African Rainbow Minerals PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

African Rainbow Minerals Bundle

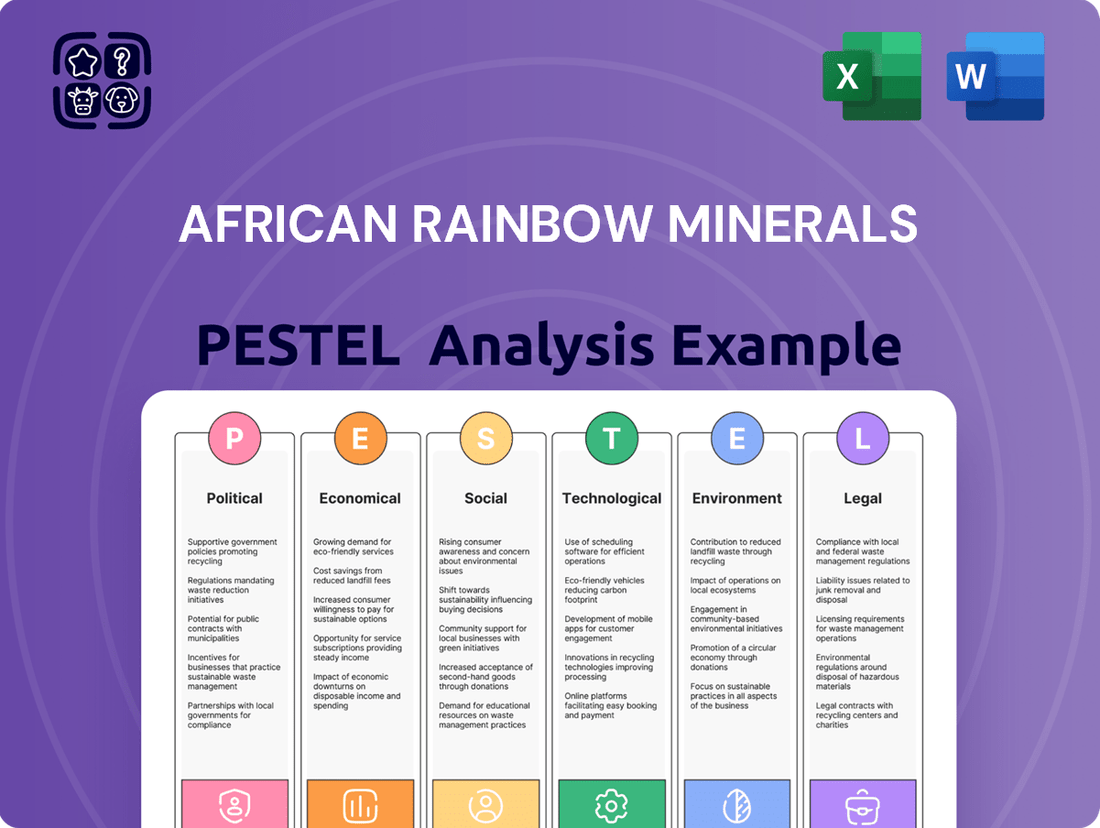

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping African Rainbow Minerals's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate this complex landscape. Download the full report to gain a strategic advantage and make informed decisions.

Political factors

African Rainbow Minerals (ARM) navigates South Africa's dynamic mining policy. The proposed Mineral Resources Development Bill, set to supersede the 2002 Mineral and Petroleum Resources Development Act, seeks to simplify licensing and boost local beneficiation, potentially affecting ARM's operational efficiency and investment strategies.

Further legislative shifts, such as the Upstream Petroleum Resources Development Act and the Mine Health and Safety Amendment Bill, introduce new compliance demands. These changes can directly influence ARM's operational expenditures and strategic expansion plans by modifying the overall business operating environment and regulatory burden.

Black Economic Empowerment (BEE) policies in South Africa are a significant political consideration for African Rainbow Minerals (ARM). These regulations are designed to address past injustices and promote broader participation in the economy.

ARM must navigate BEE requirements, which impact its ownership structure, supply chain, and workforce diversity. For instance, the Mining Charter III, a key BEE-related framework, mandates specific levels of black ownership and management representation.

Meeting these targets, including ensuring Historically Disadvantaged South Africans (HDSA) hold at least 26% of equity and 40% of management positions, is vital for ARM's operational continuity and its ability to secure and retain mining licenses.

South Africa's political stability is a cornerstone for investor confidence in sectors like mining, directly influencing companies such as African Rainbow Minerals (ARM). Uncertainty around policy, particularly concerning mining regulations and ownership structures, can deter crucial foreign direct investment, impacting ARM's ability to secure capital for expansion and operational upgrades. For instance, ongoing discussions and potential shifts in the Mining Charter can create a climate of unpredictability, making long-term strategic planning more challenging for ARM.

Labor Relations and Union Influence

South Africa's mining sector is characterized by a history of robust labor unions and a propensity for industrial action. African Rainbow Minerals (ARM) must navigate these dynamics, as government mediation and labor legislation significantly shape employer-employee relationships. For instance, the period leading up to mid-2024 saw ongoing wage negotiations in the platinum sector, a key area for ARM, highlighting the persistent influence of unions.

Strikes or extended wage discussions can directly impact ARM's operations, leading to production halts and escalating operating expenses. This can erode profitability and hinder overall efficiency. ARM's financial reports for the fiscal year ending June 2024 indicated that disruptions from labor disputes, though managed, contributed to a slight increase in cost per ton for certain commodities.

- Union Density: While precise figures fluctuate, union membership in South African mining remains high, often exceeding 60% in key segments.

- Wage Settlements: Recent wage agreements in the broader mining industry have ranged from 5% to 8% increases, setting benchmarks that ARM faces in its negotiations.

- Productivity Impact: Labor disruptions, as seen in isolated incidents during 2023-2024, can lead to lost production days, estimated to cost the industry billions of rand annually.

- Regulatory Environment: The Department of Mineral Resources and Energy, along with the Department of Employment and Labour, actively oversees labor practices and dispute resolution within the mining sector.

International Trade Agreements and Relations

Global trade policies and South Africa's international relationships significantly influence the demand and pricing of commodities like platinum group metals (PGMs), iron ore, and coal, which are central to African Rainbow Minerals' (ARM) operations. For instance, the European Union's ongoing review of critical raw materials, which includes PGMs, could impact demand from a key market for ARM.

Geopolitical tensions and trade disputes can either create new opportunities or impose restrictions on ARM's export markets, directly affecting sales volumes and revenue streams. The ongoing trade friction between major economies, while not directly targeting South African minerals, creates a volatile global demand environment that ARM must navigate.

- Impact of Global Trade Policies: Changes in tariffs, quotas, and trade agreements, such as those potentially emerging from the African Continental Free Trade Area (AfCFTA) implementation, can alter export competitiveness and market access for ARM's products.

- Geopolitical Influence on Pricing: International relations and political stability in key consuming nations or transit routes can lead to price volatility for commodities like iron ore, impacting ARM's profitability.

- Strategic Market Adaptation: ARM's ability to monitor and adapt its market strategies in response to evolving international trade landscapes, including new bilateral agreements or sanctions, is crucial for sustained growth and risk mitigation.

The South African government's commitment to transforming the mining sector through Black Economic Empowerment (BEE) remains a critical political factor for African Rainbow Minerals (ARM). Adherence to frameworks like the Mining Charter, which mandates specific ownership thresholds for historically disadvantaged persons, directly influences ARM's operational licenses and strategic partnerships.

ARM's ability to meet BEE targets, such as maintaining at least 26% black ownership and 40% management representation, is crucial for its social license to operate and its access to capital. The ongoing evolution of these policies, including potential revisions to the charter, necessitates continuous adaptation by ARM to ensure compliance and maintain investor confidence.

Political stability in South Africa is paramount for the mining sector, impacting investor sentiment and capital allocation for companies like ARM. Policy uncertainty, particularly concerning mining regulations and ownership, can deter foreign direct investment, a vital component for ARM's expansion and operational upgrades.

The government's stance on resource nationalism and the potential for policy shifts in areas like beneficiation and local content requirements also present significant political considerations for ARM. These policies can shape the company's investment decisions and its approach to value chain development.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting African Rainbow Minerals across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these global and regional trends present both challenges and strategic opportunities for the company's growth and sustainability.

Provides a concise version of African Rainbow Minerals' PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Helps support discussions on external risk and market positioning for African Rainbow Minerals during planning sessions by clearly outlining political, economic, social, technological, environmental, and legal influences.

Economic factors

African Rainbow Minerals' (ARM) financial health is deeply tied to the ebb and flow of global commodity prices, particularly for platinum group metals, iron ore, coal, copper, and gold. These price swings directly influence ARM's profitability.

For instance, a notable drop in average realized dollar iron ore prices, alongside weaker thermal coal prices, contributed to a decline in ARM's headline earnings. The company reported a 33% decrease in headline earnings for the six months ended December 31, 2023, largely due to these commodity price pressures.

The inherent cyclicality of these commodity markets means that ARM's revenue and overall financial performance are subject to significant volatility, making strategic financial planning crucial.

Exchange rate fluctuations significantly impact African Rainbow Minerals (ARM). The strength of the South African Rand (ZAR) against major currencies like the US Dollar (USD) directly affects ARM's financial performance. For instance, a stronger Rand can diminish the Rand value of export revenues, as seen in ARM's financial reporting where unfavorable rand/USD movements have contributed to lower headline earnings.

Conversely, a weaker Rand can provide a tailwind for ARM by increasing the Rand equivalent of its dollar-denominated sales. In the first half of the 2024 financial year, ARM reported that the average realized USD price for palladium was $1,021 per ounce, while for platinum it was $900 per ounce, with fluctuations in the ZAR/USD exchange rate playing a crucial role in translating these commodity prices into local currency earnings.

Rising inflation, especially in energy, labor, and raw materials, directly impacts African Rainbow Minerals' (ARM) operating expenses. For instance, the significant increase in global energy prices throughout 2024 has a direct pass-through effect on ARM's mining operations, from powering equipment to transportation.

ARM has experienced cost pressures exceeding general inflation rates at its iron ore and coal mines. In the first half of the 2024 financial year, the company noted that cash operating costs for its iron ore segment saw an increase, partly driven by these inflationary pressures on consumables and logistics.

Effectively managing these escalating costs through enhanced operational efficiencies and shrewd procurement strategies is vital for ARM to safeguard its profit margins. This focus on cost control becomes even more critical as the company navigates the persistent high-inflationary landscape projected into 2025.

Infrastructure and Logistics Constraints

South Africa's infrastructure, particularly in electricity, water, and transport, poses significant economic hurdles for mining companies like African Rainbow Minerals (ARM). Power outages and water scarcity directly impact operational efficiency and can lead to costly production stoppages.

For ARM, these infrastructure deficits translate into increased operational expenses and potential disruptions to their extraction and export schedules. For instance, Transnet's rail network, crucial for moving bulk commodities, has faced capacity issues, impacting delivery times and costs throughout 2023 and into early 2024.

- Electricity Supply: Eskom's ongoing challenges with load shedding, which continued through much of 2023 and is projected to remain a factor into 2024, directly affects ARM's energy-intensive mining operations.

- Water Availability: Water scarcity in certain mining regions of South Africa can constrain operations, requiring significant investment in water management and recycling.

- Rail and Port Logistics: Inefficiencies and capacity constraints within the rail network and port operations, as highlighted by Transnet's performance in 2023, can delay exports and increase overall supply chain costs for ARM.

- Infrastructure Investment: The need for substantial investment in upgrading and maintaining these critical infrastructure components remains a key challenge for the mining sector.

Investment and Capital Allocation

African Rainbow Minerals (ARM) navigates a dynamic economic landscape by prioritizing disciplined capital allocation. This approach ensures the company can fund growth initiatives while sustaining its current operational base, even amidst challenging market conditions. For instance, ARM's commitment to investing in its mines, such as the Khumani and Khwezela mines, reflects this strategic focus.

The company balances shareholder returns with future-proofing its operations. Dividends are declared, but this is carefully weighed against the need for strategic investments in exploration and the development of new projects. This dual focus aims to create sustainable long-term value for stakeholders.

ARM's capital expenditure for the financial year ending June 30, 2024, is projected to be within the range of R7.5 billion to R8.5 billion. This significant investment underscores their commitment to both maintaining existing assets and pursuing growth opportunities, demonstrating a clear strategy for capital deployment.

- Disciplined Capital Allocation: ARM maintains a strategic approach to allocating capital, balancing investment in growth projects with the upkeep of existing operations.

- Operational Investment: The company demonstrates a firm commitment to investing in its mines, ensuring operational efficiency and longevity.

- Dividend and Growth Balance: ARM carefully manages dividend payouts, ensuring they are aligned with strategic investments in future growth and exploration activities.

- Projected Capital Expenditure (FY2024): ARM anticipates capital expenditure between R7.5 billion and R8.5 billion for the fiscal year ending June 30, 2024, highlighting significant investment in its portfolio.

Global economic trends significantly shape ARM's performance, with commodity price volatility being a primary driver. For instance, the average realized dollar price for platinum in the first half of FY2024 was $900 per ounce, and for palladium, it was $1,021 per ounce, demonstrating the direct link between market prices and ARM's revenue potential.

Inflationary pressures continue to impact ARM's operational costs. The company noted increases in cash operating costs for its iron ore segment in the first half of FY2024, driven by rising expenses for consumables and logistics, underscoring the need for ongoing cost management strategies.

South Africa's infrastructure challenges, particularly in energy and logistics, create operational headwinds. Eskom's load shedding and Transnet's rail network constraints have continued to affect mining operations and export capabilities through early 2024, adding to operational complexities.

ARM's disciplined capital allocation strategy is evident in its projected capital expenditure for FY2024, estimated between R7.5 billion and R8.5 billion. This investment aims to maintain existing assets and pursue growth opportunities, balancing immediate operational needs with long-term strategic development.

| Economic Factor | Impact on ARM | Key Data/Observation (H1 FY2024) |

|---|---|---|

| Commodity Prices | Directly influences revenue and profitability. | Platinum: $900/oz, Palladium: $1,021/oz (average realized USD prices) |

| Inflation | Increases operating expenses. | Rising cash operating costs in iron ore segment due to consumables and logistics. |

| Infrastructure | Causes operational disruptions and increased costs. | Ongoing load shedding (Eskom) and rail network constraints (Transnet) impacting operations. |

| Capital Allocation | Supports operational maintenance and growth initiatives. | Projected FY2024 Capex: R7.5 billion - R8.5 billion. |

Preview Before You Purchase

African Rainbow Minerals PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of African Rainbow Minerals delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company’s operations and strategic decisions.

Sociological factors

African Rainbow Minerals (ARM) places significant emphasis on fostering robust community relations, recognizing this as fundamental to its social license to operate. The company actively engages with communities surrounding its mining operations, viewing these relationships as a cornerstone of its long-term sustainability strategy.

ARM's commitment is demonstrated through substantial investments in local development. For instance, in the 2023 financial year, ARM allocated R367 million towards community development programs, focusing on critical areas such as infrastructure upgrades, educational support, and healthcare initiatives. These projects are designed not only to improve living standards but also to build local capacity and foster economic self-sufficiency.

Effective community engagement and visible social upliftment are paramount for ARM. By proactively addressing community needs and contributing to socio-economic well-being, ARM aims to mitigate potential operational disruptions and build trust. This approach is vital for ensuring the continued acceptance and support of its mining activities, thereby safeguarding its social license to operate and promoting a stable operating environment.

African Rainbow Minerals (ARM) plays a crucial role as a major employer, actively investing in training and skills development programs. These initiatives, including adult education, training, and bursaries, are vital for bridging the skills gap prevalent in the mining sector and boosting the employability of both its workforce and local community members. For instance, in the 2023 financial year, ARM reported a total workforce of 15,489 employees, underscoring its significant impact on employment.

By focusing on enhancing the capabilities of its employees and community members, ARM directly contributes to local economic upliftment and tackles pressing socio-economic issues within its operational areas. This commitment to skills development not only benefits individuals but also strengthens the overall economic fabric of the regions where ARM operates, fostering sustainable growth and addressing critical societal needs.

African Rainbow Minerals (ARM) places a high priority on health and safety, aiming for zero harm to all individuals on its sites. This commitment is reflected in their ongoing efforts to enhance safety performance, which has led to a decrease in lost-time injury frequency rates. For instance, in the financial year ending June 30, 2023, ARM reported a significant improvement in safety metrics across its operations.

The mining industry inherently presents health challenges, and ARM actively works to mitigate these risks, particularly those like silicosis. By implementing robust health monitoring programs and providing appropriate protective measures, the company ensures the well-being of its workforce, which is crucial for both ethical conduct and sustained productivity.

Diversity and Inclusion

African Rainbow Minerals (ARM) actively pursues improved representation of Historically Disadvantaged South Africans (HDSA) within its management ranks, fostering an inclusive workplace culture. This commitment is evident in their initiatives that specifically target women, individuals with disabilities, and young people for participation in community development projects, underscoring a dedication to social equity. These actions not only reflect ARM's core values but also align with broader national objectives for a more inclusive society.

ARM's focus on diversity and inclusion is a strategic imperative, aiming to create a workforce that mirrors the South African demographic landscape. For instance, in the 2023 financial year, ARM reported that 46% of its management positions were held by HDSAs, with a specific target to increase female representation in leadership roles. Their community development programs, which often prioritize skills development and job creation for marginalized groups, received R150 million in social investment during the same period, demonstrating a tangible commitment to upliftment.

- HDSA Management Representation: ARM aims to increase the proportion of HDSAs in management positions, reflecting national demographic targets.

- Women in Leadership: Specific programs are in place to enhance the representation and progression of women within ARM's leadership structures.

- Youth and Disability Inclusion: Community development initiatives prioritize the inclusion of youth and people living with disabilities, fostering economic empowerment and social integration.

- Social Investment: ARM's substantial social investment, particularly in community development projects, directly supports these diversity and inclusion goals.

Impact on Local Economies

African Rainbow Minerals (ARM) plays a vital role in bolstering local economies through its extensive employment opportunities and robust procurement practices. The company's commitment to enterprise development, particularly benefiting historically disadvantaged communities, directly fuels local entrepreneurship and economic expansion.

ARM's preferential procurement policies ensure that a significant portion of its spending goes towards South African businesses. For instance, in the fiscal year ending June 30, 2023, ARM reported R11.1 billion in procurement from local suppliers, a substantial injection into the national economy and a direct benefit to communities surrounding its operations.

- Job Creation: ARM directly employs thousands of individuals, providing stable income and contributing to household economic well-being in operational areas.

- Local Procurement: The company's focus on sourcing goods and services locally stimulates demand for South African products and services, fostering business growth.

- Enterprise Development: Initiatives like ARM's are designed to nurture small and medium-sized enterprises (SMEs), enhancing their capacity and market access, thereby creating a multiplier effect on local economies.

- Community Investment: Beyond direct economic contributions, ARM invests in social infrastructure and development programs, improving the overall quality of life and economic potential within its host communities.

Sociological factors significantly influence African Rainbow Minerals (ARM) operations, particularly concerning community relations and workforce development. ARM's commitment to social upliftment is evident in its substantial investments in community development programs, with R367 million allocated in the 2023 financial year for infrastructure, education, and healthcare. This focus on tangible improvements is crucial for maintaining its social license to operate.

The company's role as a major employer, with a workforce of 15,489 in 2023, underscores its societal impact. ARM actively invests in skills development, offering training and bursaries to enhance employability and address sector-specific skill gaps. This dedication to human capital development benefits both its employees and the broader community, fostering local economic growth.

Furthermore, ARM prioritizes diversity and inclusion, aiming for greater representation of Historically Disadvantaged South Africans (HDSA) in management. In 2023, 46% of management positions were held by HDSAs, with targeted efforts to increase female leadership. These initiatives, supported by R150 million in social investment for community projects in the same year, demonstrate a commitment to social equity and national development goals.

| Sociological Factor | Description | 2023 Data/Impact |

|---|---|---|

| Community Relations | Fostering positive relationships and contributing to local development for social license to operate. | R367 million allocated to community development programs. |

| Employment & Skills Development | Providing significant employment opportunities and investing in workforce training. | Total workforce of 15,489 employees; investment in training and bursaries. |

| Diversity & Inclusion | Promoting representation of HDSAs and marginalized groups in leadership and projects. | 46% of management positions held by HDSAs; R150 million social investment in community projects. |

Technological factors

The mining sector, including operations like those of African Rainbow Minerals (ARM), is heavily investing in mechanization and automation. This trend is driven by the pursuit of enhanced safety, greater efficiency, and boosted productivity. For instance, by 2024, the global mining automation market was projected to reach over $5 billion, indicating a significant industry-wide shift.

These technological upgrades translate into more efficient ore extraction processes and a reduction in overall operational costs. Furthermore, the implementation of advanced machinery can lead to substantially improved working conditions for employees. ARM's own reports in 2023 highlighted increased output at automated sections of their mines.

However, this technological leap forward also presents a challenge: the need for a workforce possessing the requisite skills to operate and maintain sophisticated automated equipment. This necessitates ongoing training and development programs to ensure the workforce is equipped for the evolving demands of the industry.

African Rainbow Minerals (ARM) is actively embracing digitalization, integrating technologies like artificial intelligence and advanced data analytics to refine its operations. This focus is essential for boosting efficiency across the entire mining lifecycle, from initial exploration to final product delivery.

ARM acknowledges the critical need to cultivate expertise in digital transformation to stay competitive. By harnessing the power of data, the company aims to enhance its decision-making processes, implement predictive maintenance strategies, and achieve more effective resource management, ultimately driving operational excellence.

African Rainbow Minerals (ARM) is making substantial investments in renewable energy to power its mining operations and shrink its environmental impact. A prime example is the ongoing construction of a 100 MW solar photovoltaic facility for ARM Platinum, which is slated to begin supplying power by August 2025.

This strategic move towards renewables highlights ARM's dedication to sustainable practices and addressing climate change. The company is also actively investigating diverse funding mechanisms and energy sourcing strategies for its ferrous operations, signaling a proactive approach to adopting cleaner energy alternatives.

Innovation in Processing and Beneficiation

Technological advancements in mineral processing and beneficiation are crucial for maximizing the value extracted from mined resources and boosting overall efficiency. African Rainbow Minerals (ARM) is actively investigating more cost-effective and energy-efficient smelting methods, exemplified by their work at the Machadodorp Works.

Innovation in these fields directly translates to improved yields, minimized waste generation, and ultimately, a more competitive product offering in the global market.

- Enhanced Extraction Rates: New processing techniques can unlock lower-grade ore bodies previously considered uneconomical, increasing the total recoverable resource.

- Energy Efficiency Gains: Innovations in smelting and refining are targeting reduced energy consumption, a significant cost factor in mining operations, with potential for substantial operational savings.

- Environmental Footprint Reduction: Advanced beneficiation methods often lead to less waste material requiring disposal, contributing to a smaller environmental impact.

Exploration Technologies

African Rainbow Minerals (ARM) likely benefits from advancements in exploration technologies, such as enhanced geological modeling and remote sensing. These tools improve the efficiency and success rates of identifying new mineral deposits, which is crucial for ARM's growth strategy. For instance, the increasing sophistication of geophysical surveys and AI-driven data analysis can pinpoint promising areas with greater accuracy.

While specific investment figures for ARM's exploration technology adoption are not publicly detailed, the company's business model inherently relies on successful resource discovery and expansion. ARM's focus on projects like the development of new platinum group metal (PGM) resources underscores a commitment to leveraging cutting-edge exploration methods to secure future production. This includes utilizing advanced seismic imaging and drone-based surveys.

- Improved Geological Modeling: Enhances understanding of subsurface structures, leading to more targeted drilling.

- Remote Sensing Technologies: Facilitates broad-area surveys for mineral indicators from satellites and aircraft.

- Data Analytics and AI: Processes vast geological datasets to identify patterns and potential deposit locations.

- Geophysical Survey Advancements: Offers higher resolution subsurface information for more precise exploration targeting.

Technological advancements are reshaping ARM's operational landscape, with a significant push towards automation and mechanization. This is evident in the global mining automation market, projected to exceed $5 billion by 2024, driving efficiency and safety improvements. ARM's 2023 reports indicated increased output from automated sections, underscoring the tangible benefits of these investments in enhancing ore extraction and reducing costs.

Digitalization is another key technological factor, with ARM integrating AI and advanced data analytics to optimize its entire mining lifecycle. This focus on data-driven decision-making, predictive maintenance, and resource management is crucial for maintaining a competitive edge. The company's commitment to digital transformation necessitates a skilled workforce, highlighting the ongoing need for training and development programs.

ARM is also strategically investing in renewable energy, exemplified by the 100 MW solar photovoltaic facility for ARM Platinum, expected to supply power by August 2025. This move towards cleaner energy sources, alongside advancements in mineral processing technologies like more energy-efficient smelting methods at Machadodorp Works, aims to reduce environmental impact and improve resource value extraction.

| Technological Area | Impact on ARM | Supporting Data/Examples |

| Automation & Mechanization | Increased efficiency, safety, and productivity; reduced operational costs. | Global mining automation market projected over $5 billion by 2024; ARM reported increased output from automated sections in 2023. |

| Digitalization (AI & Data Analytics) | Optimized operations, enhanced decision-making, predictive maintenance, improved resource management. | Focus on boosting efficiency across exploration, extraction, and delivery. |

| Renewable Energy | Reduced environmental impact, lower energy costs. | 100 MW solar PV facility for ARM Platinum commencing supply by August 2025. |

| Mineral Processing & Beneficiation | Maximized resource value, improved efficiency, reduced waste. | Investigation into cost-effective and energy-efficient smelting methods at Machadodorp Works. |

| Exploration Technologies | Improved success rates in identifying new mineral deposits; enhanced resource discovery. | Utilizing advanced seismic imaging and drone-based surveys for PGM resource development. |

Legal factors

African Rainbow Minerals (ARM) operates within South Africa's robust mining legal landscape, primarily governed by the Mineral and Petroleum Resources Development Act (MPRDA). This legislation dictates mineral rights allocation, licensing procedures, and the operational standards companies must adhere to. The South African government has been actively pursuing policy reforms, with a draft Mineral Resources Development Bill signaling potential shifts in the sector. For instance, proposals to streamline licensing processes and enhance support for small-scale mining operations could directly influence ARM's compliance requirements and strategic planning, potentially impacting its cost structure and market access.

Black Economic Empowerment (BEE) legislation is a cornerstone of South Africa's legal framework, directly impacting operations for companies like African Rainbow Minerals (ARM). Adherence to BEE codes, focusing on ownership, management, employment equity, and preferential procurement from black-owned businesses, is a non-negotiable legal obligation.

Failure to meet these mandated BEE targets can result in significant repercussions for ARM, including substantial financial penalties, the potential revocation of operating licenses, and considerable damage to its public image and stakeholder trust. For instance, in 2023, South African mining companies faced increased scrutiny on BEE compliance, with reports highlighting that achieving certain ownership thresholds remains a key challenge for many.

African Rainbow Minerals (ARM) navigates a complex web of environmental regulations, particularly concerning emissions, water usage, waste management, and land rehabilitation. These legal requirements are critical for minimizing environmental impact and avoiding penalties. For instance, ARM is committed to reducing its greenhouse gas (GHG) emissions, with public disclosures and net-zero targets supported by detailed decarbonization plans for each operation.

Compliance with international standards, such as the Global Standards on Tailings Management (GISTM), is a legal imperative for ARM. Adherence to these stringent guidelines is essential for responsible mining practices and to mitigate the risk of legal action stemming from environmental non-compliance. The company's 2023 Sustainability Report highlights ongoing efforts to meet these evolving environmental legal frameworks.

Labor Laws and Industrial Relations

South African labor laws significantly influence African Rainbow Minerals' (ARM) operations, particularly concerning collective bargaining, wage structures, and workplace conditions. These regulations, including those focused on occupational health and safety, directly shape ARM's human capital management strategies. For instance, the proposed Mine Health and Safety Amendment Bill, expected to be enacted in late 2024 or early 2025, aims to bolster accountability and worker safety training.

Adherence to these evolving legal frameworks and fostering strong industrial relations are paramount for ARM to mitigate the risk of labor disputes and potential legal entanglements. Effective management of these aspects is key to maintaining operational stability and avoiding costly disruptions.

Key aspects of South African labor law impacting ARM include:

- Bargaining Councils: ARM's engagement with established bargaining councils for wage negotiations and dispute resolution.

- Minimum Wage Regulations: Compliance with national and sector-specific minimum wage determinations, which can affect labor costs.

- Occupational Health and Safety: Strict adherence to the Mine Health and Safety Act and its upcoming amendments, with a focus on safety protocols and worker well-being.

- Employment Equity: Implementation of policies to ensure fair representation and prevent discrimination in the workforce.

Corporate Governance and Reporting Standards

As a publicly listed entity, African Rainbow Minerals (ARM) is bound by stringent corporate governance frameworks, notably the King IV Report, which mandates ethical leadership and accountability. This commitment extends to adhering to International Financial Reporting Standards (IFRS) for transparent financial disclosures. ARM's 2023 Integrated Report, for instance, highlights its compliance with these standards, detailing financial performance, sustainability initiatives, and risk mitigation strategies, thereby fostering investor trust.

These legal and reporting obligations are crucial for maintaining market confidence. For example, the JSE's Listings Requirements, which ARM must follow, dictate the timeliness and accuracy of financial announcements. Adherence to these regulations ensures that stakeholders have access to reliable information for decision-making.

- King IV Report: ARM's governance practices align with the principles of ethical leadership, corporate citizenship, and stakeholder engagement as outlined in the King IV Code.

- IFRS Compliance: The company's financial statements are prepared in accordance with IFRS, ensuring comparability and transparency for global investors.

- Integrated Reporting: ARM publishes comprehensive integrated reports, detailing financial, social, and environmental performance, demonstrating accountability.

- JSE Listings Requirements: Compliance with the Johannesburg Stock Exchange's rules ensures timely and accurate disclosure of material information to the market.

South Africa's evolving legal landscape, particularly concerning mining rights and environmental protection, presents both opportunities and compliance challenges for African Rainbow Minerals (ARM). The draft Mineral Resources Development Bill, expected to influence licensing and small-scale mining support, requires ARM to remain agile in its strategic planning and operational adjustments. Furthermore, strict adherence to Black Economic Empowerment (BEE) codes, including ownership and employment equity targets, is a critical legal imperative, with non-compliance risking penalties and license revocation.

ARM's commitment to environmental stewardship is legally mandated, covering emissions, water usage, and waste management, with initiatives like GHG emission reduction and adherence to the Global Standards on Tailings Management (GISTM) being key. Labor laws, including those governing collective bargaining and occupational health and safety, are also pivotal, with upcoming amendments to the Mine Health and Safety Act in late 2024 or early 2025 emphasizing enhanced worker safety and accountability.

Corporate governance and financial reporting are governed by stringent frameworks, including the King IV Report and International Financial Reporting Standards (IFRS), ensuring ethical leadership and transparent disclosures. Compliance with JSE Listings Requirements is also crucial for maintaining market confidence and timely information dissemination.

| Legal Area | Key Regulations/Frameworks | Impact on ARM | 2023/2024 Data/Trends |

|---|---|---|---|

| Mining Rights & Licensing | MPRDA, Draft Mineral Resources Development Bill | Influences operational permits and strategic planning. | Ongoing policy reviews may impact future licensing processes. |

| Black Economic Empowerment (BEE) | BEE Codes of Good Practice | Mandates ownership, management, and procurement targets. | Increased scrutiny on BEE compliance reported in 2023 for mining sector. |

| Environmental Law | Emissions, Water Use, Waste Management, GISTM | Requires compliance for operational sustainability and risk mitigation. | ARM's 2023 Sustainability Report details GHG reduction plans. |

| Labor Law | Mine Health and Safety Act, Collective Bargaining | Shapes workforce management, safety protocols, and industrial relations. | Mine Health and Safety Amendment Bill anticipated late 2024/early 2025. |

| Corporate Governance | King IV Report, IFRS, JSE Listings Requirements | Ensures ethical conduct, transparent financial reporting, and market trust. | ARM's 2023 Integrated Report reflects adherence to these standards. |

Environmental factors

African Rainbow Minerals (ARM) recognizes its role in greenhouse gas emissions and has committed to achieving net-zero Scope 1 and 2 GHG emissions from its mining operations by 2050. This ambitious target reflects both the growing regulatory landscape concerning climate change and the mounting pressure from stakeholders demanding concrete action on decarbonization.

To achieve this, ARM is actively pursuing various decarbonization strategies. A key initiative is the development of a 100 MW solar power plant specifically for its platinum operations. This investment in renewable energy is a tangible step towards reducing reliance on fossil fuels and lowering the company's overall carbon footprint.

Water scarcity is a significant environmental factor for African Rainbow Minerals (ARM), particularly in regions like the Northern Cape, a key operating area. A water supply deficit here directly impacts their ability to process ore, with projections indicating increasing stress on water resources in the coming years due to climate change. This necessitates robust management strategies.

ARM is actively addressing water challenges by diversifying its water sources, which includes exploring alternative supplies beyond traditional municipal sources. Furthermore, the company emphasizes water recycling and reuse within its operations to minimize consumption. These efforts are crucial for maintaining operational continuity and adhering to environmental regulations aimed at protecting water ecosystems.

Mining operations, by their very nature, significantly alter land use and can lead to habitat destruction and fragmentation, impacting biodiversity. African Rainbow Minerals (ARM) is actively working to address these global environmental challenges, with a particular focus on biodiversity loss.

In 2023, ARM reported that its rehabilitation efforts covered approximately 1,400 hectares across its operations, demonstrating a commitment to restoring land impacted by mining. This focus on responsible land management, coupled with robust rehabilitation programs and strategies to minimize its operational footprint, is essential for ARM to meet stringent environmental regulations and mitigate its ecological impact.

Waste Management and Tailings

Effective waste management, particularly the safe disposal of tailings and the promotion of recycling, stands as a critical environmental consideration for mining operations like those of African Rainbow Minerals (ARM). In 2023, ARM continued its commitment to robust environmental stewardship by investing significantly in tailings management infrastructure and practices.

ARM is actively implementing the Global Standards on Tailings Management (GISTM) across its operations. This initiative is designed to ensure that the company's approach to tailings management aligns with both national regulations and international benchmarks, prioritizing health, safety, and environmental protection throughout the entire mining lifecycle.

- Tailings Storage Facility (TSF) Integrity: ARM conducts regular audits and employs advanced monitoring technologies to ensure the structural integrity of its TSFs, aiming for zero catastrophic failures.

- Water Management: The company focuses on minimizing water usage and treating mine water before discharge, with a target of reducing fresh water abstraction by 15% by 2026 compared to 2022 levels.

- Recycling and Waste Reduction: ARM is exploring and implementing innovative recycling programs for mine waste, with a goal to increase the recycling rate of non-hazardous waste by 20% by 2025.

Energy Consumption and Efficiency

The mining sector's inherent energy demands make energy consumption a critical environmental factor for African Rainbow Minerals (ARM). In 2023, ARM continued its strategic push into renewable energy, with solar photovoltaic (PV) projects contributing to its energy mix. This focus on cleaner energy sources aims to mitigate the environmental impact of its operations.

ARM is actively exploring a diversified energy mix to lessen its dependence on traditional fossil fuels. This strategy not only enhances operational cost-effectiveness through improved energy efficiency but also aligns with the company's broader decarbonization objectives. By 2024, ARM aims to further integrate sustainable energy solutions across its mining and processing activities.

- Renewable Energy Investment: ARM's ongoing investment in solar PV projects demonstrates a commitment to reducing its carbon footprint.

- Energy Mix Diversification: The company is exploring various energy sources to decrease reliance on fossil fuels, enhancing resilience and sustainability.

- Cost and Decarbonization Benefits: Improved energy efficiency directly translates to lower operational expenses and supports ARM's environmental, social, and governance (ESG) targets.

Water scarcity presents a significant operational challenge for African Rainbow Minerals (ARM), particularly in regions like the Northern Cape. ARM has set a target to reduce its fresh water abstraction by 15% by 2026 compared to 2022 levels, underscoring the urgency of efficient water management and diversification of water sources.

ARM's commitment to decarbonization is evident in its goal to achieve net-zero Scope 1 and 2 GHG emissions by 2050. A key step is the development of a 100 MW solar power plant for its platinum operations, aiming to reduce reliance on fossil fuels.

Biodiversity loss and land rehabilitation are critical environmental considerations. In 2023, ARM reported rehabilitation efforts covering approximately 1,400 hectares, demonstrating a proactive approach to mitigating its ecological footprint and adhering to stringent environmental regulations.

Effective waste management, especially tailings disposal, is paramount. ARM is implementing the Global Standards on Tailings Management (GISTM) and aims to increase the recycling rate of non-hazardous waste by 20% by 2025, reinforcing its dedication to environmental stewardship.

| Environmental Factor | Key Initiatives/Targets | Data/Progress |

| GHG Emissions | Net-zero Scope 1 & 2 by 2050; 100 MW solar plant for platinum operations | Ongoing development of solar projects |

| Water Management | Reduce fresh water abstraction by 15% by 2026 (vs 2022) | Diversifying water sources, increasing recycling |

| Land Use & Biodiversity | Rehabilitation of mined land | Approx. 1,400 hectares rehabilitated in 2023 |

| Waste Management | Implement GISTM; Increase non-hazardous waste recycling by 20% by 2025 | Continued investment in tailings management infrastructure |

PESTLE Analysis Data Sources

Our PESTLE Analysis for African Rainbow Minerals is built upon a robust foundation of data from official government publications, international financial institutions, and reputable industry-specific research. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the mining sector.