Arhaus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arhaus Bundle

Discover the critical external factors shaping Arhaus's trajectory with our comprehensive PESTLE analysis. From evolving consumer behaviors to shifting economic landscapes, understand the forces that matter most. Download the full version now and unlock strategic insights to inform your own business decisions.

Political factors

Changes in trade policies and tariffs directly affect Arhaus's sourcing and pricing. For instance, the U.S. imposed tariffs on certain goods from China, a significant manufacturing hub for furniture. This could increase the cost of imported items for Arhaus, impacting their profit margins or forcing price adjustments for consumers.

Fluctuations in global trade relations, especially with countries like Vietnam or India where furniture components or finished goods are often sourced, can create uncertainty. If new trade barriers arise, Arhaus might face higher operational expenses or need to invest in diversifying its supply chain to mitigate risks, potentially shifting production to less impacted regions.

Government regulations significantly shape Arhaus's retail landscape. Zoning laws dictate where physical stores can operate, impacting expansion strategies. Consumer protection acts, such as those governing product safety and advertising, directly influence how Arhaus markets its furniture and interacts with customers, ensuring transparency and fairness.

Compliance is paramount for Arhaus to avoid legal repercussions. For instance, in 2024, the Federal Trade Commission (FTC) continued to emphasize enforcement of deceptive advertising practices, which could affect Arhaus's promotional campaigns. Failure to adhere to these regulations can result in substantial fines, potentially impacting profitability and brand reputation.

Geopolitical instability in key sourcing regions presents a significant risk for Arhaus. For instance, regions experiencing political unrest or conflict can lead to supply chain disruptions, directly impacting lead times for furniture and home décor. This instability can make material acquisition less reliable and more costly, affecting production schedules and the timely delivery of products to customers.

Fiscal Policies and Taxation

Government fiscal policies, such as corporate tax rates and sales taxes, directly influence Arhaus's bottom line and strategic investment choices. For instance, changes in the U.S. federal corporate tax rate, which stood at 21% in 2024, can significantly impact net income. Similarly, state-level sales tax variations affect consumer spending on discretionary items like furniture.

Incentives for sustainable business practices, like tax credits for energy-efficient manufacturing or renewable energy adoption, can also play a role. While specific recent data on Arhaus's utilization of such incentives is not publicly detailed, the U.S. Inflation Reduction Act of 2022 offers broad opportunities for businesses investing in clean energy and sustainable operations, potentially benefiting Arhaus's supply chain or operational footprint.

- Corporate Tax Impact: A 1% change in the U.S. federal corporate tax rate could alter Arhaus's tax liability by millions, depending on its annual profit.

- Sales Tax Influence: Varying state sales tax rates, which can range from 0% to over 10% in some jurisdictions, affect the final price paid by customers for Arhaus products.

- Sustainability Incentives: Government programs offering tax credits for green investments could reduce Arhaus's operational costs or encourage capital expenditure in eco-friendly initiatives.

Consumer Protection Legislation

New and updated consumer protection laws significantly shape Arhaus's customer interactions. Regulations concerning product quality, warranty terms, return policies, and data privacy are critical. For instance, the California Consumer Privacy Act (CCPA), expanded in 2023, places stringent requirements on how companies handle customer data, impacting Arhaus's marketing and sales strategies.

Adherence to these evolving consumer protection frameworks is paramount for Arhaus to cultivate and maintain customer trust. Non-compliance can lead to substantial fines and damage brand reputation, particularly for a company emphasizing high-quality goods and customer service. In 2024, the Federal Trade Commission (FTC) continued its focus on deceptive advertising and unfair business practices, underscoring the need for transparency in Arhaus's product claims and sales processes.

- Product Quality and Durability Standards: Evolving regulations may impose stricter testing and certification requirements for furniture materials and construction.

- Warranty and Repair Obligations: Legislation could mandate extended warranty periods or clearer stipulations on repair services for Arhaus products.

- Return and Refund Policies: Consumer protection laws often dictate the ease and conditions under which customers can return items, impacting Arhaus's operational flexibility.

- Data Privacy and Security: With increasing data breaches, Arhaus must comply with robust data protection laws, such as GDPR and CCPA, to safeguard customer information.

Political stability in key sourcing countries is crucial for Arhaus's supply chain continuity. For instance, ongoing trade negotiations and potential shifts in international relations can influence the cost and availability of raw materials and finished goods. Government stability directly impacts investment decisions and the overall risk profile of international operations.

Government fiscal policies, such as corporate tax rates and import duties, directly affect Arhaus's profitability and pricing strategies. For example, changes in U.S. corporate tax rates, which remained at 21% in 2024, influence net income. Similarly, tariffs on imported furniture components can increase costs, potentially leading to higher consumer prices.

Regulatory environments, including consumer protection laws and zoning ordinances, shape Arhaus's operational framework. Compliance with advertising standards and product safety regulations is essential to maintain brand trust. In 2024, the FTC's continued focus on deceptive advertising practices highlighted the need for transparent marketing by companies like Arhaus.

Government incentives for sustainable practices, such as tax credits for energy-efficient manufacturing, can influence Arhaus's operational investments. The U.S. Inflation Reduction Act of 2022 offers opportunities that could benefit Arhaus's supply chain or manufacturing processes, encouraging greener business models.

What is included in the product

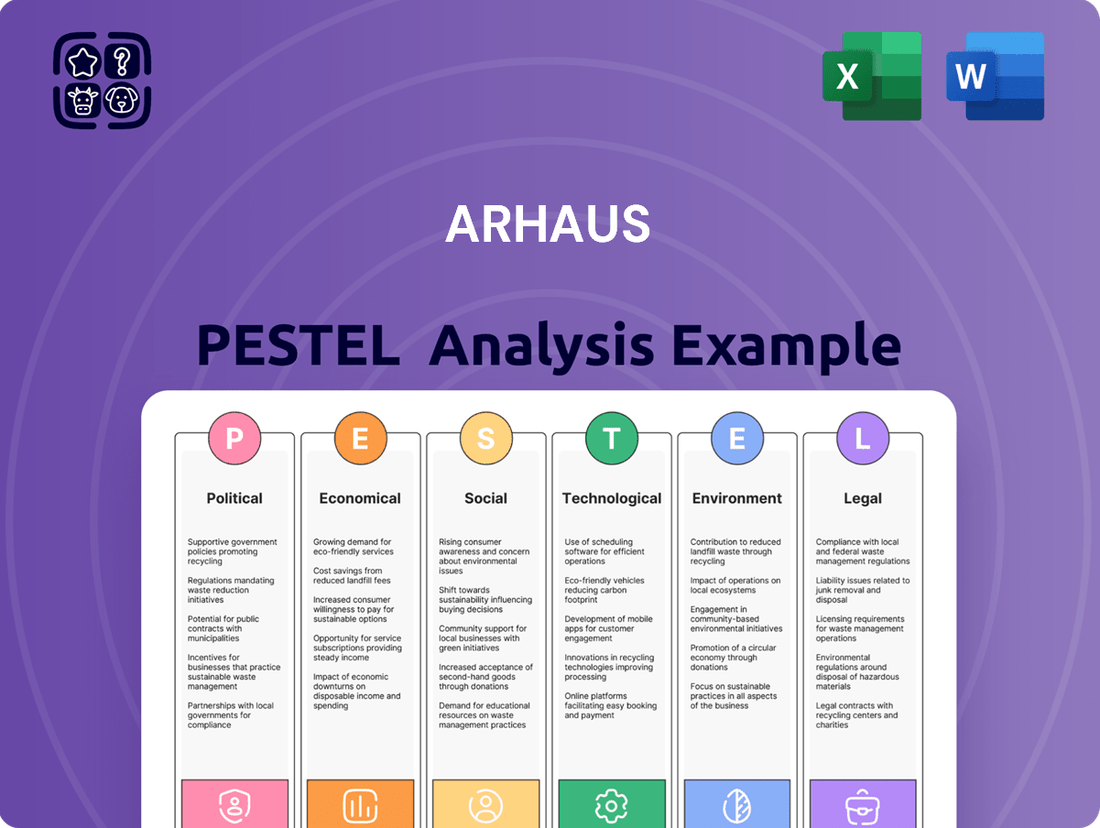

This Arhaus PESTLE analysis delves into how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—shape the company's operational landscape and strategic opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Arhaus's strategic discussions.

Economic factors

Consumer disposable income is a critical driver for Arhaus, as home furnishings are often discretionary purchases. When households have more money left after essential expenses, they are more likely to invest in higher-end items like those offered by Arhaus. For instance, in early 2024, while inflation showed signs of easing, the overall increase in real disposable income in the US, though modest, supported consumer spending on non-essential goods.

Interest rate changes directly influence mortgage affordability, a key driver of housing market activity. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25% to 5.50% through 2024 and into 2025, as anticipated by many economists, this can translate to higher mortgage rates, potentially cooling demand for new homes.

A robust housing market, characterized by increased new home construction and sales, generally boosts demand for home furnishings like those offered by Arhaus. In 2023, while housing starts saw some fluctuations, the underlying demand for updated living spaces remained, though higher borrowing costs presented a headwind for many potential buyers.

Conversely, a slowdown in the housing market, often triggered by elevated interest rates or economic uncertainty, can lead to reduced consumer spending on discretionary items such as high-end furniture. Arhaus, as a purveyor of premium home furnishings, is particularly sensitive to shifts in consumer confidence and disposable income, which are often tied to housing market performance.

Inflationary pressures continue to be a significant concern for Arhaus. In early 2024, the Consumer Price Index (CPI) showed a persistent upward trend, impacting the cost of raw materials like lumber and textiles, which are crucial for furniture manufacturing. This directly affects Arhaus's cost of goods sold.

The rising expense of manufacturing and transportation, including freight costs, further squeezes profit margins. If Arhaus cannot pass these increased costs onto consumers through price adjustments, their profitability could be eroded. For instance, global shipping rates saw notable increases throughout 2023 and into 2024, adding to the landed cost of imported goods.

Exchange Rate Volatility

Exchange rate volatility poses a significant challenge for Arhaus, a company with extensive global sourcing. Fluctuations in currency values directly impact the cost of imported furniture and decor. For instance, if the US dollar weakens against currencies like the Euro or Chinese Yuan, Arhaus’s expenses for sourcing materials and finished goods from these regions will rise. This can squeeze profit margins or necessitate price increases for consumers, potentially affecting sales volume.

The impact is particularly pronounced when considering Arhaus's reliance on international suppliers for its diverse product catalog. A stronger US dollar, conversely, could lower import costs, offering a potential pricing advantage or margin improvement. For example, during periods of significant dollar appreciation, the cost of goods sold for imported items could decrease, providing a buffer against other inflationary pressures.

- Impact on Cost of Goods Sold: A 10% depreciation of the US dollar against the Euro could increase the cost of European-sourced goods by a similar percentage.

- Pricing Strategy: Arhaus may need to adjust its pricing to offset increased import costs, potentially impacting consumer demand.

- Competitive Landscape: Competitors who source more domestically or have better currency hedging strategies might gain a pricing advantage during periods of dollar weakness.

- Profitability: Unfavorable exchange rate movements can directly reduce Arhaus's net income by increasing operational expenses.

Economic Growth and Recession Risks

The overall health of the economy significantly influences consumer confidence and Arhaus's sales performance. Periods of strong economic growth typically encourage consumers to spend more on discretionary items like home furnishings. Conversely, the specter of recession often leads to a sharp reduction in such spending.

For instance, the U.S. economy experienced a GDP growth of 2.5% in 2023, indicating a relatively stable environment for consumer spending. However, projections for 2024 suggest a moderation in growth, with forecasts hovering around 1.5% to 2.0%, which could temper demand for higher-ticket items.

- Consumer Confidence: Fluctuations in consumer sentiment directly impact discretionary spending on home goods.

- Interest Rate Environment: Higher interest rates, often a response to inflation and economic overheating, can increase borrowing costs for consumers and businesses, potentially dampening demand.

- Inflationary Pressures: Persistent inflation erodes purchasing power, making consumers more cautious about large purchases.

- Unemployment Rates: Low unemployment generally correlates with higher consumer confidence and spending capacity, benefiting retailers like Arhaus.

Consumer purchasing power, directly tied to disposable income and employment levels, is paramount for Arhaus. As of early 2024, while inflation has shown signs of moderating, the real disposable income growth in the US, projected to be around 1.5% for the year, supports continued spending on home furnishings. Low unemployment rates, hovering near multi-decade lows in the US, further bolster consumer confidence and their capacity for discretionary purchases, benefiting retailers like Arhaus.

Interest rates significantly influence the housing market, a key sector for furniture sales. With the Federal Reserve maintaining its target range for the federal funds rate between 5.25% and 5.50% through early 2024, mortgage rates remain elevated, potentially moderating new home sales and renovations. This environment can lead to a more cautious consumer approach to large discretionary purchases, impacting Arhaus's sales volume.

Economic growth directly correlates with consumer spending on non-essential items. The US economy expanded by 2.5% in 2023, providing a generally favorable backdrop for retailers. However, forecasts for 2024 anticipate a slowdown, with GDP growth projected between 1.5% and 2.0%, suggesting a potentially more constrained spending environment for premium home furnishings.

| Economic Factor | 2023 Data/Trend | 2024 Projection/Trend | Impact on Arhaus |

|---|---|---|---|

| Real Disposable Income Growth (US) | Modest positive growth | Projected 1.5% | Supports discretionary spending on home goods. |

| Federal Funds Rate (US) | 5.25%-5.50% | Expected to remain stable or see slight reductions later in 2024/2025 | Elevated rates can temper housing market activity and consumer borrowing for large purchases. |

| US GDP Growth | 2.5% | Projected 1.5%-2.0% | Slowing growth may lead to more cautious consumer spending. |

| Unemployment Rate (US) | Near multi-decade lows | Expected to remain low, potentially ticking up slightly | Low unemployment generally supports consumer confidence and spending. |

Full Version Awaits

Arhaus PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Arhaus PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the furniture retailer. It provides actionable insights for strategic planning.

You'll gain a deep understanding of market trends, competitive landscapes, and potential growth opportunities, all presented in a clear and organized format.

Sociological factors

Consumer lifestyles are definitely changing, and this directly impacts what people want in their homes. With more people working from home, there's a bigger need for comfortable and functional home office setups. Plus, many are spending more time entertaining guests at home, which boosts demand for stylish and practical dining and living room furniture.

Arhaus needs to keep up with these shifts. For instance, offering more versatile furniture that can serve multiple purposes, like a coffee table that doubles as a desk, or expanding their range of outdoor living solutions to cater to increased interest in backyard entertaining, would be smart moves. This adaptability is key to staying relevant in the current market.

Consumers are increasingly prioritizing sustainability and ethical sourcing, a trend that directly benefits Arhaus's commitment to these values. For instance, a 2024 Nielsen report indicated that 66% of global consumers are willing to pay more for sustainable brands, a significant increase from previous years. This growing demand for eco-friendly and responsibly made home furnishings presents a clear opportunity for Arhaus to solidify its market position and attract a larger base of environmentally conscious shoppers.

Demographic shifts are significantly reshaping the furniture market. For instance, the aging population in developed countries often seeks comfort and accessibility in furniture design, while younger generations, like millennials, are increasingly prioritizing smaller, multi-functional pieces suitable for urban living and potentially delayed homeownership. In 2024, the U.S. Census Bureau reported that the average household size continues to trend downwards, underscoring the demand for more compact and adaptable furniture solutions.

Arhaus must closely monitor these evolving household structures and age demographics to align its product offerings. Understanding that a growing segment of consumers may be downsizing or seeking furniture for smaller living spaces is crucial. This insight allows Arhaus to tailor its marketing and product development, ensuring its collections resonate with the specific needs and preferences of these diverse consumer groups, potentially leading to increased sales in 2025.

Influence of Online Shopping and Digital Engagement

The increasing reliance on e-commerce and digital channels profoundly shapes how consumers, including Arhaus's target demographic, make purchasing decisions. By late 2024, it's estimated that over 27% of all retail sales will occur online, a figure projected to climb higher in 2025. Arhaus must therefore prioritize a seamless digital experience, from intuitive website navigation to captivating social media engagement, to effectively reach and convert customers in this evolving landscape.

Maintaining a strong digital footprint is no longer optional; it's a necessity for capturing market share. This involves not only a functional website but also active participation on platforms where consumers spend their time. For instance, social commerce, where purchases can be made directly through social media, is a rapidly expanding segment of online retail, with projections indicating significant growth through 2025.

- E-commerce Growth: Online retail sales are projected to constitute a significant portion of total retail, expected to exceed 27% by the end of 2024 and continue its upward trajectory into 2025.

- Digital Engagement: Consumers increasingly expect personalized and interactive online experiences, including engaging content on social media platforms and user-friendly interfaces.

- Omnichannel Expectations: A seamless integration between online and physical store experiences is crucial, allowing customers to browse online, purchase in-store, or vice-versa, reflecting a growing consumer demand for flexibility.

- Social Commerce: The trend of purchasing directly through social media platforms is gaining momentum, presenting an opportunity for brands like Arhaus to leverage these channels for sales and customer interaction.

Health and Wellness Consciousness in Home Design

Consumers are increasingly prioritizing health and wellness within their homes, driving demand for natural materials, improved air quality, and spaces designed for relaxation. This shift directly influences home design choices, impacting furniture and décor preferences.

Arhaus, with its established commitment to craftsmanship and high-quality, often natural materials, is well-positioned to meet this growing consumer desire for healthier and more aesthetically pleasing living environments. For instance, the global wellness real estate market was projected to reach $2.1 trillion by 2027, indicating a significant opportunity for brands aligning with these values.

- Growing Demand: Homebuyers and renters are actively seeking homes that promote well-being, with features like non-toxic materials and good ventilation.

- Material Focus: There's a noticeable preference for sustainably sourced wood, natural fibers, and low-VOC (volatile organic compound) finishes in furniture and decor.

- Wellness Integration: The concept of creating 'sanctuaries' at home, incorporating elements that reduce stress and improve mental health, is a key driver in purchasing decisions.

- Market Growth: The wellness industry, broadly defined, continues to expand, with home design being a significant and growing segment within it.

Societal values are shifting, with a greater emphasis on experiences over possessions, and a growing appreciation for craftsmanship and unique design. This trend encourages consumers to invest in quality, long-lasting pieces that tell a story. Arhaus's focus on artisanal craftsmanship and unique, globally-inspired collections aligns perfectly with this evolving consumer mindset.

The increasing awareness of social justice and ethical business practices also plays a role. Consumers are more likely to support brands that demonstrate corporate social responsibility and fair labor practices. Arhaus's commitment to ethical sourcing and community engagement can be a significant differentiator in this regard.

Furthermore, the desire for personalized living spaces that reflect individual identity is on the rise. Arhaus's ability to offer customizable options and a wide variety of styles allows customers to curate homes that are truly their own, tapping into this need for self-expression.

The influence of social media and digital communities continues to shape trends and preferences. A 2024 survey by Statista found that 45% of consumers discover new home decor brands through social media platforms like Instagram and Pinterest, highlighting the importance of a strong online presence for Arhaus.

Technological factors

Arhaus is investing in its e-commerce platform to ensure customers have a smooth online experience. This means making the website easier to use, quicker to load, and offering personalized product suggestions. For instance, in 2024, many e-commerce businesses saw conversion rate increases of 10-20% with improved site speed and user interface design.

These platform enhancements are vital for boosting customer satisfaction and driving sales. Secure and efficient payment processing is a key component, building trust and encouraging repeat business. By mid-2025, it's projected that over 70% of online retail transactions will be completed on mobile devices, highlighting the need for robust mobile e-commerce capabilities.

Arhaus is leveraging technologies like AI for demand forecasting and IoT for real-time inventory visibility to streamline its supply chain. This focus on optimization is crucial, especially as global supply chain disruptions continued into 2024, impacting delivery times and costs for furniture retailers.

The adoption of these advanced tools aims to reduce operational costs and minimize delivery delays, enhancing Arhaus's ability to meet customer expectations. For instance, improved inventory tracking can prevent stockouts and reduce the need for costly expedited shipping, a common challenge in the sector.

Virtual and augmented reality (VR/AR) are transforming how consumers interact with products, especially in home furnishings. Arhaus can utilize these technologies to let customers see how furniture would look in their own living spaces before buying, a significant step in reducing returns. For instance, a study by Statista in 2024 indicated that 60% of consumers are more likely to purchase a product if they can visualize it in their environment using AR. This directly addresses the online-to-offline gap, boosting customer confidence and potentially increasing conversion rates for Arhaus.

Data Analytics and Personalization

Arhaus is increasingly leveraging big data analytics to understand its customers better. This allows for a deeper dive into what shoppers like, how they buy, and what's trending in the market. For instance, by analyzing purchase history and online browsing behavior, Arhaus can tailor marketing messages and product recommendations, making the customer experience more relevant.

This data-driven approach directly impacts sales and customer retention. Personalization efforts, informed by analytics, can lead to more effective campaigns and optimized product selections that resonate with specific customer segments. In 2023, companies leveraging advanced analytics reported an average of 10-15% increase in customer lifetime value, a trend Arhaus is likely pursuing.

- Customer Insights: Arhaus uses data to understand individual customer preferences and buying habits.

- Personalized Marketing: Data analytics enables targeted campaigns and customized offers for customers.

- Optimized Assortments: Insights help Arhaus stock products that are most likely to appeal to its customer base.

- Enhanced Service: Data can inform improvements in customer service interactions and support.

Sustainable Manufacturing and Material Innovation

Technological advancements in sustainable manufacturing are increasingly important for companies like Arhaus. Innovations such as 3D printing with biodegradable materials or sophisticated recycling processes can directly support Arhaus's dedication to quality craftsmanship and environmental responsibility. These technologies offer a tangible way to lessen ecological footprints and attract consumers who prioritize sustainability.

The furniture industry, in particular, is seeing a push towards more efficient and eco-friendly production. For instance, reports from 2024 indicate a growing market for recycled plastics in furniture manufacturing, with some estimates suggesting a 15% year-over-year increase in adoption. Arhaus's investment in such technologies could therefore yield both environmental benefits and a stronger market position.

- 3D Printing: Exploration of 3D printing with recycled or bio-based filaments for custom furniture components.

- Advanced Recycling: Implementation of technologies that can process post-consumer waste into usable raw materials for furniture.

- Smart Manufacturing: Adoption of AI and IoT in production lines to optimize energy consumption and reduce material waste, potentially cutting operational costs by 10-15% in 2024-2025.

Arhaus is enhancing its digital presence by investing in its e-commerce platform, aiming for a seamless online customer experience with faster loading times and personalized recommendations, a trend that saw conversion rate increases of 10-20% in 2024 for many online retailers.

The company is also integrating advanced technologies like AI for demand forecasting and IoT for real-time inventory management to optimize its supply chain, a critical move given the continued supply chain disruptions experienced globally through 2024.

Furthermore, Arhaus is exploring virtual and augmented reality (VR/AR) to allow customers to visualize products in their homes, a technology that Statista reported in 2024 makes 60% of consumers more likely to purchase.

The use of big data analytics is central to understanding customer behavior and tailoring marketing efforts, with companies leveraging such insights reporting an average 10-15% increase in customer lifetime value in 2023.

| Technology Focus | Impact | Industry Data/Trend |

|---|---|---|

| E-commerce Platform Enhancement | Improved user experience, increased conversion rates | 10-20% conversion rate increase with improved site speed (2024) |

| AI & IoT in Supply Chain | Optimized inventory, reduced delivery delays | Ongoing supply chain disruptions impacting furniture retailers (2024) |

| VR/AR Visualization | Enhanced customer confidence, reduced returns | 60% of consumers more likely to purchase with AR visualization (2024) |

| Big Data Analytics | Personalized marketing, increased customer lifetime value | 10-15% increase in customer lifetime value via analytics (2023) |

Legal factors

Arhaus must strictly adhere to product safety and quality regulations, covering aspects like flammability, lead content, and structural integrity. For instance, the Consumer Product Safety Improvement Act (CPSIA) in the US sets stringent limits on lead and phthalates in children's products, which, while not Arhaus's primary focus, highlights the broader regulatory landscape for consumer goods. Failure to comply can result in costly product recalls and legal battles, as seen when other furniture retailers have faced penalties for non-compliance with safety standards.

Arhaus must navigate a complex landscape of consumer data privacy laws, with California's Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), setting a high bar. As of 2024, businesses are increasingly focused on granular consent management and data minimization principles. The potential for new federal privacy legislation in the US, akin to Europe's GDPR, adds another layer of compliance challenge, impacting how Arhaus collects, stores, and utilizes customer information for its e-commerce and marketing efforts.

Arhaus navigates a landscape of labor laws, from minimum wage requirements to workplace safety standards, impacting its employee base across its retail footprint and supply chain. For instance, in 2024, the U.S. Department of Labor continued to enforce regulations like the Fair Labor Standards Act (FLSA), which dictates overtime pay and child labor rules. Failure to comply can result in significant penalties and legal challenges.

Maintaining fair employment practices, including non-discrimination and equal opportunity, is paramount for Arhaus's reputation and operational stability. In 2025, ongoing scrutiny of diversity and inclusion initiatives means Arhaus must demonstrate robust policies that prevent bias in hiring and promotion. This also extends to ensuring safe and healthy working conditions throughout its operations, a key tenet of labor regulations.

Intellectual Property Rights and Design Protection

Protecting its distinctive furniture designs and brand identity through patents, trademarks, and copyrights is crucial for Arhaus to sustain its competitive advantage. This legal framework safeguards their unique aesthetic and market presence from imitation.

Legal actions against intellectual property infringement are essential to prevent rivals from copying Arhaus's signature products and diluting its market positioning. For instance, in 2023, the global intellectual property rights market was valued at an estimated $300 billion, highlighting the significant economic importance of these protections.

- Patents: Arhaus likely utilizes design patents to protect the ornamental appearance of its innovative furniture pieces, preventing others from manufacturing or selling identical or substantially similar designs.

- Trademarks: The Arhaus brand name, logo, and potentially unique product line names are protected by trademarks, ensuring brand recognition and preventing consumer confusion with counterfeit goods.

- Copyrights: Original artistic elements within their product designs, marketing materials, and website content are safeguarded by copyright law, granting Arhaus exclusive rights to their reproduction and distribution.

International Trade and Customs Laws

Arhaus's reliance on global sourcing means navigating a complex web of international trade and customs laws. Understanding import/export regulations, tariffs, and trade agreements is crucial for maintaining an efficient supply chain. For instance, in 2024, the World Trade Organization (WTO) continued to monitor and enforce global trade rules, impacting duties and quotas on furniture imports.

Compliance with these regulations is not merely procedural; it directly affects Arhaus's operational costs and speed to market. Failure to adhere to customs requirements can lead to significant delays, hefty fines, and damaged supplier relationships, as seen in various supply chain disruptions reported throughout 2024.

- Tariff Rates: Fluctuations in tariff rates, such as those impacting furniture imports from certain Asian countries, can alter Arhaus's cost of goods sold.

- Trade Agreements: The impact of existing and potential new trade agreements on sourcing and distribution costs for Arhaus remains a key consideration.

- Customs Compliance: Ensuring accurate product classification and documentation is vital to avoid penalties and delays at ports of entry.

- Sanctions and Embargoes: Arhaus must remain aware of and comply with any international sanctions or embargoes that could affect its sourcing or sales activities.

Arhaus must comply with evolving consumer protection laws, ensuring product safety and accurate marketing claims. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on preventing deceptive advertising practices. Non-compliance can lead to significant fines and damage to brand reputation, as demonstrated by past enforcement actions against other retailers for misleading product descriptions.

Navigating international trade regulations and tariffs is critical for Arhaus's global sourcing strategy. In 2025, companies are increasingly focused on supply chain resilience and compliance with trade agreements, impacting import costs and delivery times. Understanding and adhering to customs laws in various markets is essential to avoid costly delays and penalties.

Intellectual property laws are vital for Arhaus to protect its unique designs and brand. In 2024, the value of global IP rights continued to grow, underscoring the importance of robust patent, trademark, and copyright protections. Safeguarding its creative assets prevents market dilution and maintains its competitive edge.

Environmental factors

Arhaus's commitment to craftsmanship and sustainability heavily relies on the responsible sourcing of materials. This includes utilizing options like Forest Stewardship Council (FSC) certified wood, recycled metals, and eco-friendly fabrics, ensuring a reduced environmental footprint.

Maintaining a transparent and ethical supply chain is paramount for Arhaus's brand integrity and meeting the growing consumer demand for environmentally conscious products. For example, by 2024, over 70% of consumers reported they were willing to pay more for sustainable products, a trend that continues to influence purchasing decisions.

Arhaus is increasingly focusing on waste reduction across its operations, from manufacturing to packaging and retail. This commitment aligns with growing consumer and regulatory pressure to adopt more sustainable practices. For instance, by the end of 2023, many retailers were reporting significant progress in reducing single-use plastics in their packaging, with some aiming for 100% recycled or recyclable materials by 2025.

Exploring circular economy principles is also a key environmental consideration for Arhaus. This involves looking at ways to extend product lifecycles and minimize landfill waste, potentially through product repair services or take-back programs. The global circular economy market is projected to reach over $4.5 trillion by 2030, highlighting the significant economic and environmental opportunities in this area.

Arhaus is increasingly focused on minimizing its carbon footprint across all operations, from sourcing materials to customer delivery. In 2023, the company continued its efforts to integrate sustainable practices, aiming to reduce energy consumption in its retail stores and distribution centers. This includes ongoing investments in energy-efficient lighting and HVAC systems.

Optimizing transportation logistics is also a key strategy for Arhaus to lower emissions. By consolidating shipments and exploring more fuel-efficient delivery methods, the company is working to reduce the environmental impact of getting its products to customers. These initiatives directly support Arhaus's broader corporate sustainability objectives and respond to growing consumer demand for eco-conscious brands.

Climate Change Impacts on Supply Chains

Climate change presents significant physical risks to Arhaus's global supply chain. Extreme weather events, such as floods, droughts, and hurricanes, can directly impact the availability of raw materials, disrupt manufacturing operations, and damage transportation infrastructure, leading to delays and increased costs. For instance, a severe drought in a key timber-producing region could limit Arhaus's access to wood for furniture production.

Adapting to these evolving environmental factors is crucial for Arhaus's operational resilience. This necessitates proactive strategies like diversifying sourcing locations to mitigate regional weather-related risks and investing in more resilient logistics planning. By building flexibility into its supply chain, Arhaus can better navigate the unpredictable impacts of a changing climate.

The financial implications of climate-related disruptions are substantial. According to a 2024 report by the World Economic Forum, supply chain disruptions due to climate change are among the top global risks. Companies are increasingly factoring these risks into their operational budgets and strategic planning, with some estimating potential losses in the billions due to climate-induced supply chain failures.

- Physical Risks: Extreme weather events impacting raw material sourcing and manufacturing.

- Supply Chain Disruptions: Delays and increased costs due to damaged transportation routes.

- Adaptation Strategies: Diversified sourcing and resilient logistics planning are essential for mitigation.

- Financial Impact: Climate-related disruptions pose significant financial risks, with potential for billions in losses globally.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly products is a significant environmental factor influencing Arhaus. A growing segment of consumers actively seeks out brands demonstrating environmental responsibility, directly impacting Arhaus's product design, sourcing, and marketing efforts. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for sustainable products, a trend Arhaus can leverage by highlighting its commitment to eco-conscious materials and manufacturing processes.

Arhaus's ability to clearly communicate its sustainable practices and offer a compelling range of eco-friendly furniture and decor can attract and retain these environmentally aware customers. This focus on sustainability is not just a trend but a fundamental shift in consumer values, with market research in late 2024 showing a 15% year-over-year increase in searches for "sustainable furniture."

- Growing Consumer Prioritization: Consumers increasingly favor brands with demonstrable environmental stewardship.

- Market Demand for Sustainability: A significant portion of consumers, estimated at over 60% in 2024, are willing to pay a premium for sustainable goods.

- Impact on Product Strategy: Arhaus must integrate eco-friendly materials and ethical sourcing into its product development to meet this demand.

- Marketing Opportunities: Transparent communication about sustainability initiatives can enhance brand loyalty and attract new customer segments.

Arhaus's environmental strategy centers on responsible material sourcing, utilizing options like FSC-certified wood and recycled metals to minimize its ecological impact. This aligns with a market where, by 2024, over 70% of consumers expressed willingness to pay more for sustainable products.

The company is actively working to reduce waste throughout its operations, from manufacturing to packaging, a move that resonates with consumer preferences and regulatory shifts, as many retailers aimed for 100% recycled or recyclable packaging by 2025.

Furthermore, Arhaus is exploring circular economy principles to extend product lifecycles and reduce landfill waste, tapping into a global market projected to exceed $4.5 trillion by 2030.

Climate change poses physical risks, potentially disrupting raw material availability and logistics, as highlighted by the World Economic Forum in 2024, which identified supply chain disruptions from climate events as a top global risk.

PESTLE Analysis Data Sources

Our Arhaus PESTLE Analysis is grounded in comprehensive data from reputable sources, including government economic reports, industry-specific market research, and global trend publications. We meticulously gather insights on political stability, economic indicators, social demographics, technological advancements, environmental regulations, and legal frameworks to ensure a thorough understanding of the macro-environment impacting Arhaus.