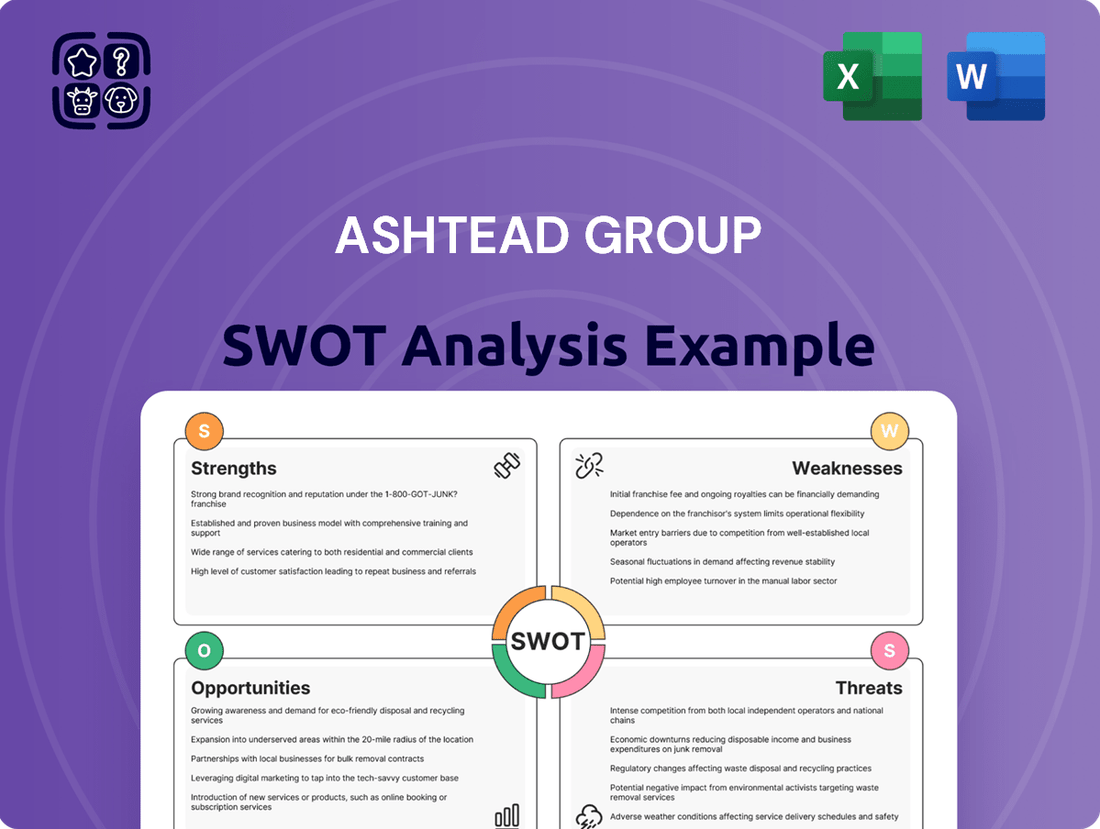

Ashtead Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashtead Group Bundle

Ashtead Group, a leader in equipment rental, demonstrates significant strengths in its expansive network and robust operational efficiency. However, potential threats from economic downturns and increased competition warrant careful consideration.

Discover the complete picture behind Ashtead Group’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Ashtead Group, largely via its Sunbelt Rentals division, has a substantial and deeply rooted operational network spanning the United States, Canada, and the United Kingdom. This extensive geographic reach is a core strength, allowing for diversified revenue generation and mitigating the risks associated with dependence on any one market's economic performance.

The company is actively pursuing a growth strategy focused on increasing location density within its primary rental markets. This approach aims to enhance market penetration and capture a larger share of regional demand, as evidenced by Sunbelt's continuous expansion efforts.

For the fiscal year ending April 30, 2024, Sunbelt Rentals reported a significant portion of Ashtead Group's total revenue, underscoring the importance of its North American operations. This wide coverage allows Ashtead to serve a broad customer base across various industries.

Ashtead Group's strength lies in its remarkably diversified customer base and the wide range of sectors it serves. This includes construction, industrial, infrastructure, and events, catering to everything from small projects to massive developments.

This broad reach significantly reduces the company's vulnerability to economic downturns in any single industry. For instance, in its fiscal year 2024, Ashtead reported that its rental revenue was well-distributed across these key end markets, demonstrating a stable demand profile.

This strategic diversification ensures a resilient revenue stream, as demand for equipment remains robust even when specific sectors experience temporary slowdowns. The company's ability to adapt its offerings to different market needs is a core advantage.

Ashtead Group, through its Sunbelt Rentals brand, boasts a truly impressive breadth of rental solutions. This isn't just about basic tools; they offer everything from general equipment to highly specialized machinery and even mobile storage units. This wide-ranging inventory means they can cater to an incredibly diverse customer base, a significant advantage in the competitive rental market.

This extensive fleet directly translates into a powerful competitive edge. Sunbelt Rentals can serve a multitude of customer requirements, from small DIY projects to large-scale industrial operations. Furthermore, this diverse offering naturally creates opportunities for upselling and cross-selling, as customers needing one type of equipment might also require another from the same provider.

A particularly noteworthy aspect of Ashtead's strength lies in its emphasis on specialty equipment. This segment of the rental industry is experiencing robust growth, and Ashtead's commitment to this area positions them well for future expansion and profitability. For example, in fiscal year 2024, rental revenue for specialty equipment demonstrated strong growth, contributing significantly to the overall performance.

Strong Brand Recognition and Market Position

Sunbelt Rentals boasts significant brand recognition, solidifying its standing as the second-largest equipment rental company in North America. This strong market position is a key asset, enabling the company to attract and retain customers, and expand its reach through strategic acquisitions and new site developments. Their ambition is clear: to capture a substantial 20% market share in the US.

This brand strength translates directly into tangible business advantages.

- Market Leadership: Sunbelt Rentals is a dominant force, particularly in the vast North American market.

- Customer Loyalty: The established brand fosters trust and encourages repeat business.

- Acquisition Advantage: Strong brand equity makes integrating acquired businesses smoother, enhancing growth.

- Expansion Capability: It supports the opening of new locations (greenfield sites), increasing accessibility and service reach.

Strategic Growth Initiatives (Sunbelt 4.0)

Ashtead Group's Sunbelt 4.0 strategy is a key strength, designed to propel growth by optimizing its current infrastructure and venturing into new territories via greenfield expansions. This plan is specifically geared towards enhancing operational efficiency and capitalizing on its established market presence.

The 'cluster' strategy within Sunbelt 4.0 is a significant driver, allowing for deeper penetration and market share gains in targeted regions. This approach is expected to deliver robust revenue growth and improved profit margins, with Ashtead projecting strong compound annual growth rates across its primary operational areas through fiscal 2025.

Furthermore, Sunbelt 4.0 explicitly integrates sustainability and technological advancements into its core objectives. This forward-looking approach positions Ashtead to meet evolving market demands and regulatory landscapes, enhancing its competitive edge. The company anticipates substantial capital expenditure to support these growth initiatives.

- Sunbelt 4.0 Focus: Leveraging existing platform, greenfield expansion, cluster strategy, operational efficiency.

- Growth Projections: Aiming for strong revenue growth and margin expansion, with significant CAGRs anticipated through FY2025.

- Strategic Pillars: Emphasis on sustainability and technology adoption to drive future performance.

- Investment: Significant capital allocation planned to support the strategic growth initiatives.

Ashtead Group’s extensive operational network, primarily through Sunbelt Rentals, provides a significant competitive advantage. This broad geographic footprint across the United States, Canada, and the United Kingdom ensures diversified revenue streams and mitigates risks tied to any single market. The company's strategic focus on increasing location density within its core markets further solidifies this strength, aiming to capture greater market share and meet localized demand effectively. For instance, Sunbelt's continuous expansion efforts are a testament to this approach.

The company's diverse customer base and the wide array of industries it serves, including construction, industrial, and infrastructure, create a resilient revenue model. This diversification reduces vulnerability to economic fluctuations in any specific sector. In fiscal year 2024, Ashtead reported a healthy distribution of rental revenue across these key end markets, highlighting a stable demand profile.

Ashtead's comprehensive fleet, ranging from general equipment to specialized machinery and mobile storage, allows it to cater to a broad spectrum of customer needs. This extensive offering fosters opportunities for upselling and cross-selling. The company's particular strength in specialty equipment, a growing segment, positions it for enhanced future profitability, as demonstrated by strong growth in this area during fiscal year 2024.

Sunbelt Rentals is recognized as the second-largest equipment rental company in North America, boasting significant brand recognition and market leadership. This strong brand equity facilitates customer acquisition and retention, supports smoother integration of acquisitions, and bolsters its capability to expand through new location developments. Their ambition to achieve a 20% market share in the US underscores this powerful market position.

What is included in the product

Delivers a strategic overview of Ashtead Group’s internal and external business factors, highlighting its market strengths, operational gaps, and potential risks.

Offers a clear breakdown of Ashtead Group's competitive landscape and internal capabilities, helping to identify and address critical strategic challenges.

Weaknesses

Ashtead Group's reliance on the construction and industrial sectors makes it particularly susceptible to economic downturns. When the economy falters, demand for rental equipment naturally decreases, directly impacting Ashtead's revenue streams and overall profitability. This cyclical nature means that periods of economic contraction can present significant headwinds for the company.

The fiscal year 2025 results highlighted this vulnerability, with revenues falling short of expectations and a dip in profit before tax. A key contributor to this performance was the subdued activity within the construction market, demonstrating how macroeconomic factors can swiftly translate into tangible financial results for Ashtead.

Ashtead's need to maintain and grow its extensive equipment fleet demands substantial capital. This is a constant drain on resources.

In fiscal year 2025, Ashtead allocated $2.4 billion to capital expenditures, a notable decrease from the $4.3 billion spent in 2024. This ongoing investment, even when reduced, still represents a significant commitment.

Such large capital outlays can put pressure on the company's cash flow. It also means Ashtead needs to continuously secure financing.

The reliance on financing makes Ashtead vulnerable to fluctuations in interest rates, which can increase the cost of capital and impact profitability.

Ashtead Group's substantial debt, used to finance its extensive rental fleet, makes it vulnerable to rising interest rates. For instance, if interest rates were to climb significantly in 2024 or 2025, the group's borrowing costs for new equipment acquisition and existing debt refinancing would increase, directly impacting profitability.

Operational Complexity and Depreciation Costs

Managing Ashtead's extensive and geographically spread-out equipment fleet presents considerable operational challenges. These include coordinating intricate logistics for equipment delivery and retrieval, ensuring timely and effective maintenance across a vast array of assets, and meticulously tracking each piece of equipment. The sheer scale and diversity of the fleet, which includes everything from small tools to large construction machinery, amplify these complexities.

The depreciation of Ashtead's substantial rental fleet represents a significant cost factor that can weigh on profitability. This is particularly true during periods of lower utilization, where the carrying cost of idle assets remains high. As the average age of the fleet increases, the rate of depreciation also tends to accelerate, further pressuring margins.

- Operational Complexity: Coordinating logistics, maintenance, and tracking for a diverse, geographically dispersed fleet of over 1 million revenue-generating units is a constant challenge.

- Depreciation Costs: In FY24 (ending April 2024), Ashtead reported significant capital expenditures, which, while expanding the fleet, also increase the depreciation base and associated costs.

- Utilization Impact: Lower fleet utilization rates directly increase the per-unit depreciation cost, impacting the profitability of individual assets and the fleet as a whole.

Intense Competition

Ashtead Group operates within a fiercely competitive equipment rental landscape. Major national rivals such as United Rentals and Herc Rentals, alongside a multitude of regional and independent providers, vie for market share. This crowded field can indeed compress rental pricing and necessitate ongoing substantial investments in fleet expansion, technological upgrades, and superior customer engagement to stay ahead.

The pressure from competitors impacts Ashtead's ability to command premium pricing and maintain its market dominance. For instance, in 2023, the broader equipment rental market saw continued pricing discipline, though the intensity of competition means that gains are hard-won. Ashtead's strategic focus on operational efficiency and its diversified service offerings are key to navigating this challenging environment.

- Intense Rivalry: Faces strong competition from established national players and numerous smaller operators.

- Pricing Pressure: Competition can limit the group's ability to increase rental rates.

- Market Share Challenges: Maintaining and growing market share requires continuous effort and investment.

- Investment Demands: Staying competitive necessitates ongoing capital expenditure on fleet modernization and technology.

Ashtead's substantial debt, incurred to finance its extensive fleet, exposes it to interest rate volatility. Fluctuations in borrowing costs, particularly in 2024 and 2025, can directly impact the company's profitability and the cost of acquiring new equipment.

Managing a vast, geographically dispersed fleet of over 1 million revenue-generating units presents significant operational challenges. This includes complex logistics for delivery and retrieval, extensive maintenance requirements, and precise asset tracking, all of which contribute to overheads and potential inefficiencies.

The depreciation of Ashtead's large equipment fleet represents a substantial ongoing expense. This cost is magnified during periods of lower fleet utilization, where idle assets still incur carrying costs and accelerated depreciation as they age.

Intense competition from national players like United Rentals and numerous regional operators puts pressure on Ashtead's pricing power and necessitates continuous investment in fleet modernization and technology to maintain market share.

| Weakness | Description | Impact |

|---|---|---|

| Debt Exposure | Financing a large rental fleet requires significant debt, making Ashtead vulnerable to rising interest rates. | Increased borrowing costs, reduced profitability, higher capital expenditure expenses. |

| Operational Complexity | Managing a vast and geographically dispersed fleet (over 1 million units) involves complex logistics, maintenance, and tracking. | Higher operating costs, potential for inefficiencies, challenges in maintaining service levels. |

| Depreciation Costs | The large equipment fleet experiences significant depreciation, a substantial ongoing cost. | Reduced asset value, pressure on profit margins, especially during low utilization periods. |

| Competitive Landscape | Operates in a highly competitive market with strong rivals and numerous smaller players. | Pricing pressure, need for continuous investment in fleet and technology, challenges in market share growth. |

What You See Is What You Get

Ashtead Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

Businesses are increasingly opting for rental equipment over outright ownership. This trend is fueled by a desire for cost savings, greater operational flexibility, and a strategic move towards asset-light business models. Ashtead Group benefits directly from this structural shift.

The current economic climate, characterized by higher borrowing costs and persistent inflation, further bolsters the appeal of equipment rental. Companies find it more financially prudent to rent rather than invest heavily in purchasing assets, creating a significant tailwind for Ashtead’s rental segment.

For instance, in fiscal year 2024, Ashtead Group reported record rental revenue, demonstrating the tangible impact of this growing demand. This growing preference for rental solutions presents Ashtead with a substantial opportunity for continued expansion and market share growth.

Government-backed infrastructure spending initiatives, such as the US Bipartisan Infrastructure Law, are injecting significant capital into projects across North America. This legislation, with an estimated $1.2 trillion allocated over ten years, directly fuels demand for construction and industrial rental equipment, benefiting Ashtead's core operations.

Ongoing commercial and residential development projects, particularly in key Ashtead markets like the United States and the United Kingdom, represent a consistent source of opportunity. For instance, in 2024, the US saw a notable uptick in new housing starts, exceeding 1.4 million annualized units, a trend that necessitates substantial equipment rental for construction phases.

These large-scale development projects are often shielded from short-term economic volatility due to their long-term planning and government backing. This provides Ashtead with a more predictable revenue stream, as infrastructure and major construction projects tend to maintain momentum even during moderate economic downturns.

The increasing focus on renewable energy infrastructure, including wind and solar farm development, further expands the scope of these opportunities. Projects such as the Sunrise Wind project in the US East Coast, requiring extensive offshore construction, will drive demand for specialized rental equipment, aligning with Ashtead's strategic growth areas.

Ashtead Group can capitalize on technological advancements to boost efficiency and customer satisfaction. The company is already seeing benefits from its digital investments, with the group's UK business, A-Plant, reporting a 15% increase in digital transactions in the first half of fiscal year 2024 compared to the previous year. By integrating IoT devices and AI into its rental platforms, Ashtead can offer predictive maintenance, reducing downtime and improving equipment availability for its customers.

The electrification of its rental fleet presents a significant opportunity for Ashtead to meet growing demand for sustainable solutions and reduce its environmental impact. In fiscal year 2024, Ashtead expanded its electric and hybrid equipment offering, with sales of these more environmentally friendly options growing by 25% across the group. This strategic move not only aligns with market trends but also opens up new customer segments seeking greener alternatives.

Strategic Acquisitions and Market Consolidation

The equipment rental industry, especially in the United States, remains quite fragmented with numerous smaller, independent operators. This presents a prime opportunity for Ashtead, through its Sunbelt Rentals segment, to expand its market dominance by strategically acquiring these smaller players. These bolt-on acquisitions allow Ashtead to efficiently integrate new locations and customer bases, thereby consolidating market share.

Ashtead has a proven track record of executing this strategy. For instance, in fiscal year 2024, Sunbelt Rentals successfully acquired 26 businesses. This pace is expected to continue into fiscal year 2025, with ongoing efforts to identify and integrate further strategic acquisitions to fuel growth and enhance operational reach.

- Market Fragmentation: The US equipment rental market is characterized by a significant number of smaller, independent companies, creating ripe conditions for consolidation.

- Strategic Bolt-on Acquisitions: Ashtead actively pursues acquisitions that complement its existing operations, adding new locations and expanding service capabilities efficiently.

- Fiscal Year 2024 Performance: Sunbelt Rentals demonstrated its commitment to this strategy by completing 26 acquisitions in the fiscal year ending April 30, 2024.

- Continued Momentum in Fiscal 2025: The company is actively continuing its acquisition strategy in fiscal year 2025, indicating a sustained focus on market consolidation.

Expansion into Specialty Niches and Sustainable Solutions

The rental market is seeing a significant uptick in demand for specialized equipment and eco-friendly alternatives, such as electric and hybrid machinery. Ashtead Group is well-positioned to capitalize on this trend.

By broadening its rental fleet to include these sustainable solutions, Ashtead can attract a growing segment of environmentally conscious customers. This expansion not only meets market demand but also enhances Ashtead’s competitive edge by aligning with global sustainability initiatives. For instance, the company has been investing in its fleet, with capital expenditure in FY24 reaching $2.4 billion, a portion of which is allocated to these growing segments.

Opportunities in specialty niches include:

- Increased demand for advanced construction technology: Offering specialized tools and equipment for complex projects.

- Growth in energy-efficient machinery rentals: Catering to the rise of green building and infrastructure projects.

- Expansion into new geographic markets: Targeting regions with high demand for specialty rentals.

- Partnerships for sustainable solutions: Collaborating with manufacturers of electric and hybrid equipment.

Ashtead Group is well-positioned to leverage ongoing market fragmentation, particularly in the United States, through strategic bolt-on acquisitions. The company's consistent execution of this strategy, evidenced by 26 acquisitions in fiscal year 2024, is expected to continue into fiscal year 2025, driving further market consolidation and operational reach.

The increasing demand for specialized equipment and eco-friendly machinery presents a significant growth avenue, with Ashtead’s capital expenditure in FY24 reaching $2.4 billion, partly allocated to these expanding segments. By broadening its fleet with sustainable solutions, Ashtead can attract environmentally conscious customers and enhance its competitive advantage.

The company's digital investments are yielding tangible results, as seen with a 15% increase in digital transactions for its UK business in the first half of FY24. Continued integration of IoT and AI promises to boost operational efficiency and customer satisfaction through improved equipment availability and predictive maintenance.

Furthermore, government infrastructure spending initiatives, such as the US Bipartisan Infrastructure Law, directly fuel demand for construction and industrial rental equipment, creating a stable revenue stream for Ashtead even amidst economic fluctuations.

Threats

A significant economic downturn poses a substantial threat to Ashtead Group. A prolonged recession could lead to a sharp decline in construction and industrial projects, directly impacting the demand for equipment rentals. For instance, while the overall rental market is expected to see growth, some areas of the non-residential construction sector are anticipated to experience slowdowns or flat growth in 2025, which could affect revenue streams.

Sustained high interest rates or further increases could significantly elevate Ashtead's borrowing costs for essential fleet acquisition and ongoing maintenance, directly impacting its bottom line. For instance, if Ashtead's cost of debt rises by 1%, this could translate to tens of millions in additional annual interest expenses, depending on their leverage.

Furthermore, elevated interest rates make it more challenging and costly for Ashtead's diverse customer base to finance their construction projects and operational needs. This increased financing burden on customers can lead to reduced capital expenditure and a subsequent dampening of rental demand for Ashtead's equipment, particularly for larger, longer-term projects.

The equipment rental landscape is fiercely competitive, featuring giants like United Rentals and Herc Rentals alongside a multitude of smaller, regional operators. This crowded market naturally creates significant pricing pressure, potentially eroding Ashtead's rental rates and squeezing profit margins if the company cannot effectively differentiate its offerings or maintain its competitive edge.

Supply Chain Disruptions and Equipment Costs

Global supply chain snags are a significant concern for Ashtead Group, potentially hindering their ability to acquire new rental equipment. These disruptions can lead to longer lead times and a reduced availability of essential machinery, impacting fleet expansion plans.

Furthermore, escalating equipment costs are a looming threat. Inflationary pressures, coupled with the possibility of tariffs on raw materials and manufactured goods, could significantly drive up the purchase price of new assets. For instance, the ongoing global semiconductor shortage, which began impacting manufacturing in 2020 and continued through 2024, has already increased the cost of technologically advanced equipment, a trend likely to persist.

- Supply chain volatility: Disruptions can delay the delivery of new equipment, affecting fleet availability.

- Increased equipment costs: Inflation and potential tariffs are driving up the purchase price of machinery.

- Impact on expansion: Higher costs and limited availability can slow down or make fleet expansion less efficient.

- Profit margin pressure: Escalating expenses can squeeze profit margins, especially if rental rates cannot fully offset the increased costs.

Regulatory Changes and Environmental Compliance

Increasing regulatory scrutiny regarding environmental impact and carbon emissions could lead to higher compliance costs for Ashtead. For example, the UK's commitment to net zero by 2050, and similar global targets, places pressure on industries to decarbonize. Ashtead, operating a large fleet of equipment, faces potential mandates for lower-emission vehicles and machinery.

While Ashtead is actively investing in sustainable solutions, with initiatives like their 'Sunbelt 2025' sustainability plan aiming to reduce Scope 1 and 2 emissions, new or evolving regulations might necessitate significant capital outlay. This could involve accelerated fleet upgrades or substantial investments in operational changes to meet potentially stricter environmental standards than currently anticipated.

- Increased Compliance Costs: Potential for higher operational expenses due to new environmental regulations.

- Capital Expenditure Requirements: Need for significant investment in upgrading equipment and machinery to meet emission standards.

- Fleet Modernization: Pressure to transition towards lower-emission vehicles and equipment, impacting capital allocation.

- Operational Adjustments: Potential changes in how equipment is operated and maintained to comply with evolving environmental rules.

Intensifying competition from established players and new entrants poses a threat to Ashtead's market share and pricing power. Emerging regional competitors could offer specialized services or more aggressive pricing, potentially impacting Ashtead's growth in specific markets. For instance, the North American equipment rental market, Ashtead's largest segment, is projected to grow at a compound annual growth rate (CAGR) of approximately 5.5% through 2027, indicating a dynamic and attractive market where competition is likely to remain robust.

The ongoing global semiconductor shortage, which impacted manufacturing throughout 2024, continues to pose a risk to Ashtead's ability to procure technologically advanced equipment. This scarcity can lead to extended lead times and increased acquisition costs for new machinery, potentially hindering fleet expansion and modernization efforts crucial for maintaining a competitive edge.

Rising inflation and supply chain disruptions are driving up the cost of new equipment for Ashtead. For example, the average price of construction equipment saw an approximate 7% increase year-over-year in early 2024, directly impacting the capital expenditure required for fleet replenishment and growth, thereby potentially squeezing profit margins if rental rates do not keep pace.

Environmental regulations, particularly those focused on carbon emissions, present a significant threat. Ashtead's commitment to sustainability, including its goal to reduce Scope 1 and 2 emissions, may require substantial capital investment in fleet upgrades and new technologies to meet evolving standards. Failure to adapt could lead to penalties and reduced competitiveness, especially as many customers prioritize suppliers with strong environmental credentials.

SWOT Analysis Data Sources

This analysis is built on robust data from Ashtead Group's official financial filings, comprehensive market research reports, and expert commentary from industry analysts, ensuring a well-rounded and accurate SWOT assessment.