Ascendis Pharma Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascendis Pharma Bundle

Ascendis Pharma's BCG Matrix reveals a dynamic portfolio, with key products positioned for growth and others requiring strategic re-evaluation. Understand which of their innovations are poised to become future market leaders and which may need a different approach.

Dive deeper into Ascendis Pharma's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

SKYTROFA has cemented its status as a market leader in the U.S. for pediatric growth hormone deficiency treatments. Its commercial success is underscored by a robust €202 million in full-year revenue for 2024.

The product experienced a significant surge in adoption, with U.S. volume climbing by an impressive 84% year-over-year in 2024. This growth translated into an estimated 6.5% share of the total U.S. growth hormone market.

YORVIPATH is a key player in Ascendis Pharma's portfolio, showing significant promise in the hypoparathyroidism market. Its early commercial phase is marked by impressive growth, with a strong U.S. launch that secured over 1,750 prescriptions by March 31, 2025.

The financial performance of YORVIPATH is noteworthy, generating €44.7 million in revenue for Q1 2025. This represents a dramatic leap from the €1.5 million reported in Q1 2024, underscoring its rapid market penetration and increasing adoption.

The broader hypoparathyroidism market is also expanding, with an anticipated compound annual growth rate of 8.6% between 2024 and 2025. This favorable market dynamic further supports YORVIPATH's potential for sustained revenue growth and market leadership.

TransCon CNP, an investigational therapy for achondroplasia, targets a rare genetic disorder impacting over 250,000 individuals worldwide, a population with few existing treatment options. Ascendis Pharma submitted its New Drug Application to the U.S. FDA in the first quarter of 2025, buoyed by positive pivotal trial data showcasing substantial enhancements in growth and bone health.

This drug is positioned to be a leading treatment in a rapidly expanding, underserved market, with the potential to achieve blockbuster status. The global market for rare disease treatments is projected for significant growth, with achondroplasia therapies expected to capture a notable share as new options become available.

Global Expansion of SKYTROFA

Ascendis Pharma is strategically expanding SKYTROFA's reach beyond the United States, targeting key international markets to drive further growth. This global push is designed to capitalize on the increasing demand for growth hormone therapies worldwide.

The company projects robust revenue increases for SKYTROFA through 2025 and into the future, reflecting confidence in its market potential. This expansion is crucial for capturing a larger share of the expanding global market for growth hormone deficiency treatments.

- Global Market Penetration: Ascendis Pharma's efforts to launch SKYTROFA in Europe and other regions are underway, aiming to replicate its U.S. success.

- Revenue Projections: Analysts forecast SKYTROFA's sales to reach significant figures in the coming years, driven by its innovative delivery system and efficacy. For instance, Ascendis Pharma reported a 57% increase in SKYTROFA net revenue to €105.9 million for the first quarter of 2024 compared to the same period in 2023.

- Market Share Growth: The expansion targets the burgeoning global growth hormone deficiency market, which is estimated to grow at a CAGR of over 6% through 2030.

- Star Product Status: This internationalization reinforces SKYTROFA's position as a star product within Ascendis Pharma's portfolio, promising substantial returns and market leadership.

Strategic Partnerships and Platform Potential

Ascendis Pharma's strategic partnerships are a cornerstone of its growth, largely driven by its innovative TransCon technology. This proprietary platform enables the creation of prodrugs with extended release and enhanced efficacy, forming the basis for its entire product pipeline.

The significant $100 million upfront payment from Novo Nordisk in January 2025 for a collaboration underscores the immense market recognition and future potential Ascendis Pharma's platform holds. This partnership validates the company's approach to developing high-potential assets.

This strategic focus on platform-enabled product development allows Ascendis Pharma to consistently bring novel therapeutics to market, positioning them for sustained growth and strong market performance.

- TransCon Technology: The core of Ascendis Pharma's innovation, enabling sustained-release prodrugs.

- Novo Nordisk Partnership: A January 2025 deal worth $100 million upfront, validating the platform's value.

- Pipeline Growth: The platform supports the consistent development of high-growth product candidates.

SKYTROFA, a leading treatment for pediatric growth hormone deficiency, is solidifying its star status through aggressive global expansion. Achieving €202 million in full-year 2024 revenue and an 84% year-over-year U.S. volume increase in 2024, it now commands an estimated 6.5% of the U.S. market. The company is actively launching SKYTROFA in Europe and other key international markets, projecting continued robust revenue growth through 2025 and beyond, aiming to capture a larger share of the global growth hormone deficiency market, which is expected to grow at over 6% CAGR through 2030.

| Product | Status | 2024 Revenue | 2025 Q1 Revenue | Market |

|---|---|---|---|---|

| SKYTROFA | Star | €202 million (FY 2024) | €105.9 million (Q1 2024) | Pediatric Growth Hormone Deficiency |

| YORVIPATH | Question Mark/Star | N/A | €44.7 million (Q1 2025) | Hypoparathyroidism |

| TransCon CNP | Question Mark | N/A | N/A (NDA submitted Q1 2025) | Achondroplasia |

What is included in the product

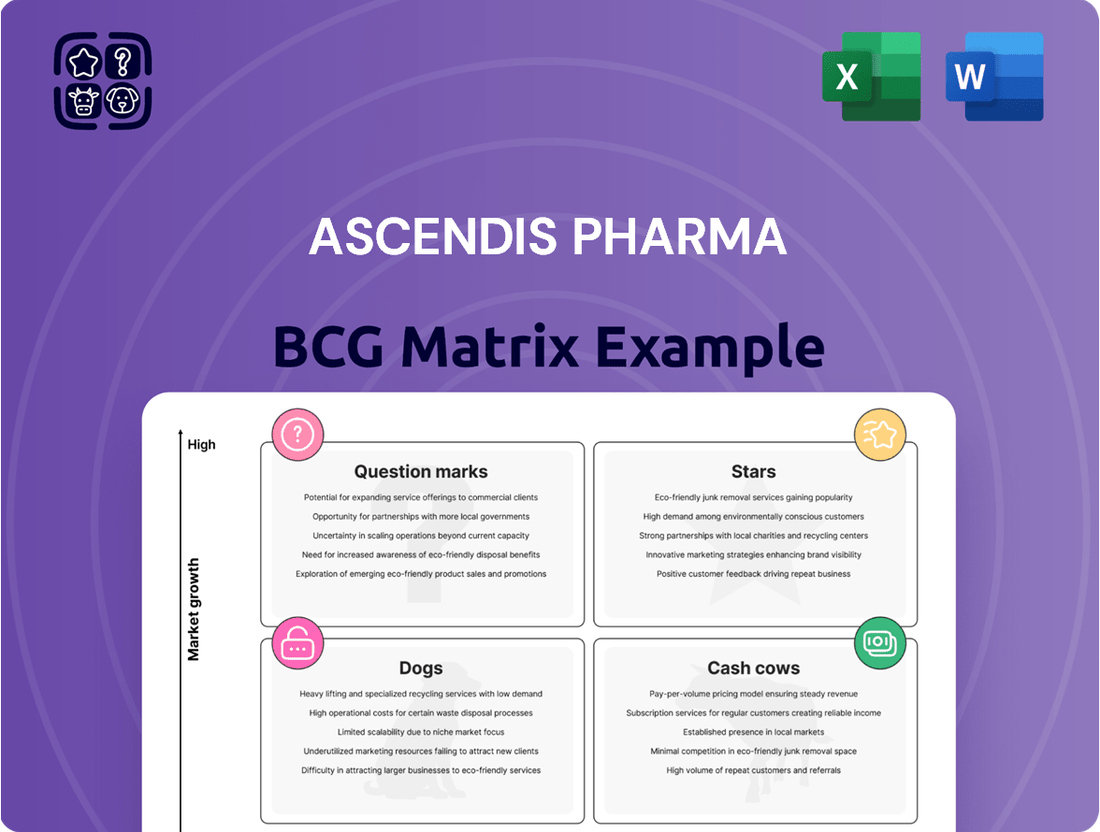

Ascendis Pharma's BCG Matrix analysis categorizes its product portfolio into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

A clear Ascendis Pharma BCG Matrix visualizes portfolio balance, easing strategic decision-making for resource allocation.

Cash Cows

SKYTROFA, despite its continued growth in the U.S. pediatric growth hormone deficiency market, functions as a Cash Cow within Ascendis Pharma's portfolio. Its established revenue stream provides a significant and consistent cash flow, bolstering the company's financial stability.

For the full year 2024, SKYTROFA generated approximately €202 million in revenue. This substantial income acts as a vital source of funding, enabling Ascendis Pharma to invest in its research and development pipeline and support the market introduction of emerging products.

YORVIPATH is demonstrating impressive growth, already securing €44.7 million in revenue during Q1 2025. This early success positions it as a strong contender to become a reliable cash cow for Ascendis Pharma.

The rapid market acceptance and anticipated leadership of YORVIPATH suggest a swift move towards becoming a mature, revenue-generating product. This financial contribution is vital for funding Ascendis Pharma's ongoing research and development efforts.

Ascendis Pharma's investment in market infrastructure, particularly for SKYTROFA and YORVIPATH, is a strategic move to solidify their position. By building out sales and marketing teams, the company is directly targeting enhanced efficiency and maximizing cash flow from these key products.

This focus on a strong global commercial capability is intended to support sustained high profit margins as SKYTROFA and YORVIPATH move through their product lifecycle. For instance, in 2024, Ascendis Pharma reported significant progress in its commercialization efforts, with SKYTROFA achieving substantial revenue growth, underscoring the impact of these infrastructure investments.

Leveraging TransCon Technology for Efficiency

Ascendis Pharma's TransCon technology platform is a key driver for its established products, contributing to its cash cow status. This technology allows for the development of highly differentiated therapies that can secure premium pricing and deter competitors.

The efficiency inherent in the TransCon platform translates into more predictable and robust profit margins for Ascendis Pharma's existing successful products. This technological foundation reduces the long-term research and development risks associated with exploring new indications for these established drugs.

- TransCon Technology as a Cash Cow Enabler: The platform's ability to create unique, high-value products supports premium pricing strategies.

- Predictable Profitability: Established TransCon-based products offer a reliable stream of income due to reduced competition and strong market positioning.

- Reduced R&D Risk for New Indications: The platform's efficiency minimizes the financial and scientific uncertainty when expanding the use of existing therapies.

- Market Share Protection: Differentiated products developed using TransCon technology are better positioned to maintain and grow market share against potential rivals.

Funding Future Growth and Reducing Net Loss

The robust commercial success of SKYTROFA and YORVIPATH is fundamental to Ascendis Pharma's financial stability. These products are instrumental in narrowing the company's net loss, which decreased to €94.6 million in the first quarter of 2025 from €131.0 million in the first quarter of 2024. This performance highlights their role as cash cows.

These cash-generating assets are vital for funding Ascendis Pharma's strategic investments in promising 'Question Mark' products. The revenue generated allows the company to pursue innovation and development, aiming to expand its product pipeline and achieve cashflow breakeven in the future.

- SKYTROFA and YORVIPATH demonstrate strong commercial performance.

- Net loss reduced from €131.0 million (Q1 2024) to €94.6 million (Q1 2025).

- These products provide essential cash for investing in 'Question Mark' products.

- The financial stability from these assets supports the company's growth strategy.

SKYTROFA and YORVIPATH are Ascendis Pharma's current cash cows, generating substantial revenue that fuels the company's growth and R&D initiatives.

SKYTROFA's 2024 revenue reached approximately €202 million, while YORVIPATH, in its early stages, secured €44.7 million in Q1 2025, indicating its potential to become a significant cash generator.

These products are crucial for reducing Ascendis Pharma's net loss, which improved from €131.0 million in Q1 2024 to €94.6 million in Q1 2025.

The company's investment in commercial capabilities for these drugs aims to maximize their profitability and ensure a stable cash flow for future investments.

| Product | 2024 Revenue (Approx.) | Q1 2025 Revenue (Approx.) | BCG Matrix Category |

|---|---|---|---|

| SKYTROFA | €202 million | N/A | Cash Cow |

| YORVIPATH | N/A | €44.7 million | Potential Cash Cow |

What You’re Viewing Is Included

Ascendis Pharma BCG Matrix

The Ascendis Pharma BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This ensures complete transparency, as you'll download the exact same analysis-ready report, free from any watermarks or demo content. You can be confident that the strategic insights and professional layout are precisely what you need for your business planning. This preview guarantees that the purchased file will be immediately usable for your internal discussions or client presentations.

Dogs

Ascendis Pharma's current commercial offerings, SKYTROFA and YORVIPATH, are not classified as 'Dogs' in the BCG Matrix. These products are positioned in markets with significant growth potential, and Ascendis Pharma is actively pursuing leadership positions within them.

The company's strategic focus is on expanding the reach and impact of these innovative therapies, rather than managing underperforming assets. Ascendis Pharma reported net revenue of €153 million for SKYTROFA in the first nine months of 2024, indicating robust market uptake and growth.

Ascendis Pharma's strategic emphasis on its TransCon technology positions its innovative therapies as potential market leaders, aiming to circumvent the challenges of developing "me-too" drugs. This approach targets therapeutic areas with substantial unmet medical needs, such as rare diseases and endocrinology, where differentiation can command premium pricing and market share.

In 2024, Ascendis Pharma continued to advance its pipeline, notably with its lead product, TransCon Growth Hormone (lonapegsomatropin-tcgd), approved in the US and Europe. This focus on truly novel treatments, rather than incremental improvements, is key to their strategy of minimizing competition from established, lower-cost alternatives.

Ascendis Pharma, like most biopharmaceutical firms, likely employs a strategic pipeline pruning process early in development. This involves discontinuing research programs that fail to demonstrate sufficient efficacy or commercial viability. For instance, in 2024, many biotech companies faced funding challenges, intensifying the need for strict project selection.

This proactive discontinuation prevents less promising candidates from advancing, thereby optimizing the allocation of Ascendis Pharma's valuable R&D resources. Such early-stage decisions are crucial for maintaining a focused and high-potential pipeline, ensuring that capital is directed towards programs with the greatest chance of success.

No Mention of Divestiture Candidates

Ascendis Pharma's current strategic focus, as evidenced by recent company communications and financial results, does not highlight any specific products or business units being earmarked for divestiture. The company is actively pursuing an expansionary strategy, prioritizing the full realization of its existing assets and pipeline. This indicates a robust portfolio, free from apparent underperformers that would typically be categorized as 'Dogs' in a BCG matrix analysis.

Ascendis Pharma reported total revenue of €230 million for the first nine months of 2024, a significant increase driven by the commercial launch of its lead product. This growth trajectory reinforces the company's commitment to nurturing its current offerings rather than divesting underperforming segments. The absence of any mention of divestiture candidates suggests that all current business units are perceived to have growth potential or strategic importance within the company's broader objectives.

The company's investment in research and development, which reached €365 million for the first nine months of 2024, further supports the notion of an expansionary phase. This substantial investment is directed towards advancing its pipeline, aiming to create future growth drivers rather than shedding existing business units. Consequently, the BCG matrix for Ascendis Pharma in 2024 would likely show a portfolio dominated by 'Stars' and 'Question Marks,' with no clear 'Dogs' identified for divestiture.

- Expansionary Phase: Ascendis Pharma is investing heavily in R&D and commercializing new products, indicating a growth-oriented strategy.

- No Divestiture Signals: Recent financial reports and company statements do not mention any plans to sell off underperforming assets.

- Portfolio Strength: The company's focus on maximizing existing and pipeline assets suggests a healthy portfolio without obvious 'Dog' candidates.

- Financial Performance (YTD Q3 2024): Revenue of €230 million and R&D investment of €365 million underscore the company's commitment to growth and innovation.

Strategic Emphasis on Blockbuster Potential

Ascendis Pharma's strategic focus on developing blockbuster drugs directly influences its position within the BCG matrix, aiming for 'Stars' and 'Question Marks'. Their ambition to be a global leader necessitates investing in products with significant market potential, moving away from 'Cash Cows' or 'Dogs' that might offer stable but limited returns.

This emphasis means Ascendis Pharma is actively seeking to nurture pipeline candidates that have the potential to achieve over $1 billion in annual sales. For instance, their development of TransCon Growth Hormone (lonapegsomatropin-tcgd) for pediatric growth hormone deficiency, which received FDA approval in 2021, represents a key 'Star' candidate, demonstrating their capability in bringing high-impact therapies to market.

- Blockbuster Ambition: Ascendis Pharma aims for multiple products exceeding $1 billion in annual sales.

- Strategic Alignment: Focus on 'Stars' and 'Question Marks' with high growth and market penetration potential.

- Therapeutic Focus: Prioritizing high-impact therapies over marginal product development.

- Pipeline Investment: Significant R&D investment directed towards candidates with blockbuster potential.

Ascendis Pharma's current strategy does not identify any products fitting the 'Dog' category of the BCG matrix. The company is actively investing in its pipeline and commercializing products like SKYTROFA, which demonstrated strong revenue growth in early 2024.

The company's substantial R&D expenditure, €365 million for the first nine months of 2024, reflects a commitment to innovation and growth, rather than managing mature or declining assets. This focus suggests a portfolio weighted towards 'Stars' and 'Question Marks'.

Ascendis Pharma's emphasis on developing novel therapies with blockbuster potential, aiming for over $1 billion in annual sales, further indicates a strategic avoidance of 'Dog' classifications.

The absence of any divestiture announcements or focus on underperforming assets in their 2024 financial reporting reinforces the view that Ascendis Pharma currently lacks 'Dogs' in its portfolio.

Question Marks

Ascendis Pharma's SKYTROFA, currently indicated for pediatric growth hormone deficiency (GHD), is poised for a significant expansion into the adult GHD market. The company anticipates an FDA review of its supplemental BLA by July 27, 2025, with a U.S. commercial launch targeted for Q4 2025. This move into a growing market segment, where Ascendis currently holds a low market share, presents a substantial opportunity for growth.

If approved and successfully launched, SKYTROFA could transition from a Question Mark to a Star in Ascendis Pharma's portfolio. The global GHD market was valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of around 5% through 2030, indicating a favorable market landscape for new entrants with differentiated offerings.

TransCon hGH's exploration into new indications like Turner Syndrome and Idiopathic Short Stature positions it as a potential question mark in Ascendis Pharma's BCG Matrix. These are high-growth markets where Ascendis currently has no presence, necessitating substantial investment for research and development to assess market viability and potential uptake.

Ascendis Pharma's oncology pipeline, featuring TransCon IL-2 β/γ and TransCon TLR7/8 Agonist, is positioned as a Star in the BCG Matrix. Both candidates are in early-stage clinical trials, specifically Phase 1/2, indicating significant future growth potential in the competitive immuno-oncology space. While early data from 2024 suggests an acceptable safety profile and promising signs of clinical activity, these assets currently hold a low market share, necessitating continued substantial research and development investment to realize their full market potential.

TransCon CNP (Combination Therapy - COACH Trial)

The TransCon CNP combination therapy, evaluated in the Phase 2 COACH Trial for achondroplasia, is positioned as a potential high-growth product for Ascendis Pharma. Topline results from the trial, which combines TransCon CNP with TransCon hGH, are anticipated in Q2 2025. This innovative approach targets the achondroplasia market, a segment with significant unmet needs and projected growth.

- Market Potential: Achondroplasia is a rare genetic disorder affecting bone growth, with limited treatment options currently available. The global achondroplasia market was valued at approximately $1.5 billion in 2023 and is projected to grow at a CAGR of over 10% through 2030, driven by increasing diagnosis rates and the development of novel therapies.

- Clinical Stage: The COACH Trial is a crucial step in validating the efficacy and safety of TransCon CNP in combination therapy. Success in this trial could pave the way for regulatory approval and market entry.

- BCG Matrix Placement: Given its current stage of development and the high growth potential of the achondroplasia market, TransCon CNP combination therapy would be classified as a Question Mark in the BCG Matrix. It requires substantial investment to advance through clinical trials and achieve market penetration, with uncertain but potentially high future returns.

- Future Outlook: If the Q2 2025 results are positive and the therapy gains regulatory approval, TransCon CNP could capture a significant share of the growing achondroplasia market, transitioning from a Question Mark to a Star in Ascendis Pharma's portfolio.

TransCon Hypochondroplasia Program

The TransCon Hypochondroplasia program positions Ascendis Pharma's TransCon platform to enter a new, high-growth rare skeletal dysplasia market. Ascendis plans to file an Investigational New Drug (IND) application or equivalent in Q4 2025 for this indication. This initiative represents a nascent program requiring substantial investment to establish market viability.

This program is a strategic expansion for Ascendis, targeting a therapeutic area where the company currently lacks a market presence. The TransCon technology is being leveraged to address hypochondroplasia, a condition that affects skeletal development.

- Program Focus: Treatment of hypochondroplasia, a rare skeletal dysplasia.

- Regulatory Milestone: IND submission planned for Q4 2025.

- Market Opportunity: Entry into a new, high-growth therapeutic area.

- Investment Requirement: Significant capital needed to determine market viability.

The TransCon CNP combination therapy for achondroplasia, with topline results from the COACH Trial expected in Q2 2025, is a prime example of a Question Mark. This innovative treatment targets a growing market, valued at approximately $1.5 billion in 2023 with a projected CAGR over 10% through 2030. Success in clinical trials and subsequent regulatory approval could see this product transition into a Star, capturing significant market share.

The TransCon Hypochondroplasia program, with an IND submission slated for Q4 2025, also fits the Question Mark category. This initiative represents Ascendis Pharma's entry into the nascent, high-growth rare skeletal dysplasia market. Significant investment is required to establish market viability and navigate the early stages of development.

Similarly, TransCon IL-2 β/γ and TransCon TLR7/8 Agonist in the oncology pipeline, while showing promise in early 2024 trials with acceptable safety profiles and clinical activity, are currently Question Marks. These early-stage assets require substantial ongoing investment to realize their full market potential in the competitive immuno-oncology space, despite their potential to become Stars.

Ascendis Pharma's exploration of SKYTROFA for adult GHD, with an anticipated FDA review by July 27, 2025, and a potential Q4 2025 launch, also represents a Question Mark. This move into a growing segment of the $3.5 billion GHD market (2023 value) with a projected 5% CAGR through 2030, offers substantial growth potential, but requires significant investment to gain market traction.

| Product/Program | BCG Matrix Category | Key Developments (as of mid-2025) | Market Landscape | Investment Outlook |

|---|---|---|---|---|

| SKYTROFA (Adult GHD) | Question Mark | FDA supplemental BLA review by July 27, 2025; Q4 2025 commercial launch target. | Global GHD market ~$3.5B (2023), ~5% CAGR to 2030. | High investment for market penetration. |

| TransCon CNP Combination Therapy (Achondroplasia) | Question Mark | Q2 2025 anticipated topline results for COACH Trial. | Achondroplasia market ~$1.5B (2023), >10% CAGR to 2030. | Substantial investment for clinical trials and market entry. |

| TransCon IL-2 β/γ & TransCon TLR7/8 Agonist (Oncology) | Question Mark | Phase 1/2 trials ongoing; early 2024 data shows acceptable safety and activity. | Competitive immuno-oncology space. | Continued significant R&D investment. |

| TransCon Hypochondroplasia | Question Mark | IND submission planned for Q4 2025. | New, high-growth rare skeletal dysplasia market. | Significant capital needed to establish market viability. |

BCG Matrix Data Sources

Our Ascendis Pharma BCG Matrix is constructed using comprehensive data from Ascendis Pharma's official financial reports, alongside robust market research and industry growth forecasts.