Ashtead Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashtead Group Bundle

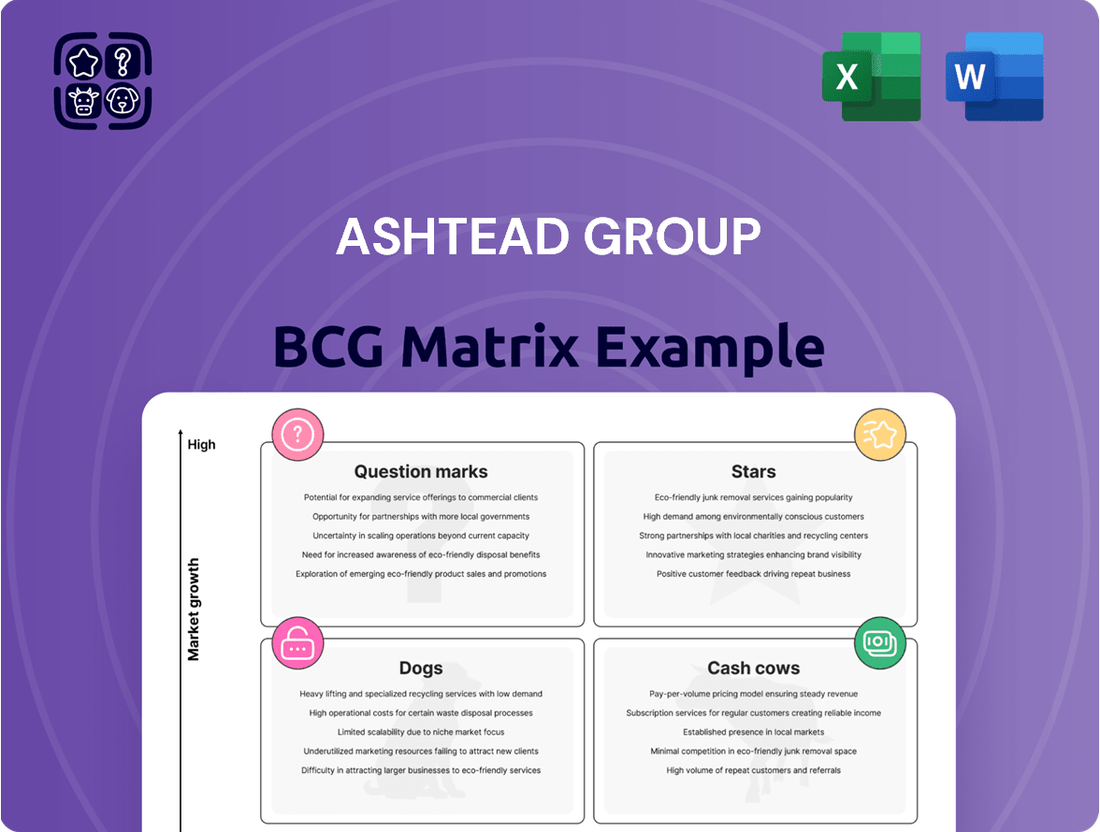

Curious about Ashtead Group's strategic positioning? Our BCG Matrix analysis reveals the hidden potential and current standing of their diverse product and service offerings. See which segments are driving growth and which might require a strategic re-evaluation.

Understand Ashtead Group's market performance at a glance. Are their key offerings Stars or Cash Cows, or are they facing challenges as Dogs or Question Marks? This preview offers a glimpse into their strategic landscape.

Don't let uncertainty guide your decisions. Purchase the full Ashtead Group BCG Matrix for a complete breakdown of their portfolio's market share and growth rate, enabling you to make informed investment choices.

Gain a competitive edge by unlocking the detailed insights within the complete BCG Matrix. This comprehensive report provides the clarity needed to optimize resource allocation and chart a path for future success.

Elevate your strategic planning with actionable intelligence. The full Ashtead Group BCG Matrix is your essential guide to navigating market dynamics and maximizing profitability.

Stars

Ashtead's Specialty Equipment Rentals in North America is a definite Star in its portfolio. This segment saw its rental-only revenue climb by a healthy 11% in FY2025. It encompasses lucrative areas such as power and HVAC solutions, facilities management, and rentals for the film and television industry, all of which are currently experiencing strong demand and contributing to this growth.

Ashtead Group's Mega Project Equipment Rental segment in North America is experiencing significant tailwinds. The company is capitalizing on a robust pipeline of large-scale projects, including those in data centers, semiconductor manufacturing, and liquefied natural gas (LNG) infrastructure. These developments are fueling substantial demand for Ashtead's specialized rental equipment, solidifying its position in a rapidly expanding market.

The ongoing investment in critical infrastructure and advanced manufacturing facilities across North America directly translates into increased utilization rates and rental revenues for Ashtead. For instance, the boom in data center construction, driven by AI and cloud computing, requires extensive use of heavy machinery and specialized tools that Ashtead readily supplies. This strategic focus on mega projects is a key growth driver for the company.

Ashtead is well-positioned to capture a larger share of this burgeoning market. Its extensive fleet, operational scale, and proven expertise in managing complex project logistics give it a competitive edge. The company anticipates further market share gains as these mega projects continue to ramp up throughout 2024 and beyond.

Ashtead Group's Sunbelt 4.0 strategy is a prime example of a digital transformation initiative, fitting squarely into the 'Stars' category of the BCG Matrix. This ongoing digital overhaul includes the development of new omnichannel e-commerce platforms and the implementation of AI-powered hyper-personalization. These advancements are designed to significantly enhance customer experience and streamline internal operations, ultimately driving greater efficiency and accelerating competitive advantages.

The focus on technology within Sunbelt 4.0 is not just about modernization; it's a direct driver of revenue growth, particularly through online channels. For instance, in the fiscal year ending January 31, 2024, Ashtead reported a 15% increase in total revenue to $10.7 billion, with digital initiatives playing a key role in this expansion by improving customer access and service delivery. This commitment to digital innovation is vital for maintaining and strengthening Ashtead's market leadership in an increasingly digitized industry.

Geographic Expansion in Under-penetrated US/Canada Markets

Ashtead Group's strategy to aggressively expand its geographic footprint in under-penetrated US and Canadian markets is a significant component of its growth strategy, positioning it as a Star in the BCG matrix. The company plans to open 300-400 new greenfield locations as part of its Sunbelt 4.0 initiative. This expansion targets markets with lower fleet density, such as California and Ontario, aiming to capture untapped demand and increase market share.

This focus on geographic expansion is designed to enhance fleet density and solidify Ashtead's market leadership. By strategically entering and developing these under-penetrated regions, Ashtead can broaden its customer base and leverage its proven cluster strategy to achieve operational efficiencies and greater market penetration.

- Geographic Focus: Targeting under-penetrated US and Canadian markets, including California and Ontario.

- Expansion Target: Addition of 300-400 greenfield locations under the Sunbelt 4.0 plan.

- Strategic Objective: Increase fleet density, capture growing demand, and broaden customer base.

- Growth Driver: Leveraging the cluster approach to achieve market leadership in new territories.

Sustainable and Electric Equipment Rental Offerings

Ashtead Group's focus on sustainable and electric equipment rentals places it in a strong position within the BCG matrix, likely categorizing it as a Star. The construction industry's growing demand for eco-friendly machinery, such as electric and hybrid models, signifies a high-growth market where Ashtead is actively expanding its offerings.

Ashtead has already made significant strides in this area, with approximately 20% of its extensive rental fleet now consisting of battery, electric, hybrid, and solar-powered assets. This substantial investment demonstrates their commitment to leading the transition towards lower carbon solutions in the equipment rental sector.

- Market Growth: The demand for sustainable construction equipment is rapidly increasing, indicating a high-growth potential for Ashtead's electric and hybrid offerings.

- Fleet Composition: Around 20% of Ashtead's current rental fleet comprises eco-friendly assets, showcasing significant existing investment and capability.

- Competitive Advantage: This strategic focus on green technology positions Ashtead to capture market share and maintain a competitive edge as environmental regulations and customer preferences evolve.

Ashtead's Specialty Equipment Rentals in North America is a definite Star, with rental-only revenue up 11% in FY2025, driven by strong demand in power, HVAC, and film/TV rentals.

The Mega Project Equipment Rental segment in North America is also a Star, benefiting from robust demand in data centers, semiconductor manufacturing, and LNG infrastructure projects.

Ashtead's Sunbelt 4.0 digital transformation, including new e-commerce platforms and AI personalization, is a Star initiative aimed at enhancing customer experience and operational efficiency.

The aggressive geographic expansion into under-penetrated US and Canadian markets, with plans for 300-400 new greenfield locations, firmly places this strategy as a Star.

Ashtead's commitment to sustainable and electric equipment rentals, with 20% of its fleet already comprising eco-friendly assets, positions it as a Star in a rapidly growing market segment.

| Segment/Initiative | BCG Category | Key Growth Drivers/Facts (as of FY2025) |

|---|---|---|

| Specialty Equipment Rentals (NA) | Star | 11% rental-only revenue growth; strong demand in power, HVAC, film/TV. |

| Mega Project Equipment Rental (NA) | Star | Capitalizing on data center, semiconductor, and LNG project booms. |

| Sunbelt 4.0 (Digital Transformation) | Star | Omnichannel e-commerce, AI personalization enhancing customer experience and operations. FY2024 total revenue $10.7 billion (+15%). |

| Geographic Expansion (US/Canada) | Star | Plan for 300-400 new greenfield locations in under-penetrated markets like California and Ontario. |

| Sustainable/Electric Equipment | Star | 20% of fleet consists of battery, electric, hybrid, solar assets; growing market demand. |

What is included in the product

Highlights which units to invest in, hold, or divest for Ashtead Group.

A clear BCG Matrix visualizes Ashtead's portfolio, alleviating confusion about strategic resource allocation.

Cash Cows

Ashtead's North American General Tool rental segment is a quintessential Cash Cow. It boasts a dominant market share within a mature industry, meaning its growth is steady rather than explosive. In fiscal year 2025, this segment experienced a modest growth rate of 1%, demonstrating its stability.

This business, which rents out a vast array of common construction and industrial equipment, is a significant contributor to Ashtead's overall profitability. Its strength lies in its extensive operational network across North America and deeply entrenched customer relationships, ensuring consistent demand.

The substantial cash flow generated by this segment is crucial. It acts as a vital financial engine, providing the necessary capital to fund growth initiatives and investments in other, more dynamic business areas within the Ashtead Group portfolio.

Sunbelt Rentals UK & Ireland is a prime example of a Cash Cow for Ashtead Group. It commands a significant market share within the United Kingdom's well-established equipment rental sector, consistently providing the company with a steady stream of revenue.

Despite a more modest growth rate of 2% in the UK during FY2025, the operation's mature market position and highly efficient management practices ensure it remains a reliable source of substantial cash flow for the group.

The strategic approach for this business segment is centered on optimizing operational efficiency and fully utilizing its existing infrastructure to boost profitability, rather than pursuing aggressive expansion.

Mobile storage solutions, a significant part of Ashtead Group's portfolio, operate as a classic Cash Cow within their business. These offerings, often linked to long-term construction projects or consistent commercial demands, benefit from a robust market share and a stable demand environment. This stability translates into predictable revenue streams for Ashtead.

The operational costs associated with mobile storage are typically lower when compared to their more actively used rental equipment, further enhancing profitability. In fiscal year 2024, Ashtead reported strong performance across its divisions, with the U.K. segment, which includes storage solutions, demonstrating resilience. This segment contributed significantly to the group's overall revenue, underscoring the Cash Cow status of these services.

Long-Term Rental Contracts

Ashtead Group's long-term rental contracts function as a robust cash cow. In 2024, medium-term contracts, typically spanning 1 to 12 months, secured approximately 48% of the rental demand, highlighting Ashtead's significant penetration into stable, recurring revenue sectors. These agreements are crucial for generating predictable cash flows, which helps to smooth out the inherent seasonality often seen in the rental industry.

The predictability offered by these longer-term arrangements significantly reduces revenue volatility. This stability is a hallmark of a cash cow, as it allows the business to reliably generate profits without requiring substantial ongoing reinvestment or aggressive marketing efforts. The established nature of these contracts means Ashtead can leverage its existing infrastructure and customer base effectively.

- Stable Revenue: Medium-term contracts accounted for nearly 48% of Ashtead's demand in 2024, signifying a strong base of recurring income.

- Reduced Cyclicality: These longer contracts buffer against the fluctuations typical of short-term rentals, contributing to consistent cash generation.

- Lower Investment Needs: The established relationships and demand for these contracts necessitate less promotional spending compared to growth-oriented ventures.

- Profitability: The reliable income stream from these contracts supports consistent profitability and cash flow for the group.

Used Equipment Sales

Used equipment sales represent a significant cash generation channel for Ashtead Group, even with recent market softness. Despite a decline in demand and pricing, Ashtead's substantial fleet size guarantees a consistent flow of assets available for resale, underpinning its cash recovery efforts.

The company’s strategic asset management relies heavily on optimizing the disposal of used equipment. While the used equipment market has experienced a downturn, it remains a vital part of Ashtead's financial strategy, ensuring capital is recycled efficiently from its extensive rental fleet.

- Historical Cash Generation: Used equipment sales have historically been a strong contributor to Ashtead's cash flow.

- Fleet Size Advantage: A large rental fleet provides a steady supply of assets for resale.

- Asset Management Strategy: This channel is integral to Ashtead's approach to managing and recovering value from its assets.

- Market Resilience: Despite current market challenges, the used equipment segment remains a crucial component of the company's financial operations.

Ashtead's North American General Tool rental segment, a prime example of a cash cow, benefits from a dominant market share in a mature industry. This segment's stability is underscored by its modest 1% growth in fiscal year 2025, reflecting consistent demand from its extensive operational network and deep customer relationships.

Sunbelt Rentals UK & Ireland is another key cash cow, holding a significant market share in the UK's established equipment rental sector. Despite a 2% growth rate in FY2025, its mature market position and efficient operations ensure a reliable and substantial cash flow for the group, focusing on optimizing existing infrastructure.

Mobile storage solutions also function as a classic cash cow, supported by robust market share and stable demand, particularly from long-term projects. Their lower operational costs compared to active rental equipment enhance profitability, as seen in the UK segment's significant revenue contribution in 2024.

Ashtead's long-term rental contracts are a vital cash cow, with medium-term contracts (1-12 months) securing approximately 48% of demand in 2024. This predictability reduces revenue volatility and allows for efficient use of existing infrastructure, generating consistent profits.

Used equipment sales, while facing market softness, remain a crucial cash generation channel due to Ashtead's substantial fleet size. This strategy is integral to asset management, ensuring capital is recycled efficiently from its extensive rental fleet, historically contributing strongly to cash flow.

| Segment | BCG Category | FY2025 Growth Rate | Key Driver | Profitability Contribution |

|---|---|---|---|---|

| North American General Tool Rental | Cash Cow | 1% | Dominant Market Share, Mature Industry, Strong Customer Relationships | High, Consistent Profitability |

| Sunbelt Rentals UK & Ireland | Cash Cow | 2% | Significant Market Share, Efficient Operations, Mature Market | Substantial, Reliable Cash Flow |

| Mobile Storage Solutions | Cash Cow | N/A (part of broader segments) | Robust Market Share, Stable Demand, Lower Operational Costs | Significant Revenue Contribution |

| Long-Term Rental Contracts | Cash Cow | N/A (contract-based) | Predictable Revenue Streams, Reduced Volatility (48% of demand in 2024) | Consistent Profitability and Cash Flow |

| Used Equipment Sales | Cash Cow | N/A (market dependent) | Large Fleet Size, Asset Management Strategy | Strong Historical Cash Generation |

Preview = Final Product

Ashtead Group BCG Matrix

The Ashtead Group BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and absolutely no surprises – just a comprehensive strategic analysis ready for your immediate use. You are seeing the exact document that has been professionally designed to provide clear insights into Ashtead Group's business portfolio.

Dogs

Certain smaller, less strategically located regional branches within Ashtead Group, particularly those integrated through bolt-on acquisitions, may be classified as Dogs in the BCG Matrix. These locations often face challenges in achieving robust market penetration and consistent profitability. For instance, in fiscal year 2024, some of Ashtead's smaller rental locations reported utilization rates below the company average, impacting their overall revenue generation relative to their operational costs.

These underperforming branches can exhibit higher operational overheads in proportion to their generated revenue, leading to a drag on overall group performance. The strategic decision might involve re-evaluating the continued investment in these areas, as the potential for significant improvement or return on investment may be limited. In 2024, Ashtead Group continued its strategic review of its portfolio, with a focus on optimizing the performance of its dispersed network of branches.

Outdated or niche equipment types with declining demand, such as older generation construction machinery or specialized tools for industries that have significantly shrunk, would fall into the Dogs category for Ashtead Group. For instance, while Ashtead's revenue from general construction equipment remains strong, specific legacy items like analog surveying equipment or older diesel generators designed for niche, now-obsolete applications are experiencing a sharp drop in rental interest.

These underutilized assets can become cash traps, as they continue to incur costs for storage, insurance, and maintenance without contributing meaningfully to rental income. In 2024, Ashtead Group, like many in the rental industry, is likely evaluating its fleet to identify such unproductive assets. A proactive strategy of divestiture or a carefully managed phased retirement of this equipment is crucial to free up capital and reduce ongoing expenses, thereby improving overall fleet efficiency.

Prior to Ashtead Group's Sunbelt 3.0 and 4.0 digital overhauls, any lingering fragmented or inefficient legacy digital systems would have fallen into the Dogs category of the BCG matrix. These systems were likely characterized by high maintenance costs and an inability to adapt, leading to operational inefficiencies and missed growth opportunities. For instance, in 2023, while Sunbelt was advancing, older systems within the broader industry were often cited as contributing to a 5-10% increase in operational overheads due to manual workarounds and data integration issues.

Segments Heavily Reliant on Highly Cyclical, Local Non-Residential Construction Starts

Segments heavily reliant on highly cyclical, local non-residential construction starts present a potential vulnerability for Ashtead Group. While the company benefits from diversification, these specific areas are susceptible during economic downturns.

If these localized segments also exhibit low market share, they might not only struggle to achieve profitability but could also become a drain on resources. This combination of high cyclicality and low market penetration places them in a weaker position within the BCG matrix.

For example, in fiscal year 2024, Ashtead's UK operations, which can be more sensitive to local construction cycles than its larger US business, might see slower growth in certain non-residential sectors. This contrasts with ongoing infrastructure projects, which provide more stable revenue streams.

- High Cyclicality Risk: Segments tied to local non-residential construction starts are directly impacted by economic cycles, leading to unpredictable demand.

- Low Market Share Impact: In these vulnerable segments, a low market share further exacerbates the risk, making it harder to achieve profitability and potentially leading to resource depletion.

- 2024 Context: While specific segment data is proprietary, broader economic indicators for the UK in 2024 suggested a cautious approach to new local construction projects compared to larger, multi-year infrastructure investments.

Small, Non-Strategic Acquisitions with Poor Integration

Small, non-strategic acquisitions that haven't integrated well into Sunbelt Rentals could be considered Dogs in Ashtead Group's BCG Matrix. These might include smaller rental companies purchased in the past that continue to operate with a low market share and limited growth prospects within the larger Sunbelt network. Ashtead's 2024 reports indicate a focus on larger, more strategic acquisitions to bolster Sunbelt's scale advantages, suggesting that smaller, less impactful ones might be under review.

These underperforming acquisitions may struggle to benefit from Ashtead's significant operational scale, potentially becoming a drag on resources. Integration challenges, such as dissimilar IT systems or differing operational cultures, can hinder their effectiveness. Furthermore, an inability to compete strongly in their specific local markets, despite being part of a larger entity, can perpetuate their Dog status.

For instance, if a small regional equipment rental business acquired in 2022 for $15 million has shown less than 5% year-over-year revenue growth and a profit margin below 8% by mid-2024, it would fit the Dog profile. Such entities might be candidates for divestiture or significant operational restructuring to improve their performance.

- Low Growth: Acquisitions showing minimal revenue increases annually.

- Low Market Share: Businesses operating with a small portion of their local market.

- Integration Issues: Companies facing difficulties in merging operational systems and cultures.

- Resource Drain: Acquisitions that consume management attention and capital without commensurate returns.

In Ashtead Group's BCG Matrix, "Dogs" represent business units or assets with low market share and low growth potential. These can include smaller, less strategically important branches, outdated equipment, or underperforming acquisitions that struggle to contribute meaningfully to overall profitability. For example, some of Ashtead's smaller, legacy rental locations in fiscal year 2024 reported utilization rates significantly below the company average, indicating low demand and market penetration.

These "Dog" segments often face challenges such as high operational overheads relative to revenue, making them a drain on resources. The company's strategic focus in 2024 has been on optimizing its portfolio, which likely involves evaluating these underperforming assets for potential divestiture or restructuring to improve efficiency and free up capital.

Specifically, certain regional branches integrated through smaller, less impactful acquisitions in prior years might be classified as Dogs if they haven't achieved significant scale or growth within the Sunbelt Rentals network by 2024. These units often suffer from integration challenges and struggle to compete effectively in their local markets, despite being part of a larger entity.

Outdated or niche equipment, such as older construction machinery types that are no longer in high demand, also falls into the Dog category. In 2024, Ashtead, like many in the equipment rental industry, actively manages its fleet to identify and phase out such unproductive assets, which incur costs without generating substantial rental income.

Question Marks

Ashtead's exploration of artificial intelligence in fleet management, focusing on hyper-personalization and remote diagnostics, positions these initiatives as Question Marks within its BCG Matrix. The company is channeling significant capital into integrating Internet of Things (IoT) data to enhance operational efficiency and customer experience. For instance, Ashtead invested £1.2 billion in capital expenditures in the fiscal year ended April 30, 2024, a portion of which is allocated to technological advancements like AI.

These AI-driven fleet solutions offer substantial growth prospects by promising improved uptime and tailored service offerings. However, their current contribution to Ashtead's overall revenue and market dominance is likely nascent, reflecting their ongoing development and rollout phases. This requires substantial ongoing investment to mature these capabilities and shift them from Question Marks to Stars.

Expansion into new, smaller geographic markets, particularly those with lower fleet density, represents Ashtead Group's strategic maneuver to establish a foothold and capture untapped potential. These ventures are akin to a "question mark" in the BCG matrix, indicating high growth prospects but currently minimal market share.

Ashtead's approach involves aggressive greenfield development in these nascent territories. Success hinges on quickly gaining traction and satisfying local demand before competitors can establish a strong presence. For example, in 2024, Ashtead continued its expansion into smaller markets across North America and Europe, aiming to replicate the success seen in its more established regions.

Developing specialized equipment for rapidly growing sectors like green energy infrastructure presents a classic Question Mark scenario for Ashtead. The global renewable energy market is booming, with significant investments pouring into solar, wind, and battery storage solutions. For example, the International Energy Agency (IEA) reported in 2024 that global renewable capacity additions reached a record high in 2023, and this trend is expected to continue. Ashtead's ability to capture a meaningful share of this expanding market hinges on its willingness and capacity to invest heavily in new, often complex, equipment tailored to these evolving needs.

While the potential upside is substantial, the current market share in these highly specialized niches may be modest. Building out a comprehensive fleet and the necessary technical expertise for emerging green technologies requires considerable upfront capital and time. This investment is crucial to compete effectively against established players or to carve out a new leadership position. The significant capital expenditure needed to acquire and maintain this specialized fleet positions these offerings as Question Marks, demanding careful strategic evaluation.

The future trajectory for these green energy infrastructure equipment offerings is undeniably promising, carrying the potential to transform into Stars. The strong secular tailwinds supporting the transition to cleaner energy sources are a powerful driver. Ashtead's strategic investments in this area, if successful, could lead to a dominant market position as these niche industries mature and their equipment needs become more standardized and widespread. The continued global push for decarbonization provides a robust foundation for these ventures to achieve star status within Ashtead's portfolio.

Advanced Digital Services Beyond Core Rental (e.g., Project Management Tools)

Ashtead Group's expansion into advanced digital services, like project management tools, represents a strategic move beyond its core equipment rental business. These offerings are designed to foster deeper customer engagement and unlock new revenue avenues. However, their current adoption rates remain modest when compared to the established rental operations. For instance, while Ashtead reported rental revenue of $8.8 billion for the fiscal year ending April 30, 2023, the contribution from these nascent digital services is still comparatively small, necessitating significant investment to achieve critical mass.

- Investment Focus: Significant capital is being allocated to the development and marketing of these digital platforms to drive customer uptake and establish market dominance.

- Revenue Diversification: The goal is to create recurring revenue streams by offering value-added services that complement the core rental offering.

- Customer Relationship Deepening: Advanced tools are intended to integrate more closely with customer workflows, enhancing loyalty and providing valuable data insights.

- Market Penetration Challenge: Overcoming existing customer habits and demonstrating the tangible benefits of these new services is a key hurdle to widespread adoption.

Ventures in Less Established International Markets (Outside Core US/Canada/UK)

Ashtead Group's consideration of expansion into less established international markets, beyond its core US, Canada, and UK operations, positions these potential ventures as distinct question marks within a BCG matrix analysis. These new territories, while promising high growth, would likely begin with a very small market share, demanding substantial upfront investment to build necessary infrastructure and brand recognition. For instance, entering markets in regions like Southeast Asia or parts of Eastern Europe would require significant capital for fleet acquisition, branch establishment, and local marketing efforts, echoing the substantial investments seen in prior market entries.

The success of these ventures is inherently uncertain, carrying a risk profile associated with nascent markets. However, if Ashtead can effectively navigate regulatory landscapes, adapt its service model to local needs, and build strong customer relationships, these question marks could indeed evolve into stars. This transition would be marked by rapidly increasing market share within a high-growth environment, potentially mirroring the early success stages observed in their North American operations when they were less mature.

- High Growth Potential: Emerging economies often exhibit faster GDP growth rates than developed nations, driving demand for equipment rental services as infrastructure and industrial projects expand.

- Low Initial Market Share: Entering unfamiliar markets means starting from a near-zero market share, necessitating aggressive strategies to gain traction against potential local incumbents or other international players.

- Significant Investment Requirements: Establishing a physical presence, acquiring a suitable rental fleet, and building brand awareness in new territories demands considerable capital outlay, impacting short-term profitability.

- Uncertain Success: Factors such as political stability, economic volatility, cultural differences, and competitive intensity in these less established markets introduce a higher degree of risk compared to core territories.

Ashtead's ventures into specialized equipment for emerging sectors, such as green energy infrastructure, represent classic question marks. The global renewable energy market is experiencing rapid growth, with record capacity additions in 2023 continuing into 2024, according to the IEA. While Ashtead has the potential to capture a significant share, this requires substantial investment in new, complex equipment, positioning these as question marks due to their modest current market share in these niche areas.

These initiatives demand significant upfront capital and time to build out comprehensive fleets and expertise. The company's capital expenditures reached £1.2 billion in the fiscal year ending April 30, 2024, with a portion allocated to these developing areas. Success in these high-growth, specialized niches hinges on Ashtead's ability to invest heavily and effectively compete, potentially transforming these question marks into stars as the market matures.

Ashtead's expansion into advanced digital services, like project management tools, also falls into the question mark category. While designed to deepen customer engagement and unlock new revenue, their current adoption rates remain modest compared to core rental operations. The fiscal year ending April 30, 2023, saw rental revenue of $8.8 billion, with digital services contributing a smaller, yet growing, share.

| Initiative | BCG Category | Rationale | Key Investment Area | Potential Upside |

| AI in Fleet Management | Question Mark | High growth potential, nascent market share, requires significant investment in IoT data integration. | Technological advancements, data analytics. | Improved uptime, personalized service, operational efficiency. |

| Expansion into Smaller Geo Markets | Question Mark | Untapped potential, low fleet density, requires aggressive greenfield development. | Branch establishment, fleet acquisition, local marketing. | Capturing new customer bases, replicating success in mature markets. |

| Specialized Green Energy Equipment | Question Mark | Booming market, high growth, but requires investment in new, complex equipment and expertise. | Acquisition and maintenance of specialized fleet, technical expertise development. | Dominant market position in a rapidly expanding sector. |

| Advanced Digital Services | Question Mark | Modest current adoption, aims to create recurring revenue, requires investment to achieve critical mass. | Platform development, marketing, customer uptake initiatives. | Deeper customer integration, data insights, recurring revenue streams. |

BCG Matrix Data Sources

Our Ashtead Group BCG Matrix leverages comprehensive financial disclosures, detailed market research, and competitor performance data to accurately position each business unit.