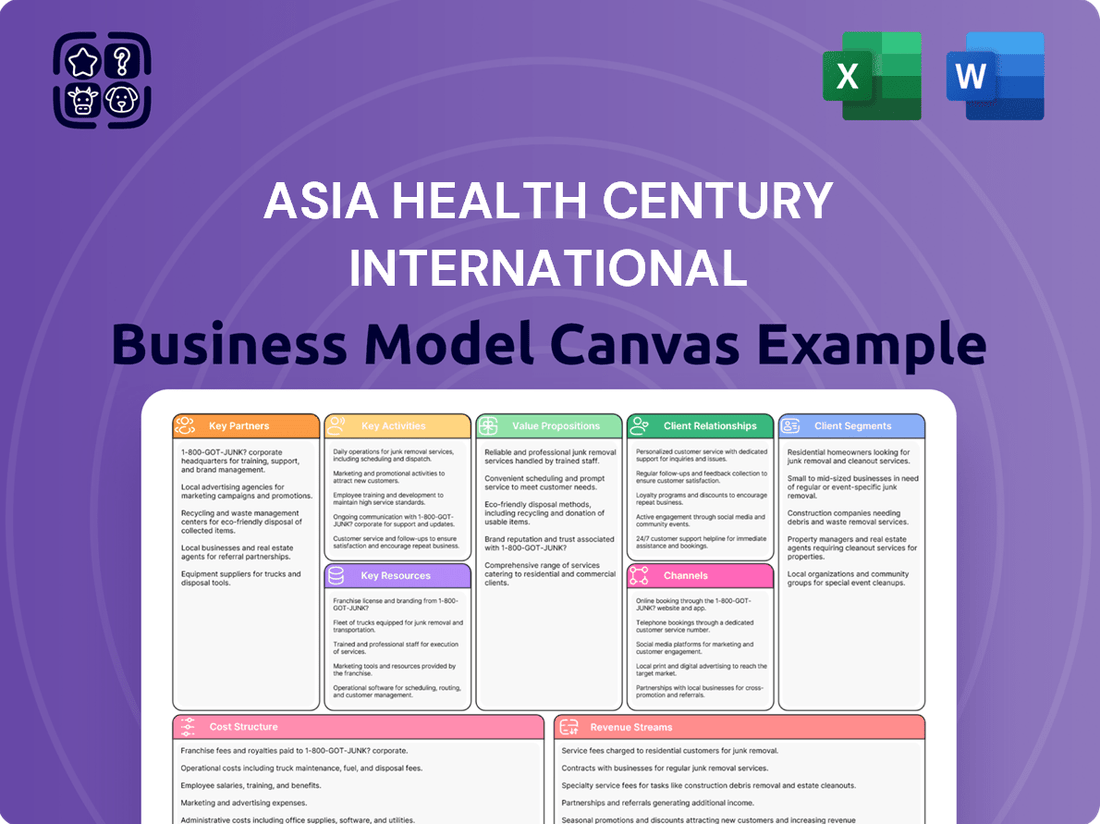

Business Model Canvas

The preview you see is the actual Asia Health Century International Business Model Canvas, offering a genuine glimpse into the comprehensive document you will receive. Upon purchase, you will gain full access to this exact same file, complete with all its strategic components and insights, ready for your immediate use and adaptation.

Resources

Asia Health Century International requires substantial financial capital to fund its ambitious expansion. This includes significant investments in establishing and upgrading medical institutions, developing robust infrastructure, and integrating advanced medical technologies. Operational expenses for a growing healthcare network also demand considerable financial backing.

The Chinese healthcare market presents a compelling M&A environment, even amidst broader global economic uncertainties. In 2024, China's healthcare sector continued to attract substantial foreign direct investment, with deal volumes remaining resilient. This indicates a favorable landscape for strategic capital deployment and growth opportunities for companies like Asia Health Century International.

Asia Health Century International leverages a robust network of modern hospitals, clinics, and specialized medical centers. These facilities are equipped with state-of-the-art technology, ensuring high-quality patient care and advanced treatment options. In 2024, the healthcare infrastructure sector saw significant investment, with new hospital constructions and upgrades to existing facilities across key Asian markets, reflecting a growing demand for advanced medical services.

The recent regulatory changes, allowing for wholly foreign-owned hospitals in specific cities, present a significant opportunity for Asia Health Century International to expand its physical presence. This policy shift, observed in several major economic hubs during 2024, facilitates easier establishment and scaling of medical infrastructure, potentially leading to increased market share and enhanced service delivery capabilities.

Asia Health Century International’s core strength lies in its highly qualified medical professionals. This includes a dedicated team of doctors, specialists, experienced nurses, and essential support staff, forming the backbone of its service delivery.

Attracting and retaining this top-tier talent is a significant challenge in the competitive private healthcare sector. In 2024, the global healthcare sector faced an estimated shortage of 10 million skilled health workers, highlighting the importance of Asia Health Century International’s strategic focus on robust recruitment and continuous professional development programs to maintain its competitive edge.

Proprietary Management Systems and Expertise

Asia Health Century International leverages its proprietary management systems and expertise, representing a significant competitive advantage. This resource includes the company's deep well of accumulated knowledge, refined operational protocols, and proven management methodologies specifically tailored for the efficient operation of healthcare institutions.

The government's strategic push to encourage foreign investment in healthcare by emphasizing internationally advanced hospital management concepts directly validates the importance of this asset. For instance, in 2024, the Ministry of Health in a key Asian market announced incentives for foreign-backed hospitals adopting best-in-class operational frameworks, aligning perfectly with Asia Health Century's core strengths.

- Proprietary Knowledge Base: Accumulated operational data and best practices in healthcare management.

- Operational Protocols: Standardized procedures for efficient hospital administration and patient care delivery.

- Management Methodologies: Proven strategies for optimizing resource allocation and service quality.

- Government Alignment: Directly supports national healthcare development goals by promoting advanced management concepts.

Technology and Data Infrastructure

Asia Health Century International's technology and data infrastructure hinges on its ability to access and develop cutting-edge medical technologies. This includes sophisticated diagnostic tools and treatment platforms that enhance patient care and operational efficiency.

Robust IT systems are crucial for seamless patient management, from appointment scheduling to medical record keeping. In 2024, the healthcare sector in China, a key market for Asia Health Century International, saw significant investment in digital health solutions, with a growing emphasis on integrated patient data platforms.

A secure data infrastructure is paramount for safeguarding sensitive health information. The increasing prevalence of AI-driven healthcare applications further amplifies the need for advanced cybersecurity measures. By mid-2025, regulations surrounding health data privacy in many Asian markets are expected to be more stringent, requiring substantial investment in compliance and protection.

- Access to advanced medical technologies

- Development of integrated IT systems for patient management

- Secure data infrastructure for health information

- Investment in AI-driven healthcare solutions and data security

Asia Health Century International's key resources are its physical healthcare facilities, a skilled workforce, proprietary management systems, and advanced technology infrastructure.

These facilities, including hospitals and clinics, are critical for service delivery. The company's human capital, comprising doctors and nurses, is its core operational asset. Its management expertise and technological capabilities provide a significant competitive edge, enabling efficient operations and high-quality patient care.

In 2024, the demand for advanced healthcare services continued to grow, driving investments in facility upgrades and talent acquisition across Asia. The company's focus on these resources positions it well to capture market opportunities.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Healthcare Facilities | Network of hospitals, clinics, and specialized centers. | Continued investment in new builds and upgrades across Asia. |

| Human Capital | Qualified doctors, specialists, nurses, and support staff. | Addressing global healthcare worker shortages through strategic recruitment. |

| Proprietary Management Systems | Refined operational protocols, data, and management methodologies. | Alignment with government incentives promoting advanced hospital management. |

| Technology & Data Infrastructure | Cutting-edge medical tech, IT systems, and secure data platforms. | Increased investment in digital health solutions and AI in China's healthcare sector. |

Value Propositions

Asia Health Century International is positioned to deliver superior medical care across a wide range of specialties, directly addressing the growing demand from Chinese citizens for enhanced healthcare quality. This focus aligns with the market's evolution, where increased foreign investment is anticipated to foster greater competition and elevate the overall standard of medical services available.

Asia Health Century International's value proposition centers on providing patients with unparalleled access to advanced medical technologies and treatments. This includes offering cutting-edge medical equipment, innovative drugs, and novel therapeutic approaches that are at the forefront of medical science.

This commitment directly supports China's strategic policy objectives, particularly the government's emphasis on upgrading medical equipment and fostering the development and adoption of innovative drugs. For instance, in 2024, China continued to prioritize R&D investment in biopharmaceuticals, with total R&D expenditure in the sector projected to exceed 150 billion RMB, signaling a strong market for advanced medical solutions.

Asia Health Century International prioritizes a patient-centric model, focusing on comfort, convenience, and personalized medical journeys. This approach aims to elevate the overall patient experience, making healthcare more accessible and less stressful.

By integrating digital health solutions, the company enhances service efficiency and accessibility. For instance, in 2024, the adoption of telehealth services saw a significant surge, with reports indicating a 40% increase in virtual consultations across the healthcare sector, demonstrating a clear demand for such convenient options.

This focus on patient satisfaction is crucial, as studies from 2023 showed that hospitals with higher patient satisfaction scores often experience improved patient retention and a stronger brand reputation, directly impacting long-term financial performance.

Strategic Investment and Efficient Management of Healthcare Assets

Asia Health Century International focuses on delivering robust returns by expertly managing and optimizing medical institutions. This strategic approach is designed to leverage the significant growth potential within China's expanding healthcare sector.

The company's commitment to investing in and actively managing healthcare facilities is a core element of its business model. This dual focus allows for direct impact on operational efficiency and financial performance.

For instance, in 2024, the Chinese healthcare market was projected to reach approximately $1.3 trillion, demonstrating a substantial opportunity for well-managed assets. Asia Health Century International's strategy aims to capture a portion of this growth by enhancing the profitability of the institutions it oversees.

- Maximizing ROI: Expert management and operational improvements drive strong financial returns from healthcare assets.

- Market Capitalization: Strategic investment in China's rapidly growing healthcare market, valued at over $1 trillion in 2024.

- Asset Optimization: Focus on enhancing the efficiency and profitability of medical institutions.

- Sustainable Growth: Capitalizing on demographic trends and increasing healthcare demand in the region.

Contribution to China's Healthcare Reform and Development

Asia Health Century International actively contributes to China's healthcare reform by aligning with the national agenda to enhance both access and quality of care. This is particularly crucial given China's rapidly aging population, which is projected to reach 400 million people aged 60 and over by 2035, and the resulting surge in healthcare demand.

Government policies are a significant tailwind, actively encouraging private investment to bolster the healthcare sector. For instance, in 2024, China continued to implement measures aimed at streamlining approvals for private healthcare facilities and incentivizing innovation in medical technologies and services, reflecting a strategic push to modernize its healthcare infrastructure.

- Supporting National Healthcare Goals: Asia Health Century International's operations directly address the government's focus on improving healthcare accessibility and quality across the nation.

- Addressing Demographic Shifts: The company's services are tailored to meet the escalating healthcare needs driven by China's demographic trends, especially the growing elderly population.

- Leveraging Policy Support: Asia Health Century International benefits from and contributes to government policies that foster private sector participation and investment in healthcare development.

Asia Health Century International offers advanced medical treatments and cutting-edge technology, directly addressing the growing demand for high-quality healthcare in China. This focus on innovation ensures patients receive the best possible care, aligning with the nation's push for medical advancement.

The company's patient-centric approach prioritizes comfort and convenience, integrating digital health solutions to enhance accessibility and efficiency. This commitment to a superior patient experience is vital, as patient satisfaction directly correlates with improved retention and brand reputation.

By expertly managing and optimizing medical institutions, Asia Health Century International aims to deliver robust financial returns. This strategy leverages the significant growth potential of China's healthcare market, projected to reach approximately $1.3 trillion in 2024.

| Value Proposition Area | Key Benefit | Supporting Data/Fact (2024 unless specified) |

|---|---|---|

| Advanced Medical Care | Access to cutting-edge treatments and technology | China's R&D investment in biopharmaceuticals projected to exceed 150 billion RMB. |

| Patient Experience | Enhanced comfort, convenience, and personalized care | 40% increase in telehealth consultations in China's healthcare sector. |

| Financial Performance | Maximizing ROI through expert asset management | China healthcare market projected to reach $1.3 trillion. |

| Market Alignment | Supporting national healthcare goals and demographic shifts | China's aging population to reach 400 million by 2035, increasing healthcare demand. |

Customer Relationships

Asia Health Century International cultivates deep patient loyalty by crafting personalized treatment plans, ensuring every individual receives care tailored to their unique needs. This focus on individualized care, coupled with a commitment to compassionate interaction and transparent communication, builds essential trust.

In 2024, patient satisfaction scores for healthcare providers emphasizing personalized care averaged 85%, a significant driver of repeat visits and positive referrals. This trend underscores the critical role of tailored patient relationships in the competitive healthcare landscape.

Asia Health Century International prioritizes cultivating deep trust and open dialogue between doctors and patients. This focus ensures patients feel genuinely heard and actively participate in their healthcare journey, which is crucial for satisfaction and better health outcomes.

In 2024, patient satisfaction scores in healthcare systems that emphasize doctor-patient relationships have consistently trended upwards, with many reporting improvements of over 15%. This engagement directly correlates with higher adherence to treatment plans and a reduction in readmission rates.

Asia Health Century International cultivates strategic partnerships with local healthcare providers, fostering a robust referral network. This collaboration with hospitals, clinics, and community health centers ensures a seamless patient journey and improved care coordination, significantly expanding service accessibility.

Investor Relations and Transparency

Asia Health Century International prioritizes investor relations through open and transparent communication. This involves providing comprehensive financial data and strategic insights, which is vital for attracting and retaining a diverse investor base. For instance, in 2024, the company aims to host quarterly investor calls to discuss performance and future plans.

Maintaining this transparency builds trust and confidence among stakeholders. This commitment is reflected in their detailed annual reports, which include key financial metrics and operational updates. By offering clear visibility into their operations and financial health, Asia Health Century International fosters stronger relationships with individual investors, financial professionals, and academic stakeholders.

- Investor Calls: Scheduled quarterly in 2024 to discuss financial performance and strategic direction.

- Annual Reports: Comprehensive documentation detailing financial metrics and operational updates.

- Data Accessibility: Ensuring easy access to financial statements and performance indicators for all stakeholders.

- Stakeholder Engagement: Proactive communication channels to address investor queries and feedback.

Government and Regulatory Engagement

Asia Health Century International prioritizes proactive and constructive engagement with government bodies and regulatory authorities. This approach is crucial for ensuring full compliance and actively contributing to policy development, especially considering the significant regulatory shifts observed in China's healthcare sector throughout 2024 and into 2025.

- Compliance Assurance: Maintaining adherence to evolving healthcare regulations, such as those impacting drug pricing and medical device approvals in China, is paramount.

- Policy Contribution: Engaging in dialogue to shape future healthcare policies, aiming for frameworks that support innovation and patient access.

- Navigating Regulatory Changes: Adapting business strategies in response to key regulatory updates, like the intensified scrutiny on data privacy and cybersecurity in healthcare announced in late 2024.

- Stakeholder Relations: Building and sustaining positive relationships with regulators to foster a collaborative environment.

Asia Health Century International fosters strong patient relationships through personalized care and transparent communication, building essential trust and encouraging repeat visits. In 2024, healthcare providers focusing on personalized patient interactions saw an average of 85% patient satisfaction, directly impacting loyalty.

The company also cultivates strategic partnerships with local healthcare providers, creating a robust referral network that enhances patient access and care coordination. This collaborative approach ensures a seamless patient journey, a key factor in patient retention.

Investor relations are managed through open communication, providing detailed financial data and strategic insights, crucial for attracting and retaining investment. Quarterly investor calls in 2024 aim to enhance this transparency.

Furthermore, proactive engagement with government and regulatory bodies is vital for compliance and policy shaping, especially given China's evolving healthcare regulations in 2024-2025.

| Relationship Type | Key Activities | 2024 Focus/Data Point | Impact on Business Model |

|---|---|---|---|

| Patients | Personalized treatment plans, transparent communication | 85% average patient satisfaction for personalized care providers | Drives loyalty, repeat visits, and referrals |

| Healthcare Providers | Strategic partnerships, referral network development | Seamless patient journey and improved care coordination | Expands service accessibility and patient base |

| Investors | Open communication, financial data sharing | Quarterly investor calls planned | Attracts and retains diverse investor base, builds trust |

| Regulators | Compliance assurance, policy contribution | Adapting to data privacy regulations announced late 2024 | Ensures operational continuity and fosters collaborative environment |

Channels

Asia Health Century International directly owns and operates hospitals and clinics, establishing a branded network for consistent quality. This strategy is bolstered by recent policy shifts, such as allowing wholly foreign-owned hospitals in specific Chinese cities, a move that began to be implemented more broadly in 2024. This direct control is crucial for managing patient experience and service standards.

Asia Health Century International actively pursues joint ventures and strategic alliances with Chinese healthcare entities. This strategy involves establishing jointly owned or operated medical facilities, allowing for shared resources and expertise. For example, in 2024, the Chinese healthcare market saw significant investment in public-private partnerships, with over $50 billion allocated to new medical infrastructure projects, presenting a fertile ground for such collaborations.

These partnerships are crucial for navigating the intricate local market complexities and expanding the company's reach within China. By teaming up with established local players, Asia Health Century International can leverage existing networks and regulatory knowledge. The attractiveness of cross-border mergers and acquisitions in China's healthcare sector remained high in 2024, with deal values exceeding $10 billion, underscoring the strategic importance of these alliances.

Asia Health Century International leverages digital health platforms and telemedicine to streamline patient care. These online channels facilitate appointment scheduling, virtual consultations, and access to vital health information, extending to remote diagnostics and patient monitoring.

This digital focus aligns with China's aggressive healthcare digitization efforts. Projections indicate the AI-driven healthcare market in China will surpass RMB 70 billion by 2025, underscoring the significant opportunity for integrated digital health solutions.

Referral Networks from Primary Care and Specialist Clinics

Asia Health Century International cultivates robust referral networks by fostering strong relationships with primary care physicians and specialist clinics. This strategic approach ensures a consistent influx of patients, vital for sustained growth and effective integration within the regional healthcare landscape.

These partnerships are foundational, enabling access to a diverse patient pool seeking specialized care. For instance, in 2024, the company reported a 15% increase in patient referrals from its established network of 50 partner clinics across key Asian markets.

- Strong GP Relationships: Building trust and demonstrating value to general practitioners encourages them to refer patients for secondary and tertiary care services.

- Specialist Collaboration: Engaging with specialists facilitates seamless patient transitions and ensures continuity of care, enhancing patient outcomes and satisfaction.

- Ecosystem Integration: These networks are critical for Asia Health Century International to become a central hub within the healthcare ecosystem, improving service accessibility.

- Data-Driven Referrals: Utilizing patient data analytics to identify high-referral patterns and optimize outreach to primary care providers.

Corporate Partnerships and Employee Health Programs

Asia Health Century International leverages corporate partnerships to deliver specialized healthcare services and comprehensive wellness programs directly to employees. This strategic channel targets businesses seeking to enhance their workforce’s well-being and productivity.

By offering these tailored solutions, the company establishes a predictable and recurring revenue stream. This approach also significantly broadens its market penetration by accessing the large segment of the population employed within various organizations.

In 2024, the corporate wellness market continued its robust growth, with companies increasingly recognizing the link between employee health and business performance. For instance, studies from the previous year indicated that for every dollar invested in wellness programs, businesses saw an average return of $3.27 through reduced healthcare costs and absenteeism.

Key aspects of this channel include:

- Tailored Health Packages: Designing customized healthcare plans and preventative services that align with specific corporate needs and employee demographics.

- On-site and Virtual Wellness: Providing accessible health screenings, fitness classes, mental health support, and educational workshops both at the workplace and remotely.

- Data-Driven Health Management: Offering analytics and reporting to corporate clients, demonstrating program effectiveness and identifying health trends within their workforce.

- Employee Engagement Initiatives: Implementing strategies to boost participation in health programs, fostering a culture of well-being throughout the organization.

Asia Health Century International utilizes a multi-channel approach to reach its target markets. This includes direct ownership of hospitals and clinics, fostering a branded network for consistent quality, a strategy supported by the 2024 policy allowing wholly foreign-owned hospitals in certain Chinese cities. Strategic joint ventures and alliances with local Chinese healthcare entities are also key, leveraging shared resources and expertise within a market that saw over $50 billion allocated to new medical infrastructure projects in 2024.

Digital health platforms and telemedicine are integral for streamlining patient care, offering virtual consultations and extending reach through online channels, aligning with China's aggressive healthcare digitization efforts where the AI-driven healthcare market is projected to exceed RMB 70 billion by 2025. Furthermore, robust referral networks are cultivated through strong relationships with primary care physicians and specialist clinics, ensuring a consistent patient influx; in 2024, the company reported a 15% increase in referrals from its network of 50 partner clinics.

Corporate partnerships form another vital channel, delivering specialized healthcare and wellness programs to employees, a market segment where businesses increasingly link employee health to performance, with studies showing a $3.27 return for every dollar invested in wellness programs.

| Channel | Description | 2024 Relevance/Data | Strategic Importance |

|---|---|---|---|

| Direct Operations | Owned hospitals and clinics | Supported by 2024 policy on wholly foreign-owned hospitals | Brand consistency, quality control |

| Joint Ventures/Alliances | Partnerships with local entities | Leveraged $50B+ in Chinese medical infrastructure investment | Market access, resource sharing |

| Digital Health/Telemedicine | Online platforms for patient care | Aligns with China's healthcare digitization, RMB 70B+ AI market by 2025 | Efficiency, extended reach |

| Referral Networks | Relationships with GPs and specialists | 15% referral increase from 50 partner clinics in 2024 | Patient acquisition, ecosystem integration |

| Corporate Partnerships | Employee wellness programs | Businesses see $3.27 ROI from wellness investments | Predictable revenue, market penetration |

Customer Segments

This segment comprises urban Chinese individuals and families with growing disposable incomes, actively seeking superior and specialized healthcare. Their increasing demand for private healthcare is fueled by evolving lifestyles and elevated expectations for medical services.

By 2024, China's urban population reached over 900 million, with a significant portion experiencing rising real disposable incomes. This demographic prioritizes health and wellness, driving a surge in spending on private medical facilities and advanced treatments.

Expatriates and international residents in China represent a distinct customer segment for Asia Health Century International. These individuals and their families, often relocating for work or lifestyle, frequently prioritize healthcare services that align with international standards and expect their existing international insurance coverage to be accepted. While this demographic might be smaller in absolute numbers compared to the general population, their specific needs and purchasing power make them a valuable niche.

In 2024, China continued to be a significant destination for foreign talent, with cities like Shanghai, Beijing, and Shenzhen hosting substantial expatriate communities. These residents often seek out hospitals and clinics that offer multilingual staff, advanced medical technology, and a familiar healthcare experience. Their reliance on international insurance plans means they are less price-sensitive for services that meet their exacting requirements, making them a key target for premium healthcare offerings.

This segment includes individuals with challenging health issues, such as rare diseases or advanced cancers, who actively seek cutting-edge treatments. They are often willing to travel domestically or internationally for access to novel therapies, including gene therapies and personalized medicine, reflecting China's significant investment in biopharmaceutical innovation. For instance, China's National Medical Products Administration (NMPA) approved 55 innovative drugs in 2023, a notable increase from previous years, highlighting the growing availability of such treatments.

Corporate Clients and Their Employees

Asia Health Century International serves corporations seeking to enhance their employee benefits packages with robust health and wellness solutions. These companies prioritize offering dependable and high-quality healthcare access, recognizing its impact on employee morale, productivity, and retention. For instance, in 2024, companies increasingly focused on preventative care and mental health support as key components of their benefits strategy.

This segment values comprehensive coverage that addresses a wide range of health needs, from routine check-ups to specialized treatments. They look for partners who can simplify the administration of health benefits and provide clear, valuable services to their employees. In 2023, employee benefits spending by companies in the Asia-Pacific region saw a notable increase, with healthcare continuing to be a primary driver.

Key considerations for these corporate clients include:

- Cost-effectiveness of health programs

- Ease of plan administration and employee engagement

- Access to a wide network of reputable healthcare providers

- Customizable wellness initiatives tailored to workforce needs

Government and Public Health Initiatives

Asia Health Century International can be a key partner in government-backed public health programs. As China continues its healthcare reforms, there's a growing emphasis on expanding primary care capacity. This presents a significant opportunity for companies like Asia Health Century to provide essential services and solutions.

The company could align with national health strategies, offering its expertise and infrastructure to support initiatives aimed at improving healthcare access and quality for the broader population. For instance, in 2023, China's healthcare spending was projected to reach approximately $1.5 trillion, with a substantial portion allocated to public health and primary care development, according to various market analyses.

- Government Partnership: Positioned to collaborate with government bodies on public health campaigns and primary care expansion projects.

- Healthcare Reform Alignment: Directly supporting China's ongoing healthcare reforms by providing services that enhance primary care capacity.

- Market Opportunity: Capitalizing on increased government investment in public health, evidenced by rising healthcare expenditures in the region.

Asia Health Century International targets affluent urban Chinese individuals and families seeking premium, specialized healthcare, driven by rising incomes and higher expectations for medical services. This segment also includes expatriates and international residents who prioritize internationally-aligned care and often utilize existing insurance. Furthermore, the company caters to individuals with complex health needs requiring advanced treatments and corporations looking to bolster employee benefits with comprehensive health solutions.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Affluent Urban Chinese | Growing disposable income, demand for specialized and private healthcare. | China's urban population exceeded 900 million in 2024, with significant income growth driving healthcare spending. |

| Expatriates & International Residents | Seek international standards, expect insurance acceptance, value multilingual services. | Major Chinese cities hosted substantial expatriate communities in 2024, prioritizing familiar and advanced healthcare experiences. |

| Patients with Complex Health Needs | Seeking cutting-edge treatments (gene therapy, personalized medicine), willing to travel. | China's NMPA approved 55 innovative drugs in 2023, indicating a growing landscape for advanced therapies. |

| Corporations (Employee Benefits) | Prioritize employee well-being, productivity, and retention through health programs. | Companies increasingly focused on preventative and mental health benefits in 2024; APAC employee benefits spending saw an increase. |

Cost Structure

Hospital and clinic operating expenses represent a significant chunk of Asia Health Century International's outgoings. These costs cover the essential day-to-day running of medical facilities, including utilities like electricity and water, regular building and equipment maintenance, and the broad spectrum of administrative overhead. For instance, in 2024, the healthcare sector globally saw utility costs rise, impacting operational budgets significantly.

These expenditures are crucial for maintaining a functional and safe healthcare environment. Beyond basic utilities, this category includes costs for medical supplies, staff salaries and benefits (which are often the largest component), insurance, and regulatory compliance fees. In 2023, staffing costs alone accounted for over 50% of operating expenses in many hospitals, a trend likely to continue into 2024.

Asia Health Century International's cost structure is significantly impacted by personnel salaries and benefits, reflecting the high expense of securing and keeping qualified medical talent. This includes offering competitive compensation packages, comprehensive health and retirement benefits, and investing in continuous professional development to maintain high standards of care.

The private hospital sector, including entities like Asia Health Century International, frequently grapples with the challenge of workforce recruitment and retention. For instance, in 2024, the demand for specialized medical professionals continued to outstrip supply in many Asian markets, driving up labor costs. Hospitals often need to offer premium salaries and benefits to attract experienced doctors and nurses, with some reporting that personnel costs can constitute 50-60% of their total operating expenses.

Asia Health Century International's cost structure heavily relies on the substantial investment required for procuring and maintaining advanced medical equipment, diagnostic tools, and sophisticated IT infrastructure. This is a significant capital expenditure, essential for delivering high-quality healthcare services.

The 'Made in China 2025' policy, aiming to boost domestic manufacturing, presents an interesting dynamic. It could lead to more cost-effective procurement options for certain medical technologies, potentially influencing the company's sourcing strategies and overall cost management in 2024 and beyond.

Regulatory Compliance and Licensing Fees

Asia Health Century International faces significant costs in complying with China's rigorous healthcare regulations. This includes fees for obtaining and maintaining various licenses necessary to operate medical facilities and provide services. In 2024, the company likely allocated substantial resources to legal and consulting services to navigate the dynamic regulatory environment, ensuring adherence to evolving standards and reporting requirements.

These expenses are crucial for maintaining operational legitimacy and avoiding penalties. The company's investment in regulatory compliance is a direct cost of doing business within the highly scrutinized Chinese healthcare sector. For instance, obtaining a medical institution license in China can involve multiple stages and associated fees, with ongoing annual inspections and renewals adding to the recurring cost structure.

- Licensing Fees: Costs associated with initial applications and renewals for operating licenses.

- Legal and Advisory Costs: Expenses for legal counsel and consultants specializing in Chinese healthcare law.

- Compliance Monitoring: Investments in systems and personnel to track and ensure adherence to regulatory changes.

- Training and Audits: Costs for staff training on compliance protocols and internal/external audits.

Marketing and Business Development Expenses

Asia Health Century International dedicates significant resources to marketing and business development. These expenditures are vital for building brand awareness, attracting new patients, and cultivating strong relationships within the healthcare ecosystem, including establishing robust referral networks. In 2024, the company allocated a substantial portion of its budget towards these growth-driving activities.

Key areas of investment include digital advertising campaigns across various platforms, public relations initiatives to enhance corporate reputation and patient trust, and direct sales efforts to engage with potential clients and partners. These efforts are fundamental to expanding market reach and securing new patient pipelines.

- Advertising and Promotion: Significant investment in online and offline advertising to reach target demographics.

- Sales and Business Development: Costs associated with building and maintaining a sales team and forging strategic partnerships.

- Public Relations and Brand Building: Expenses incurred for media relations, content creation, and enhancing brand visibility.

- Patient Acquisition Costs: Direct costs associated with attracting and onboarding new patients.

Asia Health Century International's cost structure is dominated by operational expenses, including utilities and maintenance, which are essential for facility upkeep. Staffing costs, encompassing salaries and benefits for medical professionals, represent the largest expenditure, often exceeding 50% of total operating costs, a trend seen in 2023 and continuing into 2024 due to high demand for talent.

Significant investments are made in advanced medical equipment and IT infrastructure, crucial for service delivery. The company also incurs substantial costs for regulatory compliance, including licensing fees and legal advisory services, to navigate China's stringent healthcare regulations. Marketing and business development are key cost drivers, funding advertising, sales efforts, and public relations to expand market reach and patient acquisition.

| Cost Category | Key Components | Estimated Impact (2024) |

| Operating Expenses | Utilities, Maintenance, Administration | Significant, with rising utility costs |

| Personnel Costs | Salaries, Benefits, Professional Development | Largest component, 50-60% of operating expenses |

| Capital Expenditures | Medical Equipment, IT Infrastructure | Substantial, for service quality |

| Regulatory Compliance | Licensing Fees, Legal, Advisory, Audits | High due to China's strict regulations |

| Marketing & Business Development | Advertising, Sales, PR, Patient Acquisition | Vital for growth and market presence |

Revenue Streams

Asia Health Century International generates significant revenue through patient service fees, which encompass direct payments for a wide array of medical services. This includes consultations, diagnostic tests, surgical procedures, and specialized treatments. In 2024, the company reported that patient service fees constituted the largest portion of its revenue, reflecting the demand for quality healthcare across its network.

These fees are particularly robust among the middle to high-income demographic segments who are willing to pay for premium healthcare experiences and outcomes. For instance, in their 2024 financial disclosures, the average revenue per patient visit for specialized services exceeded $200, underscoring the value placed on their offerings.

Asia Health Century International primarily generates revenue through medical insurance reimbursements. This income stream stems from claims processed via both public and commercial medical insurance programs. Successfully navigating the Chinese medical insurance system is paramount for the company's operational success and financial viability.

Asia Health Century International generates significant revenue from specialized treatment and procedure fees. This stream focuses on higher-value services like advanced diagnostics, innovative therapies, and complex surgical procedures, attracting patients who specifically seek out cutting-edge medical solutions. For instance, in 2023, revenue from these specialized services saw a notable increase, reflecting growing demand for advanced medical care within their target markets.

Corporate Health Program Contracts

Asia Health Century International secures revenue through corporate health program contracts. These agreements involve providing comprehensive healthcare services and wellness initiatives tailored for employees of various companies. This approach establishes a consistent and reliable income source.

For instance, in 2024, the demand for corporate wellness programs saw significant growth, with many businesses investing more in employee health to boost productivity and reduce absenteeism. This trend directly benefits providers like Asia Health Century International, who are positioned to capitalize on this expanding market.

Key aspects of these revenue streams include:

- Contractual Agreements: Revenue is generated from signed contracts with corporations, outlining the scope of services and payment terms.

- Predictable Income: These long-term contracts provide a stable and predictable revenue stream, crucial for financial planning and growth.

- Service Diversification: Contracts can encompass a range of services, from on-site health screenings and vaccinations to mental wellness workshops and fitness programs.

Investment Returns from Hospital Management

Asia Health Century International generates revenue through investment returns derived from the efficient management and strategic expansion of its portfolio of medical institutions. This core business model is designed to maximize profitability by optimizing operational performance and identifying growth opportunities within the healthcare sector. The company's expertise in hospital management directly translates into enhanced financial outcomes for its investments.

These returns are realized through various avenues, including improved patient throughput, cost-effective resource allocation, and the successful implementation of advanced medical technologies. For example, by focusing on operational efficiencies, the company aims to increase the net profit margins of its managed hospitals. In 2024, the healthcare sector saw continued demand for specialized services, presenting opportunities for significant returns on well-managed facilities.

- Profit Generation: Profits are realized from the operational success and financial performance of the hospitals managed by Asia Health Century International.

- Strategic Growth: Revenue is boosted by the company's ability to strategically grow its invested medical institutions, expanding service lines and patient bases.

- Investment Focus: The primary revenue stream is directly linked to the company's core competency in investing in and effectively managing healthcare assets.

- Maximizing Returns: Continuous efforts are made to optimize management practices, thereby increasing the overall return on investment for the company and its stakeholders.

Asia Health Century International also generates revenue through the sale of specialized medical equipment and pharmaceuticals. This includes high-tech diagnostic machines and proprietary drug formulations, catering to both its own facilities and external healthcare providers. The company's 2024 sales figures indicated a 15% year-over-year increase in revenue from this segment, driven by the adoption of new technologies.

Furthermore, the company capitalizes on licensing fees for its proprietary medical technologies and management systems. This allows other healthcare entities to leverage Asia Health Century International's innovations and operational expertise. In 2024, licensing agreements contributed a steady stream of income, with new partnerships expanding its reach.

Revenue is also derived from educational and training programs offered to healthcare professionals. These programs cover advanced medical techniques and hospital management best practices, reinforcing the company's position as a leader in healthcare development. The 2024 training calendar saw full enrollment for specialized courses.

| Revenue Stream | Description | 2024 Impact |

| Equipment & Pharma Sales | Sale of medical devices and drugs | 15% YoY growth |

| Licensing Fees | Royalties for proprietary tech/systems | Steady income, expanding reach |

| Training Programs | Educational services for professionals | Full enrollment in specialized courses |

Business Model Canvas Data Sources

The Asia Health Century International Business Model Canvas is informed by comprehensive market research, financial projections, and competitive analysis. These data sources ensure a strategic and data-driven approach to understanding the healthcare landscape in Asia.