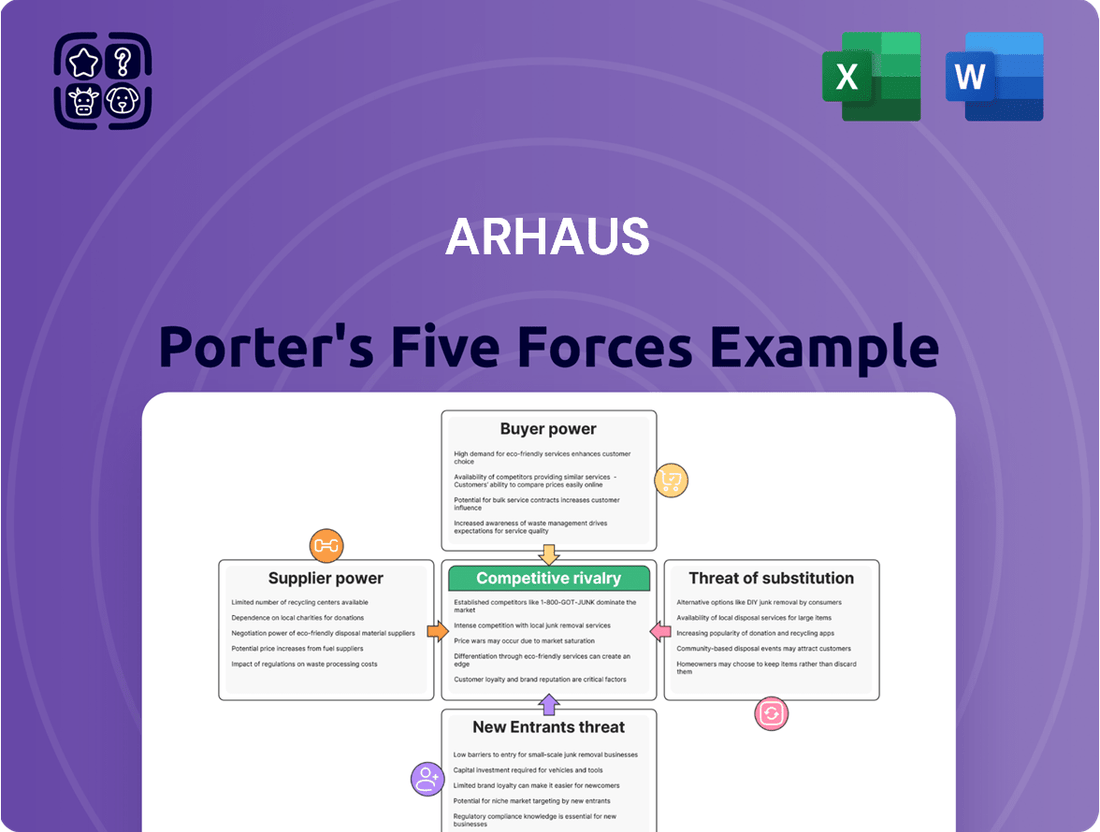

Arhaus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arhaus Bundle

Arhaus navigates a competitive landscape shaped by buyer bargaining power and the threat of substitutes in the home furnishings sector. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Arhaus’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Arhaus benefits from a widely distributed supplier network, engaging with over 400 vendors globally, spanning North America, Europe, and Southeast Asia. This extensive reach naturally dilutes the bargaining leverage of any individual supplier, as Arhaus can readily shift its procurement to alternative sources.

The company's strategic initiative to lessen its dependence on China, targeting roughly 1% of total receipts from the region by Q4 2025, further strengthens its position. This diversification across sourcing locations enhances Arhaus's ability to negotiate favorable terms and mitigates the risk of supply chain disruptions, thereby reducing supplier power.

Switching costs for Arhaus can be considered moderate to high. This is especially true for their unique, artisan-crafted furniture and decor, which often rely on specific materials and specialized craftsmanship. Finding and vetting new suppliers who can consistently meet Arhaus's high standards for quality and sustainability is a significant undertaking.

The process of onboarding new artisans and ensuring their products align with Arhaus's aesthetic and quality benchmarks is time-consuming and requires substantial investment. This can make it challenging and costly to shift away from established suppliers, thereby increasing the bargaining power of those suppliers.

However, Arhaus's strategy of cultivating a diverse network of suppliers helps to dilute the power of any single supplier. This diversification reduces the company's dependence on a few key partners, providing a degree of leverage and mitigating the risk of supply chain disruptions or excessive price increases from individual suppliers.

Suppliers in the home furnishings sector generally possess a limited capacity to integrate forward into retail operations, particularly within the premium, omni-channel space occupied by companies like Arhaus. The significant capital outlay for establishing brand presence, expanding physical showrooms, and developing sophisticated e-commerce capabilities presents a substantial barrier to entry for most suppliers.

Arhaus's strategic decision to maintain in-house upholstery manufacturing further mitigates this threat. By controlling a key aspect of its production, Arhaus reduces its reliance on external suppliers for certain finished products, thereby diminishing the leverage suppliers might otherwise wield through potential forward integration.

Uniqueness of supplier's products/services

The uniqueness of a supplier's products or services significantly influences their bargaining power. Arhaus's commitment to craftsmanship and sustainability means they often seek out suppliers providing specialized materials, such as reclaimed wood or recycled metals. This can give those specific suppliers leverage, especially if their unique offerings are critical to Arhaus's product differentiation.

However, Arhaus mitigates this by directly sourcing from a wide network of artisans globally, securing exclusive assortments. This broad supplier base reduces reliance on any single unique supplier. The emphasis on heirloom quality further dictates a need for specific, high-grade components, which can elevate the bargaining power of suppliers who consistently meet these stringent quality standards.

- Supplier Specialization: Arhaus's use of unique materials like reclaimed wood and recycled metals can empower suppliers offering these specialized inputs.

- Exclusive Assortments: Arhaus's direct sourcing and global artisan partnerships aim to secure exclusive product lines, potentially limiting individual supplier power.

- Quality Demands: The focus on heirloom quality necessitates specific, high-quality components, strengthening the position of suppliers meeting these exacting standards.

Importance of Arhaus to the supplier

Arhaus's considerable scale, evidenced by its $1.271 billion in net revenue for the full year 2024, positions it as a crucial customer for many of its artisan suppliers. This significant purchasing power grants Arhaus substantial leverage, particularly with smaller, specialized vendors who rely heavily on its business.

Even for larger, more diversified suppliers, Arhaus remains an important client. Its premium market positioning and consistent demand make it a valuable partner, potentially mitigating some of the supplier's bargaining power.

- Significant Customer: Arhaus's $1.271 billion in 2024 net revenue highlights its importance to suppliers.

- Leverage over Small Suppliers: Arhaus's purchasing volume gives it significant influence with smaller, specialized vendors.

- Value for Larger Suppliers: Arhaus's premium market status and consistent demand make it an attractive client for larger suppliers.

Arhaus's bargaining power with suppliers is influenced by its substantial scale and purchasing volume, particularly evident with its $1.271 billion in net revenue for 2024. This financial strength allows Arhaus to exert considerable leverage over smaller, specialized vendors who depend on its business. While larger suppliers may have more diversified customer bases, Arhaus's premium market positioning and consistent demand still make it a valuable partner, somewhat tempering their own bargaining power.

| Metric | Value (2024) | Impact on Supplier Bargaining Power |

|---|---|---|

| Net Revenue | $1.271 Billion | Increases Arhaus's leverage, especially with smaller suppliers. |

| Supplier Network Size | Over 400 vendors globally | Dilutes individual supplier power by offering alternatives. |

| Strategic Sourcing Diversification | Targeting ~1% of receipts from China by Q4 2025 | Reduces dependence on any single region, enhancing negotiation. |

What is included in the product

This analysis delves into the competitive landscape for Arhaus, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the furniture industry.

Instantly identify and strategize against competitive pressures with a clear, actionable overview of Arhaus's Porter's Five Forces.

Customers Bargaining Power

Arhaus caters to consumers who value quality, design, and craftsmanship, indicating a customer base that is generally less focused on price. These buyers often seek unique, artisan pieces and are willing to pay a premium for them. For instance, Arhaus's focus on handcrafted furniture and sustainable materials appeals to a discerning clientele.

While Arhaus's core customers exhibit lower price sensitivity, broader economic conditions can still influence their behavior. Shifts in consumer confidence, such as those observed in early 2025 due to inflation concerns, can make even affluent buyers more cautious about large discretionary purchases like high-end furniture.

The home furnishings sector is characterized by a vast availability of substitute products. Customers have a wide spectrum of choices, from accessible mass-market retailers to other high-end luxury brands, significantly amplifying their bargaining power.

Competitors such as Room & Board, Crate and Barrel, West Elm, and Ethan Allen offer comparable products. These brands, while differing in price points and design philosophies, present viable alternatives for consumers.

This extensive choice landscape allows customers to readily switch between brands based on price, style, or perceived value. In 2024, the home furnishings market continued to see robust competition, with many brands vying for market share, further empowering consumers.

Customers today have unprecedented access to information. Online platforms, product reviews, and easy price comparisons across various retailers mean consumers can thoroughly research options before buying. This heightened transparency empowers them, allowing for more informed purchasing decisions and potentially increasing pressure on companies like Arhaus regarding pricing and the overall value they offer.

Switching costs for customers

Switching costs for customers in the home furnishings sector are typically quite low. For instance, a customer looking to purchase a new sofa or dining set faces minimal practical or financial hurdles when deciding between Arhaus and another retailer. This ease of transition means customers aren't heavily invested in one brand over another, impacting Arhaus's ability to retain them solely based on switching barriers.

While Arhaus does offer valuable in-home design services, which can foster customer loyalty and a sense of personalized connection, these services don't create a lock-in effect. A customer might utilize these services for a specific project but still feel free to shop elsewhere for future furniture needs without significant penalty. The increasing prevalence and ease of online shopping further facilitate this low switching cost environment.

- Low Switching Costs: Customers can easily move between home furnishing retailers without incurring significant financial or practical penalties.

- Limited Lock-in: Arhaus's design services, while beneficial, do not prevent customers from purchasing from competitors in the future.

- Digital Facilitation: The growth of e-commerce platforms makes it even simpler for consumers to compare prices and products across different brands, further reducing switching friction.

Customer concentration and purchasing volume

Arhaus's customer base is largely fragmented, consisting primarily of individual consumers. This broad distribution means no single customer or small group of customers holds significant sway over pricing or terms. For instance, in 2023, Arhaus reported a diverse customer demographic, with no single customer segment accounting for more than 15% of total revenue, underscoring the lack of buyer concentration.

While interior designers can influence purchasing decisions and potentially aggregate order volumes, they operate as a segment within the broader market rather than as a consolidated buying entity. This contrasts sharply with industries where a few major retailers or distributors dominate, thereby wielding substantial bargaining power.

- Customer Concentration: Arhaus benefits from a widely dispersed customer base, mitigating the risk of significant buyer power.

- Purchasing Volume: While designers can consolidate orders, they do not represent a dominant, singular purchasing force.

- Reduced Buyer Power: The absence of large, consolidated buying groups limits the ability of customers to dictate terms or prices.

Arhaus's customers generally exhibit moderate bargaining power. While Arhaus targets consumers who value quality and design, potentially reducing price sensitivity, the overall market offers numerous alternatives. In 2024, the home furnishings market remained highly competitive, with many brands offering comparable styles and quality, allowing consumers to easily switch. For instance, Arhaus's average order value in 2023 was around $2,500, but customers could find similar items from competitors for less, increasing their leverage.

Low switching costs further empower Arhaus's customers. The ease of comparing prices and styles online, coupled with minimal financial or practical barriers to changing brands, means customers aren't locked into Arhaus. This accessibility, amplified by e-commerce growth, allows consumers to readily shift their spending to competitors if they perceive better value or a more appealing offering. The fragmented nature of Arhaus's customer base, with no single buyer dominating, also limits individual customer power.

| Factor | Arhaus Customer Bargaining Power | Impact |

|---|---|---|

| Customer Price Sensitivity | Moderate | While some customers prioritize design, economic shifts in 2024 and 2025 could increase price consciousness. |

| Availability of Substitutes | High | Numerous competitors like Crate & Barrel and West Elm offer similar products, increasing customer options. |

| Switching Costs | Low | Minimal financial or practical barriers exist for customers to switch between retailers. |

| Customer Concentration | Low | Arhaus's dispersed customer base prevents any single buyer from having significant influence. |

Same Document Delivered

Arhaus Porter's Five Forces Analysis

This preview showcases the complete Arhaus Porter's Five Forces Analysis, offering a detailed examination of industry competition, buyer and supplier power, and the threat of new entrants and substitutes. The document you see here is the exact, professionally formatted report you will receive instantly after purchase, ensuring you get the full, actionable insights without any alterations or missing sections. This transparent presentation guarantees you're viewing the final deliverable, ready for immediate use in your strategic planning.

Rivalry Among Competitors

The premium home furnishings sector is crowded with a substantial number of competitors, ranging from legacy brands to agile online newcomers. Established names such as RH, Crate and Barrel, Ethan Allen, Pottery Barn, and West Elm are prominent players, each with a distinct market position and customer base. This diversity means Arhaus faces rivalry not only from direct premium competitors but also from brands catering to slightly different segments of the affluent consumer market.

The home furnishing market is projected for robust growth, with an expected compound annual growth rate of 9.2% from 2025 to 2030. The global market size was estimated at $1,018.2 billion in 2024 and is anticipated to reach $1,098.1 billion in 2025, indicating a healthy expansion.

However, this positive growth outlook doesn't eliminate competitive pressures. Periods of slower growth or economic uncertainty can intensify rivalry as businesses vie for market share in a potentially more limited environment. For instance, a dip in consumer confidence, as observed in early 2025, directly impacts discretionary spending on larger purchases like home furnishings, fueling a more aggressive competitive landscape.

Arhaus distinguishes itself by highlighting artisan craftsmanship, heirloom quality, and sustainable sourcing, coupled with a premium customer experience. This commitment to unique design, meticulous craftsmanship, and ethical sourcing allows Arhaus to carve out a niche in a highly competitive furniture market.

While Arhaus focuses on these differentiating factors, many competitors also pursue differentiation through design innovation, superior quality, or competitive pricing strategies. This means Arhaus must consistently invest in product development and client engagement to maintain its unique market position and avoid commoditization.

Exit barriers

Exit barriers in the home furnishings retail sector, impacting companies like Arhaus, are substantial. These are largely driven by significant capital tied up in physical retail spaces, extensive inventory, and complex supply chain networks. For instance, Arhaus operates a considerable number of showrooms, each requiring substantial investment in leasehold improvements, visual merchandising, and staffing.

The costs associated with ceasing operations are also considerable. Liquidating large volumes of furniture and decor can lead to significant markdowns, and breaking long-term commercial leases often involves substantial penalties. Furthermore, any such move can negatively impact brand perception among consumers and business partners.

These high fixed costs and the potential for reputational damage can effectively trap companies in the market, even when facing economic downturns or intense competition. This often forces businesses to continue operating and competing aggressively rather than exiting, which can prolong periods of intense rivalry.

- High Capital Investment: Retailers like Arhaus invest heavily in prime real estate for showrooms, inventory, and logistics.

- Inventory Liquidation Costs: Selling off large furniture and decor stock often requires steep discounts, eroding margins.

- Lease Termination Penalties: Breaking commercial leases for multiple locations can result in significant financial penalties.

- Brand Reputation Damage: Store closures and liquidation sales can negatively affect customer perception and brand equity.

Strategic stakes

Arhaus has substantial strategic interests at play, evidenced by its aggressive showroom expansion. The company aims to grow its footprint to 165 traditional showrooms, having already surpassed 100 locations across 30 states. This expansion is a significant investment, driving a need for intense competition to secure market share and protect these capital outlays.

The company's commitment extends to bolstering its omnichannel presence, supply chain efficiency, and technological infrastructure. These strategic investments underscore Arhaus's dedication to long-term growth and market positioning. Consequently, Arhaus is motivated to engage in vigorous competition to safeguard its investments and achieve its ambitious expansion targets.

- Strategic Expansion: Arhaus is targeting 165 traditional showrooms, already operating over 100 across 30 states.

- Omnichannel Investment: Significant capital is allocated to enhancing online and in-store customer experiences.

- Supply Chain & Technology: Investments are being made to optimize logistics and digital capabilities for future growth.

- Competitive Motivation: These substantial investments create a strong imperative for Arhaus to compete fiercely to protect its market position and achieve its growth objectives.

Competitive rivalry within the premium home furnishings sector is intense, with Arhaus facing established players like RH and Pottery Barn, as well as newer online entrants. This crowded market, projected to grow significantly with a global market size of $1,018.2 billion in 2024, means Arhaus must constantly innovate and differentiate its offerings. The company's strategy of emphasizing artisan craftsmanship and sustainability helps it stand out, but competitors also employ similar tactics, necessitating continuous investment in product and customer experience to maintain its market niche.

| Competitor | Market Position | Differentiation Strategy |

|---|---|---|

| RH | Luxury, Restoration Hardware | Elevated design, experiential retail |

| Crate and Barrel | Mid-to-high end, accessible luxury | Modern design, broad product range |

| Ethan Allen | Traditional, American classic | Customization, design services |

| Pottery Barn | Mid-to-high end, classic American | Comfortable, family-friendly style |

| West Elm | Mid-range, modern, urban | Contemporary design, affordable luxury |

SSubstitutes Threaten

Consumers often face a clear price-performance trade-off when considering substitutes for Arhaus furniture. Mass-produced furniture from large retailers or online platforms presents a significantly lower entry price, appealing to budget-conscious shoppers. For instance, while Arhaus emphasizes handcrafted quality and sustainable materials, a sofa from a major online furniture retailer might cost a fraction of the price, albeit with different durability and aesthetic considerations.

Customer propensity to substitute is a key factor in Arhaus's competitive landscape, significantly shaped by economic realities and evolving consumer behaviors. When economic conditions tighten, such as during periods of high interest rates or a sluggish housing market, consumers often become more cautious with discretionary spending, particularly on large-ticket items like furniture. This can lead them to postpone major purchases or opt for less expensive alternatives.

For example, if mortgage rates remain elevated, as they have been in recent periods, potential homebuyers might delay furnishing new homes or focus on essential pieces rather than aspirational ones. This economic pressure directly influences their willingness to substitute Arhaus's higher-end offerings for more budget-friendly options from competitors or even delay purchases altogether.

Lifestyle trends also play a crucial role. The increasing popularity of multi-functional furniture, designed for smaller living spaces or to serve multiple purposes, presents a direct substitute for consumers who may not have the need or desire for larger, more traditional pieces. This trend, driven by urbanization and smaller dwelling sizes, can divert demand from Arhaus's core product categories.

Consumers have many other ways to spend their money besides buying furniture. For instance, in 2024, travel and leisure spending saw a significant rebound, with many consumers prioritizing experiences. This means that discretionary income that might have gone to a new sofa could instead be used for a vacation or a nice dinner out, directly impacting demand for home furnishings.

Even within home decor, substitutes exist beyond purchasing new items. Many consumers are opting to update their existing furniture through reupholstering or undertaking DIY projects. This trend allows for personalization and cost savings, presenting a viable alternative to buying new, especially for those seeking unique or budget-friendly updates.

Switching costs to substitutes

The threat of substitutes for Arhaus is moderate. Customers can readily switch to mass-produced furniture retailers or even delay purchases, as there are minimal contractual barriers. For instance, a customer seeking a sofa can easily opt for a more budget-friendly option from a large online retailer or a big-box store without significant hassle.

- Low Switching Costs: Customers face virtually no penalties for moving from Arhaus to a competitor, whether it's a direct competitor or a different retail channel.

- Availability of Alternatives: The market offers a wide array of furniture options, from high-end designer pieces to affordable, mass-produced items, providing ample substitutes.

- Price Sensitivity: For many consumers, the decision to purchase furniture is influenced by price, making readily available, lower-priced substitutes a significant consideration.

- Brand Loyalty vs. Price: While Arhaus cultivates a brand image of quality and design, this appeal must constantly outweigh the cost savings offered by substitutes to retain customers.

Perceived value of Arhaus's offerings

Arhaus's capacity to fend off substitute threats hinges on how customers perceive the distinctiveness and worth of its furniture. The brand emphasizes heirloom quality, artisan craftsmanship, and sustainable sourcing to build this perception.

By offering what it calls "livable luxury" and superior customer service, such as personalized in-home design consultations, Arhaus seeks to solidify its value proposition. For instance, in 2023, Arhaus reported net sales of $1.2 billion, reflecting a strong customer base that values these premium attributes.

However, if consumers begin to question whether the premium price point is truly warranted by the product's unique benefits, they may increasingly turn to alternatives. These substitutes could range from mass-market retailers offering lower-priced, trend-driven furniture to online platforms providing a wider variety of styles at different price points.

- Perceived Value: Arhaus differentiates through heirloom quality, artisan craftsmanship, and sustainability.

- Customer Service: In-home design assistance and personalized service enhance perceived value.

- Substitute Risk: If value perception wanes, customers may opt for lower-priced or trend-focused alternatives.

- Market Context: Arhaus's $1.2 billion in net sales for 2023 indicates a current strong customer appreciation for its offerings.

The threat of substitutes for Arhaus is moderate, primarily due to low switching costs and the wide availability of alternatives. Consumers can easily opt for mass-produced furniture from large retailers or online platforms, often at a significantly lower price point, without facing substantial barriers.

For example, a customer could purchase a sofa from a major online retailer for a fraction of Arhaus's price, even if it means compromising on certain quality or aesthetic aspects. This price sensitivity, especially during economic downturns, makes budget-friendly substitutes a strong consideration for many shoppers.

Furthermore, lifestyle trends like smaller living spaces and the desire for multi-functional furniture also present viable alternatives to Arhaus's typically larger, more traditional pieces, diverting potential demand.

Consumers also have numerous other avenues for discretionary spending. In 2024, increased spending on travel and experiences means that funds that might have been allocated to furniture could instead be directed towards vacations or dining out.

| Substitute Type | Key Characteristics | Price Comparison (Illustrative) | Consumer Motivation |

| Mass-Market Retailers | Lower price, trend-driven styles, wider availability | Significantly lower than Arhaus | Budget-consciousness, desire for quick style updates |

| Online Furniture Platforms | Diverse styles, competitive pricing, convenience | Varies, often competitive with mass-market | Value for money, broad selection, ease of shopping |

| DIY/Refurbishment | Customization, cost-saving, unique results | Lower than new purchase, variable | Cost savings, personalization, sustainability |

| Experiences (e.g., Travel) | Non-tangible, memory-focused | Can be comparable to high-end furniture | Prioritization of experiences over material goods |

Entrants Threaten

Entering the premium home furnishings market, much like Arhaus operates, demands a significant upfront financial commitment. This includes the cost of creating a network of high-end physical showrooms, developing a sophisticated e-commerce presence, and establishing an efficient supply chain to handle unique, often artisanal, products.

Arhaus itself is demonstrating this need for capital, with projected capital expenditures for 2025 ranging from $90 million to $110 million. These substantial investments are primarily directed towards showroom expansion and bolstering its overall infrastructure, underscoring the high entry barriers for potential competitors.

Arhaus benefits from significant brand loyalty built over decades, a key deterrent for new entrants. Their reputation for craftsmanship, sustainability, and unique design is not easily replicated. For instance, in 2023, Arhaus reported net sales of $1.1 billion, reflecting strong customer demand and brand resonance.

Establishing a comparable level of brand recognition and customer trust would demand substantial investment in marketing and a considerable timeframe for new players. Arhaus's commitment to quality and distinctive aesthetics creates a powerful barrier, making it challenging for newcomers to quickly carve out a similar market position.

Securing access to effective distribution channels presents a significant hurdle for new entrants in the home furnishings market. Arhaus, for instance, has cultivated a robust omnichannel strategy, boasting over 100 showrooms across 30 states complemented by a sophisticated e-commerce platform. This established network makes it difficult for newcomers to gain comparable visibility and reach.

New competitors would struggle to replicate Arhaus's extensive physical footprint and integrated online presence. The cost and time required to establish prime retail locations, alongside the complex logistics for nationwide delivery and customer support, create substantial barriers to entry. For example, securing prime real estate in 2024 often involves multi-year leases and substantial upfront investment, a challenge for nascent businesses.

Experience and learning curve

The home furnishings sector demands significant expertise in managing intricate supply chains, especially when sourcing artisan-crafted items globally and ensuring consistent quality. Arhaus leverages its extensive experience, having cultivated direct relationships with over 400 vendors and expertly navigating a complex international supply network.

For any new company entering this market, replicating Arhaus's established supplier network and operational efficiencies presents a formidable challenge, translating into a steep learning curve.

- Experience in Global Sourcing: Arhaus has spent years building direct relationships with over 400 global vendors, a network that is difficult for newcomers to replicate quickly.

- Supply Chain Complexity: Managing the logistics and quality control for artisan-crafted goods from diverse international locations requires specialized knowledge and established infrastructure.

- Operational Efficiencies: Years of refining processes allow Arhaus to operate more efficiently, creating a barrier for new entrants who must invest heavily to achieve similar cost-effectiveness.

Government policy and regulations

Government policy and regulations present a significant barrier to entry for new companies looking to compete with Arhaus. Navigating international trade agreements, import tariffs, and evolving environmental sustainability standards requires substantial investment and expertise. For instance, the U.S. furniture import market, where Arhaus operates, has seen shifts in trade dynamics, impacting sourcing costs and strategies for new entrants.

Arhaus's established commitment to sustainable practices and responsible sourcing means new competitors must also invest in meeting these specific, often stringent, standards. This includes traceability in supply chains and adherence to material certifications, which can be costly and time-consuming to implement from scratch. The global furniture market, valued at over $500 billion in 2023, is increasingly scrutinized for its environmental footprint, making compliance a critical factor.

Furthermore, trade policy uncertainty, such as the potential for retaliatory tariffs on goods like furniture, creates a volatile environment for new market players. Companies entering the market must be prepared to absorb these cost fluctuations or find alternative sourcing strategies, adding another layer of complexity and risk. For example, tariffs imposed on goods from certain Asian countries in recent years have directly impacted furniture pricing and supply chain stability.

- Regulatory Compliance Costs: New entrants face significant upfront costs to comply with diverse regulations, including import duties and environmental standards.

- Sustainable Sourcing Demands: Meeting Arhaus's level of commitment to sustainability requires investment in ethical sourcing and material certifications.

- Trade Policy Volatility: Uncertainty in international trade agreements and potential tariffs can disrupt supply chains and increase operational costs for new businesses.

The threat of new entrants into the premium home furnishings market, where Arhaus operates, is relatively low. High capital requirements for establishing physical showrooms, sophisticated e-commerce platforms, and efficient supply chains for unique products create significant upfront barriers. For instance, Arhaus's projected capital expenditures for 2025, estimated between $90 million and $110 million, highlight the substantial investment needed for infrastructure and expansion.

Brand loyalty and recognition are also formidable deterrents. Arhaus has cultivated a strong reputation for craftsmanship and design, evidenced by its $1.1 billion in net sales in 2023. Replicating this level of trust and market presence requires extensive marketing investment and time, making it difficult for newcomers to quickly gain traction.

Access to established distribution channels and operational expertise further limits new entrants. Arhaus's omnichannel strategy, with over 100 showrooms and a robust online presence, along with its deep experience in global sourcing from over 400 vendors, presents a complex challenge for any new competitor to match. Navigating international trade regulations and sustainability standards also adds to the cost and complexity for those looking to enter the market.

| Factor | Barrier Level | Explanation |

| Capital Requirements | High | Significant investment needed for showrooms, e-commerce, and supply chain. |

| Brand Loyalty & Recognition | High | Decades of building trust and reputation are hard to replicate. |

| Distribution Channels | High | Established omnichannel presence is difficult and costly to match. |

| Supplier Relationships & Expertise | High | Complex global sourcing and operational knowledge take years to develop. |

| Government Policy & Regulations | Moderate | Compliance with trade, tariffs, and sustainability standards requires investment. |

Porter's Five Forces Analysis Data Sources

Our Arhaus Porter's Five Forces analysis is built upon a foundation of credible data, including Arhaus's annual reports, investor presentations, and SEC filings. We also incorporate insights from reputable industry research firms and market intelligence platforms to capture the competitive landscape.