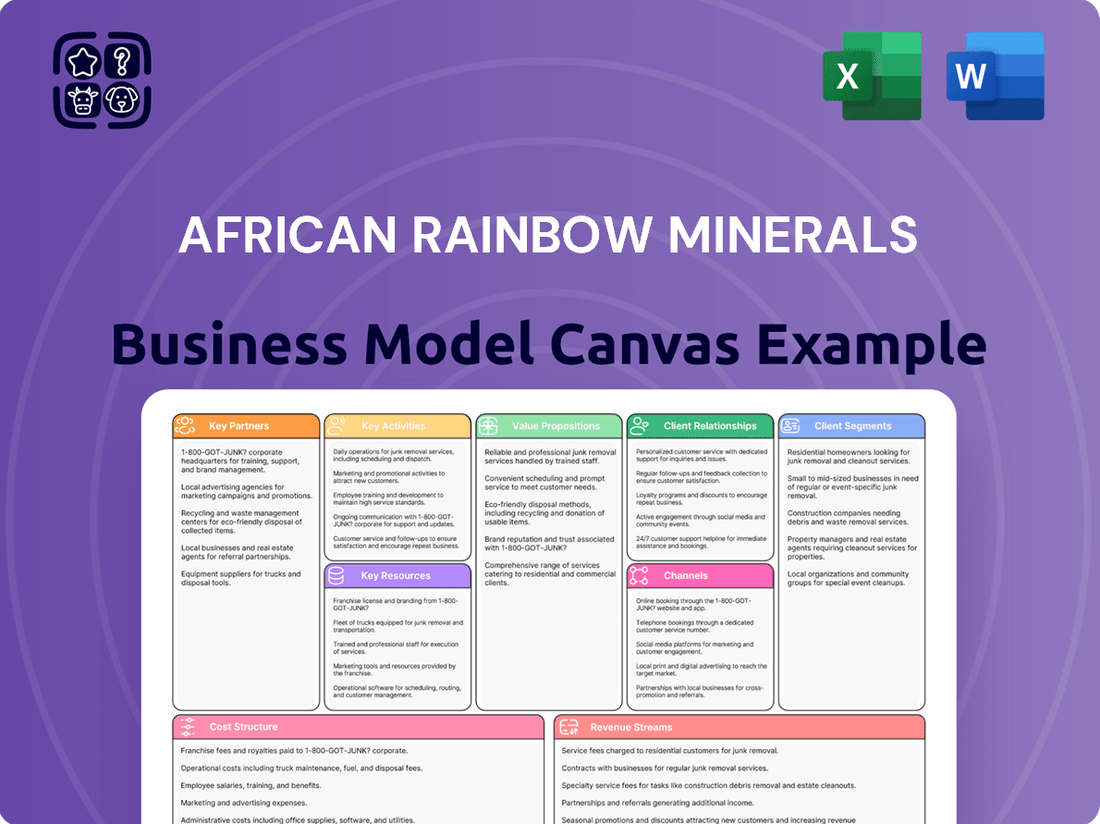

African Rainbow Minerals Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

African Rainbow Minerals Bundle

Unlock the strategic blueprint behind African Rainbow Minerals's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how they leverage key partnerships and activities to deliver value in the mining sector. Discover their customer segments and revenue streams to gain actionable insights for your own ventures.

Partnerships

African Rainbow Minerals (ARM) actively pursues joint ventures and strategic alliances to enhance its operational capabilities and market reach. A prime example is its significant 50% stake in Assmang, a major player in the mining of manganese, iron ore, and chrome, which allows ARM to share the substantial capital expenditure and operational risks associated with these large-scale mining operations.

Further diversifying its portfolio, ARM holds a strategic investment in Harmony Gold Mining Company, a prominent gold producer. This alliance allows ARM to tap into the gold sector's potential while leveraging Harmony's established expertise and infrastructure. In 2024, ARM’s share of headline earnings from its 50% interest in Assmang contributed significantly to its overall financial performance, underscoring the value of these key partnerships.

African Rainbow Minerals (ARM) actively collaborates with academic institutions like Wits University to drive technological advancements in mining. These partnerships are crucial for developing innovative solutions and ensuring a strong future talent pool.

These collaborations focus on critical areas such as blending and grade control strategies, as well as tailings deposition, aiming to enhance operational efficiency and sustainability. For instance, in 2024, ARM's investment in research and development, including these academic ties, underscores its commitment to staying at the forefront of mining technology.

African Rainbow Minerals (ARM) relies heavily on energy and infrastructure providers to ensure operational continuity and efficiency across its mining activities. These partnerships are fundamental for securing consistent and cost-effective power, a critical input for extraction and processing.

A prime example of this strategic reliance is ARM Platinum's commitment to renewable energy. The company has entered into a significant 20-year power purchase agreement with SOLA Group. This agreement specifically covers a 100MW solar photovoltaic facility, which is anticipated to commence operations by August 2025. This move underscores ARM's dedication to integrating sustainable energy sources, aiming to reduce its carbon footprint and ensure long-term energy security.

Government and Regulatory Bodies

African Rainbow Minerals (ARM) actively collaborates with government and regulatory bodies to secure essential mining licenses and maintain operational compliance. This engagement is crucial for navigating South Africa's complex mining sector, ensuring adherence to environmental and social governance standards, and aligning with national development goals. For example, ARM's operations are strictly governed by the JSE Listings Requirements and the South African Companies Act, underscoring the importance of these partnerships.

- Securing Mining Licenses: Partnerships facilitate the acquisition and renewal of licenses critical for exploration and production.

- Regulatory Compliance: Collaboration ensures adherence to environmental protection laws and social responsibility mandates.

- National Development: Engagement supports government objectives related to job creation and economic contribution within the mining sector.

Local Communities and Stakeholder Engagement

African Rainbow Minerals (ARM) actively cultivates strong relationships with local communities, recognizing them as vital partners in sustainable mining operations. This commitment translates into tangible investments aimed at fostering socio-economic development and enhancing community resilience.

ARM's engagement strategy involves direct investment in critical infrastructure and social upliftment projects, tailored to meet the specific needs identified through ongoing dialogue. For example, in the 2023 financial year, ARM reported significant contributions to community development initiatives across its operations, underscoring its dedication to shared value creation.

- Community Investment: ARM's focus on community development includes projects in education, healthcare, and infrastructure, aiming to build long-term sustainability beyond the mine's lifespan.

- Stakeholder Dialogue: Regular consultations with community leaders and residents ensure that ARM's initiatives are aligned with local priorities and foster a sense of shared ownership.

- Economic Empowerment: The company supports local economic development through procurement opportunities and skills training programs, aiming to create lasting economic benefits for the communities in which it operates.

ARM's key partnerships are foundational to its success, particularly its 50% stake in Assmang, a venture that shares capital expenditure and operational risks in iron ore, manganese, and chrome mining. This strategic alliance is crucial for large-scale mining operations. Furthermore, ARM's investment in Harmony Gold provides access to the gold sector, leveraging established expertise.

Collaborations with energy providers, such as the 20-year power purchase agreement for a 100MW solar facility with SOLA Group, are vital for operational continuity and sustainability. ARM also partners with academic institutions like Wits University to drive technological innovation and talent development in mining, focusing on efficiency and sustainability.

Engaging with government and regulatory bodies is essential for securing licenses and ensuring compliance with environmental and social standards. ARM's commitment to local communities through socio-economic development projects and dialogue is also a critical partnership for sustainable operations.

| Partnership Type | Key Partner Example | Strategic Importance | 2024 Financial Impact/Data Point |

|---|---|---|---|

| Joint Venture | Assmang (50% stake) | Risk sharing, capital access for iron ore, manganese, chrome | Significant contribution to ARM's headline earnings |

| Strategic Investment | Harmony Gold Mining Company | Access to gold sector, leveraging expertise | Diversification of ARM's portfolio |

| Energy Provider | SOLA Group (100MW solar agreement) | Energy security, sustainability, cost efficiency | 20-year agreement commencing operations by August 2025 |

| Academic Collaboration | Wits University | Technological advancement, talent pipeline | Focus on blending, grade control, and tailings deposition |

What is included in the product

This Business Model Canvas provides a strategic overview of African Rainbow Minerals' operations, focusing on its key customer segments, value propositions, and revenue streams within the mining sector.

It details the company's core activities, resources, and partnerships, offering insights into its competitive advantages and operational efficiency.

African Rainbow Minerals' Business Model Canvas acts as a pain point reliever by clearly mapping its value proposition of sustainable and responsible mining, addressing stakeholder concerns about environmental impact and community engagement.

It provides a structured approach to identify and mitigate operational risks and inefficiencies, thereby alleviating pain points related to cost management and resource optimization.

Activities

African Rainbow Minerals (ARM) actively engages in the crucial process of identifying and evaluating potential new mineral deposits through extensive exploration activities. This foundational step is vital for securing future resource pipelines and ensuring long-term growth.

Following successful exploration, ARM undertakes the complex and capital-intensive task of mine development. This includes building the necessary infrastructure to extract minerals efficiently. For instance, the development of the Merensky project represents a significant investment in bringing new resources online.

However, ARM’s approach to mine development is also strategic and adaptable. The company may defer or adjust development timelines for certain projects based on prevailing market conditions and economic outlooks, demonstrating a pragmatic response to industry volatility. This flexibility helps manage capital and optimize returns in a dynamic global market.

African Rainbow Minerals (ARM) is deeply engaged in the extraction of a diverse range of valuable commodities. These include platinum group metals (PGMs), iron ore, manganese ore, chrome ore, coal, copper, and nickel, showcasing the breadth of its mining portfolio.

The company’s operational footprint is primarily located in South Africa, with a significant presence also in Malaysia. ARM places a strong emphasis on ensuring these extraction processes are both efficient and adhere to the highest safety standards.

For the fiscal year 2023, ARM reported a substantial increase in headline earnings to R12.4 billion, driven by strong commodity prices and operational performance, underscoring the success of its mining and extraction activities.

African Rainbow Minerals (ARM) actively engages in mineral beneficiation and processing, transforming raw mined materials into higher-value products. This critical step goes beyond simple extraction, adding significant value to their diverse mineral portfolio.

ARM's processing capabilities span a wide range of commodities, including iron ore, manganese ore, chrome ore, platinum group metals (PGMs), nickel, and coal. They also produce manganese alloys, further refining their output for specific market demands.

For instance, in the fiscal year 2023, ARM's manganese operations, including alloy production, contributed significantly to their overall performance, demonstrating the economic importance of their beneficiation activities.

Sales, Marketing, and Distribution

African Rainbow Minerals (ARM) actively manages the sale, marketing, and distribution of its various mineral products to a worldwide customer base. This involves strategic engagement with global markets to ensure optimal reach and customer satisfaction.

The company's operations are significantly influenced by global commodity price volatility and fluctuating exchange rates, which ARM actively monitors and manages to maximize sales volumes and overall revenue. This proactive approach is crucial for maintaining profitability in a dynamic market.

In 2024, ARM's sales performance is closely tied to the global demand for key commodities like platinum group metals and iron ore. For instance, platinum prices saw fluctuations throughout the year, impacting the revenue generated from ARM's platinum operations.

- Global Reach: ARM distributes its mineral products to a diverse international clientele, ensuring a broad market presence.

- Price and Exchange Rate Management: The company actively navigates fluctuating commodity prices and exchange rates to optimize sales revenue.

- Market Dynamics: Sales strategies are adapted to respond to global demand shifts for commodities such as platinum group metals and iron ore.

Environmental, Social, and Governance (ESG) Management

African Rainbow Minerals (ARM) actively manages its environmental, social, and governance (ESG) impact through a commitment to responsible mining. This includes focused efforts on decarbonization, aiming to reduce greenhouse gas emissions, and diligent water management across its operations. Furthermore, ARM prioritizes community development initiatives, fostering positive relationships and contributing to local well-being.

Key activities in ARM's ESG management for 2024 and beyond include setting ambitious targets for greenhouse gas emission reductions, aligning with global sustainability goals. The company is also implementing specific programs to enhance safety performance, ensuring the well-being of its workforce. These efforts are crucial for maintaining operational integrity and stakeholder trust.

- Decarbonization Efforts: ARM is implementing strategies to lower its carbon footprint, with a focus on energy efficiency and exploring cleaner energy sources for its mining operations.

- Water Management: The company employs advanced water management techniques to minimize consumption and ensure responsible discharge, protecting local water resources.

- Community Development: ARM invests in social upliftment programs, education, and infrastructure development in the communities where it operates, aiming for shared value creation.

- Safety Performance: Continuous improvement in safety protocols and training is a core activity, with the goal of achieving zero harm to employees and contractors.

ARM's key activities revolve around the entire mining value chain, from discovering new mineral deposits through exploration to extracting and processing valuable commodities like platinum group metals and iron ore. The company actively manages sales and marketing, navigating global market dynamics and commodity price fluctuations to maximize revenue. Furthermore, ARM demonstrates a strong commitment to environmental, social, and governance (ESG) principles, focusing on decarbonization, water management, and community development to ensure responsible and sustainable operations.

Full Version Awaits

Business Model Canvas

The African Rainbow Minerals Business Model Canvas preview you see is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, professionally structured analysis that will be yours to use immediately. No mockups or samples, just the full, ready-to-deploy Business Model Canvas for ARM.

Resources

African Rainbow Minerals' (ARM) most crucial assets are its vast mineral reserves, spanning platinum group metals (PGMs), iron ore, manganese, chrome, coal, copper, and gold. These reserves are the bedrock of its operations and future potential.

These extensive mineral deposits are complemented by the essential mining rights and licenses that ARM holds. These legal entitlements are fundamental to the company's long-term operational sustainability and its ability to extract value from its resource base.

For instance, as of the fiscal year ending June 30, 2023, ARM reported attributable attributable marketable ore reserves of 2.3 billion tonnes, with a significant portion being iron ore. This demonstrates the sheer scale of the resources ARM has secured.

African Rainbow Minerals (ARM) relies heavily on its substantial physical assets, which include operational mines, advanced processing plants, and extensive related infrastructure. These tangible resources are fundamental to the company's ability to extract and refine valuable mineral resources efficiently.

The company also maintains a significant fleet of specialized mining equipment, essential for various stages of the extraction and processing lifecycle. This includes heavy-duty vehicles, drilling machinery, and beneficiation equipment, all critical for operational success and cost-effectiveness.

For the fiscal year ending June 30, 2023, ARM reported capital expenditure of R7.9 billion, a significant portion of which was directed towards maintaining and upgrading its existing mining infrastructure and equipment, underscoring the importance of these key resources to its operations and future growth.

African Rainbow Minerals (ARM) relies heavily on its highly skilled workforce, a critical resource for its operations. This team includes geologists, engineers, skilled operators, and experienced management professionals.

The collective expertise of these individuals is fundamental to ARM's success, covering everything from initial exploration and resource evaluation to efficient mining, processing, and overall operational management. Their deep understanding drives innovation within the company.

For the fiscal year 2024, ARM reported a significant investment in its people, with employee-related costs amounting to R6.7 billion. This investment underscores the company's commitment to nurturing and retaining the talent essential for its competitive edge.

Financial Capital and Investment Capacity

African Rainbow Minerals (ARM) leverages its strong financial capital and investment capacity to fuel growth. As of the first half of the 2024 financial year, ARM reported a substantial net cash position, demonstrating its financial resilience and capacity to fund operations and strategic initiatives.

This robust financial standing is particularly vital for ARM's capital-intensive mining ventures, enabling significant investments in exploration, development, and operational enhancements. The company's ability to generate and maintain healthy cash flows underpins its long-term sustainability and expansion plans.

- Net Cash Position: ARM's financial strength allows for strategic deployment of capital in a demanding industry.

- Investment Capacity: The company can readily fund new projects and enhance existing operations.

- Growth Prospects: Financial flexibility enables ARM to capitalize on value-enhancing opportunities.

- Capital Intensity: ARM's financial resources are essential for the high costs associated with mining.

Technology and Innovation

African Rainbow Minerals (ARM) leverages advanced mining technologies as a core resource, investing significantly in exploration, extraction, and processing innovations. This commitment ensures efficient operations and competitive advantage.

The company's focus extends to environmental management technologies, crucial for sustainable mining practices. Additionally, ARM actively develops and implements renewable energy solutions to power its mining activities, reducing operational costs and environmental impact.

- Access to advanced exploration and extraction technologies

- Investment in processing and beneficiation innovations

- Development and deployment of renewable energy solutions for operations

- Implementation of environmental management and monitoring technologies

ARM's key resources are its substantial mineral reserves, including PGMs, iron ore, and manganese, supported by essential mining rights and licenses. These are complemented by significant physical assets like operational mines and processing plants, along with a specialized fleet of mining equipment. The company also heavily relies on its skilled workforce, encompassing geologists, engineers, and management, whose expertise drives operational success. Furthermore, ARM leverages strong financial capital, evidenced by its net cash position, enabling strategic investments in growth and operational enhancements, and embraces advanced mining technologies, including those for environmental management and renewable energy integration.

| Resource Category | Key Components | Fiscal Year Data (Ending June 30, 2023/H1 2024) |

|---|---|---|

| Mineral Reserves | PGMs, Iron Ore, Manganese, Chrome, Coal, Copper, Gold | Attributable marketable ore reserves: 2.3 billion tonnes (FY23) |

| Physical Assets | Operational mines, processing plants, infrastructure, mining equipment | Capital expenditure: R7.9 billion (FY23) towards infrastructure and equipment |

| Human Capital | Skilled workforce (geologists, engineers, operators, management) | Employee-related costs: R6.7 billion (FY24) |

| Financial Capital | Investment capacity, cash flow generation | Substantial net cash position (H1 2024) |

| Technology | Exploration, extraction, processing, environmental management, renewable energy | Ongoing investment in technological advancements and sustainable solutions |

Value Propositions

African Rainbow Minerals (ARM) boasts a robust and diversified mineral portfolio, encompassing platinum group metals (PGMs), iron ore, coal, copper, and gold. This strategic spread ensures a stable supply of materials vital for numerous global industries, from automotive manufacturing to construction and electronics.

This inherent diversification acts as a crucial risk mitigation strategy for ARM. By not relying on a single commodity, the company is better positioned to weather the inherent volatility and price fluctuations common in the global commodities market, providing a more predictable revenue stream.

For the fiscal year 2023, ARM reported headline earnings of R11.9 billion, demonstrating the financial strength derived from its diverse asset base. The company's iron ore operations, in particular, contributed significantly, with attributable sales volumes reaching 11.8 million tonnes for the year.

African Rainbow Minerals (ARM) prioritizes a dependable supply of its diverse mineral portfolio, ensuring consistent delivery to its global customer base. This commitment is underpinned by rigorous operational standards, aiming to meet market demands efficiently.

The company's dedication to responsible mining practices is a cornerstone of its value proposition. ARM actively invests in safety protocols and environmental management systems, reflecting a deep commitment to ethical operations. For instance, in the fiscal year ending June 30, 2023, ARM reported a strong safety record, with a Lost Time Injury Frequency Rate (LTIFR) of 0.50 per million man-hours across its operations.

This focus on safety and environmental stewardship not only mitigates operational risks but also significantly bolsters ARM's reputation. By consistently demonstrating high standards of corporate responsibility, ARM solidifies its position as a trusted and preferred supplier in the competitive international mining sector, fostering long-term partnerships.

African Rainbow Minerals (ARM) actively fuels economic development by creating substantial employment opportunities. In the 2023 financial year, ARM reported employing over 14,000 people, a significant portion of whom are from local communities. This direct job creation injects vital income into regional economies.

ARM prioritizes local procurement, channeling a considerable portion of its operational spending back into the communities where it operates. In 2023, the company spent R7.5 billion on local suppliers, fostering the growth of small and medium-sized enterprises and building local capacity.

Beyond direct economic contributions, ARM invests in community development projects focused on education, health, and infrastructure. These initiatives, such as the support for the University of the Witwatersrand's mining engineering department, aim to create long-term, sustainable benefits and shared value for all stakeholders.

Operational Excellence and Efficiency

African Rainbow Minerals (ARM) is deeply committed to achieving operational excellence and efficiency across its diverse mining portfolio. This focus is driven by a continuous improvement ethos, aiming to refine mining techniques, enhance cost management strategies, and strategically adopt new technologies. The goal is to consistently optimize production volumes and drive down unit costs, ensuring resilience even when market conditions become challenging.

ARM's pursuit of efficiency is evident in its ongoing efforts to streamline operations and leverage innovation. For instance, in the fiscal year ending June 30, 2024, the company reported a significant focus on optimizing its platinum group metals (PGM) operations, which directly impacts cost structures and production output. This dedication to improvement underpins ARM's ability to deliver value.

- Continuous Improvement: Ongoing refinement of mining methods and processes to boost productivity and reduce waste.

- Cost Management: Strict adherence to cost control measures across all operational facets, from exploration to processing.

- Technological Adoption: Strategic implementation of advanced technologies to enhance safety, efficiency, and resource recovery.

- Production Optimization: Maximizing output volumes while minimizing per-unit production expenses, even amidst market volatility.

Commitment to Sustainability and Climate Action

African Rainbow Minerals (ARM) demonstrates a strong commitment to long-term sustainability, actively pursuing ambitious targets for net-zero greenhouse gas emissions. This focus on environmental stewardship resonates deeply with a growing segment of environmentally conscious customers and investors who prioritize responsible sourcing and corporate accountability.

ARM's strategic investments in renewable energy infrastructure are a tangible manifestation of this commitment. For instance, by 2024, the company has been actively developing and integrating solar power solutions across its operations, aiming to significantly reduce its carbon footprint. This proactive approach not only aligns with global climate action goals but also positions ARM as a leader in responsible mining practices within the African continent.

- Net-Zero Targets: ARM is actively working towards achieving net-zero greenhouse gas emissions by a specified future date, demonstrating a clear long-term environmental strategy.

- Renewable Energy Investments: The company is investing in and implementing renewable energy sources, such as solar power, to decarbonize its operations and reduce reliance on fossil fuels.

- Investor Appeal: This commitment attracts investors who are increasingly focused on environmental, social, and governance (ESG) factors, seeking out companies with strong sustainability credentials.

- Customer Preference: Environmentally conscious customers are more likely to choose products and partners that align with their values, making ARM's sustainability efforts a key differentiator.

ARM offers a diversified mineral portfolio, including PGMs, iron ore, coal, copper, and gold, ensuring a stable supply for global industries. This diversification mitigates risk from commodity price volatility, leading to more predictable revenue streams.

ARM prioritizes dependable supply through rigorous operational standards and a commitment to responsible mining, evidenced by a strong safety record. For the fiscal year ending June 30, 2023, ARM reported a Lost Time Injury Frequency Rate (LTIFR) of 0.50 per million man-hours.

The company fuels economic development by creating jobs, employing over 14,000 people in FY2023, and prioritizes local procurement, spending R7.5 billion on local suppliers in 2023. ARM also invests in community projects focused on education, health, and infrastructure.

ARM is committed to operational excellence and efficiency, continuously refining mining techniques and managing costs. The company is strategically adopting new technologies to optimize production and reduce unit costs, as seen in its focus on PGM operations in FY2024.

Customer Relationships

African Rainbow Minerals (ARM) secures its revenue streams through robust, long-term commercial contracts. These agreements are primarily with industrial end-users, manufacturers, and commodity traders who rely on a consistent and high-quality supply of minerals.

These enduring relationships are built on a foundation of dependable delivery, unwavering product quality, and attractive pricing structures. For instance, in the fiscal year 2023, ARM’s focus on these stable contract sales contributed significantly to its operational stability and predictable cash flow.

African Rainbow Minerals (ARM) leverages direct sales channels and dedicated account management to foster strong relationships with its primary clientele. This approach ensures that ARM can offer customized solutions and maintain prompt communication, leading to a more profound understanding of individual customer requirements and prevailing market trends.

African Rainbow Minerals (ARM) prioritizes transparent and proactive communication with its investors and shareholders. This includes regular financial reporting, investor presentations, and timely dividend declarations, all designed to foster and sustain investor confidence. For the fiscal year ended June 30, 2023, ARM reported a headline attributable profit of R10.7 billion, demonstrating a strong financial performance that underpins these relationships.

Community Engagement and Social Investment

African Rainbow Minerals (ARM) actively cultivates deep connections with the communities surrounding its operations. This is achieved through targeted social investment and local economic development initiatives designed to tackle pressing socio-economic issues and bolster community capabilities. This strategy is crucial for securing and maintaining a positive social license to operate.

In 2024, ARM's commitment to community engagement was evident through its significant investments. For instance, the company allocated R280 million towards social economic development and R175 million towards enterprise development initiatives, demonstrating a tangible dedication to uplifting local economies and improving livelihoods. These efforts are not merely about compliance; they represent a core aspect of ARM's operational philosophy.

- Community Investment: ARM's social investment programs focus on areas such as education, health, and infrastructure, directly addressing community needs.

- Local Economic Development: The company prioritizes local procurement and supports small and medium-sized enterprises (SMEs) within host communities, fostering sustainable economic growth.

- Skills Development: ARM invests in training and development programs to enhance the skills of community members, improving their employability and entrepreneurial potential.

- Stakeholder Dialogue: Regular engagement with community leaders and residents ensures that ARM’s initiatives are aligned with community priorities and expectations.

Industry Associations and Partnerships

African Rainbow Minerals (ARM) actively engages with industry associations and participates in various mining forums. This involvement is crucial for fostering strong relationships across the broader mining landscape. For instance, ARM's participation in organizations like the Minerals Council South Africa allows for collaborative problem-solving and advocacy on critical industry issues.

These interactions are vital for knowledge sharing and the promotion of best practices within the sector. By contributing to and benefiting from these platforms, ARM stays abreast of evolving industry standards and technological advancements. This collaborative approach helps address common challenges faced by mining companies, ensuring a more sustainable and responsible industry.

- Industry Engagement: ARM's membership in key mining associations facilitates direct interaction with peers and stakeholders.

- Knowledge Exchange: Participation in forums allows for the sharing of operational insights and the adoption of new methodologies.

- Best Practice Promotion: ARM contributes to and benefits from the collective effort to establish and uphold high industry standards.

- Challenge Resolution: Collaborative discussions within these groups help in finding solutions to shared operational, environmental, and social challenges.

ARM cultivates enduring customer relationships through dependable delivery, consistent quality, and competitive pricing, primarily via long-term commercial contracts with industrial clients. This strategy underpins operational stability and predictable cash flow, as seen in fiscal year 2023. The company also emphasizes direct sales and dedicated account management to tailor solutions and maintain open communication, fostering a deeper understanding of client needs.

Channels

African Rainbow Minerals (ARM) leverages its dedicated direct sales and marketing teams to cultivate robust relationships with industrial clients and commodity buyers worldwide. This direct engagement facilitates personalized negotiations and the development of tailored solutions, enhancing customer satisfaction and loyalty.

In 2024, ARM's direct sales strategy has been crucial in navigating volatile commodity markets, allowing for agile responses to customer needs and market shifts. The company's focus on building strong, personal connections with key buyers underpins its ability to secure long-term offtake agreements and maintain a competitive edge.

African Rainbow Minerals (ARM) leverages global commodity markets and exchanges to sell its diverse mineral output, including platinum group metals, iron ore, and coal. These platforms offer essential liquidity and price discovery mechanisms, crucial for maximizing revenue from its extensive resource base.

In 2024, global commodity markets continued to be influenced by geopolitical events and shifts in demand. For instance, the platinum market, a key segment for ARM, saw its price fluctuate significantly, underscoring the importance of ARM's access to liquid exchanges for efficient sales and hedging strategies.

African Rainbow Minerals (ARM) depends heavily on its robust logistics and supply chain to move vast quantities of raw materials and processed minerals. This intricate network is the backbone of their operations, ensuring resources reach processing facilities and then customers efficiently.

The effectiveness of ARM's supply chain hinges on critical infrastructure like roads, railways, and port facilities. For instance, in 2024, South Africa's Transnet Freight Rail faced challenges impacting mineral exports, highlighting the sensitivity of ARM's operations to these external factors and the need for resilient logistics planning.

Timely and cost-effective delivery is paramount. ARM's ability to manage these transportation costs directly influences its profitability and competitiveness in the global minerals market, making strategic partnerships and infrastructure investment key considerations.

Investor Relations Platforms and Publications

African Rainbow Minerals (ARM) actively engages its investor audience through a multi-channel approach. The company's official website serves as a central hub, offering readily accessible financial data, operational updates, and strategic insights. This digital presence is crucial for maintaining transparency and providing stakeholders with timely information.

ARM also leverages financial news services to disseminate key announcements and performance figures. Furthermore, the company publishes integrated annual reports, which provide a comprehensive overview of its financial health, operational achievements, and future outlook. These reports are vital for in-depth analysis by investors and financial professionals.

- Official Website: ARM's corporate website is a primary channel for detailed financial statements, investor presentations, and news releases.

- Financial News Services: Dissemination of critical information through platforms like Bloomberg and Reuters ensures broad reach among the financial community.

- Integrated Annual Reports: These detailed publications offer a holistic view of ARM's performance, strategy, and sustainability efforts, often highlighting key metrics such as revenue growth and operational efficiency. For instance, ARM reported a headline loss of 12 cents per share for the six months ended December 31, 2023, a significant shift from the headline earnings of 236 cents per share in the prior comparable period, reflecting challenging market conditions.

Public Relations and Media Outlets

African Rainbow Minerals (ARM) actively leverages public relations and media outlets to shape its corporate image and disseminate vital information. This strategy is crucial for communicating their commitment to sustainability, highlighting operational successes, and engaging with a broad audience, including investors and the general public.

By proactively managing its public perception, ARM aims to build trust and ensure stakeholders are well-informed about the company's performance and strategic direction. This includes transparent reporting on environmental, social, and governance (ESG) initiatives, which are increasingly important to investors.

- Brand Reputation Management: ARM uses media relations to foster a positive brand image, emphasizing responsible mining practices and community engagement.

- Information Dissemination: Key operational achievements and financial results are communicated through press releases and media interviews to inform the market and stakeholders.

- Stakeholder Engagement: Public relations efforts facilitate dialogue with a diverse range of stakeholders, including government bodies, local communities, and industry associations.

- Sustainability Communication: ARM highlights its sustainability programs and their impact, aligning with global efforts towards responsible resource extraction and contributing to a lower carbon future.

ARM utilizes its direct sales force for key industrial clients and commodity buyers, fostering strong relationships and tailored solutions. This direct engagement in 2024 has been vital for navigating market volatility and securing offtake agreements, emphasizing personalized service.

Customer Segments

Global industrial manufacturers are a cornerstone customer segment for African Rainbow Minerals (ARM). These companies, spanning sectors like steel, automotive, chemicals, and electronics, rely heavily on ARM's diverse mineral output. For instance, ARM's iron ore is a critical input for steel production, a foundational material for countless manufacturing processes.

The demand from these industries directly impacts ARM's sales volumes. In the fiscal year 2023, ARM reported strong performance in its iron ore segment, contributing significantly to its overall revenue. This highlights the direct correlation between the health of global manufacturing and ARM's operational success.

ARM's platinum group metals (PGMs), chrome, copper, and nickel are equally vital for advanced manufacturing. The automotive industry, in particular, uses PGMs for catalytic converters and copper for electrical components. As global vehicle production trends upward, so does the demand for these essential minerals from manufacturers.

International commodity trading houses are crucial partners for African Rainbow Minerals (ARM), acting as the arteries for global mineral distribution. These firms, such as Glencore and Trafigura, are instrumental in moving ARM's output, like platinum group metals and coal, to markets worldwide. In 2023, global commodity trading revenue reached hundreds of billions of dollars, highlighting the scale of these operations and their importance to producers like ARM.

These trading giants manage the complex logistics and financial risks associated with international trade, including hedging against price fluctuations. For example, the price of platinum can be volatile; in early 2024, it traded around $900-$1000 per ounce, a range that requires sophisticated risk management by traders to ensure stable returns for ARM.

Energy producers and power utilities are key customers for African Rainbow Minerals (ARM), as they purchase ARM's coal to fuel electricity generation. In 2024, ARM continued to supply significant volumes of coal to the domestic South African power utility, Eskom, playing a vital role in the nation's energy mix.

Beyond traditional fossil fuels, ARM's strategic investments in renewable energy projects, such as solar and wind, position it to serve emerging customer segments. These are entities actively transitioning towards cleaner energy sources, seeking reliable partners for their evolving power needs.

Investors and Shareholders

Individual and institutional investors, including fund managers and financial analysts, are key stakeholders for African Rainbow Minerals (ARM). These investors are primarily driven by the prospect of financial returns and are closely monitoring ARM's performance. For instance, ARM's market capitalization as of early 2024 reflects investor confidence and valuation. They also place significant importance on transparency in ARM's reporting and its commitment to sustainable business practices.

These investors directly influence ARM's access to capital and its overall market valuation. Their decisions, based on financial analysis and outlook, can significantly impact ARM's share price and its ability to fund future projects. ARM's dividend policy and its track record of profitability are critical factors for this segment.

Key considerations for investors and shareholders include:

- Financial Performance: ARM's profitability, revenue growth, and earnings per share are closely scrutinized.

- Dividend Payouts: The consistency and growth of dividends are important indicators of financial health and shareholder returns.

- ESG Commitments: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions.

- Market Sentiment: Overall market conditions and investor appetite for mining stocks impact ARM's valuation.

Local Communities and Government Bodies

Local communities and government bodies are essential partners for African Rainbow Minerals (ARM), even though they aren't direct buyers of our minerals. Our operations have a significant impact on their well-being, making their support critical for our social license to operate. In 2024, ARM continued its commitment to community development, investing significantly in projects focused on education, health, and infrastructure, aiming to foster sustainable growth and shared prosperity.

Maintaining positive relationships with these stakeholders is paramount. This involves not only fulfilling our regulatory obligations but also actively engaging in initiatives that uplift the communities where we operate. For instance, ARM’s contributions to local economies extend beyond job creation, encompassing skills development programs designed to empower residents with transferable expertise.

- Social License to Operate: Ensuring community support is vital for uninterrupted operations.

- Community Development Investments: ARM's focus on education, health, and infrastructure in 2024 aimed to create lasting positive impacts.

- Regulatory Compliance: Strict adherence to all government regulations is a cornerstone of our stakeholder engagement.

- Economic Contribution: Beyond employment, ARM invests in local skills development to enhance community economic resilience.

African Rainbow Minerals (ARM) serves a diverse customer base, including global industrial manufacturers who depend on its iron ore, platinum group metals (PGMs), chrome, copper, and nickel for production. These manufacturers, vital to sectors like automotive and steel, drive significant demand for ARM's output. For example, ARM's iron ore segment reported strong performance in fiscal year 2023, underscoring this critical link.

International commodity trading houses are key intermediaries, facilitating the global distribution of ARM's minerals, such as PGMs and coal. These firms manage complex logistics and financial risks, ensuring stable market access for ARM. The volatile nature of commodity prices, like platinum trading around $900-$1000 per ounce in early 2024, highlights the importance of these trading partners.

Energy producers and power utilities, particularly domestic entities like South Africa's Eskom, are significant coal purchasers for electricity generation. ARM's continued supply to these sectors in 2024 demonstrates its role in the energy infrastructure. Furthermore, ARM's expansion into renewable energy projects positions it to serve emerging clean energy customers.

Individual and institutional investors, including fund managers, are crucial stakeholders focused on financial returns and ARM's market valuation. Their decisions, influenced by financial performance, dividend payouts, and ESG commitments, impact ARM's capital access and share price. ARM's market capitalization in early 2024 reflects this investor confidence.

| Customer Segment | Key Products/Services | 2023/2024 Relevance |

|---|---|---|

| Global Industrial Manufacturers | Iron Ore, PGMs, Chrome, Copper, Nickel | Strong demand for steel, automotive components; Iron ore segment performance in FY2023 |

| International Commodity Trading Houses | All minerals (distribution) | Facilitate global sales, manage price volatility (e.g., platinum ~$900-$1000/oz in early 2024) |

| Energy Producers & Power Utilities | Coal | Continued supply to Eskom in 2024; emerging renewable energy customers |

| Investors (Individual & Institutional) | Financial returns, ESG performance | Influence capital access, market valuation; focus on FY2023 results and ESG commitments |

Cost Structure

A substantial part of African Rainbow Minerals' (ARM) cost structure stems from the direct expenses involved in mining and processing. These include the costs of extracting minerals, refining them through beneficiation, the significant energy required for these operations, and the wages paid to the workforce at its numerous mine locations.

For the fiscal year ending June 30, 2023, ARM reported headline earnings of R11.4 billion. While specific breakdowns of operating costs for mining and processing aren't always isolated in headline earnings, these direct operational expenditures are fundamental drivers of profitability.

African Rainbow Minerals (ARM) commits significant capital expenditure to both establishing new mining ventures and enhancing current operations. This includes the substantial costs associated with exploration, mine construction, and the acquisition of necessary heavy machinery. For instance, in the financial year ending June 30, 2023, ARM's capital expenditure was R6.2 billion, a notable increase from R4.9 billion in the previous year, reflecting these ongoing investments.

Maintaining the operational integrity of existing mines and processing facilities also demands considerable capital. This ongoing investment ensures the safety, efficiency, and longevity of ARM's assets, covering everything from essential repairs to technological upgrades. These expenditures are vital for sustaining production levels and mitigating potential disruptions, directly impacting operational continuity and cost-effectiveness.

Logistics and transportation are significant cost drivers for African Rainbow Minerals (ARM). These expenses encompass moving ore from mines to processing facilities and then transporting finished products to markets. For instance, in the fiscal year ending June 30, 2023, ARM's cost of sales was R38.7 billion, with a substantial portion attributable to these logistical operations.

The company relies on a mix of rail, road, and port infrastructure to get its commodities to customers. Challenges such as limited rail capacity or port congestion can directly inflate these transportation costs, impacting overall profitability. These external factors are critical considerations in ARM's cost management strategy.

Employee Wages, Benefits, and Safety

Employee wages, benefits, and comprehensive safety programs represent a substantial portion of African Rainbow Minerals (ARM) operational expenditures. These costs are fundamental to maintaining a skilled and safe workforce, crucial for the demanding nature of mining operations. For the fiscal year ending June 30, 2023, ARM reported employee-related costs, encompassing salaries, wages, and benefits, as a key component of their overall cost structure. The company's commitment to stringent safety protocols necessitates ongoing investment in training, equipment, and health initiatives, further contributing to this significant cost center.

ARM's dedication to employee well-being is reflected in its continuous investment in safety. This includes:

- Competitive remuneration packages: Ensuring fair wages and comprehensive benefits to attract and retain talent.

- Extensive safety training: Implementing rigorous programs to minimize workplace risks and accidents.

- Health and wellness initiatives: Providing resources and support for employee physical and mental health.

- Safety infrastructure: Investing in advanced safety equipment and maintaining a safe working environment.

Environmental and Social Compliance Costs

African Rainbow Minerals (ARM) incurs significant costs related to environmental protection and social responsibility. These expenses are crucial for maintaining its social license to operate and adhering to increasingly stringent regulations.

These costs encompass investments in decarbonization strategies, aiming to reduce greenhouse gas emissions from its mining operations. For example, in the fiscal year ending June 30, 2024, ARM continued its focus on improving energy efficiency and exploring renewable energy sources for its mines.

Water management is another key area, with substantial spending on ensuring responsible water usage and minimizing environmental impact. This includes investments in water treatment facilities and water conservation programs across its various mining sites.

Furthermore, ARM allocates resources to community development projects, fostering positive relationships with the communities in which it operates. These initiatives often focus on education, healthcare, and economic empowerment, reflecting a commitment to shared value creation.

- Decarbonization Investments: Ongoing capital expenditure for energy efficiency upgrades and renewable energy integration at mining sites.

- Water Management Systems: Costs associated with advanced water treatment, recycling, and responsible discharge practices.

- Community Development Programs: Funding for local education, healthcare, infrastructure, and socio-economic initiatives.

- Regulatory Compliance: Expenses for environmental monitoring, reporting, permitting, and adherence to national and international standards.

African Rainbow Minerals' cost structure is heavily influenced by operational expenditures, including mining, processing, and energy consumption. Significant capital is also allocated to exploration, mine development, and maintaining existing assets. Logistics and transportation form another substantial cost component, directly impacted by infrastructure availability. Employee costs, encompassing wages, benefits, and safety programs, are critical to sustaining a skilled workforce.

Environmental and social responsibility also contribute to ARM's costs, with investments in decarbonization, water management, and community development initiatives. For the fiscal year ending June 30, 2023, ARM reported capital expenditure of R6.2 billion, underscoring ongoing investment in its operations and future growth.

| Cost Category | FY2023 (R billion) | FY2022 (R billion) | Notes |

|---|---|---|---|

| Cost of Sales | 38.7 | 34.5 | Includes mining, processing, and logistics costs. |

| Capital Expenditure | 6.2 | 4.9 | Investment in new projects and existing operations. |

| Employee Costs | Significant component | Significant component | Wages, benefits, and safety programs. |

Revenue Streams

African Rainbow Minerals (ARM) generates significant revenue from selling platinum group metals (PGMs) like platinum, palladium, and rhodium. These precious metals are crucial components in catalytic converters and various industrial applications, making their sales a cornerstone of ARM's income.

The PGM market is known for its price volatility, which directly affects ARM's headline earnings. For instance, in the 2023 financial year, ARM reported a substantial decrease in headline earnings, partly due to lower PGM prices compared to the previous year, highlighting the impact of market fluctuations on this key revenue stream.

Sales of iron ore are a cornerstone of African Rainbow Minerals' (ARM) revenue generation, primarily driven by its substantial investment in Assmang. This segment is highly sensitive to global commodity markets, meaning fluctuations in iron ore prices and the volume of ore sold directly impact ARM's financial performance.

For the fiscal year ending June 30, 2023, ARM's attributable iron ore sales revenue reached R32.4 billion. This highlights the critical role of iron ore in the company's overall financial health, underscoring the importance of managing production and market exposure effectively.

African Rainbow Minerals (ARM) generates significant revenue from the mining and sale of manganese ore, a crucial component in steel production. In the fiscal year 2023, ARM's manganese operations, particularly through its joint venture with Assmang, demonstrated robust performance, contributing substantially to the company's overall financial results.

Beyond raw ore, ARM also profits from the production and sale of manganese alloys, such as ferromanganese and silicomanganese. These value-added products are essential for enhancing the properties of steel and represent a key part of ARM's diversified income strategy, providing a higher margin compared to raw ore sales.

Coal Sales

African Rainbow Minerals (ARM) generates a significant portion of its revenue through the sale of thermal coal. This revenue is directly tied to global commodity markets, meaning prices can shift based on demand and supply dynamics.

In 2024, ARM's coal operations, particularly its stake in the ARM Coal business, continue to be a key contributor to its overall financial performance. Factors like international demand for energy and the efficiency of export logistics play a crucial role in the volume and value of coal sold.

- Thermal Coal Sales: ARM's primary revenue driver from coal involves selling thermal coal, used primarily for power generation.

- Price Volatility: Revenue is subject to fluctuations in global coal prices, which are influenced by energy demand and geopolitical factors.

- Export Volumes: The quantity of coal exported is a critical determinant of revenue, impacted by port capacity and shipping costs.

Copper and Gold Investments

African Rainbow Minerals (ARM) generates revenue and holds strategic value through its involvement in copper and gold, despite a broader diversification across other minerals. This dual focus allows ARM to tap into different commodity cycles and leverage its expertise in mining operations.

ARM's strategic investment in gold is primarily channeled through its significant stake in Harmony Gold Mining Company. This relationship provides ARM with exposure to gold production and market dynamics without direct operational control, aligning with its diversified investment strategy. As of early 2024, Harmony Gold is a significant player in the South African gold mining sector.

Further expanding its copper footprint, ARM recently acquired a stake in Surge Copper Corp. This move signifies a deliberate effort to bolster its presence in the copper market, a metal increasingly vital for electrification and renewable energy technologies. Surge Copper Corp. is actively developing copper projects, offering ARM potential for future growth and value creation in this key commodity.

- Strategic Gold Investment: ARM holds a substantial investment in Harmony Gold Mining Company, a major South African gold producer.

- Copper Market Entry: ARM has acquired a stake in Surge Copper Corp., marking an expansion into copper exploration and development.

- Diversification Benefits: These investments in copper and gold complement ARM's primary mineral portfolio, offering exposure to different market drivers and revenue streams.

ARM's revenue streams are primarily derived from the sale of platinum group metals (PGMs), iron ore, manganese, and coal. The company also generates income from its strategic investments in gold and copper. These diverse commodity sales are influenced by global market prices and demand.

| Mineral | Key Products | 2023 Revenue (Attributable, R billions) | Key Drivers |

| Platinum Group Metals (PGMs) | Platinum, Palladium, Rhodium | Significant contributor, though specific figure not detailed separately from overall PGM operations | Catalytic converters, industrial demand, price volatility |

| Iron Ore | Iron Ore | 32.4 | Steel production, global commodity markets |

| Manganese | Manganese Ore, Ferromanganese, Silicomanganese | Substantial contribution from manganese operations | Steel production, value-added alloys |

| Coal | Thermal Coal | Key contributor, specific figure not detailed separately | Power generation, global energy demand, export logistics |

| Gold | N/A (Investment) | N/A (Investment) | Harmony Gold stake, market dynamics |

| Copper | N/A (Investment) | N/A (Investment) | Surge Copper Corp. stake, electrification demand |

Business Model Canvas Data Sources

The African Rainbow Minerals Business Model Canvas is built using extensive financial disclosures, operational reports, and market intelligence. These sources provide a comprehensive understanding of the company's strategic positioning and market dynamics.