Ashtead Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashtead Group Bundle

Navigate the complex external forces shaping Ashtead Group's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are impacting rental and equipment hire markets globally. Our expert insights will equip you to identify opportunities and mitigate risks.

Gain a critical understanding of social trends and environmental regulations that influence Ashtead Group's operational strategies and sustainability efforts. This analysis provides the crucial context needed for informed decision-making in a dynamic industry.

Unlock actionable intelligence on legal frameworks and the competitive landscape Ashtead Group operates within. Strengthen your own market strategy by leveraging these detailed insights.

Don't be left behind; download the full PESTLE analysis for Ashtead Group now and gain a significant competitive advantage.

Political factors

Government investment in infrastructure projects like roads, bridges, and utilities is a major driver for equipment rental demand. Ashtead Group's business is heavily tied to the political will and financial commitment to these large-scale projects, particularly in key markets such as the US, UK, and Canada. These initiatives create a consistent stream of rental opportunities for Ashtead's diverse equipment fleet.

In the US, the Infrastructure Investment and Jobs Act, enacted in late 2021, allocates approximately $1.2 trillion over several years for infrastructure improvements. This significant federal funding is expected to bolster demand for construction and rental equipment throughout 2024 and into 2025. Similarly, the UK's National Infrastructure Strategy aims to boost investment, and Canada's infrastructure plans also present opportunities for rental companies.

Ashtead's financial results, therefore, are sensitive to policy changes. A sustained political commitment to infrastructure spending provides a predictable revenue stream and supports Ashtead's growth strategy. Conversely, any significant slowdown or redirection of public funds away from infrastructure can present considerable challenges, impacting project pipelines and rental volumes.

Ashtead Group operates in markets where political stability is a significant driver. For instance, the United Kingdom, a key market, experienced a period of regulatory flux surrounding Brexit, which initially introduced uncertainty. However, by 2024, many of these regulatory frameworks have been clarified, providing a more predictable operating environment.

The United States, Ashtead's largest market, generally offers a stable political and regulatory landscape, crucial for a business reliant on long-term asset investment. In 2024, the US tax policies remained relatively consistent, supporting capital expenditure. For example, the Infrastructure Investment and Jobs Act, passed in late 2021, continues to foster demand for rental equipment, positively impacting Ashtead's US operations.

Changes in environmental regulations, such as emissions standards or waste disposal rules, can influence the capital expenditure decisions Ashtead makes regarding its fleet. The group actively monitors and adapts to these evolving regulations across its operational geographies, aiming to maintain compliance and operational efficiency.

The overall business environment in 2024, particularly in the US, has been characterized by a focus on infrastructure development and a robust construction sector. This environment, underpinned by stable political support for these initiatives, directly benefits Ashtead's rental model by driving consistent demand for its services.

Ashtead Group's operational costs are significantly influenced by international trade policies and tariff structures. For instance, changes in tariffs on construction equipment or spare parts imported into key markets like the United States or the United Kingdom could directly increase procurement expenses. The company's ability to access essential components and machinery hinges on these trade agreements.

The evolving landscape of global trade relations, particularly concerning major manufacturing economies, poses a risk of higher sourcing costs or potential disruptions to Ashtead's extensive supply chain. For example, a shift in trade policy between the US and China, where many industrial components are manufactured, could necessitate finding alternative, potentially more expensive, suppliers.

These trade dynamics directly impact Ashtead's capacity to refresh and expand its rental fleet efficiently and to effectively manage its overall operational expenditures. Fluctuations in import duties, as seen in the steel industry impacting heavy machinery prices, can create cost pressures that need careful management to maintain fleet competitiveness and profitability.

Labour Market Regulations

Government policies directly affect Ashtead Group's labor costs and operational flexibility. For instance, changes in minimum wage laws, like those seen in various US states and the UK in 2024 and 2025, can increase payroll expenses. These regulations also dictate working hours and influence unionization efforts, impacting workforce management and potential negotiation costs.

Stricter labor regulations or unexpected hikes in labor costs can notably affect Ashtead's profitability and its capacity for efficient operational scaling. For example, if minimum wages rise significantly across its operating regions, the company must absorb these increased costs, potentially squeezing profit margins.

Compliance with a patchwork of labor laws across different countries is a substantial undertaking for Ashtead. Navigating these varying regulations, from employment standards in North America to those in Europe, requires continuous monitoring and adaptation to avoid penalties and maintain smooth operations.

- Minimum Wage Increases: Many regions saw minimum wage hikes in 2024, with further adjustments anticipated for 2025, directly impacting Ashtead's staffing expenses.

- Working Hour Regulations: Adherence to mandated working hours and overtime rules across diverse jurisdictions affects scheduling and labor utilization.

- Unionization Trends: Government stances and employee rights regarding union formation can influence labor relations and collective bargaining agreements, potentially adding to operational complexity.

- Compliance Costs: The administrative burden and potential legal expenses associated with adhering to a complex web of international labor laws represent a continuous operational factor.

Geopolitical Risks and International Relations

Broader geopolitical tensions and international relations, while seemingly distant, can significantly impact Ashtead's operations by disrupting global supply chains and influencing energy prices. For instance, ongoing trade disputes or regional conflicts can lead to increased shipping costs and delays for equipment and parts, directly affecting Ashtead's inventory management and profitability. In 2023, global supply chain disruptions, exacerbated by geopolitical events, continued to pose challenges for many industrial companies.

Instability in key regions or shifts in foreign policy can also lead to economic slowdowns or increased operational uncertainties, influencing demand for construction and industrial equipment. For example, a major conflict in an oil-producing region could spike energy prices, slowing down construction projects reliant on fuel. Ashtead's reliance on international markets means it is sensitive to such global economic shifts, with a slowdown in key markets like North America or Europe directly impacting rental demand.

- Geopolitical Tensions: Heightened tensions between major global powers can lead to trade restrictions and increased uncertainty, impacting the cost of goods and demand for rental equipment.

- Energy Price Volatility: Fluctuations in global energy prices, often linked to geopolitical events, can affect the operational costs for Ashtead's customers and influence their capital expenditure on new projects.

- Supply Chain Disruptions: International conflicts or trade disputes can interrupt the flow of manufactured goods, affecting Ashtead's ability to source and maintain its rental fleet.

- Foreign Policy Shifts: Changes in government policies regarding international trade, investment, and infrastructure spending can create or diminish opportunities for Ashtead in different geographical markets.

Government infrastructure spending remains a critical political factor for Ashtead Group. The ongoing implementation of the US Infrastructure Investment and Jobs Act, with approximately $1.2 trillion allocated, is projected to continue driving demand for rental equipment through 2024 and into 2025.

Political stability in Ashtead's core markets, like the US and UK, provides a predictable environment for long-term investment. While the UK navigated post-Brexit regulatory adjustments, by 2024, a clearer framework emerged, fostering operational stability.

Environmental regulations, such as evolving emissions standards, directly influence Ashtead's fleet acquisition and maintenance strategies. The company actively adapts to these mandates across its global operations to ensure compliance and efficiency.

Trade policies and tariffs significantly impact Ashtead's procurement costs for equipment and parts. For example, changes in import duties on heavy machinery can affect fleet expansion and overall operational expenditures.

What is included in the product

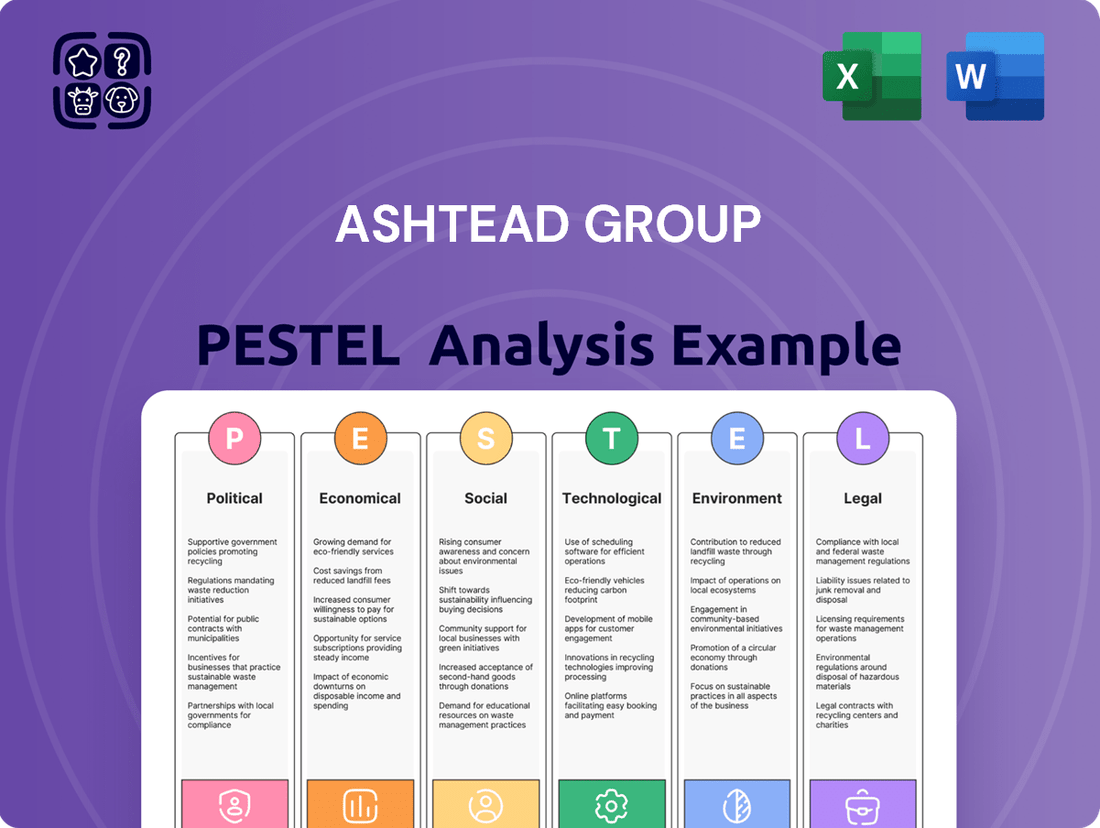

The Ashtead Group PESTLE analysis meticulously examines how political, economic, social, technological, environmental, and legal forces shape the company's operational landscape and strategic direction.

A clear, actionable summary of Ashtead Group's PESTLE analysis, transforming complex external factors into manageable insights for strategic decision-making.

This PESTLE analysis for Ashtead Group offers a concise overview, enabling teams to quickly identify and address external threats and opportunities, thereby alleviating the pain of information overload.

Economic factors

The United States, Ashtead's largest market, experienced a robust GDP growth of 2.5% in 2023, signaling a healthy economic environment that directly fuels demand for rental equipment in construction and industrial sectors. This positive economic momentum is expected to continue, with projections for 2024 indicating a growth rate of around 1.7% according to the Congressional Budget Office, supporting sustained activity in Ashtead's core markets.

In the UK, Ashtead's second-largest market, GDP growth was more subdued, estimated at 0.1% for 2023, presenting a more cautious outlook for construction and industrial investment. However, forecasts for 2024 suggest a modest rebound, with the Bank of England anticipating growth to reach 0.7%, which should gradually improve rental demand.

Construction activity is a key indicator for Ashtead's performance. In the US, non-residential construction spending showed resilience through 2023, and while some sectors might see moderation, overall infrastructure spending from initiatives like the Infrastructure Investment and Jobs Act is expected to provide a solid base for equipment rental demand through 2025.

The industrial sector's health, often correlated with manufacturing output and capital expenditure, also directly impacts Ashtead. A strong manufacturing PMI (Purchasing Managers' Index) in the US, generally above 50 indicating expansion, suggests continued need for industrial equipment rental for maintenance, upgrades, and new projects.

Changes in interest rates significantly impact Ashtead Group's financial operations. For instance, the Bank of England base rate, which influences many borrowing costs, remained at 5.25% through much of late 2024 and early 2025. This directly affects Ashtead's expenses when financing its extensive equipment fleet and for general corporate needs. Higher borrowing costs can curb investment in new machinery or put pressure on profit margins.

Furthermore, interest rates indirectly influence demand for Ashtead's services. When borrowing becomes more expensive for customers undertaking construction or industrial projects, their willingness or ability to invest in new ventures can decrease. This slowdown in customer projects can translate into reduced rental demand for Ashtead's equipment, impacting revenue generation across its markets.

Inflationary pressures significantly affect Ashtead Group's operational expenses, particularly for fuel, vehicle maintenance, spare parts, and labor. For instance, the average price of diesel fuel in the UK saw a notable increase throughout 2023 and into early 2024, impacting transportation costs.

While Ashtead can adjust its rental rates to offset some of these rising costs, sustained high inflation can squeeze profit margins if cost management isn't exceptionally effective. This dynamic was evident in the company's reported operating costs in its 2024 fiscal year, where inflationary impacts were a key consideration.

The company's ability to maintain tight control over its internal expenditures is therefore paramount for ensuring consistent profitability in an inflationary economic climate. Efficient fleet management and strategic sourcing of parts are critical components of this cost control strategy.

Supply Chain Dynamics and Equipment Availability

Global supply chain disruptions continue to pose a challenge for Ashtead Group, affecting the availability and delivery times of new rental equipment. For instance, in fiscal year 2024, Ashtead noted ongoing pressures on equipment lead times, although improvements were beginning to materialize. These delays directly impact Ashtead's capacity to expand its fleet and satisfy escalating customer demand, underscoring the vital role of robust supply chain management.

Efficiently navigating these supply chain dynamics is paramount for Ashtead to maintain a competitive edge and ensure its rental fleet remains modern and well-equipped. The company's ability to secure timely deliveries of new assets directly influences its revenue generation potential and market responsiveness. Ashtead's capital expenditure in fiscal year 2024 was approximately $5.6 billion, reflecting significant investment in fleet growth despite these logistical hurdles.

- Impact of Delays: Extended lead times can restrict Ashtead's ability to capitalize on market opportunities and meet customer needs promptly.

- Fleet Modernization: Consistent access to new equipment is crucial for keeping the rental fleet up-to-date and technologically advanced.

- Cost Implications: Supply chain bottlenecks can also lead to increased costs for new equipment, impacting Ashtead's profitability.

- Strategic Sourcing: Ashtead's focus on strong relationships with manufacturers and diversified sourcing strategies is key to mitigating these risks.

Customer Industry Performance

Ashtead Group's rental demand is intrinsically linked to the economic health of its core customer industries. In 2024, the construction sector, a major driver for Ashtead, shows mixed signals. Non-residential construction, particularly in logistics and industrial facilities, is expected to remain robust, supported by ongoing supply chain adjustments and manufacturing reshoring initiatives. Residential construction, however, faces headwinds from higher interest rates, potentially dampening demand for certain rental equipment.

The industrial manufacturing sector continues to be a steady contributor, with ongoing investments in automation and upgrades supporting rental needs. Looking ahead to 2025, we anticipate continued strength in areas like renewable energy infrastructure development, such as wind and solar farm construction, which will create substantial opportunities for Ashtead’s specialized equipment. Conversely, any significant downturn in broader manufacturing output or a contraction in major construction projects could present challenges.

The entertainment sector also plays a role, with large-scale events and film production impacting demand for temporary power and staging solutions. The recovery and growth in live events post-pandemic have been positive, though economic sensitivity can lead to fluctuations. For instance, a slowdown in consumer discretionary spending could impact the frequency and scale of major events, thereby affecting rental volumes for this segment.

- Non-residential construction growth: Expected to remain strong in 2024, driven by logistics and industrial facility expansion.

- Residential construction challenges: Higher interest rates are a headwind, potentially impacting demand in this segment.

- Renewable energy infrastructure: Projected to be a significant growth area for rental demand in 2025.

- Entertainment sector recovery: Positive trends in live events are boosting demand, though economic sensitivity remains a factor.

The economic landscape in 2024 and 2025 presents a mixed but generally supportive environment for Ashtead Group. While the US economy shows steady GDP growth, around 1.7% projected for 2024, the UK anticipates a modest 0.7% expansion, indicating varying regional demand dynamics.

Interest rates, such as the Bank of England's 5.25% base rate, impact Ashtead's financing costs and indirectly influence customer investment decisions, potentially moderating rental demand.

Inflationary pressures, particularly on fuel and labor, are being managed through operational efficiencies and rate adjustments, as seen in fiscal year 2024 cost considerations.

Supply chain bottlenecks continue to affect equipment delivery times, though Ashtead invested approximately $5.6 billion in fleet expansion in fiscal year 2024 to mitigate these issues.

| Market | 2023 GDP Growth | 2024 GDP Growth Projection | Key Economic Factor |

|---|---|---|---|

| United States | 2.5% | ~1.7% | Robust construction and industrial activity |

| United Kingdom | 0.1% | ~0.7% | Subdued but recovering economic outlook |

| General Inflation | Elevated | Managed | Impact on operating costs and rental rates |

| Interest Rates | High/Stable | High/Stable | Affects financing costs and customer investment |

Preview Before You Purchase

Ashtead Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ashtead Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Understand how global economic trends, regulatory changes, and technological advancements shape the rental industry. This detailed report provides actionable insights for strategic decision-making.

Sociological factors

The aging workforce in key markets like the US and UK presents a dual challenge for Ashtead Group. In the US, the average age of construction workers is nearing 44, a trend that contributes to a growing shortage of skilled labor in essential trades. This scarcity directly impacts Ashtead's customers, potentially delaying or limiting their project capacity, which in turn can dampen demand for rental equipment.

Simultaneously, Ashtead relies heavily on its own skilled workforce for critical functions such as equipment maintenance, efficient logistics, and specialized technical support. As the demographic landscape shifts, the company must proactively adapt its recruitment and training programs to attract and retain talent, ensuring operational continuity and service quality in a competitive labor market.

Global urbanization continues unabated, fueling a significant demand for new construction projects across residential, commercial, and essential infrastructure sectors, especially within Ashtead's key markets. This persistent trend translates into a steady, long-term need for rental equipment and support services, directly benefiting Ashtead’s business model.

The United Nations projects that by 2050, nearly 70% of the world's population will live in urban areas, a substantial increase from today’s figures. This demographic shift directly impacts the volume and type of construction activity, creating diverse market opportunities for equipment rental companies like Ashtead.

For instance, infrastructure spending in the US alone was projected to reach over $1.7 trillion by 2027, according to some analyses, with a significant portion dedicated to urban renewal and expansion projects. This investment surge directly correlates with increased demand for rental equipment for road construction, utility upgrades, and building developments.

Societal expectations are increasingly prioritizing health and safety, particularly within industries where Ashtead operates, such as construction and industrial services. This heightened awareness directly impacts how equipment is designed, maintained, and used.

Ashtead must adhere to rigorous safety standards, ensuring its rental equipment is safe and its services contribute to secure work environments for clients. For instance, in 2023, the UK's Health and Safety Executive reported that over 50,000 workers suffered from work-related ill health, highlighting the critical need for robust safety protocols.

A commitment to a strong safety culture not only mitigates risks but also significantly bolsters Ashtead's reputation. Companies with exemplary safety records often attract more business and experience lower insurance premiums.

Shifting Work Preferences and Gig Economy

The increasing preference for flexible work arrangements and the expansion of the gig economy significantly shape the labor market. This trend directly affects Ashtead Group by influencing the availability and cost of essential personnel like drivers and technicians. For instance, a growing number of workers seeking project-based or freelance opportunities might lead to a more dynamic, yet potentially less stable, labor pool.

Ashtead may need to adjust its recruitment and retention strategies to remain competitive in attracting skilled labor. The rise of remote work and flexible schedules, accelerated by events in recent years, means the company must consider how to offer appealing employment packages. This could involve exploring different contract types or enhancing benefits to secure the necessary workforce.

- Gig Economy Growth: The global gig economy was projected to reach $347 billion in 2024, indicating a substantial shift towards non-traditional employment.

- Talent Acquisition Challenges: A 2024 survey by ManpowerGroup found that 77% of companies globally reported a talent shortage, impacting sectors reliant on skilled trades and logistics.

- Demand for Flexibility: Data from Statista indicates a steady increase in employees seeking flexible work options, with a significant portion prioritizing remote or hybrid models.

Community Engagement and Social License to Operate

As societal expectations around corporate responsibility grow, Ashtead Group's activities are under closer examination for their effects on the communities where they operate. For instance, in 2024, a significant portion of their stakeholder engagement focused on local impact initiatives.

Securing and keeping a social license to operate, which is essential for continued business success, hinges on fostering strong community ties. This involves actively contributing to local economies, perhaps through job creation or local sourcing, and consistently demonstrating ethical conduct in all business dealings.

Ashtead's commitment to community well-being directly influences its brand image and public perception. Positive community relations in 2024 were highlighted in their annual sustainability report, noting improved local sentiment in key operating regions.

- Community Investment: Ashtead Group’s 2024 initiatives included partnerships with local charities and skills training programs, aiming to foster economic development in their operational areas.

- Stakeholder Dialogue: Regular engagement with community leaders and residents in 2024 helped address concerns and build trust, reinforcing their social license.

- Ethical Operations: Adherence to stringent ethical standards in 2024 ensured that Ashtead’s business practices aligned with community values, minimizing negative externalities.

- Brand Reputation: Positive community feedback in 2024 contributed to an enhanced brand reputation, as evidenced by improved local media coverage and customer loyalty metrics.

The growing demand for flexible work arrangements and the rise of the gig economy present both opportunities and challenges for Ashtead. In 2024, 77% of companies globally reported talent shortages, impacting sectors reliant on skilled trades. This trend means Ashtead must adapt its recruitment strategies to attract and retain a dynamic workforce, potentially through offering more flexible contracts or enhanced benefits to secure essential personnel like drivers and technicians.

Societal expectations regarding health and safety are increasingly paramount, influencing equipment design and operational standards. With over 50,000 workers suffering from work-related ill health reported in the UK in 2023, Ashtead's commitment to robust safety protocols is crucial. Exemplary safety records not only mitigate risks but also enhance reputation and potentially lower insurance costs.

As urbanization continues, projected to house nearly 70% of the world's population in urban areas by 2050, Ashtead benefits from sustained demand for construction equipment. US infrastructure spending alone was projected to exceed $1.7 trillion by 2027, driving significant demand for rental equipment in urban development and renewal projects.

| Sociological Factor | Impact on Ashtead | Supporting Data (2023-2025) |

| Aging Workforce | Skilled labor shortage, impacting customer project capacity and Ashtead's operational needs. | US construction worker average age nearing 44. |

| Urbanization | Increased demand for construction equipment and services in key markets. | UN projects 70% global urban population by 2050; US infrastructure spending over $1.7 trillion by 2027. |

| Health & Safety Expectations | Need for safe equipment and services, enhancing reputation. | UK HSE reported >50,000 work-related ill health cases in 2023. |

| Gig Economy & Flexibility | Challenges in talent acquisition and retention, requiring adaptive HR strategies. | Global gig economy projected at $347 billion in 2024; 77% of companies reported talent shortages in 2024. |

Technological factors

The rental industry is rapidly shifting towards digital platforms for everything from booking equipment to tracking its usage and maintenance. Ashtead Group is actively investing in this trend through its online portals and mobile applications.

These digital tools are designed to significantly improve how customers interact with Ashtead, making the rental process smoother and more convenient. For example, by 2024, digital bookings are expected to represent a substantial portion of all transactions, a trend that has accelerated post-pandemic.

Furthermore, the integration of telematics systems into their fleet allows for real-time monitoring of equipment performance and location. This not only boosts operational efficiency by enabling proactive maintenance and optimizing logistics but also provides Ashtead with crucial data insights into equipment utilization and customer behavior.

This strategic digital transformation positions Ashtead Group to gain a significant competitive advantage. By enhancing customer experience and streamlining operations, Ashtead is better equipped to meet the evolving demands of a fast-paced market, a strategy that contributed to their revenue growth of 12% in the fiscal year ending April 2024.

Technological advancements in electrification and alternative fuels are rapidly transforming the construction equipment landscape. We're seeing a significant push towards electric and hybrid machinery, driven by innovations in battery technology and the development of sustainable fuel sources. This shift is directly impacting how companies like Ashtead Group operate and what their customers expect.

Ashtead Group's strategic advantage will lie in its capacity to provide a broad spectrum of equipment, including these increasingly popular eco-friendly options. Meeting customer demand for greener solutions is becoming paramount, especially as many clients prioritize sustainability in their project planning. For instance, the European Union's Green Deal initiatives are accelerating the adoption of low-emission vehicles and machinery across various sectors.

Furthermore, evolving environmental regulations, particularly in densely populated urban centers, are mandating the use of cleaner equipment. Cities worldwide are implementing stricter emissions standards for construction sites, making electric and alternative fuel machinery not just a preference but a necessity for accessing certain projects. This trend is expected to intensify, with many jurisdictions targeting 2030 and beyond for significant reductions in construction equipment emissions.

The integration of telematics and Internet of Things (IoT) sensors into Ashtead's equipment fleet is a significant technological driver. This allows for real-time tracking of equipment location, usage patterns, and critical maintenance indicators.

By leveraging telematics, Ashtead can proactively manage its vast fleet, optimizing utilization rates and minimizing costly downtime. For instance, predictive maintenance algorithms, powered by IoT data, can anticipate component failures before they occur, ensuring equipment availability for customers.

This technology also enhances security through geofencing and real-time alerts, reducing theft and unauthorized usage. In 2024, Ashtead reported that its investment in digital transformation, including telematics, contributed to improved operational efficiency, with a notable reduction in equipment downtime across its Sunbelt Rentals segment.

Furthermore, Ashtead can now offer data-driven insights to its customers, providing them with valuable information on equipment performance and operational efficiency. This value-added service strengthens customer relationships and differentiates Ashtead in a competitive market.

Automation and Robotics

The growing adoption of automation and robotics in construction and industrial sectors significantly influences the demand for and application of rental equipment. This trend could shift demand towards specialized machinery that complements automated processes, requiring Ashtead Group to strategically adjust its fleet offerings. For instance, the global industrial robotics market was projected to reach $81.5 billion in 2024 and is expected to grow substantially in the coming years.

Ashtead must consider how automation might reduce the need for certain types of traditional equipment while creating new revenue streams for advanced, robotics-supportive rentals. This evolution necessitates a forward-thinking approach to fleet management, ensuring the company remains competitive by offering solutions that align with the changing operational landscape.

- Increased demand for specialized rental equipment supporting automated construction and industrial processes.

- Potential reduction in demand for traditional manual labor-intensive equipment.

- Opportunities for Ashtead to offer integrated solutions combining rental equipment with automation technology.

- The global industrial robotics market is a significant and growing sector, indicating a broader trend towards automation across industries Ashtead serves.

Data Analytics and Predictive Maintenance

Ashtead Group is increasingly leveraging big data analytics, drawing insights from telematics and operational systems across its Sunbelt Rentals and Ashtead Plant & Tool Hire fleets. This allows for the implementation of sophisticated predictive maintenance strategies. By analyzing vast datasets on equipment usage, performance metrics, and environmental factors, Ashtead can anticipate potential equipment failures before they manifest. For instance, monitoring engine vibrations or hydraulic pressures can flag an impending issue, enabling proactive servicing. This proactive approach significantly minimizes costly downtime, ensuring that rental equipment is consistently available and in optimal condition for customers, thereby boosting customer satisfaction and rental utilization rates.

The financial impact of these technological advancements is substantial. Predictive maintenance not only extends the operational lifespan of Ashtead's extensive fleet, estimated at over 600,000 revenue-generating items as of early 2024, but also reduces unexpected repair costs. By shifting from reactive to proactive servicing, the group can optimize maintenance schedules and parts inventory, leading to greater operational efficiency and cost savings. This focus on data-driven asset management is a key enabler of Ashtead's strategy to maintain its competitive edge in the rental market.

- Data-driven insights: Telematics data from the fleet informs predictive maintenance models.

- Reduced downtime: Proactive identification of potential failures minimizes equipment unavailability.

- Extended asset life: Regular, targeted maintenance based on data analysis prolongs equipment usability.

- Enhanced customer service: Consistent availability of reliable equipment improves rental experience.

Ashtead Group is heavily invested in digital platforms, with online bookings expected to be a significant portion of transactions by 2024, enhancing customer convenience and operational efficiency. Telematics integration into their fleet provides real-time data for proactive maintenance and logistics optimization, contributing to a 12% revenue growth in fiscal year ending April 2024.

Legal factors

Ashtead Group operates in highly regulated environments where stringent health and safety regulations are non-negotiable. These rules cover everything from equipment maintenance to operational procedures in the construction and industrial sectors across its key markets like the US, UK, and Europe. Non-compliance can lead to significant fines, operational disruptions, and severe reputational damage, underscoring the critical need for robust safety protocols.

The company must continuously adapt to evolving health and safety legislation, which often includes new standards for machinery, worker protective gear, and site management. For instance, in the UK, the Health and Safety Executive (HSE) enforces regulations like the Control of Substances Hazardous to Health (COSHH) and the Provision and Use of Work Equipment Regulations (PUWER), impacting how Ashtead manages its rental fleet. Similarly, the Occupational Safety and Health Administration (OSHA) in the US sets rigorous standards that Ashtead adheres to, aiming to prevent workplace accidents and injuries.

Investing in regular, comprehensive training for all employees is a cornerstone of Ashtead's strategy to ensure adherence to these diverse legal frameworks. This includes training on the safe operation of equipment, emergency procedures, and understanding specific site requirements. Such a commitment not only mitigates legal risks but also reinforces Ashtead's reputation as a responsible and reliable equipment rental provider, which is crucial for maintaining customer trust and market position.

Environmental Protection Laws, particularly those concerning emissions, waste management, noise pollution, and the handling of hazardous materials, directly influence Ashtead Group's operational strategies and equipment procurement. Compliance with these regulations is paramount, especially when managing older rental fleets and making new acquisitions, ensuring legal standing and showcasing corporate environmental stewardship.

For instance, stricter emissions standards in key markets like the UK and US might necessitate accelerated replacement cycles for diesel-powered equipment, impacting capital expenditure. Ashtead's commitment to sustainability is evident in their ongoing efforts to expand their electric and hybrid equipment offerings, aligning with evolving environmental mandates and customer demand for greener solutions, a trend that is expected to intensify through 2024 and 2025.

As an international employer, Ashtead Group must navigate a complex web of employment and labor laws across its key operating regions: the US, Canada, and the UK. These regulations cover critical areas such as minimum wage requirements, workplace safety standards, anti-discrimination provisions, and collective bargaining rights. For instance, in the US, the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime pay, while the National Labor Relations Act (NLRA) governs union activities. In the UK, the Employment Rights Act 1996 provides a framework for employee rights and protections.

Changes in these legal landscapes can significantly impact Ashtead's recruitment strategies, employee retention efforts, and ultimately, its operational expenses. For example, an increase in the minimum wage in any of its operating countries would directly affect labor costs. In 2024, many US states saw minimum wage increases, with some reaching $15 or more per hour, a trend likely to continue. Similarly, evolving regulations around remote work or gig economy classification could necessitate adjustments to employment contracts and benefits, requiring continuous legal monitoring and adaptation to ensure compliance and mitigate potential liabilities.

Contract Law and Liability

Ashtead Group operates within a complex web of contract law, where the terms of service for equipment rental are paramount. These agreements dictate liability for damage, wear and tear, and specify insurance requirements, directly influencing Ashtead's risk exposure. In fiscal year 2024, Ashtead reported that its insurance and claims costs were meticulously managed, a testament to robust legal and contractual frameworks. Navigating these legalities across its various operating regions, including North America and Europe, is crucial for asset protection and minimizing litigation.

Variations in contract law across different jurisdictions present a significant challenge and opportunity. For instance, consumer protection laws may differ substantially between the UK and the US, impacting how rental agreements are structured and enforced. Ashtead's proactive approach to legal compliance in 2024 ensured adherence to these diverse regulations, safeguarding its operational integrity and financial health.

- Contractual Clarity: Ashtead’s rental agreements clearly define responsibilities for equipment damage and usage terms.

- Jurisdictional Adaptation: The company actively adapts its contracts to comply with the specific legal requirements of each country it operates in.

- Liability Management: Robust insurance policies and contractual clauses are in place to manage potential liabilities arising from equipment rental.

- Dispute Resolution: Ashtead's legal teams are equipped to handle and resolve potential legal disputes efficiently, minimizing operational disruption.

Competition and Anti-Trust Laws

Ashtead Group navigates highly competitive rental markets, making adherence to competition and anti-trust laws crucial. These regulations are designed to prevent monopolistic behavior and ensure fair play among industry participants. For instance, in the US, the Federal Trade Commission (FTC) actively monitors market concentration.

Regulatory bodies closely examine market share and any proposed mergers or acquisitions. This scrutiny is particularly intense in fragmented sectors where Ashtead operates, potentially impacting its expansion plans and growth avenues. In 2024, the rental industry continues to see consolidation, making merger approvals a key consideration.

- Regulatory Oversight: Ashtead must comply with anti-trust regulations globally, impacting its market strategies.

- Merger & Acquisition Scrutiny: Potential acquisitions are subject to regulatory review, affecting growth opportunities.

- Market Dominance Concerns: Regulators monitor for any signs of monopolistic practices in the rental sector.

- Fair Competition: Laws ensure a level playing field, influencing how Ashtead competes with rivals.

Ashtead Group's operations are heavily influenced by evolving health and safety legislation, requiring continuous adaptation to maintain compliance. Adherence to regulations like OSHA in the US and HSE in the UK is critical for preventing fines and reputational damage, with significant investment in employee training essential for mitigating legal risks.

Environmental protection laws, particularly concerning emissions and waste management, directly shape Ashtead's equipment procurement and operational strategies. Stricter emissions standards are accelerating the shift towards electric and hybrid equipment, a trend expected to intensify through 2024 and 2025, impacting capital expenditure and aligning with sustainability goals.

Navigating diverse employment and labor laws across its international operations, including minimum wage and workplace safety standards, is paramount for Ashtead. Increases in minimum wage, such as those seen in many US states in 2024, directly impact labor costs, necessitating ongoing legal monitoring and adaptation.

The company must also maintain rigorous clarity in its rental agreements, adhering to contract law and consumer protection variations across jurisdictions. Robust insurance and contractual clauses are vital for managing liabilities, with Ashtead's fiscal year 2024 performance reflecting meticulous management of insurance and claims costs.

Environmental factors

Governments worldwide are intensifying efforts to curb carbon emissions, a trend that directly affects the equipment rental sector by demanding cleaner machinery. Ashtead Group, like its peers, is under significant pressure to adopt more fuel-efficient and electric equipment to align with global climate change targets and growing customer preferences for sustainable rentals.

Meeting these environmental mandates necessitates strategic shifts in Ashtead's fleet procurement and operational planning. For instance, the UK government's legally binding target to reach net-zero emissions by 2050, alongside similar commitments in the US and Europe, creates a strong incentive for rental companies to invest in low-carbon alternatives, impacting capital expenditure decisions.

The availability of essential raw materials for manufacturing new rental equipment is a significant environmental consideration, directly impacting Ashtead Group's operational costs and supply chain resilience. As global demand for resources like steel and specialized components fluctuates, Ashtead must navigate potential price volatility. Furthermore, the responsible management of waste generated from equipment maintenance and the disposal of end-of-life assets presents a growing challenge.

Ashtead Group's strategic focus on circular economy principles, such as extending equipment lifespan through robust repair and refurbishment programs, is crucial. This approach not only mitigates waste but also enhances the efficiency of their asset utilization. For example, in the fiscal year ending April 30, 2024, Ashtead reported a significant portion of their fleet was maintained through in-house repair capabilities, reducing the need for new equipment purchases and associated material inputs.

Ashtead Group faces increasingly stringent noise and air pollution regulations, especially in urban construction settings. This means there's a growing demand for quieter and cleaner machinery. For instance, many European cities are implementing low-emission zones that restrict older, more polluting vehicles and equipment, potentially impacting the usability of older assets in Ashtead's fleet.

To comply, Ashtead needs to invest in newer, more fuel-efficient, and electrically powered equipment. This shift is not just about meeting legal requirements but also about maintaining competitiveness and operational flexibility across its rental fleet. The group’s capital expenditure plans for 2024 and 2025 will likely reflect this trend, with a focus on upgrading to meet these evolving environmental standards.

Water Usage and Management

While Ashtead Group's direct impact on water usage might seem minor compared to some industries, it's a relevant environmental factor, especially at their large service centers. Operations like equipment cleaning and general site maintenance require water, and managing this resource responsibly is part of their commitment to environmental stewardship.

Ashtead's approach to water management involves adhering to local regulations and implementing sustainable practices. This can include water recycling initiatives or using water-efficient cleaning methods. Such efforts contribute to the company's overall environmental, social, and governance (ESG) profile, which is increasingly important for investors and stakeholders.

- Water Consumption: Though not extensively detailed in public reports, water is used in fleet washing and facility maintenance across Ashtead's extensive network.

- Regulatory Compliance: Ashtead must comply with varying water usage and discharge regulations in all operating regions, impacting operational costs and practices.

- Sustainability Initiatives: The company's broader ESG strategy likely includes evaluating and improving water efficiency to minimize its environmental footprint.

Biodiversity and Land Use Impact

Large-scale infrastructure projects, a core area where Ashtead Group's rental equipment is utilized, can have substantial effects on biodiversity and land use. While Ashtead is not the primary developer, its role in these projects necessitates awareness of and alignment with customer and regulatory initiatives aimed at reducing ecological impacts.

Companies like Ashtead are increasingly expected to demonstrate commitment to environmental stewardship. For instance, in 2023, the construction sector, a major client for Ashtead, faced growing scrutiny regarding its environmental footprint. Regulations are tightening, pushing for sustainable practices in land development and resource management.

- Regulatory Pressure: Environmental agencies worldwide are imposing stricter guidelines on land use and biodiversity protection for construction projects, influencing equipment rental needs.

- Client Demand: Ashtead’s clients are increasingly seeking partners who can support their sustainability goals, including minimizing environmental disruption on project sites.

- Reputational Risk: A strong environmental reputation is becoming a competitive advantage. Ashtead’s responsible operations contribute positively to its brand image and stakeholder relations, especially as environmental, social, and governance (ESG) factors gain prominence in investment decisions.

- Operational Alignment: Ashtead’s equipment can play a role in facilitating more environmentally conscious construction methods, such as those designed to reduce soil disturbance or protect sensitive habitats.

Governments globally are pushing for reduced carbon emissions, directly influencing Ashtead's need for cleaner, more efficient equipment. This push is evident in targets like the UK's net-zero by 2050 goal, requiring significant investment in low-carbon alternatives and impacting capital expenditure. The availability and cost of raw materials for manufacturing new machinery also present challenges, with price volatility affecting operational expenses and supply chain stability.

Stricter noise and air pollution regulations, particularly in urban areas, are driving demand for quieter and electric machinery. Ashtead's fleet upgrades for 2024 and 2025 are likely to reflect this, as compliance is key to competitiveness and operational flexibility. Furthermore, water usage at service centers, while not a primary focus, is managed through compliance with local regulations and sustainability initiatives, enhancing the company's ESG profile.

Ashtead's role in large infrastructure projects necessitates an awareness of biodiversity and land use impacts. Growing client demand for sustainable practices and stricter regulations on construction sites mean Ashtead's commitment to environmental stewardship is crucial for its reputation and competitive advantage.

| Environmental Factor | Impact on Ashtead Group | Supporting Data/Trends (2024-2025 Focus) |

| Carbon Emission Reduction | Demand for cleaner, electric equipment; increased CAPEX for fleet upgrades. | Global net-zero targets (e.g., UK 2050); growing customer preference for sustainable rentals. |

| Resource Availability & Waste Management | Potential raw material price volatility; responsible disposal of end-of-life assets. | Fluctuations in steel and component prices; emphasis on circular economy principles and repair programs. |

| Pollution Regulations (Noise & Air) | Need for quieter, low-emission machinery; potential obsolescence of older fleet assets. | Implementation of low-emission zones in European cities; focus on upgrading to meet evolving standards. |

| Water Usage & Management | Compliance with local regulations; implementation of water-saving initiatives. | Adherence to discharge regulations; integration into broader ESG strategies to minimize environmental footprint. |

| Biodiversity & Land Use | Alignment with client sustainability goals; responsible operations on project sites. | Increased scrutiny on construction's environmental footprint; demand for partners supporting sustainability. |

PESTLE Analysis Data Sources

Our Ashtead Group PESTLE analysis is meticulously crafted using data from official government publications, industry-specific market research reports, and reputable financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.