Ares Management Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ares Management Bundle

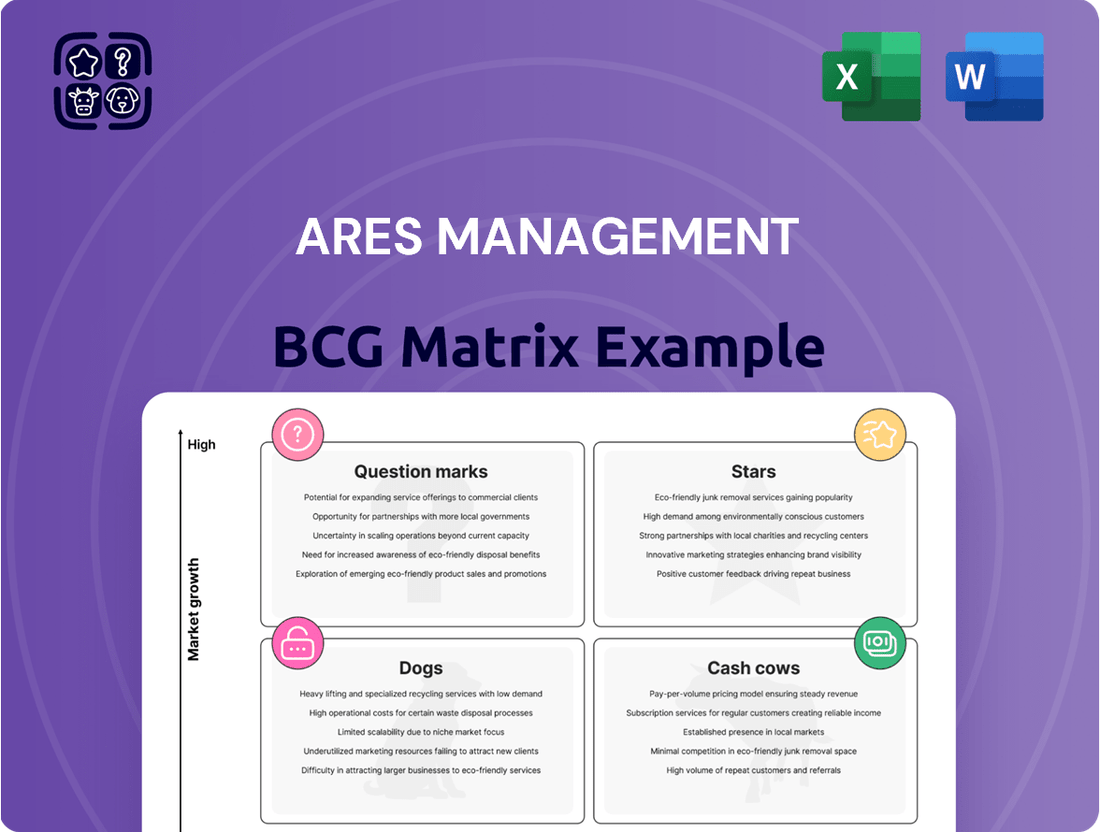

Curious about Ares Management's strategic product portfolio? This glimpse into their BCG Matrix reveals the foundational insights into their market positioning. Understand which of their offerings are poised for growth and which are generating steady returns.

To truly unlock the strategic advantage, dive into the full Ares Management BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with data-backed recommendations for optimized resource allocation and future investment decisions. Purchase the full report for actionable insights that drive competitive success.

Stars

Ares Management's Credit Group is a powerhouse in direct lending, boasting significant market share in both the U.S. and Europe. This segment of the private credit market is experiencing rapid growth, and Ares is at the forefront.

In 2024, Ares achieved impressive origination volumes, committing $48.2 billion to U.S. direct lending deals. Furthermore, the firm successfully raised €30 billion for its European direct lending strategy. These figures underscore Ares' dominant global leadership in this expanding asset class.

Ares Management's Infrastructure Debt platform is a key growth engine, boasting nearly $11 billion in assets under management as of March 31, 2025. This robust platform has deployed over $21 billion in capital throughout its 15-year existence, showcasing a consistent track record of significant financial activity.

The team's strategic emphasis on climate and sustainable infrastructure, exemplified by ventures like the solar joint venture with Savion, places Ares at the forefront of a rapidly expanding sector. This focus aligns perfectly with prevailing global megatrends, ensuring continued investment and expansion opportunities.

Ares Management's Secondaries Strategy is a key component of its diversified approach, leveraging the growing demand for liquidity in private markets. This segment has seen substantial expansion, with Ares actively participating in this dynamic market.

The acquisition of Landmark Partners significantly boosted Ares' capabilities, leading to a 30% increase in Assets Under Management (AUM) for its secondaries business. This strategic move underscores Ares' commitment to strengthening its position in this specialized area of private equity.

Further illustrating the success of this strategy, the Ares Private Markets Fund (APMF) in Australia achieved A$3 billion in AUM as of September 30, 2024. This substantial growth highlights the fund's appeal and Ares' ability to attract significant capital in key global markets.

This thriving secondaries strategy demonstrates Ares' adeptness at identifying and capitalizing on high-growth opportunities, solidifying its market share by providing essential liquidity solutions within the complex landscape of private markets.

Alternative Credit Growth

Alternative credit is a standout performer for Ares Management, showing the most robust organic growth among its strategies. This segment is poised for significant expansion, with a goal to reach $70 billion in assets under management by 2028, a substantial jump from $33.9 billion at the close of 2023.

This ambitious growth trajectory highlights alternative credit as a star within Ares' portfolio. The strategy is well-positioned due to increasing demand from institutional investors actively searching for higher yields in the current market environment.

Furthermore, the evolving landscape where banks are scaling back their involvement in leveraged lending creates a favorable environment for Ares' direct lending approach to flourish. This dynamic allows Ares to capture market share and capitalize on these shifts.

- Fastest Organic Growth: Alternative credit is Ares' leading growth engine.

- Ambitious AUM Target: Aiming for $70 billion by 2028, up from $33.9 billion in 2023.

- Market Demand: Driven by institutional investors seeking yield.

- Favorable Competitive Landscape: Benefits from banks reducing leveraged lending exposure.

Wealth Management Solutions Expansion

Ares Management's Wealth Management Solutions are experiencing robust growth, positioning them as a star in the BCG matrix. The firm is targeting an impressive $100 billion in Assets Under Management (AUM) by 2028, a significant leap from their current approximately $25 billion. This aggressive expansion is fueled by consistent strong inflows and a broadening array of product offerings designed to meet diverse investor needs.

The strategic focus on scaling this segment underscores its importance to Ares' overall business. By actively broadening its client base and bringing institutional-quality investment solutions to individual investors, Ares is capitalizing on a growing market opportunity. This diversification and enhanced product accessibility are key drivers behind the segment's star status.

- Target AUM: $100 billion by 2028, up from ~$25 billion.

- Growth Drivers: Strong inflows and expanding product suite.

- Strategic Focus: Diversifying client base and offering institutional-quality solutions to retail investors.

- Market Position: Identified as a key 'star' due to high growth potential and market attractiveness.

Ares Management's Wealth Management Solutions are experiencing robust growth, positioning them as a star in the BCG matrix. The firm is targeting an impressive $100 billion in Assets Under Management (AUM) by 2028, a significant leap from their current approximately $25 billion. This aggressive expansion is fueled by consistent strong inflows and a broadening array of product offerings designed to meet diverse investor needs.

The strategic focus on scaling this segment underscores its importance to Ares' overall business. By actively broadening its client base and bringing institutional-quality investment solutions to individual investors, Ares is capitalizing on a growing market opportunity. This diversification and enhanced product accessibility are key drivers behind the segment's star status.

Ares' Wealth Management Solutions are a clear star within its BCG matrix. The segment is on track for substantial growth, aiming for $100 billion in AUM by 2028, a significant increase from its current ~$25 billion. This rapid expansion is driven by strong investor inflows and a diverse product suite, catering to a wider client base with institutional-grade offerings.

| Strategy | Current AUM (Approx.) | Target AUM (2028) | Key Growth Drivers | BCG Status |

| Wealth Management Solutions | $25 billion | $100 billion | Strong inflows, expanding product suite, retail investor focus | Star |

What is included in the product

Highlights which units to invest in, hold, or divest

Tailored analysis for Ares Management's product portfolio

Ares Management BCG Matrix: A visual tool that simplifies complex portfolio analysis, easing the pain of strategic decision-making.

Cash Cows

Ares Management's established credit funds are a cornerstone of their business, acting as significant cash cows. These mature funds, which exclude faster-growing direct lending areas, boast a substantial market share. This dominance translates into robust, predictable fee-paying assets under management (AUM) and consistent management fees, solidifying their role as a stable income generator.

The operational efficiency within these well-established credit markets allows Ares to extract maximum value from these segments. For instance, as of the first quarter of 2024, Ares Management reported total AUM of $422.4 billion, with their Credit segment being the largest contributor. This segment's stability is crucial for funding growth in other areas of the business.

Perpetual capital vehicles are a cornerstone of Ares Management's strategy, demonstrating remarkable growth with Assets Under Management (AUM) reaching $154.8 billion in Q1 2024, a significant 41.8% increase year-over-year. These long-duration funds are the primary drivers of the firm's financial stability, accounting for a substantial 83% of total AUM and a commanding 92% of management fees.

While operating in markets characterized by lower growth, these vehicles possess high market share and consistently generate strong cash flows. This combination of stable revenue and market dominance firmly positions them as Ares' cash cows, underpinning the firm's overall financial strength and operational capacity.

Ares Capital Corporation (ARCC) stands out as a prime example of a cash cow within Ares Management's broader strategy. As a leading publicly traded business development company, ARCC generates substantial management fees for the Credit Group. Its extensive investment portfolio boasts strong credit quality, a testament to its prudent management.

ARCC's financial performance is characterized by a remarkable track record of delivering stable or increasing quarterly dividends for over fifteen consecutive years. This consistent income stream, coupled with its established market position, firmly categorizes ARCC as a mature and reliable cash cow, providing dependable returns.

Core Industrial and Multifamily Real Estate

Ares Management's Real Estate group heavily emphasizes industrial and multifamily properties, making them key cash cows. Industrial assets represent a significant 50% of their portfolio, while multifamily accounts for 25%.

These sectors are known for their consistent revenue streams and robust occupancy rates, especially in established real estate markets. This stability is a hallmark of cash cow businesses.

- Industrial Real Estate: Represents 50% of Ares' Real Estate portfolio.

- Multifamily Real Estate: Constitutes 25% of Ares' Real Estate portfolio.

- GCP International Acquisition: Strengthened Ares' position in global logistics real estate.

- Sector Stability: Both sectors typically offer stable cash flows and high occupancy.

Mature Private Equity Strategies

Ares Management's Private Equity Corporate Opportunities and APAC Private Equity strategies are key cash cows, boasting approximately $24.7 billion in assets under management as of mid-2024. These mature strategies are built on extensive existing relationships and a demonstrated history of success. They generate stable, high-margin fees by effectively managing a portfolio of established companies.

The consistent performance of these mature funds provides a reliable income stream for Ares. While the broader private equity landscape can involve opportunistic plays, the foundation of these long-standing strategies offers predictable revenue generation.

- AUM: $24.7 billion in mid-2024 for Corporate Opportunities and APAC Private Equity.

- Revenue Source: Consistent, high-margin fees from stable, mature portfolio companies.

- Strategy Basis: Leverages existing relationships and a proven track record.

- Income Stability: Provides reliable income due to the mature nature of the funds.

Ares Management's established credit funds, particularly those in mature markets, function as significant cash cows. These segments, characterized by high market share and predictable fee-paying assets, generate consistent management fees. The firm's overall AUM reached $422.4 billion in Q1 2024, with the Credit segment being the largest contributor, underscoring the stability these cash cows provide.

Perpetual capital vehicles, representing 83% of Ares' total AUM and 92% of management fees in Q1 2024, are also key cash cows. Despite operating in lower-growth markets, their high market share ensures strong, stable cash flows, funding other business areas.

Ares Capital Corporation (ARCC), a leading BDC, exemplifies a cash cow through its consistent quarterly dividends and strong credit quality portfolio. Its established market position and reliable income stream solidify its role as a dependable revenue generator for the firm.

Within Real Estate, industrial and multifamily properties, making up 75% of the group's portfolio, are considered cash cows due to their stable revenue streams and high occupancy rates in established markets.

| Segment | AUM (Q1 2024) | Contribution to Total AUM | Role |

|---|---|---|---|

| Credit Funds (Mature) | Significant portion of $422.4B total AUM | Largest contributor | Stable income, predictable fees |

| Perpetual Capital Vehicles | $154.8B | 83% | Primary driver of financial stability |

| Ares Capital Corporation (ARCC) | N/A (Publicly Traded BDC) | N/A | Consistent dividends, reliable returns |

| Real Estate (Industrial/Multifamily) | 50% Industrial, 25% Multifamily of Real Estate AUM | Significant portion of Real Estate AUM | Stable revenue, high occupancy |

Delivered as Shown

Ares Management BCG Matrix

The Ares Management BCG Matrix preview you're viewing is the identical, fully formatted document you'll receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report ready for immediate strategic application. You can confidently use this preview to assess the depth and quality of the BCG Matrix analysis, knowing the purchased version will be exactly the same. It's designed for clarity and professional use, enabling you to seamlessly integrate it into your business planning and decision-making processes.

Dogs

Ares Management's European real estate equity portfolio experienced a downturn, posting negative gross returns of -1.9% in the second quarter of 2024 and a more significant -5.1% over the preceding twelve months. This performance indicates that some of these European equity holdings are likely classified as 'dogs' within the BCG matrix framework. Despite Ares' ongoing capital deployment activities, these particular investments are currently absorbing resources without delivering commensurate financial gains, highlighting a need for strategic review.

Within Ares Management's extensive portfolio, any legacy or smaller niche investment strategies that haven't achieved significant scale, operate in slow-growth sectors, or hold a minor market position could be categorized as dogs. These areas would likely see reduced capital investment and could eventually be considered for sale if they consistently underperform.

Certain smaller, less diversified regional funds within Ares Management's portfolio, particularly those focused on low-growth local markets, may find themselves in the "dog" category. These funds often struggle to build substantial market share due to intense competition and limited expansion opportunities.

If these regional vehicles cannot achieve the economies of scale or develop a distinct competitive edge compared to Ares' larger, global platforms, they risk becoming capital drains. For instance, a regional real estate fund operating in a mature market with a 2% annual growth rate might face significant challenges in outperforming broader, more diversified real estate strategies. As of early 2024, many smaller regional funds globally are reporting net asset growth rates below 3%, indicating a potential struggle for scale.

Assets Requiring Significant Turnaround

Within Ares Management's diverse portfolio, assets categorized as 'dogs' would represent those facing substantial financial or operational challenges with dim prospects for recovery. These entities typically consume significant capital and management attention without generating adequate returns, potentially hindering the overall performance of the fund. Identifying and addressing these underperforming assets is crucial for optimizing resource allocation.

While specific portfolio companies are seldom publicly labeled as 'dogs,' Ares Management, like other alternative asset managers, would continually assess its holdings. For instance, if a portfolio company in a declining industry, such as a traditional brick-and-mortar retail chain acquired by Ares, experienced a sustained revenue decline of over 15% year-over-year in 2024 and failed to adapt its business model, it might be considered a dog. Such an asset would likely require a comprehensive restructuring or a strategic divestment to mitigate further losses.

- Underperforming Portfolio Companies: Assets demonstrating consistent negative cash flow or declining market share.

- High Debt-to-Equity Ratios: Companies with leverage exceeding industry norms and struggling to service debt obligations.

- Operational Inefficiencies: Businesses plagued by outdated technology or inefficient supply chains, leading to reduced profitability.

- Market Obsolescence: Holdings in sectors experiencing rapid technological change or shifting consumer preferences, rendering their core offerings less relevant.

Historically Underperforming Investment Themes

Historically underperforming investment themes within Ares Management, if identified, would be categorized as dogs in a BCG matrix. These are areas that consistently deliver below-average returns or are situated in industries facing significant decline without a clear turnaround strategy. Ares would likely reduce or eliminate new capital allocation to these segments, redirecting resources toward more promising opportunities.

While specific 'dog' assets are not publicly disclosed, a hypothetical example could involve a legacy private equity fund focused on a mature, non-disruptive manufacturing sector that has seen declining demand. For instance, if Ares had a significant allocation to traditional brick-and-mortar retail investments that have struggled against e-commerce growth, this could represent a dog category. As of early 2024, many traditional retail segments continued to face headwinds, with some sectors experiencing sales declines of over 5% year-over-year.

The strategic response to such underperforming themes involves a disciplined capital allocation approach. Ares would aim to:

- Divest or wind down existing positions in these dog categories to recoup capital.

- Avoid new commitments to similar industries or strategies that exhibit similar characteristics.

- Reallocate capital to growth-oriented sectors such as technology, renewable energy, or specialized credit opportunities where market dynamics are more favorable.

Within Ares Management's portfolio, 'dogs' represent investments that are underperforming and have limited growth potential. These could be legacy strategies in slow-growth sectors or smaller regional funds struggling to gain market share. Such assets consume capital without generating adequate returns, necessitating a strategic review or divestment.

For instance, Ares' European real estate equity portfolio saw negative gross returns of -1.9% in Q2 2024. Investments within this segment that consistently underperform, perhaps those in mature markets with low growth rates (e.g., under 3% net asset growth as seen in many smaller regional funds globally in early 2024), would likely be classified as dogs. These holdings demand capital but offer little prospect of significant future gains.

A hypothetical example of a 'dog' could be a private equity investment in a traditional retail chain that experienced a revenue decline of over 15% year-over-year in 2024 due to e-commerce competition. Ares would likely seek to divest such an asset to free up capital for more promising ventures in growth areas like technology or renewable energy.

Identifying and managing these 'dog' assets is crucial for Ares to optimize its capital allocation. The firm would typically divest or wind down these positions, avoid new investments in similar underperforming areas, and reallocate capital to sectors with more favorable market dynamics and growth potential.

Question Marks

The launch of Ares Special Opportunities Fund III, aiming for $7 billion, introduces a new distressed investment vehicle. This fund targets a market experiencing rising corporate distress, a sector known for its high growth potential but also significant volatility.

As a new entrant in this specialized area, the fund's performance remains a key question mark. Its ability to navigate complex distressed situations and deliver strong returns is still being established.

The full operational integration of recent significant acquisitions, such as GCP International which closed in March 2025 and added $45.3 billion to Ares Management's Assets Under Management (AUM), presents a question mark in their BCG Matrix positioning. While these acquisitions immediately bolster AUM and market presence, the realization of full synergies and the optimization of profitability across the combined entities are complex undertakings. Initial integration headwinds have been noted, potentially impacting margins in the short term as operational efficiencies are sought.

Ares Management is actively pursuing expansion in emerging geographic markets, with a notable focus on the Asia-Pacific region for select investment strategies. This strategic push aims to capitalize on significant growth opportunities driven by favorable demographics and powerful industry trends.

While Ares is building its presence, its market share in certain emerging sub-regions or specialized strategies within these markets may still be relatively low. For instance, in 2024, while Ares has a strong established presence in North America and Europe, its penetration in specific emerging Asian markets for its credit strategies might still be in the early stages of development, requiring substantial capital deployment to gain a more dominant position.

Nascent Climate Infrastructure Ventures

Ares Management's infrastructure segment, particularly its nascent climate infrastructure ventures, can be viewed through the lens of a BCG Matrix. While their established infrastructure debt platform represents a strong cash cow, newer initiatives in climate infrastructure are emerging as question marks.

These ventures, such as the solar joint venture with Savion, are operating in a high-growth market driven by increasing demand for decarbonization solutions. However, they are characterized by significant capital requirements and the need for strategic development to gain substantial market share. For instance, the global renewable energy market is projected to grow significantly, with investments in solar and energy storage expected to be key drivers. In 2023, global investment in energy transition technologies reached an estimated $1.7 trillion, underscoring the market's expansion.

- Savion Solar JV: Represents a key strategic move into a high-growth segment of climate infrastructure.

- Energy Storage & Niche Renewables: These smaller-scale initiatives are currently question marks, requiring further investment and market validation.

- Capital Intensity: The development of climate infrastructure, including solar and storage, demands substantial capital outlay.

- Market Growth Potential: The climate infrastructure sector offers significant long-term growth prospects, driven by global decarbonization efforts.

Developing Private Wealth Product Offerings

Ares Management is actively expanding its private wealth product offerings, targeting significant growth in Assets Under Management (AUM) by 2028. This strategic push aims to tap into a high-demand market for institutional-quality investment solutions tailored for individual investors.

While the demand is robust, Ares is in the developmental phase for a comprehensive suite of these products. The firm's ability to successfully scale and achieve widespread adoption among wealth clients for these newer offerings is a key consideration.

- AUM Growth Target: Ares aims for substantial AUM growth in its private wealth segment by 2028.

- Market Opportunity: The private wealth channel presents strong demand for institutional-quality investment solutions.

- Development Stage: Ares is actively developing and distributing a comprehensive product suite for this channel.

- Adoption Uncertainty: Scaling new product offerings and gaining broad client adoption remain key areas to monitor.

Ares Management's expansion into emerging geographic markets, particularly Asia, represents a strategic growth initiative. While the firm is actively building its presence, its market share in certain sub-regions or specialized strategies within these markets is still developing. For example, in 2024, Ares' penetration in specific emerging Asian markets for its credit strategies might be in the early stages, requiring substantial capital deployment to gain a more dominant position compared to its established North American and European markets.

The firm's infrastructure segment, especially its nascent climate infrastructure ventures, can be seen as question marks. While their established infrastructure debt platform is a strong performer, newer climate-focused initiatives like the solar joint venture with Savion operate in a high-growth market but require significant capital and strategic development to capture substantial market share. Global investment in energy transition technologies reached an estimated $1.7 trillion in 2023, highlighting the sector's expansion potential.

Ares' increasing focus on private wealth product offerings presents another area of potential growth, with targets for AUM expansion by 2028. However, the firm is still in the developmental phase for a comprehensive suite of these products. Successfully scaling these new offerings and achieving widespread adoption among wealth clients are key considerations for Ares in this segment.

The launch of Ares Special Opportunities Fund III, targeting $7 billion, introduces a new distressed investment vehicle in a market experiencing rising corporate distress. As a new entrant in this specialized and volatile sector, the fund's ability to navigate complex distressed situations and deliver strong returns remains a key question mark, with its performance still being established.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.