Ares Management PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ares Management Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Ares Management's trajectory. Our meticulously researched PESTLE analysis provides actionable intelligence to navigate these complex external forces. Equip yourself with the insights needed to anticipate challenges and seize opportunities. Download the full version now for a strategic advantage.

Political factors

Government policy and regulation are crucial for Ares Management, a global alternative investment firm. Changes in financial services rules, tax legislation, and trade agreements directly affect its investment strategies, ability to raise capital, and the overall profitability of its credit, private equity, real estate, and infrastructure divisions. For instance, evolving regulations around private credit markets or government initiatives in infrastructure development can present both new avenues for growth and potential hurdles.

Global geopolitical tensions, including ongoing conflicts and rising protectionist policies, are creating significant uncertainty in financial markets. For Ares Management, this instability directly impacts its international operations and diverse investor base. For instance, heightened tensions in the Middle East or Europe could lead to capital flight and reduced investment appetite among its clients, affecting capital flows and asset valuations.

The firm's extensive global footprint means that political instability in key regions can disrupt investment strategies. In 2024, the World Bank projected a slowdown in global growth partly due to these geopolitical risks, which directly influences the risk appetite of institutional investors that form a significant portion of Ares's capital. This environment necessitates a careful calibration of risk and a focus on resilient investment strategies.

Furthermore, geopolitical events can have tangible effects on Ares's infrastructure and real estate portfolios. Supply chain disruptions and energy security concerns, exacerbated by international conflicts, directly impact the operational viability and valuation of physical assets. For example, energy price volatility, a common consequence of geopolitical instability, can significantly alter the profitability of energy infrastructure projects that Ares may invest in.

Changes in global trade policies and the potential for new tariffs present a significant political factor for Ares Management. For instance, the ongoing trade tensions between major economies could impact the profitability and operational costs of companies within Ares' diverse portfolio, especially those reliant on international sourcing or export markets. In 2024, the World Trade Organization (WTO) reported that the value of world merchandise trade was projected to grow by 2.6%, a modest increase, but any significant protectionist measures could easily disrupt these forecasts.

Political Influence on Regulatory Environment

Political shifts can significantly alter the regulatory landscape for financial services. For instance, the ongoing debate around digital asset regulation in 2024 and 2025 highlights how differing national political priorities can lead to a patchwork of rules. This divergence impacts firms like Ares Management, which operate globally, by creating compliance challenges and potentially fragmenting markets.

The drive for national financial stability and data sovereignty, often politically motivated, can result in varied approaches to areas like capital requirements and cross-border data flows. This means Ares must navigate a complex web of differing standards, increasing operational costs. For example, the EU's Digital Finance Strategy aims for a harmonized approach, while other regions might prioritize bespoke national frameworks.

- Varying Digital Asset Regulations: By mid-2025, expect continued divergence in how countries like the US, EU, and Singapore approach crypto regulation, impacting Ares' potential involvement.

- Data Governance Divergence: Political emphasis on data localization could increase compliance burdens for Ares' global operations, with countries implementing stricter data residency laws.

- National Interest Over Cooperation: Policymakers may favor national champions or domestic market protection, leading to less international regulatory alignment and higher compliance costs for global players.

ESG Policy and Anti-ESG Sentiment

The growing prominence of ESG policies presents both opportunities and challenges for Ares Management. While many investors, including institutional ones, increasingly favor ESG integration, the rise of anti-ESG sentiment, particularly in certain US states, introduces regulatory complexity and potential shifts in capital allocation. For instance, as of late 2024, several US states have enacted legislation restricting state pension funds from investing with firms that heavily emphasize ESG criteria, potentially impacting Ares's ability to secure certain mandates.

This political pushback against ESG can create an uncertain operating environment, forcing firms like Ares to navigate differing regulatory landscapes and investor preferences. The debate often centers on fiduciary duty and whether ESG factors detract from maximizing financial returns, leading to varied interpretations of investment mandates. Ares must therefore remain adaptable, potentially offering tailored investment solutions that address both ESG-aligned and ESG-agnostic investor needs.

- ESG Investment Trends: Global sustainable investment assets reached an estimated $37.7 trillion in early 2024, indicating strong underlying demand, though growth rates have moderated.

- Anti-ESG Legislation: Over 20 US states have introduced or passed legislation related to ESG investing, with some directly prohibiting state funds from engaging with ESG-focused asset managers.

- Market Sentiment Shift: Public discourse and political rhetoric can influence investor perception and capital flows, requiring Ares to actively communicate its ESG strategy and its alignment with long-term value creation.

- Regulatory Uncertainty: The evolving nature of ESG regulations globally creates a dynamic environment, necessitating continuous monitoring and strategic adjustments to compliance and investment approaches.

Political stability and government policies are paramount for Ares Management's global operations. Shifts in fiscal policy, trade agreements, and financial regulations directly influence investment opportunities and capital flows across its diverse asset classes.

Geopolitical tensions and nationalistic policies can disrupt international trade and investment, impacting Ares' global portfolio performance and investor confidence. For example, trade disputes can affect supply chains and corporate valuations within Ares' private equity holdings.

The evolving regulatory landscape for digital assets and data governance presents significant compliance challenges. Differing national approaches to crypto regulation by mid-2025, for instance, require careful navigation for firms like Ares operating across multiple jurisdictions.

Political sentiment surrounding ESG investing creates a complex environment. While global sustainable investment assets were estimated at $37.7 trillion in early 2024, over 20 US states have introduced anti-ESG legislation, impacting capital allocation strategies for asset managers.

| Political Factor | Impact on Ares Management | Supporting Data/Trend (2024-2025) |

| Regulatory Changes | Affects investment strategies, capital raising, and profitability across divisions. | Divergence in digital asset regulation expected by mid-2025. |

| Geopolitical Tensions | Creates market uncertainty, impacting international operations and investor appetite. | World Bank projected global growth slowdown due to geopolitical risks in 2024. |

| Trade Policies | Influences profitability and operational costs of portfolio companies. | WTO projected 2.6% growth in world merchandise trade in 2024, vulnerable to protectionism. |

| ESG Policy Debates | Creates compliance complexity and potential shifts in capital allocation. | Over 20 US states enacted anti-ESG legislation by late 2024. |

What is included in the product

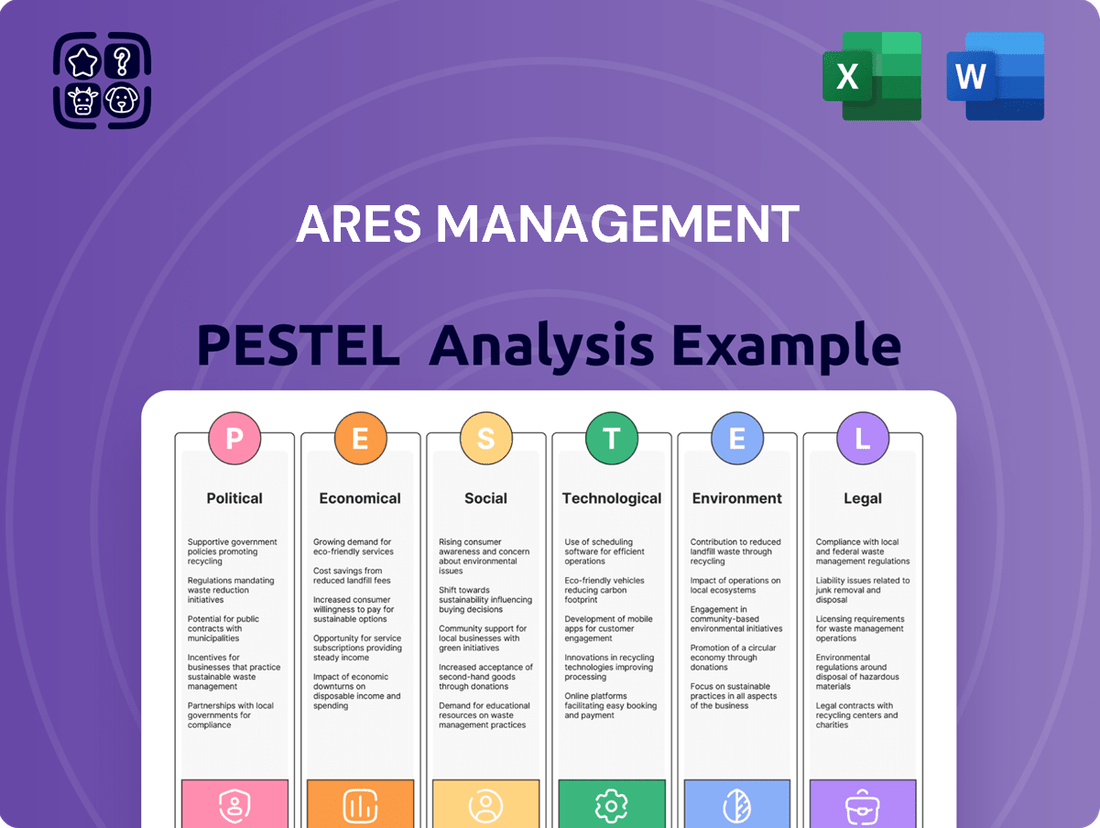

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Ares Management, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify opportunities within Ares Management's operating landscape.

A clear, actionable summary of Ares Management's PESTLE analysis, presented in a digestible format, alleviates the pain of wading through complex data, enabling faster strategic decision-making.

Economic factors

The prevailing interest rate environment and ongoing inflation are critical considerations for Ares Management. As of early 2024, the Federal Reserve has signaled a potential shift towards rate cuts, a departure from the aggressive hikes seen in 2022-2023, which had pushed the federal funds rate to a 22-year high. However, inflation, while moderating from its 2022 peak of over 9%, remained above the Fed's 2% target, creating a complex backdrop for investment decisions.

Fluctuations in interest rates directly influence Ares' core businesses, especially credit and real estate. Higher rates increase borrowing costs for Ares' portfolio companies, potentially impacting their ability to service debt and hindering growth. In real estate, rising rates can depress property valuations and slow transaction volumes. Ares' strategy involves providing flexible capital solutions designed to navigate these market shifts and secure risk-adjusted returns across different economic cycles.

The global economy in 2024 and early 2025 shows a mixed picture. While some regions are experiencing moderate growth, the risk of recession remains a significant concern, particularly in developed economies. For Ares Management, this translates to a cautious deployment of capital, as economic slowdowns can depress asset valuations and increase the likelihood of defaults across their credit investments.

In 2024, global GDP growth is projected to be around 2.7%, a slight slowdown from the previous year, according to the IMF. This environment directly impacts Ares' strategy; lower valuations can present buying opportunities, but heightened recessionary fears mean increased diligence on credit quality to mitigate potential losses. The firm's diversified approach across credit, private equity, and real estate helps buffer against sector-specific downturns.

Global capital markets are experiencing a dynamic period. As of early 2025, while dealmaking activity has shown signs of recovery from 2023 lows, challenges persist. For Ares Management, the ease of fundraising and the availability of liquidity directly influence the success of its private equity and credit strategies.

Wide bid-ask spreads and a somewhat cautious approach to mergers and acquisitions by many companies can create headwinds. This environment requires Ares to be particularly adept at identifying opportunities and deploying capital efficiently, as demonstrated by its continued fundraising efforts across various strategies.

Ares Management's capacity to attract and deploy capital is intrinsically linked to these capital market conditions. For instance, in Q1 2025, the alternative asset management sector saw significant inflows, but competition for attractive deals remained intense, underscoring the importance of navigating liquidity and deal flow effectively.

Investor Demand for Alternative Investments

Investor demand for alternative investments is on the rise, a key economic factor for Ares Management. This surge is fueled by the search for diversification and potentially higher returns than those offered by traditional stocks and bonds. Many investors are looking beyond conventional markets to bolster their portfolios.

The accessibility of alternative investments has broadened significantly, bringing them within reach of a wider array of investors. This trend directly supports Ares Management’s fundraising efforts and overall asset growth. For instance, by the end of Q1 2024, Ares reported total AUM of $422 billion, a testament to this expanding investor base.

- Diversification Appeal: Investors are increasingly allocating capital to alternatives to reduce overall portfolio risk.

- Yield Enhancement: The pursuit of yields exceeding those in public markets is a primary driver for alternative investment inflows.

- Democratization of Access: Financial innovation and platforms are making alternative strategies available to a broader investor spectrum.

- Ares's AUM Growth: Ares Management's AUM reached $422 billion by Q1 2024, reflecting strong investor appetite for its alternative offerings.

Sector-Specific Economic Trends

Economic trends within specific sectors, such as the surging demand for data centers, the green transition, and the need for new infrastructure, directly impact Ares Management's investment groups. These trends create targeted investment opportunities in areas like renewable energy, logistics, and multifamily housing, influencing where Ares deploys its capital.

For instance, the global data center market was valued at approximately $273.6 billion in 2023 and is projected to reach $619.4 billion by 2030, growing at a CAGR of 12.5%. This surge fuels investment in digital infrastructure. Similarly, the global renewable energy market, valued at $1,162.7 billion in 2023, is expected to reach $2,171.1 billion by 2030, demonstrating a CAGR of 9.2%. This presents significant opportunities for Ares in clean energy projects.

- Data Center Growth: The exponential rise in data consumption and AI development is driving substantial investment in data center infrastructure, a key area for Ares.

- Green Transition: Significant capital is being allocated towards renewable energy sources and sustainable technologies, aligning with Ares' focus on the green transition.

- Infrastructure Needs: Global infrastructure spending is projected to reach $15.5 trillion by 2030, creating diverse opportunities in logistics, transportation, and utilities.

- Multifamily Housing Demand: Urbanization and demographic shifts continue to bolster demand for multifamily housing, a consistent focus for Ares' real estate investments.

The economic landscape in early 2025 presents a mixed outlook for Ares Management. While inflation has moderated from its 2023 highs, it remains a key consideration, impacting borrowing costs and asset valuations. Global GDP growth projections for 2024 hover around 2.7%, indicating a slowdown that necessitates cautious capital deployment and rigorous credit quality assessment.

Interest rate movements continue to be a critical factor, influencing Ares' credit and real estate portfolios. The Federal Reserve's stance on potential rate cuts, following aggressive hikes in 2022-2023, creates a dynamic environment for investment strategies. Ares' ability to provide flexible capital solutions is crucial for navigating these shifts and achieving risk-adjusted returns.

Investor appetite for alternative assets remains robust, driven by diversification goals and the search for yield. This trend supports Ares' fundraising efforts, as evidenced by its substantial Assets Under Management (AUM). The firm’s AUM reached $422 billion by Q1 2024, highlighting strong investor confidence in its diversified strategies.

Sector-specific economic trends, such as the rapid expansion of data centers and the ongoing green transition, are creating significant investment opportunities. The global data center market, projected to reach $619.4 billion by 2030, and the renewable energy market, expected to hit $2,171.1 billion by 2030, are key areas where Ares is actively deploying capital.

| Economic Factor | 2024 Projection/Status | Impact on Ares Management | Supporting Data (as of early 2025) |

|---|---|---|---|

| Global GDP Growth | Projected ~2.7% for 2024 | Cautious capital deployment, focus on credit quality due to potential slowdowns. | IMF estimates indicate a moderate global growth rate. |

| Inflation Rate | Moderating but above target | Influences borrowing costs and asset valuations; requires flexible capital solutions. | Inflation remains a key focus for central banks globally. |

| Interest Rates | Potential shift towards cuts (Fed signaling) | Affects credit portfolio performance and real estate market dynamics. | Federal funds rate reached a 22-year high in 2023, with potential easing in 2024. |

| Alternative Investment Demand | Rising | Supports fundraising and AUM growth; drives allocation to diversification and yield enhancement. | Ares' AUM reached $422 billion by Q1 2024. |

| Data Center Market Growth | Strong CAGR (est. 12.5%) | Creates investment opportunities in digital infrastructure. | Market valued at ~$273.6 billion in 2023, projected to reach $619.4 billion by 2030. |

| Renewable Energy Market Growth | Strong CAGR (est. 9.2%) | Drives investment in clean energy projects and sustainable technologies. | Market valued at ~$1,162.7 billion in 2023, projected to reach $2,171.1 billion by 2030. |

Full Version Awaits

Ares Management PESTLE Analysis

The preview shown here is the exact Ares Management PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. It delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the firm.

This is a real screenshot of the Ares Management PESTLE Analysis you’re buying—delivered exactly as shown, no surprises. You'll gain a comprehensive understanding of the external forces shaping their business strategy.

The content and structure shown in the preview is the same Ares Management PESTLE Analysis document you’ll download after payment. It provides actionable insights for strategic planning and risk assessment.

Sociological factors

Global demographic shifts, with a projected world population reaching 8.5 billion by 2030, are significantly reshaping investment landscapes. Urbanization is a key driver, with over half the world's population now living in cities, a figure expected to climb to 68% by 2050 according to UN data. This trend directly fuels demand for housing, urban development, and essential infrastructure, creating substantial opportunities for Ares Management to deploy capital in these vital sectors.

Consumer behavior is rapidly shifting, with a notable acceleration in the adoption of e-commerce and a heightened demand for digital services across the board. This trend has profoundly impacted how people shop and interact with businesses, influencing purchasing decisions and the very nature of retail.

This evolution directly fuels the need for physical infrastructure that supports online commerce, such as modern warehouses and distribution centers. For instance, global e-commerce sales were projected to reach over $6.3 trillion in 2024, a significant increase from previous years, underscoring the robust demand for logistics and supply chain real estate.

Furthermore, the increasing reliance on digital platforms and services drives substantial investment in data centers. As of early 2025, the global data center market is valued in the hundreds of billions of dollars and continues to expand as companies prioritize cloud computing and digital transformation initiatives, aligning perfectly with Ares' strategic investments in 'New Economy' sectors.

Ares Management's success hinges on securing and keeping highly skilled professionals, especially in the competitive alternative investment sector. For instance, the firm actively recruits from top universities and industry leaders, ensuring a pipeline of talent adept at navigating complex financial markets. This focus on talent is crucial for both Ares's internal operations and the strategic growth of its diverse portfolio companies.

Evolving workforce dynamics, including remote work trends and the demand for specialized skills, present both opportunities and challenges. Ares must adapt its talent acquisition and retention strategies to attract professionals who value flexibility and continuous learning. Managing labor-related risks, such as wage inflation and employee engagement, within its portfolio companies is also a key consideration for maintaining operational efficiency and profitability.

Social Awareness and Activism

Growing societal concern over human rights, fair labor, and community well-being is increasingly shaping investment choices. This trend directly impacts how firms like Ares evaluate potential investments and manage their existing portfolios. Companies demonstrating strong social responsibility often see improved brand perception and attract a wider investor base, fitting well with Ares' focus on responsible investing.

For instance, a 2024 survey indicated that 65% of institutional investors consider Environmental, Social, and Governance (ESG) factors when making allocation decisions. This heightened awareness translates into pressure on portfolio companies to adopt more ethical practices. Ares Management, by integrating social impact considerations, can mitigate reputational risks and tap into growing pools of capital seeking sustainable investments.

- Growing ESG Investment: Global sustainable investment assets reached an estimated $37.8 trillion in early 2024, highlighting the significant financial impact of social awareness.

- Consumer Demand for Ethics: Studies in 2024 show that over 70% of consumers are more likely to purchase from brands with strong ethical track records.

- Regulatory Scrutiny: Increased governmental focus on supply chain transparency and labor practices in 2024 means companies face greater compliance burdens and potential penalties for social missteps.

Diversity, Equity, and Inclusion (DEI)

The increasing societal focus on Diversity, Equity, and Inclusion (DEI) is a powerful sociological trend influencing corporate behavior and investment strategies. Ares Management's proactive stance on integrating DEI principles into its own organizational structure and its efforts to foster these practices within its portfolio companies are crucial. This commitment not only aligns with evolving social expectations but also has the potential to broaden its appeal to a more diverse and socially conscious investor community.

Ares Management reported in its 2024 ESG report that 42% of its employees identify as belonging to an underrepresented group, and 35% of its leadership positions are held by women. Furthermore, the firm actively tracks and encourages DEI metrics within its portfolio companies, aiming to drive positive social outcomes alongside financial returns. This focus can lead to enhanced innovation, better risk management, and a stronger reputation, ultimately attracting a wider range of capital and talent.

- DEI as a Social Imperative: Growing public and investor demand for companies to demonstrate tangible progress in DEI.

- Ares's Commitment: Ares Management's internal DEI targets and its influence on portfolio companies to adopt similar practices.

- Investor Attraction: The potential for strong DEI performance to attract a broader investor base, including ESG-focused funds.

- Societal Impact: Contributing to positive social change through responsible investment and corporate governance.

Societal expectations regarding corporate responsibility are evolving, with a significant emphasis on Diversity, Equity, and Inclusion (DEI). Ares Management's commitment to these principles, reflected in its 2024 ESG report showing 42% of employees from underrepresented groups and 35% of leadership positions held by women, directly addresses this trend. This focus not only enhances its own organizational appeal but also influences portfolio companies to adopt similar practices, potentially attracting a broader investor base and fostering innovation.

| Sociological Factor | Description | Ares Management Relevance | 2024/2025 Data/Trend |

|---|---|---|---|

| DEI Initiatives | Emphasis on fair representation and opportunity across all demographics within an organization and its investments. | Ares actively promotes DEI internally and within portfolio companies. | 42% of Ares employees identify with underrepresented groups; 35% of leadership are women (2024 ESG Report). |

| Consumer & Investor Ethics | Growing demand for ethical business practices and social impact from consumers and investors. | Strong ethical track records attract customers and capital. | Over 70% of consumers favor brands with ethical histories (2024 consumer study). |

| Talent Acquisition & Retention | Evolving workforce expectations regarding flexibility, purpose, and professional development. | Ares must adapt strategies to attract and retain skilled professionals in a competitive market. | Continued demand for specialized skills in alternative investments sector. |

Technological factors

The relentless march of digitalization is fueling an insatiable appetite for data infrastructure. This translates into a robust demand for data centers, cloud computing services, and the underlying technologies like IoT, 5G, and AI. For Ares Management, this represents a prime area for strategic investment and growth.

The global data center market, for instance, was projected to reach over $275 billion by 2025, highlighting the sheer scale of this technological shift. Companies are increasingly relying on robust digital frameworks, creating a fertile ground for infrastructure development and the specialized services Ares can provide.

The accelerating integration of Artificial Intelligence (AI) is a significant technological factor reshaping industries and investment strategies. AI's influence extends to critical areas like power demand, driving the need for robust data center infrastructure, a sector where Ares Management has strategic interests.

For Ares Management and its diverse portfolio, AI presents opportunities to boost operational efficiency and gain a competitive edge. For instance, AI-powered analytics can refine investment decision-making processes, potentially leading to more informed capital allocation. By mid-2024, AI adoption rates across financial services were projected to continue their upward trajectory, with firms increasingly leveraging AI for tasks ranging from risk assessment to client service.

Technological advancements are significantly broadening access to alternative investments, traditionally the domain of institutional players. Platforms leveraging technology are streamlining the investment process, making private markets more approachable for retail investors. This trend is exemplified by the rise of digital alternative investment platforms, which saw substantial growth in 2024, facilitating easier entry into asset classes like private equity and venture capital.

Ares Management can capitalize on this democratization by further integrating technology into its offerings, potentially developing or partnering with platforms that simplify access to its diverse alternative investment strategies. This move would not only expand its investor base but also enhance client engagement by providing more intuitive and transparent investment experiences, aligning with the increasing demand for digital financial solutions observed throughout 2024 and projected into 2025.

Cybersecurity and Data Security Risks

Cybersecurity and data security are critical concerns for Ares Management, given its extensive use of digital platforms to manage vast amounts of sensitive financial information. The increasing sophistication of cyber threats necessitates robust defenses to safeguard client data and proprietary information. A breach could severely damage investor confidence and disrupt operations.

The financial services industry, including alternative asset managers like Ares, is a prime target for cyberattacks. In 2023, the financial sector experienced a significant rise in ransomware attacks, with reported incidents costing organizations millions. Ares Management must continually invest in advanced security measures to mitigate these evolving risks and ensure the integrity of its digital infrastructure.

Key considerations for Ares Management include:

- Data Encryption and Access Controls: Implementing strong encryption for data at rest and in transit, coupled with stringent access controls, is vital.

- Threat Detection and Response: Deploying sophisticated systems for real-time threat monitoring and establishing rapid response protocols are essential.

- Employee Training and Awareness: Regular cybersecurity training for all employees is crucial to prevent human error, a common vector for breaches.

- Regulatory Compliance: Adhering to evolving data protection regulations, such as GDPR and CCPA, is paramount to avoid penalties and maintain trust.

Automation and Operational Efficiency

Ares Management's embrace of automation technologies is poised to significantly boost operational efficiency across its own functions and within its diverse portfolio companies. By automating routine tasks in areas like investment analysis, due diligence, and client reporting, Ares can achieve substantial cost reductions and enhance its capacity to manage a growing number of assets and complex transactions. This focus on streamlining operations is particularly critical in the fast-paced financial services sector, where speed and accuracy directly impact competitive advantage.

The impact of automation extends to critical functions such as risk management. Advanced algorithms and AI-powered tools can more effectively identify, assess, and mitigate potential risks in real-time, a crucial capability for a firm managing billions in assets. This not only protects investor capital but also allows for more agile decision-making. For instance, in 2024, many alternative asset managers reported leveraging AI for enhanced compliance monitoring, reducing manual review by an estimated 30-40%.

Furthermore, automation facilitates improved scalability. As Ares Management continues to grow its assets under management and expand its service offerings, automated processes ensure that operational overhead does not grow proportionally. This allows the firm to handle increased transaction volumes and client demands without a commensurate increase in headcount or infrastructure costs. By 2025, it's projected that firms with robust automation strategies will see operational cost savings of up to 15% compared to peers relying on manual processes.

- Streamlined Investment Analysis: AI-driven data aggregation and analysis tools can process vast datasets faster than human analysts, identifying potential investment opportunities and risks more efficiently.

- Enhanced Risk Management: Automated systems can continuously monitor portfolio exposures, market volatility, and regulatory changes, providing proactive alerts for potential issues.

- Automated Client Reporting: Generating customized reports for investors can be significantly sped up and made more accurate through automated data extraction and formatting.

- Improved Back-Office Operations: Automation in areas like trade settlement, reconciliation, and compliance checks reduces errors and frees up staff for higher-value activities.

The increasing adoption of AI is a significant technological driver, impacting everything from power consumption in data centers to the efficiency of investment analysis. By mid-2024, AI integration in financial services was accelerating, with firms using it for risk assessment and client interactions.

Automation is also a key trend, promising to boost operational efficiency and reduce costs. In 2024, alternative asset managers reported using AI for compliance, cutting manual review by up to 40% and projected savings of 15% by 2025 for firms with strong automation strategies.

The technological landscape is also democratizing access to alternative investments, with digital platforms making private markets more accessible. This trend saw substantial growth in 2024, enabling easier entry into asset classes like private equity.

Cybersecurity remains paramount, with the financial sector experiencing a rise in ransomware attacks in 2023, costing organizations millions and necessitating continuous investment in advanced security measures.

Legal factors

Ares Management navigates a dense web of financial services regulations worldwide. This necessitates strict compliance with rules for asset management, investment vehicles, and capital market activities, influencing fund creation, reporting, and investor safeguards.

In 2024, the financial sector continues to see increased regulatory scrutiny globally. For instance, the European Union's MiFID II (Markets in Financial Instruments Directive II) framework, which aims to enhance investor protection and market transparency, remains a significant factor for firms like Ares operating within the EU.

Furthermore, evolving capital requirements and liquidity rules, such as those influenced by Basel III and its ongoing revisions, directly impact how Ares structures its capital and manages its balance sheet, particularly for its credit and alternative investment strategies.

Ares Management faces growing ESG disclosure mandates, like the EU's CSRD and ISSB standards, impacting its reporting and investment strategies. These rules demand comprehensive ESG data, pushing firms to integrate sustainability into their core operations to mitigate greenwashing accusations.

Changes in tax laws, both domestically and internationally, significantly impact Ares Management's profitability and the returns generated for its investors. For instance, shifts in corporate tax rates, such as the US federal corporate tax rate which stands at 21% as of 2024, can directly alter net income.

Navigating these evolving tax landscapes requires Ares to strategically optimize its tax efficiency across its diverse investment funds and operations. This includes adapting strategies to leverage tax credits or deferrals where applicable, while ensuring strict compliance with all relevant tax regulations globally.

The firm's ability to effectively manage tax liabilities is crucial for maximizing after-tax returns for both Ares and its limited partners. For example, the introduction of new international tax reporting standards or changes in capital gains tax can necessitate adjustments to investment structures and fund management approaches.

Anti-ESG Legislation and Regulatory Scrutiny

The rise of anti-ESG legislation, especially in the United States, presents a significant legal hurdle for Ares Management. This trend introduces uncertainty into investment strategies and can reshape fund mandates, requiring careful adherence to evolving, often politically motivated, investment standards.

Regulatory bodies are increasing their scrutiny of ESG-related disclosures and practices. For instance, in 2024, several US states enacted legislation restricting the use of ESG factors in state pension fund investments, impacting the potential pool of capital and investment opportunities for firms like Ares.

- Increased Compliance Costs: Navigating varying state and federal regulations on ESG requires enhanced legal and compliance resources.

- Potential Litigation Risks: Missteps in ESG reporting or investment decisions could lead to legal challenges and reputational damage.

- Shifting Investment Mandates: Ares may need to adapt its investment criteria to comply with new legal frameworks that limit or prohibit ESG considerations.

- Market Access Limitations: Certain jurisdictions may restrict Ares' ability to offer specific ESG-focused products or services.

Data Privacy and Governance Regulations

Ares Management, like all financial institutions, must navigate a complex web of data privacy and governance regulations. Laws such as the General Data Protection Regulation (GDPR) in Europe, and similar frameworks emerging globally, dictate how the firm collects, stores, processes, and protects sensitive client and investment data. Failure to comply can result in substantial fines and reputational damage, impacting investor confidence.

The increasing reliance on digital technologies and artificial intelligence within Ares Management's operations amplifies the importance of robust data governance. For instance, the EU's proposed AI Act, expected to be fully implemented by 2025, will introduce new compliance obligations for AI systems used in financial services, requiring thorough risk assessments and transparency in data handling. This necessitates a proactive approach to data management and security to maintain trust and operational integrity.

Key considerations for Ares Management include:

- Data Minimization: Collecting only necessary client and investment data.

- Consent Management: Ensuring clear consent for data usage.

- Data Security: Implementing strong cybersecurity measures to prevent breaches.

- Cross-Border Data Transfers: Adhering to regulations governing international data movement.

Ares Management operates within a dynamic legal landscape, facing evolving regulations across its global operations. Compliance with financial services laws, tax codes, and data privacy mandates is paramount, directly influencing operational strategies and profitability. The firm must remain agile to adapt to new legislation and enforcement actions, ensuring robust governance and risk management frameworks are in place.

Environmental factors

Climate change poses significant physical and transition risks for Ares Management's diverse investment portfolio. Physical risks, such as increased frequency of extreme weather events like hurricanes and floods, directly impact real estate and infrastructure assets, potentially leading to property damage and business disruptions. For instance, in 2024, global insured losses from natural catastrophes were estimated to be around $130 billion, highlighting the growing financial impact of these events on physical assets.

Transition risks are equally critical, stemming from the global shift towards a lower-carbon economy. These risks manifest through evolving climate policies, the adoption of new technologies, and changing consumer preferences. For Ares, this means portfolio companies in carbon-intensive sectors may face increased regulatory scrutiny, higher operating costs due to carbon pricing mechanisms, or reduced market demand if they fail to adapt. The International Energy Agency projects that investments in clean energy technologies will need to triple by 2030 to meet net-zero goals, indicating a substantial market shift that could disadvantage unprepared companies.

Ares Management is actively working to manage these climate-related risks by integrating ESG considerations into its investment processes and seeking opportunities in climate solutions. This proactive approach aims to not only mitigate potential losses but also to capitalize on the growth potential within the sustainable economy. The firm’s commitment to investing in climate solutions reflects a strategic understanding of the long-term economic implications of climate change and the opportunities arising from the transition to a more sustainable future.

The global transition to renewable energy presents substantial investment avenues for Ares Management, especially through its infrastructure and private equity divisions. This shift is driven by increasing governmental support and corporate sustainability goals, creating a fertile ground for capital deployment in green technologies.

Investments in solar, wind, and energy storage are experiencing robust growth, directly supporting the broader ‘green transition’ and global decarbonization efforts. For instance, the International Energy Agency (IEA) projected in early 2024 that renewable capacity additions would continue to surge, with solar PV alone expected to account for over two-thirds of the increase in 2024, reaching nearly 700 gigawatts globally.

Growing global awareness of resource scarcity, particularly concerning critical minerals and water, is a significant environmental factor. This trend is boosting the appeal of circular economy principles, where companies focus on resource efficiency, waste reduction, and product longevity. For instance, the global circular economy market was valued at approximately $2.4 trillion in 2023 and is projected to reach $4.7 trillion by 2030, presenting substantial investment avenues.

Ares Management can capitalize on this by identifying and investing in businesses that champion sustainable production and waste valorization. Opportunities exist in sectors like renewable energy infrastructure, advanced recycling technologies, and companies developing innovative materials that minimize environmental impact, aligning with long-term sustainability objectives and potentially offering attractive returns.

ESG Integration and Sustainable Finance

Ares Management is increasingly incorporating environmental, social, and governance (ESG) factors into its investment strategies, recognizing their growing importance for both financial performance and societal impact. This focus on environmental considerations, in particular, aligns with the broader trend of sustainable finance, attracting capital from investors prioritizing positive environmental outcomes.

The firm's commitment to integrating environmental factors into its responsible investment programs aims to foster sustainable business practices across its portfolio. This strategic approach not only seeks to mitigate environmental risks but also to identify opportunities for growth in sectors contributing to a greener economy, potentially enhancing long-term value and appealing to a wider investor base.

As of early 2024, the global sustainable investment market is substantial, with assets under management showing consistent growth. For example, the US sustainable investment market alone reached over $8 trillion in 2023, indicating a strong investor appetite for ESG-integrated strategies. Ares' proactive stance in this area positions it to capitalize on this expanding market, with specific initiatives often highlighted in their annual sustainability reports.

- Growing Investor Demand: Over 70% of institutional investors surveyed in a 2023 industry report indicated that ESG factors are now a standard part of their investment process.

- Climate Risk Focus: Ares actively assesses climate-related risks within its portfolio companies, a critical component given that climate change is projected to cost the global economy trillions by 2050.

- Sustainable Investments: The firm aims to deploy capital into businesses that demonstrate strong environmental stewardship, contributing to the global push for net-zero emissions by mid-century.

Environmental Regulations and Reporting

Environmental regulations are becoming increasingly stringent, affecting how Ares Management operates and invests. For instance, new mandates on carbon emissions and waste management directly influence the operational costs and strategic decisions of their portfolio companies. Ares needs to ensure its investments align with these evolving standards, such as the EU's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023 and will fully apply from 2026, impacting sectors like steel and cement within their portfolio.

Transparent reporting on environmental, social, and governance (ESG) metrics is no longer optional but a critical component for risk management and maintaining investor confidence. Ares Management, like many in the financial sector, faces growing pressure from regulators and stakeholders to demonstrate robust sustainability practices. For example, the SEC's proposed climate disclosure rules, though currently undergoing revisions, signal a clear trend towards more standardized environmental reporting for U.S. companies, which will inevitably cascade to their investors.

- Evolving Regulations: Ares must navigate complex and changing environmental laws globally, impacting everything from energy use to supply chain management in its diverse portfolio.

- Emissions Targets: Many jurisdictions are setting ambitious emissions reduction targets, requiring significant investment in cleaner technologies and operational changes for portfolio firms.

- Sustainability Reporting: Increased demand for ESG data means Ares and its companies must accurately report on environmental performance, including carbon footprint and resource efficiency.

- Risk Mitigation: Non-compliance or poor environmental performance can lead to fines, reputational damage, and reduced access to capital, directly impacting investment valuations.

The increasing global focus on environmental sustainability presents both challenges and significant opportunities for Ares Management. Climate change, resource scarcity, and stringent regulations are reshaping investment landscapes, demanding proactive adaptation and strategic capital allocation towards greener solutions.

Ares is strategically positioned to leverage the transition to a low-carbon economy, with substantial growth expected in renewable energy and circular economy models. The firm's commitment to ESG integration and responsible investing aligns with growing investor demand for sustainable financial products.

Navigating evolving environmental regulations and reporting requirements is crucial for risk mitigation and maintaining investor confidence, underscoring the need for robust sustainability practices across Ares' portfolio.

| Environmental Factor | Impact on Ares Management | Key Data/Trends (2023-2025) |

|---|---|---|

| Climate Change Risks | Physical and transition risks impacting portfolio assets; need for adaptation and mitigation strategies. | Global insured losses from natural catastrophes estimated at $130 billion in 2024. |

| Transition to Renewables | Significant investment opportunities in solar, wind, and energy storage; growth driven by policy and corporate goals. | Solar PV capacity additions expected to reach nearly 700 GW globally in 2024. |

| Resource Scarcity & Circular Economy | Growing appeal of resource efficiency and waste reduction; investment avenues in sustainable production and recycling. | Global circular economy market projected to reach $4.7 trillion by 2030 (from ~$2.4 trillion in 2023). |

| Environmental Regulations | Need for portfolio companies to comply with evolving mandates on emissions, waste, and reporting. | EU's CBAM transitional phase began Oct 2023; SEC climate disclosure rules signaling increased reporting demands. |

| ESG Integration & Investor Demand | Growing investor preference for ESG-integrated strategies; demand for transparent sustainability reporting. | Over 70% of institutional investors consider ESG factors standard in their process (2023 survey); US sustainable investment market over $8 trillion in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ares Management is built on a robust foundation of data from leading financial institutions, regulatory bodies, and reputable market research firms. We synthesize information from economic indicators, policy updates, technological advancements, and environmental reports to provide a comprehensive view.