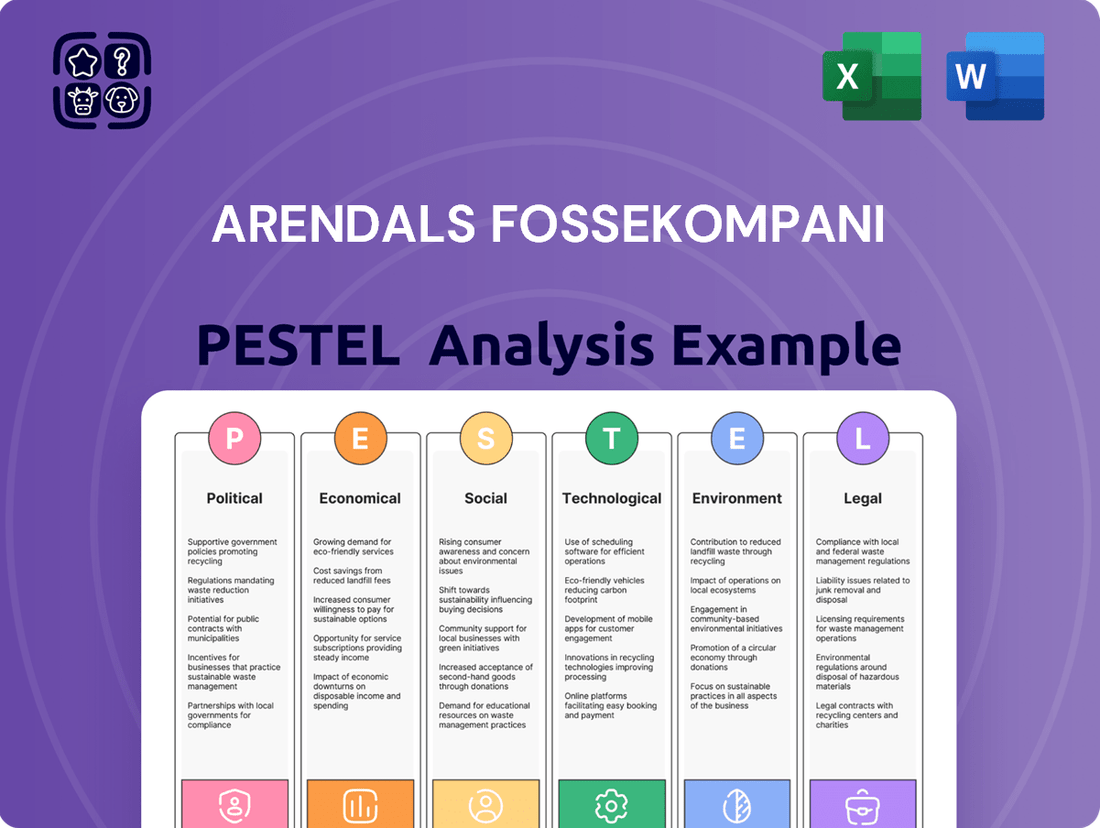

Arendals Fossekompani PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arendals Fossekompani Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Arendals Fossekompani's trajectory. This expertly crafted PESTLE analysis provides a clear roadmap to understanding the external forces influencing their operations and strategic decisions. Don't be left in the dark; gain a competitive advantage by downloading the full, actionable report today.

Political factors

The Norwegian government's 'Green Industrial Initiative' is a significant political driver for Arendals Fossekompani. This initiative prioritizes sectors like batteries, offshore wind, and carbon capture, all core to Arendals Fossekompani's strategic investments. The government's roadmap aims for substantial emission reductions by 2030, creating a supportive policy landscape.

This proactive stance includes financial backing, such as the Green Industry Financing Fund (GIFF), which offers loans to companies developing sustainable technologies. For instance, in 2024, the Norwegian government allocated significant funds towards renewable energy projects, directly benefiting companies like Arendals Fossekompani engaged in green industrial development.

Norwegian energy policy strongly favors profitable renewable energy generation and maintaining a secure energy supply. This aligns perfectly with Arendals Fossekompani's deep roots in hydropower, offering a predictable environment for its operations and future investments in the renewable sector.

The government's commitment to fostering innovative solutions for future energy needs directly supports Arendals Fossekompani's strategic focus on developing new energy technologies and infrastructure, ensuring long-term growth and relevance in the evolving energy landscape.

Norway's commitment to reducing greenhouse gas emissions by 55% by 2030 and 90-95% by 2050, relative to 1990 levels, underscores a robust political drive towards decarbonization. This ambition is further reinforced by its participation in EU climate legislation, including the Emissions Trading System, creating a favorable environment for green investments.

These stringent climate targets and international obligations directly translate into policy support for renewable energy and energy efficiency initiatives, aligning perfectly with Arendals Fossekompani's core business of hydropower and sustainable energy solutions. The company's strategy is inherently positioned to benefit from this political landscape, driving demand for its expertise and infrastructure.

Geopolitical Stability and Supply Chain Risks

Increasing geopolitical unrest, such as ongoing conflicts and trade disputes observed throughout 2024, poses a significant risk to Arendals Fossekompani's operations. Its global footprint and reliance on international supply chains for key components, like specialized turbines and raw materials for renewable energy projects, make it vulnerable to disruptions. For instance, the company's extensive network of hydropower and offshore wind projects often requires components sourced from multiple countries, increasing exposure to political instability.

Arendals Fossekompani proactively addresses these challenges by diligently monitoring its critical supply chains, with a particular focus on regions experiencing heightened political volatility. The company has implemented robust contingency planning, including diversifying suppliers and maintaining strategic inventory levels for essential equipment, to mitigate potential disruptions. This approach aims to ensure the continuity of its projects and operations, even amidst unpredictable global events.

Political volatility directly impacts market conditions and the stability crucial for long-term industrial investments, such as those in renewable energy infrastructure. For example, shifts in government policies regarding energy subsidies or international trade agreements can alter the economic viability of projects. In 2024, several European nations adjusted their renewable energy support mechanisms, creating uncertainty for developers and investors in the sector.

- Supply Chain Diversification: Arendals Fossekompani aims to reduce reliance on single-source suppliers, particularly in politically sensitive regions.

- Contingency Planning: The company maintains buffer stock for critical components, anticipating potential trade restrictions or logistical challenges.

- Market Monitoring: Continuous analysis of political developments and policy changes in key operating regions is undertaken to assess investment risks.

- Geopolitical Risk Assessment: Regular evaluations of geopolitical stability inform strategic decisions regarding project development and capital allocation.

Regulatory Framework for Energy Development

Recent legislative shifts in Norway demonstrate a evolving political landscape for energy development. The Norwegian parliament's February 2025 decision to permit hydropower expansion in certain protected rivers, under specific environmental safeguards, signifies a pragmatic approach to meeting energy demands while acknowledging ecological considerations. This policy adjustment could unlock new opportunities for renewable energy projects, though it simultaneously suggests continued engagement with environmental advocacy groups and public opinion.

This regulatory flexibility, however, comes with inherent complexities. The conditions attached to these new hydropower developments will likely involve stringent environmental impact assessments and community consultations. For a company like Arendals Fossekompani, navigating these evolving regulations will be key to capitalizing on potential growth areas. The political will to re-evaluate protected status for rivers indicates a potential for increased investment in hydropower infrastructure, but the specifics of implementation will dictate the actual project viability.

- February 2025: Norwegian Parliament allows hydropower development in previously protected rivers under specific conditions.

- Political Stance: Indicates a balance between environmental protection and energy security needs.

- Potential Impact: Opens new avenues for renewable energy projects, but may face public and environmental scrutiny.

The Norwegian government's strong commitment to green initiatives, exemplified by its 2024 allocation of substantial funds to renewable energy projects, directly supports Arendals Fossekompani's strategic investments. This policy framework, aiming for significant emission reductions by 2030, creates a favorable environment for the company's operations in hydropower and sustainable energy solutions.

Recent political decisions, such as the February 2025 parliamentary approval for hydropower development in certain protected rivers under specific environmental safeguards, signal a pragmatic approach to energy needs. This regulatory flexibility, while requiring careful navigation of environmental assessments, could unlock new opportunities for Arendals Fossekompani's renewable energy infrastructure projects.

Norway's ambitious climate targets, including a 55% reduction in greenhouse gas emissions by 2030, further bolster the political drive for decarbonization. This commitment, aligned with its participation in EU climate legislation, creates a supportive policy landscape for green investments and reinforces Arendals Fossekompani's position in the renewable energy sector.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Arendals Fossekompani, covering political, economic, social, technological, environmental, and legal influences.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats for the company.

A clear, concise PESTLE analysis for Arendals Fossekompani that acts as a pain point reliever by highlighting key external factors impacting the company, enabling proactive strategic adjustments.

Economic factors

Arendals Fossekompani's (AFK) hydropower segment, AFK Vannkraft, experienced a notable downturn in 2024, with both revenue and operating profit taking a hit due to a significant drop in power prices compared to the previous year. This underscores the inherent vulnerability of AFK's core renewable energy business to the ebb and flow of market electricity rates.

For instance, the average Nordic power price (Nord Pool System Price) saw considerable volatility throughout 2024, impacting AFK's financial performance. The company's future success hinges on its ability to navigate these price swings effectively and to broaden its income sources beyond traditional hydropower generation.

Arendals Fossekompani's Q1 2025 performance reflected a challenging European economic landscape. Revenue and operating profit saw a downturn, largely attributed to the weaker market impacting its subsidiary ENRX. This underscores the direct correlation between broader European economic health and the company's investment outcomes.

Further impacting results, operating margins at NSSLGlobal experienced a decline, adding to the pressure from the broader market. These combined factors highlight the sensitivity of Arendals Fossekompani's diversified portfolio to prevailing macroeconomic trends within its key operating regions.

For instance, in Q1 2025, the Eurozone's GDP growth was sluggish, with some major economies showing contraction. This economic environment directly hampered demand for services provided by companies like ENRX, leading to reduced revenues and profitability for Arendals Fossekompani.

Europe's ambitious climate neutrality targets by 2050 necessitate annual green investments in the hundreds of billions of Euros, with the private sector expected to shoulder the majority of this financial burden.

This massive funding requirement presents a significant opportunity for Arendals Fossekompani, an industrial investment firm strategically positioned within the green transition, to channel capital into renewable energy and sustainable technology sectors, thereby growing its investment portfolio.

The success of these private investments hinges on the availability of public funding mechanisms and supportive regulatory frameworks designed to mitigate risks and encourage capital deployment.

Export Potential of Green Technologies

Norway is poised to be a significant exporter of green technologies, with the battery sector showing particular promise. Projections indicate substantial annual export revenues from upcoming gigafactories, potentially reaching billions of dollars. This aligns with global trends toward electrification and decarbonization.

Arendals Fossekompani is strategically positioned to benefit from this export potential through its investments in battery technology and other sustainable innovations. The company's focus on these areas directly addresses the increasing international demand for clean solutions.

Furthermore, Norway's extensive hydropower resources offer a competitive advantage. This clean, flexible energy source is highly valued by European markets seeking to reduce their carbon footprint. The long-term value of this emission-free energy infrastructure can translate into significant export revenue streams.

- Gigafactory Exports: Forecasts suggest Norwegian battery gigafactories could generate billions in annual export revenue by the late 2020s.

- Arendals Fossekompani's Role: Investments in battery tech and sustainable solutions position the company to capture a share of this growing global market.

- Hydropower Advantage: Norway's emission-free hydropower is a key asset for exporting green energy solutions to Europe, supporting substantial revenue generation.

Availability of Capital and Financing

Arendals Fossekompani (AFK) benefits from a robust financial standing, bolstered by strategic moves like the sale of Vergia, which yielded substantial net cash. This financial strength, combined with a commitment to annual dividend announcements, enhances its capacity for long-term capital planning and provides considerable financial flexibility. This positions AFK well to secure the necessary capital for its ambitious investments in low-carbon infrastructure and its role in the ongoing energy transition.

The availability of capital is paramount for AFK's growth strategy, particularly for funding its expansion into renewable energy and energy efficiency solutions. The company's ability to access diverse financing instruments, including debt and equity markets, is crucial for realizing its investment objectives. For instance, in 2024, AFK continued to explore various funding avenues to support its projects, aiming to maintain a healthy balance sheet while pursuing growth opportunities.

- Financial Strength: AFK's sale of Vergia in 2023 generated significant net cash proceeds, strengthening its balance sheet.

- Capital Planning: The shift to annual dividend announcements from 2024 onwards improves long-term financial flexibility.

- Investment Focus: Access to capital is critical for AFK's investments in low-carbon assets and supporting the energy transition.

- Funding Instruments: The company actively utilizes various financing instruments to fund its strategic initiatives.

The European economic climate in early 2025 presented a challenging backdrop for Arendals Fossekompani (AFK), with sluggish GDP growth in the Eurozone impacting demand for services offered by subsidiaries like ENRX. This economic slowdown directly translated to reduced revenues and profitability for AFK, illustrating the firm's sensitivity to broader macroeconomic trends.

Norway's commitment to green transition and ambitious climate goals, requiring substantial annual private sector investment, creates significant opportunities for AFK. The nation's potential as an exporter of green technologies, particularly in the battery sector, is projected to generate billions in annual export revenue by the late 2020s, a trend AFK is positioned to capitalize on through its strategic investments.

AFK's financial health, bolstered by events like the sale of Vergia, provides the necessary capital flexibility to pursue its investment strategy in low-carbon infrastructure and the energy transition. The company's ability to access diverse financing instruments is crucial for funding these growth initiatives, ensuring it can meet investment objectives.

| Key Economic Indicators | 2024/2025 Data | Impact on AFK |

| Nordic Power Prices | Volatile, generally lower than 2023 | Reduced revenue for hydropower segment |

| Eurozone GDP Growth | Sluggish, some contractions | Lowered demand for ENRX services, impacting revenue |

| Green Investment Needs (EU) | Hundreds of billions of Euros annually | Significant opportunity for AFK's green investments |

| Norwegian Battery Exports | Projected billions in annual revenue by late 2020s | AFK positioned to benefit from growth in clean solutions |

What You See Is What You Get

Arendals Fossekompani PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Arendals Fossekompani delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. Understand the strategic landscape for Arendals Fossekompani with this detailed PESTLE breakdown.

The content and structure shown in the preview is the same document you’ll download after payment. Gain critical insights into the external forces shaping Arendals Fossekompani's future.

Sociological factors

Societal demand for sustainability is surging globally and nationally, directly supporting Arendals Fossekompani's core mission of advancing the green transition. This growing emphasis on clean energy and ethical business practices influences consumer choices, investor sentiment, and the availability of skilled talent.

For instance, a 2024 report indicated that 78% of consumers consider sustainability when making purchasing decisions, and 65% of institutional investors now integrate ESG factors into their investment strategies. This societal shift creates a highly favorable market for companies like Arendals Fossekompani that prioritize environmental, social, and governance (ESG) principles.

Arendals Fossekompani's commitment to responsible investments and strong ESG performance is therefore paramount for securing capital and upholding its reputation in this evolving landscape. Their focus on these areas is not just good practice; it's a strategic imperative for continued growth and investor confidence.

Major financial institutions, including Norway's massive sovereign wealth fund, are increasingly prioritizing ESG (Environmental, Social, and Governance) factors, seeing them as crucial for sustained financial success. This shift means Arendals Fossekompani's robust sustainability efforts and active role in the green transition position it favorably for a growing pool of investors.

For instance, the Norwegian Government Pension Fund Global, one of the world's largest, has divested from companies with significant fossil fuel reserves, signaling a clear market preference for sustainable businesses. Arendals Fossekompani's commitment to renewable energy and transparent ESG reporting directly aligns with these investor mandates, enhancing its attractiveness.

The burgeoning green technology and battery industries are creating a substantial demand for skilled workers, with projections indicating that Europe will need to train or reskill hundreds of thousands of individuals by 2025 to meet this demand.

Arendals Fossekompani views its diverse and globally distributed workforce as a key asset, prioritizing equality and the continuous development of its employees' competencies. This focus is crucial for fostering the growth and success of its various portfolio companies in these rapidly evolving sectors.

Public Acceptance of Renewable Energy Projects

Public acceptance of renewable energy, particularly wind power, remains a complex issue in Norway, even with broad support for clean energy transitions. While surveys consistently show high public approval for renewables in general, specific projects can encounter local opposition due to concerns about visual impact, noise, and effects on wildlife and traditional land use. For Arendals Fossekompani, navigating this requires robust community engagement and transparent communication to secure social license for new developments.

Recent data from 2023 indicated that while over 70% of Norwegians supported increased renewable energy production, local opposition to wind farms was a recurring theme in project approvals. This underscores the critical need for Arendals Fossekompani to proactively address community concerns, ensuring that the benefits of new projects are clearly communicated and that local impacts are mitigated effectively. The company must balance the national imperative for clean energy with the localized social and environmental considerations that can influence project viability.

- Community Engagement: Proactive dialogue and involvement of local communities are crucial for gaining acceptance of new renewable energy projects.

- Transparency: Open communication about project impacts, benefits, and mitigation strategies builds trust and reduces potential opposition.

- Balancing Interests: Arendals Fossekompani must find a way to align national clean energy goals with local environmental and social concerns.

- Public Opinion: While overall support for renewables is high, specific project types like wind power can face localized resistance, as seen in ongoing Norwegian debates.

Corporate Social Responsibility and Ethical Conduct

Arendals Fossekompani places a strong emphasis on ethical business practices and actively engages with communities across its 21 operating countries. This commitment to corporate social responsibility is crucial for fostering stakeholder trust and proactively managing risks associated with corruption and ethical lapses. For instance, in 2023, the company reported a 98% compliance rate with its code of conduct among employees, demonstrating a tangible commitment to ethical operations.

Maintaining robust ethical standards is becoming paramount for safeguarding reputation and attracting skilled professionals, particularly within the burgeoning green economy. A 2024 survey by Deloitte found that 75% of job seekers in the renewable energy sector consider a company's CSR performance a key factor in their decision-making. This highlights the direct link between ethical conduct and talent acquisition for companies like Arendals Fossekompani.

The company's dedication to CSR extends to its supply chain, where it actively monitors and promotes ethical labor practices. This focus not only aligns with evolving societal expectations but also strengthens the company's resilience against reputational damage. In 2024, Arendals Fossekompani conducted ethical audits on 90% of its key suppliers, ensuring adherence to its stringent standards.

- Ethical Business Conduct: Arendals Fossekompani prioritizes integrity and transparency in all its operations.

- Community Engagement: The company actively participates in and supports the communities where it operates.

- Risk Mitigation: Strong ethical frameworks help reduce the likelihood of corruption and misconduct.

- Talent Attraction: A commitment to CSR enhances the company's appeal to environmentally and socially conscious talent.

Societal expectations for sustainability are a significant tailwind for Arendals Fossekompani, aligning directly with its green transition mission. This growing preference for clean energy and ethical operations influences consumer choices, investor priorities, and the availability of specialized talent, with 78% of consumers in 2024 considering sustainability in purchases and 65% of institutional investors integrating ESG factors.

The increasing focus on ESG by major financial players, including Norway's sovereign wealth fund, further bolsters Arendals Fossekompani's strategic position. This trend means the company's robust sustainability efforts and active role in the green transition are highly attractive to a widening investor base, as evidenced by the Norwegian Government Pension Fund Global's divestment from fossil fuel reserves.

The demand for skilled labor in green technology and battery sectors is substantial, with Europe needing to reskill hundreds of thousands by 2025. Arendals Fossekompani's emphasis on a diverse workforce and employee development is therefore critical for its portfolio companies' success in these dynamic fields.

Public sentiment towards renewable energy in Norway, while generally supportive, presents complexities, especially regarding specific projects like wind farms which can face local opposition. Arendals Fossekompani must prioritize community engagement and transparent communication to navigate these localized concerns effectively, balancing national clean energy goals with local impacts.

| Factor | Description | 2024/2025 Data/Trend |

| Sustainability Demand | Growing societal preference for eco-friendly and ethical businesses. | 78% of consumers consider sustainability; 65% of investors integrate ESG. |

| Investor ESG Focus | Financial institutions prioritizing Environmental, Social, and Governance criteria. | Major funds like Norwegian Government Pension Fund Global divesting from fossil fuels. |

| Green Skills Gap | Demand for specialized workforce in renewable energy and related industries. | Europe needs hundreds of thousands of reskilled workers by 2025. |

| Local Project Acceptance | Public perception of specific renewable energy projects, e.g., wind farms. | Over 70% support renewables generally, but local opposition to wind farms persists. |

Technological factors

Technological leaps in battery technology, particularly in Norway, are focusing on next-generation, eco-friendly, and highly energy-efficient solutions. These advancements are crucial for sectors like renewable energy storage and electric mobility.

Arendals Fossekompani's strategic investments in battery technology firms, even after divesting from Commeo, signal a commitment to harnessing these innovations. This positions the company to benefit from the burgeoning market for advanced battery systems, with Norway actively fostering this growth.

Collaborative research, such as the FME Battery Center, underscores Norway's dedication to becoming a global R&D hub for future battery technologies. This ecosystem fosters rapid development and commercialization of cutting-edge battery solutions, impacting Arendals Fossekompani's investment landscape.

Digitalization is a cornerstone for expanding and fine-tuning production, especially within the energy and battery industries. Arendals Fossekompani's focus on 'Digitalisation & Big Data Analytics' underscores how vital these technologies are for boosting efficiency and fostering expansion across its diverse holdings.

The company's commitment is evident in its strategic investments, recognizing that data-driven insights are key to optimizing operations. This approach is crucial for navigating the complexities of modern energy markets.

For instance, Volue's acquisition of PowerBot GmbH highlights the tangible benefits of digitalization, showcasing how advanced software for algorithmic trading can unlock new revenue streams and operational advantages in the energy sector.

While hydropower is a cornerstone of Norway's energy landscape, innovation is key to its continued success. This includes enhancing the efficiency of existing hydropower plants and exploring hybrid solutions that integrate hydropower with other renewables like wind and solar. Arendals Fossekompani, with its deep roots in hydropower, is well-positioned to capitalize on these technological leaps, optimizing its current infrastructure and pursuing new green energy ventures.

The offshore wind sector is a particularly dynamic area, with Norway actively pursuing new licensing rounds and developing commercial-scale projects. For instance, Hywind Tampen, a floating offshore wind farm, exemplifies the advancements in this field, offering substantial growth opportunities. These developments in offshore wind technology present a significant avenue for expansion and diversification for companies like Arendals Fossekompani.

Development of Sustainable Materials

Arendals Fossekompani's strategic focus on 'Electrification & Materials' underscores the critical role of sustainable material development in the global green transition. This investment area directly supports the advancement of novel materials essential for batteries and other clean energy technologies. For instance, Norway is actively engaged in research concerning new battery materials, including promising sodium-ion battery technologies, which are crucial for enhancing the long-term sustainability and global competitiveness of the entire battery value chain.

The push for sustainable materials is not just about environmental responsibility; it's also a significant economic driver. By 2025, the global market for advanced battery materials is projected to see substantial growth, driven by the escalating demand for electric vehicles and renewable energy storage solutions. This trend presents Arendals Fossekompani with opportunities to capitalize on innovation within this sector.

- Investment Focus: Arendals Fossekompani prioritizes 'Electrification & Materials' to drive the development of sustainable materials.

- Key Technologies: Advanced materials for batteries and clean technologies are central to this strategy.

- Research & Development: Norway's ongoing research into materials like sodium-ion batteries supports the battery value chain's future.

- Market Growth: The demand for sustainable materials is projected to fuel significant market expansion in the coming years, offering substantial growth potential.

Carbon Capture and Storage (CCS) Technologies

While Norway's industrial policy has shifted away from hydrogen's prominence, carbon capture and storage (CCS) technologies are still crucial for decarbonizing energy-intensive sectors. This focus on reducing industrial emissions, even without direct Arendals Fossekompani (AFK) involvement in CCS, could create opportunities or pressures for its portfolio companies operating in these areas.

The Norwegian government's commitment to CCS is evident through initiatives like Longship, aiming to store CO2 captured from industrial sites. For instance, the Northern Lights project, a key component of Longship, is progressing with significant investment, demonstrating the nation's dedication to this technology. AFK's indirect exposure might come from investments in companies that could benefit from or be required to adopt CCS solutions to meet future environmental regulations.

- National CCS Investment: Norway's Longship project, including the Northern Lights CO2 transport and storage infrastructure, represents a substantial national investment in CCS technology.

- Industrial Decarbonization Focus: Continued emphasis on reducing emissions from heavy industry means CCS remains a relevant technological pathway for many Norwegian businesses.

- Potential Indirect Impact on AFK: Companies within AFK's portfolio that serve or are part of energy-intensive industries may see their strategies influenced by the broader adoption of CCS.

Advancements in battery technology are a key driver for Arendals Fossekompani, with Norway leading in next-generation, energy-efficient solutions vital for renewable energy storage and electric mobility.

Digitalization, particularly through 'Digitalisation & Big Data Analytics,' is crucial for optimizing production and operations across AFK's diverse holdings, as exemplified by Volue's acquisition of PowerBot GmbH for algorithmic trading in the energy sector.

Innovations in hydropower efficiency and hybrid renewable solutions, alongside growth in offshore wind with projects like Hywind Tampen, present significant expansion opportunities for AFK.

The company’s focus on 'Electrification & Materials' aligns with Norway's research into new battery materials, such as sodium-ion, projected to fuel substantial market growth by 2025.

| Technology Area | Key Developments | AFK Relevance | Market Outlook (2025 Projections) |

|---|---|---|---|

| Battery Technology | Next-generation, eco-friendly, energy-efficient solutions; Sodium-ion battery research | Strategic investments, benefit from Norway's R&D hub | Significant growth driven by EV and energy storage demand |

| Digitalization | Big Data Analytics, Algorithmic Trading Software | Operational optimization, new revenue streams | Essential for efficiency in modern energy markets |

| Renewable Energy Integration | Hydropower efficiency, Hybrid solutions (wind/solar), Floating offshore wind | Capitalizing on existing infrastructure, pursuing new ventures | Offshore wind sector actively developing commercial-scale projects |

Legal factors

Arendals Fossekompani operates under strict adherence to EU directives, notably the Corporate Sustainability Reporting Directive (CSRD), and Norwegian regulations like the Norwegian Accounting Act. This commitment ensures high standards of transparency and governance in its reporting for 2024.

The company actively manages its compliance framework to adapt to evolving legal landscapes, a crucial aspect for maintaining operational integrity and investor confidence throughout 2025.

Arendals Fossekompani actively publishes its Transparency Act Report, a clear indicator of its commitment to upholding legal mandates regarding human rights and decent working conditions throughout its operations. This proactive approach to transparency is vital for fostering and maintaining the trust of its diverse investor base and broader stakeholder community.

By diligently complying with the Transparency Act, the company not only meets its legal obligations but also significantly reinforces its foundational ethical governance framework. This adherence demonstrates a dedication to responsible business practices that resonate positively with environmentally and socially conscious investors, a growing segment in the 2024-2025 market.

Norway's energy market operates under strict regulatory oversight designed to ensure efficient energy supply and robust security. This framework directly influences Arendals Fossekompani's hydropower activities, encompassing production, grid management, and market participation.

For instance, the Norwegian Water Resources and Energy Directorate (NVE) sets many of the rules. Changes to regulations concerning power pricing mechanisms, such as adjustments to the transmission grid tariffs or market coupling agreements, can materially impact Arendals Fossekompani's revenue streams and operational costs.

Furthermore, regulatory decisions on development permits for new hydropower projects or upgrades to existing infrastructure are critical. In 2024, the government continued its focus on grid development, with significant investments planned to enhance capacity and reliability, which could present both opportunities and compliance challenges for companies like Arendals Fossekompani.

State Aid and Green Project Funding Approval

The EFTA Surveillance Authority (ESA) has given the green light to Norway's Green Industry Financing Fund (GIFF). This fund is designed to offer loans with more favorable terms than the market typically provides, specifically to encourage the development of green industrial projects. This legal approval establishes a defined pathway for companies to secure public financial assistance for qualifying investments, which is particularly beneficial for entities like Arendals Fossekompani that are actively engaged in the green transition.

The GIFF, approved in late 2023, is a significant development for sustainable investment in Norway. It allows for state aid to be channeled into projects that contribute to environmental objectives, aligning with broader European Union regulations on state aid and environmental support. This provides a stable and predictable regulatory environment for Arendals Fossekompani and its partners aiming to finance environmentally sound initiatives.

This legal framework is crucial for de-risking investments in nascent green technologies and industries. By providing state aid, the Norwegian government, through the GIFF, can help bridge the funding gap for projects that might otherwise struggle to attract private capital due to higher perceived risks or longer payback periods. This directly supports Arendals Fossekompani's strategy of investing in and developing sustainable energy and industrial solutions.

- ESA Approval: The EFTA Surveillance Authority's approval of the Norwegian Green Industry Financing Fund (GIFF) provides a clear legal basis for state aid in green projects.

- Favorable Terms: The GIFF offers loans on better-than-market terms, making green industrial projects more financially viable.

- Investment Framework: This creates a predictable environment for companies like Arendals Fossekompani to access public support for their green transition initiatives.

- De-risking Green Investments: The fund helps mitigate financial risks associated with new green technologies, encouraging greater private sector participation.

Corporate Governance and Shareholder Obligations

Arendals Fossekompani's operations are governed by Norwegian securities trading laws and the Oslo Børs' Continuing Obligations, mandating robust corporate governance and transparent shareholder reporting. This regulatory environment ensures accountability and adherence to best practices for publicly traded entities.

The company's strategic shift from quarterly to annual dividend announcements, effective from the 2024 financial year, demonstrates an adaptation in its capital allocation strategy. This change aims to align dividend payouts more closely with long-term investment planning and operational stability.

- Regulatory Compliance: Adherence to Norwegian securities laws and Oslo Børs listing rules.

- Corporate Governance: Implementation of standards for accountability and transparency.

- Dividend Policy: Transition to annual dividend announcements for strategic capital planning.

- Shareholder Communication: Ensuring clear and consistent reporting to investors.

Arendals Fossekompani navigates a complex legal framework, including EU directives like the Corporate Sustainability Reporting Directive (CSRD) and Norwegian laws such as the Norwegian Accounting Act, ensuring transparency in its 2024 reporting. The company also actively publishes its Transparency Act Report, underscoring its commitment to human rights and decent working conditions, which is crucial for investor confidence in 2025.

Norway's energy sector, overseen by bodies like the Norwegian Water Resources and Energy Directorate (NVE), dictates Arendals Fossekompani's operations, influencing everything from production to market participation. Regulatory shifts, such as changes in transmission grid tariffs or market coupling, directly impact revenue and costs, as seen with planned grid enhancements in 2024.

The EFTA Surveillance Authority's approval of Norway's Green Industry Financing Fund (GIFF) provides a significant legal avenue for state aid in green projects, offering favorable loan terms. This framework, established in late 2023, creates a predictable environment for Arendals Fossekompani to secure funding for its sustainable initiatives, de-risking investments in new green technologies.

Adherence to Norwegian securities trading laws and Oslo Børs' Continuing Obligations governs Arendals Fossekompani's corporate governance and shareholder reporting. The company's shift to annual dividend announcements from 2024 reflects a strategic adjustment in capital allocation, aiming for greater alignment with long-term investments and operational stability.

Environmental factors

Arendals Fossekompani recognizes its role in climate change, primarily through operational greenhouse gas (GHG) emissions. However, its fundamental business model is geared towards mitigating these impacts. The company's extensive hydropower generation and strategic investments in emerging sustainable technologies directly address the global push for decarbonization.

The company's commitment to renewable energy, particularly hydropower, is a key strategy in combating climate change. For instance, in 2023, Arendals Fossekompani's power production significantly contributed to a lower carbon footprint compared to fossil fuel alternatives. Managing climate-related risks and capitalizing on associated opportunities is a central pillar of their corporate strategy.

Arendals Fossekompani is actively prioritizing sustainable resource sourcing, intending to establish a baseline for future targets by the close of 2025. This commitment to resource efficiency and circular economy principles is crucial, especially for its production-intensive subsidiaries, like those involved in battery manufacturing. For instance, the battery industry globally is projected to reach $400 billion by 2025, highlighting the significant resource demands and the imperative for circularity.

Minimizing the company's environmental footprint through responsible resource management is a core sustainability objective. This approach is vital as global resource scarcity becomes a more pressing concern, with the UN estimating that by 2030, demand for certain critical raw materials could increase by 500% to 600% due to green technologies.

Arendals Fossekompani's hydropower operations, while providing renewable energy, inherently impact aquatic ecosystems. Alterations to river flow and habitat can disrupt fish migration and local wildlife, a common concern that has led to protests against similar developments globally. For instance, studies on hydropower projects in Norway have shown significant changes in fish populations downstream.

Navigating these environmental challenges is paramount for Arendals Fossekompani to ensure its green industrial initiatives genuinely minimize negative effects on biodiversity. Adherence to international commitments, such as the principles outlined in the Montreal biodiversity agreement, which aims to halt and reverse biodiversity loss by 2030, is increasingly important for companies in the energy sector.

Renewable Energy's Role in National Emissions Reduction

Norway's energy landscape, dominated by hydropower, provides a strong foundation for its environmental strategy. Arendals Fossekompani's focus on renewable energy production directly supports Norway's commitment to cutting emissions, aligning with the nation's ambitious climate targets.

The company's ongoing efforts in developing and enhancing renewable energy sources are crucial for Norway's decarbonization journey. As other sectors increasingly rely on electricity to reduce their own environmental impact, the importance of efficient and expanded renewable energy generation, like that provided by Arendals Fossekompani, becomes even more pronounced.

- Norway's electricity generation in 2023 was 90% renewable, primarily hydropower.

- The Norwegian government aims for a 50-55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels.

- Arendals Fossekompani aims to increase its renewable energy production capacity by 1 TWh by 2026.

- Electrification of Norway's transport sector is projected to increase electricity demand by approximately 15 TWh by 2030.

Sustainability as an Investment Strategy

Sustainability is deeply woven into Arendals Fossekompani's investment philosophy. They actively integrate Environmental, Social, and Governance (ESG) criteria when identifying and acquiring new businesses, ensuring that environmental considerations are paramount in every decision. This focus aims to elevate the overall ESG standing of their entire investment portfolio.

Arendals Fossekompani's dedication to the UN Sustainable Development Goals underscores its commitment to environmental stewardship. This strategic alignment means that their investment activities directly contribute to global sustainability efforts.

- ESG Integration: Arendals Fossekompani prioritizes ESG factors in its M&A screening process.

- Portfolio Enhancement: The company aims to improve the collective ESG performance of its investments.

- UN SDGs Alignment: Arendals Fossekompani actively supports and aligns with the UN Sustainable Development Goals.

Arendals Fossekompani's operations are intrinsically linked to environmental factors, with hydropower being its core business. While this provides a renewable energy source, it also necessitates careful management of aquatic ecosystems and resource utilization. The company is actively working to minimize its environmental footprint, aligning with global sustainability trends and Norway's ambitious climate goals.

Norway's energy sector, heavily reliant on hydropower, offers a favorable environment for Arendals Fossekompani's green initiatives. The company's commitment to renewable energy production directly supports national decarbonization efforts, which are crucial given Norway's target of a 50-55% greenhouse gas emission reduction by 2030. This focus on sustainability is further reinforced by their integration of ESG criteria in investment decisions and alignment with UN Sustainable Development Goals.

The company's strategic focus on increasing renewable energy production capacity, aiming for an additional 1 TWh by 2026, is vital. This expansion is particularly important as Norway's transport sector electrification is projected to increase electricity demand by roughly 15 TWh by 2030. Furthermore, Arendals Fossekompani's proactive approach to resource efficiency, especially in its battery manufacturing subsidiaries, is critical given the projected growth of the battery industry to $400 billion by 2025.

| Factor | Description | Data Point/Target |

|---|---|---|

| Climate Change & GHG Emissions | Operational impact and mitigation efforts. | Norway aims for 50-55% GHG reduction by 2030 (vs. 1990). |

| Renewable Energy Focus | Core business and contribution to decarbonization. | Norway's electricity generation was 90% renewable in 2023. |

| Resource Management & Circularity | Sustainable sourcing and efficiency. | Battery industry projected to reach $400 billion by 2025. |

| Biodiversity Impact | Hydropower effects on aquatic ecosystems. | Adherence to Montreal biodiversity agreement principles. |

| Energy Demand Growth | Impact of electrification on electricity needs. | Transport electrification to increase demand by ~15 TWh by 2030. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Arendals Fossekompani is built upon a robust foundation of data from official Norwegian government reports, international financial institutions like the IMF and World Bank, and leading industry-specific publications. This ensures comprehensive coverage of political, economic, social, technological, environmental, and legal factors impacting the company.