African Rainbow Minerals Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

African Rainbow Minerals Bundle

African Rainbow Minerals faces a dynamic industry shaped by significant supplier power, particularly for specialized mining equipment and raw materials. The threat of new entrants is moderate, as substantial capital and expertise are required, but technological advancements could lower these barriers. Understanding these forces is crucial for any stakeholder.

The complete report reveals the real forces shaping African Rainbow Minerals’s industry—from buyer power to substitute threats. Gain actionable insights to drive smarter decision-making and unlock the full competitive landscape.

Suppliers Bargaining Power

The mining sector, including companies like African Rainbow Minerals (ARM), often faces a concentrated supplier base for highly specialized equipment and advanced processing technologies. When only a handful of companies can provide essential components or proprietary solutions, their bargaining power increases significantly. This can translate into higher prices for ARM, directly impacting its cost of production and profitability, especially for critical inputs needed for complex mining operations.

The uniqueness of inputs for African Rainbow Minerals (ARM) significantly influences supplier bargaining power. For instance, specialized mining software, proprietary explosives, or advanced geological survey tools, if not readily available from multiple sources, grant suppliers leverage. In 2024, the global mining technology market, which includes such specialized software, was valued at approximately $15 billion, with growth driven by demand for efficiency and safety, indicating the critical nature of these unique inputs.

High switching costs significantly bolster suppliers' leverage over African Rainbow Minerals (ARM). For ARM, these costs can manifest as substantial investments in retooling existing mining and processing equipment to accommodate components from a new supplier. Furthermore, the expense of retraining personnel on new operational software or handling the intricate logistics of terminating and initiating large-scale supply agreements adds to this burden.

These embedded costs create a strong disincentive for ARM to explore alternative suppliers, even when faced with potential price hikes from their current partners. For instance, in the mining sector, specialized equipment often requires specific material inputs, making a switch to a different ore or chemical supplier a complex and costly undertaking. This dependency ensures that suppliers can command more favorable terms.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the mining sector, while generally less common for suppliers of highly specialized equipment, could significantly enhance their bargaining power. Should a supplier of a crucial component or advanced technology decide to enter mining operations directly, it would diminish their dependence on companies like African Rainbow Minerals (ARM) and potentially jeopardize ARM's access to essential inputs.

This forward integration is a more realistic concern for providers of sophisticated processing technologies or specialized mineral services. For instance, a company that develops and supplies advanced ore beneficiation technology might consider establishing its own mining ventures to capture more value, thereby altering the supply dynamics for existing mining firms.

- Forward Integration Threat: Suppliers moving into mining operations directly increases their leverage.

- Impact on ARM: Reduced reliance by suppliers could limit ARM's access to critical inputs.

- Plausible Scenarios: More likely for suppliers of processing tech and niche mineral services.

- Example: A beneficiation technology provider establishing its own mines.

Importance of ARM to the Supplier

The significance of African Rainbow Minerals (ARM) as a customer directly impacts the bargaining power of its suppliers. If ARM constitutes a substantial portion of a supplier's overall sales, that supplier is likely to be more amenable to negotiating favorable terms and pricing with ARM. This dependency strengthens ARM's position.

Conversely, if ARM represents a minor segment of a supplier's business, particularly a large and diversified one, ARM's individual leverage is considerably reduced. In such scenarios, the supplier has less incentive to offer preferential treatment, and ARM may find it harder to secure advantageous pricing or service agreements.

- Supplier Dependence: The degree to which a supplier relies on ARM for revenue is a key determinant of ARM's influence.

- Market Share: ARM's market share within the supplier's customer base dictates the supplier's willingness to negotiate.

- ARM's Purchasing Volume: High purchase volumes from ARM can give it more sway in price discussions.

The bargaining power of suppliers to African Rainbow Minerals (ARM) is significant due to the specialized nature of mining equipment and technology. When suppliers offer unique inputs, like proprietary software or advanced processing tools, their leverage increases, potentially leading to higher costs for ARM. For example, the global mining technology market was valued at approximately $15 billion in 2024, highlighting the critical and often specialized nature of these supplies.

High switching costs further empower suppliers, as ARM faces substantial expenses in retooling equipment or retraining staff if it changes suppliers for critical components. This dependency makes it difficult for ARM to negotiate better terms, as the cost of changing is often prohibitive.

The threat of suppliers integrating forward into mining operations could also enhance their bargaining power, although this is more plausible for providers of processing technologies. If a technology supplier were to start its own mining ventures, it could reduce its reliance on companies like ARM, impacting input availability.

ARM's influence over suppliers is also tied to its purchasing volume; a larger share of a supplier's business gives ARM more negotiation power. Conversely, if ARM is a small customer for a diversified supplier, its leverage is considerably diminished.

What is included in the product

Tailored exclusively for African Rainbow Minerals, analyzing its position within its competitive landscape by evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Effortlessly navigate the complexities of the mining industry by visualizing African Rainbow Minerals' competitive landscape, turning potential strategic blind spots into clear opportunities.

Customers Bargaining Power

The concentration of customers for African Rainbow Minerals' (ARM) diverse mineral portfolio, encompassing platinum group metals (PGMs), iron ore, coal, copper, and gold, significantly influences their bargaining power. For instance, in the iron ore market, where ARM is a notable producer, a limited number of large steel manufacturers globally can dictate terms due to the commodity's bulk nature and the availability of alternative suppliers.

This concentration is particularly potent for bulk commodities like iron ore and coal, where buyers often have numerous sourcing options. If a few major industrial consumers or international commodity traders represent a substantial portion of ARM's sales for a particular mineral, they can leverage this position to negotiate lower prices or more favorable payment terms, thereby increasing their bargaining power.

The sheer volume of minerals that individual customers or segments purchase significantly influences their negotiation strength. For African Rainbow Minerals (ARM), major buyers like large steel manufacturers purchasing iron ore or automotive companies acquiring platinum group metals (PGMs) wield considerable power. Their substantial orders are vital to ARM's overall income, allowing them to push for reduced prices, more favorable payment schedules, and tailored product specifications.

The bargaining power of customers for African Rainbow Minerals (ARM) is significantly influenced by product standardization. For commodities like iron ore and coal, where ARM operates, products are largely undifferentiated. This means buyers can readily switch between suppliers based on price, giving them substantial leverage. For instance, in 2023, global iron ore prices experienced volatility, allowing major steel producers to demand more favorable terms from suppliers like ARM.

Buyer's Switching Costs

Buyer's switching costs significantly shape customer bargaining power for African Rainbow Minerals (ARM). If customers can easily shift to alternative suppliers with minimal disruption or additional expense, their ability to negotiate favorable terms increases. For instance, in the market for certain widely available mineral grades where transportation and handling infrastructure is standardized, switching costs for buyers are typically low. This allows them to exert greater pressure on ARM regarding pricing and supply conditions.

Conversely, if customers face substantial costs when switching from ARM to a competitor, their bargaining power is diminished. These costs can include financial outlays for new equipment, retraining personnel, or the time and effort involved in establishing new supplier relationships and quality assurance processes. For specialized mineral products or integrated supply chain solutions offered by ARM, these switching costs can be quite high, thereby reducing the customers' leverage.

For example, in 2024, the global seaborne iron ore market, a key commodity for ARM, often sees competitive pricing influenced by freight costs and port availability. Buyers with flexible logistics and access to multiple supply sources can more readily switch between producers, enhancing their bargaining power. Conversely, contracts that involve specific quality requirements or long-term supply agreements can embed higher switching costs for the buyer.

- Low switching costs: Buyers can easily change suppliers for common mineral grades, increasing their price sensitivity and negotiation leverage.

- High switching costs: Customers face significant expenses or disruptions when switching, reducing their bargaining power over ARM.

- 2024 Market Dynamics: The iron ore market, for instance, demonstrates how freight costs and buyer logistics capacity can influence switching ease and thus bargaining power.

Threat of Backward Integration by Customers

The threat of customers integrating backward, meaning they start producing the minerals themselves, significantly bolsters their bargaining power against suppliers like African Rainbow Minerals (ARM). If a major consumer, such as a large steel manufacturer, were to invest in its own iron ore mining operations, it would directly reduce its need for ARM's output. This shift would inevitably weaken ARM's ability to dictate prices and maintain its market position for iron ore.

Consider the automotive sector's increasing focus on securing critical minerals for electric vehicle batteries. In 2024, major automotive companies are actively exploring direct sourcing agreements and even equity stakes in mining operations to gain control over their supply chains. For instance, reports indicate significant investments by global car manufacturers in lithium and cobalt projects in Africa, signaling a clear intent to reduce reliance on third-party suppliers.

This trend directly impacts ARM by creating a scenario where key buyers might become competitors. The potential for such backward integration means ARM must remain competitive not only on price but also on reliability and value-added services to retain its customer base. The bargaining power of customers is thus amplified as they possess the credible threat of bringing production in-house.

- Customer Integration Threat: Customers producing their own minerals increases their leverage over suppliers like ARM.

- Example: A steel producer owning iron ore mines reduces dependence on ARM, diminishing ARM's pricing power.

- 2024 Trend: Automotive companies are investing in critical mineral sourcing for EVs, potentially leading to backward integration.

- Impact on ARM: ARM faces pressure to maintain competitiveness to prevent customers from becoming self-sufficient.

The bargaining power of customers for African Rainbow Minerals (ARM) is significantly influenced by the concentration of buyers and the volume of their purchases. For bulk commodities like iron ore, where a few large steel manufacturers represent a substantial portion of sales, these buyers can negotiate lower prices and more favorable terms. Their substantial orders are critical to ARM's revenue, giving them considerable leverage.

Product standardization further amplifies customer power. For undifferentiated minerals such as iron ore and coal, buyers can easily switch suppliers based on price. This was evident in 2023 when iron ore price volatility allowed major steel producers to demand better terms. Low switching costs for common mineral grades mean customers have increased negotiation leverage.

The threat of backward integration by customers also strengthens their position. As seen in 2024, automotive companies are investing in critical mineral sourcing for EVs, potentially leading them to produce minerals themselves. This reduces their reliance on suppliers like ARM and pressures ARM to remain competitive.

| Factor | Impact on ARM's Customer Bargaining Power | 2024 Relevance |

| Customer Concentration | High for bulk commodities (e.g., iron ore) | Key steel manufacturers hold significant leverage. |

| Purchase Volume | Large buyers have more negotiation strength | Vital orders allow customers to push for better pricing. |

| Product Standardization | Increases buyer price sensitivity | Easy switching between suppliers for common grades. |

| Switching Costs | Low for standardized products | Customers can readily change suppliers, enhancing leverage. |

| Backward Integration Threat | Customers may produce minerals themselves | Automotive sector's EV mineral sourcing shows this trend. |

Preview Before You Purchase

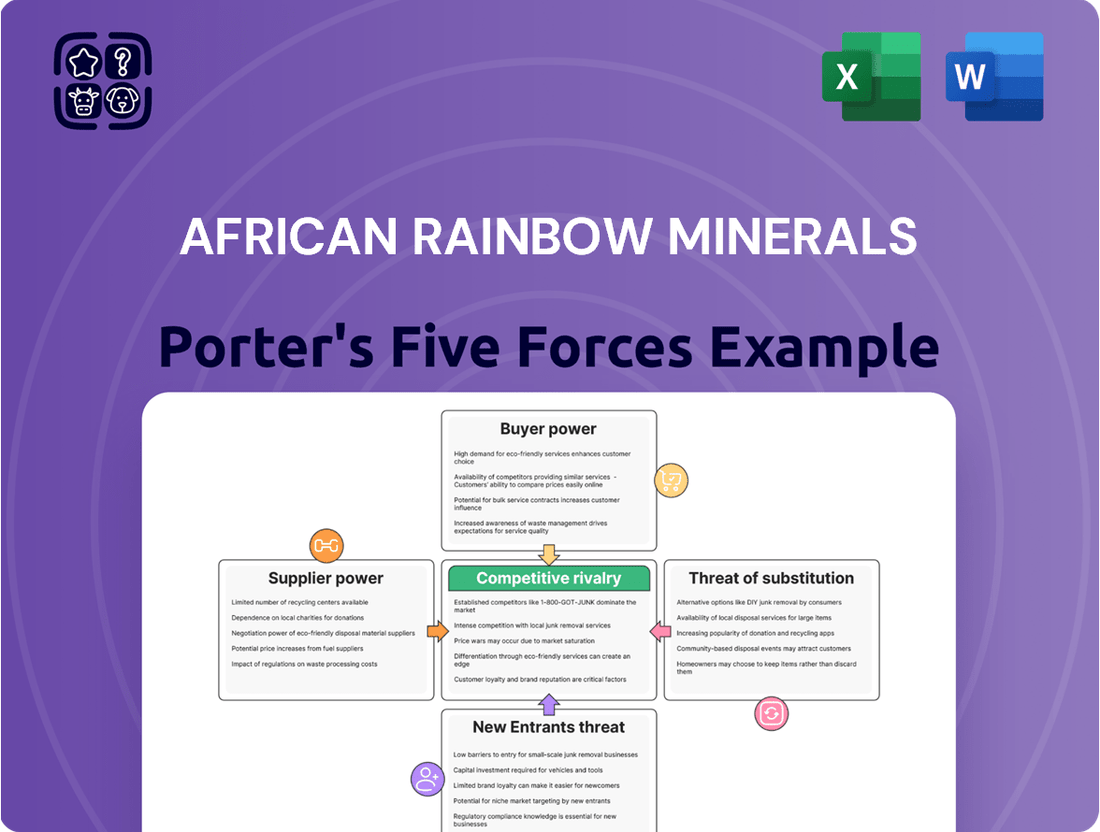

African Rainbow Minerals Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for African Rainbow Minerals, detailing the competitive landscape and strategic positioning of the company within the mining sector. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, providing actionable insights without any placeholders or alterations.

Rivalry Among Competitors

The South African and global mining arenas where African Rainbow Minerals (ARM) operates are populated by a considerable number of substantial, diversified mining entities. Prominent among these are Anglo American Platinum, Sibanye-Stillwater, Gold Fields, and AngloGold Ashanti, each possessing significant market influence and operational scale.

This dense concentration of large players fuels intense competition. Companies like ARM are constantly engaged in a struggle for market share, access to valuable mineral resources, and the attraction of crucial investment capital, all of which elevates the level of competitive rivalry.

The pace at which the markets for platinum group metals (PGMs), iron ore, coal, copper, and gold expand significantly shapes the competitive landscape for African Rainbow Minerals (ARM). For instance, the PGM market, a core area for ARM, experienced a notable slowdown in demand in early 2024, putting pressure on producers.

When growth falters or turns negative, companies like ARM often see intensified competition for market share. This can manifest as price wars, as businesses try to move inventory, and a ramp-up in marketing to retain customers. In 2023, the global iron ore market, another key commodity for ARM, saw price volatility, reflecting this dynamic.

For African Rainbow Minerals (ARM), competitive rivalry is influenced by product differentiation, which is typically low for raw commodities like iron ore and coal, making price a key differentiator. However, ARM might find some advantage in offering specific mineral grades or engaging in value-added processing, which could soften the direct price competition.

In 2024, ARM's iron ore sales volumes were significant, contributing substantially to its revenue. While the global iron ore market is largely commoditized, ARM's focus on operational efficiency and consistent product quality for its export markets can create a marginal degree of differentiation against competitors solely competing on price.

Exit Barriers

High exit barriers in the mining sector, including substantial investments in specialized equipment and infrastructure, can trap capital. For instance, in 2024, the global mining industry saw significant capital expenditure, with major players investing billions in new projects and maintaining existing operations. These sunk costs make it exceedingly difficult for companies to divest, even when market conditions turn unfavorable.

Long-term contractual obligations, such as supply agreements and labor contracts, further cement companies within the industry. Environmental rehabilitation costs, a critical component of mining operations, represent another substantial exit barrier. Companies are legally required to restore mined land to its original state, a process that can cost millions, as seen in various regulatory frameworks worldwide that mandate extensive post-closure plans.

- Significant Capital Investment: Mining operations require massive upfront investment in fixed assets like processing plants and specialized machinery, often running into hundreds of millions or even billions of dollars.

- Long-Term Contracts: Commitments to suppliers, customers, and labor unions can create ongoing financial responsibilities that are hard to shed quickly.

- Environmental Rehabilitation: The cost of restoring mining sites after operations cease is substantial, often involving extensive land reclamation and monitoring, adding a significant financial burden to exiting the market.

- Specialized Assets: Mining-specific equipment and infrastructure have limited resale value outside the industry, making it difficult to recoup invested capital upon exit.

Cost Structure and Capacity

The cost structure and production capacity within the mining sector significantly fuel competitive rivalry. Mining operations are characterized by substantial fixed costs, including exploration, equipment, and infrastructure. For instance, in 2024, major platinum group metal (PGM) producers like Anglo American Platinum and Impala Platinum continue to invest heavily in maintaining and upgrading their extensive mining and processing facilities, reflecting these high capital outlays.

Companies burdened by these high fixed costs face immense pressure to operate at or near full capacity. This drive to spread fixed expenses over a larger output volume often compels them to engage in aggressive pricing tactics. Even when market demand is sluggish or the industry is saturated, firms may lower prices to secure sales and avoid underutilization penalties, intensifying competition among players like African Rainbow Minerals.

- High Fixed Costs: Mining operations inherently involve significant upfront capital expenditure on exploration, machinery, and infrastructure, creating a strong incentive to maximize production to amortize these costs.

- Capacity Utilization: Companies with large production capacities are motivated to maintain high output levels to achieve economies of scale and reduce per-unit costs.

- Price Competition: The need to cover fixed costs and utilize capacity can lead to price wars, especially when market demand softens, impacting profitability across the industry.

- Operational Efficiency: Firms that can manage their cost structures more effectively and achieve higher capacity utilization often gain a competitive advantage through lower production costs.

African Rainbow Minerals (ARM) operates in a highly competitive mining sector, facing rivals like Anglo American Platinum and Sibanye-Stillwater. This intense rivalry is driven by a limited number of large, diversified players vying for market share and resources. The commoditized nature of many minerals, such as iron ore, means price often dictates success, although ARM can find differentiation through product quality and processing.

High fixed costs and the need for capacity utilization further fuel this competition. Companies must maintain high output to cover substantial investments in equipment and infrastructure, leading to aggressive pricing strategies even in soft markets. For example, significant capital expenditure across the mining industry in 2024 highlights these ongoing cost pressures.

The mining industry also presents high exit barriers due to specialized assets and environmental rehabilitation costs, trapping capital and intensifying competition among existing players. These factors collectively create a challenging environment where operational efficiency and strategic resource management are paramount for ARM.

| Key Competitors | Primary Commodities | Market Position Indicator (Illustrative) |

|---|---|---|

| Anglo American Platinum | Platinum Group Metals (PGMs) | Major Global PGM Producer |

| Sibanye-Stillwater | PGMs, Gold, Nickel | Leading PGM and Gold Producer |

| Gold Fields | Gold | Significant Global Gold Miner |

| AngloGold Ashanti | Gold | Major Gold Producer with Global Operations |

| African Rainbow Minerals (ARM) | PGMs, Iron Ore, Coal, Copper, Gold | Diversified South African Miner |

SSubstitutes Threaten

The availability and performance of substitutes for African Rainbow Minerals' (ARM) diverse mineral portfolio present a significant threat. For example, the automotive industry's shift towards battery electric vehicles (BEVs) is directly impacting the demand for platinum and palladium, key components in traditional catalytic converters. This trend is projected to continue, with BEV sales in 2024 showing robust growth globally, potentially diminishing the market for these precious metals.

The price-performance trade-off is a critical factor in assessing the threat of substitutes for African Rainbow Minerals (ARM). If alternative materials or technologies offer similar or better performance at a lower price point, customers are more inclined to switch away from ARM's products.

For instance, innovations in battery technology that significantly lower costs or improve efficiency could reduce the demand for platinum group metals (PGMs), a key commodity for ARM. Similarly, if renewable energy sources become substantially more cost-effective than coal, this would directly impact ARM's thermal coal business, increasing the threat of substitution.

African Rainbow Minerals (ARM) faces a significant threat from substitutes, particularly as global environmental regulations tighten and technological innovation accelerates. For instance, the increasing adoption of electric vehicles (EVs) directly impacts the demand for platinum group metals (PGMs) like platinum and palladium, which are crucial components in catalytic converters for traditional internal combustion engines. In 2024, global EV sales are projected to exceed 17 million units, a substantial increase from previous years, indicating a growing market segment that bypasses PGM-intensive automotive technology.

Furthermore, the global energy transition away from fossil fuels presents another substitute threat. Coal, a significant commodity for ARM, faces mounting pressure from renewable energy sources such as solar and wind power. By the end of 2023, global renewable energy capacity additions reached a record high, demonstrating a clear market shift that diminishes reliance on coal for power generation.

Switching Costs for Buyers to Substitutes

The threat of substitutes for African Rainbow Minerals (ARM) is influenced by the switching costs buyers face. If it's easy and inexpensive for customers to switch to alternative materials or energy sources, the threat is amplified. For instance, if steel producers can readily adopt different types of iron ore or even alternative metals with minimal disruption, ARM's market position weakens.

Conversely, high switching costs can significantly deter substitution. These costs can include the expense of retooling manufacturing equipment, redesigning products to accommodate new materials, or the time and effort involved in qualifying new suppliers. For example, a significant change in the type of coal used in a particular industrial process might require extensive testing and regulatory approval, making it less likely for buyers to switch away from their current suppliers.

In 2024, the global mining industry, including ARM, is navigating a landscape where the cost and availability of key commodities are paramount. The energy transition, for instance, presents both opportunities and threats. While demand for minerals like copper and platinum group metals (used in electric vehicles and catalytic converters) remains strong, the potential for advancements in battery technology or alternative energy storage could eventually reduce reliance on some of these materials, thereby increasing the threat of substitution in the long term.

Consider these factors impacting switching costs:

- Technological Advancements: Innovations that simplify the integration of substitute materials.

- Capital Investment: The cost of new machinery or facility upgrades required to use alternatives.

- Supply Chain Integration: The ease with which new suppliers of substitute materials can be incorporated.

- Performance Characteristics: Whether substitute materials can match the quality and functionality of ARM's offerings.

Innovation in Substitute Industries

The constant drive for innovation in industries offering alternatives to African Rainbow Minerals' (ARM) core products poses a substantial long-term risk. For instance, breakthroughs in electric vehicle (EV) battery technology that reduce or eliminate the need for platinum group metals (PGMs) could significantly impact demand for platinum and palladium, key commodities for ARM. Similarly, advancements in sustainable steelmaking that lower iron ore requirements directly challenge ARM's iron ore segment.

Consider the following examples of this threat:

- New Battery Chemistries: Ongoing research into solid-state batteries and sodium-ion batteries for EVs aims to reduce reliance on lithium and cobalt, but also potentially PGMs used in some fuel cell technologies.

- Green Steel Advancements: The development of hydrogen-based direct reduced iron (DRI) processes, while still evolving, could decrease the demand for traditional blast furnace iron ore, a major product for ARM.

- Material Substitution: The search for lighter, stronger, and more cost-effective materials in construction and manufacturing could lead to the displacement of steel and other metals produced from ARM's raw materials.

- Circular Economy Initiatives: Increased emphasis on recycling and the circular economy may reduce the need for primary extraction of minerals, thereby lessening demand for raw materials like those supplied by ARM.

The threat of substitutes for African Rainbow Minerals (ARM) is significant, driven by technological advancements and the global energy transition. For example, the increasing adoption of electric vehicles (EVs) directly impacts the demand for platinum group metals (PGMs) like platinum and palladium, crucial for catalytic converters. Global EV sales in 2024 are projected to surpass 17 million units, a substantial increase that bypasses traditional PGM-intensive automotive technology.

Furthermore, the shift away from fossil fuels poses a threat to ARM's thermal coal business, as renewable energy sources like solar and wind power gain traction. Record high renewable energy capacity additions by the end of 2023 underscore this market shift, reducing reliance on coal.

Switching costs also play a role; if customers can easily and affordably switch to alternatives, ARM's market position weakens. Conversely, high switching costs, such as retooling or redesigning products, deter substitution.

Here's a look at key substitute threats and their impact:

| Commodity | Substitute Threat | Impact on ARM | 2024 Trend/Data Point |

|---|---|---|---|

| Platinum Group Metals (PGMs) | Electric Vehicles (EVs) | Reduced demand for catalytic converters | Global EV sales projected to exceed 17 million units |

| Thermal Coal | Renewable Energy (Solar, Wind) | Decreased demand for power generation | Record renewable capacity additions by end of 2023 |

| Iron Ore | Green Steel (Hydrogen DRI) | Potential decrease in demand for traditional iron ore | Ongoing development in green steelmaking processes |

Entrants Threaten

The mining sector demands massive upfront capital. For instance, developing a new platinum mine can easily cost billions of dollars, creating a formidable hurdle for potential new competitors looking to enter the market. This high barrier significantly limits the threat of new entrants for established players like African Rainbow Minerals.

Established mining giants like African Rainbow Minerals (ARM) leverage substantial economies of scale, particularly in bulk purchasing of raw materials and operational efficiency. For instance, ARM's significant production volumes in platinum group metals (PGMs) in 2024 allow for more favorable contract terms with suppliers and optimized processing costs.

Newcomers would find it challenging to match these cost advantages. A hypothetical new entrant would need immense capital investment to reach a production level that could even begin to compete on cost per unit with established players like ARM, making entry financially prohibitive.

Newcomers face significant challenges in securing access to established distribution networks for minerals, a critical bottleneck that African Rainbow Minerals (ARM) has already navigated. Furthermore, obtaining the rights to high-quality, economically viable mineral deposits presents another substantial barrier.

ARM's established operational footprint and strategic partnerships provide a distinct advantage in overcoming these hurdles, allowing for more efficient market penetration and resource acquisition compared to nascent competitors.

Government Policy and Regulation

The South African mining industry is characterized by intricate and frequently changing government policies, regulations, and licensing procedures. These complex frameworks act as a substantial hurdle for new companies looking to enter the sector, requiring significant investment in compliance and legal expertise.

Navigating these regulatory landscapes, securing essential permits, and adhering to stringent environmental and social governance (ESG) standards present a significant barrier to entry. For instance, in 2024, the Department of Mineral Resources and Energy continued to emphasize local content requirements and beneficiation, adding layers of complexity for potential new miners.

- Regulatory Complexity: South Africa's mining laws, such as the Mineral and Petroleum Resources Development Act (MPRDA), are extensive and can be challenging for new entrants to fully comprehend and comply with.

- Licensing and Permitting: Obtaining mining rights and environmental permits can be a lengthy and resource-intensive process, often taking several years, which deters smaller or less capitalized new companies.

- ESG Compliance: Increasing focus on environmental protection and social impact, including community engagement and broad-based black economic empowerment (B-BBEE) requirements, adds significant operational and financial burdens for new entrants.

- Policy Uncertainty: Evolving government policies, including potential changes to mining royalties or ownership structures, create an environment of uncertainty that can discourage new investment.

Brand Loyalty and Differentiation

While commodity markets typically see less emphasis on brand loyalty compared to consumer goods, established players like African Rainbow Minerals (ARM) can cultivate a strong reputation. This reputation is built on factors such as consistent supply chain reliability, adherence to quality standards, and demonstrated commitment to responsible mining and environmental, social, and governance (ESG) practices. For instance, ARM's focus on community engagement and sustainable operations, as highlighted in their 2023 sustainability reports, can differentiate them.

This established trust and proven track record can act as a subtle but significant barrier for new entrants. Newcomers often face the challenge of convincing major buyers, who rely on predictable and high-quality output, to switch from a known and trusted supplier. Without years of demonstrated performance and established relationships, new mining operations may struggle to secure the crucial long-term contracts that underpin profitability in the sector, potentially impacting their initial market penetration.

For example, in 2024, the global demand for platinum group metals, a key area for ARM, remained robust, driven by automotive catalysts and industrial applications. Companies that can guarantee consistent delivery and meet stringent buyer specifications, backed by a history of operational excellence, are more likely to secure market share. New entrants would need to invest heavily in building this credibility, which can be a lengthy and capital-intensive process.

- Reputation for Reliability: ARM's operational history contributes to buyer confidence, making it harder for new entrants to secure initial contracts.

- ESG Commitment: Demonstrating strong environmental and social practices, a growing factor for buyers, provides ARM with a competitive edge over less established firms.

- Buyer Trust: Major off-takers often prefer established suppliers with a proven history of meeting quality and volume requirements, creating a hurdle for new competitors.

- Long-Term Contracts: The difficulty new entrants face in securing these essential contracts can significantly slow their market entry and growth.

The threat of new entrants in the mining sector, particularly for companies like African Rainbow Minerals (ARM), is significantly constrained by several high barriers. These include the immense capital required for mine development, the need to achieve economies of scale to compete on cost, and the challenges in securing mineral rights and distribution networks.

Furthermore, navigating complex regulatory environments, including licensing and ESG compliance, and building a reputation for reliability and trust with buyers are substantial deterrents for potential new competitors. These factors collectively make it difficult for new players to effectively challenge established entities in 2024.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for African Rainbow Minerals is built upon comprehensive data from annual reports, investor presentations, and industry-specific research from reputable sources like S&P Global Market Intelligence. This ensures an accurate assessment of competitive dynamics within the mining sector.