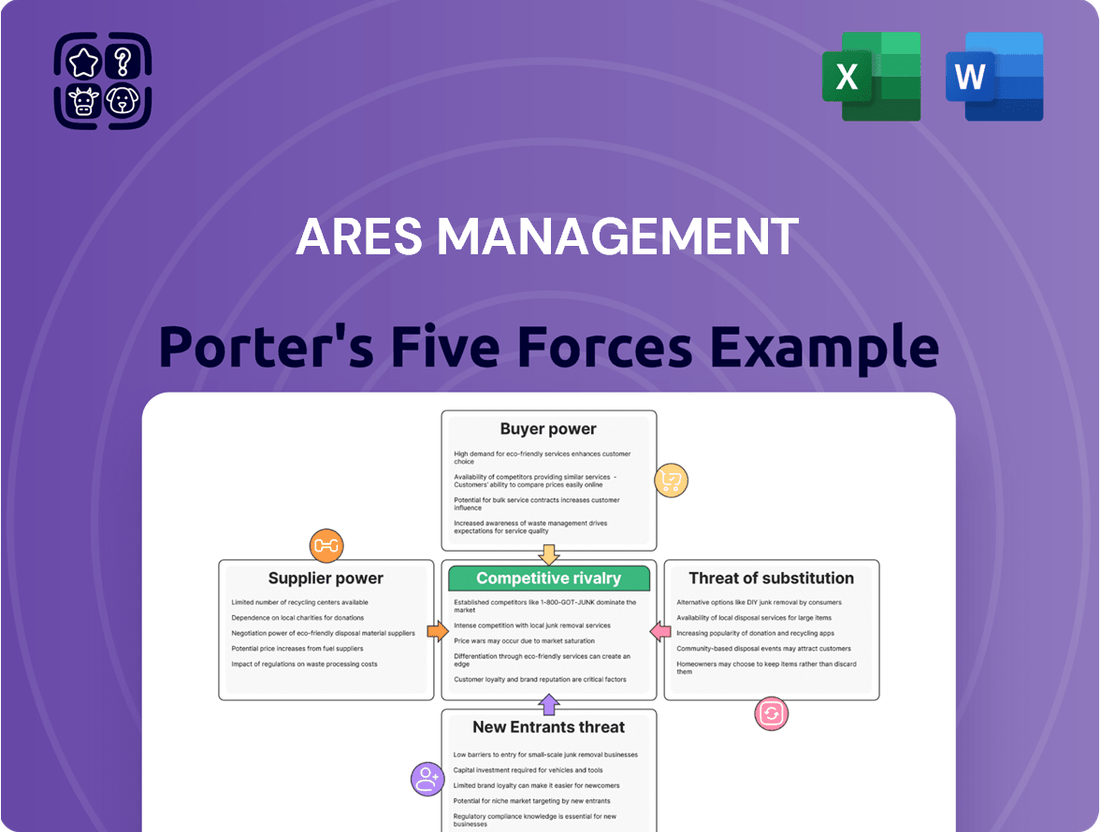

Ares Management Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ares Management Bundle

Ares Management operates in a dynamic landscape shaped by intense competition and evolving market conditions. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this environment.

The complete report reveals the real forces shaping Ares Management’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ares Management's suppliers are primarily its investors and the investment opportunities it can access. The firm's strong ability to attract capital, evidenced by raising $93 billion in 2024, significantly reduces the bargaining power of individual capital providers. This substantial capital base allows Ares to diversify its funding sources, drawing from a wide array of investors like pension funds, sovereign wealth funds, and retail clients, thereby strengthening its position.

The specialized nature of alternative investments places significant bargaining power in the hands of highly skilled investment professionals. Ares Management's commitment to talent is evident in its substantial growth, with its global client solutions team expanding from around 80 to 400 professionals since 2019, underscoring the value placed on expertise.

While these sought-after individuals can command substantial compensation, Ares's extensive scale and diversified platform offer compelling career progression and opportunities. This broad appeal may serve to moderate the individual bargaining power of new talent, balancing the need for specialized skills with the company's strategic talent acquisition approach.

Information and data providers hold significant sway over firms like Ares Management, especially in the alternative asset space where proprietary market data, analytics, and research are crucial for making sound investment choices. Ares, like many large players, likely taps into a variety of financial intelligence platforms and specialized data vendors to gain a competitive edge.

The bargaining power of these suppliers is directly tied to how unique and essential their data offerings are. If a provider possesses exclusive datasets or highly sought-after analytical tools that are difficult to replicate, their leverage increases. However, a firm as substantial as Ares can often mitigate this by leveraging its purchasing volume and negotiating long-term, favorable contracts, potentially reducing the impact of individual supplier power.

Technology and Software Vendors

Technology and software vendors hold considerable bargaining power over investment management firms like Ares Management. This is because sophisticated software is crucial for daily operations, including portfolio management, risk analysis, and overall efficiency. Ares, as a major player, represents a significant client for these specialized vendors.

The bargaining power of these technology suppliers is amplified by the unique and specialized nature of their software solutions. Furthermore, the high switching costs associated with migrating to alternative systems can lock in clients, strengthening the vendors' negotiating position. For instance, a significant portion of the global financial technology market, valued at over $1.2 trillion in 2023, is dominated by a few key players offering highly integrated and complex systems.

- High Switching Costs: Implementing new financial software can involve substantial costs for data migration, system integration, and employee retraining, often running into millions of dollars for large firms.

- Specialized Offerings: Many software vendors provide highly specialized tools tailored to the intricate needs of asset management, making it difficult for firms to find direct, equally capable replacements.

- Vendor Consolidation: The financial technology sector has seen consolidation, leading to fewer providers for certain critical software categories, thereby increasing their leverage.

Regulatory and Legal Services

Operating within the stringent financial sector, Ares Management relies heavily on regulatory and legal services. The complexity of financial regulations, including evolving compliance standards and cross-border transaction laws, necessitates specialized legal expertise. This demand for niche skills grants these service providers a degree of bargaining power.

However, Ares's substantial scale and market presence enable it to engage with a broad network of legal firms. This allows for competitive bidding and negotiation of terms, thereby mitigating the suppliers' leverage. For instance, in 2024, the global legal services market was valued at over $700 billion, indicating a competitive landscape where large clients can often secure more favorable arrangements.

- Specialized Expertise: Legal firms offering deep knowledge in financial regulation and international law hold sway.

- Regulatory Complexity: The ever-changing legal landscape in finance increases the need for and value of expert advice.

- Ares's Scale: Ares's significant size allows for multiple supplier relationships and robust negotiation.

- Market Dynamics: The broad legal services market provides Ares with options to source services competitively.

Ares Management's suppliers, including capital providers, specialized talent, data vendors, and technology firms, generally hold moderate to high bargaining power. The firm's substantial capital raise of $93 billion in 2024, however, significantly dilutes the power of individual investors by diversifying its funding base. Conversely, the specialized nature of alternative investments and the high switching costs associated with critical technology solutions amplify the bargaining power of key vendors and highly skilled professionals.

| Supplier Type | Bargaining Power Factors | Mitigation by Ares | 2024 Data/Context |

|---|---|---|---|

| Capital Providers | Diversified investor base, strong capital attraction | Raising $93 billion in 2024 reduces reliance on any single provider. | Global alternative asset market size exceeding $13 trillion in 2024. |

| Specialized Talent | Unique skills in alternative investments | Scale and career opportunities moderate individual power. | Global financial services workforce numbers in the millions. |

| Data & Analytics Vendors | Proprietary data, essential for investment decisions | Purchasing volume, long-term contracts. | Financial data market valued at over $30 billion in 2024. |

| Technology & Software Vendors | Specialized, integrated systems, high switching costs | Negotiating power as a large client. | FinTech market valued over $1.2 trillion in 2023. |

What is included in the product

This analysis unpacks the competitive landscape for Ares Management by examining the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, all within the context of the alternative investment industry.

Ares Management's Porter's Five Forces analysis provides a structured framework to identify and mitigate competitive threats, offering a clear roadmap for strategic advantage.

Customers Bargaining Power

Ares Management's large institutional investors, like pension funds and sovereign wealth funds, wield considerable bargaining power. These sophisticated clients, committing substantial capital, can negotiate favorable terms, fees, and co-investment rights, directly impacting Ares's profitability.

Ares Management's diversified investor base significantly tempers customer bargaining power. By actively broadening its reach to include institutional, wealth, and insurance clients, the firm reduces its dependence on any single segment. This strategic diversification, with a notable expansion into retail investor channels, means no single customer group can exert undue pressure on Ares's terms or pricing.

Ares Management's impressive performance is a significant dampener on customer bargaining power. For instance, achieving a 53% total stock return in 2024 demonstrates a strong ability to generate attractive returns, making clients less inclined to seek alternatives.

This consistent ability to deliver superior results means investors are more likely to stick with Ares, reducing their leverage to negotiate fees or terms. A proven track record effectively locks in clients who prioritize capital appreciation and reliable management.

Long-Term Relationships and Cross-Pollination

Ares Management cultivates enduring client connections, a strategy that significantly dampens customer bargaining power. Since 2019, a substantial 85% of Ares' inflows have originated from these established relationships, highlighting the effectiveness of their partnership approach.

This deep client engagement, coupled with the opportunity for clients to invest across Ares' diverse strategies, a concept known as cross-pollination, creates strong customer loyalty. When clients can easily access and diversify within multiple Ares offerings, their propensity to seek alternative providers diminishes, thereby reducing their individual leverage.

- Client Retention: Approximately 85% of Ares' inflows since 2019 stem from existing client relationships.

- Cross-Pollination Strategy: Clients can invest across various Ares strategies, increasing engagement and reducing the need to seek external options.

- Reduced Bargaining Power: Deep relationships and diversified investments make clients less likely to exert pressure for better terms.

Access to Specialized Strategies

Ares Management's diverse offerings in specialized investment strategies across credit, private equity, real estate, and infrastructure create a scenario where clients seeking these niche solutions often face limited alternatives. This scarcity of comparable options inherently reduces their bargaining power.

For instance, in the realm of private credit, where Ares is a significant player, clients requiring highly tailored financing structures may find few other managers capable of executing such complex deals. As of early 2024, the alternative asset management industry continues to see strong demand for specialized strategies, with Ares reporting substantial inflows into its credit funds, indicating client commitment to these unique approaches.

- Limited Comparability: The complexity and unique nature of Ares' alternative asset strategies mean clients have fewer direct substitutes to choose from.

- Reduced Client Leverage: This lack of readily available alternatives diminishes the clients' ability to negotiate terms, thus lowering their bargaining power.

- Industry Trends: The ongoing growth in demand for specialized alternative investments, as evidenced by Ares' consistent AUM growth, reinforces this dynamic.

Ares Management's ability to consistently deliver strong performance, such as a 53% total stock return in 2024, significantly reduces customer bargaining power. Clients are less likely to negotiate favorable terms when presented with such attractive returns, prioritizing capital appreciation over fee reductions.

Furthermore, Ares' strategic focus on cultivating deep client relationships, with 85% of inflows since 2019 coming from existing clients, fosters loyalty. This loyalty, combined with the convenience of cross-pollination across various Ares strategies, diminishes clients' inclination to seek alternative providers or exert pressure for better terms.

The specialized nature of Ares' alternative asset offerings, particularly in areas like private credit, limits clients' options for comparable solutions. This scarcity of direct substitutes inherently weakens their bargaining power, as fewer managers can execute complex, tailored deals.

| Factor | Impact on Ares' Customer Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Performance Track Record | Reduces Power | 53% total stock return in 2024 |

| Client Relationship Depth | Reduces Power | 85% of inflows since 2019 from existing clients |

| Cross-Pollination Strategy | Reduces Power | Clients invest across multiple Ares strategies |

| Specialized Offerings | Reduces Power | Limited alternatives for niche strategies like private credit |

Full Version Awaits

Ares Management Porter's Five Forces Analysis

This preview showcases the complete Ares Management Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. The document you see here is precisely what you will receive immediately after purchase, ensuring transparency and immediate utility for your strategic planning. You can trust that this professionally formatted analysis is ready for your immediate use.

Rivalry Among Competitors

The alternative asset management sector is intensely competitive, with numerous firms actively seeking investor capital. This fragmentation means many players are vying for the same limited pool of funds, driving up marketing costs and potentially dampening returns for smaller entities.

However, a significant trend towards consolidation is reshaping this landscape. Larger, established managers, such as Ares Management, are strategically acquiring smaller competitors. This allows them to achieve greater economies of scale, expand their product offerings, and attract a larger volume of Assets Under Management (AUM).

By mid-2024, Ares Management itself has been a key participant in this consolidation, with its AUM reaching over $429 billion by the end of the first quarter of 2024. This growth underscores the advantage larger firms gain in a fragmented market through strategic M&A activity.

Ares Management faces intense competition from other large global alternative investment managers. Firms like Blackstone, Apollo Global Management, KKR, and The Carlyle Group boast substantial assets under management (AUM), diversified investment platforms, and strong brand recognition.

This robust competitive landscape means Ares must constantly vie for both investor capital and prime deal flow. For instance, as of the first quarter of 2024, Blackstone reported over $1 trillion in AUM, highlighting the sheer scale of capital these competitors manage and deploy.

The presence of these global giants intensifies the pressure on Ares to deliver superior returns and innovative strategies. This rivalry directly impacts Ares' ability to secure advantageous terms on investments and attract top-tier talent, shaping its market position and strategic choices.

The alternative investment sector thrives on seasoned investment professionals, making competition for top talent fierce. This escalating demand for skilled individuals drives up compensation costs, posing a significant hurdle for firms like Ares Management.

In 2024, the demand for specialized talent in areas like private equity and credit continued to surge. Firms are increasingly investing in retention strategies and offering competitive packages, including substantial performance-based bonuses, to secure and keep their most valuable investment teams.

Performance-Driven Competition

Firms in the alternative asset management space, including Ares Management, engage in fierce competition driven primarily by investment performance and the returns they generate for their clients. Institutional investors, such as pension funds and endowments, are highly attuned to historical performance data when making capital allocation decisions, making a strong track record paramount.

Ares's commitment to delivering consistent and attractive returns is fundamental to its ability to retain existing capital and attract new mandates. This performance-driven rivalry means that managers are constantly evaluated on their ability to outperform benchmarks and peers, directly impacting their assets under management (AUM) and profitability. For instance, as of the first quarter of 2024, Ares reported $3.5 trillion in AUM, a testament to its performance-driven strategy in attracting and retaining client capital.

- Ares Management's AUM growth reflects its competitive performance.

- Institutional investors prioritize demonstrated investment returns.

- Consistent outperformance is key to market share in alternative assets.

- The pressure to generate alpha intensifies competition among asset managers.

Product and Geographic Diversification

Firms are increasingly diversifying their investment strategies and geographic footprints to gain a competitive advantage. Ares Management has strategically expanded its real estate footprint through acquisitions, demonstrating a commitment to broadening its market presence.

This diversification extends across multiple asset classes, including credit, private equity, real estate, and infrastructure on a global scale. By offering a wide range of solutions, Ares aims to cater to diverse investor needs and capture opportunities across different economic cycles and regions.

- Diversified Offerings: Ares provides solutions across credit, private equity, real estate, and infrastructure, reducing reliance on any single market.

- Geographic Expansion: The firm has actively expanded its real estate footprint globally, indicating a strategy to tap into international growth opportunities.

- Competitive Advantage: Diversification allows Ares to mitigate risks and leverage synergies across its various business segments, enhancing its overall competitive positioning.

- 2024 Focus: In 2024, Ares continued to emphasize growth in its credit and real estate segments, with significant capital deployment noted in European real estate markets.

The competitive rivalry within the alternative asset management sector is fierce, with Ares Management contending against global giants like Blackstone and Apollo. These competitors, managing trillions in AUM, exert significant pressure on Ares to deliver superior performance and secure prime investment opportunities.

The battle for talent is also a critical component of this rivalry, driving up compensation costs as firms compete for seasoned professionals in specialized areas like private equity and credit.

Ares's ability to attract and retain capital hinges on its consistent investment performance, as institutional investors heavily scrutinize track records. This necessitates a continuous drive to generate alpha and outperform peers.

Firms are increasingly diversifying their strategies and geographic reach to gain an edge. In 2024, Ares has notably expanded its real estate presence, particularly in European markets, to broaden its appeal and mitigate sector-specific risks.

| Competitor | Approximate Q1 2024 AUM (USD Billions) | Key Strengths |

|---|---|---|

| Blackstone | 1,000+ | Scale, diversified platforms, brand recognition |

| Apollo Global Management | 671 | Credit expertise, opportunistic investing |

| KKR | 578 | Private equity leadership, global reach |

| The Carlyle Group | 425 | Sector specialization, diverse strategies |

SSubstitutes Threaten

Traditional public market investments like stocks and bonds remain significant substitutes for alternative investments. In 2024, despite the growing appeal of private markets, public equities still command vast liquidity, with the S&P 500 alone representing trillions in market capitalization, offering investors easy entry and exit points.

While alternative strategies aim for diversification and potentially higher returns, the inherent liquidity and transparency of public markets, especially during times of economic uncertainty, can make them a more attractive option for many investors. For instance, during periods of market stress, the ability to readily sell public holdings often outweighs the potential long-term gains of less liquid alternatives.

Investors often look beyond a single firm's offerings to find the best fit for their diversification and risk-return goals. For instance, while Ares Management boasts a robust platform across private equity, credit, and real estate, investors might still explore other alternative asset classes like hedge funds or specialized areas such as litigation finance. These can provide different avenues for achieving specific investment objectives.

Despite the existence of these other options, Ares Management's strength lies in its comprehensive suite of services. By offering a wide array of major alternative asset classes under one roof, Ares aims to be a one-stop shop for sophisticated investors. This broad accessibility can reduce the perceived threat from substitutes by providing a compelling and integrated alternative.

Large institutional investors, including significant pension funds and sovereign wealth funds, are increasingly exploring direct investment strategies. This trend means they might bypass external asset managers like Ares, opting instead to deploy their capital directly into assets. For instance, in 2023, sovereign wealth funds globally saw their assets under management reach an estimated $11.1 trillion, with a growing portion earmarked for direct deals.

This shift can directly impact the capital available for alternative investment managers. When these large allocators decide to go it alone, it shrinks the overall pool of third-party capital that firms like Ares typically rely on for their funds. The growing appetite for direct investments among institutions suggests a potential reduction in management fees and performance fees for external managers.

Lower-Cost Investment Vehicles

The proliferation of lower-cost investment vehicles, such as broad-market Exchange Traded Funds (ETFs) and index funds, presents a significant threat of substitutes for Ares Management. These options offer passive exposure to various asset classes, directly competing with Ares' more actively managed and often higher-fee private market strategies for investors prioritizing cost efficiency over specialized alpha generation.

For instance, in 2024, the average expense ratio for passively managed ETFs in the US hovered around 0.18%, a stark contrast to the typical management and performance fees associated with private equity or credit funds. This cost differential makes ETFs an attractive substitute for retail and even some institutional investors seeking broad market participation without the premium associated with active management and illiquidity. The sheer accessibility and liquidity of these vehicles further enhance their appeal as substitutes, allowing investors to enter and exit positions with ease, a characteristic less common in private markets.

- Lower Expense Ratios: ETFs and index funds often charge significantly lower fees compared to actively managed private market funds, making them a more cost-effective alternative for passive investors.

- Broad Market Exposure: These vehicles provide diversified exposure to major market segments, fulfilling the investment objectives of many who might otherwise consider private market allocations for diversification.

- Liquidity and Accessibility: ETFs and index funds are traded on public exchanges, offering superior liquidity and ease of access for investors compared to the often illiquid nature of private market investments.

- Growing AUM: The assets under management in the ETF industry continued to grow, reaching trillions globally by 2024, indicating a substantial pool of capital that could be allocated away from alternative investment managers.

Increased Accessibility of Alternatives

The rise of accessible alternative investment platforms and new fund structures is making it easier for a broader range of investors to access strategies previously reserved for institutional clients. This democratization, while positive for market inclusivity, can heighten the threat of substitutes. Investors might bypass traditional fund managers by directly investing in these more readily available alternatives, potentially reducing demand for certain fund products.

For instance, the growth of private credit funds accessible to retail investors, or platforms offering fractional ownership in real estate or infrastructure, presents direct alternatives to traditional pooled investment vehicles. In 2024, the global alternative investment market saw continued expansion, with retail participation growing, indicating a tangible shift in investor behavior. This trend means that traditional asset managers face increased pressure to differentiate their offerings or risk losing market share to these more accessible substitutes.

- Democratization of Alternatives: New platforms and fund structures are lowering barriers to entry for retail investors in alternative asset classes.

- Direct Investment Pathways: Investors can now more easily access direct real estate, private equity, or private credit opportunities, bypassing traditional intermediaries.

- Increased Competition: The proliferation of these accessible alternatives intensifies competition for traditional fund managers.

- Investor Behavior Shift: In 2024, a notable trend is the increasing willingness of retail investors to explore and invest in these more direct substitute options.

The threat of substitutes for Ares Management's offerings is multifaceted, encompassing both traditional public markets and increasingly accessible alternative investment vehicles. While public equities and bonds offer liquidity and transparency, their lower return potential compared to private markets can be a limiting factor for some investors. Conversely, the growing accessibility of private markets through new platforms and fund structures presents a direct challenge, allowing investors to bypass traditional managers like Ares.

For instance, the proliferation of lower-cost ETFs, with average US expense ratios around 0.18% in 2024, directly competes with Ares' actively managed, higher-fee strategies. Furthermore, large institutional investors, managing trillions globally, are increasingly pursuing direct investment strategies, potentially reducing the pool of capital available to external managers. This trend, evidenced by sovereign wealth funds' growing direct deal allocations in 2023, highlights a significant shift in how capital is deployed.

| Substitute Category | Key Characteristics | Impact on Ares Management | 2024 Data/Trend |

|---|---|---|---|

| Public Markets (Stocks/Bonds) | High liquidity, transparency, lower fees | Attracts risk-averse investors; less attractive for alpha-seeking investors | S&P 500 market cap in trillions; high investor demand during uncertainty |

| Low-Cost ETFs/Index Funds | Passive exposure, broad diversification, very low fees | Direct competition on cost efficiency; potential loss of retail and some institutional capital | Average US ETF expense ratio ~0.18% |

| Direct Investments by Institutions | Control, potential cost savings, bespoke strategies | Reduced capital availability for third-party managers; pressure on fees | Global SWF AUM ~$11.1 trillion in 2023; increasing direct deal allocation |

| Accessible Alternative Platforms | Democratized access to private markets, fractional ownership | Increased competition; potential disintermediation of traditional managers | Growing retail participation in alternatives market |

Entrants Threaten

Entering the alternative investment management arena, particularly at the scale Ares operates, demands immense capital. This includes funding for establishing new investment funds, building robust operational infrastructure, and securing highly skilled personnel. For instance, launching a new private equity fund often requires hundreds of millions, if not billions, in initial commitments, a sum that deters many potential competitors.

Established firms like Ares Management have cultivated robust brand reputations and extensive track records, often spanning decades. This deep-seated credibility is a significant barrier for newcomers. For instance, Ares Management's success in raising capital, exemplified by its approximately $340 billion in assets under management as of the first quarter of 2024, highlights the trust institutional investors place in its established name and consistent performance.

New entrants struggle to replicate this level of trust and proven ability to generate consistent returns. Attracting substantial institutional capital, a critical component for growth in the asset management sector, becomes exceedingly difficult without a history of successful investment strategies and a recognized brand. This lack of established reputation means new firms often face higher hurdles in securing the funding necessary to compete effectively.

The alternative investment industry, including firms like Ares Management, is subject to a complex web of regulations that are constantly evolving. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to refine rules around private fund disclosures and marketing, adding to the compliance burden.

New entrants must invest heavily in legal, compliance, and operational infrastructure to navigate these intricate frameworks. These upfront and ongoing costs can be substantial, creating a significant barrier to entry for smaller or less capitalized firms aiming to compete with established players.

Access to Deal Flow and Relationships

Ares Management's advantage in accessing deal flow and cultivating deep industry relationships presents a significant barrier for new entrants. Building comparable networks and securing exclusive access to high-quality investment opportunities, which are fundamental to success in private markets, would be a formidable challenge for any newcomer. For instance, in 2023, Ares deployed over $50 billion across its credit, private equity, and real estate strategies, underscoring the scale and breadth of its sourcing capabilities.

New firms would need substantial time and resources to replicate Ares' established rapport with intermediaries, limited partners, and management teams. This established trust and familiarity directly translate into a more consistent and superior pipeline of investment prospects. In 2024, the competitive landscape for private equity deals saw increased activity, with global private equity deal value reaching approximately $1.2 trillion by mid-year, highlighting the premium placed on efficient deal sourcing.

- Proprietary Deal Sourcing: Ares leverages its extensive network to identify off-market opportunities, giving it an edge over firms relying on more public or competitive processes.

- Relationship Capital: Decades of building trust with business owners and advisors mean Ares often gets first look at compelling investment situations.

- Network Effects: The more successful Ares is, the stronger its relationships become, creating a virtuous cycle that is difficult for new entrants to penetrate.

- Information Asymmetry: Deep industry insights gained through these relationships allow Ares to better assess risk and potential, a critical advantage in private markets.

Economies of Scale and Diversification

Larger, diversified firms like Ares Management naturally possess significant advantages due to economies of scale. This means they can spread their substantial operational costs over a larger volume of business, leading to lower per-unit expenses. For instance, in 2023, Ares reported total assets under management of $392 billion, a figure that allows for significant cost efficiencies in areas like technology, compliance, and marketing compared to smaller, emerging asset managers.

Furthermore, Ares's diversification across various asset classes, including credit, private equity, and real estate, makes it a more appealing proposition to a wider range of investors. This broad product offering is a substantial barrier for new entrants, who would struggle to build the expertise and infrastructure needed to compete across multiple sophisticated markets simultaneously. The ability to cater to diverse investor needs, from institutional pension funds to individual wealth management clients, solidifies Ares's market position.

- Economies of Scale: Ares's large asset base ($392 billion in AUM as of 2023) allows for lower per-unit operational costs.

- Diversification Advantage: A broad product suite across credit, private equity, and real estate attracts a wider investor base.

- Replication Difficulty: New entrants face substantial hurdles in matching Ares's scale and product breadth.

The threat of new entrants for Ares Management is generally low due to substantial capital requirements for launching alternative investment funds, which often need hundreds of millions to billions in initial commitments. Established firms benefit from strong brand reputations and decades-long track records, fostering investor trust that newcomers find difficult to replicate. For instance, Ares Management managed approximately $340 billion in assets as of Q1 2024, a testament to its credibility.

Navigating the complex and evolving regulatory landscape, such as the SEC's refined rules on private fund disclosures in 2024, demands significant investment in legal and compliance infrastructure. This creates a considerable barrier for less capitalized firms. Furthermore, Ares's extensive deal flow and deep industry relationships, crucial for sourcing quality investments, are difficult and time-consuming for new entrants to build. In 2023, Ares deployed over $50 billion across its strategies, showcasing its sourcing prowess.

Economies of scale are a significant advantage for Ares, with $392 billion in assets under management in 2023, allowing for lower per-unit operational costs. Its diversification across credit, private equity, and real estate also attracts a broader investor base, a breadth that new entrants struggle to match. The competitive landscape for private equity deals in 2024 saw approximately $1.2 trillion in global deal value by mid-year, emphasizing the importance of efficient deal sourcing capabilities.

| Barrier | Description | Example for Ares Management |

| Capital Requirements | High initial funding needed for funds and operations. | Launching a private equity fund requires hundreds of millions to billions. |

| Brand Reputation & Track Record | Established trust and history of performance. | Approx. $340 billion AUM in Q1 2024 signifies investor confidence. |

| Regulatory Compliance | Costly and complex navigation of evolving financial regulations. | SEC's 2024 focus on private fund disclosures increases compliance burden. |

| Deal Sourcing & Relationships | Access to investment opportunities through extensive networks. | Over $50 billion deployed in 2023 highlights strong sourcing capabilities. |

| Economies of Scale & Diversification | Cost efficiencies and broad product offerings. | $392 billion AUM in 2023 enables lower operational costs and wider investor appeal. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ares Management is built upon a foundation of publicly available financial disclosures, including annual and quarterly reports, alongside industry-specific market research and analyst reports.