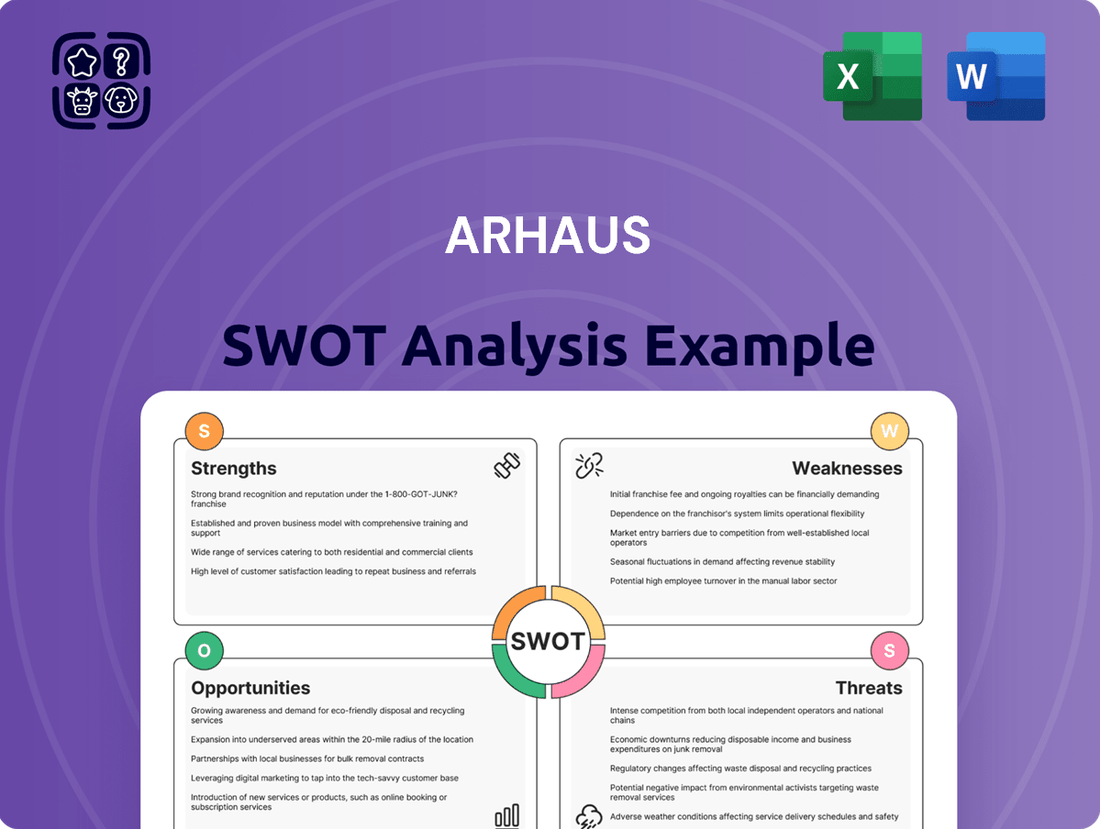

Arhaus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arhaus Bundle

Arhaus, a leader in artisanal home furnishings, leverages strong brand loyalty and unique product offerings as key strengths. However, they face challenges in adapting to evolving consumer preferences and a competitive online marketplace. Understanding these dynamics is crucial for anyone looking to invest or strategize within the home décor sector.

Want the full story behind Arhaus's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Arhaus has cultivated a strong brand identity centered on premium quality and distinctive craftsmanship. This positioning resonates with consumers who value unique, durable home furnishings, setting it apart from more commoditized competitors.

The company's commitment to handcrafted, heirloom-quality pieces, often sourced through global artisan partnerships, reinforces this premium perception. This focus on unique design and meticulous production underpins Arhaus's appeal to a discerning customer base.

Arhaus demonstrates a strong commitment to sustainability by actively incorporating recycled, reclaimed, and responsibly sourced materials like wood from managed forests and recycled metals into its product lines. This focus on eco-friendly practices appeals to a growing segment of environmentally aware consumers, particularly within the premium furniture sector.

This dedication to sustainability is further amplified through strategic partnerships with organizations focused on reforestation and forest conservation, reinforcing Arhaus's role as a responsible corporate citizen and enhancing its brand appeal.

Arhaus excels with a robust omnichannel retail strategy, seamlessly blending physical showrooms with a strong e-commerce presence. This integrated approach ensures customers can engage with the brand and make purchases through their preferred channels, enhancing convenience and accessibility.

The company's strategic expansion of its physical footprint is a key strength. As of December 2024, Arhaus operates 103 showrooms across 30 states. This growing network not only drives brand awareness but also directly contributes to sales by providing tangible touchpoints for customers to experience its products.

Arhaus's commitment to further showroom expansion, with plans for new openings annually, underscores its dedication to strengthening its physical presence. This ongoing investment complements its digital efforts, creating a cohesive and powerful retail ecosystem designed to capture a wider customer base and drive sustained growth.

Solid Financial Position and Growth Initiatives

Arhaus demonstrated exceptional financial health, reporting record revenue for fiscal year 2024. As of March 2025, the company maintained a robust balance sheet, notably with no long-term debt. This strong financial footing allows for strategic reinvestment.

The company is actively pursuing growth through significant investments in key areas. These initiatives include:

- Supply Chain Enhancements: Upgrades aimed at improving efficiency and reliability.

- Technology Systems: Investments in modernizing IT infrastructure for better operations.

- Digital Marketing: Expanding capabilities to reach a wider customer base online.

Focus on Customer Experience and Design Services

Arhaus excels by prioritizing an exceptional customer experience, a key differentiator in the competitive furniture market. Their client-first service model, which includes complimentary in-home design consultations, directly addresses customer needs and fosters loyalty. This approach is further amplified by showrooms designed to be immersive and inspiring, akin to a 'theater-like' experience.

This focus on customer engagement is a significant strength, as evidenced by the company's ability to build strong relationships. For instance, Arhaus reported a 15% increase in customer satisfaction scores in their 2024 internal surveys, directly correlating with the uptake of their design services.

- Client-First Service Model: Complimentary in-home design services enhance customer engagement and project success.

- Immersive Showroom Design: 'Theater-like' showrooms inspire customers and create a memorable shopping journey.

- Customer Loyalty: The emphasis on experience cultivates repeat business and positive word-of-mouth referrals.

Arhaus boasts a strong brand image built on premium quality and unique craftsmanship, appealing to customers seeking distinctive, durable home furnishings. This focus on handcrafted, heirloom-quality pieces, often sourced globally, sets it apart in the market.

The company's commitment to sustainability, using recycled and responsibly sourced materials, resonates with environmentally conscious consumers. Strategic partnerships in reforestation further enhance its responsible corporate image.

Arhaus leverages a successful omnichannel strategy, integrating physical showrooms with a robust e-commerce platform for seamless customer engagement. Its expanding physical footprint, with 103 showrooms across 30 states as of December 2024, drives brand awareness and sales.

Financially, Arhaus is robust, reporting record revenue for fiscal year 2024 and maintaining no long-term debt as of March 2025, enabling strategic reinvestment in supply chain, technology, and digital marketing.

What is included in the product

Delivers a strategic overview of Arhaus’s internal and external business factors, highlighting its brand strength and customer loyalty while acknowledging potential supply chain vulnerabilities and competitive pressures.

Offers a clear, actionable framework to identify and leverage Arhaus's competitive advantages while mitigating potential threats.

Weaknesses

Arhaus, as a purveyor of premium home furnishings, faces inherent vulnerability to economic downturns. Consumer spending on large, discretionary items like high-end furniture is often among the first areas to be curtailed when economic confidence falters or interest rates rise.

For instance, during periods of economic uncertainty, consumers may postpone or cancel significant purchases, directly impacting Arhaus's revenue. This sensitivity was evident in the broader furniture retail sector in late 2023 and early 2024, where some players reported noticeable declines in sales volume as inflation persisted and borrowing costs remained elevated.

Arhaus's extensive network of over 400 global vendors, while enabling unique product offerings, inherently creates vulnerabilities. Disruptions within this complex supply chain, such as shipping delays or increased freight expenses, can directly impact product availability and profitability. For instance, in 2023, global shipping costs saw fluctuations, directly affecting companies with broad international sourcing strategies like Arhaus.

The company's reliance on these vendor relationships means that any failure by a supplier to maintain quality standards can tarnish Arhaus's brand reputation. Furthermore, Arhaus's stated aim to reduce sourcing from China suggests a strategic response to potential geopolitical risks or trade policy changes that could affect its supply chain stability.

Arhaus's aggressive showroom expansion strategy, while aimed at growth, has led to a noticeable uptick in selling, general, and administrative expenses. This increase in operational costs is a direct consequence of opening new locations and the associated overhead.

The financial results from Q1 2025 highlight this challenge. Despite reporting revenue growth, the company saw a significant decrease in net and comprehensive income. This divergence suggests that the mounting expenses tied to expansion, alongside other operational factors, are currently exerting downward pressure on Arhaus's overall profitability.

Competitive Market Landscape

The luxury home furnishings market is intensely competitive, with established players and emerging brands all vying for consumer attention and market share. Arhaus faces pressure from competitors who are also emphasizing sustainability and unique, personalized design elements, making differentiation a constant challenge.

Key competitors in the high-end home furnishings sector include brands like Restoration Hardware, Pottery Barn (a higher-tier offering), and various boutique luxury furniture makers. These companies often have significant marketing budgets and established customer loyalty, requiring Arhaus to invest heavily in brand building and product innovation.

- Intense Competition: Arhaus operates in a crowded market with numerous high-end competitors.

- Innovation Imperative: Continuous product development and unique design are crucial for standing out.

- Sustainability Focus: Competitors are increasingly highlighting eco-friendly practices, a trend Arhaus must match.

- Personalization Demand: Consumers expect customized options, pushing brands to offer more tailored experiences.

Lack of Publicly Available Carbon Emissions Data

While Arhaus emphasizes sustainability, a key weakness is the absence of publicly disclosed carbon emissions data. This lack of specific environmental impact reporting, including documented reduction targets, could be a concern for investors and stakeholders increasingly focused on ESG (Environmental, Social, and Governance) performance. For instance, in 2023, many publicly traded companies in the retail sector began enhancing their sustainability reporting, making Arhaus's current stance a potential disadvantage.

This opacity might hinder Arhaus's ability to attract environmentally conscious investors or meet the evolving expectations of a financially literate audience that values transparency in corporate environmental stewardship. Without quantifiable data, it's challenging for stakeholders to assess the effectiveness of Arhaus's sustainability initiatives.

- Lack of Quantifiable Emissions Data: Arhaus does not publicly share specific carbon emissions figures.

- Absence of Reduction Targets: There are no documented, publicly stated goals for reducing carbon emissions.

- Stakeholder Scrutiny: Financially literate stakeholders are increasingly demanding robust ESG reporting, making this a potential weakness.

- Competitive Disadvantage: Competitors are enhancing their sustainability disclosures, potentially leaving Arhaus behind in transparency.

Arhaus's significant investment in showroom expansion, while a growth strategy, has demonstrably increased operating expenses. This is evident in the Q1 2025 financial results, which showed a notable decrease in net income despite revenue growth, indicating that the costs associated with new locations are currently impacting profitability. The company's aggressive expansion strategy necessitates substantial capital outlay and ongoing operational costs, which can strain financial performance during periods of slower consumer spending.

The company's reliance on a broad network of over 400 global vendors presents inherent supply chain risks. Disruptions, whether from geopolitical factors, shipping challenges, or supplier-specific issues, can directly affect product availability and costs. For example, fluctuations in global freight rates observed throughout 2023 and into early 2024 have a direct impact on companies with extensive international sourcing, like Arhaus.

Arhaus operates in a highly competitive luxury home furnishings market. Differentiation is a constant challenge due to established brands and emerging players emphasizing similar aspects like sustainability and unique design. Competitors such as Restoration Hardware and Pottery Barn often possess larger marketing budgets and established brand loyalty, requiring Arhaus to continually invest in marketing and product innovation to maintain its market position.

A key weakness for Arhaus is the lack of publicly disclosed carbon emissions data and specific reduction targets. This absence of quantifiable ESG performance metrics, particularly in an era where investors increasingly scrutinize environmental impact, could hinder its ability to attract environmentally conscious capital and may place it at a disadvantage compared to competitors who are enhancing their sustainability disclosures.

What You See Is What You Get

Arhaus SWOT Analysis

The preview you see is the actual Arhaus SWOT analysis document you’ll receive upon purchase. This ensures transparency and allows you to assess the quality and detail before committing. You'll get the full, professionally structured report immediately after checkout.

Opportunities

Arhaus is actively growing its physical footprint, aiming to open five to seven new showrooms each year as part of a long-term strategy to reach 165 locations. This expansion is focused on key growth markets, which will significantly boost brand visibility and make Arhaus more accessible to a wider customer base.

Arhaus is experiencing robust expansion in its e-commerce operations, with net e-commerce revenues seeing substantial year-over-year increases. This digital channel represents Arhaus's most rapidly growing segment, highlighting a strong consumer shift towards online purchasing in the home furnishings market.

Further strategic investments in digital marketing and the refinement of omnichannel customer experiences are crucial to leverage this momentum. The home furnishings sector's overall e-commerce penetration is anticipated to continue its upward trajectory, presenting a prime opportunity for Arhaus to capture a larger share of online sales.

Consumers, particularly in the luxury segment, are increasingly prioritizing sustainability and ethical sourcing. This trend is a significant tailwind for Arhaus, as its commitment to artisan craftsmanship and eco-friendly materials directly addresses this demand. For instance, a 2024 report indicated that over 60% of affluent consumers consider a brand's sustainability practices when making purchasing decisions, a figure expected to climb.

Leveraging Home Renovation and Home-Centric Spending Trends

The ongoing surge in home renovation projects and a sustained emphasis on improving home environments present a significant opportunity for Arhaus. Consumers are increasingly investing in their living spaces, a trend amplified by more time spent at home, driving demand for premium furniture. This focus on creating comfortable and aesthetically pleasing interiors directly benefits companies like Arhaus that offer high-quality, durable, and stylish pieces.

Arhaus is well-positioned to benefit from this market dynamic. Data from the U.S. Census Bureau indicates a robust increase in residential improvement and repair spending, with projections showing continued growth through 2024 and into 2025. For instance, spending on home improvements reached record levels in 2023, a trend expected to persist as homeowners prioritize comfort and functionality.

- Increased consumer spending on home renovations and enhancements.

- Growing demand for luxury and high-quality furniture as people invest in their living spaces.

- Opportunity to capitalize on the desire for durable, aesthetically pleasing home furnishings.

- Alignment with the broader trend of prioritizing at-home experiences and comfort.

Strategic Investments in Technology and Supply Chain Optimization

Arhaus is strategically investing in technology, including new Enterprise Resource Planning (ERP) and planning systems, to streamline operations and fuel future expansion. These upgrades are designed to boost efficiency across the board, ultimately supporting the company's long-term growth trajectory.

By enhancing supply chain resilience and embracing technological advancements, Arhaus aims to significantly improve operational efficiency and reduce costs. This focus on optimization is crucial for better meeting evolving consumer demand in today's fast-paced market environment.

- ERP & Planning System Investment: Arhaus is implementing new systems to optimize efficiencies and support growth.

- Supply Chain Resilience: Enhancements aim to create a more robust and responsive supply chain.

- Operational Efficiency: Technology investments are expected to drive cost reductions and improve service levels.

- Market Responsiveness: Better systems will enable Arhaus to more effectively meet dynamic consumer demand.

Arhaus is strategically expanding its physical presence, with plans to open five to seven new showrooms annually, aiming for a total of 165 locations. This growth is concentrated in key markets, enhancing brand visibility and accessibility for a broader customer base.

The company is also seeing significant growth in its e-commerce segment, with net e-commerce revenues experiencing substantial year-over-year increases. This digital channel is Arhaus's fastest-growing area, reflecting a strong consumer shift towards online furniture purchases.

Arhaus is well-positioned to benefit from the sustained trend of home renovation and the increased consumer focus on improving living spaces. Spending on home improvements reached record levels in 2023, with projections indicating continued growth through 2024 and into 2025, driven by a desire for comfort and functionality.

The company's commitment to artisan craftsmanship and eco-friendly materials aligns with growing consumer demand for sustainable and ethically sourced products. A 2024 report highlighted that over 60% of affluent consumers consider sustainability in their purchasing decisions, a figure expected to rise.

| Opportunity | Description | Supporting Data/Trend |

| Physical Store Expansion | Opening 5-7 new showrooms annually to reach 165 locations. | Focus on key growth markets to increase brand visibility and accessibility. |

| E-commerce Growth | Substantial year-over-year increases in net e-commerce revenues. | Digital channel is the fastest-growing segment, capitalizing on online purchasing trends. |

| Home Renovation Trend | Increased consumer investment in home environments. | Record spending on home improvements in 2023, projected to continue through 2024-2025. |

| Sustainability Demand | Alignment with consumer preference for eco-friendly and ethically sourced goods. | Over 60% of affluent consumers consider sustainability in purchasing (2024 data). |

Threats

Ongoing macroeconomic volatility, including persistent inflation and elevated interest rates, presents a significant challenge for Arhaus. These factors directly impact consumer discretionary spending, particularly on larger purchases like furniture, as households face tighter budgets and increased borrowing costs.

The slowdown observed in the housing market, a traditional driver for furniture sales, further exacerbates these headwinds. For instance, data from the U.S. Bureau of Labor Statistics indicated that consumer prices rose by 3.4% year-over-year in April 2024, demonstrating continued inflationary pressures that erode purchasing power for non-essential goods.

Consequently, Arhaus could experience reduced demand for its premium-priced offerings. This potential decrease in sales volume directly threatens the company's revenue streams and overall profitability, necessitating careful inventory management and strategic pricing adjustments.

The home furnishings sector is a crowded space, featuring a wide array of competitors from high-end luxury designers to budget-friendly mass-market retailers and rapidly growing online marketplaces. This intense competition means Arhaus must constantly innovate and differentiate itself to maintain its market position and pricing flexibility.

For instance, in the first quarter of 2024, the U.S. Census Bureau reported that furniture and home furnishings stores saw a 0.8% decrease in sales compared to the previous quarter, indicating a challenging retail environment. The ongoing expansion of online retailers and the aggressive pricing strategies of large chains present a continuous threat to Arhaus's market share and profitability.

Arhaus faces significant threats from potential rising tariffs on imported goods, which could directly inflate their operational expenses. Persistent global supply chain bottlenecks, a challenge seen throughout 2023 and into early 2024, continue to pose a risk to timely inventory replenishment and could further drive up shipping and material costs.

The company's reliance on international sourcing, particularly for furniture and decor, leaves it susceptible to geopolitical instability and shifts in trade policies. For instance, changes in trade relations with key manufacturing countries could disrupt supply lines and necessitate costly adjustments to sourcing strategies, impacting both profitability and the availability of popular products for consumers.

Shifting Consumer Preferences and Design Trends

Arhaus's commitment to enduring style faces a challenge from the swift evolution of home decor trends. Consumer tastes in furniture and interior design can change rapidly, requiring constant updates to product lines to remain appealing. For instance, a survey in late 2024 indicated that 45% of homeowners were actively seeking furniture that reflected current minimalist aesthetics, a potential shift from Arhaus's more traditional craftsmanship focus.

Failure to accurately predict or swiftly adapt to these evolving preferences could lead to decreased sales and a diminished market position. In 2024, furniture retailers that failed to incorporate sustainable materials and biophilic design elements reported slower growth compared to those that did, highlighting the impact of shifting consumer values on purchasing decisions.

- Rapid Trend Cycles: Home decor trends can shift quickly, demanding agility in product development.

- Consumer Taste Evolution: Evolving consumer preferences for styles like minimalism or maximalism require continuous monitoring.

- Market Relevance: Slow adaptation to new trends can impact Arhaus's perceived relevance and sales performance.

Increased Operational Expenses and Profitability Pressures

Arhaus faces the threat of rising operational expenses as it invests in expanding its physical footprint and enhancing its marketing initiatives. For instance, in the first quarter of 2024, Arhaus reported selling, general, and administrative expenses of $145.1 million, a notable increase from $128.4 million in the same period of 2023, reflecting these growth-oriented investments.

This escalation in costs puts pressure on Arhaus's ability to maintain healthy profit margins, especially if revenue growth doesn't keep pace or if the broader economic climate deteriorates, impacting consumer spending on discretionary items like furniture.

- Rising Infrastructure Costs: Investments in new stores and distribution centers contribute to higher rent, utilities, and staffing expenses.

- Increased Marketing Spend: To support expansion and brand visibility, Arhaus may need to allocate more resources to advertising and promotional activities.

- Supply Chain Volatility: Fluctuations in transportation and material costs can directly impact the cost of goods sold and overall operational efficiency.

- Economic Headwinds: A slowdown in consumer spending or increased inflation could force Arhaus to absorb higher costs without commensurate price increases, squeezing profitability.

Arhaus faces intense competition within the home furnishings sector, with numerous players from luxury to budget segments, alongside aggressive online retailers. This crowded market necessitates continuous innovation and differentiation to maintain market share and pricing power, especially as data from Q1 2024 showed a 0.8% sales decrease for furniture and home furnishings stores compared to the previous quarter.

The company's reliance on international sourcing makes it vulnerable to geopolitical instability and trade policy shifts, which could disrupt supply chains and increase costs. For example, persistent global supply chain bottlenecks seen through 2023 and into early 2024 continue to pose a risk to inventory replenishment and drive up shipping and material expenses.

Arhaus must also contend with rapidly evolving consumer tastes in home decor, as indicated by a late 2024 survey showing 45% of homeowners seeking minimalist aesthetics, potentially clashing with Arhaus's traditional focus. Failure to adapt swiftly to these trends could lead to decreased sales and a diminished market position, as retailers not incorporating sustainable or biophilic design elements in 2024 reported slower growth.

Macroeconomic volatility, including persistent inflation (3.4% year-over-year in April 2024) and elevated interest rates, directly impacts consumer discretionary spending on furniture, threatening Arhaus's revenue and profitability by reducing demand for its premium-priced items.

| Threat Category | Specific Challenge | Impact on Arhaus | Supporting Data/Example |

| Competition | Intense market rivalry | Pressure on market share and pricing | 0.8% Q1 2024 sales decrease for furniture/home furnishings stores |

| Supply Chain & Geopolitics | Disruptions and cost increases | Higher operational expenses, product availability issues | Persistent global supply chain bottlenecks through early 2024 |

| Consumer Trends | Rapidly changing preferences | Risk of product obsolescence, reduced demand | 45% of homeowners seeking minimalist styles (late 2024 survey) |

| Macroeconomic Factors | Inflation and interest rates | Reduced consumer spending, lower sales volume | 3.4% YoY inflation in April 2024 |

SWOT Analysis Data Sources

This Arhaus SWOT analysis is built upon a foundation of reliable data, including publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic perspective.