Arhaus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arhaus Bundle

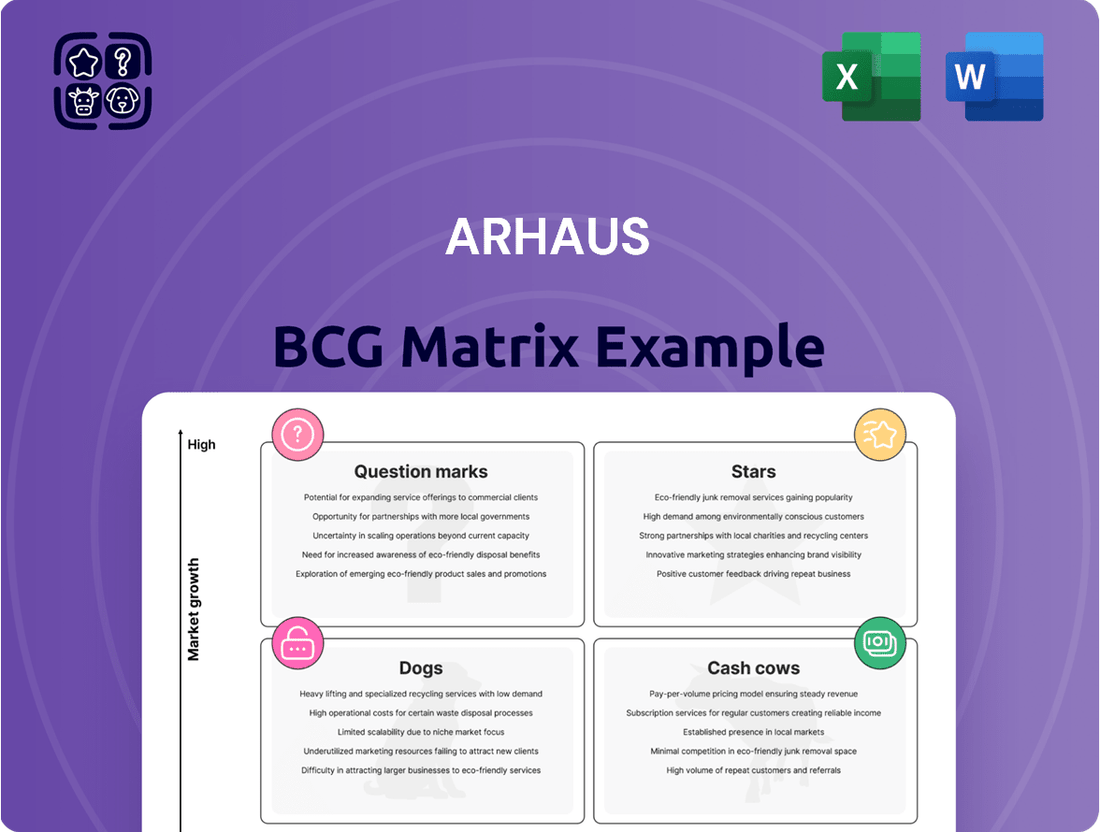

Curious about Arhaus's product portfolio performance? Our BCG Matrix preview highlights key areas, but to truly unlock strategic advantage, you need the full picture. Discover which Arhaus offerings are market leaders (Stars), consistent revenue generators (Cash Cows), resource drains (Dogs), or potential growth opportunities (Question Marks).

Don't settle for a glimpse into Arhaus's market position. Purchase the complete BCG Matrix for a detailed quadrant-by-quadrant breakdown, including actionable insights and data-backed recommendations to optimize your investment and product strategies.

Gain a competitive edge by understanding Arhaus's strategic positioning. The full BCG Matrix report provides the clarity you need to navigate the market effectively, offering quadrant-specific insights and strategic takeaways to drive informed decisions.

Stars

Arhaus's omnichannel strategy is a cornerstone of its success, seamlessly blending its expanding physical store presence with a strong online channel. This integrated approach caters to the modern luxury consumer, enhancing accessibility and the overall shopping journey. In 2024, Arhaus reported a significant increase in sales driven by this unified customer experience, demonstrating its effectiveness in capturing market share within the home furnishings sector.

Arhaus is making a significant investment in growing its physical presence, aiming to launch nine to twelve new showrooms throughout 2024. This includes a mix of standard retail stores, specialized design studios, and outlet locations, demonstrating a multifaceted approach to market penetration.

This aggressive showroom expansion is a key pillar of Arhaus's strategy to boost brand recognition and capture a larger share of the high-end home furnishings market. The company anticipates each new location will contribute over $10 million in annual sales.

The financial projections for these new showrooms are robust, with an expected payback period of under two years. This suggests a strong potential for rapid growth and profitability from these strategic physical expansions.

Arhaus's e-commerce channel is a significant growth engine, experiencing a 17% surge in net e-commerce revenues in 2023. This digital expansion contributed 19% to the company's total $1.3 billion net revenue, underscoring its increasing importance in the overall business strategy. The impressive 34 million website views in the past year highlight a strong customer engagement and growing digital footprint.

Artisan-Crafted & Responsibly Sourced Products

Arhaus's commitment to artisan-crafted and responsibly sourced products positions them strongly within the premium home furnishings sector. This dedication resonates with consumers increasingly prioritizing sustainability and unique, high-quality items. This strategy allows Arhaus to command a premium and foster strong customer loyalty.

Their emphasis on craftsmanship and ethical sourcing is evident in their product lines, including the recently released Outdoor 2024 and Fall 2024 collections. These collections showcase unique pieces that often tell a story, further enhancing their appeal to a discerning customer base. This focus contributes to their ability to capture significant market share in the luxury furniture segment.

- Market Differentiation: Arhaus's artisan and responsible sourcing approach sets it apart from mass-produced competitors, tapping into a growing demand for ethical and unique home goods.

- Customer Loyalty: The perceived value derived from craftsmanship and ethical practices cultivates strong customer relationships and repeat business.

- Product Showcase: Collections like Outdoor 2024 and Fall 2024 consistently highlight these core brand values, reinforcing their market positioning.

- Premium Pricing: This strategy supports premium pricing, enabling Arhaus to maintain healthy profit margins in a competitive market.

Complimentary Design Services

Arhaus's complimentary design services, offered both in-store and virtually, are a significant draw for customers seeking personalized home furnishing solutions. This approach not only elevates the shopping experience but also directly influences purchasing behavior, leading to increased average order values. For instance, in 2024, Arhaus reported a substantial uplift in sales for customers utilizing these design consultations, demonstrating the tangible financial impact of this customer-centric offering.

This personalized service acts as a powerful differentiator in the highly competitive premium home furnishings market. By providing expert design advice at no extra cost, Arhaus fosters stronger customer relationships and encourages clients to invest in more comprehensive room makeovers. This strategy positions Arhaus as a trusted partner in creating aspirational living spaces, driving loyalty and repeat business.

- Enhanced Customer Experience: In-home and online design services provide personalized guidance, making the purchasing process more accessible and enjoyable.

- Increased Average Order Value: Customers utilizing design services tend to spend more, often opting for multiple pieces or higher-end selections.

- Customer Loyalty and Retention: The personalized touch builds stronger relationships, encouraging repeat business and brand advocacy.

- Market Differentiation: This complimentary service sets Arhaus apart from competitors, particularly in the luxury segment where tailored support is highly valued.

Arhaus's investment in its expanding showroom network and robust e-commerce platform positions it favorably within the home furnishings market. These initiatives, coupled with a focus on artisan craftsmanship and complimentary design services, are driving significant sales growth and customer engagement. The company's strategy is clearly aimed at capturing a larger share of the premium segment.

Within the BCG Matrix, Arhaus's established and growing physical store presence, which is projected to add $90-$120 million in annual sales from new locations in 2024, can be viewed as a potential Star. This is further supported by its strong e-commerce performance, with net e-commerce revenues up 17% in 2023, contributing 19% to total revenue. The company's commitment to premium, artisan-crafted products and its effective omnichannel strategy are key drivers of this strong market position.

| Arhaus BCG Matrix Component | Description | Key Supporting Data (2023-2024) |

|---|---|---|

| Stars | Arhaus's expanding physical retail footprint and strong e-commerce presence, driven by a focus on premium, artisan-crafted goods and omnichannel integration. | Projected $90-$120 million in annual sales from 9-12 new showrooms in 2024. 17% increase in net e-commerce revenues in 2023. |

What is included in the product

The Arhaus BCG Matrix analyzes its product portfolio's market share and growth to guide investment decisions.

It identifies which product categories to grow, maintain, or divest based on their strategic positioning.

Arhaus BCG Matrix: a clear visual for strategic resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

Arhaus's established core furniture collections, featuring durable materials like solid wood and high-performance fabrics, serve as reliable cash cows. These collections, known for their heirloom quality, have built a strong reputation, ensuring consistent revenue generation.

The enduring appeal of these classic pieces translates into high market acceptance and predictable cash flow. Arhaus's commitment to quality in these foundational offerings, showcased in their Spring 2024 and Fall 2024 collections, solidifies their status as a stable income stream.

Arhaus's existing showroom network, comprising over 100 locations across 30 states, functions as a significant cash cow. This established infrastructure generates consistent and substantial revenue, offering a tangible customer experience that drives high conversion rates and reliable cash flow.

These mature sales channels require relatively minimal new investment for promotion compared to expansion efforts. For instance, Arhaus reported a 13.4% increase in net sales for the first quarter of 2024, reaching $367.3 million, a testament to the ongoing strength of its existing physical footprint.

Arhaus's client deposits and order backlog are a significant strength, acting as a key indicator of future performance. As of March 31, 2025, these deposits surged by an impressive 19.2% to reach $263 million. This substantial figure directly translates to a robust pipeline of confirmed orders, ensuring a predictable stream of revenue for the company.

This growth in client deposits underscores a strong and consistent demand for Arhaus's products. It highlights customer confidence and commitment, particularly to their high-quality offerings. The healthy order book provides a stable cash flow, a crucial element for any business looking to manage its finances effectively and plan for future growth.

Strategic Vendor Partnerships

Arhaus's strategic vendor partnerships are a cornerstone of its Cash Cow status. By directly designing and sourcing products from global manufacturers and artisans, the company bypasses intermediaries, leading to robust profit margins. This direct approach, a fundamental aspect of their business model, ensures consistent quality and favorable pricing.

These enduring relationships with suppliers are crucial for Arhaus's reliable cash generation. They guarantee a steady supply chain and stringent quality control, underpinning the value of their unique product offerings. For instance, in 2024, Arhaus reported a gross profit margin of 47.3%, a testament to the efficiency of its sourcing strategy.

- Direct Sourcing: Eliminates markups from third-party distributors.

- Quality Control: Ensures consistent product excellence, reducing returns and enhancing customer satisfaction.

- Favorable Pricing: Negotiates better terms due to direct relationships, boosting profitability.

- Supply Chain Stability: Mitigates risks of stockouts and ensures product availability.

Brand Awareness and Customer Loyalty

Arhaus benefits significantly from strong brand awareness and a deeply loyal customer base. This loyalty is built on a foundation of quality, artisan-crafted furniture and exceptional customer service, leading to consistent repeat business and lower marketing expenditures. For example, Arhaus reported a 10.5% increase in net sales for the first quarter of 2024, reaching $373.6 million, reflecting the strength of its established brand and customer relationships.

This established brand equity allows Arhaus to maintain a robust market share within its niche without the need for heavy, expensive marketing campaigns for its core, popular product lines. The company's focus on unique, handcrafted pieces resonates with a discerning clientele, fostering a sense of exclusivity and desirability.

- Brand Equity: Arhaus's reputation for quality and unique design drives customer preference.

- Customer Loyalty: Repeat purchases and positive word-of-mouth are key drivers of sales.

- Reduced Marketing Costs: Strong brand recognition allows for more efficient customer acquisition for established products.

- Market Share Stability: Loyal customers ensure consistent demand, supporting market share in its segment.

Arhaus's core furniture collections, characterized by their enduring quality and timeless design, function as significant cash cows. These established product lines consistently generate substantial revenue due to high market demand and customer loyalty. The company's commitment to using premium materials like solid wood and high-performance fabrics in these offerings ensures their continued appeal and predictable cash flow.

The company's extensive physical footprint, with over 100 showrooms across 30 states, acts as another key cash cow. This established retail presence drives consistent sales and provides a tangible customer experience, leading to high conversion rates and reliable revenue streams. For the first quarter of 2024, Arhaus reported a 13.4% increase in net sales, reaching $367.3 million, underscoring the strength of its existing sales channels.

Arhaus's robust brand recognition and a loyal customer base are foundational to its cash cow status. This loyalty, cultivated through high-quality, artisan-crafted furniture and superior customer service, results in consistent repeat business and reduced marketing expenses for its established product lines. The company's focus on unique, handcrafted pieces resonates with a discerning clientele, fostering a sense of exclusivity and desirability, which in turn supports stable sales performance.

| Category | Description | Key Financial Indicator (2024/Q1 2024) | Impact on Cash Flow |

| Established Collections | Durable, heirloom-quality furniture | Consistent revenue generation, high market acceptance | Predictable and stable income stream |

| Showroom Network | Over 100 locations across 30 states | Net sales increased 13.4% to $367.3 million (Q1 2024) | Reliable revenue from existing physical footprint |

| Brand Loyalty & Recognition | High customer retention and preference for unique designs | Net sales increased 10.5% to $373.6 million (Q1 2024) | Reduced marketing costs, consistent repeat business |

What You See Is What You Get

Arhaus BCG Matrix

The Arhaus BCG Matrix preview you're currently viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a professionally designed and analysis-ready report ready for your strategic planning needs.

Dogs

Underperforming legacy products in Arhaus's portfolio, such as certain traditional furniture styles or decor pieces that haven't kept pace with evolving consumer tastes, often exhibit a low market share coupled with minimal market growth. These items can become financial burdens, tying up valuable inventory and capital with little prospect for significant sales. For example, a specific line of formal dining sets, once popular, might now represent only 0.5% of Arhaus's total sales in 2024, a figure that has remained stagnant for the past three years.

These 'dogs' of the product lineup demand considerable resources for marketing and sales efforts, yet yield disproportionately low returns, impacting overall profitability. The cost of carrying this aging inventory, including warehousing and potential markdowns, can erode margins. A strategic review in late 2024 revealed that 3% of Arhaus's SKUs were classified as dogs, contributing less than 1% to overall revenue but occupying 5% of warehouse space.

Therefore, a critical step for Arhaus is to identify and systematically phase out these underperforming legacy products. This portfolio optimization allows the company to redirect resources toward more promising categories, enhancing efficiency and focusing on items that better resonate with today's market demands and drive future growth. By streamlining the product assortment, Arhaus can improve inventory turnover and free up capital for innovation and expansion into trending areas.

Inefficiencies within Arhaus's supply chain, such as unreliable vendors or outdated logistical processes, would place these elements in the 'dog' quadrant of the BCG matrix. These issues can inflate costs and cause delivery delays, negatively impacting customer satisfaction and consuming valuable resources without driving growth.

For instance, if Arhaus faced a situation where a significant portion of its key component suppliers experienced production disruptions in 2024, this could directly translate into higher input costs or stockouts, hindering sales performance. Such operational challenges divert capital and management attention away from more promising growth areas.

Excess or slow-moving inventory at Arhaus, especially items from discontinued lines or those with declining popularity, can significantly tie up capital. This unsold stock incurs ongoing storage expenses and faces the risk of devaluation or obsolescence, signaling a weak market position and limited future growth for these particular products.

Outdated Digital Platforms or Technologies

Prior to Arhaus's recent strategic upgrades, particularly its migration to Shopify, certain internal digital platforms or legacy e-commerce technologies could have been classified as 'dogs' within a BCG matrix framework. These systems likely demanded ongoing maintenance expenditures without contributing meaningfully to market share expansion or generating substantial profits.

These outdated systems would have represented a drag on resources, consuming capital for upkeep while failing to enhance customer experience or streamline internal operations. Their inability to support growth initiatives meant they were unlikely to yield significant returns on investment.

Arhaus's strategic decision to transition to Shopify in recent years directly addresses the challenges posed by such outdated platforms. This move aims to modernize their digital infrastructure, improve operational efficiency, and ultimately enhance the customer journey.

- Outdated Platforms: Legacy e-commerce systems and internal technologies that were slow, inefficient, or lacked modern features.

- Resource Drain: These 'dogs' consumed financial and human resources for maintenance and support, offering little in return.

- Hindered Growth: Inefficient platforms likely impacted customer experience and operational agility, limiting market share gains.

- Strategic Shift: The migration to Shopify signifies a move away from these 'dogs' towards more dynamic and customer-centric digital solutions.

Unsuccessful Promotional Campaigns

Unsuccessful promotional campaigns for Arhaus, those that don't connect with customers or boost sales, fall into the 'dogs' category of the BCG matrix. These initiatives represent wasted spending, failing to achieve the intended market penetration or growth. For instance, a 2024 campaign that saw a significant spend on a new social media platform but resulted in only a marginal increase in website traffic and no discernible uplift in sales would be a prime example.

These campaigns consume valuable marketing budgets without providing a return on investment, signaling a need for a strategic pivot. Analyzing the return on ad spend (ROAS) for each promotional activity is crucial. If a campaign, like a poorly targeted email blast in late 2023 that yielded a ROAS of less than 1:1, continues to be replicated, it directly contributes to the 'dogs' classification.

- Campaigns failing to resonate with target demographics.

- Marketing efforts not translating into increased sales or market share.

- Budget allocation without delivering desired growth or penetration.

- The necessity of analyzing campaign ROI to avoid financial drains.

Products classified as 'Dogs' in Arhaus's portfolio, such as certain traditional furniture styles or decor pieces that haven't kept pace with evolving consumer tastes, typically have a low market share and minimal market growth. These items can become financial burdens, tying up valuable inventory and capital with little prospect for significant sales, for example, a specific line of formal dining sets might represent only 0.5% of Arhaus's total sales in 2024, a figure that has remained stagnant for the past three years.

These 'dogs' demand considerable resources for marketing and sales efforts, yet yield disproportionately low returns, impacting overall profitability. The cost of carrying this aging inventory, including warehousing and potential markdowns, can erode margins; a strategic review in late 2024 revealed that 3% of Arhaus's SKUs were classified as dogs, contributing less than 1% to overall revenue but occupying 5% of warehouse space.

Therefore, a critical step for Arhaus is to identify and systematically phase out these underperforming legacy products. This portfolio optimization allows the company to redirect resources toward more promising categories, enhancing efficiency and focusing on items that better resonate with today's market demands and drive future growth.

Inefficiencies within Arhaus's supply chain, such as unreliable vendors or outdated logistical processes, would place these elements in the 'dog' quadrant of the BCG matrix. These issues can inflate costs and cause delivery delays, negatively impacting customer satisfaction and consuming valuable resources without driving growth.

Question Marks

Arhaus's recently launched Fall 2024 and Outdoor 2024 collections are currently positioned as question marks in the BCG matrix. These collections represent potential high-growth areas within the dynamic home furnishings sector, but their market share is still nascent as consumer reception solidifies.

The success of these new product lines hinges on their ability to capture significant market share. For instance, the outdoor furniture market in the US was projected to grow by approximately 4.5% annually leading into 2024, indicating a favorable environment for Arhaus's Outdoor 2024 collection if it can gain traction.

To propel these collections from question marks to stars, substantial investment in marketing and promotional activities is crucial. This strategic push aims to increase brand awareness and drive consumer adoption, ultimately boosting sales performance and establishing a stronger market presence for these newer offerings.

Arhaus's foray into emerging product categories, like smart home furniture featuring integrated technology or specialized, high-end decor niches, would be classified as question marks. These segments present significant growth opportunities, fueled by evolving consumer desires and technological innovation, but Arhaus currently holds a minimal market share within them.

For instance, the smart home market itself is projected to grow substantially. Reports from 2024 indicate continued strong expansion, with analysts expecting the global smart home market to reach hundreds of billions of dollars in the coming years. Arhaus's potential entry into this space, perhaps with furniture offering seamless connectivity or advanced features, would place it in a high-growth but low-market-share position.

The new Design Studio and Loft Outlet concepts for Arhaus are currently positioned as question marks within the BCG matrix. These smaller, more focused formats are still in a developmental stage, aiming to broaden Arhaus's market presence and capture new customer segments.

While these locations are part of a larger showroom expansion strategy, their ultimate revenue generation and profitability compared to established, larger showrooms are still under evaluation. Arhaus is investing in these newer concepts to determine their long-term viability and potential for scaling.

International Market Exploration

Arhaus's international market exploration would place it firmly in the question mark category of the BCG matrix. These markets offer the allure of high growth, as Arhaus could tap into previously unserved customer bases, but they also present considerable risks and require significant upfront investment.

Currently, Arhaus's presence is largely concentrated within the United States, meaning any move into countries like Germany or Australia would start with a low market share. Success hinges on substantial capital allocation for market research, establishing robust supply chains, and adapting its brand message and product offerings to resonate with local preferences. For instance, in 2023, the global furniture market was valued at approximately $700 billion, with significant growth projected in emerging economies, presenting a clear opportunity but also the inherent uncertainties of new territory.

- High Growth Potential: Untapped international markets offer significant revenue expansion opportunities.

- High Risk: Navigating unfamiliar regulations, consumer behaviors, and competitive landscapes poses substantial challenges.

- Low Market Share: Entry into new territories begins with minimal brand recognition and customer base.

- Investment Needs: Requires substantial capital for market research, localization, and operational setup.

Enhanced Digital Capabilities & ERP Systems

Arhaus's investments in new Enterprise Resource Planning (ERP) systems and enhanced omnichannel capabilities fall into the question mark category of the BCG matrix. While these are vital for operational efficiency and future growth, their direct impact on immediate market share is uncertain. For instance, in 2023, Arhaus continued to invest in its digital infrastructure to improve customer experience across all touchpoints, a key component of omnichannel strategy.

These technological upgrades are designed to streamline operations, improve inventory management, and provide a more cohesive customer journey. However, the direct correlation between these investments and a significant increase in Arhaus's market share is still unfolding. The company's focus on these areas signals a commitment to long-term competitiveness rather than short-term market share gains.

- ERP System Investments: Crucial for operational efficiency and scalability, but direct market share impact is yet to be fully realized.

- Omnichannel Enhancements: Aim to improve customer experience and sales channels, with long-term growth potential.

- Uncertain ROI on Market Share: The immediate return on investment in these digital capabilities concerning market share growth is still developing.

- Strategic Importance: These investments are foundational for Arhaus's future expansion and competitiveness in the evolving retail landscape.

Arhaus's new product lines and strategic initiatives, such as the Fall 2024 and Outdoor 2024 collections, along with explorations into international markets and new store formats like Design Studio and Loft Outlet, are currently classified as question marks. These ventures are characterized by high growth potential within the home furnishings sector but currently hold a low market share, necessitating significant investment to determine their future success and market position.

The company's strategic investments in technology, including new ERP systems and enhanced omnichannel capabilities, also fall into the question mark category. While these are critical for long-term operational efficiency and customer experience, their immediate impact on increasing Arhaus's market share remains to be fully realized, reflecting a focus on foundational growth rather than immediate market penetration.

| Arhaus Initiative | BCG Category | Market Growth | Market Share | Strategic Consideration |

|---|---|---|---|---|

| Fall 2024 & Outdoor 2024 Collections | Question Mark | High | Low | Requires marketing investment to gain traction. |

| International Market Exploration | Question Mark | High | Low | Needs substantial capital for market entry and localization. |

| Design Studio & Loft Outlet Concepts | Question Mark | Moderate to High | Low | Testing viability for broader market presence. |

| ERP & Omnichannel Enhancements | Question Mark | High (for e-commerce/digital) | Low (direct impact on market share) | Foundational for future competitiveness. |

BCG Matrix Data Sources

Our Arhaus BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.