Ascendis Pharma Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascendis Pharma Bundle

Ascendis Pharma operates within a dynamic biotech landscape, where the threat of new entrants is significant due to the high R&D costs and regulatory hurdles. Understanding these forces is crucial for strategic positioning.

The complete report reveals the real forces shaping Ascendis Pharma’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a significant factor in the biopharmaceutical sector. For companies like Ascendis Pharma, especially in niche areas such as rare diseases, the reliance on a small number of specialized suppliers for crucial components like active pharmaceutical ingredients (APIs) and advanced manufacturing services can be substantial. This limited supplier base often translates into considerable bargaining power for those suppliers.

This concentrated supplier power becomes particularly acute when dealing with proprietary components or unique manufacturing processes that are not easily replicated. If a key supplier experiences disruptions, such as an API shortage, it can directly impede Ascendis Pharma's production capabilities and inevitably drive up costs. For instance, in 2024, several pharmaceutical companies faced challenges due to global shortages of specific APIs, leading to production delays and increased procurement expenses.

Switching suppliers in the biopharmaceutical industry, particularly for a company like Ascendis Pharma, is a complex and costly undertaking. The rigorous regulatory environment, including FDA and EMA approvals, necessitates extensive validation of any new supplier to ensure product quality and safety. This process can take years and involve significant financial investment.

These high switching costs mean Ascendis Pharma has less leverage when negotiating with its current suppliers. Suppliers, knowing the difficulty of replacement, can command higher prices or more favorable terms, thereby increasing their bargaining power. This is a critical factor in Ascendis Pharma's operational costs and strategic planning.

The proprietary nature of Ascendis Pharma's TransCon technology likely exacerbates this reliance on specialized suppliers. Developing and validating suppliers for unique components or manufacturing processes related to this technology further entrenches Ascendis Pharma's dependence, amplifying supplier bargaining power.

Ascendis Pharma's reliance on its proprietary TransCon technology means that specialized components and processes are crucial. If these inputs are sourced from a limited number of suppliers or require unique expertise, those suppliers gain significant leverage. For instance, the development of novel drug delivery systems often involves intricate manufacturing processes where a few specialized firms might hold a near-monopoly on the necessary technology or raw materials.

Threat of Forward Integration by Suppliers

In the biopharmaceutical sector, suppliers of critical raw materials or specialized manufacturing services possess the potential to integrate forward. This could involve them developing and marketing their own drug products, leveraging their existing components and expertise.

While this threat is less pronounced for suppliers of basic raw materials, highly specialized Contract Development and Manufacturing Organizations (CDMOs) with proprietary technologies or unique manufacturing capabilities present a more significant concern. Such CDMOs could, in theory, develop their own pipeline of drug candidates, thereby limiting Ascendis Pharma's access to essential resources or creating direct competition.

- Supplier Integration Risk: The potential for specialized suppliers, particularly CDMOs, to develop their own drug products poses a threat by potentially restricting Ascendis Pharma's access to critical manufacturing capabilities.

- Specialized Capabilities are Key: The threat is amplified when suppliers possess unique or proprietary technologies that are difficult for Ascendis Pharma to replicate or source elsewhere.

- Market Dynamics: While direct forward integration by raw material suppliers is rare, the evolving landscape of biopharmaceutical manufacturing and the increasing reliance on specialized CDMOs make this a factor to monitor.

Importance of Supplier's Input to Ascendis Pharma's Product

The quality and timely delivery of raw materials and specialized services are absolutely crucial for biopharmaceutical companies like Ascendis Pharma. This directly influences the efficacy, safety, and ultimately, the regulatory approval of their drugs. For Ascendis Pharma, focusing on critical areas like endocrinology, rare diseases, and oncology, the dependability of their suppliers is non-negotiable for achieving positive patient outcomes and commercial success.

This reliance significantly bolsters the bargaining power of Ascendis Pharma's suppliers. If a supplier provides a unique or highly specialized component essential for Ascendis Pharma's innovative therapies, like their PASylation technology, they hold considerable sway. For instance, in 2024, Ascendis Pharma reported significant progress with their pipeline, underscoring the ongoing need for consistent, high-quality inputs from their supply chain partners.

- Criticality of Inputs: Ascendis Pharma's innovative therapies depend on specialized raw materials and manufacturing services, making supplier reliability paramount.

- Impact on Patient Outcomes: The quality of supplier inputs directly affects drug efficacy and safety, which are vital for patients with unmet medical needs.

- Regulatory Scrutiny: The biopharmaceutical industry faces stringent regulatory oversight, meaning any disruption or quality issue from suppliers can have severe consequences.

- Supplier Leverage: Companies providing unique or essential components for Ascendis Pharma's advanced treatments possess substantial bargaining power.

The bargaining power of suppliers for Ascendis Pharma is notably strong due to the specialized nature of the biopharmaceutical industry. Suppliers of critical raw materials, such as complex chemical compounds or unique biologics, often face limited competition. This concentration means that Ascendis Pharma, like its peers, may have few alternative sources for essential inputs, granting these suppliers significant leverage in price negotiations and contract terms.

The high switching costs associated with changing suppliers in this regulated sector further solidify supplier power. Ascendis Pharma must navigate extensive validation processes, which are both time-consuming and expensive, to ensure any new supplier meets stringent quality and regulatory standards. This inertia makes it difficult and costly to move away from established suppliers, even if terms are unfavorable.

The proprietary nature of Ascendis Pharma's innovative technologies, such as its TransCon technology, often necessitates highly specialized components or manufacturing processes. Suppliers who possess the unique expertise or patented materials required for these advanced therapies are in a commanding position. For example, a supplier of a critical linker molecule for a novel drug delivery system could dictate terms due to their indispensable role.

The potential for suppliers to integrate forward, particularly specialized Contract Development and Manufacturing Organizations (CDMOs), represents another facet of their bargaining power. If a CDMO develops its own drug pipeline using its proprietary manufacturing capabilities, it could limit Ascendis Pharma's access to essential services or even become a competitor, increasing supplier leverage.

| Factor | Impact on Ascendis Pharma | Example/Data Point (2024) |

| Supplier Concentration | High dependency on few specialized suppliers | Limited number of manufacturers for specific rare disease APIs |

| Switching Costs | Significant financial and time investment for supplier change | Years of validation required for new API suppliers due to regulatory hurdles |

| Proprietary Inputs | Reliance on suppliers with unique technologies or materials | Suppliers of specialized excipients for advanced drug formulations |

| Forward Integration Threat | Potential for CDMOs to develop own drug candidates | Increased competition for manufacturing slots from specialized CDMOs |

What is included in the product

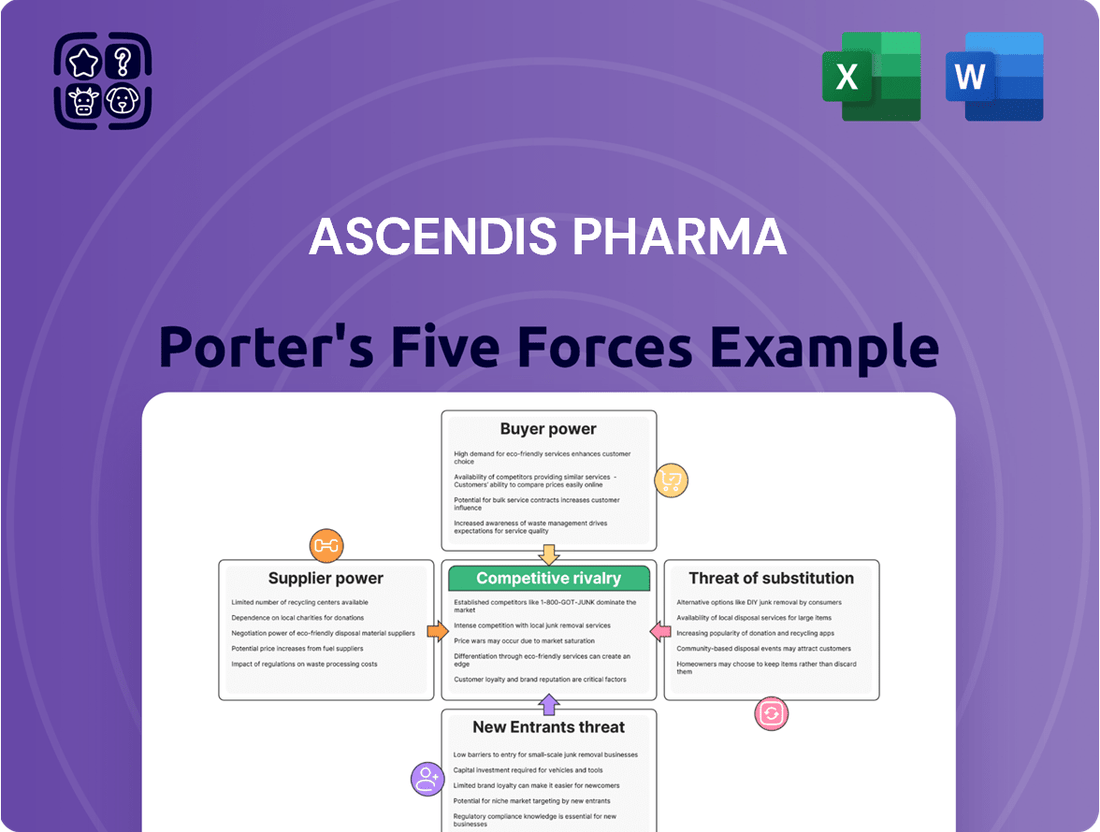

This Porter's Five Forces analysis for Ascendis Pharma dissects the competitive intensity within the biopharmaceutical sector, focusing on the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Ascendis Pharma.

Customers Bargaining Power

Customers in the biopharmaceutical sector, encompassing healthcare systems, insurers, and patients, exhibit significant price sensitivity. This is particularly true as the cost of novel treatments, especially those for rare conditions, continues to climb.

The median annual list price for new drugs reached over $370,000 in 2024, a figure driven largely by the development of therapies for rare diseases. This escalating cost directly impacts purchasing decisions and reimbursement negotiations.

The ongoing discourse surrounding drug pricing and reimbursement hurdles, such as Ascendis Pharma's efforts to secure full reimbursement for YORVIPATH, further underscores this customer price sensitivity and its influence on market dynamics.

The availability of substitute products significantly impacts Ascendis Pharma's customer bargaining power. While Ascendis's TransCon technology aims for superior drug profiles, the existence of alternative treatments, even if less advanced, grants patients and healthcare providers choices. For example, Ascendis's SKYTROFA, a once-weekly treatment for growth hormone deficiency, competes with established daily somatropin therapies, offering a degree of leverage to customers seeking different administration schedules or familiar treatment regimens.

The bargaining power of customers for Ascendis Pharma is significantly influenced by buyer volume and concentration. Large healthcare systems, national health services, and major insurance providers represent concentrated buying power. These entities, by purchasing or covering substantial volumes of drugs, can negotiate more favorable terms and discounts.

This concentrated purchasing power directly impacts Ascendis Pharma by exerting downward pressure on product prices. For instance, in 2024, major payers in the US healthcare market, such as UnitedHealth Group, continued to wield considerable influence, often demanding rebates and preferred formulary placement, which directly affects the net revenue for pharmaceutical companies.

Customer Information and Transparency

Customer information and transparency are significantly impacting the bargaining power within the pharmaceutical sector. Increased transparency in drug pricing and treatment outcomes, often spurred by regulatory bodies and public demand for accountability, equips patients and healthcare providers with more data. This allows for more informed comparisons of therapeutic options, including their costs and effectiveness, thereby enhancing the customer's ability to negotiate or seek alternatives. For Ascendis Pharma, this means customers are better positioned to question pricing and demand demonstrable value.

The growing availability of comparative data on drug efficacy and cost-effectiveness directly influences customer leverage. For instance, by mid-2024, numerous health technology assessment (HTA) bodies globally, such as NICE in the UK and IQWiG in Germany, are increasingly publishing detailed analyses that compare new drugs against existing treatments. These reports often highlight variations in clinical benefit relative to price, giving payers and patients concrete grounds for negotiation. Ascendis Pharma must therefore present robust evidence of superior value to justify its pricing strategies.

- Increased Information Access: Patients and payers have greater access to comparative drug pricing and efficacy data through HTA reports and public databases.

- Price Sensitivity: Transparency fosters price sensitivity among customers, who can more easily identify cost-effective treatment options.

- Demand for Value: Customers are empowered to demand greater value, meaning demonstrable clinical benefit and improved patient outcomes, in exchange for higher drug prices.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Ascendis Pharma, particularly concerning its innovative therapies, is generally considered low. While large entities like integrated healthcare providers or pharmacy benefit managers (PBMs) could theoretically develop generic or biosimilar versions of drugs post-patent expiry, this is a complex and costly undertaking. For Ascendis Pharma's specialized and novel treatments, the significant investment in research and development, coupled with proprietary technology, creates a substantial barrier to entry for potential customer integration.

For instance, the development of a complex biologic can cost billions of dollars and take over a decade. In 2024, the average R&D expenditure for a new drug approval was estimated to be around $2.6 billion. This high financial and technical hurdle makes it impractical for most customers to engage in backward integration for Ascendis Pharma's product pipeline.

- High R&D Costs: The immense cost of developing novel therapies acts as a significant deterrent to backward integration by customers.

- Specialized Technology: Ascendis Pharma's focus on advanced and often patented technologies requires expertise not readily available to most potential customers.

- Market Size and Complexity: While large customers might consider integration for high-volume generics, the niche nature of some advanced therapies limits this possibility.

- Patent Protection: Strong patent protection for Ascendis Pharma's innovative products further reduces the immediate threat of customer-led generic competition.

Customers in the biopharmaceutical sector, including healthcare systems and insurers, possess considerable bargaining power due to increasing price sensitivity. The median annual list price for new drugs surpassed $370,000 in 2024, a trend fueled by therapies for rare diseases, directly influencing purchasing and reimbursement decisions.

The availability of alternative treatments, even if less advanced, grants customers leverage. For example, Ascendis Pharma's SKYTROFA competes with established daily growth hormone therapies, offering patients and providers choices in administration and treatment regimens.

Large healthcare systems and insurers, representing concentrated buying power, can negotiate more favorable terms and discounts. In 2024, major US payers like UnitedHealth Group continued to demand rebates and preferred formulary placement, impacting Ascendis Pharma's net revenue.

Increased transparency in drug pricing and outcomes empowers customers to compare options and negotiate. By mid-2024, HTA bodies globally publish comparative analyses, providing payers with data to question pricing and demand demonstrable value from Ascendis Pharma.

| Factor | Impact on Ascendis Pharma | Customer Leverage |

| Price Sensitivity | High due to rising drug costs | Strong, especially for novel therapies |

| Availability of Substitutes | Moderate, depending on therapeutic area | Moderate, as alternatives exist |

| Buyer Concentration | Significant, from large payers | High, enabling strong negotiation |

| Information Transparency | Increasing, driven by HTA and public demand | Increasing, allowing for better comparisons |

Preview Before You Purchase

Ascendis Pharma Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Ascendis Pharma, detailing the competitive landscape and strategic implications for the company. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering actionable insights without any surprises.

Rivalry Among Competitors

The biopharmaceutical arena Ascendis Pharma competes in is fiercely contested. A multitude of companies, from large, established players to nimble startups, are all striving to capture market share. This intense rivalry is a defining characteristic of the industry.

Ascendis Pharma focuses on critical therapeutic areas like endocrinology, rare diseases, and oncology. Within these segments, they face competition not only from other biotech firms but also from major pharmaceutical corporations with substantial resources and existing market presence. For instance, in the rare disease space, companies like Takeda have significant operations and product portfolios.

Specific competitors such as PLIVA and Biocon also contribute to the competitive landscape. PLIVA, part of the Teva Pharmaceutical Industries, has a broad range of pharmaceutical products, while Biocon is a significant player in biosimilars and biopharmaceuticals, often competing in similar therapeutic niches. The sheer number and varied capabilities of these competitors underscore the high level of rivalry Ascendis Pharma navigates.

The biopharmaceutical sector is experiencing robust expansion, with the rare disease segment alone anticipated to grow at a compound annual growth rate of 12.4% from 2024 to 2032. This healthy market growth doesn't negate intense competition, as numerous companies often target the same lucrative opportunities.

Ascendis Pharma demonstrates its capacity to navigate this competitive environment by achieving significant revenue increases for its products YORVIPATH and SKYTROFA. This success highlights their effectiveness in securing market share within a dynamic and growing industry.

Ascendis Pharma's competitive rivalry is significantly shaped by its product differentiation strategy, primarily driven by its proprietary TransCon technology. This innovation allows for sustained drug release and improved pharmacokinetic profiles, positioning their therapies as potentially best-in-class. For example, the FDA approval of SKYTROFA for adult growth hormone deficiency, offering a convenient once-weekly dosing regimen, directly contrasts with more frequent administration of existing treatments, thereby carving out a distinct market position.

High Fixed Costs and Exit Barriers

The biopharmaceutical sector, including companies like Ascendis Pharma, is built on a foundation of immense fixed costs. These aren't just operational expenses; they are foundational investments in innovation and compliance. Think about the billions spent on drug discovery, the rigorous and lengthy clinical trial phases, and the specialized, high-tech manufacturing facilities required. In 2023, for instance, major pharmaceutical companies reported R&D spending in the tens of billions of dollars annually, a figure that continues to climb. This level of capital commitment makes exiting the market incredibly difficult.

These high fixed costs act as significant exit barriers, essentially trapping companies within the industry. Even when market conditions are challenging or a company's pipeline isn't performing as expected, the sunk costs in R&D, manufacturing, and regulatory approvals mean that shutting down operations is often not a financially viable option. Instead, these companies are compelled to continue competing, often aggressively, to try and recoup their investments. This dynamic intensifies competitive rivalry as players fight to maintain market share and achieve profitability.

- High R&D Investment: Biopharma companies invest a substantial portion of their revenue back into research and development. For example, in 2024, many leading biopharmaceutical firms are expected to allocate over 20% of their sales to R&D.

- Clinical Trial Expenses: Conducting Phase III clinical trials alone can cost hundreds of millions of dollars, with some trials exceeding $1 billion, making them a significant fixed cost.

- Manufacturing Infrastructure: Building and maintaining state-of-the-art manufacturing facilities for biologics and complex pharmaceuticals requires billions in capital expenditure.

- Regulatory Hurdles: Navigating the stringent regulatory approval processes globally involves significant ongoing costs for compliance and documentation.

Strategic Stakes

Ascendis Pharma's strategic vision hinges on dominating its chosen therapeutic areas, making competitive rivalry a significant factor. The company's commitment to pipeline expansion and achieving cash flow positivity means that every market entry and product launch carries immense weight.

This high-stakes environment fuels aggressive research and development as well as commercialization strategies. For instance, in 2024, Ascendis Pharma continued to invest heavily in its late-stage pipeline, particularly in rare diseases and endocrinology, where it aims to establish market leadership.

- Strategic Importance of Therapeutic Areas: Ascendis Pharma's success is directly tied to its ability to gain significant market share in its core therapeutic focus, driving its ambition to be a global biopharmaceutical leader.

- Pipeline Expansion and Cash Flow Goals: The company's drive to expand its product pipeline and reach cash flow positivity intensifies the competitive pressure, necessitating robust R&D and commercial execution.

- Aggressive Market Strategies: High strategic stakes translate into aggressive R&D investments and competitive commercialization efforts to outmaneuver rivals and capture market share.

- 2024 Investment Focus: Ascendis Pharma's continued substantial investment in its late-stage pipeline during 2024 highlights its commitment to competing fiercely in key therapeutic segments like rare diseases and endocrinology.

Ascendis Pharma operates in a highly competitive biopharmaceutical landscape, facing rivals ranging from established pharmaceutical giants to specialized biotech firms. The intense rivalry is fueled by the significant market opportunities in therapeutic areas like endocrinology and rare diseases, where Ascendis Pharma has a strategic focus. Companies are aggressively pursuing innovation and market share, leading to a dynamic and challenging competitive environment.

The sheer number of players and the high stakes involved in drug development and commercialization intensify this rivalry. For example, the rare disease market, a key area for Ascendis Pharma, is projected to grow substantially, attracting significant investment and competition. This growth, coupled with the high costs associated with bringing new therapies to market, means that companies must continually innovate and execute effectively to succeed.

Ascendis Pharma's competitive edge is often derived from its proprietary TransCon technology, which enables differentiated product profiles, such as the once-weekly dosing of SKYTROFA. This focus on innovation is crucial for carving out market share against competitors who may have broader portfolios or larger commercial infrastructures. The company's success in gaining market traction for its products underscores its ability to compete effectively in this demanding sector.

| Competitor Type | Key Characteristics | Impact on Ascendis Pharma |

| Large Pharmaceutical Companies | Extensive R&D budgets, established market presence, broad product portfolios | Significant pressure on market share, potential for aggressive pricing and marketing |

| Biotech Firms (Specialized) | Focus on niche therapeutic areas, innovative technologies, agile R&D | Direct competition in specific disease segments, potential for rapid innovation |

| Biosimilar Manufacturers | Focus on cost-effective alternatives to biologics | Pressure on pricing for established therapies, potential market erosion |

SSubstitutes Threaten

The threat of substitutes for Ascendis Pharma's innovative prodrugs is a significant consideration. While Ascendis focuses on advanced delivery systems like their once-weekly SKYTROFA for growth hormone deficiency, established alternatives remain. For instance, daily injections of somatropin are a readily available, albeit less convenient, substitute for patients.

Furthermore, the rapidly evolving landscape of regenerative medicine poses a long-term threat. The continuous advancements in gene and cell therapies, particularly for rare diseases where Ascendis Pharma is active, could offer fundamentally different and potentially more curative treatment modalities, thereby substituting their current prodrug approaches.

The threat of substitutes for Ascendis Pharma’s innovative therapies hinges significantly on the price-performance trade-off. Patients and healthcare providers will consider switching if a substitute offers comparable efficacy at a substantially lower price point. For instance, if a generic drug can achieve similar therapeutic results for a chronic condition at half the cost of an Ascendis Pharma biologic, it presents a considerable competitive pressure.

Ascendis Pharma’s TransCon technology, designed to improve drug delivery and patient convenience, can be a key differentiator. By offering potentially better patient outcomes or a more user-friendly treatment regimen, Ascendis can justify a premium price. For example, a therapy requiring less frequent administration compared to a daily pill could sway patient preference even if the initial cost is higher, thereby mitigating the threat from cheaper, less convenient alternatives.

Switching from an established therapy to a new one, even if it's a substitute, often comes with costs for both patients and physicians. Patients might need to learn new ways to administer medication or deal with potential new side effects. Physicians face the learning curve of new protocols and navigating reimbursement complexities.

These switching costs can act as a barrier, lessening the immediate impact of substitute therapies. However, if a new therapy demonstrates significantly superior benefits, these hurdles become much more manageable for both parties involved.

Innovation in Other Therapeutic Approaches

Innovation in alternative treatment modalities presents a significant threat. Beyond direct pharmaceutical competition, advancements in medical devices, minimally invasive surgical techniques, and even sophisticated lifestyle management programs can offer viable substitutes for Ascendis Pharma's therapies. For instance, the growing market for wearable health trackers and personalized digital health solutions, projected to reach over $100 billion globally by 2025, could reduce reliance on traditional drug treatments for managing chronic conditions.

These broader therapeutic avenues can chip away at Ascendis Pharma's potential patient base, especially for conditions where symptom management rather than a complete cure is the primary goal. While Ascendis focuses on innovative endocrinology therapies, the increasing efficacy and accessibility of non-pharmacological interventions pose a subtle but persistent challenge to market share. Consider the orthopedic sector where robotic surgery, a medical device innovation, is increasingly substituting traditional open procedures, impacting the market for pain management drugs.

The threat is amplified by the potential for these substitutes to offer lower long-term costs or fewer side effects, making them attractive to both patients and healthcare systems. Ascendis Pharma must continuously demonstrate the superior value proposition of its drug candidates against these evolving non-drug alternatives.

- Medical Devices: Growing adoption of advanced diagnostic and therapeutic devices.

- Surgical Interventions: Advancements in minimally invasive and robotic surgery reducing the need for pharmaceutical interventions.

- Lifestyle Modifications: Increased focus on wellness, diet, and exercise as primary or complementary treatments.

- Digital Health Solutions: Proliferation of health apps, wearables, and telehealth platforms offering alternative management strategies.

Patient Acceptance and Compliance with Substitutes

Patient acceptance and compliance are critical factors in determining the true threat posed by substitute treatments. If a substitute is cumbersome to use or causes significant side effects, its appeal and effectiveness are naturally reduced.

Ascendis Pharma's strategic emphasis on patient convenience, particularly through their development of sustained-release formulations, directly addresses this. By making treatments easier to manage and potentially reducing adverse events, they aim to boost patient compliance and create a competitive advantage against existing or emerging alternatives.

- Patient Compliance as a Barrier: A substitute's efficacy is only realized if patients adhere to the prescribed regimen. For instance, complex dosing schedules or unpleasant side effects can lead to lower compliance, diminishing the perceived threat of a substitute.

- Ascendis Pharma's Strategy: Ascendis Pharma is actively working to mitigate this threat by investing in drug delivery technologies that enhance patient convenience. Their focus on sustained-release formulations is designed to improve adherence, thereby strengthening their market position against less user-friendly alternatives.

- Market Impact of Convenience: In 2024, the pharmaceutical market continues to show a strong preference for therapies that offer improved patient experience. Studies indicate that adherence rates can increase by as much as 30-50% when drug formulations are more convenient to use, directly impacting the competitive landscape for treatments.

The threat of substitutes for Ascendis Pharma's therapies is multifaceted, encompassing both existing pharmaceutical options and emerging non-drug alternatives. While Ascendis focuses on innovative delivery systems, the market for treatments like growth hormone deficiency already has established, albeit less convenient, daily injection options. The broader healthcare landscape also presents substitutes, with advancements in regenerative medicine and digital health solutions offering new paradigms for patient care.

The competitive pressure from substitutes is significantly influenced by the price-performance ratio and the switching costs involved. If a substitute therapy offers comparable efficacy at a lower price, or if patient and physician adoption hurdles are low, the threat intensifies. Ascendis Pharma's strategy of enhancing patient convenience through technologies like their TransCon platform aims to create a value proposition that justifies potential price premiums and discourages switching.

In 2024, the pharmaceutical industry continues to see a strong demand for treatments that improve patient adherence and experience. For example, studies suggest that more convenient drug formulations can boost adherence rates by 30-50%, directly impacting a company's competitive standing against less user-friendly alternatives. This highlights the importance of Ascendis Pharma's focus on sustained-release formulations to mitigate the threat from substitutes.

| Substitute Category | Example for Ascendis Pharma | Key Consideration | Market Trend (2024) |

|---|---|---|---|

| Established Pharmaceuticals | Daily somatropin injections for growth hormone deficiency | Convenience, adherence | Continued preference for less frequent dosing |

| Regenerative Medicine | Gene or cell therapies for rare diseases | Potential for curative treatments | Significant R&D investment and clinical trial advancements |

| Medical Devices | Advanced drug delivery devices | Improved patient outcomes, reduced side effects | Growing adoption in chronic disease management |

| Digital Health Solutions | Health apps, wearables for chronic condition monitoring | Personalized management strategies | Projected global market exceeding $100 billion by 2025 |

Entrants Threaten

The biopharmaceutical sector, where Ascendis Pharma operates, is characterized by incredibly high capital requirements. Developing a new drug from initial research through extensive clinical trials and finally to market can cost upwards of $2.6 billion, according to industry estimates. This immense financial burden for research and development, regulatory approvals, and specialized manufacturing facilities acts as a significant deterrent for potential new entrants.

Stringent regulatory hurdles significantly deter new entrants in the pharmaceutical sector. Ascendis Pharma, like its peers, must navigate a complex and lengthy approval process, encompassing preclinical research, multiple phases of clinical trials, and extensive documentation for agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). For instance, the average time to bring a new drug to market in the U.S. can exceed 10 years, with development costs often surpassing $2 billion, creating a formidable barrier for smaller or less capitalized companies.

Ascendis Pharma's significant investment in its proprietary TransCon technology, a key differentiator, presents a formidable barrier to new entrants. This innovative platform underpins its growing pipeline and approved therapies, creating a robust intellectual property moat. For instance, the successful development and approval of therapies like Skytrofa (lonapegsomatropin-tcgd) showcase the value and complexity of this technology.

Economies of Scale in Research, Development, and Manufacturing

Established biopharmaceutical players, including those like Ascendis Pharma, leverage significant economies of scale in their research, development, and manufacturing operations. This allows them to distribute substantial fixed costs across a wider range of products, creating a cost advantage that is difficult for new entrants to overcome, particularly during the critical initial phases of bringing a new drug to market.

For instance, the immense capital required for clinical trials and regulatory approvals presents a formidable barrier. In 2023, the average cost of developing a new drug was estimated to be over $2 billion, a figure that new entrants, lacking established infrastructure and market presence, find exceptionally challenging to absorb.

- High R&D Investment: The sheer cost of drug discovery and clinical trials, often exceeding $2 billion per drug as of 2023, deters many potential new entrants.

- Manufacturing Efficiency: Larger companies achieve lower per-unit production costs due to high-volume manufacturing, a benefit new companies cannot immediately replicate.

- Distribution Networks: Existing players have established global distribution channels, reducing logistical costs and increasing market reach, which is a significant hurdle for newcomers.

- Regulatory Expertise: Navigating complex regulatory landscapes requires specialized knowledge and resources that established firms have already developed, creating a competitive moat.

Established Distribution Channels and Brand Recognition

New entrants into the pharmaceutical market face a significant hurdle in establishing effective distribution channels and cultivating brand recognition. Ascendis Pharma has already solidified its market presence through successful product launches, such as SKYTROFA and YORVIPATH, which has fostered trust among healthcare professionals and patients. This existing infrastructure and established reputation make it considerably more difficult for new companies to gain traction and compete effectively.

The challenge is amplified by the need to build new relationships with prescribers, payers, and patient advocacy groups. Ascendis Pharma’s established network provides a distinct advantage, allowing for more efficient market penetration and a quicker path to revenue generation compared to newcomers. For instance, Ascendis Pharma reported net product revenue of €278 million in the first quarter of 2024, demonstrating the strength of its market access and brand equity.

- Established Distribution Networks: Ascendis Pharma leverages existing relationships and infrastructure, reducing the cost and time for new product launches.

- Brand Recognition and Trust: Successful past product introductions, like SKYTROFA, build credibility with healthcare providers and patients, a difficult asset for new entrants to replicate.

- Market Penetration Challenges: Newcomers must overcome significant barriers to gain market share against established players with proven track records and patient support programs.

- Financial Strength for Market Entry: Ascendis Pharma’s reported net product revenue of €278 million in Q1 2024 indicates a financial capacity to further entrench its market position against potential new competitors.

The threat of new entrants in the biopharmaceutical sector, where Ascendis Pharma operates, is significantly mitigated by several formidable barriers. These include the immense capital investment required for research and development, which can exceed $2.6 billion per drug, and the lengthy, complex regulatory approval processes that can take over a decade. Furthermore, Ascendis Pharma's proprietary TransCon technology and established economies of scale in manufacturing create substantial cost advantages and intellectual property moats that new companies struggle to overcome.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Drug development costs can exceed $2.6 billion. | High financial barrier, limiting entry to well-funded entities. |

| Regulatory Hurdles | Drug approval process can take over 10 years (e.g., FDA, EMA). | Demands significant time, expertise, and resources to navigate. |

| Proprietary Technology | Ascendis's TransCon technology offers a competitive edge. | Creates an intellectual property moat, difficult for competitors to replicate. |

| Economies of Scale | Established players benefit from lower per-unit costs in R&D and manufacturing. | New entrants face higher initial operating costs and reduced pricing flexibility. |

| Distribution & Brand Equity | Existing networks and brand trust (e.g., SKYTROFA) are hard to build. | Newcomers face challenges in market access and customer acquisition. |

Porter's Five Forces Analysis Data Sources

Our Ascendis Pharma Porter's Five Forces analysis is built upon a robust foundation of data, including Ascendis Pharma's SEC filings, investor presentations, and annual reports. We also leverage industry-specific market research from reputable firms and data from financial databases like Bloomberg to ensure a comprehensive understanding of the competitive landscape.