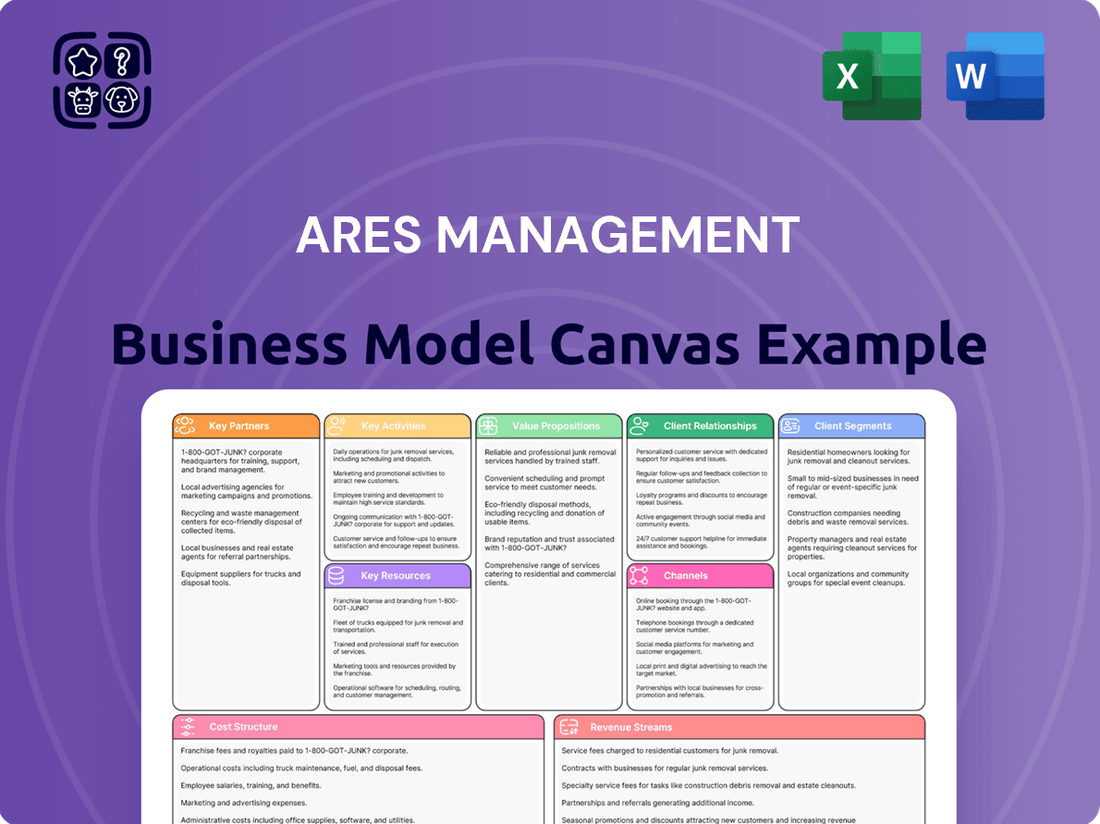

Ares Management Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ares Management Bundle

Unlock the full strategic blueprint behind Ares Management's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Ares Management actively cultivates strategic alliances and joint ventures to broaden its investment horizons and enhance its operational capabilities. A prime example is its joint venture with Savion, specifically designed to target investments in U.S. solar power generation projects, reflecting a commitment to renewable energy infrastructure.

These partnerships are crucial for Ares, enabling it to tap into specialized expertise and gain entry into previously inaccessible markets, thereby strengthening its competitive edge. For instance, in 2023, Ares committed $1 billion through its Infrastructure and Real Estate strategies, with a significant portion likely funneled through such collaborative ventures to achieve scale and diversification.

Furthermore, these collaborations often manifest as co-investments in particular assets or projects. This approach allows for the pooling of capital and the equitable sharing of risks and rewards, making larger, more complex deals feasible and more attractive to all parties involved.

Ares Management places significant emphasis on its institutional investor relationships, viewing them as foundational to its fundraising success. These include major players like pension funds, sovereign wealth funds, and insurance companies, which are vital for securing substantial capital commitments across Ares' various investment strategies.

In 2024, Ares continued to cultivate these crucial partnerships, demonstrating a broad reach within the institutional investor landscape. This strategic focus ensures a consistent flow of capital, underpinning the firm's ability to execute its investment plans and generate returns for its stakeholders.

Ares Management heavily relies on its partnerships with banks and other financial institutions for its debt financing operations and to maintain a robust capital market network. These alliances are crucial for securing credit facilities that enable the deployment of capital across Ares's diverse investment strategies.

In 2024, Ares continued to leverage these relationships, which are fundamental for facilitating large-scale transactions and syndicating loans. For instance, Ares's credit segment, which includes direct lending, often collaborates with banks for co-lending opportunities, expanding its reach and deal capacity.

Asset Originators and Operators

Ares Management actively collaborates with asset originators and operators, particularly within real estate and infrastructure sectors, to identify and secure compelling investment prospects. These partnerships are fundamental to building a robust pipeline of high-quality assets.

A prime example of this strategy is Ares' acquisition of GCP International. This move significantly boosted their presence and operational capabilities in logistics real estate, solidifying their position as a substantial investor and operator in the market.

- Strategic Acquisitions: The GCP International acquisition in 2021, valued at approximately $3.2 billion, demonstrates Ares' commitment to scaling its real estate portfolio through key partnerships.

- Pipeline Development: These relationships with originators and operators ensure a consistent flow of attractive investment opportunities, crucial for deploying capital effectively.

- Sector Expertise: By partnering with specialists in areas like logistics real estate, Ares gains access to deep market knowledge and operational efficiencies.

Wealth Management Platforms and Distributors

Ares Management actively collaborates with wealth management platforms and financial advisors to expand its reach to individual investors. This strategic alliance is crucial for diversifying its investor base beyond traditional institutional capital. For instance, the Ares Private Markets Fund (APMF) in Australia exemplifies this approach, providing wholesale clients access to Ares's established private equity capabilities.

These partnerships are vital for democratizing access to alternative investments. By leveraging these distribution networks, Ares can tap into a broader pool of capital, enhancing its Assets Under Management (AUM). In 2024, the alternative investment sector, particularly private markets, continued to see significant inflows, with wealth management channels playing an increasingly important role in channeling this capital.

- Distribution Expansion: Partnering with wealth management platforms broadens Ares's access to individual and high-net-worth investors.

- Product Accessibility: Initiatives like the APMF aim to make sophisticated private market strategies available to a wider audience of wholesale clients.

- Investor Diversification: This strategy reduces reliance on traditional institutional investors by tapping into the retail and mass affluent segments.

- Market Trends: The growing demand for alternative investments among individual investors in 2024 underscores the importance of these distribution partnerships.

Ares Management's key partnerships are foundational to its growth and market penetration. These alliances span various sectors, from renewable energy with entities like Savion to real estate operations through acquisitions such as GCP International. This collaborative approach allows Ares to access specialized expertise, expand its geographic reach, and build a robust pipeline of investment opportunities.

What is included in the product

Ares Management's business model focuses on generating fees from managing diverse alternative investment strategies for institutional clients, leveraging its global reach and specialized expertise.

Ares Management's Business Model Canvas offers a clear, structured framework to identify and address complex financial challenges.

It simplifies the intricate operations of a global investment firm, making strategic planning and problem-solving more accessible.

Activities

Ares Management's fundraising and capital formation is a critical engine, constantly seeking new investments for its Credit, Private Equity, Real Estate, and Infrastructure divisions. This ongoing effort is vital for fueling growth and providing capital to its portfolio companies.

In 2024, Ares demonstrated exceptional success by raising a record $93 billion in new capital commitments. This significant achievement highlights the firm's ability to attract substantial investment across its diverse strategies.

The process involves actively cultivating relationships with a broad spectrum of investors, ranging from large institutional entities to individual wealth clients. Securing these commitments for various investment vehicles is a cornerstone of their capital formation strategy.

Ares Management actively sources, evaluates, and executes investments across its various strategies, deploying significant capital into promising opportunities. In 2024 alone, Ares deployed a record $107 billion on behalf of its fund investors, demonstrating a robust pipeline and efficient execution.

This capital deployment spans a wide array of asset classes, including direct lending, private equity buyouts, real estate acquisitions, and infrastructure investments. Such broad engagement necessitates deep market intelligence and a consistently disciplined approach to ensure capital is allocated to its most attractive avenues.

Ares Management actively manages its diverse portfolio of existing companies and assets, focusing on driving value creation through strategic oversight and operational enhancements. This hands-on approach is fundamental to their business model, ensuring invested businesses and properties are optimized for growth.

In 2024, Ares continued to emphasize active management, a strategy that has historically yielded strong results. For instance, their credit strategies have consistently aimed for attractive risk-adjusted returns, a testament to their ongoing efforts in portfolio optimization and value realization.

The firm's commitment to generating consistent and attractive investment returns for clients is directly linked to these key activities. By implementing strategic guidance and operational improvements, Ares seeks to enhance the performance of its holdings, paving the way for successful strategic exits and capital appreciation.

Risk Management and Due Diligence

Ares Management places a strong emphasis on robust risk management and thorough due diligence as cornerstones of its investment process. This commitment ensures that every potential investment undergoes rigorous scrutiny, safeguarding investor capital and aligning with the firm's disciplined approach to capital deployment.

The firm's due diligence encompasses a multi-faceted analysis, examining not only the intrinsic value of an asset but also the prevailing market conditions and the complex regulatory landscape. This proactive stance is crucial for identifying and mitigating potential risks before capital is committed.

- Risk Assessment: Ares employs sophisticated analytical tools to assess credit, market, and operational risks associated with each investment opportunity.

- Due Diligence Process: This involves in-depth financial analysis, operational reviews, legal and compliance checks, and management team evaluations.

- Capital Deployment Discipline: A disciplined approach ensures that capital is allocated to opportunities that meet stringent risk-return profiles, as demonstrated by their consistent focus on value creation across various market cycles.

- Regulatory Compliance: Adherence to all relevant regulations and legal frameworks is paramount, forming an integral part of the due diligence and ongoing risk management framework.

Investor Relations and Reporting

Ares Management’s investor relations and reporting are crucial for maintaining trust and attracting capital. This involves consistently sharing financial updates, hosting investor calls, and offering insights into market dynamics and fund performance. For instance, in the first quarter of 2024, Ares reported total fee-paying assets under management of $398.1 billion, a testament to ongoing investor confidence.

Key activities include:

- Regular Financial Disclosures: Providing timely and accurate quarterly and annual financial reports to all stakeholders.

- Investor Communications: Conducting earnings calls, webcasts, and one-on-one meetings to discuss strategy and performance.

- Performance Updates: Offering detailed insights into the performance of various funds and strategies managed by Ares.

- Market Commentary: Sharing perspectives on economic trends and their potential impact on investment strategies.

Ares Management's core activities revolve around sourcing, managing, and deploying capital across a spectrum of alternative investment strategies, including credit, private equity, and real estate. They excel at raising substantial funds from a diverse investor base and then actively managing these investments to generate value. This involves rigorous due diligence and a hands-on approach to portfolio enhancement.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Fundraising & Capital Formation | Attracting capital commitments from institutional and individual investors for various funds. | Raised a record $93 billion in new capital commitments. |

| Investment Sourcing & Execution | Identifying, evaluating, and executing investments across credit, private equity, real estate, and infrastructure. | Deployed a record $107 billion on behalf of fund investors. |

| Active Portfolio Management | Driving value creation through strategic oversight and operational enhancements of portfolio companies and assets. | Emphasized value realization and optimization across credit strategies. |

| Risk Management & Due Diligence | Conducting thorough analysis to mitigate risks and ensure capital is deployed prudently. | Integral to all investment decisions, safeguarding investor capital. |

| Investor Relations & Reporting | Maintaining transparency and trust with investors through regular communication and performance updates. | Fee-paying AUM reached $398.1 billion in Q1 2024, indicating strong investor confidence. |

Full Document Unlocks After Purchase

Business Model Canvas

The Ares Management Business Model Canvas you are previewing is precisely what you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use document. Once your order is complete, you will gain full access to this identical file, allowing you to immediately leverage its insights.

Resources

Ares Management's experienced investment professionals and management team represent a core intellectual capital. Their collective expertise across diverse asset classes, including credit, private equity, and real estate, is fundamental to sourcing and executing profitable investment opportunities. This team's deep industry insights and established relationships are critical differentiators.

The firm's leadership structure, highlighted by recent appointments of Co-Presidents, underscores a commitment to robust governance and strategic direction. This experienced management is instrumental in navigating complex market conditions and driving Ares's growth strategy. Their proven ability to generate alpha across multiple economic cycles is a key resource.

Ares Management's extensive global network is a cornerstone of its operations. This network includes a diverse range of investors, businesses, and key industry contacts, facilitating access to unique investment opportunities and crucial market intelligence.

These deep-seated relationships are instrumental in sourcing proprietary deal flow, which are investment opportunities not widely available on the open market. Furthermore, they enable Ares to secure co-investment opportunities, allowing them to partner with other investors on significant transactions.

With a strategic presence spanning North America, Europe, Asia Pacific, and the Middle East, Ares Management leverages its global reach to cultivate and maintain these vital connections. This broad geographical footprint ensures a continuous flow of diverse and valuable market insights, crucial for navigating complex financial landscapes.

Ares Management's ability to attract and deploy significant capital from a broad spectrum of institutional and wealth investors is a core resource. This robust fundraising capacity is crucial for fueling its diverse investment strategies.

As of June 30, 2025, Ares Management's Assets Under Management (AUM) stood at an impressive $572.4 billion, underscoring its substantial financial firepower. This vast pool of capital directly enables the execution of its alternative investment approaches.

Proprietary Investment Platforms and Data

Ares Management's proprietary investment platforms and data are central to its competitive advantage. These sophisticated systems allow for in-depth financial modeling and rigorous market analysis, directly informing investment selection and ongoing portfolio management. The firm's disciplined approach is heavily reliant on these advanced technological resources.

These platforms are crucial for identifying alpha opportunities and optimizing investment strategies. By leveraging extensive datasets and advanced analytical tools, Ares can gain deeper insights into market trends and asset valuations. This data-driven methodology underpins their ability to manage risk effectively and pursue attractive returns across various market cycles.

- Proprietary Platforms: Ares utilizes advanced technology for financial modeling and market analysis.

- Data-Driven Decisions: Extensive data resources inform investment selection and portfolio optimization.

- Competitive Edge: These resources provide a distinct advantage in identifying and managing investments.

- Disciplined Philosophy: Robust systems support the firm's structured investment approach.

Brand Reputation and Track Record

Ares Management's strong brand reputation as a premier global alternative investment manager is a cornerstone of its business model. This reputation is built on a consistent track record of generating attractive returns for its investors, fostering deep trust in a highly competitive marketplace.

The company's long-standing history, dating back to its inception in 1997, significantly bolsters this invaluable resource. This extensive period of performance underpins investor confidence and serves as a key differentiator.

- Brand Reputation: Ares is recognized globally as a leading alternative investment manager.

- Track Record: Consistent generation of attractive returns for investors.

- Investor Trust: Reputation builds credibility and attracts capital.

- Market Differentiation: Strong brand sets Ares apart in a crowded industry.

Ares Management's key resources include its highly skilled investment professionals, a robust global network, significant capital-raising capabilities, proprietary technology platforms, and a strong brand reputation. The firm's intellectual capital, exemplified by its experienced management team, is crucial for identifying and executing investment strategies across various alternative asset classes. Their deep industry knowledge and relationships are vital for sourcing proprietary deal flow.

As of June 30, 2025, Ares Management managed $572.4 billion in assets, demonstrating its substantial financial capacity to deploy capital effectively. This AUM figure highlights the firm's ability to attract and manage significant investments from a diverse investor base, fueling its growth and operational capabilities. The firm's global presence across North America, Europe, Asia Pacific, and the Middle East further enhances its ability to access diverse markets and opportunities.

| Key Resource | Description | Supporting Data/Fact |

|---|---|---|

| Intellectual Capital | Experienced investment professionals and management team | Deep expertise across credit, private equity, and real estate |

| Global Network | Extensive relationships with investors and businesses | Facilitates access to unique investment opportunities and market intelligence |

| Capital Raising | Ability to attract and deploy significant capital | $572.4 billion in Assets Under Management (AUM) as of June 30, 2025 |

| Proprietary Platforms | Advanced technology for financial modeling and market analysis | Enables data-driven decisions and effective risk management |

| Brand Reputation | Premier global alternative investment manager | Built on a consistent track record of generating attractive returns since 1997 |

Value Propositions

Ares Management offers clients a broad spectrum of alternative investment strategies, spanning Credit, Private Equity, Real Estate, and Infrastructure. This extensive range provides investors with opportunities to diversify their portfolios beyond conventional assets, tapping into asset classes that often exhibit lower correlation to traditional markets.

By gaining exposure to these alternative avenues, clients can potentially achieve enhanced risk-adjusted returns. Ares’ approach is designed to meet diverse investor needs through flexible capital solutions, ensuring a tailored experience for those seeking to optimize their investment outcomes.

As of the first quarter of 2024, Ares reported approximately $422 billion in assets under management, showcasing its significant scale and reach in providing these diverse alternative investment opportunities to a global client base.

Ares Management is committed to delivering consistent and attractive investment returns for its investors, navigating diverse market conditions effectively. This focus on performance is underpinned by a disciplined investment philosophy and active management strategies.

The firm's success in achieving these returns is evident in its financial performance. For the fiscal year ending December 31, 2024, Ares Management reported a total stock return of 53%, showcasing its capability to generate significant shareholder value.

Ares Management provides highly adaptable capital solutions, precisely crafted to meet the unique requirements of businesses needing funding and investors seeking personalized investment avenues. This flexibility enables Ares to participate in a broad spectrum of deals, offering bespoke financing arrangements.

Their offerings encompass direct lending and a diverse array of other credit solutions, demonstrating a commitment to meeting varied client needs. For instance, Ares Capital Corporation, a key part of their strategy, reported originating $13.8 billion in new capital commitments in 2023, highlighting the scale and demand for their flexible financing.

Global Reach and Market Expertise

Ares Management leverages its extensive global network, spanning North America, Europe, and Asia Pacific, to offer clients unparalleled access to diverse investment opportunities. This broad geographical presence is complemented by profound local market knowledge, enabling informed decision-making in varied economic landscapes.

The strategic acquisition of GCP International in 2023 was a pivotal move, significantly bolstering Ares's global footprint, especially within the burgeoning logistics real estate sector. This expansion means clients benefit from a wider array of investment options and deeper insights into regional market dynamics.

Ares's commitment to global reach and market expertise is a cornerstone of its value proposition, providing a distinct advantage in identifying and capitalizing on opportunities worldwide. This integrated approach ensures clients receive comprehensive coverage and specialized intelligence across key international markets.

- Global Presence: Operations across North America, Europe, and Asia Pacific.

- Market Expertise: Deep understanding of local investment landscapes.

- Acquisition Impact: GCP International acquisition enhanced logistics real estate reach.

- Opportunity Access: Broader universe of investment opportunities for clients.

Trusted Stewardship and Risk Management

Ares Management positions itself as a trusted steward of capital, prioritizing rigorous risk management and thorough due diligence to safeguard client assets. This dedication to protecting investor interests is a cornerstone of their value proposition.

Their commitment to responsible investing and a disciplined investment approach cultivates deep confidence among their clientele. This focus on long-term value creation and the prudent deployment of capital sets them apart in the market.

- Capital Stewardship: Ares acts as a fiduciary, managing capital with a focus on preservation and growth.

- Risk Mitigation: Robust risk management frameworks are integrated into every investment decision.

- Due Diligence: Extensive research and analysis are conducted to ensure informed capital allocation.

- Client Confidence: A proven track record and transparent practices build trust with investors.

Ares Management provides a wide array of alternative investment strategies, including credit, private equity, real estate, and infrastructure, allowing clients to diversify beyond traditional assets and potentially achieve better risk-adjusted returns. Their flexible capital solutions are tailored to diverse investor needs, aiming to optimize investment outcomes.

The firm's scale is significant, managing approximately $422 billion in assets under management as of Q1 2024, demonstrating its broad reach in offering these alternative investment opportunities globally.

Ares is dedicated to delivering consistent investment performance through disciplined strategies, as evidenced by a 53% total stock return for the fiscal year ending December 31, 2024.

Their value proposition centers on providing adaptable capital solutions, exemplified by Ares Capital Corporation originating $13.8 billion in new capital commitments in 2023, showcasing their capacity for bespoke financing.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Diverse Alternative Investments | Access to a broad spectrum of asset classes beyond traditional markets. | Assets Under Management (AUM): $422 billion (Q1 2024) |

| Enhanced Risk-Adjusted Returns | Strategies designed to optimize portfolio performance. | Total Stock Return: 53% (FY 2024) |

| Flexible Capital Solutions | Tailored financing to meet unique business and investor needs. | Ares Capital new commitments: $13.8 billion (2023) |

| Global Market Access & Expertise | Leveraging an extensive network for diverse investment opportunities. | Acquisition of GCP International (2023) enhanced logistics real estate reach. |

| Capital Stewardship & Risk Management | Prioritizing asset protection through rigorous due diligence and risk mitigation. | Focus on fiduciary duty and client confidence. |

Customer Relationships

Ares Management cultivates enduring relationships with major institutional investors like pension funds, sovereign wealth funds, and insurance companies. These partnerships are built on personalized service, including dedicated relationship managers and bespoke reporting tailored to each client's unique investment goals.

The firm actively seeks to expand its presence within this critical segment, consistently working to onboard new institutional clients. As of the first quarter of 2024, Ares reported approximately $396 billion in assets under management, a significant portion of which comes from these institutional relationships, demonstrating the scale and importance of these partnerships.

Ares Management is significantly deepening its engagement with the wealth management sector, aiming to democratize access to private markets. By providing educational content and specialized investment options, they are empowering financial advisors and their clients.

This strategic push includes offering accessible open-ended credit products and diverse investment vehicles designed for individual investors. Ares' 2024 initiatives focus on bridging the gap between individual capital and the opportunities within private markets, a segment traditionally harder for retail investors to access.

Ares Management’s customer relationships are built on an advisory and consultative approach, positioning the firm as a thought leader in alternative investments. They offer expert advice and insights, guiding clients through complex market dynamics and helping them identify suitable investment strategies.

This advisory role is crucial for fostering trust and long-term partnerships. For instance, in 2023, Ares reported $377 billion in assets under management, a significant portion of which is likely driven by clients seeking their specialized guidance in navigating the intricacies of the alternative investment landscape.

Transparency and Consistent Communication

Ares Management prioritizes transparency and consistent communication to foster strong customer relationships. This involves providing investors with regular updates on fund performance, market trends, and the firm's evolving investment strategies.

Maintaining these open lines of communication is crucial for building and sustaining trust with their diverse client base. For instance, Ares's commitment to clarity ensures investors understand the rationale behind investment decisions and the potential impact of market shifts.

- Regular Performance Reporting: Investors receive detailed reports on their fund's performance, often on a quarterly basis, highlighting key metrics and investment outcomes.

- Market Insights and Strategy Updates: Ares frequently shares analyses of current market conditions and provides updates on how their investment strategies are adapting to these dynamics.

- Investor Relations Channels: Dedicated investor relations teams are available to address queries and provide personalized communication, reinforcing accessibility and responsiveness.

- Commitment to Disclosure: The firm adheres to strict disclosure requirements, ensuring all material information is readily available to clients, thereby upholding a high standard of transparency.

Tailored Solutions and Product Innovation

Ares Management actively crafts bespoke investment solutions and drives product innovation to align with shifting client needs. This agility allows the firm to deliver pertinent and impactful strategies across its various asset classes.

- Tailored Investment Strategies: Ares develops customized investment approaches, such as its €1.2 billion European private credit fund launched in 2024, designed to meet specific investor objectives and market conditions.

- Product Development Pipeline: The firm consistently introduces new fund structures and investment vehicles, exemplified by its expansion into new geographies and strategies, demonstrating a commitment to evolving its product suite.

- Strategic Acquisitions: Ares enhances its platform through targeted acquisitions, like the integration of a new real estate debt platform in early 2024, which broadened its capabilities and client offerings.

Ares Management's customer relationships are characterized by a deep commitment to institutional investors, offering personalized service and bespoke reporting to meet their unique goals. The firm actively expands its institutional client base, as evidenced by its significant assets under management. By focusing on transparency and consistent communication, Ares builds trust and fosters long-term partnerships, providing clients with regular performance updates and market insights.

| Client Segment | Relationship Focus | 2024 Initiatives/Data Points |

|---|---|---|

| Institutional Investors | Personalized service, dedicated managers, bespoke reporting | Continued expansion of institutional client base; ~$396 billion AUM (Q1 2024) |

| Wealth Management Sector | Democratizing private market access, education, accessible products | Offering open-ended credit products and diverse investment vehicles for individual investors |

| All Clients | Advisory, thought leadership, transparency, consistent communication | Emphasis on guiding clients through complex markets; $377 billion AUM (2023) reflects demand for expertise |

Channels

Ares Management's direct sales and investor relations teams are the bedrock for engaging sophisticated institutional investors, cultivating deep, personal connections that are vital for securing substantial capital. These dedicated professionals are instrumental in building trust and providing tailored communication, ensuring that large allocators like pension funds, endowments, and sovereign wealth funds feel well-informed and valued.

In 2024, Ares continued to leverage these direct relationships to drive capital formation. For instance, by the end of the first quarter of 2024, Ares reported approximately $422 billion in assets under management, a significant portion of which was raised through these direct channels, highlighting the efficacy of their investor relations efforts in attracting and retaining major institutional capital.

The Ares Wealth Management Solutions platform acts as a crucial distribution channel, specifically targeting individual investors and financial advisors. This initiative broadens access to Ares' private market strategies through the distribution of non-listed vehicles and open-ended funds, democratizing alternative investments. By offering these products, Ares aims to capture a larger share of the growing retail investment market, which saw significant inflows into alternative assets in 2024.

Strategic partnerships and joint ventures act as crucial channels for Ares Management, enabling them to broaden their market presence and tap into specialized investment prospects or client groups. These alliances allow Ares to enter new regions or asset categories by utilizing the partner's established networks and specialized knowledge.

For instance, Ares's joint venture with Savion, a prominent renewable energy developer, highlights this strategy. This collaboration focuses on developing solar energy projects, demonstrating how Ares leverages partnerships to access the growing renewable energy sector.

Online Presence and Digital Platforms

Ares Management leverages its corporate website and various digital platforms to disseminate crucial information, share market insights, and provide comprehensive investor resources. While these channels are not typically used for direct transaction execution of large institutional investments, they are vital for building brand awareness, showcasing thought leadership, and engaging with a broader audience.

These digital touchpoints act as a primary conduit for communicating the firm's investment strategies, performance updates, and market perspectives. In 2024, Ares continued to enhance its online presence, with its corporate website serving as a central hub for news, research reports, and firm-wide announcements, attracting significant traffic from potential investors and industry professionals.

Furthermore, secure investor portals offer clients exclusive and confidential access to fund-specific data, performance reports, and important documentation, reinforcing transparency and client service. This digital infrastructure is key to maintaining strong relationships with its diverse investor base.

- Corporate Website: Serves as the primary information hub, detailing Ares' strategies, leadership, and market commentary.

- Investor Portals: Provide secure, authenticated access to personalized fund performance data and reporting for clients.

- Digital Content: Includes white papers, market outlooks, and podcasts, establishing thought leadership and attracting prospective investors.

- Social Media Engagement: While not a direct sales channel, platforms are used for brand visibility and sharing firm news.

Industry Conferences and Events

Ares Management actively participates in key industry conferences and investor days, leveraging these platforms to connect with a broad audience. These events are crucial for showcasing the firm's investment strategies and market insights, fostering deeper engagement with both current and potential clients. For instance, Ares often presents at major financial forums, providing valuable perspectives on alternative investments and credit markets.

- Client Engagement: Conferences offer direct interaction opportunities with a diverse client base, from institutional investors to high-net-worth individuals.

- Thought Leadership: Presenting at these events allows Ares to highlight its expertise and market outlook, reinforcing its position as a leader in alternative asset management.

- Networking: Industry gatherings provide invaluable networking avenues, facilitating relationship building with peers, potential partners, and key stakeholders.

- Brand Visibility: Consistent participation enhances Ares' brand recognition and reinforces its commitment to transparency and client communication.

Ares Management utilizes a multi-faceted approach to reach its diverse investor base, encompassing direct engagement, wealth management solutions, strategic partnerships, and robust digital platforms. These channels are designed to cultivate relationships, distribute products, and disseminate information effectively.

The firm's direct sales and investor relations teams are paramount for securing capital from institutional investors, building trust through tailored communication. Ares' Wealth Management Solutions platform broadens access to alternative investments for individual investors and advisors via non-listed vehicles. Strategic partnerships, like the one with Savion for renewable energy projects, expand market reach and expertise.

Digital channels, including the corporate website and investor portals, are crucial for brand building, thought leadership, and client service by providing performance data and market insights. Participation in industry conferences further enhances engagement and visibility.

| Channel | Target Audience | 2024 Focus/Activity |

|---|---|---|

| Direct Investor Relations | Institutional Investors | Securing substantial capital, cultivating deep relationships. |

| Wealth Management Solutions | Individual Investors, Financial Advisors | Distributing alternative assets through non-listed vehicles. |

| Strategic Partnerships | Specialized Client Groups, New Markets | Accessing new regions/asset categories via partner networks. |

| Digital Platforms (Website, Portals) | Broad Audience, Existing Clients | Brand awareness, thought leadership, client reporting. |

| Industry Conferences | Broad Investor Base, Industry Professionals | Showcasing strategies, networking, enhancing visibility. |

Customer Segments

Large institutional investors, encompassing corporate and public pension funds, insurance companies, sovereign wealth funds, and substantial endowments and foundations, represent a cornerstone client base for Ares Management.

These sophisticated entities typically deploy significant capital across Ares's diverse fund offerings, prioritizing access to alternative asset classes and aiming for robust long-term investment performance.

As of the first quarter of 2024, Ares reported total AUM of $397 billion, with a substantial portion of this managed on behalf of these large institutional clients, highlighting their critical role in Ares's growth and strategy.

Ares continues to actively cultivate and expand its relationships within this vital segment, demonstrating a strategic focus on deepening engagement and capital commitments from these key investors.

Ares Management actively caters to high-net-worth individuals and family offices, often leveraging its robust wealth management platform or partnering with financial advisors. This segment is particularly drawn to Ares for its ability to unlock access to private market investments, opportunities typically beyond the reach of conventional investment avenues.

The firm recognizes the significant growth potential within this investor base and is strategically expanding its product and service portfolio to meet their evolving needs. For instance, as of the first quarter of 2024, Ares reported approximately $422 billion in total AUM, a portion of which is directly attributable to these sophisticated investors seeking differentiated strategies.

Financial advisors and wealth managers represent a critical customer segment for Ares Management. These professionals, including registered investment advisors (RIAs), act as crucial intermediaries, channeling client capital into Ares's diverse range of funds. Ares actively supports this group by providing comprehensive educational resources and user-friendly investment products designed to facilitate the integration of private market strategies into their clients' portfolios.

This segment is a significant driver of Ares's growth, as evidenced by the increasing demand for alternative investments among high-net-worth individuals and institutional clients. In 2024, the U.S. wealth management industry saw substantial inflows into alternative assets, with some reports indicating that alternatives now represent over 20% of assets under management for many advisory firms, a trend Ares is well-positioned to capitalize on.

Corporate and Private Companies

Ares Management's Credit and Private Equity divisions actively engage with corporate and private companies, offering tailored capital solutions. These businesses are key customers, benefiting from Ares's financing for strategic initiatives like expansion, mergers, and refinancing. For instance, Ares Capital Corporation, a significant player, specifically targets middle-market companies, demonstrating a focus on a broad spectrum of corporate clients.

These corporate clients represent a vital customer segment for Ares, seeking capital to fuel their growth and operational needs. In 2024, the demand for flexible financing solutions remained robust across various industries. Ares's ability to provide diverse capital structures, including debt and equity, positions it as a preferred partner for companies navigating complex financial landscapes.

- Middle-Market Focus: Ares Capital Corporation, a leading provider of capital to U.S. middle-market companies, reported a total investment portfolio of approximately $22.4 billion as of the first quarter of 2024.

- Growth Capital: Companies across sectors like technology, healthcare, and industrials utilize Ares's funding for organic growth and strategic acquisitions, a trend that continued strongly into 2024.

- Recapitalization Needs: Ares provides capital for companies looking to optimize their balance sheets through recapitalization, enhancing financial flexibility and shareholder value.

- Private Equity Partnerships: Ares's private equity funds partner with established private companies, offering strategic guidance and capital to drive operational improvements and market expansion.

Other Investment Managers and Funds

Ares Management actively engages with other investment managers and funds, viewing them as crucial partners for capital deployment and strategic growth. This segment encompasses firms that might co-invest alongside Ares in specific deals or allocate capital to Ares's diverse, specialized investment strategies. These collaborations are often built on complementary expertise, where Ares's established track record and specialized knowledge can enhance another firm's investment mandate.

These partnerships are vital for expanding Ares's reach and its ability to deploy capital effectively across various markets. By teaming up with other managers, Ares can access new deal flow, share investment risks, and leverage broader networks. For instance, in 2024, Ares continued to build out its strategic partnerships, aiming to broaden its investor base and enhance its competitive edge in a dynamic global financial landscape.

- Co-Investment Opportunities: Other investment managers may partner with Ares on specific transactions, sharing capital commitments and due diligence efforts.

- Strategic Capital Allocation: Funds and asset managers allocate capital to Ares's specialized strategies, seeking exposure to Ares's expertise in areas like credit, private equity, and real estate.

- Complementary Mandates: Collaborations are often structured around complementary investment mandates, allowing both parties to benefit from each other's strengths and market access.

- Expanded Deployment Capabilities: These relationships enable Ares to deploy capital more efficiently and access a wider range of investment opportunities, thereby increasing its overall influence and market presence.

Ares Management serves a diverse clientele, including large institutional investors like pension funds and endowments, high-net-worth individuals, and family offices seeking access to alternative assets. The firm also partners with financial advisors and wealth managers who act as intermediaries, channeling client capital into Ares's offerings.

Furthermore, Ares provides tailored capital solutions to corporate and private companies, facilitating their growth and strategic initiatives. The firm also collaborates with other investment managers and funds, leveraging complementary expertise and expanding capital deployment capabilities.

| Customer Segment | Key Characteristics | Ares's Value Proposition | 2024 Data/Insights |

|---|---|---|---|

| Institutional Investors | Large capital pools, long-term focus, seeking alternative asset exposure | Access to diverse strategies, robust performance track record | AUM of $397 billion (Q1 2024) |

| High-Net-Worth & Family Offices | Seeking differentiated investment opportunities, often private markets | Access to exclusive deals, tailored wealth management solutions | Significant portion of AUM ($422 billion total AUM, Q1 2024) |

| Financial Advisors & Wealth Managers | Intermediaries for client capital, demand for alternatives | Educational resources, user-friendly products, integration support | Alternatives represent >20% AUM for many advisory firms in 2024 |

| Corporates & Private Companies | Need for growth capital, M&A financing, recapitalization | Flexible financing solutions, debt and equity options | Ares Capital Corp. portfolio ~$22.4 billion (Q1 2024) |

| Other Investment Managers | Seeking co-investment opportunities, strategic partnerships | Complementary expertise, expanded market access, risk sharing | Continued building of strategic partnerships in 2024 |

Cost Structure

Employee compensation and benefits represent a major cost for Ares Management. This includes competitive salaries, significant bonuses tied to performance, and comprehensive benefits packages for their extensive team of investment professionals and support personnel. In 2023, Ares reported total compensation and benefits expenses of approximately $2.5 billion, highlighting the critical investment in human capital necessary for a knowledge-intensive business.

General, administrative, and operating expenses at Ares Management cover a broad spectrum of costs essential for daily business, including rent for their global offices, the technology powering their operations, and necessary legal and compliance functions. These overheads are a significant component of their business model, reflecting the scale of their international reach and the complexity of their financial services.

In 2024, Ares Management reported significant investments in its operational infrastructure and growth initiatives. For instance, the firm's commitment to expanding its marketing presence and the development of its new corporate headquarters in Miami have demonstrably increased these expenditures. These strategic moves are designed to support future growth and enhance client engagement.

Ares Management incurs substantial costs related to its strategic acquisition activities. These include fees for thorough due diligence, the often complex process of integrating newly acquired entities, and payments for various professional services like legal and financial advisory. For example, the acquisition of GCP International in 2021, a significant move for Ares, involved considerable transaction expenses that directly impacted its cost structure for that period.

Fund Operating Expenses and Carried Interest Related Costs

Ares Management's cost structure includes significant operating expenses for its diverse investment funds. These encompass administrative fees, external audit services, and legal counsel, all crucial for maintaining fund integrity and compliance. For instance, in 2023, Ares reported consolidated total operating expenses of $3.9 billion, reflecting the scale of these operations.

A notable component of their cost structure, albeit performance-driven, is the potential for carried interest payouts. This incentive compensation is paid to investment professionals based on the profits generated by the funds, aligning their interests with investors but representing a substantial variable cost. In 2023, Ares's compensation and benefits, which includes carried interest, was $4.5 billion.

- Fund Administration: Costs for managing fund operations, including accounting, reporting, and compliance.

- Audit and Legal Fees: Expenses incurred for independent audits and legal services to ensure regulatory adherence.

- Carried Interest: Performance-based compensation paid to fund managers, contingent on achieving specific return thresholds.

- Personnel Costs: Salaries, bonuses, and benefits for investment professionals and support staff.

Interest and Financing Costs

Ares Management incurs significant interest and financing costs. These expenses stem from the company's own corporate debt and the credit facilities it utilizes. These facilities are crucial for managing day-to-day liquidity and for funding various strategic growth initiatives.

These financing costs are an integral part of Ares' overall cost structure, especially given the substantial assets it manages. For instance, as of the first quarter of 2024, Ares reported total debt of approximately $6.5 billion, reflecting its leverage to support operations and investments.

- Interest Expense: Costs associated with outstanding debt obligations.

- Credit Facility Fees: Charges for maintaining access to committed lines of credit.

- Impact on Profitability: These costs directly reduce net income and impact earnings per share.

Ares Management's cost structure is heavily influenced by personnel expenses, including salaries, bonuses, and benefits for its investment professionals, which totaled $4.5 billion in 2023. Additionally, the firm incurs substantial operating expenses for fund administration, audit, and legal services, amounting to $3.9 billion in consolidated total operating expenses in 2023. Strategic growth initiatives and infrastructure investments, such as new headquarters, also contribute to these costs, as seen in increased expenditures in 2024.

| Cost Category | 2023 Expense (Approx.) | Key Drivers |

|---|---|---|

| Personnel Costs | $4.5 billion | Salaries, bonuses, benefits, carried interest |

| Operating Expenses | $3.9 billion | Fund administration, audit, legal, technology |

| Financing Costs | Variable (based on debt levels) | Interest on corporate debt, credit facility fees |

Revenue Streams

Management fees form the bedrock of Ares Management's revenue, providing a stable and predictable income source. These fees are generally calculated as a percentage of the total assets managed or capital committed by investors, ensuring a consistent revenue flow regardless of short-term market fluctuations.

This recurring revenue model is crucial for the firm's financial health. For instance, in the second quarter of 2025, Ares Management reported a significant 24% year-over-year increase in management fees, reaching $900.3 million. This growth highlights the expanding scale of their operations and investor confidence.

Incentive fees, often called carried interest, are a crucial revenue stream for Ares Management. These fees are essentially a share of the profits generated by their investment funds, but only after those funds meet specific performance benchmarks. This means Ares's earnings from these fees can fluctuate significantly, directly tied to how well their investments perform.

For Ares, carried interest represents a substantial opportunity for upside. In 2023, for instance, Ares reported $1.3 billion in incentive fees and other income, highlighting the significant impact of performance-driven compensation on their overall financial results. This structure aligns the firm's interests with those of its investors, as both parties benefit from successful investment outcomes.

Ares Management generates significant revenue through transaction and advisory fees tied to its investment activities. These fees can include origination charges, arrangement fees for structuring deals, and ongoing advisory services provided to their portfolio companies.

For instance, in the first quarter of 2024, Ares reported fee-related earnings of $696 million, a substantial portion of which stems from these deal-specific and advisory income streams.

Interest and Dividend Income from Investments

Ares Management generates significant revenue through interest and dividend income, primarily from its Credit Group. This income stems from the debt and equity securities held across its diverse investment portfolios. For instance, in the first quarter of 2024, Ares reported robust performance in its credit segment, highlighting the importance of this income stream.

The yield on these underlying investments directly impacts the profitability of this revenue channel. Higher interest rates and strong dividend payouts from portfolio companies contribute to increased earnings for Ares. This was evident in their reported figures for 2023, where net interest income and dividend income played a crucial role in their overall financial results.

- Interest Income: Earned from debt instruments held by the Credit Group.

- Dividend Income: Received from equity holdings within investment portfolios.

- Yield Sensitivity: Revenue directly correlates with the prevailing interest rates and dividend yields of underlying assets.

Other Fees and Income

This segment encompasses a variety of ancillary revenue streams that bolster Ares Management's financial stability. These include administration fees collected from specific investment vehicles, which provide a steady income. Additionally, income generated from distinct business units, such as Ares Insurance Solutions, adds further diversification.

These other fees and income sources are crucial for the overall financial health of Ares. For instance, in the first quarter of 2024, Ares reported total fee-related earnings of $712 million, showcasing the significance of these diverse revenue streams. This category highlights Ares's ability to generate income beyond its core asset management fees.

- Administration Fees: Income derived from managing specific investment funds and vehicles.

- Other Business Segments: Revenue generated from specialized units like Ares Insurance Solutions.

- Revenue Diversification: These streams contribute to a more robust and less concentrated revenue base for Ares.

- Q1 2024 Performance: Fee-related earnings of $712 million underscore the importance of these income sources.

Ares Management's revenue streams are diverse, with management fees forming a consistent base, typically a percentage of assets under management. Incentive fees, or carried interest, provide a significant upside potential, directly linked to fund performance. Transaction and advisory fees arise from deal structuring and ongoing support for portfolio companies, while interest and dividend income are generated from the firm's credit and equity investments.

| Revenue Stream | Description | Q1 2024 Impact (Millions USD) | 2023 Impact (Millions USD) |

| Management Fees | Percentage of assets under management or capital committed. | $900.3 (Q2 2025 YoY increase of 24%) | N/A |

| Incentive Fees (Carried Interest) | Share of profits from successful fund performance above benchmarks. | N/A | $1,300 |

| Transaction & Advisory Fees | Fees from deal origination, structuring, and advisory services. | $696 (Part of Fee-Related Earnings) | N/A |

| Interest & Dividend Income | Generated from debt and equity securities in portfolios. | Robust performance in Credit Group | Key contributor to overall results |

| Other Fees & Income | Includes administration fees and income from specialized units. | $712 (Total Fee-Related Earnings) | N/A |

Business Model Canvas Data Sources

The Ares Management Business Model Canvas is constructed using a blend of proprietary financial models, extensive market research reports, and internal operational data. This multi-faceted approach ensures a comprehensive and accurate representation of the firm's strategic framework.