African Rainbow Minerals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

African Rainbow Minerals Bundle

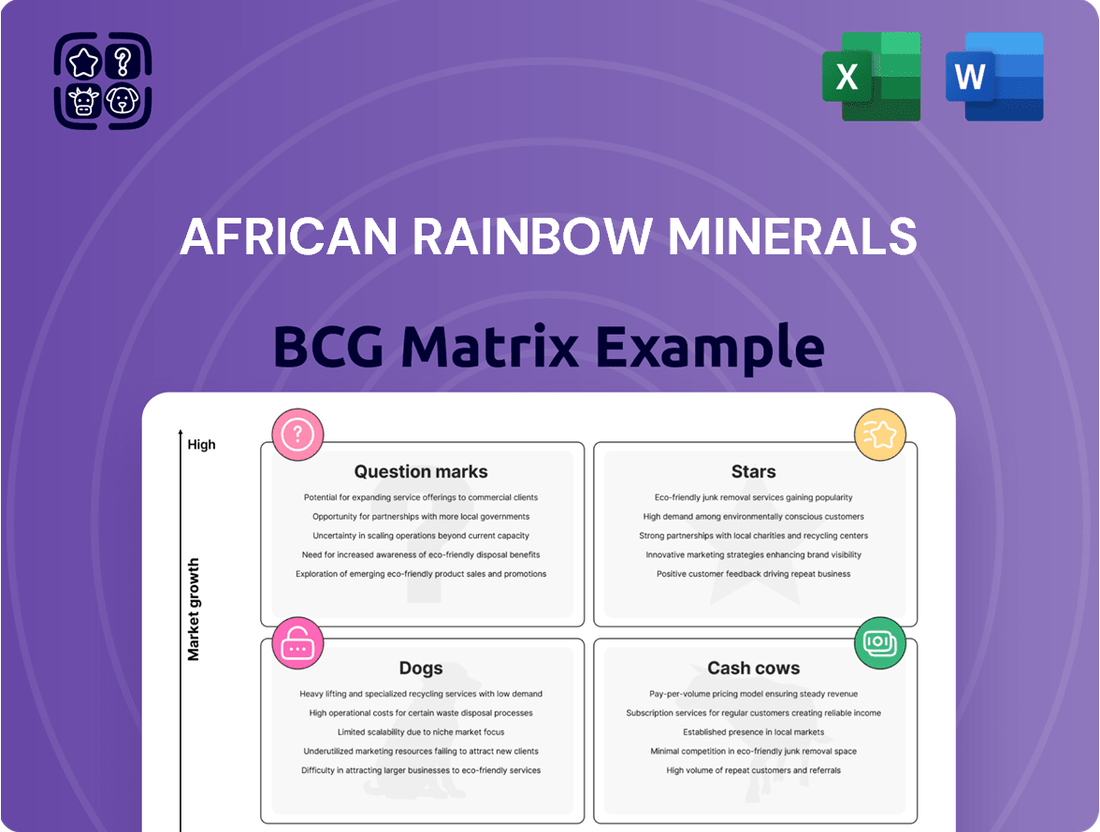

African Rainbow Minerals' strategic positioning in the mining sector is laid bare with its BCG Matrix. Discover whether its key commodities are market-leading Stars, reliable Cash Cows, underperforming Dogs, or promising Question Marks.

This preview offers a glimpse into the core of ARM's portfolio. Unlock the full BCG Matrix to gain actionable insights into resource allocation, investment opportunities, and a clear path to maximizing profitability.

Don't miss out on the complete strategic blueprint. Purchase the full BCG Matrix for a detailed breakdown of each product's market share and growth potential, empowering you to make informed decisions.

Stars

African Rainbow Minerals (ARM) has significant copper operations. The global copper market is currently booming, fueled by massive investments in upgrading and expanding power grids to support the digital economy and the transition to clean energy. This surge in demand is a key factor in assessing ARM's position.

Refined copper demand is expected to reach almost 27 million tonnes in 2024, with projections indicating a rise to 37 million tonnes by 2050. Given this robust growth trajectory and ARM's involvement in the sector, its copper assets are well-positioned to be considered Stars within the BCG matrix.

African Rainbow Minerals (ARM) is actively involved in mining and processing manganese ore, further refining it into valuable manganese alloys. This dual approach positions them to capture value across the manganese supply chain.

The global manganese market is experiencing robust expansion, with projections indicating continued growth. A key driver for this surge is the increasing demand from the steel industry, which relies heavily on manganese for its strengthening properties.

Furthermore, the burgeoning market for lithium-ion batteries presents a significant new avenue for manganese demand, especially for battery-grade manganese. This burgeoning sector is expected to see substantial growth, offering ARM a prime opportunity to strengthen its market standing as a major producer.

African Rainbow Minerals (ARM) holds a strategic stake in Harmony Gold Mining Company Limited. If Harmony Gold exhibits robust growth and a leading market position within the gold industry, especially in a favorable precious metals market, this investment could be classified as a Star in ARM's portfolio, indicating high potential for future returns.

Future-focused Exploration and Development

African Rainbow Minerals (ARM) actively pursues exploration and development projects, signaling a strategic push into new, potentially high-growth areas. This focus on the entire mining lifecycle, from discovery to operation, positions ARM to capitalize on emerging commodity demands.

Successful exploration in commodities vital for the energy transition, such as copper or platinum group metals, could unlock significant future revenue streams for ARM. For instance, platinum group metals are critical for catalytic converters, a key component in managing vehicle emissions, and are also being explored for use in hydrogen fuel cells.

- Exploration Focus: ARM's commitment to identifying and developing new mining ventures.

- Energy Transition Commodities: Targeting resources crucial for renewable energy and electric vehicles.

- Operational Lifecycle: Involvement from exploration through to mine operation ensures control and potential value capture.

- Market Outlook: Aligning development with commodities expected to see sustained demand growth.

Potential for New Energy Minerals

The global push for a lower-carbon economy is creating significant demand for minerals crucial to renewable energy and electric vehicles. African Rainbow Minerals (ARM) is well-positioned to capitalize on this trend, given its diverse asset base and ongoing exploration activities. This strategic focus on new energy minerals presents a compelling opportunity for high-growth potential, aligning with ARM's long-term vision.

ARM's exploration efforts are actively targeting minerals like copper, nickel, and cobalt, which are vital components in battery technology and electric vehicle manufacturing. For instance, the demand for cobalt, a key element in lithium-ion batteries, is projected to grow substantially. Analysts in 2024 forecast a compound annual growth rate (CAGR) of over 10% for the cobalt market through 2030, driven by EV adoption.

- Copper Demand: Global copper demand is expected to reach 31 million tonnes by 2030, a significant increase from 2024 levels, largely due to its use in wind turbines, solar panels, and EVs.

- Nickel for Batteries: Nickel sulfate, a key ingredient in EV batteries, saw its price surge in early 2024, reflecting strong demand from the automotive sector.

- Cobalt Market Growth: The cobalt market is projected for robust expansion, with forecasts indicating a CAGR exceeding 10% in the coming years, fueled by battery production.

- Lithium's Role: While not directly mined by ARM currently, the increasing demand for lithium-ion batteries underscores the broader ecosystem shift ARM can benefit from.

ARM's copper operations are positioned as Stars due to the booming global copper market, driven by energy transition investments. Refined copper demand is projected to hit nearly 27 million tonnes in 2024 and rise to 37 million tonnes by 2050, indicating strong future growth potential for ARM's copper assets.

Similarly, ARM's manganese business, which includes mining and alloy production, benefits from robust global market expansion. The steel industry's consistent demand, coupled with the burgeoning lithium-ion battery sector's need for battery-grade manganese, solidifies manganese as another Star in ARM's portfolio.

The company's strategic investment in Harmony Gold Mining Company Limited also presents Star potential, contingent on the gold market's performance and Harmony's leading position. Furthermore, ARM's active exploration in commodities vital for the energy transition, such as copper and platinum group metals, represents potential future Stars.

ARM's focus on copper, nickel, and cobalt, critical for batteries and EVs, highlights its strategic positioning for growth. For example, the cobalt market is anticipated to grow with a CAGR exceeding 10% through 2030, driven by electric vehicle adoption.

| Commodity | 2024 Demand (Est.) | Projected 2030 Demand | Key Growth Drivers | ARM's Position |

|---|---|---|---|---|

| Copper | ~27 million tonnes (refined) | 31 million tonnes | Energy transition, EVs, power grids | Star (Strong market growth) |

| Manganese | Growing | Significant growth from batteries | Steel industry, Lithium-ion batteries | Star (Dual market strength) |

| Cobalt | Growing | CAGR > 10% (through 2030) | EV battery production | Potential Star (Exploration focus) |

| Platinum Group Metals | Stable to Growing | Emerging demand in fuel cells | Catalytic converters, Hydrogen fuel cells | Potential Star (Exploration focus) |

What is included in the product

This BCG Matrix overview analyzes African Rainbow Minerals' portfolio, highlighting which units to invest in, hold, or divest based on market share and growth.

The African Rainbow Minerals BCG Matrix provides a clear, visual roadmap, alleviating the pain of strategic uncertainty by identifying growth opportunities.

Cash Cows

African Rainbow Minerals (ARM) benefits from substantial iron ore operations, notably through its stake in Assmang. This segment is a cornerstone of ARM's portfolio, capitalizing on the foundational role of iron ore in the global steel industry.

The iron ore market, valued at approximately USD 279.35 billion in 2023 and projected to reach USD 290.25 billion in 2024, is characterized by its large scale and stability. While growth is moderate, the consistent demand from the steel sector positions ARM's iron ore assets as strong cash generators.

African Rainbow Minerals' (ARM) established manganese operations are classic cash cows within the BCG matrix. While manganese has exciting high-growth applications, its overwhelming use, exceeding 90%, remains in steel production, a mature and stable industry.

ARM's long-standing manganese ore and alloy businesses, especially those serving the steel sector, are positioned to deliver reliable cash flows. Given the predictable demand from steelmakers, these operations likely require minimal investment in marketing or expansion, allowing them to efficiently generate profits. For example, in the fiscal year ending June 30, 2023, ARM reported that its manganese segment contributed significantly to its overall performance, underscoring its role as a stable income generator.

African Rainbow Minerals (ARM) actively mines Platinum Group Metals (PGMs), a segment crucial to its portfolio. The PGM market, though subject to price fluctuations, remains a robust sector driven by consistent demand, particularly from the automotive industry for catalytic converters and the enduring appeal of jewelry.

Despite a recent dip in average realized PGM prices, ARM's established mining operations in this area are expected to generate steady cash flow. This stability is largely attributed to ARM's significant market presence and the inherent demand for these precious metals.

Chrome Ore Operations

African Rainbow Minerals (ARM) actively mines chrome ore, a foundational element for stainless steel production. While the chrome market's growth rate might be moderate compared to some emerging commodities, it benefits from consistent, established industrial demand. This stability positions ARM's chrome operations as a reliable source of cash flow.

ARM's chrome segment, particularly if it commands a significant market share, functions as a cash cow. This means it generates more cash than it needs to maintain its operations and market position. For example, in the financial year ending June 30, 2023, ARM reported that its chrome operations contributed significantly to its overall profitability, underscoring its role as a stable income generator.

- Chrome Ore's Role: ARM's chrome operations are key to its diversified mining portfolio, providing stable revenue streams.

- Market Stability: The established industrial uses for chrome ensure predictable demand, supporting consistent cash generation.

- Financial Contribution: In FY2023, ARM's chrome segment demonstrated its cash-generating capacity, reinforcing its cash cow status within the company's BCG matrix.

Thermal Coal Operations

African Rainbow Minerals (ARM) operates thermal coal mines, a segment that typically functions as a cash cow in the BCG matrix. While the global thermal coal market faces headwinds due to decarbonization efforts and generally exhibits low growth, ARM's operations in this area are designed to be highly efficient and maintain a strong market position. This allows the segment to generate significant, consistent cash flows, which can then be reinvested into other areas of the business with higher growth potential.

For example, in the fiscal year ending June 30, 2023, ARM's coal operations contributed significantly to its overall financial performance. The company reported that its coal segment generated robust cash flows, underscoring its role as a reliable generator of funds. This financial strength from coal is crucial for ARM's strategy of funding growth in other business units.

- ARM's thermal coal operations are a key cash generator, despite a mature global market.

- The company focuses on maintaining market share and operational efficiency in its coal segment.

- These operations provide substantial cash flow to support investments in other ARM business units.

African Rainbow Minerals' (ARM) established manganese and chrome operations are classic cash cows. These segments benefit from mature markets with stable demand, primarily from the steel industry. Their consistent profitability requires minimal reinvestment, allowing them to generate significant surplus cash for ARM.

For instance, in the fiscal year ending June 30, 2023, ARM's manganese segment was a strong contributor to earnings, and its chrome operations also demonstrated robust financial performance. These established mining assets are crucial for funding growth initiatives in other parts of ARM's portfolio.

| ARM Segment | BCG Classification | FY2023 Contribution (Illustrative) | Market Characteristic |

|---|---|---|---|

| Manganese | Cash Cow | Significant profit generator | Mature, stable demand from steel |

| Chrome | Cash Cow | Strong profitability | Established industrial demand |

Preview = Final Product

African Rainbow Minerals BCG Matrix

The African Rainbow Minerals BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This comprehensive analysis, crafted with strategic insights, will be immediately available for your use without any watermarks or demo content. You can confidently expect to download the exact same document, ready for immediate integration into your business planning and strategic decision-making processes.

Dogs

Some of African Rainbow Minerals' (ARM) Platinum Group Metals (PGMs) assets, like the Two Rivers Mine Merensky project, are currently in a challenging phase. This operation was put on care and maintenance because of falling average realized US dollar PGM prices. In fact, ARM reported a significant 162% drop in headline earnings for its PGMs segment, highlighting the pressure these assets are facing.

The Nkomati Mine, a significant asset for African Rainbow Minerals (ARM), currently operates under a care and maintenance status. This strategic pause indicates that the mine, which historically produced nickel, platinum group metals (PGMs), and chrome, is not actively contributing to revenue generation.

This operational state strongly suggests that Nkomati Mine fits the profile of a 'Dog' within the BCG matrix. A 'Dog' typically exhibits a low market share and low growth potential, often requiring significant capital to maintain without generating substantial returns.

While specific financial data for Nkomati's current care and maintenance period isn't publicly detailed in isolation, ARM's overall financial reports would reflect the costs associated with preserving the asset. For instance, in their 2023 financial results, ARM reported a decrease in headline earnings, partly influenced by the performance of its lower-performing assets, which would encompass operations like Nkomati.

Smaller, non-strategic assets with limited market share or growth potential, not explicitly highlighted in recent reports, would fit here. These could include minor mineral rights or smaller, underperforming operations. For instance, if ARM reported divestment of a small, non-core platinum group metals asset in late 2023, it would exemplify this category.

Inefficient or High-Cost Mines

Inefficient or high-cost mines within African Rainbow Minerals' (ARM) portfolio would fall into the Dogs category of the BCG matrix. These operations are characterized by significant operational expenses, low output efficiency, or diminishing ore quality, leading to poor profitability and a shrinking market presence. Such mines consume valuable capital and management attention without generating commensurate returns.

For instance, if a particular ARM mine in 2024 reported an all-in sustaining cost (AISC) significantly above the industry average for its commodity, coupled with a declining production volume despite substantial investment, it would exemplify a Dog. This scenario highlights a business unit that is underperforming and likely a drain on the company's resources.

- High Operating Costs: Mines with AISC exceeding 20% above the commodity's average for 2024.

- Low Production Efficiency: Operations with a year-on-year decline in output per employee or per unit of energy consumed.

- Declining Ore Grades: Mines experiencing a consistent drop in metal content per tonne of ore processed, impacting recovery rates and overall economics.

- Negative Profitability: Operations consistently reporting losses or very thin profit margins, even during periods of strong commodity prices.

Segments with Persistent Logistics or Power Challenges

Segments experiencing persistent logistics or power disruptions, as highlighted in African Rainbow Minerals' (ARM) 2024 executive chairman's report, can be categorized as Dogs in a BCG Matrix. These operational hurdles directly impede efficiency and increase costs, thereby affecting profitability. For instance, if a particular mine consistently struggles with unreliable electricity supply or inadequate transportation infrastructure, its ability to compete and grow is severely hampered.

These challenges can lead to a shrinking market share and stagnant or negative growth rates, characteristic of the Dog quadrant. ARM's 2024 financial results indicated that while overall performance was robust, specific operational challenges did contribute to cost pressures in certain areas. The company's commitment to investing in infrastructure and energy solutions aims to mitigate these Dog-like characteristics in its segments.

- Logistics Constraints: Difficulty in transporting raw materials or finished products due to poor road networks or port congestion.

- Power Instability: Frequent power outages or high energy costs impacting mining operations and processing.

- Diminished Market Share: Competitors with more reliable infrastructure gain an advantage, eroding the segment's market position.

- Low Growth Prospects: Inability to expand production or reach new markets due to ongoing operational limitations.

Assets like the Nkomati Mine, currently on care and maintenance, represent Dogs in ARM's portfolio. These are operations with low market share and growth potential, often requiring significant investment without generating substantial returns. For instance, ARM's 2023 financial results showed a considerable drop in headline earnings for its PGMs segment, partly due to underperforming assets.

Inefficient mines with high operating costs, such as those with an all-in sustaining cost (AISC) significantly above the 2024 industry average, also fall into the Dog category. These units consume resources without delivering commensurate profits. Persistent logistical or power disruptions, as noted in ARM's 2024 reports, further contribute to Dog-like characteristics by hindering efficiency and increasing costs.

| Asset Example | BCG Category | Reasoning |

|---|---|---|

| Nkomati Mine | Dog | Care and maintenance status, historical underperformance, low current contribution to revenue. |

| Two Rivers Mine (Merensky) | Dog | Care and maintenance due to falling PGM prices, significant drop in segment earnings. |

| High-Cost Operations | Dog | AISC exceeding 20% above 2024 commodity average, declining production efficiency. |

| Segments with Infrastructure Issues | Dog | Logistics or power disruptions impacting efficiency and profitability, leading to diminished market share. |

Question Marks

African Rainbow Minerals' (ARM) new exploration projects, currently in the pre-production phase, are positioned as question marks within its BCG matrix. These ventures focus on identifying and developing mineral resources that are not yet producing or have no established market share, representing a significant investment in future potential.

These projects are strategically targeting minerals crucial for emerging sectors, such as those powering the renewable energy transition. For instance, ARM has been actively exploring for platinum group metals (PGMs) and copper, both vital for electric vehicles and green technologies. The company's 2024 financial reports highlight ongoing capital expenditure in these exploration activities, indicating a commitment to future growth, even with inherent uncertainties.

African Rainbow Minerals' (ARM) investments in advanced processing technologies, such as those at its Machadodorp Works, likely position these initiatives as Question Marks within its BCG matrix. These projects, focused on developing more cost-effective and energy-efficient smelting methods, represent significant capital outlays with uncertain immediate returns.

While the long-term potential for improved profitability and market competitiveness is clear, the actual realization of these benefits is still in development. For instance, ARM reported a 13% increase in headline earnings for the six months ended December 31, 2023, to R6.6 billion, demonstrating overall company strength, but the specific impact of these advanced technologies on future earnings remains speculative.

Venturing into entirely new commodity markets for African Rainbow Minerals (ARM) would place these initiatives squarely in the Question Marks category of the BCG Matrix. This means they would be in potentially high-growth sectors but would start with a low market share and an unproven track record.

For instance, if ARM were to explore emerging battery metals like lithium or cobalt, which are experiencing significant demand growth driven by electric vehicles, these would represent new ventures. In 2024, the global lithium market alone was projected to reach over $30 billion, showcasing the growth potential, but ARM's initial entry would likely mean a small slice of this pie.

The strategic challenge for ARM would be to determine which of these new ventures have the potential to become Stars or Cash Cows in the future. This requires careful market analysis and significant investment to build market share and operational expertise. Without this, these ventures risk remaining Question Marks or even becoming Dogs.

Minority Investments in Early-Stage Companies

Minority investments by African Rainbow Minerals (ARM) in early-stage companies, particularly within mineral technology or emerging mining ventures, would be classified as question marks in the BCG Matrix. These are ventures with high growth potential but uncertain futures, requiring significant investment without immediate returns. For instance, ARM's strategic investments in innovative mineral processing technologies or exploration projects in underexplored regions would fit this category.

These early-stage companies, while not yet major contributors to ARM's revenue or market share, represent potential future stars. Their success hinges on market acceptance and technological viability.

- High Growth Potential: These companies operate in sectors with anticipated rapid expansion, such as critical minerals extraction or advanced material processing.

- Low Market Share: As early-stage entities, they have minimal current market penetration and brand recognition.

- High Investment Needs: Significant capital is required for research, development, and initial operational setup.

- Uncertain Future Cash Flow: Profitability and cash generation are speculative and dependent on successful market entry and scaling.

Response to Evolving 'Green Steel' Demand

The global push towards decarbonization is significantly reshaping the iron ore market, with 'green steel' production gaining traction. While iron ore itself is a mature Cash Cow for African Rainbow Minerals (ARM), their strategic investments and market position in the specific, lower-emission iron ore products required for green steel could be considered a Question Mark.

This segment is experiencing rapid growth, but ARM's established market share in this developing niche is still being defined. The company's response to this evolving demand, particularly in adopting or investing in technologies that align with green steel production, represents a strategic area with uncertain future returns but high potential growth.

- Growing Green Steel Market: Global demand for green steel is projected to rise significantly, driven by environmental regulations and corporate sustainability goals. For instance, by 2030, it's estimated that a substantial portion of steel production could incorporate green hydrogen or other low-carbon methods.

- ARM's Strategic Position: ARM's existing iron ore operations are strong cash generators. However, their specific focus and investment in producing the high-purity or specially processed iron ore needed for green steel production is a developing area, making it a Question Mark in their BCG matrix.

- Investment in Innovation: The success of ARM's Question Mark status hinges on their ability to adapt and invest in new technologies or partnerships that facilitate the production of iron ore suitable for green steel. This might include exploring direct reduced iron (DRI) grade ore or investing in processing techniques that reduce the carbon footprint of their existing operations.

- Market Uncertainty and Potential: While the green steel market offers significant future potential, the exact market share ARM can capture and the profitability of these specialized products remain uncertain, characteristic of a Question Mark in strategic portfolio analysis.

New exploration projects for African Rainbow Minerals (ARM) are classified as Question Marks due to their pre-production status and unproven market share. These ventures, often targeting minerals like copper and platinum group metals essential for green technologies, represent significant investments with uncertain future returns. ARM's 2024 financial reports confirm ongoing capital expenditure in these high-potential but speculative exploration activities.

ARM's investments in advanced processing technologies, such as improved smelting methods, also fall into the Question Mark category. While these aim for long-term cost efficiencies and market competitiveness, their immediate impact on profitability is still developing. Despite ARM's overall financial strength, as shown by a 13% increase in headline earnings for the six months ending December 31, 2023, the success of these specific technological advancements remains speculative.

Venturing into new commodity markets, like battery metals such as lithium, positions ARM's initiatives as Question Marks. These sectors offer substantial growth, with the global lithium market projected to exceed $30 billion in 2024. However, ARM's entry into these markets means a low initial market share and an unproven track record, requiring significant investment to build expertise and market presence.

Minority investments in early-stage mineral technology or mining ventures are also considered Question Marks. These companies, while offering high growth potential, require substantial capital for development with no guaranteed returns. Their success depends on market acceptance and technological viability, making them potential future stars but currently uncertain contributors to ARM's revenue.

ARM's strategic focus on producing specialized iron ore for the burgeoning green steel market is another Question Mark. While the iron ore market is mature, this niche segment is experiencing rapid growth driven by environmental goals. ARM's market share in this developing area is still being defined, and its success hinges on adapting to and investing in technologies that support low-carbon steel production, presenting uncertain but high-potential future returns.

BCG Matrix Data Sources

Our African Rainbow Minerals BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on market share, and expert commentary on growth prospects.