Ascendis Pharma PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascendis Pharma Bundle

Unlock the external forces shaping Ascendis Pharma's trajectory with our comprehensive PESTLE analysis. Understand the political landscape, economic shifts, and technological advancements impacting their innovation and market access. Don't get left behind; download the full analysis now for actionable intelligence to refine your own strategic planning.

Political factors

Government regulations are a major force in the biopharmaceutical sector, directly impacting Ascendis Pharma's progress. The approval process for new drugs, overseen by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), is critical for bringing therapies to market.

Ascendis Pharma's success in commercializing treatments like Yorvipath for hypoparathyroidism and the extended approval of Skytrofa for adult growth hormone deficiency hinges on these regulatory bodies. For instance, the FDA's review timelines for new molecular entities can vary, influencing when Ascendis can generate revenue from these innovative products.

Shifts in regulatory expectations or the speed of approvals can significantly alter Ascendis Pharma's commercialization schedules and financial forecasts. In 2024, the FDA's emphasis on real-world evidence in post-market surveillance could also influence ongoing regulatory interactions for Ascendis's approved products.

Government healthcare policies, particularly concerning drug pricing and reimbursement, are pivotal for Ascendis Pharma's financial health and ability to reach patients. These regulations directly impact profitability and market access for their innovative therapies.

The U.S. Inflation Reduction Act (IRA) and comparable European Union initiatives are intensifying scrutiny on drug expenditures. Notably, starting in 2026, Medicare will have the authority to negotiate prices for high-cost medications, a significant shift impacting the pharmaceutical landscape.

This evolving regulatory environment compels Ascendis Pharma to meticulously assess its pricing strategies and market entry plans. Such evaluation is crucial for guaranteeing both patient affordability and the company's long-term financial sustainability in key markets.

Ascendis Pharma, as a global biopharmaceutical player, navigates a complex landscape shaped by international trade policies and geopolitical stability. For example, the ongoing trade tensions between major economic blocs, including those stemming from the US-China trade friction, can directly influence the cost of raw materials and the accessibility of key markets for Ascendis's innovative therapies. These dynamics can create significant headwinds or tailwinds for companies operating across borders.

The potential for increased protectionism, as seen in some trade agendas, could lead to higher tariffs on imported components or finished goods, thereby impacting Ascendis's cost of goods sold. Furthermore, political instability in regions critical for supply chain operations, such as disruptions in Eastern Europe or parts of Asia, poses a tangible risk to the timely and cost-effective procurement of essential materials and the distribution of Ascendis's life-saving treatments to patients worldwide.

Public Funding for Research and Development

Government funding for basic research and early-stage drug development plays a crucial role in shaping the innovation ecosystem for biopharmaceutical companies like Ascendis Pharma. Increased public investment can accelerate scientific breakthroughs, potentially leading to new therapeutic targets and technologies that Ascendis can leverage. For instance, in 2024, the U.S. National Institutes of Health (NIH) allocated over $47 billion to biomedical research, much of which supports foundational science relevant to drug discovery.

While Ascendis Pharma relies on its proprietary TransCon technology, a robust public research landscape can indirectly benefit the company. Greater public investment in areas like gene editing, immunology, or advanced drug delivery systems can create a more fertile ground for innovation and open doors for potential collaborations or licensing opportunities. A strong pipeline of publicly funded research can also lead to a more skilled workforce, which is vital for Ascendis's own R&D efforts.

Changes in government research funding priorities can impact the overall pace of innovation within the biopharmaceutical sector. If public funding shifts away from areas critical to Ascendis's therapeutic focus, it might slow down the discovery of new foundational science. For example, a significant reduction in funding for rare disease research could impact the discovery of novel targets in Ascendis's areas of interest. Conversely, increased funding in areas like precision medicine in 2025 could provide new avenues for Ascendis's pipeline development.

- Government funding for R&D fuels the foundational science that underpins biopharmaceutical innovation.

- NIH funding alone exceeded $47 billion in 2024, supporting critical early-stage research.

- Public investment can foster an environment ripe for new discoveries and potential partnerships for Ascendis Pharma.

- Shifts in public research priorities can directly influence the speed and direction of innovation across the biopharma industry.

Political Stability and Investment Climate

Political stability is a cornerstone for investor confidence in the biopharmaceutical sector. Fluctuations in government policies, particularly concerning drug pricing and regulatory approvals, can significantly sway investment decisions. For Ascendis Pharma, a stable political environment in its key markets, including the U.S. and Europe, is crucial for attracting the substantial capital needed to advance its innovative pipeline through clinical trials and commercialization.

The upcoming U.S. presidential election in late 2024 and the subsequent transition in 2025 introduce a degree of policy uncertainty. Potential shifts in healthcare legislation or regulatory approaches could impact the biopharmaceutical industry's operating landscape, affecting everything from research and development incentives to market access for new therapies. This uncertainty can translate into market volatility, potentially making it more challenging for companies like Ascendis Pharma to secure funding or impacting the valuation of their assets.

- Investor Confidence: In 2024, venture capital investment in biotech saw a notable increase, with reports indicating a significant rebound in deal values compared to the previous year, underscoring the sensitivity of funding to perceived political stability.

- Policy Impact: Changes in healthcare policy, such as potential reforms to the Inflation Reduction Act's drug pricing provisions, could directly influence Ascendis Pharma's revenue streams and R&D investment strategies.

- Market Access: Political decisions on reimbursement rates and market exclusivity periods for novel therapeutics are critical for biopharmaceutical companies aiming for profitability and further innovation.

Government regulations are a major force in the biopharmaceutical sector, directly impacting Ascendis Pharma's progress. The approval process for new drugs, overseen by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), is critical for bringing therapies to market.

Ascendis Pharma's success in commercializing treatments like Yorvipath for hypoparathyroidism and the extended approval of Skytrofa for adult growth hormone deficiency hinges on these regulatory bodies. For instance, the FDA's review timelines for new molecular entities can vary, influencing when Ascendis can generate revenue from these innovative products. In 2024, the FDA's emphasis on real-world evidence in post-market surveillance could also influence ongoing regulatory interactions for Ascendis's approved products.

Government healthcare policies, particularly concerning drug pricing and reimbursement, are pivotal for Ascendis Pharma's financial health and ability to reach patients. The U.S. Inflation Reduction Act (IRA) and comparable European Union initiatives are intensifying scrutiny on drug expenditures, with Medicare set to negotiate prices for high-cost medications starting in 2026. This evolving environment compels Ascendis Pharma to meticulously assess its pricing strategies and market entry plans to ensure patient affordability and long-term financial sustainability.

What is included in the product

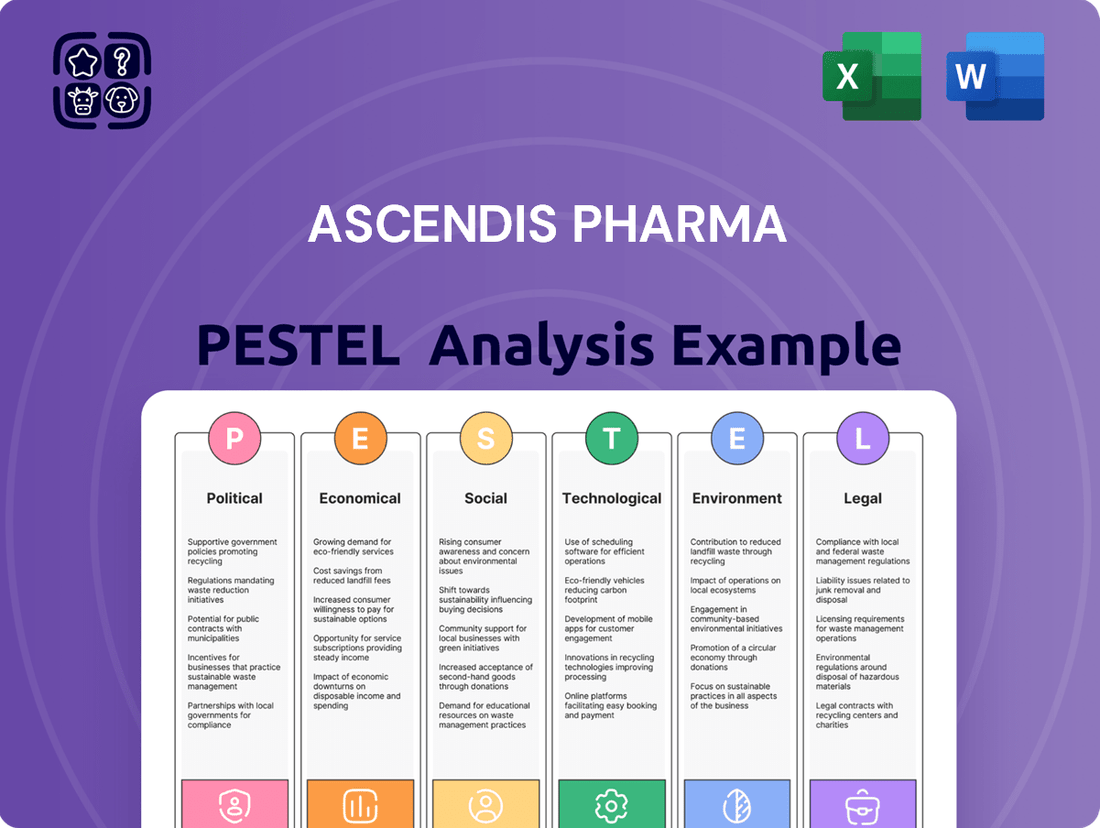

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Ascendis Pharma, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions. It offers actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering Ascendis Pharma a clear understanding of external factors impacting their business.

Helps support discussions on external risk and market positioning during planning sessions, allowing Ascendis Pharma to proactively address challenges and capitalize on opportunities.

Economic factors

Global economic conditions significantly influence Ascendis Pharma's financial health. For instance, persistently high inflation rates in major markets throughout 2024 and into 2025 can escalate operational expenses, from raw material procurement to labor costs. Similarly, elevated interest rates, like the Federal Reserve's benchmark rate hovering around 5.25%-5.50% in early 2024, make financing for crucial research and development or strategic expansion initiatives more expensive, potentially tempering investment appetite.

The economic environment significantly shapes healthcare expenditure across all sectors. In 2024, global healthcare spending was projected to reach over $10 trillion, highlighting the substantial economic impact of this industry. This overall spending is directly influenced by factors like inflation and disposable income.

Growing demands for cost-effective medicines, especially in key markets like the United States and Europe, are pushing pharmaceutical firms, including Ascendis Pharma, to re-evaluate their pricing and commercialization approaches. For instance, in the U.S., drug price negotiations, particularly for Medicare, gained momentum in 2024, impacting revenue forecasts for many companies.

This heightened emphasis on affordability can directly affect how readily new treatments are adopted and their overall revenue-generating capacity. Companies that can demonstrate strong value propositions and cost-effectiveness are better positioned for market success in this evolving landscape.

Ascendis Pharma's commitment to research and development is a significant economic driver for its future growth. The company reported increased R&D expenses in the first quarter of 2025, underscoring its strategic focus on innovation.

Sustaining these substantial R&D investments is critical for Ascendis Pharma to broaden its drug pipeline and capitalize on its proprietary TransCon technology to tackle significant unmet medical needs.

However, potential economic downturns or periods of tightened capital markets could pose a challenge, potentially limiting the company's capacity to maintain or expand these crucial R&D expenditures.

Market Competition and Product Pricing

The biopharmaceutical market, especially in rare diseases and oncology, is intensely competitive. Ascendis Pharma faces pressure from established players and emerging biotechs, directly impacting its ability to set and maintain drug prices. For instance, the oncology sector saw significant competition in 2024, with multiple new drug approvals intensifying the pricing landscape.

The introduction of novel therapies or even improved generics can significantly erode market share and force price reductions. Ascendis's success hinges on its capacity to demonstrate clear clinical advantages for its treatments, justifying premium pricing. In 2025, the market anticipates further innovation, potentially leading to a more challenging pricing environment for existing therapies.

- Market Share Dynamics: Ascendis's pricing strategy must account for competitor market penetration, especially in its key therapeutic areas.

- Pricing Power Erosion: The availability of biosimil or alternative treatments in 2024 and projected for 2025 could exert downward pressure on Ascendis's revenue streams.

- Clinical Differentiation: Maintaining a competitive edge through superior efficacy and safety data is crucial for Ascendis to command favorable pricing in 2025.

- R&D Investment Impact: High R&D costs for novel therapies in rare diseases require robust pricing to ensure profitability, a balance Ascendis must continually strike.

Currency Exchange Rate Fluctuations

Ascendis Pharma, being a global entity headquartered in Denmark and operating across numerous countries, is significantly exposed to the ebb and flow of currency exchange rates. These fluctuations directly influence the company's financial results as revenues and expenses generated in foreign currencies must be translated back into its reporting currency, the Euro.

For instance, a stronger US dollar against the Euro would positively impact Ascendis Pharma's reported revenues from its US operations when converted. Conversely, a weaker dollar would have the opposite effect. This dynamic means that even if underlying sales volumes remain constant, reported financial performance can vary considerably due to currency movements alone.

Consider the economic landscape of late 2024 and early 2025. The Euro experienced some volatility against major currencies like the US dollar and the Swiss franc. For Ascendis Pharma, this translates to potential shifts in the reported value of its international sales and operational costs.

- Impact on Revenue: A stronger USD relative to the EUR in late 2024 could have boosted reported revenues from US sales for Ascendis Pharma.

- Impact on Expenses: Conversely, if Ascendis Pharma incurs significant costs in USD, a weaker USD would reduce those expenses when reported in EUR.

- Financial Reporting: Currency fluctuations necessitate careful financial reporting and hedging strategies to mitigate potential negative impacts on profitability and investor confidence.

- Strategic Planning: Understanding these currency dynamics is crucial for Ascendis Pharma's strategic planning, influencing pricing strategies, investment decisions, and overall financial forecasting.

Economic headwinds, such as persistent inflation and elevated interest rates seen through 2024 and into 2025, directly increase Ascendis Pharma's operational costs and borrowing expenses. Global healthcare spending, projected to exceed $10 trillion in 2024, offers a large market, but increasing demands for cost-effectiveness, exemplified by U.S. Medicare drug price negotiations in 2024, pressure pricing strategies.

Full Version Awaits

Ascendis Pharma PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ascendis Pharma delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

Patient advocacy groups are increasingly influential, shining a spotlight on rare diseases and critical unmet medical needs. This heightened awareness directly fuels demand for specialized therapies like those developed by Ascendis Pharma. A prime example is the HypoPARAthyroidism Association's positive reception of Yorvipath, underscoring the vital role of innovative treatments for patients.

This growing patient voice also translates into significant pressure on healthcare systems and payers for improved access and favorable reimbursement policies. As more patients become aware of potential treatment options, advocacy efforts amplify calls for broader availability, directly impacting market penetration for companies like Ascendis Pharma.

Global demographics are undergoing significant shifts, most notably an aging population. By 2050, the World Health Organization projects that one in six people globally will be over 65, a substantial increase from one in eleven in 2020. This aging trend directly impacts disease prevalence, often leading to a higher incidence of chronic conditions and age-related illnesses.

Ascendis Pharma's strategic focus on endocrinology, rare diseases, and oncology aligns well with these demographic changes. For instance, the prevalence of osteoporosis, an endocrinology-related condition, is expected to rise with an aging population, as bone density naturally decreases with age. Similarly, many rare diseases and cancers disproportionately affect older individuals, suggesting a growing patient pool for Ascendis Pharma's therapeutic pipeline.

The company's commitment to developing treatments for these specific areas positions it to capitalize on the increasing demand for therapies driven by these evolving demographic patterns. Understanding and anticipating these shifts in disease prevalence is therefore a critical component of Ascendis Pharma's long-term market strategy and pipeline development.

Societal demands for fair access to healthcare and cutting-edge treatments significantly shape how governments regulate pharmaceutical companies and how the public views them. Ascendis Pharma's commitment to patient access, demonstrated through initiatives like those for Yorvipath, directly addresses these expectations by assisting patients with treatment navigation and financial support.

The increasing focus on health equity within the biopharmaceutical sector means companies like Ascendis Pharma must actively consider how their innovations reach diverse patient populations. For instance, in 2024, global healthcare spending was projected to reach over $10 trillion, highlighting the immense scale and societal importance of access to medical advancements.

Public Perception of Pharmaceutical Industry

Public perception of the pharmaceutical industry significantly influences Ascendis Pharma's standing. Concerns about drug pricing and corporate accountability are prominent, with surveys in 2024 indicating that a majority of the public believes pharmaceutical companies prioritize profits over patient well-being. This sentiment can lead to increased scrutiny and pressure on companies like Ascendis Pharma to justify their pricing strategies and demonstrate ethical conduct.

Maintaining transparency in research and development costs, clinical trial data, and pricing models is crucial for building trust. Ascendis Pharma's commitment to patient-centricity, evident in its focus on unmet medical needs, can help counter negative perceptions. For instance, in 2024, the company highlighted its efforts to improve patient access to its therapies through various support programs.

- Public Trust: A 2024 Gallup poll found that only 39% of Americans trust the pharmaceutical industry to act in their best interest.

- Pricing Concerns: Over 70% of respondents in a 2024 Kaiser Family Foundation survey expressed concern about prescription drug costs.

- Corporate Responsibility: Ascendis Pharma's initiatives in 2024 aimed at enhancing transparency in its drug development and pricing discussions are key to managing public sentiment.

- Stakeholder Relations: Positive public perception fosters stronger relationships with regulators, payers, and patient advocacy groups, which is vital for Ascendis Pharma's long-term success.

Lifestyle and Disease Incidence

Broader societal shifts in lifestyle, diet, and environmental exposures are significantly impacting disease patterns globally. These trends, even for companies like Ascendis Pharma focusing on rare diseases, shape the overall healthcare environment and the potential patient pool. For instance, rising rates of obesity and sedentary lifestyles, which are prevalent in many developed nations, contribute to an increased incidence of chronic conditions like diabetes and cardiovascular disease, indirectly influencing healthcare resource allocation and research priorities.

While Ascendis Pharma’s core strategy targets rare and orphan diseases, general health trends can still indirectly influence its operating landscape. For example, increased awareness and diagnosis of chronic conditions may lead to greater overall investment in healthcare infrastructure and research, potentially benefiting companies across various therapeutic areas. The World Health Organization (WHO) reported in 2024 that non-communicable diseases (NCDs) accounted for an estimated 74% of all deaths worldwide, highlighting the pervasive impact of lifestyle-related factors.

Specific lifestyle and disease incidence trends relevant to the broader healthcare market include:

- Rising prevalence of autoimmune diseases: Factors like environmental pollutants and dietary changes are being investigated for their role in the increasing incidence of conditions such as rheumatoid arthritis and inflammatory bowel disease.

- Impact of aging populations: As global life expectancy continues to rise, the demand for treatments for age-related diseases, including neurodegenerative disorders and certain cancers, is expected to grow.

- Mental health awareness: Increased societal focus on mental well-being is driving demand for innovative treatments for conditions like depression and anxiety, reflecting a shift in healthcare priorities.

Patient advocacy groups are increasingly influential, directly fueling demand for specialized therapies like those developed by Ascendis Pharma. The growing patient voice also translates into significant pressure on healthcare systems and payers for improved access and favorable reimbursement policies, amplifying calls for broader availability.

Global demographics are shifting, with an aging population driving a higher incidence of chronic conditions. Ascendis Pharma's focus on endocrinology, rare diseases, and oncology aligns well with these changes, as many such conditions disproportionately affect older individuals.

Societal demands for fair access and cutting-edge treatments shape regulatory environments and public perception. Ascendis Pharma's patient-centric initiatives, like those for Yorvipath, address these expectations, while the focus on health equity necessitates considering how innovations reach diverse populations.

Broader societal shifts in lifestyle and environmental exposures are impacting disease patterns, indirectly influencing the healthcare landscape for companies like Ascendis Pharma. While targeting rare diseases, general health trends can affect overall healthcare investment and research priorities.

Technological factors

Ascendis Pharma's competitive edge is built on its proprietary TransCon technology platform. This innovative system allows for the development of prodrugs designed for sustained release, offering a significant leap in drug delivery capabilities.

The TransCon platform enables the predictable release of unmodified parent drugs. This technological advancement can lead to enhanced therapeutic efficacy, better patient tolerability, and a reduced need for frequent dosing, directly impacting patient outcomes and treatment adherence.

Continuous advancements in drug discovery, including genomics and bioinformatics, are rapidly accelerating the identification of new therapeutic targets and the creation of novel compounds. Ascendis Pharma's strategic integration of these technological leaps directly fuels its ability to innovate, potentially shortening development timelines and strengthening its position in the competitive biopharmaceutical landscape.

Innovations in biomanufacturing and supply chain management are critical for companies like Ascendis Pharma. These advancements can significantly boost efficiency and lower production costs, making drug manufacturing more reliable. For instance, the global biopharmaceutical contract manufacturing market was valued at approximately $20 billion in 2023 and is projected to grow substantially, highlighting the importance of these innovations.

Ascendis Pharma can leverage advanced manufacturing techniques, such as continuous manufacturing, to streamline its processes. Exploring decentralized manufacturing models could also enhance supply chain resilience, a crucial factor given recent global disruptions. This approach can better support Ascendis's global commercial expansion plans by ensuring consistent product availability.

Digital Health and Patient Monitoring

The increasing adoption of digital health tools, including remote patient monitoring and connected devices, is a significant technological factor. These innovations are proven to boost treatment adherence and improve patient health outcomes. For a company like Ascendis Pharma, these technologies could offer a powerful synergy with their sustained-release therapies, providing crucial real-time data on how patients are responding to treatment and enabling more effective overall management.

The market for digital health solutions is experiencing robust growth. For instance, the global digital health market was valued at approximately $211 billion in 2022 and is projected to grow significantly, with some estimates reaching over $800 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 18-20% in the coming years. This expansion indicates a strong trend towards integrating technology into healthcare delivery.

Specific technological advancements relevant to patient monitoring include:

- Wearable biosensors: Devices capable of continuously tracking vital signs like heart rate, blood pressure, and glucose levels.

- Telehealth platforms: Enabling remote consultations and data sharing between patients and healthcare providers.

- AI-powered analytics: Tools that process patient data to identify trends, predict adverse events, and personalize treatment plans.

- Connected inhalers and injection devices: Providing data on medication usage and adherence for chronic conditions.

Data Analytics and Artificial Intelligence in R&D

The integration of data analytics and AI is revolutionizing pharmaceutical R&D, speeding up drug discovery and refining clinical trials. Ascendis Pharma can harness these advancements to improve its development pipelines, uncover new uses for current treatments, and deepen its comprehension of disease pathways.

For instance, AI-driven platforms are showing remarkable success in identifying drug candidates. In 2024, AI was estimated to have contributed to the discovery of several new drug molecules entering early-stage clinical trials, a significant increase from previous years. This trend is expected to accelerate, with projections suggesting that AI will play a role in over 50% of new drug approvals by 2030.

- Accelerated Drug Discovery: AI algorithms can analyze vast biological datasets to identify potential drug targets and molecules much faster than traditional methods.

- Optimized Clinical Trials: Data analytics can improve patient selection, predict trial outcomes, and reduce the time and cost associated with clinical development.

- Personalized Medicine: AI enables the analysis of patient-specific data to tailor treatments for better efficacy and fewer side effects.

- Efficiency Gains: By automating data analysis and prediction, these technologies free up researchers to focus on strategic decision-making and innovation.

Ascendis Pharma's core strength lies in its TransCon technology, enabling sustained drug release and improved patient outcomes. Continuous advancements in genomics and bioinformatics are accelerating drug discovery, a trend Ascendis is strategically leveraging to shorten development timelines.

Innovations in biomanufacturing, including continuous manufacturing, are vital for efficiency and cost reduction. The global biopharmaceutical contract manufacturing market, valued around $20 billion in 2023, underscores the importance of these advancements for reliable production and global expansion.

Digital health tools, such as wearable biosensors and telehealth platforms, are enhancing patient adherence and outcomes. The digital health market, projected to grow significantly from its 2022 valuation of $211 billion, offers synergistic opportunities with Ascendis's therapies.

AI and data analytics are transforming R&D, speeding up drug discovery and optimizing clinical trials. AI is expected to contribute to over 50% of new drug approvals by 2030, a significant shift Ascendis can capitalize on for pipeline enhancement and personalized medicine.

| Technological Factor | Description | Impact on Ascendis Pharma | Market Data/Projections |

| TransCon Technology | Proprietary prodrug platform for sustained release | Enhanced therapeutic efficacy, improved patient adherence | N/A (Proprietary) |

| Genomics & Bioinformatics | Advancements in gene sequencing and data analysis | Accelerated drug target identification, shorter development cycles | Significant growth in genomic data analysis market |

| Biomanufacturing | Innovations in production processes (e.g., continuous manufacturing) | Increased efficiency, reduced costs, supply chain reliability | Biopharma contract manufacturing market ~ $20B (2023) |

| Digital Health Tools | Wearables, telehealth, AI analytics | Improved patient monitoring, treatment adherence, personalized care | Digital health market $211B (2022), projected strong CAGR |

| AI in R&D | Machine learning for drug discovery and clinical trial optimization | Faster discovery, more efficient trials, personalized medicine potential | AI to influence >50% of drug approvals by 2030 |

Legal factors

The legal framework for drug approval, including pathways for rare diseases and accelerated approvals, is critical for Ascendis Pharma's commercialization efforts. The U.S. Food and Drug Administration (FDA) plays a central role, with its decisions directly influencing product launch timelines and market access.

Ascendis Pharma's recent successes, such as the FDA approval of Yorvipath (palovarotene) for fibrodysplasia ossificans progressiva and Skytrofa (lonapegsomatropin-tcgd) for pediatric growth hormone deficiency, highlight their proficiency in navigating these intricate regulatory landscapes. These approvals underscore the company's ability to meet stringent efficacy and safety standards.

Potential shifts in regulatory pathways, particularly under a new U.S. administration, could impact future development and approval timelines for Ascendis Pharma's pipeline. For instance, changes to the Prescription Drug User Fee Act (PDUFA) reauthorization or modifications to expedited review programs could alter the speed at which new therapies reach patients.

Ascendis Pharma's reliance on its proprietary TransCon technology and novel drug candidates means that strong intellectual property (IP) protection, particularly through patents, is fundamental to its long-term success and market exclusivity.

The pharmaceutical industry frequently faces patent expirations for established products, underscoring the critical importance of a robust IP strategy to secure ongoing revenue streams and competitive advantage for companies like Ascendis Pharma.

Any legal challenges that successfully invalidate Ascendis Pharma's patents could directly threaten its profitability by opening the door to generic competition and reducing the exclusivity period for its key therapeutic assets.

Legal frameworks governing drug pricing and reimbursement significantly impact Ascendis Pharma's financial performance and market penetration. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, empowers Medicare to negotiate prices for certain high-cost prescription drugs, a move that could affect the profitability of Ascendis Pharma's pipeline products. In the European Union, evolving Health Technology Assessment (HTA) regulations are increasingly scrutinizing the value and cost-effectiveness of new therapies, influencing reimbursement decisions and market access across member states.

Product Liability and Safety Regulations

Ascendis Pharma operates within a highly regulated pharmaceutical landscape, making product liability and safety paramount. Adherence to Good Manufacturing Practices (GMP) and rigorous clinical trial protocols is non-negotiable. For instance, the U.S. Food and Drug Administration (FDA) oversees drug safety, with companies like Ascendis needing to meticulously document trial results and potential side effects. Failure to comply can result in severe penalties, including product recalls and substantial fines.

The company must also maintain robust post-market surveillance systems to monitor for adverse events once a product is available to patients. This proactive approach is crucial for identifying and addressing any unforeseen safety concerns. In 2024, the pharmaceutical industry continued to face increased scrutiny regarding data integrity in clinical trials, underscoring the importance of transparent and accurate reporting for companies like Ascendis.

- Regulatory Compliance: Ascendis Pharma must comply with global regulatory bodies such as the FDA, EMA, and others, ensuring all products meet strict safety and efficacy standards.

- Product Recalls: A product recall, driven by safety concerns, can incur significant costs, estimated to be in the millions of dollars for major pharmaceutical products, impacting revenue and market share.

- Litigation Risks: Product liability lawsuits can lead to substantial financial settlements and damage a company's reputation, affecting investor confidence and future product launches.

- Post-Market Surveillance: Ongoing monitoring for adverse events is critical; for example, pharmacovigilance systems are designed to detect rare but serious side effects that may not appear in clinical trials.

Data Privacy and Compliance

Ascendis Pharma must navigate a complex web of data privacy laws. Compliance with regulations like the EU's General Data Protection Regulation (GDPR) and the U.S.'s Health Insurance Portability and Accountability Act (HIPAA) is paramount, particularly given the sensitive patient data Ascendis handles from its clinical trials and commercial operations. Failure to comply can result in significant fines and reputational damage.

Establishing and maintaining robust data ethics and compliance frameworks is not just a legal necessity but a cornerstone of trust. Ascendis Pharma's commitment to safeguarding sensitive patient information directly impacts its relationships with trial participants, healthcare providers, and regulatory bodies. In 2024, the global cost of data breaches continued to rise, with the average cost reaching $4.45 million, underscoring the financial implications of inadequate data protection measures.

- GDPR Fines: Non-compliance can lead to fines of up to 4% of global annual revenue or €20 million, whichever is higher.

- HIPAA Penalties: Violations can result in civil penalties ranging from $100 to $50,000 per violation, with annual caps.

- Data Breach Costs: The average cost of a data breach in 2024 was $4.45 million, a testament to the financial impact of security failures.

- Patient Trust: Maintaining patient trust is crucial for successful clinical trial recruitment and ongoing commercial success.

Ascendis Pharma's legal standing is heavily influenced by intellectual property rights, particularly patents, which are crucial for market exclusivity. The company's reliance on its TransCon technology means that any patent infringement claims or challenges could significantly impact its revenue streams and competitive edge. For instance, a successful challenge to a key patent could lead to generic competition, eroding market share and profitability.

Navigating global pricing and reimbursement regulations is another critical legal factor. The Inflation Reduction Act (IRA) in the U.S., enacted in 2022, allows Medicare to negotiate drug prices, potentially affecting Ascendis Pharma's profitability for its pipeline products. Similarly, evolving Health Technology Assessment (HTA) frameworks in the EU scrutinize drug value and cost-effectiveness, influencing market access and reimbursement decisions across member states.

| Legal Factor | Impact on Ascendis Pharma | Key Considerations / Data (2024-2025) |

|---|---|---|

| Intellectual Property (Patents) | Secures market exclusivity and competitive advantage. | Patent expirations can lead to generic competition; robust IP strategy is vital. |

| Pricing & Reimbursement Regulations | Affects financial performance and market penetration. | IRA price negotiation (US) and HTA scrutiny (EU) are key influences. |

| Product Liability & Safety Compliance | Ensures adherence to Good Manufacturing Practices (GMP) and clinical trial protocols. | FDA oversight and post-market surveillance are critical; data integrity in trials is under scrutiny. |

| Data Privacy Laws (GDPR, HIPAA) | Protects sensitive patient data and maintains trust. | Non-compliance can result in substantial fines; average data breach cost in 2024 was $4.45 million. |

Environmental factors

Ascendis Pharma's dedication to sustainable manufacturing significantly shapes its environmental impact and how stakeholders view the company. This commitment translates into tangible actions like minimizing waste generation, enhancing energy efficiency, and carefully managing water usage across its operational sites.

By actively implementing these sustainable practices, Ascendis Pharma not only reduces its ecological footprint but also strengthens its reputation among environmentally conscious investors and consumers. For instance, many pharmaceutical companies are setting ambitious targets; in 2024, the industry saw a growing trend towards renewable energy sourcing for manufacturing, with some aiming for 100% renewable electricity by 2030.

Furthermore, strict adherence to evolving environmental regulations and standards is crucial for mitigating potential regulatory risks and avoiding penalties. This proactive approach to environmental stewardship is becoming increasingly vital for long-term business resilience and market acceptance.

Ascendis Pharma faces stringent environmental regulations regarding the disposal of biopharmaceutical waste, including hazardous materials from its manufacturing processes and expired products. Proper waste management is essential to mitigate ecological impact and ensure compliance. In 2024, the global biopharmaceutical waste management market was valued at approximately $12.5 billion, indicating the significant operational and cost considerations involved.

Ascendis Pharma faces increasing risks to its supply chain and manufacturing due to climate change, with extreme weather events like floods and heatwaves becoming more frequent. For instance, the World Meteorological Organization reported that the cost of weather and climate disasters in 2023 reached $250 billion globally, highlighting the growing economic impact.

To ensure business continuity, Ascendis Pharma must build resilience into its operations. This involves diversifying its sourcing of raw materials and active pharmaceutical ingredients (APIs) across different geographic regions to mitigate the impact of localized disruptions. Implementing robust risk mitigation strategies, such as advanced inventory management and contingency planning for transportation, is crucial.

Resource Scarcity and Raw Material Sourcing

Ascendis Pharma's reliance on specialized raw materials for its innovative drug development, particularly for its TransCon technology, presents a clear environmental factor. The availability and cost of these materials can be significantly impacted by global supply chain disruptions and increasing demand, potentially affecting production timelines and profitability. For instance, the pharmaceutical industry's overall demand for active pharmaceutical ingredients (APIs) and excipients has seen steady growth, with market research indicating a compound annual growth rate (CAGR) of around 6-8% projected through 2027, highlighting the competitive landscape for sourcing essential components.

To navigate these challenges, Ascendis Pharma is increasingly focused on sustainable sourcing and exploring alternative materials. This proactive approach not only addresses potential resource scarcity but also aligns with growing investor and regulatory emphasis on environmental, social, and governance (ESG) factors. The company's commitment to responsible supply chain management is crucial for long-term resilience.

Key considerations for Ascendis Pharma regarding resource scarcity include:

- Dependence on specific, potentially scarce, raw materials for drug synthesis.

- Vulnerability to price fluctuations in the global commodities market for pharmaceutical inputs.

- The need for robust supplier relationships and diversified sourcing strategies.

- The imperative to invest in research for bio-based or synthetically derived alternatives to reduce reliance on traditional sources.

Environmental, Social, and Governance (ESG) Reporting

Ascendis Pharma's dedication to Environmental, Social, and Governance (ESG) reporting underscores its commitment to transparency regarding its environmental footprint. The company's 2023 Sustainability & P|ESG Report details its proactive steps to comply with evolving regulations, such as the European Union's Corporate Sustainability Reporting Directive (CSRD), which mandates enhanced disclosure for a broad range of companies operating within the EU.

This focus on robust ESG practices is not merely about compliance; it directly influences investor perception. Companies demonstrating strong ESG performance often attract greater investor interest and potentially lower their cost of capital. For instance, a growing number of institutional investors are integrating ESG criteria into their investment decisions, seeking companies that manage environmental risks and opportunities effectively.

Ascendis Pharma's ESG reporting highlights specific areas of focus:

- Environmental Initiatives: Efforts to reduce greenhouse gas emissions and manage waste responsibly.

- Social Responsibility: Commitment to employee well-being, diversity, and ethical supply chain practices.

- Governance Standards: Adherence to strong corporate governance principles and transparent stakeholder engagement.

Ascendis Pharma operates within a framework of increasing environmental regulations, particularly concerning waste management and emissions. The company's commitment to sustainability, evident in its 2023 ESG report, aligns with industry-wide trends towards greener manufacturing. For example, many pharmaceutical firms are setting targets for renewable energy adoption, with a notable push for 100% renewable electricity by 2030.

Climate change poses a tangible risk to Ascendis Pharma's supply chain and operations, with extreme weather events causing significant global economic disruption, as seen in the $250 billion cost of weather and climate disasters reported for 2023. To counter this, diversification of raw material sourcing and robust contingency planning are essential for maintaining business continuity.

The company's reliance on specialized raw materials for its innovative therapies, such as its TransCon technology, makes it susceptible to supply chain disruptions and price volatility. The pharmaceutical industry's demand for APIs and excipients is projected to grow at a CAGR of 6-8% through 2027, intensifying the competition for essential components.

Ascendis Pharma's proactive approach to ESG reporting, including compliance with directives like the EU's CSRD, enhances transparency and investor confidence. Strong ESG performance is increasingly linked to attracting investment and potentially lowering capital costs, as many institutional investors now integrate these criteria into their decision-making processes.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ascendis Pharma is built on comprehensive data from leading financial news outlets, regulatory filings, and industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.